Review The Results Of The Investigation

The credit bureau involved must provide you with results of the investigation in writing and also a free copy of your credit report if the dispute results in a change to that report. The credit bureau must also provide you with the name, address and phone number of the furnisher that reported the incorrect information.

If a furnisher continues to report a disputed item, it is required to notify the credit bureau involved about your dispute. If the disputed information is found to be inaccurate, the furnisher must tell the credit bureau to update or delete the item. The furnisher must also notify all the credit bureaus to which it sent the incorrect information so that the bureaus can correct their records.

Even if the furnisher insists that the disputed information is accurate, you can still request that the credit bureau include a statement in your credit file explaining the dispute.

Dispute Mistakes With The Credit Bureaus

You should dispute with each credit bureau that has the mistake. Explain in writing what you think is wrong, include the credit bureaus dispute form , copies of documents that support your dispute, and keep records of everything you send. If you send your dispute by mail, you can use the address found on your credit report or a credit bureaus address for disputes.

Equifax

What Is A Pay

A pay-for-delete letter is when you offer to settle a balance on a negative account in exchange for the debt being deleted from your credit report. The creditor or debt collector is not obligated to agree to your request, but it may be worth sending the request. If you’re sending the request to a collection agency, you’ll need to offer enough for it to be profitable for them to settle. There’s no way to know how much that is, though. If you’re close to the seven-year mark for the item to fall off your credit report, it may not be worth sending a pay-for-delete letter.

Recommended Reading: Does Paypal Credit Report To The Credit Bureaus 2019

Ask The Experts: Dealing With Disputes

For a greater understanding of the credit report dispute process, we asked a panel of credit experts to weigh in on the following questions. You can meet our panel and read their responses below.

Send Your Credit Dispute Letter

You shouldnt just throw these into an envelope and then toss them into the mail.

You need a way to verify if and when they received the letters so that you can be sure that the investigation was completed in a timely manner .

So be sure to take these to the post office and send these as Certified Letters return receipt requested.

Once they receive the items you will be notified that they have received the certified letters. This helps you keep track of things, as mentioned above.

What Happens Next

It will take about 30 days before you receive a response from the credit bureaus, although it could be less or more. Be patient, but dont lose track.

Your response will be that they deleted all the item, some of the items or none of the items. If they deleted all of them, youre done. You need not do anything more from here. Congratulations!

Youve completed the task and will only re-open the investigation if you do contact them regarding errors already deleted. We dont want that, obviously. No need to contact them again if they deleted all of the items.

If they deleted some of them or none of them, then its time to get back to work. Now we can send a new letter regarding the items that were not deleted .

Note: You can move directly to the Method of Verification letter or send out a similar letter to the original. The MoV will have more of a positive effect for you, but if youre patient enough sending out a second letter may be easier.

This right states that:

Full Name

You May Like: What Is Aoc Credit Score

Dispute Your Credit Reports Errors

Under the Fair Credit Reporting Act, both the credit reporting bureau and the company that reports the information about you to the credit bureau are required to accept disputes from consumers and correct any inaccurate or incomplete information about you in that report.

The U.S. Federal Trade Commission recommends taking these actions:

- Tell the credit bureau, in writing, what information you think is inaccurate. The Federal Trade Commission provides a sample dispute letter that makes this step easier. The letter outlines what information to include, from presenting the facts to requesting that the error be removed or corrected.

- Include copies, not originals, of materials that support your position.

- Consider enclosing a copy of your credit report with the errors circled or highlighted.

- Send your letter by certified mail with return receipt requested to ensure the letter is delivered. Keep your post office receipt.

- Keep copies of everything you send.

What Documents Do I Need To Submit

When you file a dispute, you’ll need to provide some documentation. What you will need to provide depends on what information you are disputing. Here are some examples of the types of documents we may need copies of during our investigation:

Personal information

- One piece of government-issued ID confirming your name, date of birth, and/or address

- Birth certificate

- Document confirming the name and address on the ID

Account information

- Current bank statements with account information

- Letters from a creditor supporting your claim

- Proof that an account was created through or impacted by identity theft

Other information

- Bankruptcy discharge or other court documents

- Release letters from lenders, collection agencies or satisfaction of judgment

Read Also: Paypal Credit Affect Credit Score

Errors On Credit Reports Could Include

- Identity-related errors such as a misspelled name, wrong phone number or address, or your information incorrectly merged with another persons credit record

- Incorrectly reported accounts, such as a closed account reported as open or an account wrongly reported as delinquent

- Account balance and credit limit errors

- Reinsertion of inaccurate information after its corrected

What To Do If You Disagree With The Outcome Of Your Dispute

If you don’t agree with the results of your dispute, here are some additional steps you can take:

- Contact the information source. Your best next step is to contact the entity that originally provided the disputed information to Experian and offer proof their information is incorrect. The source may be the lender or financial institution that issued you a loan or credit, but it could also be a collection agency or government office. Contact information for each source appears on your credit report, and you can use it to reach out to them.

