Minimize Your Overall Credit Card Debt

, both of which contribute to credit scores. From a personal finance perspective, its always best to pay your credit card statement balance in full each month to avoid debt, but its also a good idea when it comes to maintaining the highest possible credit scores.

You might improve your scores by having multiple credit cards provided you dont max them out or carry a balance so you have a high available total credit limit and low utilization. You can also decrease your credit utilization rate without opening new credit accounts by asking for a credit limit increase. In some cases, being added as an authorized user to a family members credit card may also give you more available credit, lowering your credit utilization, and ultimately, increasing your credit scores.

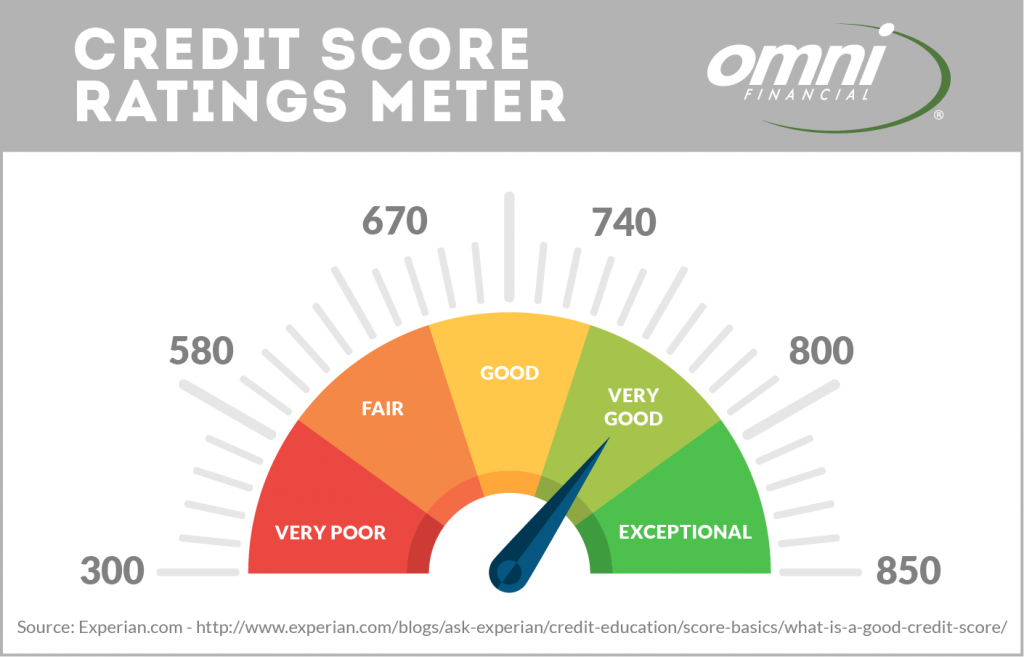

What Is A Poor Credit Score Range

Poor credit score = 550 619: Credit agencies consider consumers with credit delinquencies, account rejections, and little credit history as subprime borrowers due to their high credit risk. Although it is possible to qualify for credit, it is often at very disadvantageous terms you will pay much higher interest rates and penalty fees.

If you find yourself in this range, you should begin to address any specific credit problems you have to try to boost your score before applying for credit. Subprime borrowers typically become delinquent 50% of the time.

California Holds The Top Five Areas With The Highest Concentration Of People With Perfect Fico Scores

Looking at the concentration of perfect FICO® Scores by metropolitan statistical area , California held all top five spots. The San Luis Obispo-Paso Robles, California, area had the highest concentration of perfect FICO® Scores, with 2.27% of its scores reaching 850, according to Experian data from the fourth quarter of 2018. Oxnard-Thousand Oaks-Ventura, California, and Santa Rosa-Petaluma, California, came next with 2.15% and 2.13% of people with perfect scores, respectively. San Jose-Sunnyvale-Santa Clara, California, came in fourth with 2.03% of all scores being perfect. And finally, San Francisco-Oakland-Fremont, California, came in fifth with 1.99% of all FICO® Scores reaching 850.

