How Much Will My Credit Score Increase If A Negative Item Is Removed

This can depend on what the negative item or derogatory mark is, whether its a late payment or something else. A negative item can continue to affect your credit score for up to 7 years, even after its removed. The best thing you can do to repair your score is to take steps to build your credit back up.

A Good Credit Score Means You’re Rich

False. Credit scores are just a measure of your risk . “A good credit score means you’re a good credit risk,” Ulzheimer says. “A low score means you’re a poor risk. That’s all they mean.”

Having a high salary doesn’t guarantee a higher line of credit, but if you update your income with a card issuer to a higher amount, you may see an increase in your credit limit, which could be positive for your credit utilization ratio . Also some cards, like the American Express® Gold Card, have no preset spending limit, which means there is no assigned credit limit.

How Long Will Negative Information Remain On My Credit Reports

It depends on the type of negative information. Heres the basic breakdown of how long different types of negative information will remain on your credit reports:

- Late payments: 7 years from the original delinquency date.

- Chapter 7 bankruptcies: 10 years from the filing date.

- Chapter 13 bankruptcies: 7 years from the filing date.

- Collection accounts: 7 years from the original delinquency date of the account

- Public Record: Generally 7 years

Keep in Mind: For all of these negative items, the older they are the less impact they will have on your FICO® Scores. For example, a collection that is 5 years old will hurt much less than a collection that is 5 months old.

Read Also: Paypal Credit On Credit Report

How A Hard Inquiry Impacts Your Credit Score

Although hard inquiries remain on your credit report for two years, FICO only considers inquiries from the last 12 months when calculating your credit score.

For example, if you see a hard inquiry listed on your credit report but it was from over a year ago, it wouldn’t influence your credit score or deduct any points from it.

Your credit history also plays a role in how much a hard inquiry would impact your credit score.

According to FICO, one credit inquiry on most people’s credit reports will take less than five points off of their FICO score. They say “most” people because not everyone has the same credit history. If you have a healthy credit history and credit score to begin with, it’s likely that any hard inquiry on your credit report would do very little damage to your score, or even none at all.

Hard inquiries tend to have a greater impact on the credit scores of people with a short credit history or few credit accounts. This means that for those just starting to build their credit, a hard inquiry can knock off more points from your credit score than it would for someone who has a long credit history. But don’t let that prevent you from applying for credit. It’s OK to have inquiries periodically it indicates you are trying to build credit but you just don’t want too many hard inquiries on your credit report in a short amount of time.

Myth #: You Can Only Check Your Credit Score For Free Once A Year

You can actually pull your credit report from each credit bureau once per year for free by mail or phone. This only gives you access to the debts that are listed on your report and their ratings. Getting your credit score requires paying an additional fee. Services such as and Borrowell provide free access to your credit score, drawing on information from the credit bureaus, and provide a good ballpark idea of what your score is. However, it should be noted that these third-party services dont always provide the full picture and can sometimes worry Albertans for no reason. The most reliable way to know your score is by ordering it from the credit bureaus directly.

You May Like: Syncb Ppc Card

Paying Off Debts Will Erase The Transaction From Credit Report

Do not be under the illusion that paying off a debt will erase that entry from your credit history. The evidence of the debt will stay put with your credit history for years and impact your credit score and credit availability.

Such entries in your credit history will show that you have handled your debts responsibly and have been successful in paying it off. It will reassure any prospective lenders and put in a good word about you. On the other hand, any missed payments and defaulting registered can tell the lenders about your finance handling capabilities and stop them from approving your credit application.

Negative information can stay on your report for up to seven years bankruptcy information can stay for as long as 10 years.

What Is A Credit Bureau

A credit bureau, also known as a consumer reporting agency, collects and stores individual credit information and provides it to creditors so they can make decisions on granting loans and other credit activities. Typical clients include banks, mortgage lenders, and credit card issuers. The three largest credit bureaus in the U.S. are Equifax®, Experian®, and TransUnion®.

Don’t Miss: How To Unlock Transunion Credit Report

Viewing A Free Score From A Website Is The Same As A Fico Score

The truth: No, the free scores provided by websites are not a FICO score.

