What Happens When An Account Goes Into Collections

Step by step, here’s what happens when you have an account go into collection:

Virtually any type of unpaid debt can be sent to collection, including:

When Will A Paid Collection Fall Off Your Credit Report

While its better to pay off a debt collection, unfortunately, payment doesnt immediately remove the account from your credit report unless you negotiate beforehand to have the account removed upon payment. Unless you negotiate a pay-for-delete agreement, the collection will stay on your credit report for the entire credit reporting time limit, and the balance due will be updated to $0. Still, a paid collection can improve your credit score and will look better when you apply for new credit.

How Long Does Info Stay On The Record

How long adverse information remains on your credit report depends on what is being reported. Positive information can stay on your report indefinitely. Negative information must be removed in accordance with limits set by the Fair Credit Reporting Act.

According to Experian, adverse information for business credit reports can remain on your report for as little as 36 months, or as long as nine years and nine months. Trade, bank, government and leasing data can remain for up to 36 months. Uniform Commercial Code filings stay for five years. Judgments, tax liens and collections remain for six years and nine months. Bankruptcies remain on your business credit report the longestup to nine years and nine months.

Adverse information generally remains on individual consumer credit reports for seven to 10 years. Bankruptcies remain the longest: up to 10 years from the order date or date of adjudication. If you defaulted on a government-backed student loan, the reporting period can be longer.

Civil suits, civil judgments and records of arrest can remain on your credit report for up to seven years or until the statute of limitations has expired, which ever is longer. Tax liens remain until they are paid, and then remain for seven years thereafter.

Recommended Reading: Do Student Loans Fall Off Your Credit

Helpful Tips Regarding Collections

Throughout this website, there are numerous articles regarding collections and collection agencies. Our best advice is to pay your bills on time and avoid an account from going into collections. But we know there are circumstances beyond your control and sometimes you have no choice but to let an account become seriously delinquent. If this happens to you, fear not, we have a lot of great articles to help you get through this difficult time. Such as:

- Dealing with Collection Agencies Using debt validation as a way to remove a collection.

- Five Methods of Dealing With Collections We have five methods for you to use when dealing with collection agencies.

- Pay for a Delete Removing a collection from your report by paying it off.

- What Are My Rights Regarding Collection Agencies? Learn what collection agencies can and can not do when trying to collect on a debt.

Will Paying Off A Collections Account Improve My Credit Score

Home \ Debt \ Will Paying Off a Collections Account Improve My Credit Score?

Join millions of Canadians who have already trusted Loans Canada

Having debt is something that nearly everyone will have to experience at some point during their lives. While some people only acquire debt that they can afford to pay off, there are also those who end up getting in way over their heads. When this occurs, it is common for people to be unable to make payments on their mortgage, credit card, auto loan, or any other debt they might have accumulated.

to learn how you can consolidate your credit card debt.

Unfortunately, if these kinds of debts go unpaid for a long time, there is a chance that a collections agency might be sent after you in order to try and get payment. Before we go any further into the article, lets take a closer look at what collections accounts actually are and what they aim to do.

Don’t Miss: Leasingdesk Hard Inquiry

Does The Cra Report To Canadas Credit Bureaus

The Canada Revenue Agency has a privacy policy that reduces the amount of information they are permitted to inform other organizations about its taxpayers activities. In other words, if you owe a small amount in income taxes, paid your taxes late, or had any other problems that resulted in a relatively basic penalty, the CRA will not report it to the Canadian credit bureaus.

However, if you owe so much that it warrants a court case and a collection agency gets involved, the CRA might actually put a tax lien on your credit report. Essentially, if your tax case is so bad that it becomes a matter of public record, thats when Canadas credit bureaus will get wind of your situation and your credit score will definitely be damaged.

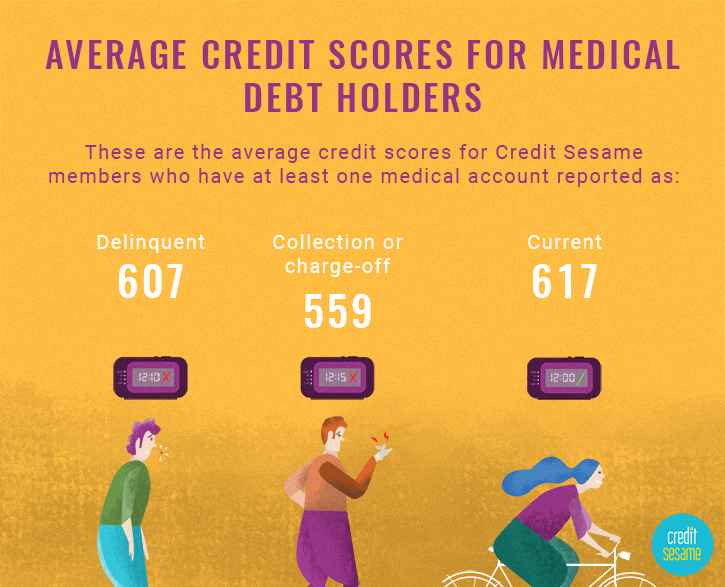

How Do Medical Bills Inpact Your Credit Report

If medical bills show up on your credit reports, it’s usually because they weren’t paid within a certain period of time. Negative information, such as collection actions, can drastically affect your creditworthiness. The best way to protect your credit from the potential negative impact of your medical bills is to pay your bills on time.

