Impact On Your Credit Score

Even though debts still exist after seven years, having them fall off your credit report can be beneficial to your credit score. Once negative items fall off your credit report, you have a better chance at getting an excellent credit score, granted you pay all your bills on time, manage newer debt, and dont have any new slip-ups.

Note that only negative information disappears from your credit report after seven years. Open positive accounts will stay on your credit report indefinitely. Accounts closed in good standing will stay on your credit report based on the credit bureaus’ policy.

When the negative items fall off your credit report, it also improves your chances of getting approved for new credit cards and loans, assuming there’s no other negative information on your credit report.

How Long These 8 Derogatory Marks Stay On Your Credit Report

The Fair Credit Reporting Act dictates how long each type of derogatory remark stays on your credit report, and the general rule is that most derogatory marks stay there for seven years.

There are some exceptions, though, and its also worth noting that the different credit bureaus may receive different information along different timelines, so theres no guarantee that your credit history will be reflected in the exact same way across all the major bureaus.

But the following table outlines how long each major type of derogatory mark stays on your credit report, and below is an explanation for each one, along with how you can get it removed once that time has passed.

| Types of Derogatory Marks on Credit Reports |

| Derogatory mark |

| Generally 7 years |

Judgments & Tax Liens: Exceptions To The Rule

According to Experian, judgments and tax liens no longer appear on credit reports. Does that mean youre in the clear if you have one?

Only as far as your credit report. A potential creditor wont find out about your tax lien from your credit report, but credit reports are not the only ways that creditors investigate potential borrowers.

Even if a judgment or tax lien doesnt appear on your credit report, its still a matter of public record. A creditor or other party investigating your creditworthiness will have access to either obligation through a public records search. Many creditors perform public records searches as part of their evaluation process.

That makes a strong case for paying off judgments and tax liens as soon as possible. Either may remain a matter of public record indefinitely, but a paid judgment or tax lien is much better than an open one.

Also Check: What Is Thd Cbna On My Credit Report

How To Remove Negative Information From Your Credit Report

As long as the information is accurate and verifiable, the credit reporting agencies will maintain it for the aforementioned timeframes. If, however, you have information on your report that you believe is incorrect, whether it’s positive or negative, then you have the right to dispute the information and have it corrected or removed from your credit reports.

The most efficient way to file a dispute is to contact the credit reporting agencies directly. And while Equifax and TransUnion have their own processes for consumers to dispute their credit reports, Experian makes available three dispute methods: You can do it over the telephone, via U.S. mail or online.

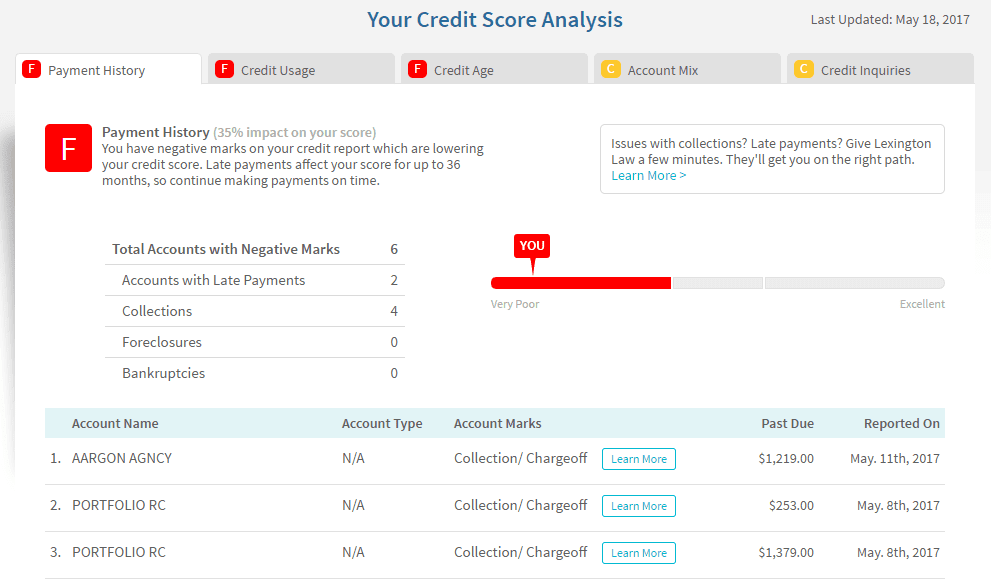

Negative Information From Collection Accounts

Collection accounts remain on your credit reports for a period of 7 years, which begins on the date the delinquency that led to the collections account is first reported to the credit bureaus.

For context, accounts that you do not pay as agreed whether they are charged-off credit accounts or unpaid medical bills, for example are often sold to collection agencies. These accounts are classified as collection accounts on your credit reports. Credit accounts sent to collections should be listed as a continuation of the charged-off trade lines that have been on your reports all along , while medical bills generally only show up once they enter collections.

You can learn more from Q& A on how long collections stay on your credit report.

