How To Check Your Cibil Score

Check your CIBIL score for free with Bajaj FinservIf you are wondering where to check your CIBIL score, you can do it easily by visiting the credit information companys website. Usually, you will need to pay a small fee to check your score. To get unlimited access to your credit score and report you can pay Rs.550 for 1 month or Rs.1,200 for a year at the CIBIL MyScore page. You can also check your CIBIL Score for free on a one-time basis here.

How To Improve Your Credit Score To Get A Lower Interest Rate

If your credit score isnât as high as youâd like it to be, you can take steps to improve it. If you have a low credit score, consider postponing your car purchase until youâve increased your score. Catching a ride or using mass transit to get to work for a little bit longer while you work on some credit repair may pay off in the long run.

To increase your score, it helps to know how are calculated. With time and determination, you can repair your credit and shore up your finances. To improve your credit for car financing, focus especially on decreasing your . You can do this by paying down your credit cards and other revolving credit accounts.

You can boost your score in other ways too. You may want to consider self-reporting your accounts to the credit reporting agencies. Additionally, make sure you have a good credit mix and a variety of different lines of credit. A could be a helpful tool in improving and increasing your credit mix while showing a good payment history.

The higher you get your credit score, the better your odds of qualifying for lower-interest financing, so keep at it and keep working to improve your credit score.

Frequent Credit Card Use Is Required To Take Full Advantage Of Rewards

Depending on the rewards offered, earning them can be a bit complicated. It may be easy in the first year, due to a generous sign-on bonus. But the ongoing rewards arent always so easy.

Take travel rewards, for example. If a travel rewards card offers two points for every $1 you spend, youll have to spend $1,000 per month to earn 2,000 points. In one years time, you can earn 24,000 points spending at that level, equal to $240 in travel purchases.

But the critical connection is being able to spend at that level every month. If you dont normally use a credit card, you may not accumulate a meaningful number of points.

Recommended Reading: Credit Score Usaa

Watch Out For The Balance Transfer Trap

A 0% introductory APR is an outstanding benefit to have, but only if you use it the right way. And the right way is to pay off any balance transferred before the 0% APR introductory term ends.

To do otherwise is to put yourself in a potential trap.

Heres why

- Balance transfer fees. Credit cards routinely charge an upfront fee of between 3%-5% of the balance transferred. If you transfer $10,000, that will be $300 to $500, paid up front.

- The 0% introductory APR could convince you to keep the balance outstandingafter all, it wont be costing you any money.

- The 0% introductory APR will end, and then youll be subject to the regular interest rate. Its possible that rate will be higher than the one youre paying on the card you transferred the balance from.

If you wont be able to pay the balance in full within the introductory term you might want to avoid a balance transfer entirely. In that situation, itll just be moving debt from one credit line to anotherwith an interest rate reprieve in the middle.

Points To Keep In Mind While Clearing Your Past Dues

- No Due Certificate: After paying your outstanding dues in full to the lender, obtain a No Due Certificate. This is the proof and indication that you have closed the loan completely.

- Incorrect Closure of Credit Card: Some agencies or the credit card issuer might offer you a discount on closing the outstanding dues on your credit card. Lured by the offer, you might tend to settle for 80% or 90% of the amount to be paid. However, this is not a complete closure. The discount will not be taken into consideration by the bureaus and eventually, you remain with bad credit. Hence, make a complete closure to clear your negative status completely.

- Removing negative issues from your credit report does not mean it will improve your credit score, it can only prevent a further drop. You should have a loan or credit card account active to get an improved credit score over a period.

- Becoming credit healthy does not happen in a day. You will have to be patient as there is a certain procedure followed across all banks and credit bureaus.

- Get your credit report and look for any errors on it. By raising a dispute resolution with the lender and credit bureau, you can get the errors removed.

Don’t Miss: Les Schwab Credit Score Requirement

Auto Loans For Excellent Credit

Having excellent credit can mean that youre more likely to get approved for car loans with the best rates, but its still not a guarantee.

