What Is A Soft Inquiry

Through April 20, 2022, Experian, TransUnion and Equifax will offer all U.S. consumers free weekly credit reports through AnnualCreditReport.com to help you protect your financial health during the sudden and unprecedented hardship caused by COVID-19.

In this article:

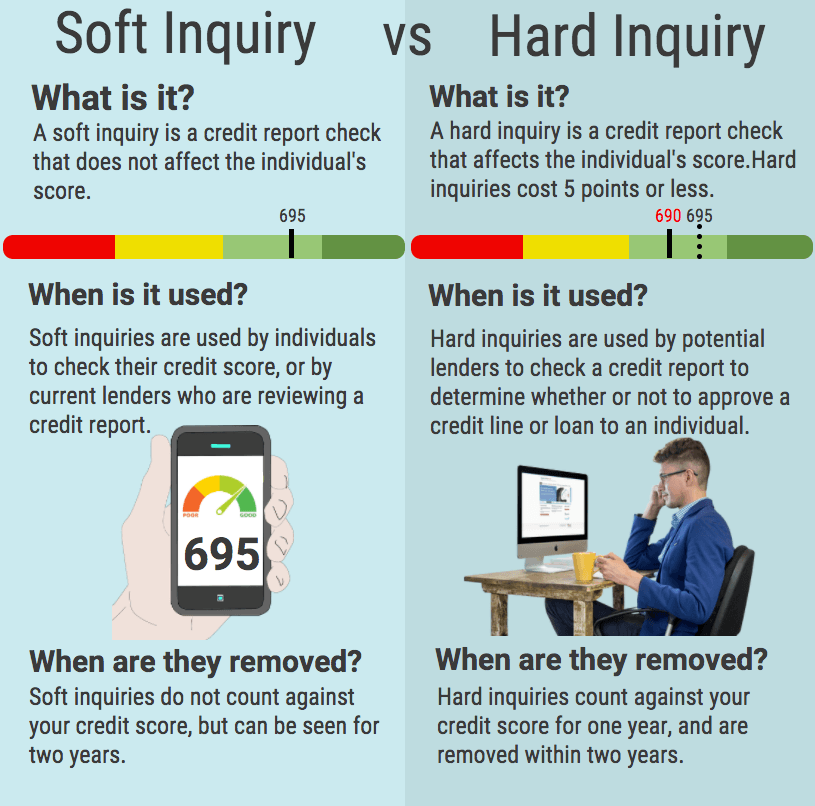

A soft inquiry, sometimes known as a soft credit check or soft credit pull, happens when you or someone you authorize checks your credit report. They can also happen when a company such as a credit card issuer or mortgage lender checks your credit to preapprove you for an offer.

Soft inquiries don’t impact your credit scores because they aren’t attached to a specific application for credit.

How To Minimize The Impact Of Hard Inquiries

Hard inquiries will do less damage than you think if youâre shopping around for the best rate on a car or home. Since these lenders are all checking at one time, for one purchase, it usually counts as a single inquiry.

Some of the newer FICO scores can give you up to 45 days to shop, but since you donât know what score will be used to measure your next loan, itâs smart to play it safe with the 14-day window.

Shop for loans only when you need them, and stay on top of your credit score, to help manage your score over time and keep you in the best position possible for great credit card offers. The more you know about your credit history, the more likely you are to take positive steps to maintain it, whether the next credit inquiry is a hard pull or a soft one.

âAre you new to credit or trying to build your credit? Petal can help.

Petal Card issued by WebBank, Member FDIC

What Is A Soft Pull

A soft pull is when a credit card company or lender checks your credit report as a background check. Its simply a review of your credit, and theres no in-depth check, so thats why your credit isnt affected.

A soft pull shows exactly what you would see if you looked at your own credit reportlines of credit, loans, your payment history, and any collections accounts.

Unfortunately, these soft pulls can occur without your permission. Which leads me to my next point.

Recommended Reading: Does Zzounds Report To Credit Bureau

How To Dispute Hard Credit Inquiries

We recommend checking your credit reports often. If you spot any errors, such as a hard inquiry that occurred without your permission, consider disputing it with the credit bureau. You may also contact the Consumer Financial Protection Bureau, or CFPB, for further assistance.