Sometimes I get emails from folks who think they have a great FICO score. Sadly, I have to tell them that the score theyre talking about is not a FICO score. Websites that offer free credit scores pull your information from one or more of the major credit bureaus. The score youll see might be a version of a VantageScore or some other type of credit score.

These scores do have value. Youll often get category grades along with advice on how to improve in certain areas. For example, if you get a C in payment history, thats the area you need to clean up.

But many credit card issuers are now showing a credit score on your card statement each month. Some of these arent real FICO scores, but theyre still helpful. If you arent sure what credit score youre viewing, ask your card issuer. And if you want a surefire way to check your FICO score for free, check out . Its a free website from Discover, and you dont have to have a Discover card to use it.

About 90% of lenders use a version of the FICO score when considering applications for credit. So its a good idea to check it occasionally and see where you stand.

Whats A Soft Credit Inquiry

According to the Consumer Financial Protection Bureau , a soft checkâalso known as a soft inquiryâis a review of your credit file and existing accounts. Soft inquiries donât impact your credit scores.

Examples of Soft Credit Inquiries

- Viewing your own credit reports and scores.

- Opening a bank account.

- Pre-qualified or pre-approved credit card offers.

Read Also: What Credit Score Do I Need For Ashley Furniture

Checking My Credit Score Lowers My Credit Score

False. Though 93% of millennials are aware of their credit score, this is probably the most common myth. Monitoring your score helps you track progress when building credit, but it is important to check it the right way.

Checking your credit score is considered a “soft pull,” which doesn’t affect your credit score. Actions, such as applying for a credit card, which requires a “hard pull,” temporarily dings your credit score.

“If you’re checking it from a legit source, like the credit bureaus themselves, then it won’t hurt,” Ulzheimer tells CNBC Select. “If you have a buddy who works for a car dealership or a mortgage broker, and they pulled your credit as a favor, everyone is going to think you’re applying for credit and the inquiry could lead to a lower score.”

You can check your credit score for free with most card issuers, using apps such as Discover’s Credit Scorecard and Chase’s Credit Journey, which are available to everyone.

Read more:How to check your credit score for free and Here’s how often your credit score updates.

How To Quickly Improve Your Credit Score

Also Check: When Does Wells Fargo Report To Credit Bureaus

What If The Cifas Marker Is There By Mistake

If you think a Cifas warning has been put on your credit file in error, you can contact the lender who put it there to see if theyll remove it.

Be aware that credit rating agencies are unlikely to remove any entry on your report if they believe the reason the marker was put on your credit file was justified. Lenders are legally obliged to report any fraudulent attempt on your account to the credit reference agencies.

Find out more about Cifas markers on the Cifas website

It’s Easy To Be In Control

Sign up for MyCredit Guide at no charge to see your detailed TransUnion credit report, updated weekly upon log in, get alerts, and use the credit score simulator.

Already enrolled to MyCredit Guide? Log In Here

Articles about Credit

Here is how to check your credit score for free and get the most accurate picture of your credit.

Enroll with MyCredit Guide to get a free credit report that you can access at anytime or you can request a copy of your credit report 3 credit bureaus once a year.

Learn about credit score ranges from FICO and VantageScore, and how they classify Excellent, Good, or Poor credit score.

Tips to Improve Your Credit Score

The better your credit score, the better chance you may have to secure a mortgage for a house or get approved for that premium credit card. Watch this short video from American Express to learn how to improve your credit score.

Don’t Miss: Uplift Pulls Which Credit Bureau

My Employer Can See My Credit Score

False. When it comes to applying for a new job, people often think prospective employers can see their credit score. While they can pull your credit report, the type of credit report that employers have access to does not include your actual credit score.

“It’s not the same type of credit report that your lenders can see,” Ulzheimer says.

What employers do see when they run a credit check is your debt and payment history so they can look for any signs of financial distress.

When Checking Your Score Hurts Your Credit

We would all like to pay less for mortgage financing, the biggest debt most of us will ever have. We all know that higher credit scores equal lower mortgage rates but does checking your credit score hurt your credit?

The answer is sometimes yes.

We each have to check credit scores with some frequency. In the past, this was terribly difficult to do because the rules for credit reports and credit scores differ.

Go to AnnualCreditReport.com, a site authorized under federal law. You can get one free credit report every 12 months from each of the three major credit reporting agencies. Thats a total of three credit reports every 12 months. What you cant get for free at this site is your credit score.

