The Length Of Credit History

Your credit history determines 15% of your credit score. The average age of all your accounts is taken into account if you have multiple accounts.

An older credit account benefits your credit score as it shows that you are experienced in handling credit. Opening new accounts or closing your old accounts can minimize your average credit age.

Short credit history can be fine too as long as you make timely payment and dont have much debt. You should leave your credit card accounts open, even if they are not used frequently or anymore.

Multiple Applications For Credit Cards

Multiple applications for credit cards are one factor that affects CIBIL score. Before processing a request for a credit card, any financial institution will compile a credit report to examine ones credit score. A hard inquiry is a term for this kind of investigation. Each time this kind of query is made, the CIBIL score gets affected negatively.

Therefore, if one has applied for credit cards from many institutions, many hard inquiries will be made about them, severely lowering their credit score. That is why one should refrain from sending out many requests simultaneously. Dont rush to apply for a credit card with a different bank if an application has been refused. Spend some time initially raising the credit score before submitting a credit card application.

Wrapping Up

The CIBIL score is an essential criterion to determine whether a person is sufficiently creditworthy to be awarded any credit. A strong CIBIL score gives more possibilities for decent credit cards with more sophisticated features and advantages. On the contrary, a low CIBIL score would make it harder for one to get a sound credit card. Having a decent credit score, often above 750, is crucial to take advantage of better lending options.

In this blog, we have discussed some important aspects of the CIBIL scoresuch as how CIBIL score is affectedby various factors. It is crucial to consider these aspects if one wants to have a decent CIBIL score.

What Do I Do If I Dont Have A Score

You should start building your credit score immediately as it increases your chances of getting a loan and/or credit cards in the future. The fastest and easiest way to start building your credit score from zero, is by creating an FD and getting a OneCard. It is the only FD backed card that gives you a credit limit of 110% of your FD amount. Additionally, you earn interest on your FD @ 6.1% p.a. Click on the link here to get your FD backed OneCard!

Don’t Miss: Is 761 A Good Credit Score

Myth: Paying Off Your Car Loan Hurts Your Credit Score

Once you pay off a term loan, like a car loan, the account will be closed since youve finished making payments under the term of the loan agreement. Closed accounts paid as agreed will be purged from your report ten years from the last reporting date.

Paying off your car loan wont necessarily hurt your credit score, but if you are working to rebuild credit, having a monthly on-time car loan payment appear on your credit score will help improve your credit score if you are rebuilding.