- Add a statement of dispute to your credit report. A statement of dispute lets you explain why you believe the information in your credit report is incomplete or inaccurate. Your statement will appear on your Experian credit report whenever it’s accessed or requested by a potential lender or creditor, so they may ask you for more details or documentation as part of their review or application process. To add a statement of dispute, go to the Dispute Center, choose the item in dispute, and select Add a Statement from the menu of dispute reasons.

- Dispute again with relevant information. If you have additional relevant information to substantiate your claim, you can submit a new dispute. If you’re filing the dispute online, follow the steps listed above for using the Dispute Center, and use the upload link to provide your supporting documentation.

Read Also: How Do I Unlock My Credit Report

How To Get A Closed Account Off Your Credit Report

Many people close credit accounts they no longer want, thinking that doing so removes the account from their credit report. The Fair Credit Report Actthe law that guides credit reportingallows credit bureaus to include all accurate and timely information on your credit report. Information can only be removed from your credit report if it’s inaccurate or outdated, or the creditor agrees to remove it.

What Kind Of Incorrect Information Can Be Displayed In A Credit Report

There are unfortunately a range of errors that could crop up in your credit report.

For example, if you received a County Court Judgement and settle it within the required time, it’s supposed to come off your record. However, in recording that information one of the credit reference agencies in theory might make an administrative error or have not received that information from the creditors.

It’s worth noting, however, that these types of errors are rare. Even so, it’s important to check your credit report, as the consequences could be severe if an error has been sitting there for a long time.

Other errors could be a missed bill payment that you managed to pay on time, or even a credit card’s activity being completely unrecorded, thus giving the impression that you have no financial history.

Recommended Reading: How To Remove Hard Inquiries In 24 Hours

Know Which Credit Report Errors You Can Dispute

Technically, you can dispute anything, but the credit bureau will do an investigation and only delete items that the law requires it to delete. You can dispute credit report items that are inaccurate, incomplete, out of date, or that you believe cannot be verified. Negative items, except bankruptcy, should only appear on your credit report for seven years bankruptcy can remain for 10. If you have negative entries older than seven years, you can dispute them.

Other things you can dispute include:

- Payments reported late that were actually on time

- Accounts that arent yours

- Inaccurate credit limit/loan amount or account balance

- Inaccurate creditor

- Inaccurate account status, for example, an account status reported as past due when the account is actually current

Is It Better To Pay Off Collections Or Wait

From the viewpoint of repairing your credit score, its better to pay off a collection sooner rather than later, assuming you can afford to do so. However, a paid collection will only help your credit score if the collector agrees to remove the item from your credit report. Short of that, paying off a collection may have no effect on your credit score.

As explained above, you may have bargaining leverage with a collection agency. This manifests when you submit a pay for delete letter that offers to pay the debt in return for removing the collection item from your credit report. Your offer may be for the full amount owed, but you can request a partial write-down of the balance due.

For example, suppose you had a $10,000 credit card balance and were unable to make payments. Eventually, the card issuer wrote off your account and sold it to a collection agency for 20 cents on the dollar. The issuer collected $2,000, which means the collection agency must collect at least that much just to break even.

The fact that your original debt was $10,000 may be less important to the collector than to the credit card issuer. If the collector were to collect, say, $4,000 on the debt, it would rack up a gross profit of 100%. Therefore, the collector may be willing to accept a pay to delete deal.

That is, a higher score will improve your access to credit and lower the amount of interest youll be charged. A higher credit limit will reduce your credit utilization ratio.

Recommended Reading: Remove Eviction From Public Record

How To Remove Disputes From Your Credit Report

When you get a mortgage you cant have disputes open. The dispute process lasts approximately 30 days, however, they arent always closed automatically after the 30-day window has passed.