This could be a sign of identity theft, according to Experian, one of the three major credit bureaus. At the very least, youll want to look into it and understand whats going on.

Keep in mind, you can only dispute hard inquiries that occur without your permission. If youve authorized a hard inquiry, it generally takes two years to fall off your credit reports.

How Business And Lender Reports Affect Your Credit Score

Maintaining good credit is about more than just paying your bills on time you also have to behave in such a way that doesnt seem suspicious. Rapidly applying for many different credit cards may be a red flag for credit scoring agencies, as it could indicate that you may have a hard time keeping up with your current credit cards.

So, now that you know the truth about your credit score, start taking advantage of your free credit reports. Keep tabs on your credit, and make sure your score is accurate.

Looking for more information on credit management? Visit CreditGUARDs page to learn more about how you can improve your credit.

You May Like: Does Speedy Cash Do Credit Checks

Improve Other Aspects Of Your Score

While credit pulls can lower your score by 3 or 5 points , this doesnt have a huge effect on your credit. Your credit utilization makes up a much larger chunk of your credit score. There isnt 1 magic percentage to hit, but the lower you keep it, the better. That means you shouldnt be spending up to the maximum of your credit line each month.

The length of your credit history is also an important contributor to your credit score. This is important to remember when youre considering closing some of your older credit and loan accounts.

»Related:

What Is A Hard Credit Check

A hard credit check, or hard inquiry, is more extensive than a soft inquiry. Whenever you apply for a loan or a new line of credit, a potential lender will look at your credit report from one of the three official credit bureaus to determine whether to offer you a loan or line of credit, such as a mortgage.

Common reasons for a hard inquiry include:

- Youve applied for a new credit card and theyre checking your credit history

- Youve signed up for a new cell phone plan

- Youre applying for a personal or business loan such as a mortgage, car loan, etc.

- Youve requested an increase to one of your current lines of credit

A hard inquiry requires you to authorize a lender or company to make the credit check because it delivers a more detailed report. Your full credit report, past hard inquiries, payment history, and public record information are all visible when a hard inquiry is made.

