Fraud Alert Frequently Asked Question

No. Federal law requires that the company that you contact to place your alert must tell the other two nationwide companies and, they, in turn, will place an alert on their versions of your report.;

Innovis is not a nationwide credit reporting agency and must be notified separately.

Whats The Purpose Of My Credit Report

Your credit report shows your credit history and tells a story of your financial health and responsibility to potential lenders like credit card companies, banks, and often even landlords and cell phone companies. Credit reporting empowers you to participate in the credit economy and have potential offers of credit extended to you.

Some Credit Cards Have A Different Interest Rate For Overdraft Cash Advances And Atm Cash Advances Check Your Credit Card Terms For Exact Pricing

When your overdraft is connected to a line of credit, you risk paying fees on the overdraft if you don’t pay the balance before the grace period runs out . If you already have a balance on your line of credit, the overdraft would just be added to your current balance.

If you don’t have enough available credit on your credit card or line of credit, your credit card issuer may decline the transaction. You might be charged an overdraft fee anyway.

Read Also: Can You Remove Hard Inquiries Off Your Credit Report

Are There Personal Loan Options For F

There are a few possibilities for OPT visa holders to obtain personal loans, both secured and unsecured, though the options are few.

Your bank may be willing to offer you a short-term personal loan as long as your salary, monthly expenditures, and fledgling credit history are in order. Other local institutions arent likely to extend such an offer.

Additionally, new service providers aimed at providing international graduates and immigrants with fair access to financial products may be able to assist you. While there are only a handful of such providers, they may be your best bet if you need access to funds to establish yourself in the United States.

How To Get Your Ssn With Your Opt Extension

Having a Social Security Number makes living in the US easier. And if youre following the visa track from F-1 to Green Card status, obtaining your OPT visa is the first chance youll have to apply for your SSN.

Social Security Numbers are used to report your earnings to the relevant government departments. In this way, it functions as a tax identification number. Having an SSN implies that you have the right to work in the US, but in and of itself, it doesnt confer the right to work. SSNs also have little to do with your current visa or future ability to remain legally in the country.

Once you have your SSN number, it will also be easier to obtain credit in the US. While this number doesnt unlock the full range of financing open to American citizens and permanent residents, you dont need to wait on your SSN to begin looking at your options.

Recommended Reading: Does Zzounds Report To Credit Bureau

What Does The Credit Information Mean

Each creditor uses its own credit evaluation standards

If you are looking at your credit report now, you may be trying to determine why you just got turned down for that loan for which you recently applied. Alternatively, you may intend to apply for a loan and want to see how your credit looks. In either case, you have the report and you can read the information, but you probably want to know what it means. You want to know whether you are credit-worthy or not.

Each creditor has its own system. Some use credit scoring, and some dont. Some have severe credit standards, whereas others are more flexible. Some even make loans to consumers who have recently filed for bankruptcy. It is difficult to know what any one creditor looks for or what they see when they look at your credit report. Your credit-reporting agency doesnt even know. However, there are some general rules of thumb.

A history of late payments and bad debts means you are a high-risk borrower

The three major credit-reporting agencies provide information about payment performance over the last 12 to 24 months. Charge-offs and judgments up to seven years old may appear on your credit report. Generally, this is bad.

If you have a history of late payments and/or bad debts, it means you are a high credit risk. The lender figures that it will have to wait for its money, work hard to get its money, or not get its money at all. Therefore, the lender is unlikely to give you the benefit of the doubt or the loan.

Gather Materials & Documents To Dispute Errors

Before you submit your dispute, you should gather the personal information and documents the credit bureau or creditor may need to investigate your claim.

