Eligible Parents Of Children Born In 2021 And Families That Added Qualifying Dependents In 2021 Should Claim The 2021 Recovery Rebate Credit Most Other Eligible People Already Received The Full Amount And Wont Need To Claim A Credit On Their Tax Return

The third-round Economic Impact Payment was an advance payment of the tax year 2021 Recovery Rebate Credit. The amount of the third-round Economic Impact Payment was based on the income and number of dependents listed on an individual’s 2019 or 2020 income tax return. The amount of the 2021 Recovery Rebate Credit is based on the income and number of dependents listed on an individual’s 2021 income tax return.

Families and individuals in the following circumstances, among others, may not have received the full amount of their third-round Economic Impact Payment because their circumstances in 2021 were different than they were in 2020. These families and individuals may be eligible to receive more money by claiming the 2021 Recovery Rebate Credit on their 2021 income tax return:

- Parents of a child born in 2021 who claim the child as a dependent on their 2021 income tax return may be eligible to receive a 2021 Recovery Rebate Credit of up to $1,400 for this child.

- All eligible parents of qualifying children born or welcomed through adoption or foster care in 2021 are also encouraged to claim the child tax credit worth up to $3,600 per child born in 2021 on their 2021 income tax return.

Q Why Are Some Of My Accounts Showing As Joint Even After A Divorce

A. The creditor is currently reporting the disputed information as a joint obligation. When co-signing for credit, you are equally responsible for repayment of that obligation. Unless you and the creditor agree to remove your name from the account, we will report these debts and subsequent credit information in the names shown on the contract or application. If the creditor agrees to release you from any obligation, please notify us immediately and we will re-investigate the account.A divorce decree does not override an original contract with a creditor. Any credit history established jointly before a divorce can be reported under both names shown on a contract or an application. If you have notified the creditor and they are willing to release you from your obligation, please notify us and we will re-investigate the account.

Submit Your Request In Person:

Equifax has four office locations where you can request a free copy of your Equifax credit report in-person and receive a printed copy of your credit report after your identity is confirmed. Copies of the request form you will need to complete are available onsite.

You need to bring with you at least two forms of identification, including 1 photo identification and proof of current address. Also, you must provide the original copies of your chosen identification – photocopies and electronic versions are not accepted at the office. Examples of acceptable documentation include:

- Driver’s License

- Utility Bills

Acceptable Supporting IDs:

- Birth Certificate Issued in Canada

- T4 slip

- Citizenship and Immigration Canada Document IMM1000 or IMM1442

- Social Insurance Number Card issued by Canadian Government

- Certificate of Naturalization

Providing your Social Insurance Number is optional. If you provide your S.I.N., we will cross-reference it with our records to help ensure that we disclose the correct information to you. We will not use it for any other purpose or share it with any third party.

Also Check: Comenity Bank Late Payment Forgiveness

Q If I Pay Accounts Will They Come Off My Credit Report

A. If an account is paid and does not contain any adverse information, the account will remain on your file for twenty years from the last date of activity. This information assists creditors to understand the type of credit you have managed successfully in the past. If you have paid an account that was not paid in agreement with the contract with the lender, this account will report for six years from the date you first became delinquent on the account.

Reasons You May Not Recognize Security Question Information

There may be several reasons you could have difficulty answering the security questions. While the presence of fraudulent activity on your report is one possibility, there may be several other explanations that are unrelated to identity theft:

If none of those reasons apply, there may be accounts opened in your name fraudulently. If you have been the victim of identity theft, you may not recognize accounts or personal information asked about in the security questions. If Experian is unable to sufficiently match your identifying information or response to the verification questions, you will need to provide documentation to verify your identity.

Recommended Reading: How Long Does Car Repo Stay On Credit

Negative Information In A Credit Report

Negative information in a can include public records–tax liens, judgments, bankruptcies–that provide insight into your financial status and obligations. A credit reporting company generally can report most negative information for seven years.