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

Read Also: How Long Does Rental History Stay On Your Credit Report

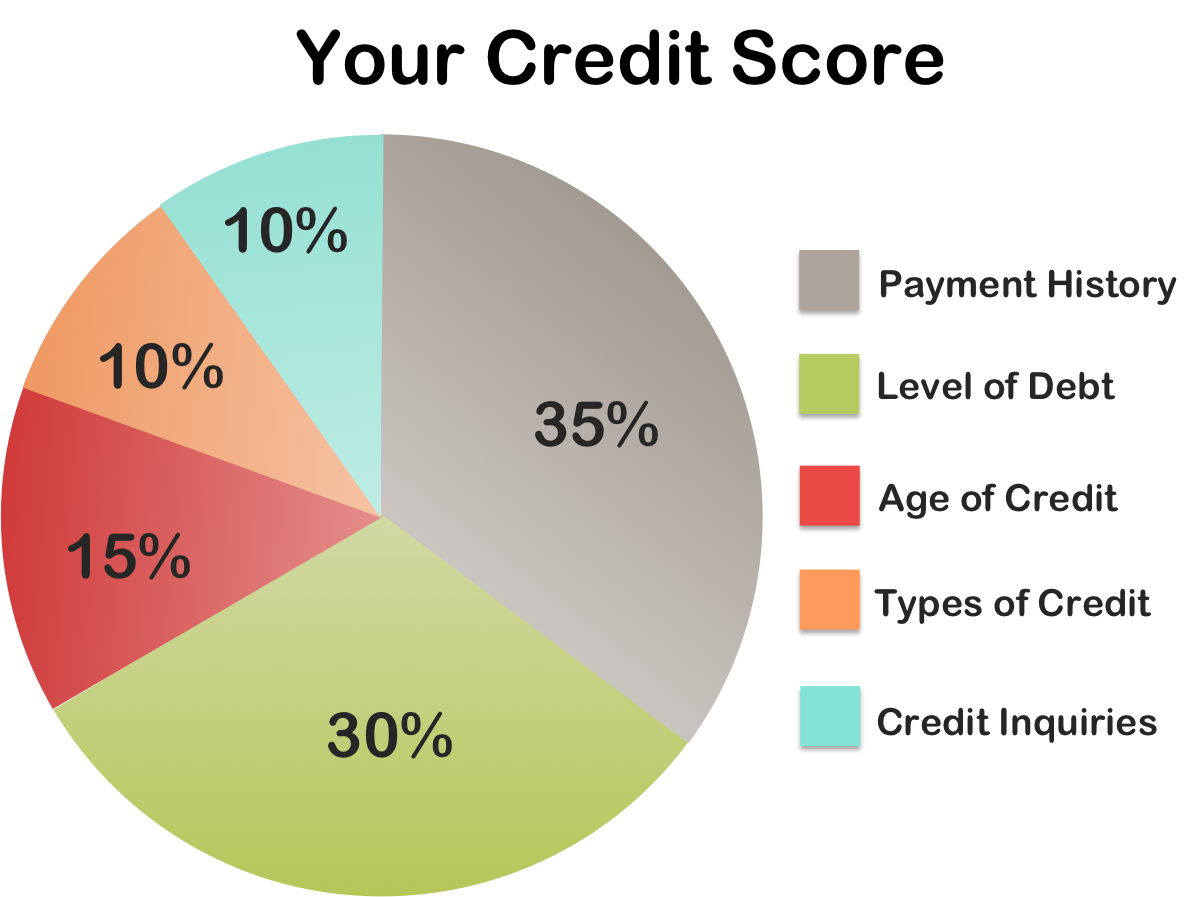

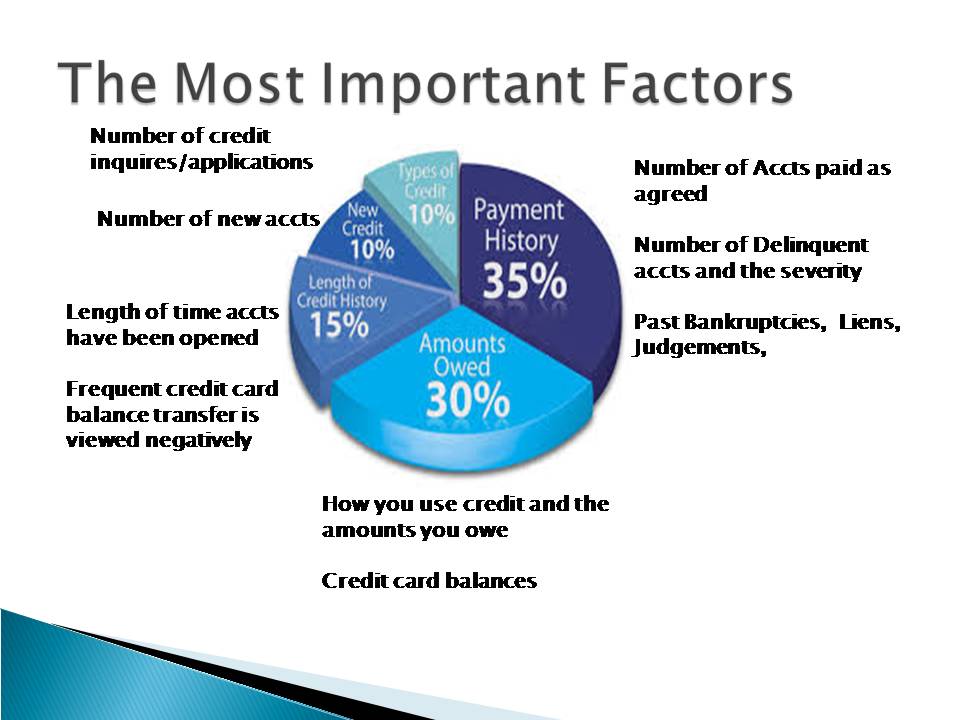

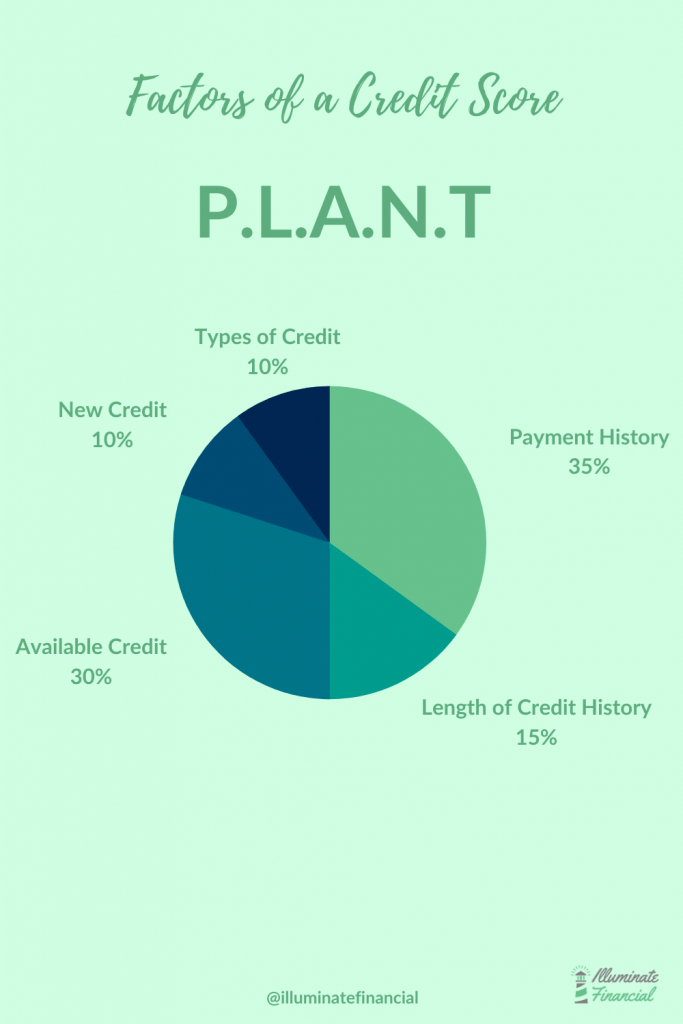

Your Payment History: 35%

If youre looking to improve your credit score, the single most important thing you can do is make on-time payments toward your credit cards and loans. Thats because your payment history accounts for 35% of your FICO score, making it the most important of the five credit factors.

When you make your debt payments, creditors report those payments to the credit bureaus, and you gradually build a good payment history. Eventually, those payments will help to boost your score.

The quickest way to negatively impact your credit score is to miss a payment.

If youre more than 30 days late on a payment, your creditor will probably notify the bureaus, which will cause your credit score to drop. If your account goes into collections which typically happens when your payment is 90 days or more past due the negative impact to your score is even worse.

Late payments and collections stay on your credit reports for up to seven years, though the impact on your score lessens with time.

How to improve: If you have trouble remembering to pay bills on time, set up automatic bill pay for at least the minimum amount due for all of your debt payments.

Also, get copies of your credit reports to look for errors. If your reports contain an account in collections that doesnt belong to you or thats past the statute of limitations, having the negative information about your payment history removed could improve your credit score.

If You Have A Goal To Reach A Higher Score Or Just Want To Learn More About Credit Scores In General Its Important To Know What Affects Your Credit Scores And How Your Actions Could Improve Or Hurt Your Credit

Although there are many credit-scoring models, the goal of these formulas is to figure out your credit risk that is, the likelihood of you paying your bill on time, or even at all. And whether youre looking at a FICO® or VantageScore® credit score, your scores are based on the same information: the data in your credit reports.

