What Is A Good Fico Score

FICO® creates different types of consumer credit scores. There are base FICO® Scores that the company makes for lenders in multiple industries to use, as well as industry-specific credit scores for credit card issuers and auto lenders.

The base FICO® Scores range from 300 to 850, and FICO defines the good range as 670 to 739. FICO®s industry-specific credit scores have a different range250 to 900. However, the middle categories have the same groupings and a good industry-specific FICO® Score is still 670 to 739.

You May Like: How Long Does A Repossession Stay On Your Credit Report

Top Results For Experian Credit Report And Score

reportand

Experian Credit Report – How To Check Your Experian Credit Report Online

Copy the link and share

greatexperian-credit-sco-re-check.cstodayll.com

reportexperianreportexperianreportandexperianreportexperianexperianreport

Experian Credit Score Check Apr 2022

Copy the link and share

Copy the link and share

trendwww.morganstanley.experiandirect.com

andand

Copy the link and share

newcheck-experian-credit-sco-re-free.cstodayll.com

experianexperianexperianreportexperianexperianexperianreportandexperianreportexperianreport

Check Experian Credit Score Free Apr 2022

Copy the link and share

andreportandand

Copy the link and share

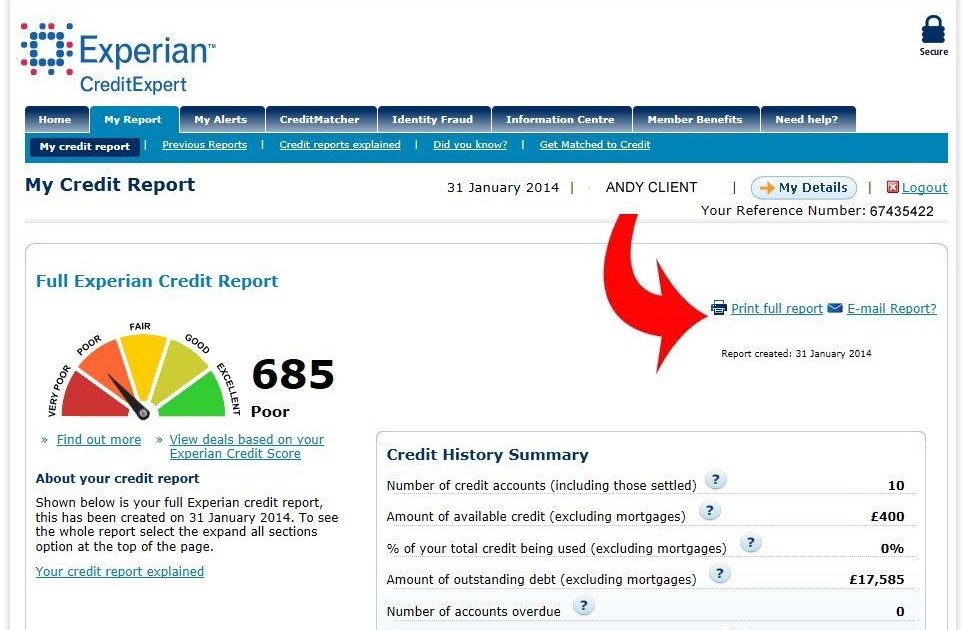

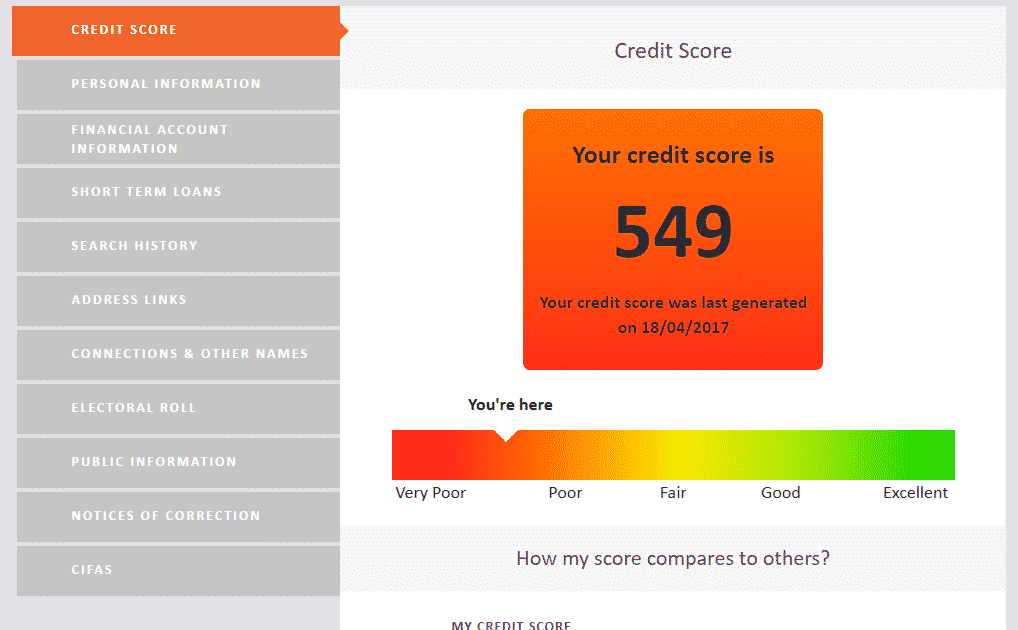

Whats A Good Or Average Credit Score

We consider a âgoodâ score to be between 881 and 960, with âfairâ between 721 and 880. However, thereâs no âmagicâ number that will guarantee lenders will approve an application if you apply.

If your credit score is poor, youâll probably find it harder to borrow money or access certain services. We consider a âpoorâ score to be between 561 and 720, with âvery poorâ between 0-560. But remember, lenders may have different views of what an ideal customer looks like to them, which will be reflected in how they calculate your credit score.

Your free Experian Credit Score is intended as a useful guide to give you an idea of how lenders may view your credit history. Knowing your score can help you make more informed choices when it comes to credit.

You May Like: Itin Number Credit Score

How To Establish And Build Business Credit