Information about a lawsuit or a judgment against you can be reported for seven years or until the statute of limitations runs out, whichever is longer. Bankruptcies can be kept on your report for up to 10 years, and unpaid tax liens for 15 years.

Correct An Inaccuracy On Your Equifax Credit Report

If you find any information that you believe is inaccurate, incomplete or a result of fraud, you have the right to file a dispute with Equifax Canada. You will need to complete the enclosed with your package. You can also review how to dispute information on your credit report for additional details on the Equifax dispute process.

Also Check: Does Drivetime Report To Credit Bureaus

How To Report Credit And Become A Data Furnisher

Establish Reporting Agreements

Companies reporting good credit or bad debt to the credit bureaus, must first establish a Data Furnishers or Service Agreement with each credit bureau to which you will be reporting. The Data Furnishers agreement is required whether you are reporting directly to the credit bureaus or through a processor/stacking service such as The Service Bureau. This is a separate agreement from pulling credit reports.

The credit bureau repositories also require a minimum number of active accounts and monthly reporting, even if you are reporting through The Service Bureau or another processor/stacking service –see example. We have provided phone numbers and account minimums for each credit repository for your convenience .

Companies reporting trade lines must use an application which is up-to-date with the Credit Reporting Resource Guide®, meets all credit reporting laws and regulations and is capable of accurately producing the Metro 2®* format layout such as.

Please Note: Consumers reporting personal loans are not eligible to report credit. Our software will upload to all bureaus that accept the Metro 2 format and support SFTP or HTTPS.

Dun & Bradstreet reviews each request individually and determines eligibility base on proprietary requirements. Participants have access to several incentives for contributing their data.

Procedures for reporting your accounts to the Credit Bureaus

Step 4 – Install Credit Manager software on your computer.

Why Should I Get A Copy Of My Report

Getting your credit report can help protect your credit history from mistakes, errors, or signs of identity theft.

Check to be sure the information is accurate, complete, and up-to-date. Consider doing this at least once a year. Be sure to check before you apply for credit, a loan, insurance, or a job. If you find mistakes on your credit report, contact the credit bureaus and the business that supplied the information to get the mistakes removed from your report.

Check to help spot identity theft. Mistakes on your credit report might be a sign of identity theft. Once identity thieves steal your personal information information like, your name, date of birth, address, credit card or bank account, Social Security, or medical insurance account numbers they can drain your bank account, run up charges on your credit cards, get new credit cards in your name, open a phone, cable, or other utility account in your name, steal your tax refund, use your health insurance to get medical care, or pretend to be you if they are arrested.

Identity theft can damage your credit with unpaid bills and past due accounts. If you think someone might be misusing your personal information, go to IdentityTheft.gov to report it and get a personalized recovery plan.

Also Check: Credit Score Of 714

Avoid Processing Delays When Claiming The 2021 Recovery Rebate Credit

The IRS strongly encourages people to have all the information they need to file an accurate return to avoid processing delays. If the return includes errors or is incomplete, it may require further review while the IRS corrects the error, which may slow the tax refund.

To claim the 2021 Recovery Rebate Credit, individuals will need to know the total amount of their third-round Economic Impact Payment, including any Plus-Up Payments, they received. People can view the total amount of their third-round Economic Impact Payments through their individual Online Account. The IRS will also send Letter 6475 through March to those who were issued third-round payments confirming the total amount for tax year 2021. For married individuals filing a joint return with their spouse, each spouse will need to log into their own Online Account or review their own letter for their portion of their couple’s total payment.

The IRS urges recipients of stimulus payments to carefully review their tax return before filing. Having this payment information available while preparing the tax return will help individuals determine if they are eligible to claim the 2021 Recovery Rebate Credit for missing third-round stimulus payments. If eligible for the credit, they must file a 2021 tax return. Using the total amount of the third payments from the individual’s online account or Letter 6475 when filing a tax return can reduce errors and avoid delays in processing while the IRS corrects the tax return.

Free Credit Report In Spanish

Additionally, Equifax is the first and only credit bureau to offer a free, translated credit report in Spanish online and by mail. There are two ways to request your Spanish credit report, online or by phone.

