Your Credit Score Can Fluctuate

You may see some short-term movement in your credit score. This happens as information is added or falls off your report, which can happen frequently. Our latestConsumer Pulse revealed one-third of consumers monitor their credit at least weekly. Its encouraging to see people take an active approach to managing their credit health. But when it comes to your credit score, theres no need to obsess over minor, day-to-day changes. Nor is it necessary to achieve a perfect score. Trying to stay within a certain credit range is a smart, less stressful way to monitor your score.

Also, your credit score may not be the only thing a lender looks at when making a lending decision. For example, if you apply for a mortgage, lenders may also verify your income, personal assets and employment history. Because lenders look at multiple factors, its important to strive for overall financial wellness in addition to any credit score goal you may have. Building an emergency savings account and creating a plan to pay down debt, if you have any, will help you be more financially secure and can reflect positively in your credit health.

How To Get A Personal Loan With A 650 Credit Score

No matter what type of credit product youre pursuing, its always a good idea to shop around for the best rates and terms. Before you take on a personal loan that accepts a credit score of 650, do your research and see which loan will cost you the least in the long run.

You can apply for a personal loan by

- Researching potential lenders and ruling out any that dont operate in the state where you live, or that dont offer loans to people with fair credit.

- Reviewing each lenders minimum and maximum loan amount requirements to ensure you can get the loan amount you need without taking out more than you need.

- Inquiring about the fees charged by each lender youre considering, such as loan origination fees.

- Confirming whether the lender charges a prepayment penalty for paying off your loan early.

- Prequalifying for the loans youre interested in so you can get an idea of whether or not its worth applying and incurring a hard credit inquiry.

- Once you get your pre-approvals back, comparing the loan amounts, APRs, fees, and repayment terms that come with each loan to determine which is the best fit for your needs and which will cost you the least.

What Is The Average Credit Score In Canada

While credit scores in Canada range from 300 – 900, the average is around 650, according to TransUnion, though it varies from province to province. Once you’ve reached a credit score of 650 or higher, you’ll be able to qualify for more financial products. A credit score below 650 is going to make it hard to qualify for new credit, and anything you are approved for will likely come with very high-interest rates.

Do you know your credit score? You can use Borrowell to get your credit score in Canada for free. With Borrowell, you’ll get weekly credit score updates, see exactly what’s impacting your credit score, and get personalized tips on how to improve your score. You can also find your free credit score here.

Check out this infographic that shows the average credit scores in Canada:

Read Also: Does Klarna Affect Your Credit Score

How To Get A Loan Despite A Poor Credit Score

- Borrow from non-banks:While non-banking financial companies, like Bajaj Finserv, still need you to have a decent credit score, they tend to have relatively simpler eligibility criteria, which may help you raise funds fast and without too much effort.

- Apply with a guarantor or co-signer to your loan account:Adding a co-borrower to your loan application helps distribute the responsibility of repayment between you and the co-borrower. When your co-borrower has a good score, you will be able to borrow a larger loan amount and boost your chances of approval too.

- Try to find a secured loan:When a loan is unsecured, the lender is more stringent with the eligibility criteria by carefully filtering and selecting the most dependable or reliable borrowers. However, if you have collateral to offer, the significance of having a good credit score diminishes.

Additional Read: Get personal loan on bad CIBIL score

Recap: What Is A Good Credit Score And How To Get One

Your credit affects all areas of your life, from house purchases to banking and even buying a car. So its essential to understand what a good credit score is to set yourself up for financial success. Getting your credit score up is the first step to qualifying for more loans, building your financial reputation, and improving your financial health. So what are you waiting for?

This post originally appeared on Savoteur.

