You Have Fewer Options For Credit

While you can still access some forms of credit without a credit score, itâs very difficult to do so. Plus, itâs likely that youâll be shut out of some of the better credit options. Yes, itâs true that you need credit to get credit. So, what should those without a credit score do? Consider some of the other credit-building activities listed later in this article.

What Causes A Good Credit Rating

A good credit rating means having a high credit rating. The best credit rating you can have from the main UK credit reference agencies is their maximum score:

-

ClearScore and Equifaxs credit scores are the same and the highest score is 700.

-

The highest and best possible credit score on TransUnion is 710.

-

Experians best possible credit rating is 999.

Your Last Collection Dropped Off Your Credit Report

When calculating credit scores, credit scoring models place people in different buckets, known as scorecards. Your credit profile is compared to other people in your scorecard to come up with your credit score. While you may have been at the top of one scorecard with the collection on your credit report, you may fall to the bottom of a different scorecard if any negative information falls off your credit report.

This type of credit score drop is outside of your control. Fortunately, as long as you keep paying your bills on time and keep your debt low, your credit score will improve.

You May Like: Is 524 Credit Score Bad

Open A Store Credit Card

The first step Bates took to build a positive credit history was opening a credit card with Macys. It had just a $100 limit, but it was what he needed to get the ball rolling.

Using the card and paying it down every month jump-started my credit score to go up, Bates tells The Penny Hoarder.

Store cards tend to have looser requirements, so you have a better chance of being approved than with a traditional card. They also tend to come with higher interest rates and fees, so only spend what youre able to repay each month to avoid accumulating debt.

You Made An Expensive Purchase

Another important factor in your credit score is the amount of available credit you’re using, or your credit utilization ratio. It comes as a surprise to many people but, if you make a big purchase on your credit card one month, you could see a credit score drop even if you pay the balance in full on your due date.

This happens because credit card issuers typically report the as of the last day of the billing cycle. The balance on your credit card statement is often the balance that appears on your credit report.

It’s relatively easy to correct the impact of a high balance. Simply pay down the balance promptly, avoid making other credit card purchases, and wait for the updated balance to show on your credit report. This will help you recover the lost credit score points.

Recommended Reading: When Does Open Sky Report To Credit Bureaus

Heres Whats Behind That Zero Credit Score

Getting a zero credit score can be a bit of a shock. If they were emojis, it would be a bit like this guy.

But dont worry, you can turn your emoji frown upside down with a few fixes.

But first, a bit about why you got a zero score.

For 85% of people with zero scores, theyll have a default or a bankruptcy on their file. This is the major problem: not paying your bills. Lenders want to know if youre going to pay your bills on time thats why they check your credit score. And your credit history gives them an idea of your financial behaviour, so its important to show that youre a good risk for them.

The remaining 15% of people with zero scores are more likely to be late making your payments, but those payments havent actually been late enough to get recorded as a default. So if youre getting a zero score but not seeing any defaults on your file, that could be why.

Its a good idea to get your full credit report so you can check everything on there and figure out exactly why youre getting the zero score. You can do this through illion, Credit Simples parent company. Its free and you can do it online .

Once youve got that info , you can start making changes to fix stuff up. A few tips include:

Other factors can also drag your score down to the unhappy zone, such as making a lot of recent applications for credit .

If youre constantly overdue with your payments, that also looks bad.

If youve defaulted on a credit agreement youll end up at the zero line.

How Long Does It Take To Get A Good Credit Score From 0

The good news is that it doesnt take too long to build up your credit history if youre starting from zero. According to Experian, one of the major credit bureaus, it takes between three and six months of regular credit activity for your file to become thick enough that a credit score can be calculated.

Recommended Reading: Does Titlemax Report To Credit Bureau

You Closed A Credit Card Or One Was Cancelled

Closing a credit card can hurt your credit score, especially if the card has a balance or more available credit than your other credit cards. Credit card issuers can also cancel your credit card, which will impact your creditnot necessarily because it was the creditor who closed the account, but because the account was closed at all.

Closing your only credit card or your oldest credit card can also impact your credit score.

What Exactly Is A Credit Score

A credit score is a three-digit number used by lenders to determine whether you qualify for credit, such as a loan or credit card. Your credit score is based on your credit report, which is a record of your credit history and how youâve managed your finances in the past. This allows lenders to assess your level of risk when you apply for credit.

Recommended Reading: 877-795-9819

Sometimes A Few Points Can Make A Big Difference

Slight day-to-day fluctuations in your credit scores are common and arent necessarily an indication that youre doing something wrong. The difference between a few points might not even matter.