To receive your credit report in Spanish, you can visit: www.equifax.com/micredito or call Equifax customer service 888-EQUIFAX and press option 8 to begin requesting your free credit report in Spanish. Our Customer Care is available between 9:00 AM and 9:00 PM ET, Mon-Fri 9:00 AM and 6:00 PM ET, Sat-Sun. When you request your Equifax credit report in Spanish by phone you will receive it in the mail.

Read Also: Zebit Report To Credit Bureau

Why Is The Irs Sending Me Letter 6475

“The Economic Impact Payment letters include important information that can help people quickly and accurately file their tax return,” the IRS said in a January release, including personal information — like your name and address — and the total amount sent in your third stimulus payment.

This could include “plus-up” payments, the additional funds the IRS sent to people who were eligible for a larger amount based on their 2019 or 2020 tax returns, or information received from the Social Security Administration, Department of Veterans’ Affairs or the Railroad Retirement Board.

You may have already received a Letter 1444-C, which showed the amount you were paid and how it was delivered, but that’s not what you want to use to prepare your 2021 return.

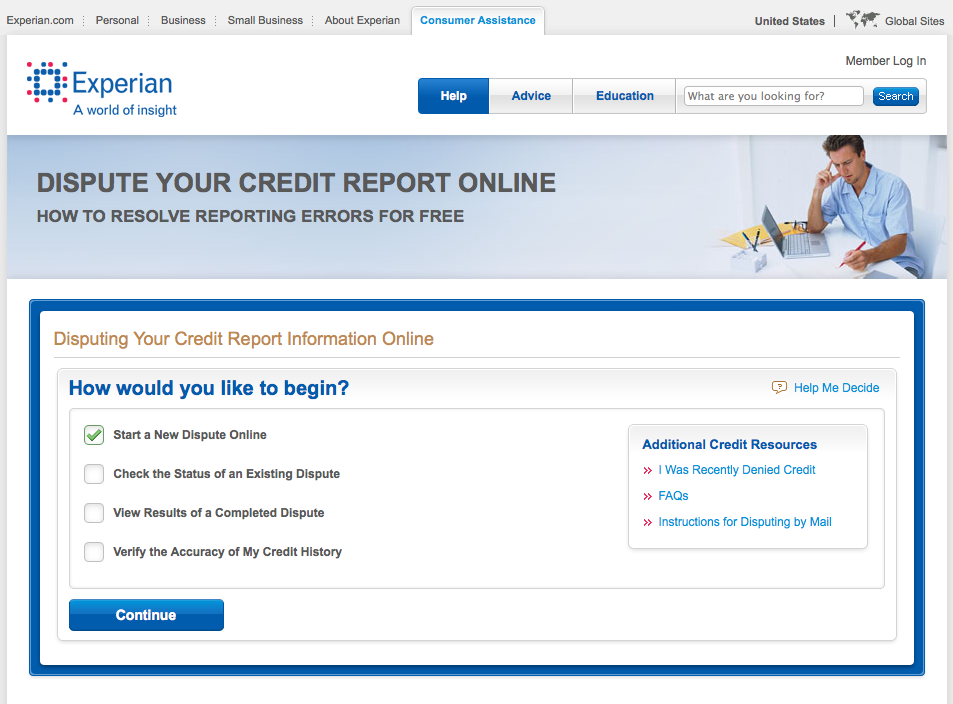

Review Your Credit Report For Errors

If you notice inaccurate information reporting on your credit report, it is important to dispute the inaccurate information with the Credit Reporting Agencies . Start your dispute .

If you are unsure how to read your credit report and you would like help in reviewing your credit report, please contact us at 1-877-FCRA-LAW , and we will be happy to assist you.