Also Check: How To Check Hard Inquiries Credit Karma

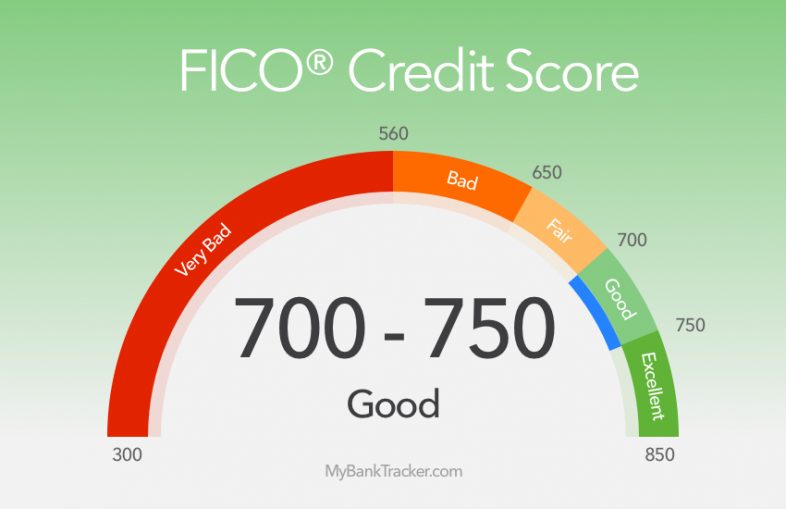

What A Fair Credit Score Means For You:

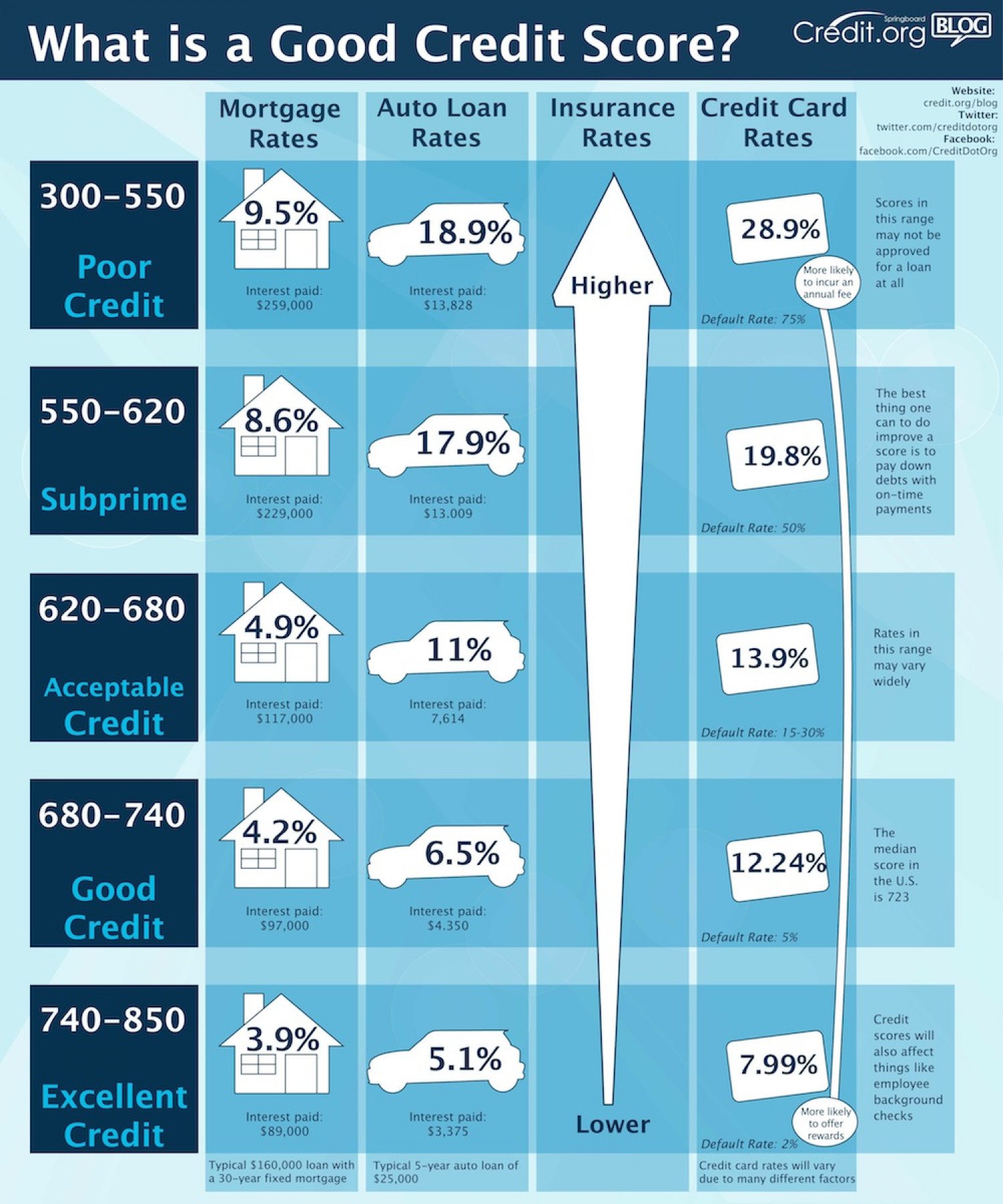

Borrowers within the “fair” credit score may push interest rates higher for their lines of credit. Borrowers in this range may incur higher charges associated with a loan or line of credit. It may be difficult to obtain a 30-year mortgage at the lower end of this range and you may expect higher interest rates. Auto loan APRs may have higher rates and credit cards may have lower limits and higher APRs.

What To Do If Your Chase Sapphire Preferred Card Application Is Rejected

When an application is rejected, you can inquire about the rejection and petition for approval by contacting Chases reconsideration line or by calling the number listed in the rejection letter. By law, card issuers are required to inform rejected applicants of the reason why an application has been denied. Applicants can respond to this information and make their case to a Chase representative using whatever valid evidence they can provide.

Its been widely reported that Chase has a strict policy against too many accounts open within a short period of time . Under this rule, if an applicant has opened five or more accounts in the last 24 months, a card application will likely be rejected. To avoid being denied for the Sapphire Preferred card for having too much activity on your credit profile, make sure youve opened fewer than five accounts in the last two years before submitting a new application. This information is readily available on a free credit report from one of the major credit bureaus .

You May Like: What Collection Agency Does Usaa Use

Your Score Range: 800

Your score sits between 800 and 850 on the FICO scale, putting you in a category with only 18 percent of the population. Although you have little or no room for improvement, this score tells lenders and potential lenders that you are an excellent investment. Achieving a top score shows that you are a low risk and that lenders are very likely to receive payment on loans they grant to you.

Does Getting A New Credit Card Hurt Your Credit

Getting a new credit card can hurt or help your credit, depending on your situation. It can help to increase your credit mix and improve your credit utilization percentage, but it will add a new hard inquiry to your account and make your average credit age youngerboth of which could lower your score. For those in the credit-building stage, adding a new credit card will most likely lower your score in the short term but also lead to a stronger credit score in the long term.

You May Like: Carecredit Minimum Score

Your Credit Report Contains The Following Information

Personal Information

- Identity verification

Each of your credit accounts will be given a rating that includes a letter and a number.

Letters

| Installment | Accounts that receive an I are installment style accounts that are paid off in predetermined fixed amounts. For example, a car loan. | |

| Open | Accounts that receive an O are open, which means they can be used up to a preset limit. An example of an open credit account is a line of credit. | |

| Revolving | Accounts that receive an R are considered revolving credit because your payments change based on how much of your limit you borrow. A credit card would receive an R. | |

| Mortgage | Depending on the credit bureau you pull your report from, your mortgage may or may not show up. If it does, it will be represented by an M. |

Numbers

| Account is in collections or bankruptcy |

Did you know that bad credit can affect your daily life? Learn more here.

Experian 2020 Consumer Credit Review

As Americans entered 2020, the economyas measured by consumer confidence, spending and stock market performancewas thriving. Two months into the year, however, the nation was struck by the COVID-19 crisis, and the economy slid into territory not seen since the Great Recession.

The coronavirus pandemic and resulting stay-at-home orders and other restrictions led to record unemployment, a plunging stock market, economic uncertainty and thousands of business closures throughout the U.S.

Despite those challenges, and perhaps partly due to relief measures enacted to combat the economic impact of the crisis, some consumers have seen certain aspects of their finances improve since the onset of the pandemic. The national average FICO® Score increased by seven points this yearthe largest annual improvement in at least a decade.

Major credit score components, such as and payment history, have also changed for the better, with average utilization rates and late payments decreasing at a record pace. Improvements of this kind add to consumers’ overall credit health and can cause scores to rise in a short period of time.

Read on for our insights and analysis.

You May Like: What Is Aoc Credit Score

Auto Debt Growth Stayed Steady

- 62% of U.S. adults have an auto loan.

- The average FICO® Score for someone with an auto loan balance in 2020 was 712.

