How To Correct Mistakes In Your Credit Report

Both the credit bureau and the business that supplied the information to a credit bureau have to correct information thats wrong or incomplete in your report. And they have to do it for free. To correct mistakes in your report, contact the credit bureau and the business that reported the inaccurate information. Tell them you want to dispute that information on your report. Heres how.

How Good Is Your Credit Score

What to Do When Your Credit Card Application Is Denied

The purpose of this question submission tool is to provide general education on credit reporting. The Ask Experian team cannot respond to each question individually. However, if your question is of interest to a wide audience of consumers, the Experian team may include it in a future post and may also share responses in its social media outreach. If you have a question, others likely have the same question, too. By sharing your questions and our answers, we can help others as well.

Personal credit report disputes cannot be submitted through Ask Experian. To dispute information in your personal credit report, simply follow the instructions provided with it. Your personal credit report includes appropriate contact information including a website address, toll-free telephone number and mailing address.

To submit a dispute online visit Experian’s Dispute Center. If you have a current copy of your personal credit report, simply enter the report number where indicated, and follow the instructions provided. If you do not have a current personal report, Experian will provide a free copy when you submit the information requested. Additionally, you may obtain a free copy of your report once a week through December 31, 2022 at AnnualCreditReport.

Resources

Errors On Your Credit Report

If you find errors on your credit report, write a letter disputing the error and include any supporting documentation. Then, send it to:

Find a sample dispute letter and get detailed instructions on how to report errors.

The credit reporting agency and the information provider are liable for correcting your credit report. This includes any inaccuracies or incomplete information. The responsibility to fix any errors falls under the Fair Credit Reporting Act.

If your written dispute does not get the error fixed, you can file a complaint with the Consumer Financial Protection Bureau .

Read Also: How To Fix Credit Report

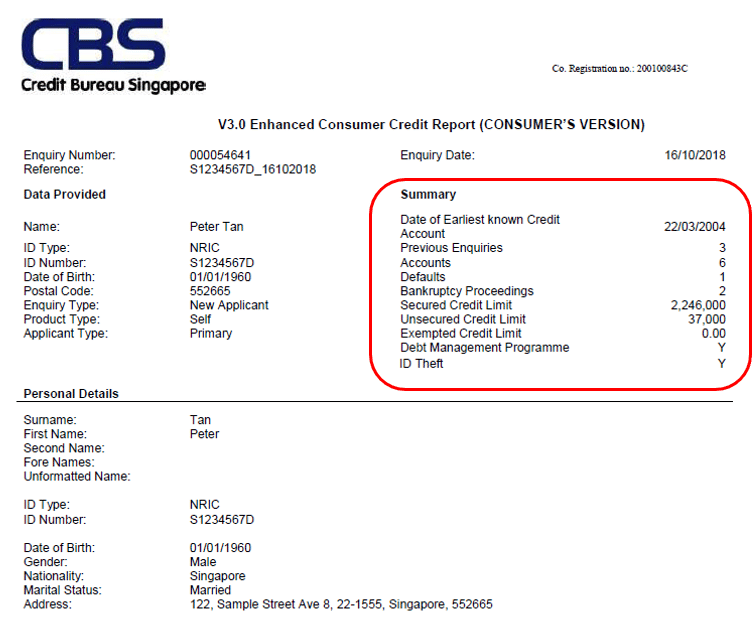

Accounts And Credit History

Your accounts and credit history will be recorded in the longest section, which should include all open credit accounts as well as accounts closed within the last seven to 10 years.

Your use of credit and history of account payments are some of the most influential , so youll want to review this section carefully. The accounts will usually be separated into several categories:

- Revolving, which includes credit cards and other lines of credit

- Installment, which includes fixed-payment debt like student loans or a car payment

- Mortgage, which is used to purchase a home

- Other, like child support or other financial obligations that are legally required to be listed on your report

Missing or late payments will also be noted here, and the report will show whether each account is in good standing . And since information is not reported every day to the credit bureaus, your balance may not be 100 percent current.

What to look for

Make sure you recognize every account and that they accurately reflect your current balances , credit limits, payment status and payment history.

Why it matters

Payment history is an extremely important factor in determining your , and missed payments can lower your credit score. That means youll want to keep an eye on late payments or high balances.