Start establishing a business credit history by legally registering your business and getting an employer identification number from the IRS. Open business bank accounts, leases, utility services and other accounts in your businesss name, rather than your own.

You can begin to build business credit by making moves such as getting a business credit card and requesting trade credit from suppliers, then making your payments on time. For these payments to help your business credit score, youll need to work with companies that report to business credit bureaus. Not all of them do, but companies are often willing to do so if you ask.

As with personal credit, paying your creditors on time is key to improving your business credit score. You should also check your business credit score regularly, making sure the information in your credit report is correct and current.

Clearscore* Free Access To Your Monthly Equifax Credit Report

What you get: Clearscore* provides free Equifax credit scores and reports, updated once a month, and also has an eligibility checker. Clearscore’s services are free for life.

Clearscore sometimes needs basic details about which bank you’re with in order for you to sign up. For instance, Clearscore might ask you to confirm the first two digits of your banking sort code and last six digits of your account number. These details are only used to match you to your credit report and are not saved.

You can also earn up to £6 for signing up if you’re new to Clearscore and sign up via this Topcashback* link.

How to cancel: Go to your ‘My Account’ page, and click on ‘Delete My Account’, you’ll be sent an email to confirm your cancellation request has been processed.

Or alternatively…

Recommended Reading: How To Delete Inquiries Off Credit Report

Get Your Credit Score

A lender will use your credit score to determine if they will lend you money and how much interest they will charge you to borrow it. Your credit score is a number calculated from the information in your credit report. It shows the risk you represent to a lender compared to other consumers.

Knowing your credit score before a major purchase, such as a car or a home, may help you to negotiate lower interest rates.

You usually need to pay a fee when you order your credit score online from the two credit bureaus.

Some companies offer to provide your credit score for free. Others may ask you to sign up for a paid service to see your score.