Why the difference between the availability of credit reports and credit scores? Long ago, it was extremely difficult to get copies of credit reports, and then the government changed the rules. The theory was that consumers should be able to see their own credit reports because it contains their information.

If that information is wrong, then an individuals credit standing can be hurt and the costs to borrow might rise significantly.

Today, there are a number of sites which offer free credit scores and do not require you to sign up for other services or provide a credit card number. How can these sites give away free credit score information? The answer is that such sites provide credit card offers and other financial services for consumers to consider.

Don’t Miss: How To Check Your Credit Score With Itin

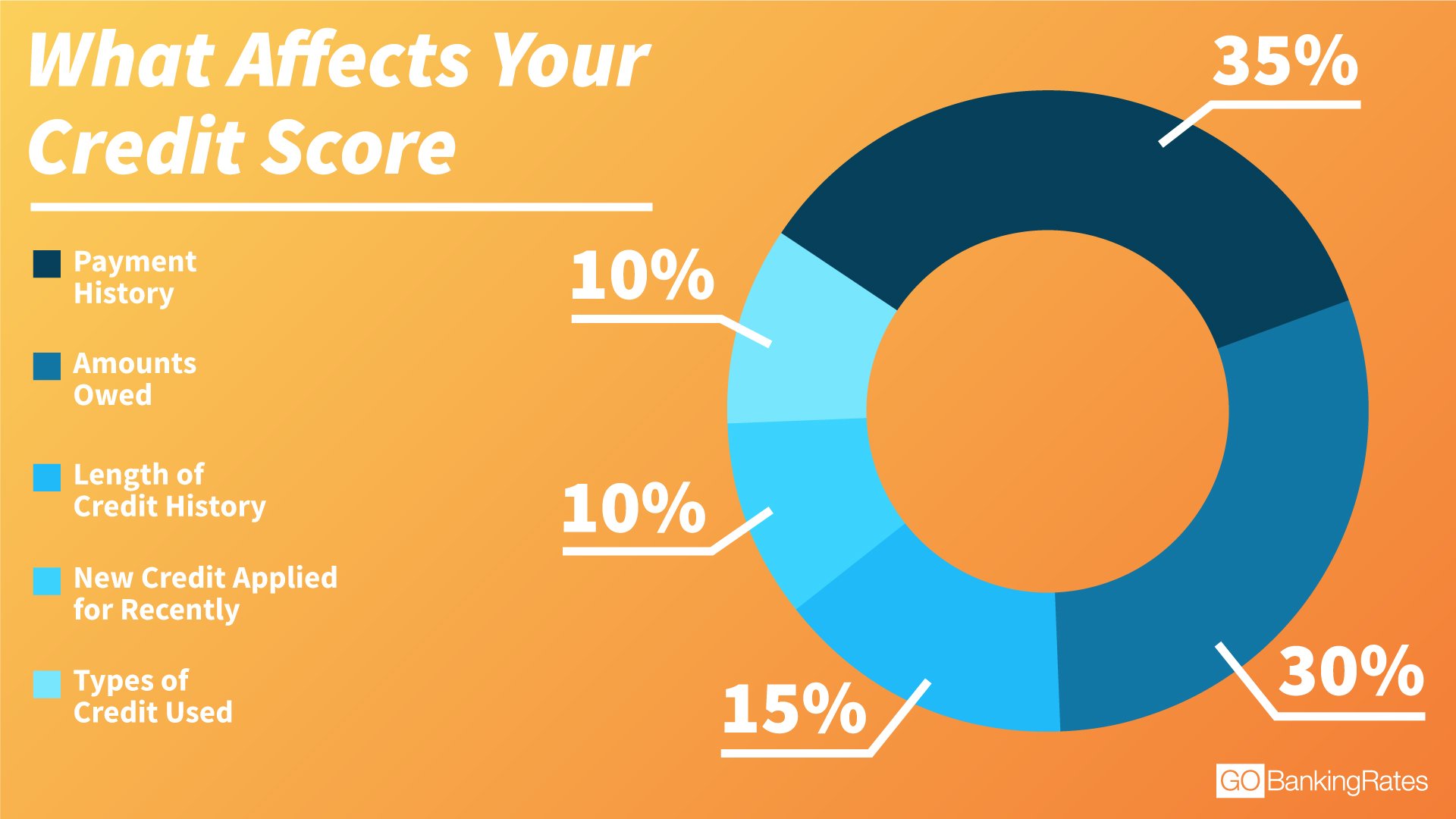

How Your Credit Score Is Calculated

Your credit score is calculated based on what’s in your credit report. For example:

- the amount of money youve borrowed

- the number of credit applications youve made

- whether you pay on time

Depending on the credit reporting agency, your score will be between zero and either 1,000 or 1,200.

