How To Remove Sprint Collections From Better Credit Blog

Jul 27, 2021 If you have Sprint debt, it will show up on your credit report as a collections account. Sprint may even pass off the collections to a

Feb 10, 2021 There is no agency specifically called Sprint Collections, but the Accounts Receivable department within the company provides collection

If youve had an unpaid Sprint bill sent to collections, there are ways to remove it so it wont drag down your credit score.

What To Do If You See Sprint Collections On Your Credit Reports

If you find yourself in the unenviable situation where Sprint Collections has popped up on your credit report, its important to act quickly.

Left unaddressed, a collection agency that appears on your report will remain for seven years, dragging down your credit score and alerting potential lenders to the fact that you failed to pay a past debt. In some cases, a collection agency may even be able to repossess the asset that was purchased with the unpaid funds.

With that said, once you find this mark on your report, its important to have a timely response. Here are a few initial actions you can take.

Should I Pay For Delete With Sprint Collections

Paying off Sprint Collections to have credit bureaus delete it from your report seems ideal. There’s one problem. Paying a debt in collections changes your credit report status from ‘unpaid’ to ‘paid’. The result? Your collections still appears on your report for 7 years . This means your credit is still affected.

But – there is one solution.

You can get your collection completely removed. Call to find out how.

Read Also: How To Get A Car Repossession Off Your Credit

Where We Got The Data

In order to provide the most accurate information possible, we employed three methods of data gathering over six hours.

First, we scoured through credit and finance forums online to see what people were reporting when it came to which credit bureau was used by their provider when they signed up for mobile phone service.

We also called the customer service agents at each of the four major U.S. mobile carriers.

We also called physical stores in New York City to see if different agents provided different answers .

Finally, we spoke to relatives and family members to gather more anecdotal evidence.

Once we put all of our data together, we were able to come to reasonable solid conclusions about which credit bureau each provider favors.

Do Mobile Carriers Make Hard Or Soft Pulls

Mobile carriers may make hard or soft pulls when you try to sign up for service.

Its hard to anticipate which type of pull will occur, but its best to assume that it will be a hard pull.

The majority of the credit checks run by mobile carriers are hard pulls because they are checking your ability to pay a new bill each month.

Now:

Don’t Miss: Care Credit Pulls From Which Bureau

What Is A Hard Pull

The reason that one credit bureau might have records of credit applications that others dont is that each time you apply for a loan, the lender will check your credit report.

It does this by contacting a credit bureau and making a hard pull on your report. The credit bureau that the lender works with will send a copy of your report to the lender.

The bureau will also make note of the hard pull on your credit file.

Each hard pull on your report will reduce your by a few points. Records of hard pulls are kept for two years.

If a lender makes a hard pull on your credit with one credit bureau, but not the others, its possible that your scores will differ based on which bureau you ask.

Thats because the bureaus dont inform each other of hard pulls.

It is also possible for a company to make a soft pull on your credit. This lets them check your credit report without impacting your score.

Featured Credit Card:

How Does 11 Charter Communications Work

Charter Communications offers a line of competitively priced telecommunications services through a massive network across the US.

In 2016 Charter merged with Time Warner Cable and Bright House Networks, expanding its home Internet services under the Spectrum brand.

With so many customers, Charter provides a lot of customer support.

Sometimes subscribers forget to pay their bills or leave a past due balance when they disconnect their services.

During the hassle of a move or a change in service providers, its easy for final payment to slip through the cracks.

When that happens, Charter can report your past due balance to all three of the major credit bureaus, Equifax, Experian, and TransUnion.

The resulting negative item on your credit reports will lower your credit score.

In many cases, companies like Charter hire debt collection agencies to recover debts from their customers.

Other times, agencies purchase the debt outright for pennies on the dollar.

They then report the debt to the and hound debtors until an agreement is reached.

A collections account entry from 11 Charter Communications, can stay on your credit report for seven years.

This can do substantial damage to your credit score.

