How Does Credit History Affect Your Credit Score

The length of your credit history, or how long youve been using credit, typically accounts for 15 percent of your total credit score.

While it isnt the most important factor used to calculate your FICO® score, the length of your credit history does matter. Generally, the longer your credit history, the better it is for your credit score.

The minimum amount of time you need to have an account open for FICO® to calculate a credit score is six months. If youve just opened your first credit account, you may not have enough credit history to calculate a score yet.

Theres also usually a limit on how long closed accounts remain a part of your credit history. Most closed accounts remain a part of your credit history for 10 years.

While a shorter credit history will prevent you from achieving a perfect credit score, its not something to fret over. Adopting good financial habits over time will help improve your credit score and history.

How Do Credit Bureaus Get Your Information

The information that the bureaus collect comes from a variety of sources.

Information reported to the bureaus by creditors Creditors, such as banks and credit card issuers, may report information about their accounts and customers to the credit bureaus. In this context, the creditors are known as data furnishers.

Information thats collected or bought by the bureaus For some types of information, the credit bureaus buy the data. For example, a consumer credit bureau might buy public records information from LexisNexis, another credit bureau, and use this information when generating your credit report. Examples of information that a credit bureau may buy include government tax liens or bankruptcy records.

Information that gets shared among the bureaus Although they are competitors, sometimes the credit bureaus must share information with one another. For example: When you place an initial fraud alert with one of the bureaus, its required to forward the alert to the other two.

Learn more about protecting yourself from identity theft.

The Rate You Are Offered On A Mortgage Can Vary Quite A Bit Depending On Your Credit Score

Your credit score is only one factor in a mortgage lenders decision, but its an important one.

While there are no firm rules about exactly how your credit score affects the interest rates you may be offered for a home loan, in general:

- The best rates go to borrowers with credit scores in the mid- to high-700s or above. These borrowers typically also have the most choices available to them.

- Borrowers with credit scores in the high-600s to the low-700s typically pay somewhat higher rates.

- Borrowers with credit scores in the low- to mid-600s range generally pay the highest rates and have the fewest choices. Borrowers in this range may have trouble qualifying for a loan, depending on the loan type and the specific lender.

- Borrowers with scores below 600 may want to improve their credit before applying for a mortgage. If you need help improving your credit, contact a HUD-approved housing counselor.

Explore interest rates for different credit scores to get a sense of how much your credit score matters.

You May Like: Will Afterpay Unfreeze My Account

How Your Credit Score Affects You

Suppose you want to borrow $200,000 in the form of a fixed rate thirty-year mortgage. If your credit score is in the highest category, 760-850, a lender might charge you 3.307 percent interest for the loan.1 This means a monthly payment of $877. If, however, your credit score is in a lower range, 620-639 for example, lenders might charge you 4.869 percent that would result in a $1,061 monthly payment. Although quite respectable, the lower credit score would cost you $184 a month more for your mortgage. Over the life of the loan, you would be paying $66,343 more than if you had the best credit score. Think about what you could do with that extra $184 per month.

How Do I Get Credit

Do you want to build your credit history? You will need to pay bills that are included in a credit report.

- Sometimes, utility companies put information into a credit report. Do you have utility bills in your name? That can help build credit.

- Many credit cards put information into credit reports.

- Sometimes, you can get a store credit card that can help build credit.

- A secured credit card also can help you build your credit.

Read Also: Ideal Credit Score To Buy A House

Check Your Reports Carefully For Errors

Look on your credit reports for any debts or credit cards you dont recognize. Also check for disputed items that still show up even though they were resolved in your favor. A late or missed payment isnt an error if it actually happened.

- Use our to review each report.

- If you find any errors on your reports, file a dispute to get them corrected as soon as possible. Learn how.

Can I See My Credit Report

You can get a free copy of your credit report every year. That means one copy from each of the three companies that writes your reports.

The law says you can get your free credit reports if you:

- go to AnnualCreditReport.com

Someone might say you can get a free report at another website. They probably are not telling the truth.

