Student Loan Delinquency Or Default

Late student loan payments can start to hurt your credit after 30 days for private student loans and 90 days for federal student loans, and those delinquencies stay on your credit report for seven years.

Federal student loans go into default if you dont make a payment for 270 days. And the government has strong debt-collection powers: It can garnish your wages, Social Security benefits or tax refunds. With private student loans, your lender can term you in default as soon as youre late, but it has to take you to court before it can force repayment.

What to do: If youve paid late but havent defaulted, consider switching to an income-driven repayment plan, putting your loan in deferment or forbearance, or asking your lender for a modified payment plan.

If youve defaulted on your federal student loans, the government offers three options: Repayment, rehabilitation and consolidation.

Dont Open New Accounts All At Once

After a bankruptcy discharge, it might surprise you that youll get a lot of credit card offers. Many of these offers are for secured credit cards with sky-high interest rates. Companies now consider you a better risk because you dont have a lot of debts anymore. However, opening multiple new accounts at once could make it difficult for you to maintain regular payments and this could harm rather than help your credit score.

Can A Collection Agency Report An Old Debt As New

Collection agencies cannot report old debt as new. If a debt is sold or put into collections, that is legally considered a continuation of the original date. It may show up multiple times on your credit report with different open dates, but they must all retain the same delinquency date. They should also all be discharged on the same date seven years after the original open date.

You May Like: Syncb Zulily Credit Card

Buy Yourself A Present: An Authorized User Tradeline

Did you know that if you piggyback on someone elses account as an authorized user, their account history and activity can affect your credit score?

Yup, even if you never use the authorized user card, their account shows up as a tradeline on your credit report and influences your score.

Do you see the golden opportunity here?

Find someone whos very responsible with their credit card, has a large limit, and has had it opened for ages.

And then convince them to add you as an authorized user.

Its kind of a lot to ask. So, what if no one close to you fits the bill?

Theres another solution: you can buy an authorized user tradeline!

I know it sounds crazy, but hear me out.

Tradeline Supply Company is an online marketplace for buying and selling tradelines.

Quick Tip:

It can take up to 30 days before you see the tradeline hit your credit report and up to 60 days before you see its true effect.

Every tradeline you buy from Tradeline Supply Company has a perfect payment history and credit utilization of 15% or less.

The best tradelines are ones that have been opened for a long time and have a high credit limit. These have the largest impact on your score.

Moral of the story?

You can pad your credit report and boost your credit score by buying authorized user tradelines.

Remember, anything you can do to improve your credit score helps reduce the negative impact of a bankruptcy.

Ask To Become An Authorized User

Getting someone to co-sign on a loan may be a tall order, but building your credit as an authorized user on someone elses credit card is often more feasible. Being an authorized user involves having a card in your name thats attached to another borrowers account, not your own. Youll be able to use the card for purchases without having to qualify for the account on your own meritsbut you wont be able to modify the account.

Credit card payments will show up on your credit report, so if these payments are made on time and the credit utilization rate stays low, your score will improve over time. Just make sure the credit card company reports authorized user payments to the three main credit bureaus so you have the greatest chance of increasing your score. While this isnt as impactful as other methods of increasing a credit score, it can still be helpful as part of a larger strategy.

Don’t Miss: Cbna Stands For

What You Can’t Change Or Remove

You can’t change or remove any information on your credit report that is correct even if it’s negative information.

For example:

- All payments you’ve made during the last two years on credit cards, loans or bills, whether you paid on time or not.

- Payments of $150 or more that are overdue by 60 days or more these stay on your report for five years, even after you’ve paid them off.

- All applications for credit cards, store cards, home loans, personal loans and business loans these stay on your report for five years.

For a full list, see what’s in your credit report.

Avoid credit repair companies that claim they can clean up this sort of thing or fix your debt. They may not be able to do what they say. They may also charge you high fees for things you can do by yourself for free.

Paying a credit repair company is unlikely to improve your credit score.

Use A Secured Credit Card

If you have a poor credit score, qualifying for loans or new credit cards may be challenging. However, banks are typically more lenient with the approval terms for secured credit cards than for unsecured ones.

A secured credit card is a type of credit card backed by a deposit account owned by the cardholder. The amount deposited acts as collateral for the credit card account, which the card issuer uses as security if the cardholder is unable to make payments.