Thats why its important to shop around and compare offers to find the best loan terms and rates available to you. Even with excellent credit, the rates you may be offered at dealerships could be higher than rates you might find at a bank, credit union or online lender.

You can figure out what these different rates and terms might mean for your monthly auto loan payment with our auto loan calculator.

And when you decide on an auto loan, consider getting preapproved. A preapproval letter from a lender can be helpful when youre negotiating the price of your vehicle at a dealership, but be aware that it might involve a hard inquiry.

If you have excellent credit, it could also be worth crunching the numbers on refinancing an existing auto loan you might be able to find a better rate if your credit has improved since you first financed the car.

Compare car loans on Credit Karma to explore your options.

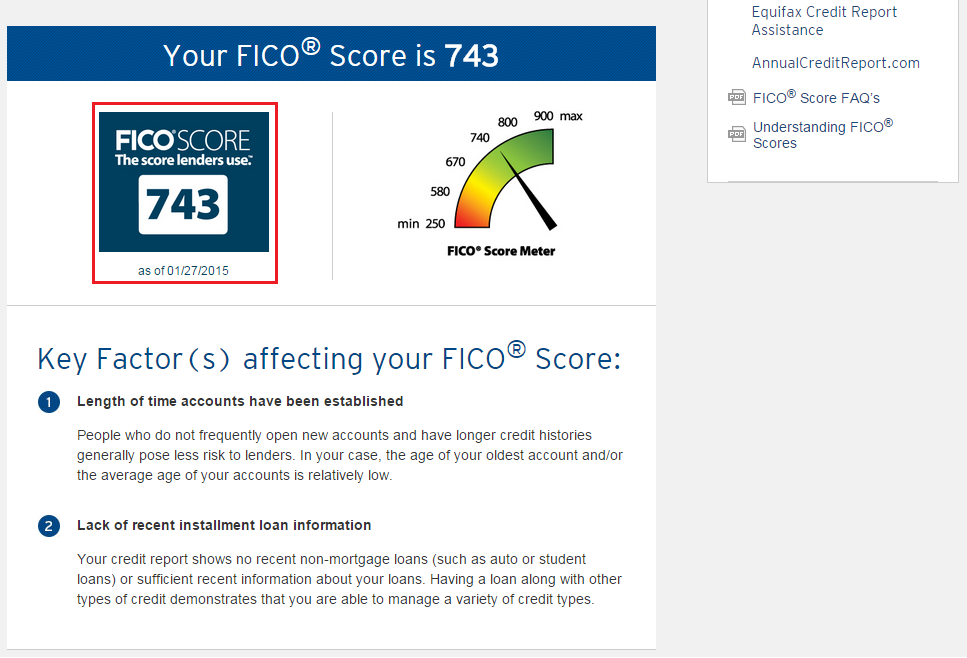

Summary: Financing A Car With A 743 Fico Score

It is when applying for loans that the distinction between an excellent and good credit score truly comes to fore. For example, when applying for a loan that is more than how much you earn, then you will need a credit score of at least 680 and it is not different when it comes to an auto loan.

It is practically impossible to secure some loans without a very good credit score. Imagine the interest on a $200,000, 30-year, settled rate contract. If you have a credit score of 760 to 850, you will have to pay an interest rate of 3.083 percent according to FICOs interest number cruncher as of October 2012.

Recommended Reading: Chase Sapphire Preferred Score Needed

Can I Get A Mortgage & Home Loan W/ A 743 Credit Score

Getting a mortgage and home loan with a 743 credit score should be easy. Your current score is in the second highest credit rating category that exists. You shouldn’t have any issues getting a mortgage or a home loan.

The #1 way to get a home loan with a 743 score is to complete minimal credit repair, and simply apply and wait for approval.

After a few short months of repairing your credit , youâll be in a much better position to get your ideal home loan terms.

What A Good Credit Score Can Get You

Having good credit matters because it determines whether you can borrow money and how much you’ll pay in interest to do so.