Don’t Miss: 672 Credit Score Auto Loan

Q How Do I Add A Consumer Statement To My Credit Report

A.If our investigation verifies that the information is reporting correctly, you may add a 100-word explanatory statement in your report to explain your dispute. Exception: 200 words in Saskatchewan. TransUnion requires the request in writing accompanied by a minimum of two pieces of acceptable identification. Together these combined pieces must contain your name, current address, date of birth and signature.This statement is referred to as a consumer statement. This statement should serve as an explanation of item contained in your credit history to companies viewing your credit report. Your statement can be removed at any time at your written request otherwise is maintained on your file for 6 years. All information should be supplied, with your signature to:Correspondence in English :Suite 201 Burlington ON L7N 3N8Correspondence in French :Centre de relations aux Consommateurs TransUnion3115 Chemin Harvester,Suite 201 Burlington ON L7N 3N8

How To Order Your Free Annual Credit Reports

The three major credit reporting companies have set up a toll-free telephone number, a mailing address, and a central website to fill orders for the free annual credit report you are entitled to under law. These are the only ways to get free credit reports without any strings attached. If you order your report by phone or mail, it will be mailed to you within 15 days if you order it online, you should be able to access it immediately. It may take longer to receive your report if the credit reporting company needs more information to verify your identity.

Do not attempt to order free credit reports directly from the credit reporting agencies. Free credit reports advertised by other sources are not really free!

To order:

- – Call 877-322-8228 .

- – Complete the Annual Credit Report Request Form available online, the only truly free credit report website, and mail it to: Annual Credit Report Request Service, P.O. Box 105281, Atlanta, GA 30348-5281.

- *Onlineat annualcreditreport.com.

Recommended Reading: Check Credit Score With Itin

Q Who Can Access My Credit Report

A. Provincial and federal laws outline the requirements for what organizations may access your personal credit information. Typically, when you establish a relationship with an organization, they will have you complete an application form that contains a consent statement advising you of how they will use your information. For example, they may inquire with the credit bureau to make a decision about your application and once you have established an account with them, they may report that information to the credit reporting agency and periodically review the status of your account.TransUnion may only provide organizations with access to your information if they have a permissible purpose as defined by provincial consumer reporting legislation. These permissible purposes typically relate to an extension of credit, collection of a debt, employment, tenancy, insurance and the establishment of a business relationship between you and an organization.Finally, you also have the right to access your credit report.

What To Look For On Your Credit Report

You need to scan the pages for information thats outdated, inaccurate or just plain wrong. All credit reports will give you the same sort of information: accounts, public records, inquiries. The only difference is the order or format the information is presented in.

If you stumble across any errors, contact the credit bureau directly online or by mail. You need to explain what they got wrong and why. Youll also want to send any documents supporting your claim.

Read Also: Dispute Verizon On Credit Report

Generate Your Credit Report Online

You can save reports to your desktop or print them out so youll have access later.

If you need to request a report or reports by mail, send a request form to:

Annual Credit Report Request ServiceP.O. Box 105281Atlanta, GA 30348-5281

Your report or reports should be sent within 15 business days.

You can also get your credit reports by calling 877-322-8228. Visually impaired consumers can also call this number to request audio, large-print or Braille reports.

Errors On Your Credit Report

If you find errors on your credit report, write a letter disputing the error and include any supporting documentation. Then, send it to:

Find a sample dispute letter and get detailed instructions on how to report errors.

The credit reporting agency and the information provider are liable for correcting your credit report. This includes any inaccuracies or incomplete information. The responsibility to fix any errors falls under the Fair Credit Reporting Act.

If your written dispute does not get the error fixed, you can file a complaint with the Consumer Financial Protection Bureau .

Recommended Reading: How Long Do Repos Stay On Credit

Medical Id Reports And Scams

Use your medical history report to detect medical ID theft. You may have experienced medical iD theft it if there is a report in your name, but you haven’t applied for insurance in the last seven years. Another sign of medical ID theft is if your report includes medical conditions that you don’t have.

Q How Is The Transunion Personal Score Calculated

The credit industry uses various types of credit scores to assess risk for different types of credit. For example, a creditor may use one type of score when assessing risk for a credit card account and another type of score when assessing risk for a mortgage account.

Read Also: Synch Ppc