- The percentage of consumers’ auto loan accounts 30 or more DPD decreased by 22% in 2020.

Auto debt is the second most popular type of credit, and more than half of the nation’s adults have an auto account listed in their credit reports. Average consumer auto debt experienced one of the more modest increases in 2020, growing by only 2%the same increase as last year.

The percentage of consumers’ auto loans 30 or more DPD went down by 22% in 2020. This decrease is a reversal from 2019, when this figure increased by 1%. Unlike other debt types, auto loans did not see any sweeping government guidance aimed at providing consumer debt relief during the pandemic. Any decisions to modify repayment of auto loanswhere and when it occurredresulted at the discretion of individual creditors. Additionally, accommodations for mortgage and student loan payments may have also contributed to consumers’ ability to make their auto payments on time.

What Is Considered A Good Cibil Score Range

A credit score ranging from 750 to 900 is considered an excellent credit score. Banks, NBFCs and other online lenders prefer candidates who have a credit score in this range. If your credit score is in this range, you will be eligible for most credit products. The following table will help you understand the CIBIL score range and its meaning.

|

Immediate Action Required |

Approval chances are very low |

As the table illustrates, having a credit score of 750 and above is considered to be excellent and it can help in easily availing several credit opportunities.

Read Also: Does Acima Build Credit

Points To Keep In Mind While Clearing Your Past Dues

- No Due Certificate: After paying your outstanding dues in full to the lender, obtain a No Due Certificate. This is the proof and indication that you have closed the loan completely.

- Incorrect Closure of Credit Card: Some agencies or the credit card issuer might offer you a discount on closing the outstanding dues on your credit card. Lured by the offer, you might tend to settle for 80% or 90% of the amount to be paid. However, this is not a complete closure. The discount will not be taken into consideration by the bureaus and eventually, you remain with bad credit. Hence, make a complete closure to clear your negative status completely.

- Removing negative issues from your credit report does not mean it will improve your credit score, it can only prevent a further drop. You should have a loan or credit card account active to get an improved credit score over a period.

- Becoming credit healthy does not happen in a day. You will have to be patient as there is a certain procedure followed across all banks and credit bureaus.

- Get your credit report and look for any errors on it. By raising a dispute resolution with the lender and credit bureau, you can get the errors removed.

Other Credit Scores Or Fico Scores

While FICO Scores are used by 90% of top lenders, there are other credit scores made available to consumers. Other credit scores may evaluate your credit report differently than FICO Scores. When purchasing a credit score for yourself, most experts recommend getting a FICO Score, as FICO Scores are used in 90% of lending decisions.

Recommended Reading: Opp Loans Credit Score

How To Earn An Excellent/exceptional Credit Score:

Borrowers with credit scores in the excellent credit range likely haven’t missed a payment in the past seven years. Additionally, they will most likely have a credit utilization rate of less than 30%: meaning that their current ratio of credit balances to credit limits is roughly 1:3 or better. They also likely have a diverse mix of credit demonstrating that many different lenders are comfortable extending credit to them.

What Is A Good Credit Score For A Credit Card

Like other lenders, credit card issuers will consult your credit score to determine the risk of doing business with you before approving you for a new credit card. If you want to open a premium travel rewards credit card, you may need good and perhaps even excellent credit scores to qualify. For other types of credit cards, even some with 0% introductory APR offers, a good credit score may be sufficient to be approved for the card.

Beyond qualifying for a credit card, your score can also have a significant impact on the APR and other terms of your account. Credit card issuers not only rely on credit scores to help them determine whether or not to approve applications, but they also use scores to set the pricing on the accounts they approve.

Take this list of top credit cards, for example. Youll notice that every credit card offer features not a specific rate, but rather an APR range. A card issuer might advertise an APR of 13.49% to 24.49%. The reason for that range is because the card issuer will base the final rate it offers you on the condition of your credit.

Defining a specific number that a credit card issuer defines as a good score is tough for two reasons:

Also Check: Comenity Shopping Cart Trick

What Is A Good Credit Score In Canada

It seems like everyone is talking about credit scores these days. Thats especially true in Canada today because about 71 percent of Canadian families are reported to have some type of debt. That could be a mortgage, loan for a vehicle, student debt, or other obligation.