While various credit-scoring models may treat factors differently, the leading models, FICO® and VantageScore®, place similar relative importance on the following five categories of information. Weve ranked them by which ones are often most important to the average consumer.

Recommended Reading: What Do You Need To Get A Credit Report

The 5 Most Important Factors That Affect Your Credit Score

Your credit score consists of a three-digit number determined through multiple financial factors. It is symbolic of your behavior in handling money and is one indication of financial health.

FICO and VantageScore are the two most common credit scoring models. Generated scores fall between 300 and 850, although the range of some models may differ. Experianâs model, for instance, starts at 200.

There are five classifications of credit scores: poor, fair, good, very good, and excellent. While thereâs no such thing as the perfect credit score, having a good credit score means easier approval from financial institutions for ventures like buying a house or a car. It also means youâll have more negotiating power when it comes to the terms of those loans.

According to FICO, a “good” score is between 670 to 739.

Read on to learn more about the factors that make up your credit score, and the types of accounts that can both help and hurt your score, as well as ways to boost your score.

Credit Age And History

If youâre very young and just starting out with credit, your score will reflect that. Credit age is about 15 percent of your credit score, and the scoring agencies will consider both the age of your oldest account and the average age of all of your accounts.

For new credit holders, thereâs not much you can do but continue using your credit wisely and wait for your accounts to get older. Closing old accounts, even if you donât use them, will shorten the overall average account age. Opening a new account will do this as well. Keep your accounts as long as it makes sense so that your oldest account can continue boosting your credit score.

Recommended Reading: What Credit Report Does Paypal Pull

What Credit Scores Are Used For

Lenders use your FICO credit score to help them predict the likelihood that you will default on repaying any borrowed money. Your score helps them decide whether to lend you money and, if so, how much and at what interest rate.

The higher your FICO score, the less likely it is that you will default. Given this, Lenders will be more willing to extend loans or credit to you and charge you a low-interest rate.

Your Credit History Age

How old is your oldest credit account? The age of credit is 15% of your credit score and considers both the age of your oldest account and the average age of all your accounts. Having an “older” credit age is better for your credit score because it shows that you have a lot of experience handling credit. Opening new accounts or closing existing accounts can lower your average credit age. For that reason, it’s typically not a good idea to open several new accounts at once.

Read Also: Does Carvana Report To Credit Bureaus

Your Payment History Is The Top Factor

Payments 30 days or more days past due, charge-offs, collections, repossessions, foreclosures, and bankruptcies severely damage your credit score. Missing a single payment can take 60 to 120 points off your FICO score.

So, if youve kept your bills paid on time and dont have any of these negative entries on your credit report, youre helping keep your score high.

Your Credit Utilization Ratio: 30%

When it comes to credit factors that actually affect your score, what matters isnt the total amount of debt you have its the percentage of your available credit that youre using, also known as your . Its the second most important credit factor, determining 30% of your score.

Heres an example: Suppose your credit card limits add up to $10,000. Your total balances amount to $3,500. Your credit utilization ratio is 35%.

The lower your credit utilization ratio, the better. A utilization ratio thats too high tells lenders that youre overly dependent on credit. While most experts recommend keeping utilization below 30%, the actual number you should be shooting for is zero.

Dont believe the credit myth that carrying a balance from month to month helps your score.

How to improve: If you need to lower your credit utilization, keep paying down your debt without adding to your balance. Aim to get to the point where you can pay off your balance in full each month.

You can also improve your credit utilization by getting more credit. If your limit increases but your balance stays the same, your credit utilization ratio goes down.

Try asking for limit increases on your existing accounts. As youre about to learn, the average age of credit and new credit are both factors that affect your score.

You May Like: Why Is My Credit Karma Score Lower Than Fico

Late Payments On Utility Or Service Accounts

Paying your cell phone or internet bills on time generally will not improve your score because these payments are small. However, a late payment on a service account will have the same negative impact on your credit rating as a late payment on a credit card. So, keep all your accounts up-to-date to avoid hurting your score.

Large Amount Of Existing Debt

Your existing debt can also increase or decrease your credit score. For example, if you are currently paying the EMIs of two to three separate loans, you would have a poor credit score until you manage to repay them successfully. Hence, it is important to ensure that you dont borrow multiple loans at the same time.