Also Check: Is 586 A Good Credit Score

What Is A Soft Credit Check

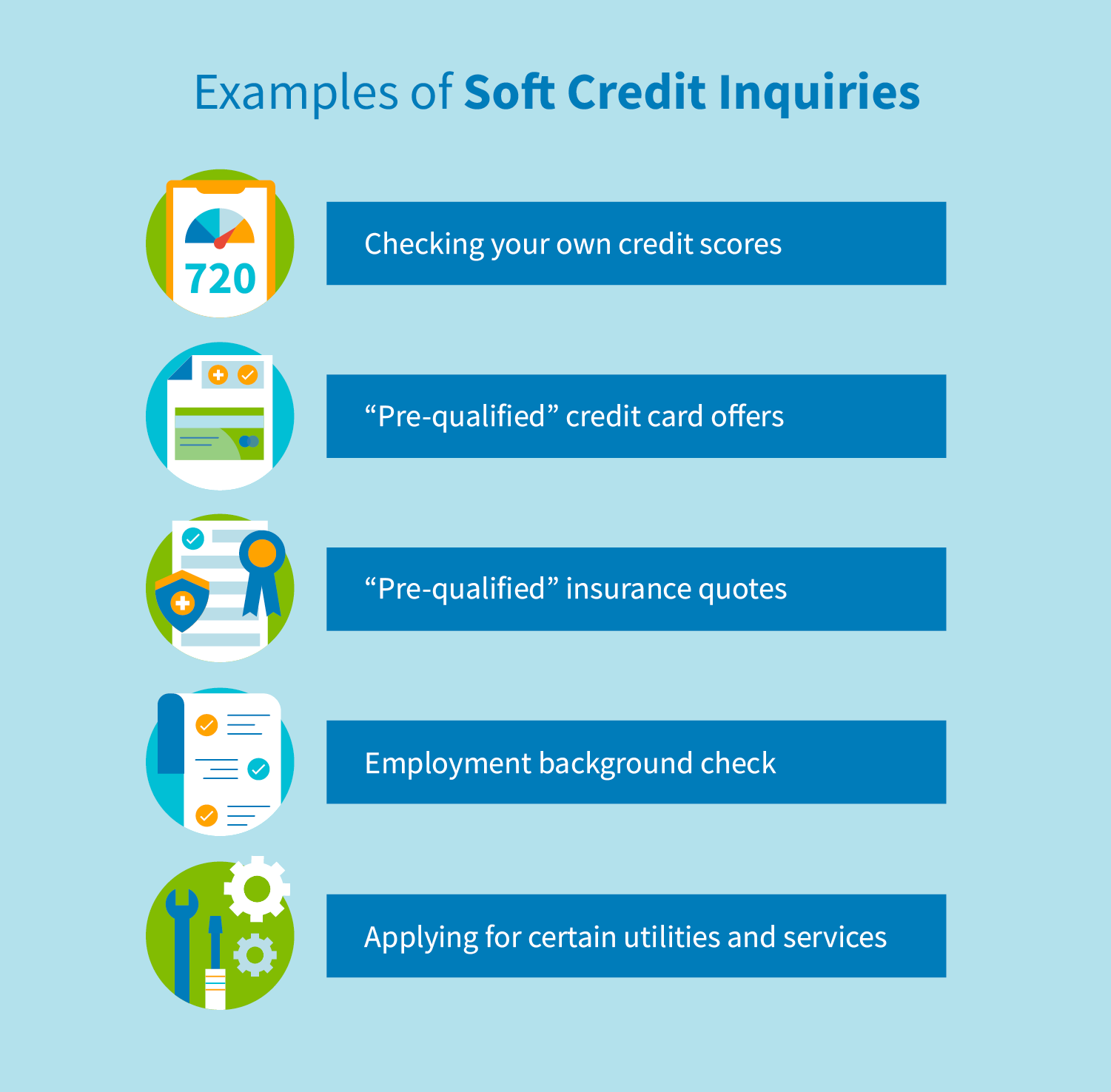

A soft credit check, or soft inquiry, occurs when a person, lender, or organization checks your credit as part of a background check. This is the most routine type of credit check, and may happen for multiple reasons:

- You check your own credit score online

- An employer views your credit score as part of a background check

- A credit card company pre-approves you for a card

- You open an insurance policy, such as renters, car, or life insurance

A soft credit check delivers a high-level summary of your credit report not your credit score. Your various lines of credit, loans, and payment history are all visible during a soft inquiry. This is helpful for lenders or companies to get a general overview of your financial responsibility if they want to extend an offer to you.

Unlike hard inquiries, the number of soft inquiries you receive are only visible to you when you check your credit report. Except for insurance companies, no other entity can see how many soft inquiries have been made on your account.

How Many Credit Checks Are Too Many

If you have a good credit score, the effects on your score could be minimal, especially if you’ve been keeping your balances low. But if you have a poor credit score and a high amount of unpaid balances, those credit inquiries may lead to application rejections and an even lower credit score.

To minimize the impact of opening up a new card account, try lowering your current debt first, to help bolster your credit score ahead of your application.

You May Like: Ccb/mprcc On Credit Report

What Is A Hard Credit Inquiry

A hard credit inquiry typically takes place when you apply for a credit card, mortgage, or car loan.

The credit bureaus track much of your financial activity, including:

Credit card balances

Loan balances

History of payments for revolving credit and installment loans

Number and type of credit accounts

Bankruptcy and other public record filings if they meet the minimum standards for reporting

The Fair Credit Reporting Act dictates that a person or organization must have a permissible purpose to access your reports. But federal law and some state laws allow quite a few parties to pull your credit if you have a current or potential relationship with them, Nolo says.

These entities can legally request your credit reports, according to the Fair Credit Reporting Act:

Employers

Insurance companies

Entities that have a court order

All hard inquiries will show up on your credit reports, and each hard pull outside the scope of rate shopping for a single loan may lower your credit score a tadby less than five points, according to FICO® . FICO and VantageScore are the two most common scoring models used to convert credit report information into credit scores, ranging from 300 to 850 points.