You May Like: Zzounds Payment Plan Denied

What Data Do The Credit Bureaus Include In Your Credit Reports

Think of a as a snapshot of your history as a borrower. To build your credit reports, each of the different credit bureaus collects a few key pieces of information.

- The types of accounts you have , the open dates for those accounts, your credit limit, account balances and payment history.

- Hard and soft inquiries These types of inquiries are also recorded on your credit reports. Generally, hard inquiries happen when you allow an individual, company or credit issuer to check your credit reports, which can temporarily drop your credit scores. Soft inquires happen when you do things like check your credit reports, which wont hurt your credit. Read more about the difference between hard and soft inquiries.

- Bankruptcy information When you filed for bankruptcy and what chapter.

- Collection accounts Any accounts with past-due payments that have been passed along to a collections agency.

Your credit reports also include personal information like your name, address, Social Security number and date of birth.

The Importance Of A Good Score

Maintaining a good credit score involves understanding how your score affects your life. You are charged a lower interest rate, and have greater access to credit, when you have high scores. Over time, the savings in interest payments from having a high score can be substantial.

To illustrate the point, myFICO offers a chart on how much your monthly payments on a $216,000 fixed-rate, 30-year mortgage would amount to based on your FICO score.

| Your FICO Score | |

|---|---|

|

$1,159 |

In this example, the difference between what someone in the highest score range in the table and someone in the lowest score range would pay over 30 years is $72,000.

For those just starting out, their limited experience with credit normally results in a thin credit file and a lower score. Young adults can begin to build their credit histories and scores by off their parents, getting a student or secured credit card and by repaying their student loans.

Recommended Reading: How Long Do Hard Credit Inquiries Stay On Your Report

What Are Advantages Of A 800 Fico Score

Important points to keep in mind. A credit score of over 800 shows lenders that you are an exceptional borrower. You can request better terms for car loans and mortgages with a high credit rating. You can also use credit cards that offer greater rewards and benefits, such as: B. Access to the airport lounges and free breakfast at the hotel.

Question: How Do I Dispute Information On My Credit Report

Answer: If you believe something on your credit report is inaccurate, you may want to contact the lender or company that reported the information to give you more details. You can also start a dispute with the credit reporting agency that issued the report. The fastest and easiest way to start a dispute with TransUnion is to dispute online.

Recommended Reading: Can You Remove Hard Inquiries From Your Credit Report

Three Key Reasons To Check Your Business Credit Score

The use of the traditional business credit scores is so commonplace that many people dont stop to question how effectively they identify a companys true credit risk. While traditional business credit reports contain valuable information, they suffer from several shortcomings. Heres how a Tillful Score can help:

Know what lenders look for: While every lender is a little different, our credit model can help you determine whether you will qualify for a credit product before you apply.

Know what is behind your number: We share the top factors that impact your score. You can focus your efforts where it counts and tape immediate steps to improve your credit profile.

Build strong credit and financial health: With our alternative credit scoring resource, you get unfettered access to your credit score any time, along with email notifications when your score changes.

Why Is My Credit Report Important

Businesses look at your credit report when you apply for:

- loans from a bank

- jobs

- insurance

If you apply for one of these, the business wants to know if you pay your bills. The business also wants to know if you owe money to someone else. The business uses the information in your credit report to decide whether to give you a loan, a credit card, a job, or insurance.

You May Like: Comenity Bank Credit Score

Fewer Credit Cards Are Better

Like many award-travel enthusiasts, I have numerous credit card accounts. In response to hearing that, some conclude that my credit must be terrible. They might be surprised to learn that I have excellent credit not despite my numerous accounts, but because of them.

Each account, when managed responsibly, adds positive information to my credit history and helps me to maintain my high credit scores. So if you have little-used accounts with no annual fee, theres really little reason to close them.

Look at it from the lenders perspective: Would you rather offer a new line of credit to someone with a very limited record of paying back loans, or someone with a very extensive history of managing multiple credit lines responsibly?