Make sure you do your research before providing a company with your information. Carefully read the terms of use and privacy policy to know how your personal information will be used and stored. For example, find out if your information will be sold to a third party. This could result in you receiving unexpected offers for products and services. Fraudsters may also offer free credit scores in an attempt to get you to share your personal and financial information.

Always check to see if a website is secured before providing any of your personal information. A secured website will start with https instead of http.

Errors On Your Credit Report

If you find errors on your credit report, write a letter disputing the error and include any supporting documentation. Then, send it to:

Find a sample dispute letter and get detailed instructions on how to report errors.

The credit reporting agency and the information provider are liable for correcting your credit report. This includes any inaccuracies or incomplete information. The responsibility to fix any errors falls under the Fair Credit Reporting Act.

If your written dispute does not get the error fixed, you can file a complaint with the Consumer Financial Protection Bureau .

Also Check: Zzounds Paypal

Difference Between Credit Reports And Credit Scores

While your credit score and credit report are related, they’re not the same thing. Your credit score is a single three-digit number that signals your credit health to lenders and creditors. Your credit report doesn’t include your credit score. The report, which includes credit activity, is used to calculate your credit score.

Why Are Experian Cir And Credit Score Important

The Experian Credit Score and Credit Information Report reveal your past credit history and creditworthiness to get a credit card or loan approval. If you have a high Experian score, your chances of loan approvals are higher. Moreover, a high Experian credit score helps you get a loan at a lower interest rate and better terms.

Recommended Reading: Does Acima Build Credit

Does Experian Boost Have Any Downsides

There have been some reports of consumer scores going down after using Experian Boost, yet these accounts dont seem to be associated with the tool itself. Everhart and Felice-Steele confirmed that Experian Boost only reports positive payments to credit reports, so the addition of new bills will ultimately improve ones credit score or be neutral.

Ulzheimer says that if someone uses Experian Boost and their credit score drops, its due to other credit factors. For example, they may have closed a credit card in the same timeframe, resulting in a sudden increase in their .

He points out that users also have the power to instantly add and remove bills through Experian Boost, so you can shut it off and have the tradelines removed any time you want.

However, Ulzheimer notes that theres an intermediary company involved with Experian Boost called Finicity. Finicity goes into your bank account and grabs all the information that is converted to a tradeline for Boost.

That is what goes on your credit report, Ulzheimer says. Ultimately, this means you have to be comfortable letting Finicity get into your bank accounts and see all your information.

Users should also know that, while incredibly useful in some cases, Experian Boost has some serious limitations.

Your Free Experian Membership Includes:

- A new Experian Credit Report and FICO® Score every 30 days on sign in.

- Experian Credit Monitoring Alerts: Includes new inquiries, new accounts, public records, fraud alerts, and personal information updates when added to your Experian credit report.

- Need to update something on your report? You can submit and track a dispute online for free.

Recommended Reading: How Long Before Eviction Shows On Credit Report

How Experian Go Works

If you’re interested in the program, you can sign up for a free account here. When creating a new account, you’ll be asked to authenticate your identity using a government-issued ID, Social Security number and a photo of your face.

Technically, there are two parts to how this all works: Experian Boost and Experian Go. Launched in 2019, Experian Boost let’s you add cell phone, utility or video streaming bill payments directly to your Experian credit report. Experian Go allows users to create new credit reports from scratch, and offers personalized recommendations for which accounts to add, using Experian Boost.

There’s no difference between an Experian Go-generated report and the traditional reports that Experian already offers, according to a company spokesperson: “To a lender, it will look just like any other Experian credit report.”

Based on the results of a targeted soft launch of Experian Go in October, Experian says that 15,000 users were able build a credit report within minutes. The company says that for those that used Experian Boost, the average starting FICO Score was 665, which is considered a “fair” score. Experian did not immediately respond to a request for additional information.

