Who Can See And Use Your Credit Report

Those allowed to see your credit report include:

- banks, credit unions and other financial institutions

- offer you a promotion

- offer you a credit increase

A lender or other organization may ask to check your credit or pull your report”. When they do so, they are asking to access your credit report at the credit bureau. This results in an inquiry in your credit report.

Lenders may be concerned if there are too many credit checks, or inquiries in your credit report.

It can seem like you’re:

- urgently seeking credit

- trying to live beyond your means

How A Lender Can Help You Understand Specific Credit Goals

If youre unsure if your credit score is high enough to qualify for the mortgage you need, you can reach out to a loan officer for guidance on reaching your credit goals to purchase a home.

They can discuss the specific qualifications you should meet to afford the home you want, such as your debt-to-income ratio and down payment amount.

Avoiding One Partners Credit Score

What if you know your partner has horrible credit? Can you omit his credit score from the loan? In a perfect world, you could omit it. Unfortunately, that also means excluding his income. If you want to use your partners income to qualify for the loan, you have to use his credit. This requires you to do a little homework. Try to figure out if you could qualify for the loan with your income alone. Do you make enough to cover just your debts, plus the mortgage? By enough, we mean, enough to make your debt ratio low enough for the program. A good rule of thumb to use is 43%. This is the maximum allowed debt ratio under the Qualified Mortgage Guidelines. This means 43% of your income can be used to cover your non-mortgage debts as well as your mortgage. If you can meet this requirement, it is worth applying without your spouse. If not, you have to grin and bear it and use his score.

Recommended Reading: Does A Late Payment Affect My Credit Rating

Keep On Top Of Your Credit Score

Everyone is entitled to receive a copy of their credit report from each of the three major credit bureaus free of charge once per year. Apply for your reports by visiting AnnualCreditReport.org. It’s a good idea to check your reports regularly, line by line. Errors such as late payments that were never late and old collection accounts that have been paid off could affect your score and in some circumstances prevent you from getting a mortgage. The Federal Trade Commission encourages consumers to challenge credit report errors using the sample letter on its website.

References

What Credit Score Do You Need For A Mortgage

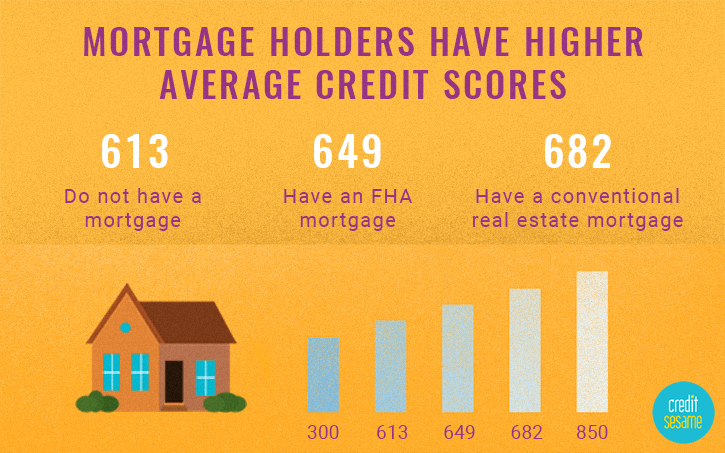

Theres no universal minimum credit score needed for a mortgage, but a better credit score will give you more options.

If youre trying to get a mortgage, your credit score matters. Mortgage lenders use credit scores as well as other information to assess your likelihood of repaying a loan on time.

Because credit scores are so important, lenders set minimum scores you must have in order to qualify for a mortgage with them. Minimum credit score varies by lender and mortgage type, but generally, a higher score means better loan terms for you.

Lets look at which loan types are best for different credit scores.

You May Like: Does Taking A Loan Payment Holiday Affect Your Credit Rating

How Lenders Use Credit Scores

When pulling a residential mortgage credit report, lenders often look at information from multiple bureaus and calculate multiple credit scores for evaluation. They look at each applicant’s credit history closely, and the scores used will ultimately determine whether to approve the mortgage and what interest rate the borrower will pay.

If you’re applying alone, your lender may pull your report from all three bureaus, calculate three FICO credit scores based on the information and then go with the middle number. Your lender could also pull your reports from two bureaus and use the lower FICO credit score or VantageScore of the two.

When applying with a co-borrower, such as your spouse, the lender usually computes scores from multiple bureaus for each of you. However, in the case where you have a high score and your co-borrower has a lower one, the lender often goes with the lower score. In some cases, a couple may decide to have just one spouse on the mortgage to avoid the risk of a denied application or unfavorable loan terms when one person has poor credit.

Which Credit Bureau Should You Pull From

Lenders pull from some of the credit bureaus when gathering information on you as a borrower.

If you need to see whats on your credit report, theres no definitive way of saying which bureau you should go through. However, you can take advantage of the free credit reports offered every year from each bureau. To do so, space out your requests so that you receive a free credit report from one of the bureaus every four months.