Among the things a good credit score can help you get:

-

An unsecured credit card with a decent interest rate, or even a balance-transfer card.

-

A desirable car loan or lease.

-

A mortgage with a favorable interest rate.

-

The ability to open new credit to cover expenses in a crisis if you don’t have an emergency fund or it runs out.

A good credit score helps in other ways: In many states, people with higher credit scores pay less for car insurance. In addition, some landlords use credit scores to screen tenants.

So having a good credit score is helpful whether you plan to apply for credit or not.

If your credit score is below about 700, prepare for questions about negative items on your credit record when shopping for a car. People with major blemishes on their credit are routinely approved for car loans, but you may not qualify for a low rate. Read about what rates to expect with your score.

You dont need flawless credit to get a mortgage. In some cases, credit scores can be in the 500s. But credit scores estimate the risk that you wont repay as agreed, so lenders do reward higher scores with lower interest rates. Read about your mortgage options by credit score tier.

Landlords or property managers generally aren’t looking for immaculate scores, they are interested in your credit record. Learn more about what landlords really look for in a credit check.

Recommended Reading: When Does Opensky Report To Credit Bureaus

Average Credit Score By Age

Making smart financial choices early in life can lead to credit score advantages as you age.

Consumers in the U.S. have an average FICO® Score of 703 and VantageScore of 711, but this can vary based on age.

. Your FICO® Score is primarily based on specific, weighted criteria including payment history , outstanding debt , credit history length , pursuit of new credit and the types of credit you use .

Regardless of your age, those who are initially building their , with those in their 20s having an average score of 660. The age group with the highest average credit score is those in their 80s, but its those between 56 and 74 that have the most consumers with a perfect score of 850. However, keep in mind that credit scores vary by age and due to a number of factors.

On This Page:

The average FICO® Score is 703, while the average VantageScore is 711.

Consumers who hit their 50s experience a significant increase in their credit score, reaching an average score of 703 and above.

How To Build A Good Credit Score

Building a good credit score comes down to using credit responsibly over time. The same is true when it comes to maintaining a good credit score. Here are five things the CFPB says you can do:

When it comes to monitoring your credit, makes it easy. Itâs free for everyoneânot just Capital One customers. And checking wonât hurt your scoreâa major plus if youâre working to improve a bad credit scoreâso you can check it as often as you like.

Learn more about Capital Oneâs response to COVID-19 and resources available to customers. For information about COVID-19, head over to the Centers for Disease Control and Prevention.

Don’t Miss: Freeannualcreditreport Com Official Site

Contact Obryan Law Offices For Credit Counseling

Getting the hang of managing your credit might seem like a daunting task at first, but it gets easier with time. With the help of a certified credit counselor in Kentucky, OBryan Law Offices will help you get your finances in order. We have extensive experience in this area of law, so you can rest assured that youre in good hands. To schedule a free consultation with one of our attorneys, please call today.

Dont Miss: How Many Bankruptcies Has Donald Trump Filed

Vantagescore Credit Score Ranges

Launched in 2003, VantageScore is a joint venture between the three major credit reporting agenciesEquifax, TransUnion and Experian. Although FICO Scores are the most popular choice among lenders, VantageScore credit scores deserve your attention too.

VantageScores use a 300 to 850 credit score range. Just like FICO Scores, the higher your credit score on the VantageScore scale, the lower the risk you represent to lenders.

Read Also: Opensky Billing Cycle

Talk To A Bankruptcy Lawyer

Need professional help? Start here.

Self-help services may not be permitted in all states. The information provided on this site is not legal advice, does not constitute a lawyer referral service, and no attorney-client or confidential relationship is or will be formed by use of the site. The attorney listings on this site are paid attorney advertising. In some states, the information on this website may be considered a lawyer referral service. Please reference the Terms of Use and the Supplemental Terms for specific information related to your state. Your use of this website constitutes acceptance of the Terms of Use, Supplemental Terms, Privacy Policy and Cookie Policy. Do Not Sell My Personal Information

What Is A Good Credit Score For An Auto Loan

Next to a mortgage, vehicles are often among the most expensive purchases the average adult makes in the United States. According to the Kelley Blue Book, an independent automotive valuation agency, the average price for a light vehicle purchase in the U.S. was $38,940 in May of 2020.