When you open a dispute, you may be asked for the following personal information:

- A copy of your drivers license or government-issued ID

- SSN

- Your current address and addresses for the past two years

In addition, you may be asked for the following documentation to support your dispute:

- Federal Trade Commission Identity Theft Report or a police report if an account has been added as a result of identity theft

- Billing statements

- Canceled check or money order stub showing a bill has been paid

You May Like: Does Speedy Cash Report To Credit Bureaus

Am I Eligible For Child Tax Credit Payments If I Didn’t File Taxes This Year

It’s not too late for low-income families to sign up for advance child tax credit payments. The child tax credit Non-Filer Sign-Up Tool;is a way for those who aren’t required to file a tax return to give the tax agency basic information on their dependents. This tool can be used by low-income families who earn too little to have filed a 2020 tax return but who need to notify the IRS of qualifying children born before 2021.

With the nonfiler tool, you’ll be able to electronically file a simple tax form with the IRS with enough information for the agency to determine your family’s eligibility for the advance child tax credit payments. You shouldn’t use this tool if you are required to file a tax return but just haven’t yet. Also, don’t use this tool if you actually filed a 2020 tax return or if you claimed all your dependents on a 2019 return.

To use the tool, families must have had a primary residence in the US for more than half the year. To register, parents should have their personal details on hand, including an email address, Social Security numbers for dependents and a bank account routing number.;

The IRS provides some guidance on how to fill out the form as a nonfiler. Note that it can take up to 48 hours for the IRS to confirm your email address — and another 48 hours after submitting your information for the IRS to accept it.

1. To get started, create an account;if you don’t yet have one. You’ll need an email address to confirm your information.

Financial Information In Your Credit Report

Your credit report may contain:

- non-sufficient funds payments, or bad cheques

- chequing and savings accounts closed for cause due to money owing or fraud committed

- bankruptcy or a court decision against you that relates to credit

- debts sent to collection agencies

- inquiries from lenders and others who have requested your credit report in the past three years

- registered items, such as a car lien, that allows the lender to seize it if you don’t pay

- remarks including consumer statements, fraud alerts and identity verification alerts

Your credit report contains factual information about your credit cards and loans, such as:

- when you opened your account

- how much you owe

- if your debt has been transferred to a collection agency

- if you go over your credit limit

- personal information that is available in public records, such as a bankruptcy

Your credit report can also include chequing and savings accounts that are closed for cause. These include accounts closed due to money owing or fraud committed by the account holder.

You May Like: Does Paypal Credit Report To Credit Bureaus

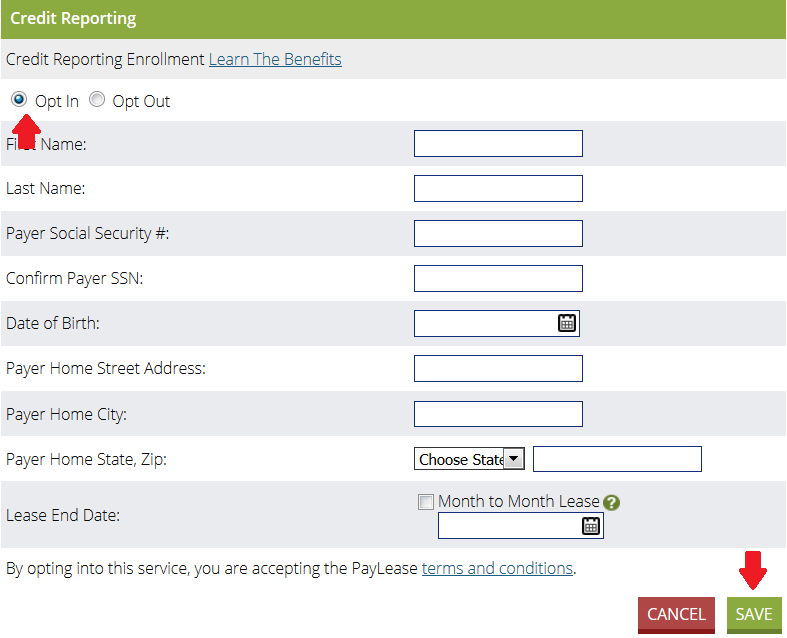

When You Can Say No

California law lets you tell your bank and other financial companies that you do not want them to share your personal financial information in some cases. You can say no to, or opt out of, having your information shared with outside companies that offer financial products or services. You also have the right to opt out of some information sharing with some companies owned or controlled by your financial company .5