Is 680 Credit Score Bad

First, viewed in perspective, the FICO credit score ranges from 300 to 850. The lower the number, the worse the credit score. The credit rating of 680 is not very low, but not very high either. A credit rating of 680 is a reasonable credit rating. No, 680 is not bad credit. 680 is a reasonable credit rating.

What is the max credit scoreWhat is maximum credit rating? Different credit limits. One type of credit score is the FICO score. The maximum FICO score is 850 . Other credit ratings are available from Schufa and other third parties.Is 900 a good credit score?A credit rating of 900 is high on the scale. 900 is not very good credit. 900 is an excellent credit score. Someone with a credit rating of 900 will probably be able to b

Also Check: Aargon Debt Collector

What Credit Score Do I Need To Get A Mortgage

In general, for a standard regular loan guaranteed by Fannie Mae or Freddie Mac, you need an average FICO score of at least 620 for fixed-rate mortgages, while adjustable-rate mortgages require at least 640 to qualify.. Determining the percentage of income you can afford on your mortgage determines your down payment.

Can Service Accounts Impact My Credit Score

Service accounts, such as utility and phone bills, are not automatically included in your credit file. Historically, the only way a utility account could impact a credit score was if you didn’t make payments and the account was referred to a collection agency.

But this is changing. A revolutionary new product called Experian Boost now allows users to get credit for on-time payments made on utility and telecom accounts.

Experian Boost works instantly, allowing users with eligible payment history see their FICO® Score increase in a matter of minutes. Currently, it is the only way you can get credit for your utility and telecom payments.

Through the new platform, users can connect their bank accounts to identify utility and phone bills. After the user verifies the data and confirms they want it added to their credit file, they will receive an updated FICO® Score instantly. Late utility and telecom payments do not affect your Boost scorebut remember, if your account goes to collections due to nonpayment, that will stay on your credit report for seven years.