When you dispute an account on your the Credit Bureau adds a comment that you disputed the accuracy of that account. That dispute notation can remain on your credit report long after the dispute is completed. Before you close on a mortgage you must have the credit bureau remove the dispute comments from the reports on your account.

One: Obtain A Recent Copy Of Your Credit Report

In order to dispute an item on your credit report, youll need to prove to the powers that be that your credit report is inaccurate. To do so, youll want to have a copy of your credit report handy. Consumers are entitled to one free credit report each year from each of the three main credit reporting agencies, which you can access through AnnualCreditReport.com. Or if youre a Mint user, you can easily view your credit score in the Mint app whenever you please!

Once youve got your credit report in front of you, pull out that red pen of yours and notate any items on the report that are inaccurate or with which you do not agree.

Also Check: Syncb Zulily Credit Card

How Do I Fix An Error On My Credit Report

If you do find an error in your credit report, it’s important to dispute credit report discrepancies quickly:

-

Your first port of call should be the provider or creditor the error was associated with. So if your credit card company recorded that you missed a payment and you want to dispute that, call up the credit card company.

-

You should obviously have some evidence of the error being in fact an error, so any receipts or statements will be useful.

-

If the credit card company agrees that it was an error, they have to update their records within a one-month period, and this update goes out to the credit reference agency.

-

However, if the credit card company says that they have no record of the error and everything is correct on their side, then speak to the credit reference agency.

-

They will review the error and make the relevant changes after an investigation into the dispute.

-

You should then also check your credit report with the other credit reference agencies to ensure that they too do not have the same error.

Unfortunately, as the process above suggests, most of the leg work falls onto the consumer. It can seem unfair if an error that’s not your fault is recorded, especially if you then you have to chase up the issue. But, if you notice a mistake, dispute it so it can be corrected if possible.

Unfortunately, the pressure to fix credit report errors falls on the consumer, not the agency or creditor

Work With A Credit Counseling Agency

Several non-profit credit counseling organizations, like the National Foundation for Credit Counseling , can help dispute inaccurate information on your record.

The NFCC can provide financial counseling, help review your credit history, help you create a budget and even a debt management plan free of charge. It also offers counseling for homeownership, bankruptcy and foreclosure prevention.

As always, be wary of companies that overpromise, make claims that are too good to be true and ask for payment before rendering services.

When looking for a legitimate credit counselor, the FTC advises consumers to check if they have any complaints with:

- Your states Attorney General

- Local consumer protection agencies

- The United States Trustee program

Don’t Miss: Check Credit Score With Itin Number

How Does Disputing An Error Affect Your Credit Score

The information on your credit report informs your credit score. Disputing an error wont impact your credit score unless the dispute leads to an error being removed, which will improve your credit score. In other words, the act of disputing alone wont hurt or improve your credit score: Its the investigation results that matter.