Recommended: Why Do I Have Different Credit Scores

Multiple inquiries from auto, mortgage, or private student loan lenders within a short period of time are typically treated as a single inquiry. For FICO, its a 45-day window for VantageScore, its 14 days.

Do Credit Inquiries Affect Your Business Credit

If you own a business, inquiries on your personal credit do not impact your business credit score. Unlike a personal score, almost anyone can pull a business commercial credit for examination. Because its so easy to obtain this information, inquires wont knock your score.

However, there are several different business credit bureaus that produce their own criteria for scores. Some scores, such as Equifax or PAYDEX, dont take inquiries into consideration. Experian Intelliscore or FICO SBCS do look at inquiries, so its possible that funding could be affected by too many credit checks.

At the end of the day, practicing smart money management and strategically applying for credit lines may help protect your score. While the prospect of a hard inquiry might seem intimidating, try to think of it as a routine part of building your financial health.

Don’t Miss: What Credit Score Does Carmax Use

More Reasons For A Soft Credit Check

Besides underwriting a loan, there are additional reasons for a soft pull to occur:

- Pre-qualified credit cards

- Employment verifications and background checks

- Self credit score checks

Remember, soft credit checks will not hurt your credit and are only visible to you when you review your credit report. If someone other than yourself looks at your credit report, they will only see the hard inquiries.

At Earnest, our two-minute Rate Check is always a soft inquiry and never dings your credit. Checking your own credit is always a soft pull, while applying for a loan is often a hard pull. An application for an apartment, signing up with a new internet or cable service provider, or renting a car can lead to either type. Again, if youre unsure, ask the provider before completing an application.

Soft Vs Hard Credit Check: How They Affect Credit Scores

Not all credit checks were created equal. In fact, credit checks come in two forms: a soft inquiry and a hard inquiry.

There are three main differences between the two types of inquiries:

- Whether or not your authorization is needed for the inquiry

- The depth of information provided by the inquiry

- How your credit score is affected by the inquiry

Its important to understand how both forms of credit checks can impact your financial health.

Have a specific question in mind? Use the links below to jump straight to the answer or keep reading for a full overview:

Read Also: Sync/ppc On Credit Report

Why Are Soft Inquiries Made

When you apply for a credit card or a loan, the card issuer or lender will usually perform a hard pull so they can see your credit history. Your score will typically drop five to eight points depending on the type of credit and other factors. A hard inquirys score impact is usually minimal and temporary but can stay on your report for two years.

Conversely, a soft credit pull can happen when somebody looks at your credit report, but you didnt submit a credit or funding application. Soft pulls arent typically a barometer of higher credit risk and, therefore, dont affect your scores. A soft inquiry can happen when:

- You check your own credit report.

- You apply for preapproval for a mortgage or loan.

- A business or credit card company checks your credit history to determine if you are eligible for a preapproval offer.

- A current creditor or financial institution runs your credit.

- You give a potential employer permission to check your credit.

There are specific financial applications that require either a soft or hard inquiry, including house or apartment rentals and opening a bank account. You can ask the management company or bank which type of inquiry they will be using in these instances.

What Is A Soft Credit Inquiry

Soft inquiries often take place during an employment background check, when you check your own credit, or sometimes when rate shopping.

Soft pulls do not affect credit scores, no matter how often they take place, and they can even occur without the individual knowing about them.

Potential employers might ask to view a to get an indication of whether you manage your finances responsibly. However, they cant see information like marital status, or even your actual credit score. Insurance companies see a similar report, which doesnt give them your credit score.

Soft inquiries are often used by companies that send out preapproved financial offers by mail, for example.

You can review your own credit reports without worrying that it will affect your credit score. In fact, the Fair Credit Reporting Act guarantees the right to access credit reports from each nationwide credit bureau every year for free. Go to www.annualcreditreport.com to order reports from Equifax, Experian, and TransUnion.