When a collections account has appeared on your credit report, the lender or collections agency can frequently call you and mail letters regarding your unpaid debts as well.

Also Check: Usaa Fico Score

Try To Settle With Sprint First

If Sprint hasnt already sent the bill to collections, you should try to settle the matter by trying to contact Sprint directly.

This is generally the best way to resolve the matter and can prevent the debt from being moved to a collection agency.

In general, most companies are willing to work with you if you arent able to pay the full amount immediately.

Ask Sprint if you can work out a payment plan with them in order to pay the account number total balance.

This will keep you in good standing with them and avoid the debt from being sent to collections.

If Sprint has already sent the debt to collections, you will need to request a copy of your credit report to find out who currently owns the debt.

You can do this by contacting the three major credit bureaus and requesting a free copy of your credit report.

You are entitled to one free copy per year under federal law.

From there, you can find out the collection agencys identity and contact information.

You will need this information in order to request debt validation and negotiate a settlement.

If you are overwhelmed by dealing with negative entries on your credit report,we suggest you ask a professional credit repair company for help.

You May Like: How Do I Get A Repo Off My Credit

Ic System Is On My Credit Report What Should I Do

Have a question? Call for a medical account or for all other inquiries.

If IC System appears on your credit report as a negative tradeline, you may have a past-due bill, or it may be an error. Our company sometimes credit reports past-accounts this might appear as a negative tradeline on your credit report. But there are a number of reasons this could appear on your credit report in error.

If you have IC System listed on your credit report, there are a few things to ask yourself. Do I owe the debt? Was this information placed on my credit report by mistake? Does the information on my credit report match my records? Whatever the answers to these questions may be, IC System can help.

If you owe the tradelineIf you discover the credit listing is valid, our company can assist with our award-winning service. For healthcare accounts, call . For all other accounts, call to speak with a consumer financial representative.

For your convenience, IC System offers an easy-to-use and secure online payment portal. Visit our Make a Payment page to arrange a payment online.

If the tradeline is an errorShould you discover that the credit listing was made in error , IC System can help you investigate this. Visit our Dispute an Account page and submit your information on the dispute form. Once we locate your information and investigate, we will follow up with a solution.

Recommended Reading: Does Affirm Help Your Credit Score

Do You Need Credit Check For Sprint Unlimited

No credit check requires valid Id. International services are only included with service plans on phone lines with credit check. Sprint Unlimited Premium Plan: Includes unlimited domestic calling, texting, 100GB LTE MHS, VPN & P2P & data. MHS reduced to 3G speeds after 100GB/mo. Third-party content/downloads are addl charge.

Consumer Assistance Topics Debt Collection Fdic

May 26, 2021 Debt Collection Basics. Debt collectors are individuals and agencies that collect debts owed to others, such as a bank, attorney, landlord, or

Have questions or need help? Wed love to connect with you. Afni, Inc. is a debt collection agency. This is an attempt to collect a debt by a debt collector

Oct 18, 2021 Some of the bigger companies that ERC Collection Agency works with are Sprint, T-mobile, AT& T, & DirectTV. Once a debt collector