Don’t Miss: Can A Repo Be Removed From Credit Report

Try A Balance Transfer Card To Get Out Of Debt

If your debt has not gone to collections yet, one option to help you save tons on interest and pay it off more quickly is to use a balance transfer credit card that offers 0% interest for an certain length of time . The options below all require at least a good credit score, so they are usually only effective to use before your debt falls into delinquency.

The Citi Simplicity® Card lets you pay off debt over a long period, with a 0% APR for the first 21 months on balance transfers .

Alternatively, if you’re looking to earn both rewards and pay down debt, you should consider the Citi® Double Cash Card, which offers 0% APR for the first 18 months on balance transfers .

How Collection Agencies Acquire Your Debts

It’s important to note that debt collectors buy debt for pennies on the dollar. When an original credit account is very delinquent, it’s viewed as unlikely to ever be paid. This type of debt is typically sold to a collection agent at a steep discount.

For example, say a debt buyer pays just $0.04 for every dollar of a debt’s face value. If that debt was $5,000, a debt collector would pay around $200 for it.

Because the debt collector paid so little to buy someone’s debt in this scenario, there would be significant room to negotiate a settlement. It’s not uncommon for a $1,000 collections account to be settled for $300 or so, for example.

Read Also: How To Report A Death To Credit Bureaus

Learn More About Credit Scores

If its not clear from everything above your credit score in the U.S. will be an essential part of living in America on a visa. That said, there are lots of other important topics around credit scores that it would be worth it to familiarize yourself with:

Its crucial that you understand these things if you want to make the most of your financial freedom in the U.S.!

The Amount Of The Collection Debt Is Irrelevant

Regardless of how high the dollar amount is, your collection debt impacts your credit score the same way. In other words, if the debt is over $1, it does not matter how much you owe.

For example, if you have a debt of $200 and it lowers your score by 50 points, a $100,000 debt would drop your credit score by the same amount50 points.

Also Check: How To Get Rid Of Repo On Credit

Will It Help Your Credit Score

All credit scoring models penalize you for having unpaid collections, although some have a $100 threshold. Some don’t continue to penalize you once collections are paid. Here’s what to know:

-

VantageScore 3.0 does not penalize paid collections, so that score will improve if you pay a collections account.

-

The FICO 8, which is used in most credit decisions, does penalize paid collections. The newer FICO 9 model does not.

-

Collections for debts that were originally under $100 are disregarded for scoring purposes in FICO 8, FICO 9 and VantageScore 3.0. However, older models, such as the ones typically used for mortgages, do consider them.

How Should You Deal With A Charge

Your best strategy depends on which course of action the creditor uses to try to get some of its money back.

If the creditor has not yet sold your debt to a collector or tried to sue you, you can negotiate a settlement in the same manner that I discussed in the section about dealing with collection accounts. Generally, this is the case for the first three to six months after your account became delinquent, although the timetable can certainly be longer or shorter than this.

On the other hand, if the creditor sues you for the debt or sells it to a third-party debt collector, it gets a little more complicated. To be clear, either of these situations will likely result in two negative items on your credit report — the original charged-off account as well as the resulting collection account or legal judgement.

You’ll probably need to deal with the collection and charge-off individually, especially if the debt has been sold to a third-party collector. A debt collector has no control over what the original creditor reports to the credit bureaus. Plus, the original creditor has no incentive to help you out simply because you paid off the debt collector.

Don’t Miss: Report Death To Credit Bureau

What Happens To Your Credit Score

Once your creditor transfers your debt to a collection agency, your credit score will go down.

A low credit score means:

- lenders may refuse you credit or charge you a higher interest rate

- insurance companies may charge you more for insurance

- landlords may refuse to rent to you or charge you more for rent

- employers may not hire you

Can Debt Collections Less Than $100 Be Reported To The Credit Bureau

Debts that make it to the collection stage can lower your credit score significantly, especially if you have a good to excellent credit score. However, collections under $100 do not factor into your credit score most of the time. In 2009, Fair Isaac Corporation, the maker of the software that major credit bureaus use to create credit scores, removed collections accounts less than $100 from the credit scoring calculations in most cases. This is a victory for consumers since unpaid library fines and small medical co-pays that slipped through the cracks should no longer impact your credit score.

Tips

-

In 2009, Fair Isaac Corporation removed collections accounts less than $100 from the credit scoring calculations in most cases. This is a victory for consumers since unpaid library fines and small medical co-pays that slipped through the cracks should no longer impact your credit score.