Don’t Miss: Do Evictions Show Up On Credit Report

How Long Does Bad Credit Stay On Your Record

Managing credit is a big responsibility, and sometimes mistakes are made. Although mistakes cant be undone, fortunately, there are ways to recover from them. For smaller errors, it may be a simple waiting game before you see improvements in your credit score. However, for those who make bigger mistakes, it can mean following a dedicated credit recovery plan and lots of time.

How long does that negative information stay on your credit report?

It can depend on where you live, the type of unfavourable details, and the credit bureau. The two main credit bureaus in Canada are Equifax and TransUnion.

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

Recommended Reading: Trueidentity Credit Freeze

What Are Negative Items

A negative item is a line on your credit report that indicates negative or derogatory information about you from a lender. Some examples of negative items include missed payments, collection accounts, repossessions and foreclosures. When a negative item is added to your credit report, it can decrease your credit score. The presence of negative items can act as a warning to future lenders and may cause them to deny your application for credit or give you less-than-favorable loan terms and interest rates.

The good news is that negative information isnt going to follow you around forever. Negative items stay on your credit report for several years, ranging anywhere from two to 10 years. Typically, the older a negative item is, the less it affects your credit. And after the maximum time has passed, the negative item must be removed from your credit report, thanks to the Fair Credit Reporting Act .

Its important to note that the FCRA doesnt state how long negative items have to stay, just the maximum amount of time they can stay based on specific factors.

Review The Claim Results

Reporting agencies and lenders usually take around 30 days to investigate disputes. Once they make a decision, they must notify you within five days of completing their review. The notice will inform you if the disputed item was found to be inaccurate or not.

If the disputed information was, in fact, inaccurate, the bureau must update or delete the item. They should include a free copy of your file if the dispute results in a change.

If the bureau or lender considers the disputed information isn’t a mistake, you can file an additional claim. Review your initial claim for any errors and correct those. If possible, you should include additional documents to support your request as this can help the bureau evaluate any data it might have missed the first time around.

Read Also: Zzounds Payment Plan Denied

Negative Information From Credit Inquiries

Both hard and soft credit inquiries stay on your credit report for two years. Only hard inquiries can affect your credit score, and the impact lasts for one year.

With that being said, on your credit report are more informational than anything else. As long as you avoid making multiple inquiries at once, your credit score should only drop by about 5-10 points. If youre interested in learning more, we have a page specifically about how long inquiries stay on your credit report.

Why Does Information Show Up On Your Credit Report For Years

Both good and bad credit information stays on your record for several years because it helps lenders determine your risk level when they consider approving you a loan.

Positive credit information, such as making your payments on time and in full, usually stays on your credit report for up to 10 years with Equifax and 20 years with TransUnion Canada.

Negative credit information, such as missed or late payments, accounts sent to collections, bad cheques, and so on, will show up on your credit for several years as well.

Equifax Canada starts counting the time from the date our debt was assigned to a collection agency and keeps the negative information on record for 7 years. TransUnion Canada starts counting from the date of your accounts first delinquency and keeps the negative information on record for 6 years.

However, different types of information stay on your credit report for different lengths of time. Heres a breakdown of how long different items show up on your credit report.

Read Also: Aargon Agency Hawaii

Confusion With The Statute Of Limitations

There’s another time period that applies to debts, the statute of limitations. This time limit varies by state and limits the amount of time a creditor or collector can use the court to force you to pay a debt – if you can prove that the statute of limitations has passed. The statute of limitations is typically separate from the credit reporting time limit. The debt may continue to be listed on your credit report even though the statute of limitations has passed, particularly if the statute of limitations is less than seven years.

How Long Do Negative Items Stay On Your Credit Report

It can take a while for some negative events to fall off your credit report. Heres how long you can expect them to have an impact on your score.

Many Americans are struggling to put their personal finances in order amid the pandemic as they are dealing with debt and other credit issues. If you’re one of them, you’re not alone and there are credit repair steps you can take. Often, the first step is determining where your credit score currently stands by checking credit reports from the three credit bureaus.

Once you’ve had a chance to look at a copy of your credit report, it’s important to check for errors. Assuming the information listed is correct, it may take some time for negative items to fall off your credit report. Read on for a look at four common negative items — foreclosure, bankruptcy, missed payments and collections — and how long they will appear on your credit report.

What are common negative items on a credit report?

1. Negative event: Foreclosure

How long it will stay on your report: 7 years

2. Negative event: Bankruptcy

How long it will stay on your report: 7-10 years, depending on the type of bankruptcy. A Chapter 7 bankruptcy remains on your credit report for 10 years while a Chapter 13 bankruptcy will only be part of your credit history for seven years.

The bottom line

You May Like: Is Opensky Reliable

What Happens To Your Credit Score When Derogatory Marks Fall Off Your Report

Most negative items should automatically fall off your credit reports seven years from the date of your first missed payment, at which point your credit scores may start rising. But if you are otherwise using credit responsibly, your score may rebound to its starting point within three months to six years.