Your Equifax Credit Score

Equifax also lets you check your credit score and credit history by registering for a 30-day free trial of their subscription service. As with the other CRAs, you should check their terms and conditions carefully. And if you choose to continue with the service beyond the trial period, a fee would apply. You can also access your Equifax credit score and credit history without fees or subscribing to any service through Clearscore.

You May Like: Check My Rental History Free

How Can I Check Credit Scores

Reading time: 2 minutes

Highlights:

-

You may be able to get a credit score from your credit card company, financial institution or loan statement

-

You can also use a credit score service or free credit scoring site

Many people think if you check your credit reports from the three nationwide credit bureaus, youll see credit scores as well. But thats not the case: credit reports from the three nationwide credit bureaus do not usually contain credit scores. Before we talk about where you can get credit scores, there are a few things to know about credit scores, themselves.

One of the first things to know is that you dont have only one credit score. Credit scores are designed to represent your credit risk, or the likelihood you will pay your bills on time. Credit scores are calculated based on a method using the content of your credit reports.

Score providers, such as the three nationwide credit bureaus — Equifax, Experian and TransUnion — and companies like FICO use different types of credit scoring models and may use different information to calculate credit scores. Credit scores provided by the three nationwide credit bureaus will also vary because some lenders may report information to all three, two or one, or none at all. And lenders and creditors may use additional information, other than credit scores, to decide whether to grant you credit.

So how can you get credit scores? Here are a few ways:

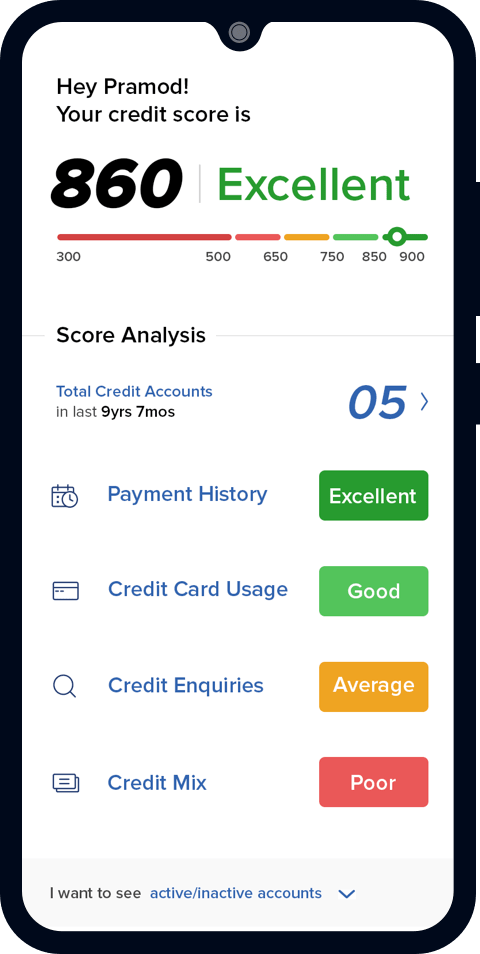

What Does Experian Credit Score Mean

Experian credit score is a numeric summary derived based on a consumers credit history of existing and previous loans/credits taken and the enquiries received from banks and financial institutions. In addition to all the information available on Experian CIR, you can also find this three-digit that represents the entire report. A higher score states that you are good to get a new credit facility makes it more favourable for lenders to trust you with their money. A lower score can be improved if repayments are made on time.

Also Check: Factual Data Hard Inquiry

Your Transunion Credit Score

TransUnion is the second largest credit reference agency in the UK. It used to be known as Callcredit. You can check your TransUnion credit score by going to Noddle. You can also access your TransUnion and Equifax credit reports at the same time by registering for a 30-day free trial of CheckMyFile. Just make sure you have a look at their terms and conditions before you register. And if you want to continue with their service beyond the 30 days, a monthly fee would apply.