There are four credit report bureaus in total. They are Equifax, Experian, Innovis, and TransUnion. Each of them posts the same information on your credit report, but the exact details depend on what they gave.

For the most part, lenders only deal with Equifax, Experian, and TransUnion.

These are the bureaus that they entrust with to gather any information about you as a borrower. Most lenders see them as equals and, as a result, will report all consumer data to the three of them instead of just one. Meanwhile, Innovis tends to get left out and often reflects more negatively on its credit status.

In theory, you could get a new credit report in front of you every three months at no cost. The information on your Innovis report would be less reliable, but its still important to check this report at least once a year. If you are going through AnnualCreditReport.com, keep in mind that its only set up to accommodate the big three bureaus: Equifax, Experian, and TransUnion.

Recommended Reading: Does Requesting A Credit Report Hurt Score

What To Consider When Applying For A Home Loan With A Low Credit Score

If you do apply for a home loan with a lower credit score, make sure you consider these factors:

- You won’t permanently damage your credit score. A home loan application shows as a hard credit pull on your credit report. This credit pull may affect your credit score.

- You can lock in a low interest rate. If you want to buy a house when interest rates are particularly low, acting sooner rather than later may be a smart idea. Waiting longer to apply could mean getting a loan when interest rates and monthly payments are higher.

- You may need a large down payment. To offset your credit score, lenders may require compensating factors such as a down payment of 20% or more of the purchase price.

- Your lender may have stricter income or asset requirements. To make up for a low credit score, your lender may require a lower DTI ratio or significant assets in reserve.

- You may end up spending more. Some low-credit score loan options require high upfront or annual payments, which can increase the cost of buying a house.

Whose Credit Score Is Used On A Joint Mortgage

A joint mortgage allows two or more people to purchase a home together, and both buyers fill out a joint mortgage application.

One of the main benefits of applying for a joint mortgage is that youll have more income to put toward your home purchase.

Including two earners on your application means you’re more likely to be approved for a mortgage, you may be able to borrow more money and you could purchase a more expensive home.

Don’t Miss: How To Fix Negative Accounts On Credit Report

Calculating Your Qualifying Credit Score

Wondering what your credit score is and what kinds of mortgages you may qualify for? If so, the mortgage professionals at Maple Tree Funding can help!

If you are interested in purchasing a home in New York, we can help you determine your qualifying credit score, calculate how much you can afford to spend on a home and help you understand the mortgage options available to you. We will guide you every step of the way, from mortgage pre-qualification to the closing table, helping you to secure the mortgage that is right for you and your budget.

We work with clients of all kinds, from first time homebuyers and individuals with less-than-perfect credit to homeowners looking to refinance their current homes. As a mortgage broker based in Upstate NY, our broad spectrum of home loan options includes government mortgages, conventional loans, fixed rate loans, adjustable rate mortgages and more.

Interested in taking the first step towards owning a home in NY? Give us a call at or contact us online today and well calculate your credit score and get you started on the path to homeownership!

Editors Note: This post was originally published in 2014 but has been updated as of March 2017.

What Else Do Mortgage Lenders Look At To Determine Mortgage Terms

Your credit scores can be an important factor in getting approved for a mortgage and the rates you’re offered. However, mortgage lenders also go beyond your credit scores when evaluating a potential borrower’s application.

They’ll also take a close look at the information within your credit reportsnot just your scores. For example, even if you have a good credit score, the lender might deny your application if you recently filed for bankruptcy or had a home foreclosed on. Or if you owe too much money to collection agencies.

Mortgage lenders may also request various financial records, including recent bank statements, investment account statements, tax returns and pay stubs. They can use these to determine your income, debts and debt-to-income ratio, which can be an important factor.

Other factors, such as the loan amount, the home’s location, your down payment and loan type can all play into whether you’ll be approved and your mortgage’s terms. Lenders may also have unique assessments, which is one reason shopping for a mortgage can be important.

Also Check: What Is The Maximum Credit Score

What Mortgage Lenders Look For When Approving A Home Loan

When you apply to get pre-approved, your lenders will review your credit history and consider your current credit outlook. This includes looking at:

- How on-time have you been with your payments and obligations?

- What does your current debt load look like, and how is spread out?

- How much experience do you have managing credit?

- Have you been recently trying to acquire access to new sources of credit?

- Do you let items go into collection?

- Have you previously filed for bankruptcy?

Lenders ask these questions to get comfortable about you. Your financial health isnt the only consideration lenders make, but how you manage your bills tells a large part of your story.

Lenders also look for specific credit events known as derogatory items, like bankruptcy or delinquent accounts.

Derogatory items dont disqualify a mortgage approval. Generally, its only required that theyre historical events and not current ones. For example, you can get approved for a mortgage if youve declared bankruptcy in the past, or if youve lost a home due to foreclosure.

Lenders know that life is unexpected and bad things happen. Whats important is whats happened in the time since the derogatory event occurred.

Do Lenders Report To All Three Bureaus

It is up to the creditor to notify the credit-reporting agency about any borrowing behavior, whether good or bad.