Don’t Miss: Do Late Payments On Closed Accounts Affect Credit Score

How Does Fico Calculate Your Score

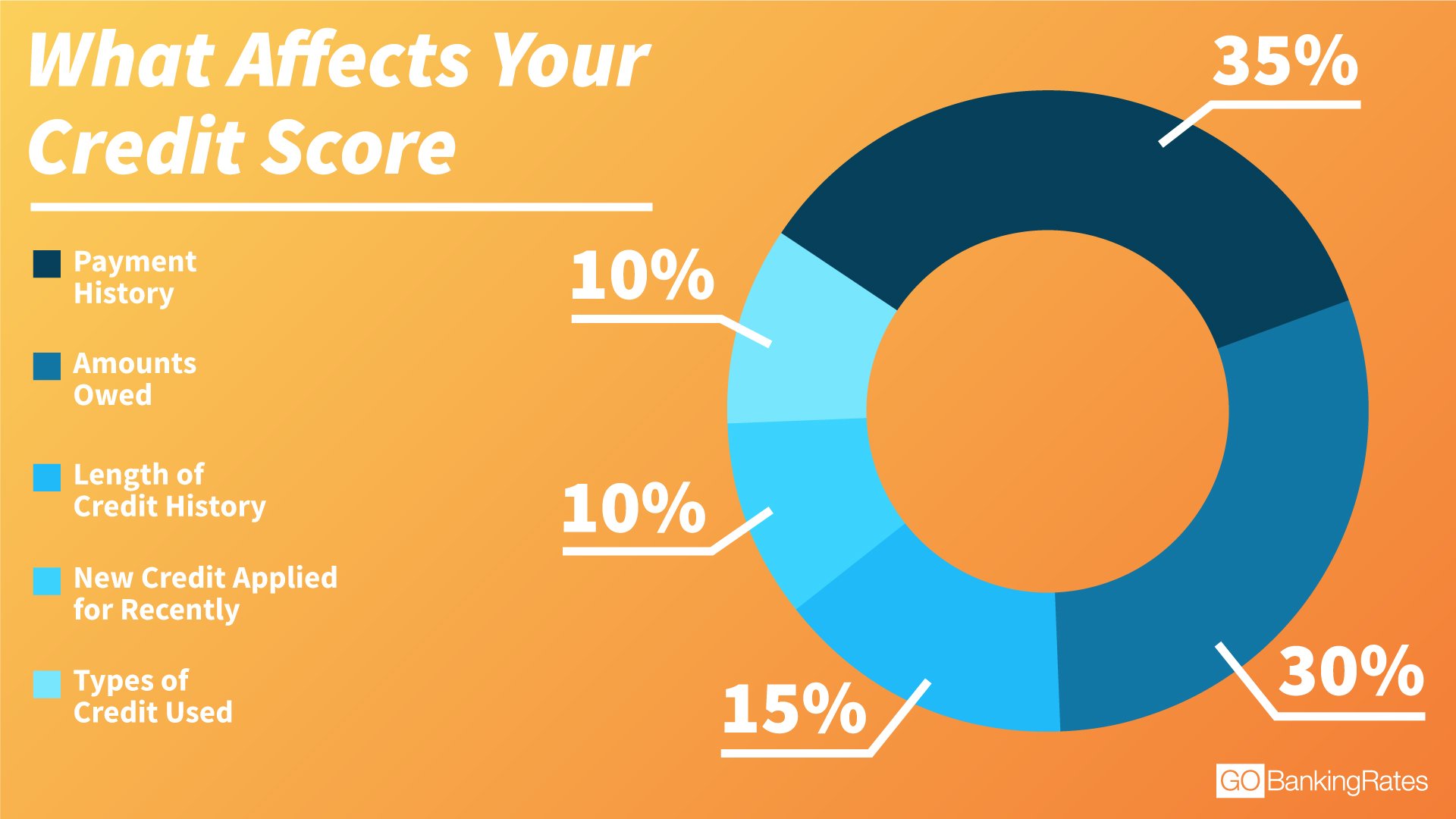

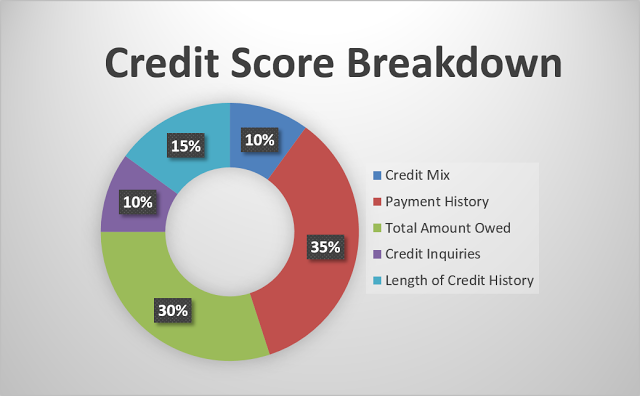

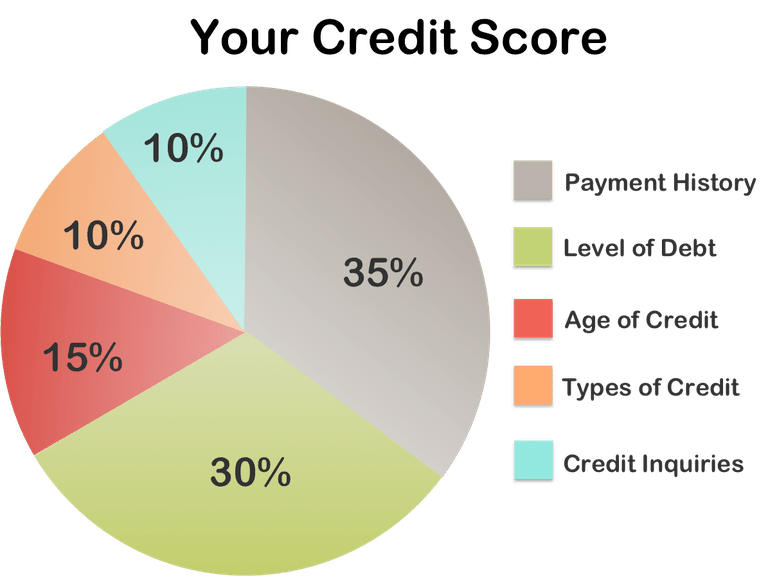

Information from your credit bureau report goes into FICOs algorithm and then produces a number that ranks you in comparison to other scored consumers. The algorithm weights certain factors more heavily than others. Below youll see that your payment history has a greater impact on your score than the length of your credit history, but that both matter.

The Five Pieces Of Your Credit Score

Your credit score is based on the following five factors:

Ultimately, the best way to help improve your credit score is to use loans and credit cards responsibly and make prompt payments. The more your credit history shows that you can responsibly handle credit, the more willing lenders will be to offer you credit at a competitive rate.

Did you know? Wells Fargo offers eligible customers free access to their FICO® Credit Score plus tools, tips, and much more. Learn how to access your FICO Credit Score.

You May Like: Syncb Ppc

Focusing On A Single Credit Score

One big mistake people make when talking about this subject is referring to someone having a single credit score, kind of like their age or their height. In fact, there are numerous credit-scoring models offered by both FICO and VantageScore. Some are used for different purposes such as mortgages, car loans and credit card applications, while others are just older formulas.

Furthermore, a lender can pull an applicants credit history data from any of the three major consumer credit bureaus and come up with a different result from each one. So when you look at a credit score, always keep in mind that its one of many and it may or may not be the one a particular lender is using.

How Does A Credit Scoring System Work

- Have you paid your bills on time? If your credit report shows that youve paid bills late, had an account put in collections, or declared bankruptcy, thats likely to affect your score negatively.

- Are you maxed out? Many scoring systems look at the amount of outstanding debt you have compared to your credit limits. If the amount you owe is close to your credit limit, its likely to hurt your score.