Recommended Reading: Does Capital One Report Authorized Users To Credit Bureaus

Have Low Credit Card Balances

A credit utilization rate of 30% or more can negatively impact your credit score. As part of an effort to stay below 30% credit utilization, you should make sure your card balances dont get too high.

You can figure out your utilization rate by dividing your total credit card balances by your total credit limits. Usually, keeping a credit cards balance smaller relative to the cards credit limit will help increase your credit scores.

For the highest credit scores, your utilization rate should be under 6%.

How Do I Get The Highest Credit Score

While it is theoretically possible to achieve a perfect 850 score, statistically it probably wont happen. In fact, about 1% of all consumers will ever see an 850, and if they do, they probably wont see it for long, as FICO scores are constantly recalculated by the credit bureaus.

And its not like you can know with absolute certainty what is affecting your credit score. FICO says 35% of your score derives from your payment history and 30% from the amount you owe . Length of credit history counts for 15%, and a mix of accounts and new credit inquiries are factored in at 10% each. Of course, in actually calculating the score, each of these categories is broken down even further, and FICO doesnt disclose how that works.

The credit bureaus that create credit scores may also change how they make their calculationssometimes for your benefit. Changes were made in 2014 and 2017, for example, to reduce the weight of medical bills, tax liens, and civil judgments. However, changes made in January 2020 for FICO 10 involving trending data, credit card debt, personal loans, and delinquencies may make getting a higher score more difficult.

You May Like: Can You Remove Hard Inquiries Off Your Credit Report

Getting The Highest Credit Score Possible

When youre familiar with what the highest credit score is, how to achieve it, and how to maintain it, youre putting yourself in a better financial situation. Your credit score impacts your ability to make big purchases like a home or car, and it also impacts smaller things like whether or not you have to put a deposit down when applying for utilities or a cell phone.

While getting a perfect score of 850 may be a long shot, getting a score in the Good or Excellent range is certainly attainable and, if you follow some of the steps outlined in this article, youll be well on your way to financial freedom.

How To Earn An Excellent/exceptional Credit Score:

Borrowers with credit scores in the excellent credit range likely haven’t missed a payment in the past seven years. Additionally, they will most likely have a credit utilization rate of less than 30%: meaning that their current ratio of credit balances to credit limits is roughly 1:3 or better. They also likely have a diverse mix of credit demonstrating that many different lenders are comfortable extending credit to them.

You May Like: When Does Capital One Report To Credit

Ways To Improve Your Credit Score

If youre looking to improve your score, there are some basics that you can work on. Those are:

If you put some of these strategies into play, its not difficult to move from one credit ranking to another.

Its Not Necessary To Have A Perfect Score

Ulzheimer says his FICO credit score has hit 850 off and on for the past five to seven years. That achievement became easier once his credit history passed the 20-year milestone, he says. Yet Ulzheimer notes he hasnt been striving for perfection with his credit score he just knows the right behaviors for managing his credit well.

Unlike Ulzheimer, Stevens says racking up a perfect FICO credit score of 850 has been his goal for a few decades.

As many do in their 20s, I experienced financial instability and suffered some setbacks that greatly impacted my credit scores. That credit also limited my economic flexibility, says Stevens, managing partner of a private car service in Austin.

He adds: As I grew older, I became more aware of how good credit opened opportunities for advancing and enhancing my life. So I continued to work on getting an ever-better score. After a while, it not only became a goal but a total obsession.

But Ulzheimer says obsessing over how close your FICO credit score is to 850 doesnt necessarily pay off. Why?

Ulzheimer says an 850 FICO score isnt needed to gain the best interest rates or APRs on credit cards and loans. In fact, he adds, theres not much difference in that regard between, say, 800 and 850. More than anything else, arriving at 850 merely gives you bragging rights, Ulzheimer says.

As long as your scores are above 760, you are likely going to get the best deals, Ulzheimer says.

You May Like: How Much Does Overdraft Affect Credit Rating

What Is A Credit Score

Your is a number that measures your creditworthiness. Its based on the information on your credit report, which includes a record of your credit card and loan history. Credit scores give creditors and lenders an easy way to understand how well you’ve handled your credit obligations in the past. Without a credit score, creditors would have to sift through all your credit information and make a more subjective decision about your credit risk. And these decisions would likely vary from one creditor to the next.