A higher score means the lender will consider you less risky. This could mean getting a better deal and saving money.

A lower score will affect your ability to get a loan or credit. See how to improve your credit score.

Can I Expect The Fico Score Version I Receive From Wells Fargo To Change

FICO® periodically updates its scoring models and Wells Fargo may choose to upgrade to a more updated score version. If this happens, we’ll notify you when a change to the score version change occurs. You can locate the score version on your FICO® Score display. It is listed directly below the score and rating.

Also Check: Does Comenity Bank Report To Credit Bureaus

Inquiries On Your Credit Report

Not all inquires into your credit report are harmful. Reporting agencies discriminate between what’s called hard inquiries and soft inquiries.

A hard inquiry takes place when a company has a legitimate business reason to look into your credit report. This usually occurs when you apply for credit and have initiated the process yourself. The company you request credit from needs to know if you’re reliable enough to do business with. If your report shows that you have a past of not paying bills on time, the company will be less likely to approve you for a loan or to give you a low interest rate.

You might be surprised to learn that companies can perform a hard inquiry on your credit even if you aren’t applying for a loan. For instance, a bank might choose to run a hard inquiry if you try to open a savings account with them . Or, a phone company might be able to perform such an inquiry when you get an account with them. Even cable and Internet companies may pull a hard inquiry when you request their services.

When you’re looking for a loan and wish to shop around by applying to a few different lending institutions, make sure to conduct all applications in a span of about two weeks. That’s because multiple inquiries can count as a single inquiry if they’re all performed around the same time. This span of time can be 14 or 45 days depending on the formula the agency uses to be safe, try to keep your inquiries within 14 days

Consent And Credit Checks

In general, you need to give permission, or your consent, for a business or individual to use your credit report.

In the following provinces a business or individual only needs to tell you that they are checking your credit report:

- Prince Edward Island

- Saskatchewan

Other provinces require written consent to check your credit report. When you sign an application for credit, you allow the lender to access your credit report. Your consent generally lets the lender use your credit report when you first apply for credit. They can also access your credit at any time afterward while your account is open.

In many cases, your consent also lets the lender share information about you with the credit bureaus. This is only the case if the lender approves your application.

Some provincial laws allow government representatives to see parts of your credit report without your consent. This includes judges and police.

Also Check: What Company Is Syncb Ppc

What Does A Cifas Marker On My Credit Report Mean

Cifas is a national fraud prevention service. It can place Protective Registration and Victim of impersonation warnings on your credit file.

Protective Registration

This is a paid service for people who have recently been victims of financial fraud. It indicates to any lender that youre potentially vulnerable to fraud so that theyll make extra checks every time you apply for a financial product. While this can protect you, it can increase how long credit application approvals can take. It will stay on your credit report for two years.

Find out more, and apply, on the Cifas website

Victim of impersonation

This is filed by your lender for your own protection if youve been the victim of identity fraud. It will stay on your report for 13 months.

If one of these is on your credit report, it gives potential lenders a fraud warning. It tells them youve been a victim of fraud in the past, or could be particularly vulnerable to fraud in the future.

Fix Mistakes In Your Credit Report

When you get your credit report, check that:

- all the loans and debts listed are yours

- details such as your name and date of birth are correct

If something is wrong or out of date, contact the credit reporting agency and ask them to fix it. This is a free service.

Some companies may try to charge you to get all negative information removed from your credit report. The only thing they can ask the credit reporting agency to remove is wrong information. And you can do that yourself see .

If there are loans or debts in your report that you know nothing about, it could mean someone has stolen your identity. See identity theft for what to do.

Read Also: Credit Report Without Ssn Or Itin