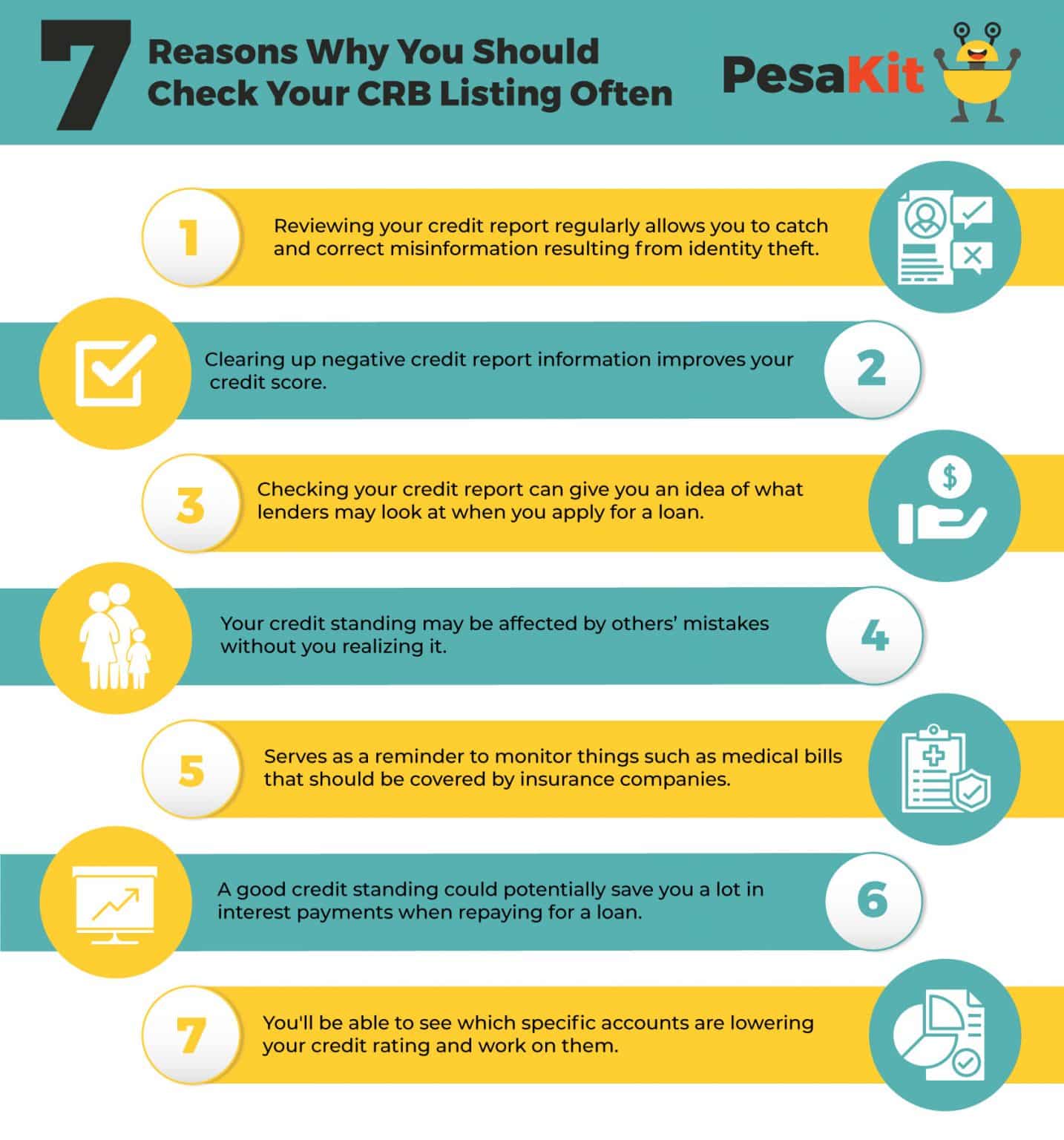

Why Should I Check My Credit Report Often

Experts indicate that it is a good idea to check your credit report for errors as regularly as possible, and more than once a year can be especially useful.

Your credit report has information about your finances and your bill-paying history, so its important to make sure its accurate, said Charles Harwood, Acting Director of the FTCs Bureau of Consumer Protection.

Seeing errors in your credit report may indicate that you have been a victim of identity theft. Responding to identity theft as quickly as possible is essential for minimizing the damage it can cause.

Not all errors in a credit report indicate identity theft. In some cases, your information may be outdated, or a payment you made on time may be listed as late. Either of these things can result in your credit score taking a hit. Fortunately, fixing an error in your credit report can help improve your score, according to CNBC.

According to a study from the Federal Trade Commission , one in four consumers identified errors in their credit reports that might affect their credit scores. Four out of five consumers who filed credit report disputes had their credit reports modified to some extent as a result.