Also Check: Does Speedy Cash Check Credit

Dealing With Sprint Collections

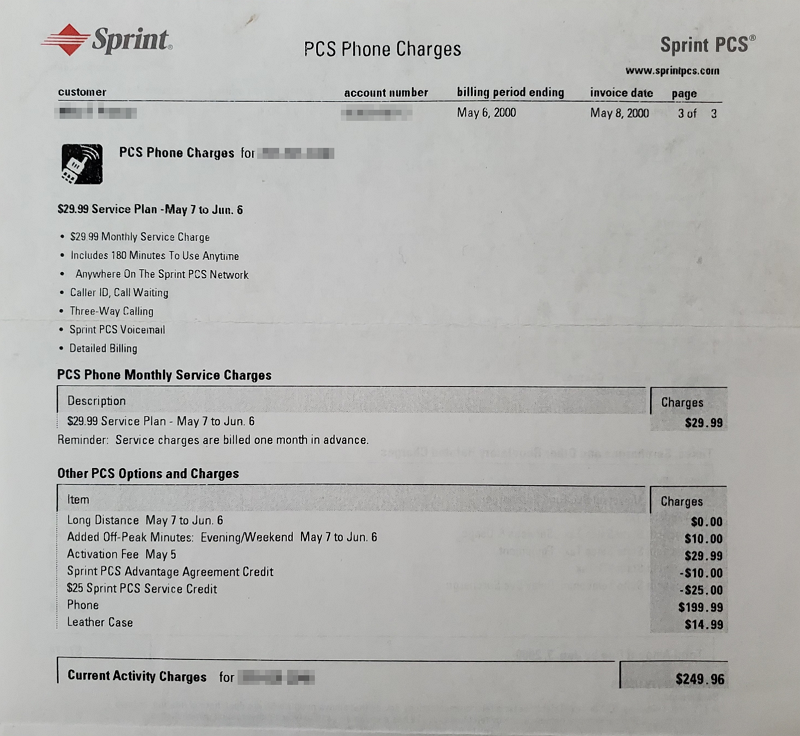

Mobile phone service accounts going into collection is hardly unusual. It often happens after you terminate service, and the company continues to pursue you for additional money.

Or there may be a dispute with billing, and your account ends up in collection.

This may be the case when youre dealing with a provider like Sprint.

Theyre now part of T-Mobile, but there are plenty of collection accounts remaining from when they were an independent entity.

If youre being pursued for a collection related to Sprint, it may be coming from different directions.

For example, if the account is relatively new, Sprint may attempt to collect the alleged debt directly from you.

Older collection accounts are more likely to be turned over to third-party collection agencies.

Whoever is instituting the collection effort against you, the strategies for dealing with Sprint collections are pretty much the same across the board.

How Collection Agencies Acquire Your Debts

Itâs important to note that debt collectors buy debt for âpennies on the dollar.â Because your original credit account was so delinquent, it was viewed as unlikely to ever be paid by the creditor and was likely sold to a debt collector for a steep discount.

In fact, one recent report found that debt buyers pay an average of just $0.04 for every dollar of the debtâs face value. So, if you owed a creditor $5,000, a debt collector likely paid in the ballpark of $200 to buy this debt.

Because the debt collector likely paid so little to buy your debt, you have significant room to negotiate a settlement. Itâs not uncommon for a $1,000 collections account to be settled for $300 or so, for example.

Also Check: Do Authorized Users Build Credit Capital One

Don’t Miss: Comenity Bank Credit Score

Should I Contact Or Pay Sprint Collections

Nothing good can come from speaking to a collection agency on the phone. And making payments on the collection account will reset the clock. So instead of helping your credit, it could make it worse. Of course, there are times when its best to just pay the collection account, especially if its new and youre sure that its legit.

The best way to handle this is to work with a professional credit repair service. They have deleted millions of negative items from companies like Sprint Collections for millions of clients nationwide.

And they can help you too.

How To Remove Erc Collections From Your Credit Reports

If youve determined that you dont owe a debt that ERC Collections is trying to collect on, you should reach out to the three major consumer credit bureaus to dispute the debt.

Once you file an official dispute, the credit bureaus are obligated to investigate. Theyll also forward information you send them to the debt collection agency, which will be required to report any inaccuracies it finds to all three of the credit bureaus.

Keep in mind that you often have only 30 days to respond to initial contact by a debt collector to request key information regarding the debt so time is of the essence.

If youre looking for additional support, the Consumer Financial Protection Bureau has resources including letter templates you can use to deal with common issues that come up with debt collectors.

You May Like: Cricket Affirm

How To Improve Your Credit

If you want to improve your credit, the best way to do it is to spend months and years paying your bills on time.

Building a long history of on-time payments is the best way to get your credit score into the seven or eight-hundreds. Even one missed payment can be a major setback in building your credit.