But if you arent familiar with the system, how do you know if your is good, bad, or somewhere in-between? And why does it matter? Lets have a look at what is a good credit score in Canada and how you can make credit scores work for you.

Better Car Insurance Rates

Add auto insurers to the list of companies that will use a bad credit score against you. Insurance companies use information from your credit report and insurance history to develop your insurance risk score, so they often penalize people who have low credit scores with higher insurance premiums. With a good credit score, youll typically pay less for insurance than similar applicants with lower credit scores.

Don’t Miss: Experian Viewreport

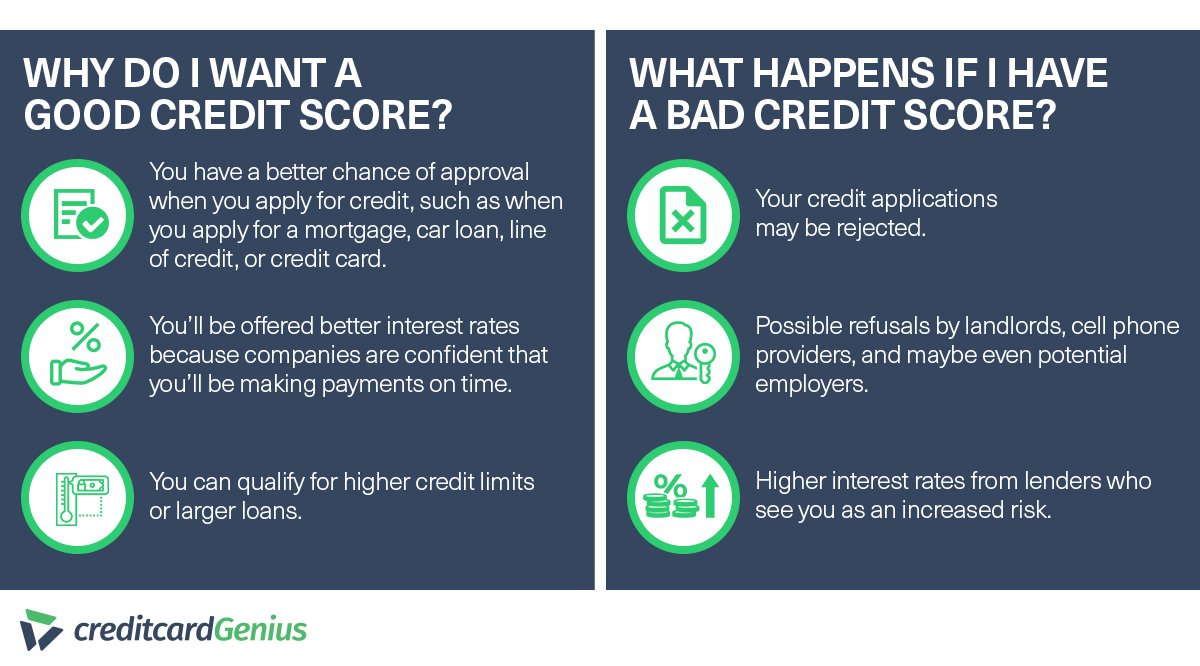

Benefits Of Good Credit

There are many benefits to having good credit. Landlords are more likely to rent you an apartment, for exampleand if youre job hunting, you might benefit if your employer reviews your credit as part of the hiring process. That said, the biggest benefits of good credit are all financial. Here are three ways in which good credit can make your life both easier and more affordable.

Get A Handle On Bill Payments

More than 90% of top lenders use FICO credit scores, and theyre determined by five distinct factors:

- Payment history

- Age of credit accounts

- New credit inquiries

As you can see, payment history has the biggest impact on your credit score. That is why, for example, its better to have paid-off debts remain on your record. If you paid your debts responsibly and on time, it works in your favor.

So, a simple way to improve your credit score is to avoid late payments at all costs. Some tips for doing that include:

- Creating a filing system, either paper or digital, for keeping track of monthly bills

- Setting due-date alerts, so you know when a bill is coming up

- Automating bill payments from your bank account

Another option is charging all of your monthly bill payments to a credit card. This strategy assumes that youll pay the balance in full each month to avoid interest charges. Going this route could simplify bill payments and improve your credit score if it results in a history of on-time payments.

Use Your Credit Card to Improve Your Credit Score

Also Check: Does Affirm Report To Credit