If you check your credit report for errors and discover incorrect information, the agency may be in violation of the Fair Credit Reporting Act , and liable. If you find this to be the case, you may be able to join this credit report error class action lawsuit investigation.

Recommended Reading: What Credit Score Do You Need For A Va Loan

Hire A Credit Monitoring Services

Various companies and online platforms offer credit monitoring or score-monitoring services, either for free or through subscription. Examples include and .

The update frequency depends on the individual service. Some also provide you with a copy of your credit report. However, its worth bearing in mind that free services usually provide your VantageScore rather than your FICO score, which is a bit less useful .

What Is Contained In A Credit Report

In addition to a persons overall credit score, a credit report lists information about all current and past debt carried by the person in question. It also includes information about the persons current and past residences. Any late payments and collections activities are listed, as well as foreclosures and bankruptcies. Depending on the bankruptcy type, it will appear for seven to ten years, after which it will be removed from the credit report. The credit score listed on the report can vary slightly among credit reporting agencies.

Don’t Miss: How To Remove Timeshare Foreclosure From Credit Report

How To Report An Inaccuracy Dispute The Error And Get It Corrected

Should you find inaccurate information on your credit report, youll want to report it immediately. Make a copy of the credit report and type a letter describing the inaccuracy in full detail. Enclose any copies of documents supporting your position, which could include statements from companies showing the bill was paid or canceled checks.

Send all of this to the consumer reporting agency. Be sure to keep a copy for yourself. Send your letter by certified mail and request a return receipt.

The credit reporting agency will be required to investigate all the items in dispute within 30 days unless they consider your dispute frivolous. Youll receive the results in writing when the investigation is complete. If a correction has been made to your credit report, youll also receive a copy of the updated report.

Disputing errors on your credit report is important if youre trying to rebuild your credit or obtain a mortgage or other loan. Following these steps are important and can help you maintain good credit.

Why Its Important To Check Your Credit Report Once A Year

Checking a credit report is a good way to improve your score and detect errors. Credit reports reveal the types of credit activity that are affecting your score. You can see your debts and create a plan to pay them off. Consumers may find errors on their credit reports, and disputing them can increase their scores. Once the major credit bureaus remove an inaccurate detail, your score will likely rise.

Don’t Miss: How To Erase Closed Accounts From Credit Report

What Determines Your Credit Score

While there are many credit scoring models used to calculate a score, they tend to be impacted by similar factors. So, while an exact score depends on the scoring model and which credit report it’s analyzing, your are likely to trend in the same direction.

Common scoring factors include:

- Experience with different types of credit

- The age of your credit accounts

- Whether you’ve recently applied for or opened new accounts

In general, having a long history of making on-time payments and maintaining low balances on your credit cards can help all of your credit scores. Missing a payment, filing for bankruptcy or having an account sent to collections can hurt all your credit scores, although the impact can also diminish over time and eventually the negative information disappears completely.

Is There A Limit To How Often You Can Check Your Credit Score

Technically, you can check your credit score as often as you want. With that said, the company providing your credit score may impose a limit to how often they provide you with an updated score.

Thankfully, checking your credit wont hurt your credit score in any way. This is because credit checks you perform on yourself are classified as soft credit checks rather than hard inquiries .

Read Also: Does It Affect Your Credit Rating To Apply For Cards

Sign Up For Free Credit Monitoring

In addition to checking your credit score before applying for a loan or credit card, you may want to monitor your scores for large unexpected drops. These could indicate that you’ve missed a payment, or that someone has fraudulently applied for credit and opened accounts in your name.

Fortunately, you can get free Experian credit monitoring with real-time alerts. Experian also offers subscriptions to identity theft protection services, which include identity theft insurance and an option to get three-bureau monitoring and alerts.

How Often Are Credit Scores Updated

How often your credit scores update depends on how often the information in your credit reports changes. Most creditors will update your account records around once per month. 1

This means your credit score will update on a monthly basis if you only have one credit account, but may update more frequently if you have multiple .

In general, even though your credit score might update several times per month, its probably enough to check your score every 12 months. You dont need to pay attention to every single updateyou just want to maintain a reasonably clear and current picture of your credit health.

Note that you have multiple credit reports that may contain different information since creditors dont always report to all three credit bureaus. Because credit scores are based on the information in your credit reports, you could have multiple different credit scores at any given time, some of which may update more frequently than others.

Make sure you understand the difference between your credit score and credit report

As we just mentioned, your credit score and credit report arent the same thing. Its important to regularly check both, and you have to do this in different ways. Well explain the difference between your credit score and report and how you can check both at the bottom of this article.