Say you have a credit score of 810, and youre eligible for a lenders best rates and terms. If your score increases to 815, it might not matter the lender was already offering you the best deal.

But some lenders underwriting criteria require an applicant to meet a credit score threshold. In these cases, a rise or drop of a few points could make a big difference. So if you dont make the cutoff, your application could automatically get rejected.

Knowing where you stand in relation to a lenders threshold or recommended credit range can help you find the financial products youre eligible for and give you a goal if youre working on building your credit.

How To Build Your Credit File

A thin file can be frustrating because you might feel that youâre put at a disadvantage even though you have not done anything wrong. However, there are ways to build your credit, and they donât mean taking on a lot of debt.

If you feel that you want to improve your credit score and build some credit history, one of the simplest ways is to open a credit card. You should only do this if you are confident that you can manage your borrowings responsibly. As long as youâre charging small amounts to it every month , paying at least the minimum payment and keeping the account open, you will be building your credit history. Setting up a direct debit for repayments as soon as you open the account will ensure you never make a late payment. And every time you pay back what you owe, you are working towards good repayment history which proves that you are a reliable customer.

Recommended Reading: Affirm Fico Score

How Does Your Credit Score Compare

Most of the top credit rating agencies have five categories for credit scores: excellent, good, fair, poor and very poor. Each credit rating agency uses a different numerical scale to determine your credit score which means each CRA will give you a different credit score. However, youll probably fall into one category with all the agencies, since they all base their rating on your financial history.

|

Experian |

|---|

|

628-710 |

A fair, good or excellent Experian Credit Score

Experian is the largest CRA in the UK. Their scores range from 0-999. A credit score of 721-880 is considered fair. A score of 881-960 is considered good. A score of 961-999 is considered excellent .

A fair, good or excellent TransUnion Credit Score

TransUnion is the UKs second largest CRA, and has scores ranging from 0-710. A credit score of 566-603 is considered fair. A credit score of 604-627 is good. A score of 628-710 is considered excellent .

A fair, good or excellent Equifax Credit Score

Equifax scores range from 0-700. 380-419 is considered a fair score. A score of 420-465 is considered good. A score of 466-700 is considered excellent .

To get a peek at the other possible credit scores, you can go to ‘What is a bad credit score‘.

It Can Affect Your Finances

Financial institutions look at your credit report and credit score to decide if they will lend you money. They also use them to determine how much interest they will charge you to borrow money.

If you have no credit history or a poor credit history, it could be harder for you to get a credit card, loan or mortgage. It could even affect your ability to rent a house or apartment or get hired for a job.

If you have good credit history, you may be able to get a lower interest rate on loans. This can save you a lot of money over time.

Don’t Miss: Remove Hard Inquiries In 24 Hours

A Good Credit Score Means You’re Rich

False. Credit scores are just a measure of your risk . “A good credit score means you’re a good credit risk,” Ulzheimer says. “A low score means you’re a poor risk. That’s all they mean.”

Having a high salary doesn’t guarantee a higher line of credit, but if you update your income with a card issuer to a higher amount, you may see an increase in your credit limit, which could be positive for your credit utilization ratio . Also some cards, like the American Express® Gold Card, have no preset spending limit, which means there is no assigned credit limit.

How Long Does It Take To Build Credit

The exact time it takes to build a credit score depends on the individual borrower. In general, it will take at least six months because the first account must be at least six months old to register on your FICO credit score.

During the process of building a credit score, be patient. Always strive to make your payments on time, keep your credit card utilization ratio below 30% and check your credit score at least once per quarter to evaluate any changes in your score.

Recommended Reading: Affirm Credit Score For Approval

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

Why You Dont Have A Credit Score

Thereâs no such thing as a zero score. Having âno scoreâ simply means you donât have any number tied to your credit profile. You can be absent from the scoring model if youâve never had a credit card or loan, or if you havenât used credit in a long time. Itâs also possible that your new line of credit hasnât been reported yet.