How To Go From Good To Great

To borrow from Leo Tolstoy, all great credit scores are alike, but all bad credit scores are bad in their own way. That is, ideal credit scores are built on a similar set of healthy financial habits, but your scores can be damaged by any number of factors. There are many different issues that can hurt your credit, such as:

Late or missed payments. Too many open credit accounts. High credit card balances. High balances on loans. Too many credit applications.

The first step toward improving your credit health is avoiding getting trapped in the highs and lows of managing your credit.

Heather Battison, vice president of TransUnion Canada explains how consistency is key: The most important factor for building and maintaining your scores is to pay your bills on time and in full each month. This activity demonstrates your ability to responsibly manage credit and can positively impact your credit scores.

Its also key to remember that your payment history isnt just about paying your credit card bill. It also includes things like your cellphone bill, says Trevor Gillis, associate vice president of account management at TD Credit Cards.

Gillis says building good credit scores is based on using your credit card responsibly, which means making at least the required monthly minimum payment , making your payments by the payment due date and keeping your credit card utilization low.

Don’t Miss: Credit Carmax

Why It Is Important To Understand The Highest Credit Score

Most peoples credit score falls into the fair category or worse, with an average of less than 621. Of 30-year olds, 38% have a score below 621, with 29% achieving a score between 621 and 680, but only 2% have a score of 780 or more. This makes it very clear that people can do a lot to improve their scores.

If you understand what the max credit score is and where your score is related to it, it helps you make improvements. It cannot be emphasized enough that you need a higher score if you want lower interest rates.

What Is A Good Credit Score For A Loan

If you need a car loan or a mortgage, it’s another story. Lower credit scores are often able to borrow money for these purchases. However, they’ll be at a major disadvantage when it comes to the interest rate they get.

The minimum FICO score required for conventional mortgage approval is 620. You can get a mortgage with this credit score, but you might have to pay more in interest. For example, as of this writing:

- The average borrower with a score of 620 can expect an APR of 5.084% for a 30-year loan

- The average borrower with a score between 700 and 759 can expect a much lower APR of 3.717% for the same 30-year loan

To put this into perspective, with a $200,000 mortgage, the lower-credit borrower would pay an additional $58,120 in interest over the term of the loan.

Because of these factors, it’s important to pay attention to your credit score. Even though it’s hard to get a perfect credit score, if you work towards the best credit score you can get, your wallet will thank you.

Don’t Miss: Does Speedy Cash Check Credit

Why Is A Good Credit Score Valuable

Now you know a little about where scores come from. But that doesnât explain why good credit scores are so valuable. Credit scores are often associated with credit card or loan applications, but their influence goes beyond that.

Good scores can affect interest rates, credit limits, housing applications and even job prospects. And they can offer more options, more bargaining power and more financial flexibility.

Pre-Approval, Pre-Qualification and Comparing Offers

For starters, you may be pre-approved or pre-qualified for more credit card offers if you have a good score. That may allow you to compare offers and find the best fit for your situationâwhether youâre looking at mortgages, credit cards or auto loans. But if youâre shopping around, be sure to understand how credit inquiries can affect your credit.

Interest Rates and Credit Limits

If youâre approved for a loan or a credit card, a good credit score could mean higher credit limits, lower interest rates or both. And when youâre paying less in interest, you may have smaller payments and be able to pay off your debt faster. In general, that means that higher credit scores could decrease the cost of borrowing money.

Beyond Credit Cards and Loans

Finally, good credit scores could affect other parts of your life, too:

Sure You Can But Holding Onto It Can Be Fleeting

You may have been able to check your credit score lately using a number of free services including from your bank or mortgage lender. But, what good is knowing your FICO score if you dont understand what the number means on the overall reporting scale? Maybe you have a 740 FICO score. If the maximum score is 750, youre pretty much a credit genius. If the max is over 1,000, youre sporting a C averagenot really all that impressive.

So what is the highest credit score possible, and how do you achieve it?