You May Like: Syncb Ppc Card

How To Improve Your Credit When You Have Collections

If you have legitimate collection accounts on your credit reports, there’s nothing you can do to get them removed before their expiration dates. But you can take steps immediately to start rebuilding your credit and reversing the damage those collections have done to your credit score:

When it comes to accurate collection entries on your credit reports, there’s nothing you can do to get rid of them except wait for their inevitable expiration date. So don’t fret over past mistakes instead, try to avoid future missteps, improve your credit habits and rebuild your credit in the process.

Next Steps: How Can I Keep Medical Collections From Ever Appearing On My Credit Report

These tips could help you keep medical bills off your consumer credit reports.

You May Like: What Credit Score Do You Need For Carecredit

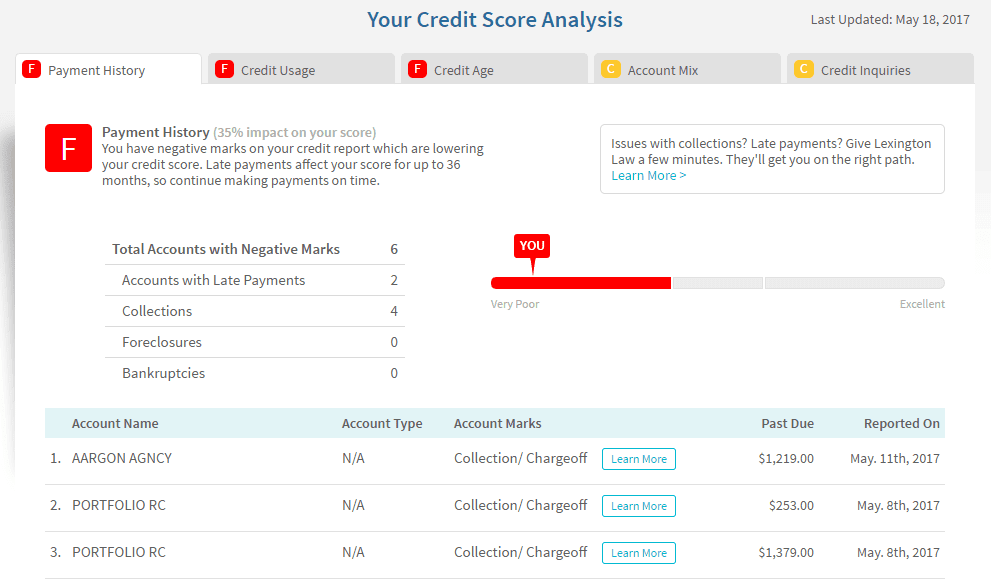

How Does A Collection Account Affect My Credit

Once an account enters collections, it will harm your credit score AND credit history. If at all possible, avoid letting an account ever enter this status because of the harsh consequences.

First, the instance stays on your credit report for 7 years from your first delinquency. That means creditors will see you as risky, and it will be difficult to increase your credit score during this time. Its also going to significantly drop your score. If you have a score of 700, for example, expect a drop of around 100 points.

Know Your Rights When Dealing With Collectors

One important thing to keep in mind before you start calling debt collectors, or before you answer their phone calls, know your rights as a consumer. The Fair Debt Collection Practices Act protects you from abusive debt collection practices. However that doesn’t mean that all collectors actually follow the rules.

With that in mind, here’s what debt collectors are not allowed to do:

- Talk about your debts to anyone except you or your attorney. They are, however, allowed to call friends or family members for the purposes of finding out how to get in touch with you.

- Harass you. They can’t keep making debt collection calls repeatedly and can’t use foul language when speaking with you.

- Keep calling if you request they stop. You can submit a request in writing to ask them to stop making collection calls. If you do that, they can only contact you to say that they’ll be stopping collection efforts or taking legal action against you. This is my preference, as it’s easier to deal with collectors in writing — plus having written records helps protect you.

- Make any claims that they can’t legally follow through on. They can’t threaten to have you arrested for not paying, or foreclose on your house.

- Lie about who they are or the purpose for their contact. Before the FDCPA, it was common practice for a collector to call pretending to be an old friend just to get you on the phone. A legitimate debt collector will not do this today.

Also Check: How To Report Death To Credit Bureaus

Deletion Of Collections Vs Paying Off Collections: What Is The Difference And Which Is Better

The deletion of collections means the accounts no longer appear on your credit report. That can happen when youve successfully disputed a reporting error or when it has reached the 7 years limitation.

Meanwhile, once you pay off your collection debts, the collection accounts will reflect a zero balance, but they remain on the report. The current version of FICO®s credit score, FICO® 9, and VantageScore® credit scores 3.0 and 4.0 wont factor in collection accounts with zero balance. This could lead to an improved credit score. However, some creditors or lenders still use the older models, which consider paid collections and that means there will be no improvements to your credit score despite having paid off your debt.

One of the benefits of paying off collection accounts is a stop to the letters and phone calls you constantly receive from your debt collectors. Plus, you wont give your collection agency a reason to sue you.

You are probably wondering, how many points will my credit score increase when I pay off collections? Unfortunately, paid collections dont automatically mean an increase in credit score. But if you managed to get the accounts deleted on your report, you can see up to 150 points increase.