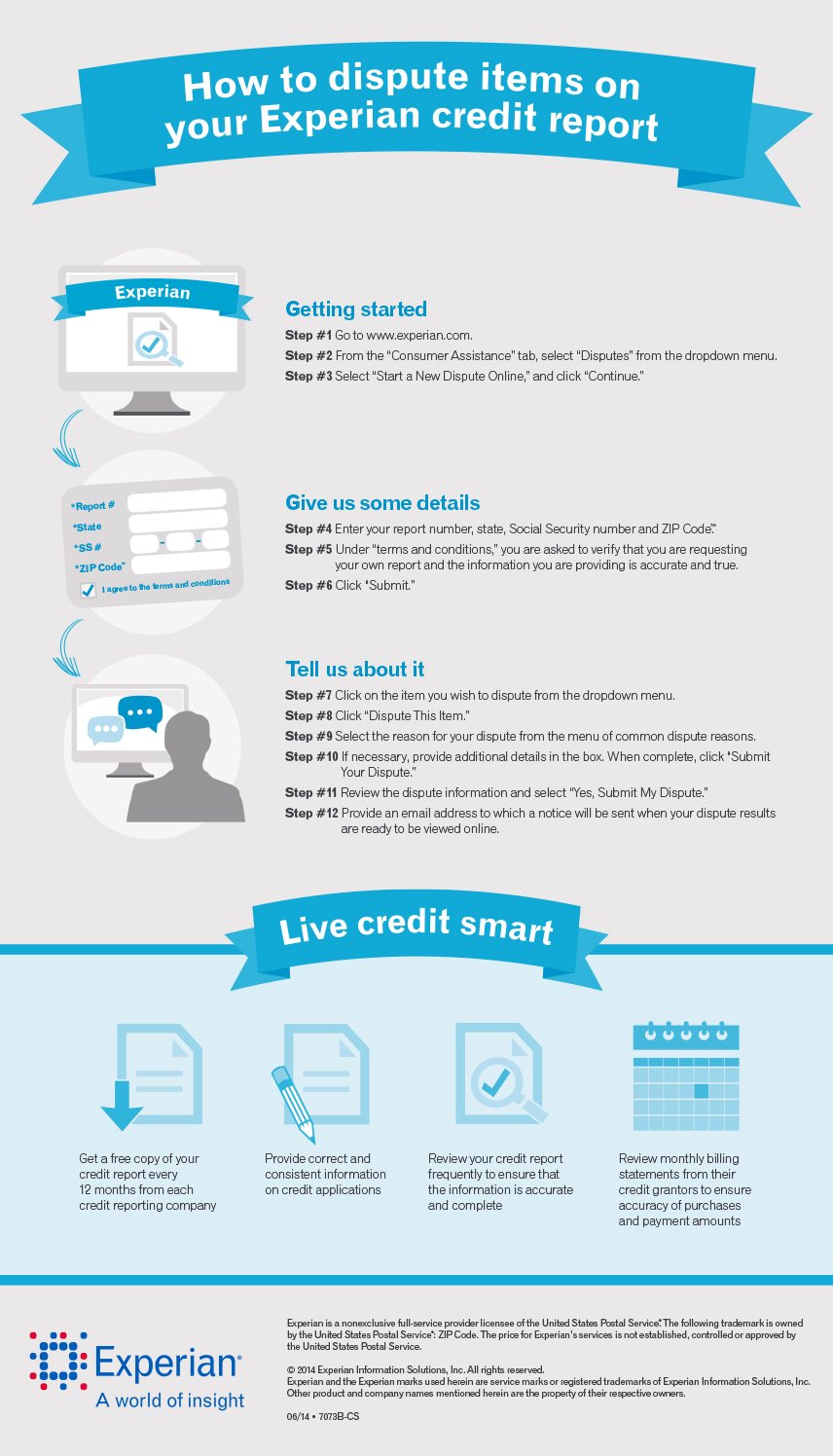

File A Dispute With The Credit Reporting Agency

Once you have your report, make sure to look through each account and see if there are creditors you dont recognize. Its also important to check whether older derogatory items are still being reported.

If you do find errors in your reports, its time to initiate a dispute directly with the reporting bureau through its website or by mail. This will prompt an investigation on the bureau’s part.

Bear in mind that you have to dispute the entry with each agency to make sure the removal is complete across the board.

How to file a dispute online

Each bureau Equifax, Experian and TransUnion has a section dedicated to walking consumers through the online dispute process. Once you create an account, you can file as many disputes as you need and check their status, for free.

How to file a dispute letter

You can also send a dispute letter to the bureaus, detailing any inaccuracies you’ve found in your credit file. When writing your letter, provide documentation that supports your claim and be precise about the information you are challenging. The Consumer Financial Protection Bureau recommends enclosing a copy of your report with the error circled or highlighted.

Depending on the information being disputed, these are some of the documents you can provide to help aid the investigation:

- Copies of checks

Include this dispute form with your letter.

You May Like: Can I Check The Credit Report Of A Deceased Person

Hire A Credit Repair Service

Disputing errors can be a time-consuming process, especially if your history has several mistakes or if you were a victim of identity theft. Reputable credit repair companies such as , Lexington Law or Sky Blue may be viable solutions if your file is riddled with inaccuracies.

Credit repair services can help you dispute inaccurate negative information and handle creditor negotiations. However, if you decide to hire a credit repair agency, bear in mind that there are consumer protection laws regulating how they operate and what they can do. The establishes the following regarding credit repair services:

- They cannot provide false or misleading information concerning a persons credit status and identification

- They must provide a detailed description of the services they provide

- They cannot charge for their services until they has been completed

- There must be a written contract detailing the services theyll provide, the time frame in which these services will be provided and the total cost for them

- They cannot promise to remove truthful information from your record before the term set by law

- You have three days in which to review the contract and cancel without penalty

Before signing up with one of these companies, its important to understand what they can and cannot do. For example, any company that promises to remove accurate negative items or create a new credit identity for you is most likely engaging in illegal practices or a scam.