How Can I Verify That My Family Qualifies

The new;Child Tax Credit Eligibility Assistant;allows families to answer a series of questions to quickly determine whether they qualify for the advance credit. This can be helpful for families who haven’t received a letter from the IRS confirming their eligibility. The tool is now available in multiple languages, including Spanish.

Read Also: Aargon Collection Agency Bbb

What Is Credit Card Preapproval

Card companies then send out mailers to those consumers letting them know they’ve been preapproved and inviting them to apply for a card. Consumers aren’t approved for the card until they apply and the card issuer checks their credit report and score. This is a hard inquiry, which means it’s a credit check that impacts a credit score.

Whats A Prescreened Or Preapproved Offer Of Credit Or Insurance

Sometimes you might get offers for credit cards or insurance that say you’ve been prescreened or prequalified. You get these offers because of information in your credit report.

Heres how it works: the credit card or insurance company decides what it takes for people to qualify for their products. They base their decision on information in peoples credit reports, like their borrowing history or credit score. Then the company asks a credit bureau like Equifax, Experian, Transunion, or Innovis to give them a list of people in their databases whose credit reports show that they meet those requirements. They also might give the credit bureau a list of potential customers and ask them to identity the people who meet their requirements.

You May Like: Does Opensky Report To Credit Bureaus

What You Should Know About An Opt Visa Extension

Who can apply for an OPT visa? F-1 visa holders.

What can you do with an OPT visa? You get the right to remain in the US to look for and secure paid employment in the field of study for a limited duration, as well as the right to obtain a social security number .

What cant you do with an OPT visa? You may not undertake work outside your field.

How long does the OPT visa last? Eligible students have a total of 12 months to use their OPT work authorisation; an additional 24 months is available for many STEM degrees.

When can you apply for an OPT visa extension?

- For pre-completion OPT: As early as 90 days before finishing your first academic year.

- For post-completion OPT: Up to 90 days before degree completion or up to 60 days after degree completion.

- For science, technology, engineering, and math extensions: Up to 90 days before the initial OPT expires.

Although the F-1 visa doesnt allow you to undertake off-campus work, youre likely to find your university has several avenues through which you can gain work experience or exposure during this time in the form of internships or other non-compensated positions.

In addition, universities are often able to offer limited on-campus work opportunities as these are considered financial aid rather than employment. That said, you shouldnt expect that youll secure one of these spots because not every programme offers them, and those that do often have more students than jobs to fill.

Can I Opt Out Of Getting These Credit And Insurance Offers

Yes. You can decide that you don’t want to get prescreened offers of credit and insurance in the mail. If you want to opt out of those offers, you have two choices:

- opt out for five years

- opt out permanently

To opt out for five years: Go to optoutprescreen.com or call 1-888-5-OPT-OUT . The major credit bureaus operate the phone number and website.

To opt out permanently: Go to optoutprescreen.com or call 1-888-5-OPT-OUT to start the process. To complete your request, youll need to sign and return the Permanent Opt-Out Election form once youve started the process.

When you call or visit optoutprescreen.com, theyll ask for your personal information, including your name, address, Social Security number, and date of birth. The information you give is confidential and will be used only to process your request to opt out.

Also Check: Aargon Agency

Consumer Wants To Opt Out Of Having A File At Equifax Other Bureaus: Money Matters

Q: Here’s something I was wondering about after the Equifax data breach. Can one opt out of having a file kept by the credit bureaus? Has anyone ever posed this question before, or is it the product of the strange workings of my mind?M.B., Sandusky

A: You are not the first person to ask me this. But you cannot opt in or out of the credit bureaus keeping files on you. Might be nice, though.