For a significant purchase like a car, having good credit could mean saving thousands when youre financing your purchase.

For example, someone with a FICO score of 620 who is looking to buy a new car is told by the car dealer they could qualify for a 60-month loan for $38,000.

According to the FICO Loan Savings Calculator, your loan in June 2020 would have an APR of 16.714% and your monthly payments would be $939. Over the life of the loan, youd pay an additional $18,315 in interest.

A $942 per month car loan payment is a significant amount, even if you can get approved. So, lets assume you hit the pause button and decide to work on improving your credit before taking out a loan. When you apply again down the line, you learn that youve boosted your score to a 670, which is considered a good credit score by most credit scoring models.

With a 670 credit score, the FICO Loan Calculator now estimates that you might qualify for an APR around 7.89%. Based on that rate, your monthly payment on the same $38,000 auto loan would be $768. You would pay $8,106 in total interest over the life of your loan.

Because you improved your credit score from poor to good, you would save:

Also Check: Approval Odds For Care Credit

Get A Secured Credit Card

If your credit score is very low or nonexistent, and you dont have any credit cards, then consider getting a secured credit card.

A secured credit card is a low-limit card that a bank can issue to you, that requires you to pay them a security deposit up front. That way, their risk is low and they can afford to give a small credit line to people with low or no credit. Many of the major issuers, like Discover and Capital one, have good offers on secured cards.

Typically, the credit limits are tiny, like $200 or less. Pretty much the only reason secured credit cards exist is to help people build credit. Start making some purchases with the card, and pay it back in full every month. Over time, youll start building a positive credit history. Make sure your other payment types are paid on time as well.

Eventually, when your credit score is higher , ask your issuing bank to convert your account to a normal, unsecured card. This way, you can get a higher limit, get better rewards, and get your security deposit back.

Whatever you do, dont close your secured card, unless for some reason you absolutely cant handle having credit. You want to start building a long-lasting credit account, because average credit age is a big factor for your credit score. So, once your score is up, convert it to a better card.

Use Your Understanding Of Credit To Build Your Credit Score

The first step in your credit journey is understanding what a credit score is and how it is calculated. Once you know the basics about credit score, you can begin to improve your credit score. Doing so doesn’t simply improve your standing in the eyes of lenders, but it can also save you thousands of dollars in interest payments over the course of your lifetime.

Enjoy 24/7 access to your account via Chases . Sign in to activate a Chase card, view your free credit score, redeem Ultimate Rewards® and more.

Also Check: 671 Credit Score Good

Can I Get A Credit Card With A 743 Credit Score

With good credit scores, you might qualify for credit cards that come with enticing perks like cash back, travel rewards, or an introductory 0% APR offer that can help you save on interest for a period of time.

Still, the very best and most-exclusive credit cards may be out of reach to those with merely good credit. You may need excellent credit to be approved for these cards, so theres still room for improvement if thats your goal.

Of course, your credit scores are only one piece of the puzzle. A credit score can be a helpful gauge in measuring your progress, but issuers may also consider other factors before making a lending decision.

For example, an issuer may consider eligibility requirements not accounted for in your credit scores, like your job status or income. Or they may give more weight to one aspect of your credit reports than another. This means its possible that two people with similar credit scores may not be approved for the same offer and even if theyre both approved, their rates and terms may be different.

This can make it difficult to understand why youre not approved but lenders are required to tell you why you were denied credit if you ask. Its illegal for lenders to discriminate against you, and getting an answer as to why you werent approved can be a first step to protecting your rights when it comes to credit and lending.

Compare offers for on Credit Karma to learn more about your options.