If you dont have months or years before the time youll need to have a good score, there are some short-term fixes you can try.

Will 11 Charter Communications Sue Me

This is the question so many account holders ask when they first hear from a collection agency:

- Could Charter sue me to force repayment?

- Could the company garnish my wages?

The law allows debt collectors such as 11 Charter Communications to sue you in civil court.

The company would have to win the lawsuit and then petition a judge to garnish your wages as repayment for a debt.

In most cases of consumer debt, a huge company like Charter will not sue for a small amount.

But to answer the question: Yes, the company could file a lawsuit against you.

Its more helpful, I think, to know what 11 Charter Communications cant do. It cant:

- Prosecute you in the criminal justice system

- Have you arrested

- Visit you in person about the bill

- Talk to your employer about your debt

If 11 Charter or any other debt collector violates your rights, let the Consumer Financial Protection Bureau or your states attorney generals office know.

Recommended Reading: Mprcc On Credit Report

Your Rights When Dealing With Sprint Collections

There are strict regulations about what a collection agency can and cannot do in the United States. For example, the Fair Debt Collection Practices Act prevents the use of abusive or deceptive tactics to collect a debt. In addition, the FDCPA provides you with many rights to ensure that collection agencies dont take advantage of you. In particular:

- It is a violation of federal law for Sprint Collections to report inaccurate or incomplete information on your credit report.

- You have a legal right to request debt validation on an alleged debt. Send the collection agency a debt validation letter. By law, they have 30 days to prove to you that the debt is really yours and the total amount is accurate. This is usually done by sending a debt validation letter.

- Sprint Collections may not threaten or harass you, call you repeatedly, swear at you, or publicly publish a list of debtors.

- Sprint Collections must be honest about who they are and what they are attempting to do. They must notify you that they are a collection agency both orally and in writing.

- Sprint Collections cannot threaten to have you arrested, and they are not allowed to threaten to take legal action if they have no intention of doing so.

Choose 007 Credit Repair Agent To Improve Your Credit Report Today

Dealing with credit repair is indeed an arduous task to do alone. But you can always ask for help, especially if you are not familiar with the procedures and the laws that protect you.

007 Credit Agent can help you in dealing with all your concerns regarding your credit. We have:

- Comprehensive and skilled credit repair experience

- Industry professionals to deal with any credit concerns

- Proven expertise in removing any collections accounts from credit reports

- Affordable services

Also Check: How Long Does Defaulted Student Loan Stay On Caivrs

Demand Sprint Collections Provide A Debt Validation Letter

Under federal law, all collection agencies are required to furnish you with a debt validation letter.

The letter spells out the terms of the collection agencys claim against you.

That includes all information surrounding the debt, including the name of the original creditor , the date the account went into collections, and the specific information that ties you to the obligation.

If the collection agency doesnt send you a debt validation letter, youll need to request one specifically.

Once you receive it, study it carefully. Pay close attention to all the details provided about the original debt.

If any information doesnt match your personal records, you may be able to dispute the account.

For example, the collection agency may be attempting to collect a payment that you already made.

If you can find and provide written evidence of the payment youve made, they should drop the claim against you.

Similarly, if any of the information about you personally is incorrect, it could be a case of mistaken identity.

But be aware that sometimes, even when the information the collection agency has is wrong and you prove that to be the case, they still dont drop the claim against you.

Thats another example of when you may need to get professional help.

Who Does Sprint Collections Collect For

Sprint Collections is a debt collector reporting a collection account on your credit report.

In some cases this means they purchased the debt from the original creditor . Usually this means they paid pennies on the dollar, sometimes 1/10th of the original cost, to buy this debt. In other cases they may not own the debt themselves, instead being paid to collect on behalf of another company.

They may attempt to communicate with you via mail or phone calls . Even worse, a collections account now appears on your credit report. This hurts your score to get approved for a loan or other important financial event.

Getting this account removed may be possible. Call to find out more.

Don’t Miss: Carmax Financing With Bad Credit