Alternate Credit Scores Launched By Lexisnexis

On 9 February, LexisNexis Risk View Spectrum and Risk View Optics were unveiled by LexisNexis Risk Solutions. Risk View Spectrum and Risk View Optics are FCRA-compliant credit scores that offer a larger view on consumer credit worthiness. The new tools that are used can improve financial inclusion by finding out more credit-worthy consumers. Over 90% of individuals who do not have a regular credit score can get a score from Risk View Spectrum and Risk View Optics. Lenders can provide better offers to individuals whose credit scores are from Risk View Spectrum and Risk View Optics.

10 February 2021

You can check your credit score from many sources, including Experian. Learning what your credit scores mean and what affects them can help you when youre getting ready to apply for new credit.

Lenders use credit scores to decide how likely it is you will repay your debts on time. There are hundreds of credit scoring models in existence, though the FICO® Score is the most common. The higher your credit scores, the better offers you are likely to receive from lenders in the form of lower interest rates and other favorable terms.

You May Like: Credit Report With Itin

How Can I Improve My Credit Score

The following sections should make it abundantly clear that maintaining a good credit score is imperative if you wish to satisfy your financial requirements. Clix Capital recommends the following actions for you to undertake if youre aiming to increase your credit score.

- Regular payments are a must. Regardless of what your dues might be credit card bills, loan EMIs, or anything else along the same lines make sure that you never default on your payments.

- Manage your credit wisely. Plan out your finances and take loans accordingly. Being careless when it comes to taking loans and issuing credit cards wont just be bad for your credit score itll also prove to be highly detrimental for your financial status in the long run.

- Make it a habit to track your credit score regularly. This will help you map out your credit behaviour, identify any problems that might be negatively affecting the same, and get any mistakes corrected if they arise.

- Keep your credit utilisation ratio in control. Exceeding 30%-40% of the limit on your credit card is not recommended. Its also important to avoid having multiple outstanding unsecured loans or credit cards.

Benefits Of Attaining Your Experian Credit Report

If you wish to avail credit, your credit history will play a crucial role in helping lenders determine whether or not you are a safe bet. Credit history also helps in determining the terms, conditions and interest rates that may be available to you. Moreover, the fact that lenders can also access your credit report means that it is an essential factor in your hopes of taking out loans or credit.

The Experian credit report helps you gain a fair understanding of your credit history, thereby allowing you to cease control of your finances and helping you make informed decisions that can help you remain protected from contingencies such as identity theft.

Don’t Miss: Is Paypal Credit Reported To The Credit Bureaus

Checking Your Credit With An Itin Number

Contrary to popular belief, you do not need a Social Security number to check your credit or open a bank account. You can use an ITIN for a too. Social Security numbers are merely a way to identify a person, but they are not the only way.

An ITIN is issued to residents with foreign status or undocumented immigrants, while a Social Security number is issued to U.S. citizens and authorized non-citizens. Thats the only significant difference between the numbers, so in many cases, an ITIN can be used in place of a Social Security number.

Check Experian Score Through Experian Website:

You can check your Experian score on its official website. Just visit the website and click on the Get Your Report Tab. It will then open a new tab where you need to enter your Name, Email, and Mobile number and verify it with OTP. Now enter your DOB, PAN card number, address, and click on the Get Report button.

You can download the report in both HTML and PDF format. The whole process takes less than 5 min and doesnt require any app downloads. The good thing is that you dont need to pay any charges to know your Experian score even on its official website. You can know your comprehensive consumer credit information on the Experian website.

Also Check: Navy Federal Credit Score For Auto Loan

Request Your Free Medical History Report

You have the right to get one free copy of your medical history report, also known as your MIB consumer file, each year. You can request a copy for:

- Yourself

- Someone else, as a legal guardian

- Someone else, as an agent under power of attorney

You can request a medical history report online from MIB or by phone at 1-866-692-6901.

Not everyone has a medical history report. Even if you currently have an insurance plan, you wont have a report if:

- You havent applied for insurance within the last seven years

- Your insurance policy is through a group or employer policy

- The insurance company isnt a member of MIB

- You didnt give an insurer permission to submit your medical reports to MIB