Recommended Reading: What Is Syncb/ppc

Benefits Of A Perfect Credit Score

The benefits of a perfect credit score are more or less the same benefits you get from having excellent credit. When you have a perfect credit score, you become eligible for nearly all of todays best credit cards, including premium credit cards like the Chase Sapphire Reserve®, the Citi Prestige® Card and The Platinum Card® from American Express. Your credit card application could still get declined if you fall on the wrong side of something like the Chase 5/24 rule , but in most cases lenders will be eager to loan you money.

Plus, your perfect credit should score you some of the best interest rates on the marketwhether youre applying for a , shopping for a car loan or taking out a mortgage. In fact, if you took out your mortgage before you earned your perfect credit score, you might be able to save a lot of money by refinancing your mortgage and lowering your interest rates.

Having a perfect credit score can also make it easier to rent an apartment since landlords often perform a credit check after you turn in your application. Perfect credit might even help you during a job search if your employer checks your credit history during the interview process.

Why Do Credit Scores Vary

The reason why a credit score differs is because of a few reasons. Given there are two scoring systems, they can have differing results.

Further, the credit bureaus dont always receive all of the same information regarding your credit accounts. Additionally, one credit bureau may receive information before another does, which could influence the score.

Also Check: Does Paypal Credit Report To Credit Bureaus

What A Fair Good Or Excellent Credit Score Means For You

The better your credit score, the more choices youll have when it comes to applying for a loan or credit card. Thats the bottom line.

If you have a fair credit score and are approved for a credit card, you may be offered a slightly higher interest rate. Your initial credit limit may also be on the lower side. But if you make your payments on time and demonstrate financial stability, you might be able to have your limit increased after 6-12 months.

If you have a good credit score, your chances of being approved for loans and credit cards increases. Youre also more likely to be offered a more competitive interest rate, as well as a more generous credit limit.

Finally, an excellent credit score makes borrowing money and getting credit cards much easier. Its also more likely to get you the best available interest rates and generous credit limits.

What Is A Good Credit Score

What is considered a good credit score? :59

Reading time: 3 minutes

-

Theres no magic number to reach when it comes to receiving better loan rates and terms

Its an age-old question we get, and to answer it requires that we start with the basics: What is a, anyway?

A credit score is a number, generally between 300 and 900, that helps determine your creditworthiness. Credit scores are calculated using information in your , including your payment history the amount of debt you have and the length of your credit history.

Its also important to remember that everyones financial and credit situation is different, and theres no magic number to reach when it comes to receiving better loan rates and terms.

There are many different credit score models used today by lenders and other organizations. These scores all have the same goal: to predict a consumers likelihood to pay their bills. There are some differences around how the various data elements on a credit report factor into the score calculations.

Although credit scoring models vary, generally, credit scores from 660 to 724 are considered good 725 to 759 are considered very good and 760 and up are considered excellent. Higher credit scores mean you have demonstrated responsible credit behaviour in the past, which may make potential lenders and creditors more confident about your ability to repay a debt when evaluating your request for credit.

How Do Your Actions Impact Credit Scores?

You May Like: How Long Does Something Stay On Chexsystems

What Are The Benefits Of Having A Good Credit Score

- Get the lowest rate on a home mortgage as previously mentioned, the higher your credit score, the better loan terms you receive from a lender. Over the life of a mortgage, the additional interest you will pay with a higher interest rate will be substantial. It makes working on getting the highest credit score possible a worthwhile effort.

- Be offered lower rates on car loans like your home mortgage, the interest you are charged on a car loan will be lower when you have good credit scores. The difference in the interest rate you will be offered with the highest credit score vs. the lowest will be substantial. Believe it or not, the difference in interest rate could be over ten percent!

- Your credit cards will offer lower rates if you tend to carry a balance on your credit cards each month, the interest payments can add up. When you increase your credit scores, credit card companies will offer you a more attractive interest rate. Many credit card companies will also offer various rewards to those who have the highest credit scores.

- Some states offer better insurance rates in some locations having a good credit score will get you a better insurance rate. In some states, however, this practice has been prohibited.