The bureaus compile information provided by banks, other creditors, public records, etc. The bureaus don’t need your permission to gather this because you’ve already given your permission to banks, credit card issuers, etc., so they can provide your information to the bureaus when you opened your account. It’s in the fine print. It’s also in the privacy policies you get from your creditors, etc., once a year.

This is one of the reasons people should read the privacy policies they receive. You learn a lot.

Below is some information from one local bank, PNC, just as an example. The wording is nearly identical among all creditors when you apply for a loan or open a credit card:

“Federal law gives consumers the right to limit some but not all sharing. Federal law also requires us to tell you how we collect, share, and protect your personal information . . .” PNC’s written privacy policy says. “The types of personal information we collect and share depend on the product or service you have with us. This information can include:

Have a question or comment?

What Are Each Of The Irs Child Tax Credit Tools For

The online tools are useful for a variety of reasons. Here’s how they help parents with eligible dependents:;

- The;Child Tax Credit Update Portal;lets you verify that your family qualifies for the credit and opt out of receiving any payments in 2021. You can use it now to view your payment history and provide the IRS with your current mailing address and bank details.;

- A;nonfiler portal;lets you provide the IRS with basic information about yourself and your dependents if you normally aren’t required to file a tax return. The tool is intended to help low-income households register for the payments.

- The;Child Tax Credit Eligibility Assistant;can help you determine whether you qualify for the advance child tax credit payments. The interactive tool is now available in Spanish and other languages.;

What other toolkits and resources are available now? The IRS regularly updates its;child tax credit FAQ page;and has a;PDF;with details on the portals. The White House has launched a;website for the child tax credit;that provides information for families, details about eligibility and more downloadable information.

The 2021 enhanced child tax credit is a financial boost for many families but for others it could spark worries about messy taxes.

Recommended Reading: Can You Remove Hard Inquiries Off Your Credit Report

What Is A Credit Report

Your credit report is a record of your credit activity and history. It includes the names of companies that have extended you credit and/or loans, as well as the credit limits, loan amounts and your payment history. You can think of it as your financial resume; it tells the story of your financial health to potential lenders.

What Do You Get With An Opt Extension

Its important to note that this extension grants work privileges as well as the possibility of additional time in the United States, referred to as a post-completion OPT.

But, its also possible to use up all your OPT time during your studies, referred to as pre-completion OPT, which may leave you with fewer visa options to remain in the US after graduation.

OPT jobs in the USA

With an OPT extension on your F-1 visa, you gain the privilege of working legally in the US for up to 12 months, as long as the work relates to your programme of study.

However, if you decide to work during your studies it counts against your 12-month extension period. If you use the entire year before you graduate, youll have to consider other options if you want to remain in the US .

Recommended Reading: How To Get Credit Report Without Social Security Number

When Can I Update Household Details

You’ll need to let the IRS know as soon as possible if your income or dependents change to avoid repaying money that you may not qualify for. Later this month, you’ll be able to indicate changes to any life circumstances since you last filed your taxes, such as a;change in income, an;addition to your family;or a change in;child custody status. For example, if you started making more or less money this year, you’ll want to update the IRS about those changes so you can get the;correct child tax credit amount.

If you had or will have;a new baby this year, it’s important to let the IRS know so you can receive payment for up to $3,600 for that child. The same applies if you’ve adopted a child or gained a new child dependent since you last filed your taxes.;

Also, if you’ve gained full custody of your child, you’ll be the parent who receives the money for your kid. Note that parents who have shared custody will not each get a payment. This is important for domestic violence survivors, according to comments;during an IRS oversight hearing;by Nina Olson, executive director of the Center for Taxpayer Rights. The;Child Tax Credit Update Portal;later this year “should allow them to enter their change in marital status and also where the children are,” Olson said.