- How long have you had credit? Generally, scoring systems consider your credit track record. A short credit history may hurt your score, but paying bills on time and having low balances can offset that.

- Have you applied for new credit lately? Many scoring systems look at inquiries on your credit report to see whether youve applied for credit recently. If youve applied for too many new accounts recently, it could hurt your score. Not every inquiry is counted: for example, inquiries by creditors who are monitoring your account or making prescreened credit offers arent counted against you.

- How many credit accounts do you have, and what kinds of accounts are they? Although its generally considered a plus to have established credit accounts, too many credit card accounts may hurt your score. Also, many scoring systems consider the type of credit accounts you have. For example, under some scoring systems loans to consolidate your debt but not loans for buying a house or car may hurt your credit score.

Recommended Reading: Will Getting Married Affect My Credit Score

Will Your Credit Score Be Based On Your Web History

Chris Hoffman is Editor-in-Chief of How-To Geek. He’s written about technology for over a decade and was a PCWorld columnist for two years. Chris has written for The New York Times, been interviewed as a technology expert on TV stations like Miami’s NBC 6, and had his work covered by news outlets like the BBC. Since 2011, Chris has written over 2,000 articles that have been read nearly one billion times—and that’s just here at How-To Geek. Read more…

Wouldnt it be great if your internet browsing history was part of your credit score? Thats what a team of researchers at the International Monetary Fund have proposed. In the future, reading How-To Geek might help your credit score!

What Is A Vantagescore

VantageScore was created by the three major credit reporting agenciesExperian, Equifax, and TransUnion. It uses similar scoring methods to FICO but yields slightly different results.

Featured Topics

One of the primary goals of VantageScore is to provide a model that is used the same way by all three credit bureaus. That would limit some of the disparity between your three major credit scores. In contrast, FICO models provide a slightly different calculation for each credit bureau, which can create more differences in your scores.

Also Check: Affirm Credit Score For Approval