You can usually see soft credit inquiries on your own credit reports. You might see language like inquiries that do not affect your credit rating with the name of the requester and the date of the inquiry.

Here are some of the benefits that can be gained from soft credit inquiries:

You can get prequalified for various types of loans.

You can receive prescreened credit card offers.

You can check your credit reports regularly to help ensure accuracy.

You May Like: Does Paypal Credit Report To Credit Bureaus

Other Ways To Manage The Impact Of Hard Inquiries On Your Credit

Hard inquiries can impact your credit. But rate shopping can help you minimize their impact. And there are other ways to manage the impact of hard inquiries too.

Hereâs how:

- Check whether youâre pre-approved or pre-qualified. Before you apply for credit, pre-approval or pre-qualification could help you compare options and find the right fitâwithout triggering a hard inquiry. For example, Capital One’s pre-approval tool can help you find out whether youâre pre-approved for some of Capital Oneâs credit cards before you even apply. Itâs quick and only requires some basic info. And since it only triggers a soft inquiry, it wonât hurt your credit scores.

- Apply only for credit you need. As the CFPB explains, âCredit scoring formulas look at your recent credit activity as a signal of your need for credit. If you apply for a lot of credit over a short period of time, it may appear to lenders that your economic circumstances have changed negatively.â

- Monitor your credit. Checking your credit reports regularly can help you stay on top of hard inquiries and other factors that impact your credit. You can get free copies of your credit reports from each of the three major credit bureausâEquifax®, Experian® and TransUnion®âby visiting AnnualCreditReport.com.

But what if youâre not a Capital One customer? Donât worry. CreditWise is free and available to everyoneâyou donât have to be a Capital One customer to use it.

What Are Inquiries On Your Credit Report

Through April 20, 2022, Experian, TransUnion and Equifax will offer all U.S. consumers free weekly credit reports through AnnualCreditReport.com to help you protect your financial health during the sudden and unprecedented hardship caused by COVID-19.

In this article:

Inquiries are entries that appear on your credit report when your credit information is accessed by a legally authorized person or organization . Most commonly, inquiries are the result of an application for credit, goods or services an account review made by a company that you already do business with or a preapproved offer of credit that has been sent to you.

There are two types of credit inquiries: hard inquiries and soft inquiries. Account reviews and preapproved offers fall under the category of soft inquiries, which have no effect on your credit scores. Hard inquiries include applications for credit or certain services, and although their impact is minimal, they can temporarily affect your scores. Here’s what you need to know about inquiries on your credit report and the differences between hard and soft inquiries.

Read Also: Syncb/ppc Closed

Checking Your Own Credit Score Wont Lower It But Other Credit Checks Might Have An Effect On Your Score

Ever wonder if checking your own credit scores will lower them? Great question! The short answer is noâchecking your credit scores yourself wonât hurt them. However, other types of credit checks could cause your scores to dropâthough the drop could just be temporary and only by a few points.

Read on to learn more about the two kinds of credit checksâsoft checks and hard checksâand how only hard checks can lower your scores.

How Do Credit Inquiries Affect Your Credit Scores

Now you know that hard credit inquiries can have an impact on credit scores. But you might be wondering how.

According to credit-scoring company FICO®, a hard inquiry can cause your credit scores to dropâusually by just a few points. Hard inquiries can stay on your credit reports for up to two years. But they might only affect your scores for a year.

Why would a hard credit inquiry cause a drop in credit scores? As the Consumer Financial Protection Bureau explains, credit-scoring models generally look at how recentlyâand how oftenâyouâve applied for credit. So a single hard inquiry may have a relatively minor impact on your scores. But multiple hard inquiriesâespecially multiple hard inquiries over a short period of timeâcould have more of an impact.

Hard inquiries can also have more of an impact on your scores if you have few accounts or a short , according to FICO.

Ultimately, as FICO explains, âThe impact from applying for credit will vary from person to person based on their unique credit histories.â

Keep in mind: Credit-scoring companies use different formulas, or models, to calculate credit scores. And there are many different credit scores and scoring models. Some credit scores even use different ranges. That means people may have more than one score out there.

Also Check: How To Remove Repossession From Credit Report