Also Check: Does Credit Karma Affect Credit Score

Fixing Errors In A Credit Report

Anyone who denies you credit, housing, insurance, or a job because of a credit report must give you the name, address, and telephone number of the credit reporting agency that provided the report. Under the Fair Credit Reporting Act , you have the right to request a free report within 60 days if a company denies you credit based on the report.

You can get your credit report fixed if it contains inaccurate or incomplete information:

- Contact both the credit reporting agency and the company that provided the information to the CRA.

- Tell the CRA, in writing, what information you believe is inaccurate. Keep a copy of all correspondence.

Some companies may promise to repair or fix your credit for an upfront fee–but there is no way to remove negative information in your credit report if it is accurate.

Review Your Identification Info

The most important part of your credit report is your identifying information: your name, address and Social Security number, says Natalie Lohrenz, strategic partner liaison at GreenPath Financial Wellness in Santa Ana, California. People obsess over tiny fluctuations in their credit score, Lohrenz says. But what they should focus on is the question: Is it accurate?

A serious error such as an incorrect Social Security number can have serious consequences and needs to be addressed immediately. After checking all the identifying information, look at the accounts and make sure theyre all yours. Keep in mind that some lenders, such as the financing companies that issue store-brand credit cards, probably will have a different name than the one on the storefront.

Don’t Miss: What Credit Score For Walmart Card

How To Dispute Credit Report Errors

The Federal Trade Commission offers a path for you to get that information removed in just a few steps:

You may also choose to work with a , as they have detailed knowledge of the dispute process and may help you by removing inaccurate information from your report.

Dispute Mistakes The Right Way

If you find a major mistake, order your credit report from all three credit bureaus to determine whether the problem is limited to just one report. Then, determine whether you need to take up your dispute with the credit-reporting bureau or the lender. If theres someone elses information on your report, or there are accounts listed that arent familiar to you, contact the credit bureau. All three bureaus have online dispute forms to help you quickly resolve credit-report errors.

Taking things up with the bureau is easier because they have one set process, says author and personal finance expert Steve Bucci. Theres a dispute process in place so you can dispute any account with the same process, whereas when you contact the creditor, everyones a little different. Its not as neat and simple.

If there is negative information thats more than seven years old or an outstanding balance that has been paid off, contact the lender directly.

Don’t Miss: Does Collections Report To Credit

What If The Information Is Rightbut Not Good

If theres information in your credit history thats correct, but negative for example, if youve made late payments the credit bureaus can put it in your credit report. But it doesnt stay there forever. As long as the information is correct, a credit bureau can report most negative information for seven years, and bankruptcy information for 10 years.

How To Use The Rule Of Thumb For Checking Your Credit Report

Checking your credit report not only gives you insight into each of your credit accounts, it allows you to view a list of companies that have checked your credit report within the past two years. At a minimum, you should check your credit report at least once a year to be sure the information is accurate, complete, and within the federal for negative information on a credit report. In most cases, a consumer reporting agency may not report adverse information more than seven years old or bankruptcies that are more than ten years old.

“Consumers are entitled to one free credit report from each of the major credit bureaus once a year. Consumers can spread them out to check them every few months, rather than checking all three at once,” Madison Block, marketing communications and programs associate at American Consumer Credit Counseling, told The Balance by email.

Don’t Miss: Does Cashnetusa Report To Credit Bureaus

Why Check Your Credit Frequently

Your credit reports update regularly to reflect new data the credit bureaus have received. Seeing incorrect information pop up in your credit file could suggest that it has been mixed in with someone elses or that you have become a victim of identity theft.

Other errors, like outdated information or a payment wrongly reported late, could hurt your credit scores, which are calculated from information in your credit reports. That could affect the credit products and interest rates you qualify for.

Fixing an error could potentially improve your scores.

In addition, if you have accepted payment modifications in response to the coronavirus pandemic, you’ll want to make sure those accounts are being reported correctly. Other times it’s smart to check are before applying for a big loan and when you are looking for a job.

What If You Disagree With The Credit Bureau’s Investigation

If you tell the information provider that you dispute an item, a notice of your dispute must be included anytime the information provider reports the item to a credit bureau while that dispute is being investigated.

Finally, if the investigation does not produce the results you feel are correct, and inaccurate information in your credit report is causing you harm, you may consider hiring a lawyer to help resolve your dispute as a last resort.

The secret to success is to be vigilant and tenacious when it comes to reviewing, repairing, and correcting the record regarding your credit reports.

Estimate your FICO Score range

Answer 10 easy questions to get a free estimate of your FICO Score range

Don’t Miss: How To Unfreeze Transunion Credit Report