The Fair Credit Reporting Act recommends that lenders report to all bureaus, but this is not mandatory. In fact, some credit unions will only report to one of the four bureaus not to worry, most financial institutions consistently report to the big three.

Another interesting fact is that lenders are not required to report any information to credit bureaus. Its possible to maintain a car or home loan for many years, while no information about it shows on your report. This is unlikely, and it usually gets fixed upon request. If any old accounts are newly factored into your FICO score, keep in mind that it might take six months before your credit rating fully adjusts.

Since lenders are not required to report it, the lack of consistently reported data can become a problem. Innovis tends to get more of the bad information and not so much of the good. Most credit card issuers and loan providers habitually report to the three major credit bureaus, while Innovis gets left out.

Recommended Reading: When Do Things Disappear From Credit Report

Whats The Difference Between Scores

In reality, the scoring formulas are pretty universally similar, but many of the formulas are designed to more closely analyze different things. Typically, the type of lender will depict what type of score or scores will be looked at. For instance, an auto lender will want to see data on whether you paid on time and in full when it comes to any past auto loans that were in your name.With that being said, the issue shouldnt be so much worrying about what credit score a lender is going to check, but whether your credit is in good shape to begin with. If its not, there are a number of tactics you can enact to get your score where it needs to be, whether youre looking to get into the range of acceptance on a loan or whether you want to get it into the range that will qualify you for the lowest offered interest rates. Heres a look at some credit repair tips:

- Pay off high-interest debts first.

- Keep your debt-to-credit ratio at or below 30 percent.

- Pay all bills on time and in full.

- Check your credit report at least once a year to ensure its accuracy. Dispute any inaccuracies accordingly.

Your Mortgage Credit Score Might Not Be What You Expect

Many home buyers dont realize they have more than one credit score. And the score a mortgage lender uses may be lower than the one you see when you check it yourself.

Finding out late in the game that you have a lower mortgage credit score could be an unwelcome surprise. You might end up with a higher interest rate and/or smaller home buying budget than youd planned.

So before you apply, its important to understand how lenders look at credit and what score you need to qualify.

Also Check: When Was The Credit Score Invented

How To Get Started

If youre ready to begin the homebuying or refinance process but are unsure about your credit situation, check with your bank or credit card issuer to get an idea of your score. You also should download your full report yearly to evaluate your history and ensure there are no errors.

Your credit history might be complicated.

To help you learn more about your situation and improve your score, consider working with your lender or a financial counselor to help you get where you need to be.

After My Down Payment What Other Related Mortgage Fees Do I Need To Consider

Once youve settled on a down payment, its important to take stock of your closing costs. Closing costs often run between two to three percent of your total loan. Other fees include the loan origination fee, the loan application fee, the title services fee and appraisal fee. Additionally, you might consider setting up an escrow account, which guarantees 12 months of property taxes and homeowners insurance.

Recommended Reading: What Is The Average Credit Score In The Us

Q Will These Manufacturers Make A Delicate Pull In Your Credit Score

These manufacturers could do a delicate pull in your credit score rating that will help you select the lender to attach with. Lenders of their networks can also conduct a delicate pull and/or a exhausting pull. Usually, a delicate pull is completed initially, after which a exhausting pull could also be executed after by a lender. Their lenders may do a number of credit score pulls.

Which Credit Scores Do Mortgage Lenders Use

When you apply for a mortgage, lenders will generally request all three of your credit reports and a FICO® Score based on each report. However, the type of FICO® Scores they request are often older versions, due to guidelines set by government-backed mortgage companies Fannie Mae or Freddie Mac. It can be important to know about these different FICO® Score versions when you’re planning to buy a home.

Also Check: What Credit Score Is Needed For A Home Loan

Why Scores Are Different

You might think that all three credit scores, even if different, would be very close. Not so. There can be differences as large as 50 to 75 points, higher or lower. For example, two bureaus might report scores of 685 and 700, yet the third might show 635. You read the credit report and learn that the third bureau shows an unpaid IRS tax lien, while the others do not. Whether true or erroneous, this entry depresses one score, but has no effect on the other two.

Why Do Credit Scores Differ Between Online Sources And Mortgage Lenders

Heres a common story: You apply with a lender thinking that you know your credit scores. Then, the lender informs you that its credit scores were far lower than the free scores you got online. Theres good explanation. There are many different versions, models, and algorithms when it comes to credit scores dependent upon the purpose and type of industry.

The main goal of credit scoring is to predict the likelihood that a person will fall at least 90 days behind on a bill within the next 24 months.

Consider this: There is no default risk to allowing you to check your credit and credit scores online or through an app. However, the default risk to an auto lender for granting you a $40,000 loan is far greater than that of a credit card company that is considering a $2,000 credit limit.

In comparison, the risk associated with granting you a $200,000 mortgage loan is far greater than any of the prior examples. It makes sense that each type of creditor would use a different type of credit scoring.

Related: Raising Your Credit Score Can Save Thousands in Interest. Heres Why.

Don’t Miss: How To Access Free Credit Report