If a negative item on your credit report is older than seven years, you can dispute the information with the credit bureau and ask to have it deleted from your credit report.

How Long Does Credit Information Stay On Your Credit Report

Home \ \ How Long Does Credit Information Stay On Your Credit Report?

Join millions of Canadians who have already trusted Loans Canada

Your credit report is essentially your credit history. It compiles all the information concerning your credit habits and creates a tool that can be used by lenders and creditors to assess your creditworthiness. While your credit report does represent a good portion of your credit history, the information is not saved for the total duration of your credit using life. Your credit information is eventually removed from your to make room for newer information.

Of course, the question on everyones mind is, how long does this credit information stay on my credit report for? This is what were going to take a closer look at so you can know exactly how long specific credit information will affect your credit report.

Don’t Miss: Does Wells Fargo Business Credit Card Report To Bureaus

How Do Collections Affect Your Credit Scores

A collection account is a negative item that can hurt your credit scores. But the impact on your score can depend on the type of credit score and whether you’ve paid off the collection.

For example, the latest FICO® Score and VantageScore® models ignore paid collection accounts, while previous score versions may count paid collections against you.

But when you’re applying for a loan with a lender that uses older scoring modelssuch as a mortgage lenderpaying down your collections could still be important. Credit scores aside, the lender may review your credit history, and having unpaid collections could make it more difficult to qualify. While even paid collection accounts are negative, they may be viewed more positively by lenders than an account that remains unpaid.

What Are The Negative Items

What does it mean that your credit file has negative items? Well, these entries reflect that you have not been responsible for your financial obligations. The presence of these items reveals whether you are a high-risk borrower.

- Collections

- Repossessions

- Other financial maladministration pieces of evidence

These are some of the many negative items and stay on your credit file for quite a while.

Since lenders want the assurity that if the debtor would be able to pay the money back, and whether or not his lifestyle can afford this borrowed amount they review the potential pledgers credit file.

You May Like: When Will A Repo Show On Your Credit

Removing Negative Items After Seven Years

Check your credit report to learn when negative items are scheduled to be deleted from your credit report. When the seven years is up, the credit bureaus should automatically delete outdated information without any action from you.

However, if there’s a negative entry on your credit report and it’s older than seven years, you can dispute the information with the credit bureau to have it deleted from your credit report.

Old Information Has Less Impact

Black marks on your credit report influence creditor lending decisions until the reporting period of seven years expires. However, the older the negative item, the less impact it has on your credit score. For example, a missed payment that is four years old damages your score less than a missed payment that is four months old.

Also Check: Usaa Credit Monitoring Service

Exceptions To The Rule

The seven-year rule has a few exceptions. Chapter 7 bankruptcies, for example, may be reported for up to 10 years. Information about indictments and arrests disappears after seven years, but criminal convictions stay on your credit report forever. Charge-offs hang around for seven years plus 180 days. Government debt, such as unpaid tax liens and defaulted, government-issued student loans remain on your report indefinitely.

Tips To Overcome Derogatory Credit

Your credit score benefits from having positive information, so your score may start improving long before the derogatory items are removed from your credit report if you’re paying other accounts on time.

Your recent credit history affects your credit more than old derogatory credit items, so having open accounts with on-time payments will help improve your credit score.

You may not be able to have excellent credit until the derogatory items are completely removed from your credit report, but with good credit, youll still be able to qualify for many credit cards and loans.

You May Like: Does Affirm Hurt Your Credit

How Long Does Negative Info Stay On Your Credit Report

The information on your credit report changes throughout your lifetime as you carry on in everyday life. Certain businesses, like credit card companies and various lenders, report your activity to credit reporting agencies to be added to your credit report, but not everything stays forever.

The Fair Credit Reporting Act is the federal law that ensures credit reports are fair and accurate. That includes limiting the amount of time negative information can remain on your credit report. For student loans, the credit reporting time limit is governed by the Higher Education Act.

Can I Get A Mortgage With A Derogatory Mark On My Credit

Ultimately, your lender will look at your total credit score when deciding whether you qualify for a loan and what terms to offer you. If you have enough derogatory marks that your credit dips into the low 600s or below, you may have trouble qualifying for certain mortgages. However, there are still mortgage options for borrowers with low credit scores, such as FHA loans, USDA loans, and VA loans.

Read Also: Paypal Credit Report To Credit Bureau

Understand How Your Credit Report Works

Your credit report is not a static piece of paper. Many things get posted onto your report, some good and others are bad. The amount of weight these factors have on your credit score can also vary depending on many factors. As there is no mathematical equation, all you can look at is what is considered good versus whats seen as bad.

Each of the negative examples from our list above should be avoided at all costs. They are all signs of bad borrowing behavior, which is exactly the opposite of what lenders want to see. To make yourself the best borrower in lenders eyes, you must not make any mistakes in return. You will have a perfect credit score to reflect on that.