Recommended Reading: 671 Credit Score Good

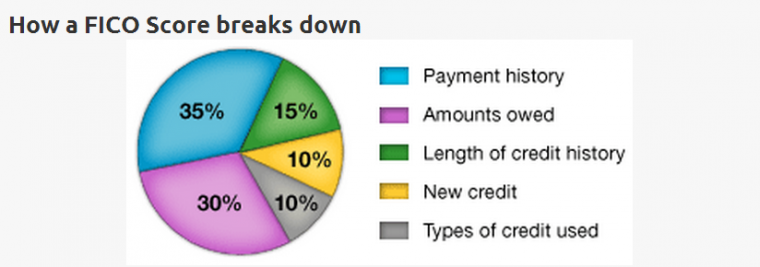

How Are Credit Scores Calculated In Canada

Generally, you need at least 6 months of credit activity in order for the credit bureaus and other credit score providers to calculate your credit scores. Depending on the credit scoring model used, the way your credit score is calculated will vary. Below is a breakdown of the common factors most credit scoring models use:

- Payment history ~ 35%:

- Public records ~ 10%

- Number of inquiries into the credit file ~ 10%

How Having No Credit History Affects Your Score

So, we have established that having no credit history means having no credit score. But where will your actual score fall once you begin building credit history?

First off, its important to understand that credit scores of zero do not exist. Both the FICO scoring method and VantageScores range from 300 to 850, so the lowest your credit score can go is 300.

Still, credit scores from 300 to 500 are typically reserved for individuals who have defaulted on some debts or those who have debt in collections. Thats why scores in this range are typically designated as poor.

While there is no set beginning credit score for those who are building credit for the first time, the first credit score you see may be closer to the fair range than the poor.

Don’t Miss: Uplift Pulls Which Credit Bureau

Sign Up For A Credit Card

Traditionally, when it comes to , retail and gas cards are usually fairly easy to qualify for and can be a good start for those new to credit.

While having credit accounts in your name is good, there are other steps you can take. One tried-and-true method is to be added to a parents or another persons account as an authorized user. Being added as an authorized user means that while you are not responsible for the payments on the account to the creditor, you still get credit for the positive payments on the account. This does not mean you should go out and charge a bunch of stuff on your dads credit card Im sure he would have something to say about that.

You might also look into obtaining a secured credit card. These cards are backed by a deposit with the lender. If payments are not made on time, the lender can take the deposit and not be out anything. That would, of course, defeat the purpose of building credit. If you choose to go this route, be sure that the cards activity will be reported to the three credit bureaus.

Theres A Mistake In Your Credit Report

Your credit score is based on the data in your credit reports. Credit report mistakes like a transposed number, a payment reported to the wrong account or a payment reported late when it wasnt can hurt your score.

The fix:Check your credit reports for mistakes and gather the documentation you need to dispute the errors. You can dispute online or by mail, and you will need to follow the process with each credit bureau individually.

Using a good deal more of your credit card balance than usual even if you pay on time can reduce your score that much until a new, lower balance is reported. A mistake in your credit report can also do it. Closed accounts and lower credit limits can also result in lower scores even if your payment behavior has not changed. Also, if you are certain it is for no reason, check to be sure you are not a victim of identity theft.

It actually wasn’t random. Credit scoring formulas use information in your credit reports to calculate your score. Closing an account, having your credit limit cut, charging more than normal, an error in your credit report or even identity theft can result in a lower score.

No, but it can feel that way. Scores are determined by formulas, and things like paying off a loan, having your credit limit reduced or closing an account can result in a lower score, as can a credit card balance that is higher than normal for you.

Recommended Reading: Whats A Good Paydex Score

Why Do Your Credit History And Score Matter

Banks stay in business by issuing credit to people who are responsible enough to pay it back. Without an intimate knowledge of how you spend your money, a credit score and credit history are the next best thing. They give the lender an idea of the risk they are taking when they lend to you. Then, they can approve or deny your application based on that risk.

How Credit Scores Work

A credit score can significantly affect your financial life. It plays a key role in a lender’s decision to offer you credit. People with credit scores below 640, for example, are generally considered to be subprime borrowers. Lending institutions often charge interest on subprime mortgages at a rate higher than a conventional mortgage in order to compensate themselves for carrying more risk. They may also require a shorter repayment term or a co-signer for borrowers with a low credit score.

Conversely, a credit score of 700 or above is generally considered good and may result in a borrower receiving a lower interest rate, which results in their paying less money in interest over the life of the loan. Scores greater than 800 are considered excellent. While every creditor defines its own ranges for credit scores, the average FICO score range is often used.

- Excellent: 800 to 850

- Fair: 580 to 669

- Poor: 300 to 579

Your credit score, a statistical analysis of your creditworthiness, directly affects how much or how little you might pay for any lines of credit you take out.

A persons credit score may also determine the size of an initial deposit required to obtain a smartphone, cable service or utilities, or to rent an apartment. And lenders frequently review borrowers’ scores, especially when deciding whether to change an interest rate or credit limit on a credit card.

What Is A Credit Score?

Recommended Reading: What Is Thd Cbna On My Credit Report