You May Like: Can You Get Late Payments Removed From Credit Report

Myth: Spouses Share Credit Scores

Everyone who borrows has their own credit score in Canada. If one person in a partnership has poor credit or requires financial assistance, such as declaring bankruptcy, this will not affect the other partners credit score. It may only affect the other persons credit if a debt is joint or is co-signed.

Factors That Impact Your Credit Score

Summary

5 factors that impact your credit score

- Did the bank turn down your loan application or offer you sky-high rates? Your bad credit score could be the culprit! If you want to fix it, youll need to know what holds sway over your score.

- There are five main factors that impact your credit score: 1) payment history, 2) credit utilization, 3) length of credit history, 4) new credit applications, and 5) the amount and variety of lenders.

- If your score is low and keeping you from achieving your goals , theres good news: you can shore it up if you take action. Credit can be rebuilt!

Read Also: Does Snap Finance Report To Credit

How To Improve Your Credit Score

Improving your credit score can be easy once you understand why your score is struggling. It may take time and effort, but developing responsible habits now can help you grow your score in the long run.

A good first step is to get a free copy of your credit report and score so you can understand what is in your credit file. Next, focus on what is bringing your score down and work toward improving these areas.

Here are some common steps you can take to increase your credit score.

Factors That Affect Your Credit Score

Your credit score is a powerful number that can affect your life now and in the futurein some ways that you might not even imagine. Your score determines interest rates you pay for credit cards and loans and helps lenders decide whether you even get approved for those credit cards and loans in the first place.

Unexpected businesses, such as insurance companies, have started to use credit scores to make decisions about you. Utility companies check your credit before establishing new service in your name, and some employers check your credit history to decide whether to give you a job, a raise, or promotion.

Protecting and building your credit is more important than ever, and how you handle the following five factors can make all the difference in determining your credit score.

Read Also: Is 760 A Good Credit Score

The Factors That Affect Credit Scores Most

The two major scoring companies in the U.S., FICO and VantageScore, differ a bit in their approaches, but they agree on the two factors that are most important. Payment history and , the portion of your credit limits that you actually use, make up more than half of your credit scores. Focus your attention mostly on those two while keeping an eye on the other factors.

Here’s a breakdown of all the factors that affect your scores:

What Is A Good Credit Score To Rent An Apartment

Most landlords prefer tenants with a credit score of 650 on average.

But dont panic if your score is lower than that. Some landlords are open to working with tenants with less-than-perfect credit. You might just need to put down a larger security deposit or agree to another compromise, such as paying rent early each month.

Read Also: Does Collections Always Go On Credit Report

What Hurts Your Credit Score

Now that you know the ways to improve your rating, Id like to talk about credit score factors you should avoid.

Missing or late payments and high credit card balances will impact your rating negatively, but there are smaller factors that many Canadians dont think about. These are the top invisible actions to avoid that hurt your credit score.

Things That Don’t Affect Credit Scores

There are a lot of myths out there about what does and does not affect credit scores. The following 5 things do not impact credit scores negatively or positively: using your debit card, your income level, checking your own credit report, interest rates, and having an application denied.

Using your debit card

Using your debit card does not involve any type of credit. You are limited to the funds in your account, which prevents you from overspending or missing a payment. If you are trying to increase your credit score, using a debit card won’t help. But it also won’t decrease your score either.

Your income level

Your income level does not impact your credit report or score. But it may affect your borrowing capacity. Lenders use something called a debt service ratio when calculating how much money to lend. The higher your income, the more money you may have access to borrowing.

Checking your own credit report

Checking your own credit report is known as a soft inquiry and does not affect your score in any way. Regularly checking your report for errors or fraud is a sound financial practice. And you can see your information for free from both Transunion and Equifax once a year.

Having a high-interest rate loan

Having high-interest rate loans or credit cards does not directly impact credit scores. But missing a payment on this type of loan can cost you a lot of money in interest charges.

Having a credit application denied

Read Also: Does Getting A Credit Report Hurt Score