Making purchases on a secured card can help improve your credit without risking overspending or falling into more debt. Additionally, if you are looking for a new credit card, you will probably gain approval for a secured credit card more easily than for an unsecured card.

Read Also: Does Speedy Cash Do Credit Checks

Get A Secured Credit Card

Reducing your dependence on credit cards can be an important step toward rebuilding credit after bankruptcy. However, the strategic use of secured credit cards can also help you begin to repair your trustworthiness in the eyes of lenders.

Taking out a secured credit card requires making a refundable security deposit and then borrowing against it. While these cards tend to come with high interest rates, if they report to all three credit bureaus, theyre a great option to show responsible credit behavior until youre better qualified for a traditional card with more competitive terms.

Some secured cards even allow you to graduate to an unsecured card after consistent on-time payments. This is a benefit since you wont have to apply for a new, unsecured card when your credit improves,

Keep in mind, however, that applying for a secured card doesnt guarantee acceptance, so take time to research the providers requirements before applying. If possible, choose a provider that offers prequalification so you can see whether youre likely to qualify before agreeing to a hard credit check that can further damage your score.

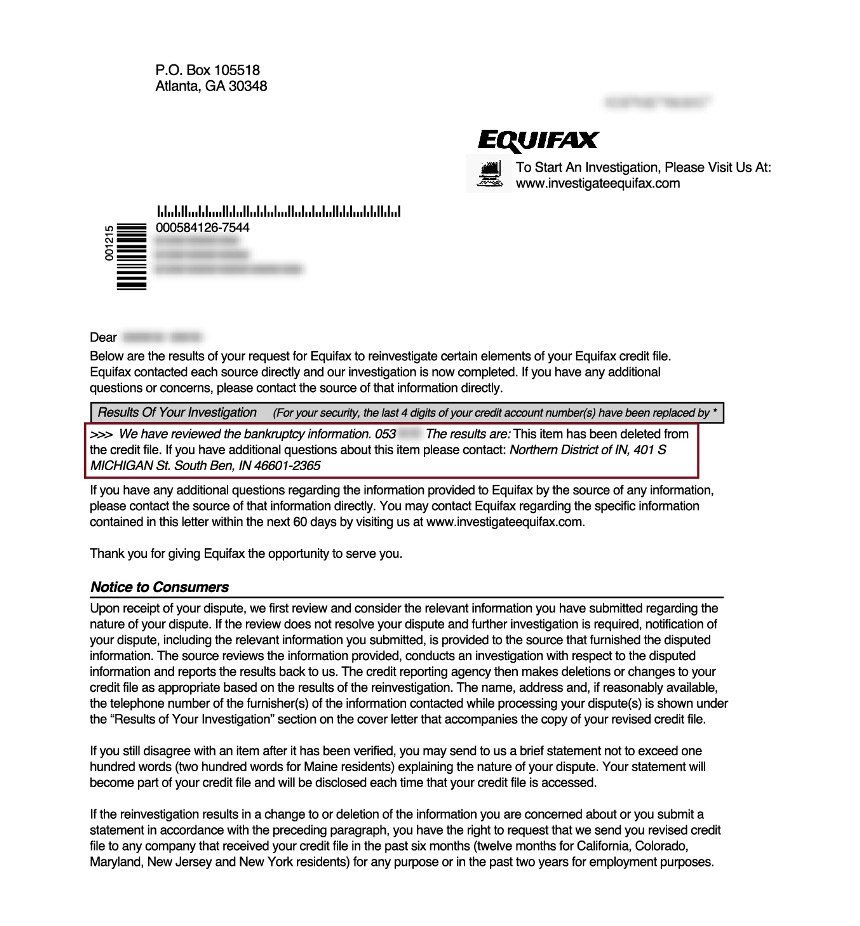

How To Dispute An Equifax Credit Report

To dispute an Equifax credit report, you will need to fill out a . You have two options as to how you want to submit the form. You can either scan and upload your documents online or you can mail in a completed form. You will also be asked to include proof of identity documents like a scan or copy of a valid driver’s licence, a birth certificate and a copy of a utility bill as proof of address. You would also need to give the credit bureau any other documents that support your case.

Don’t Miss: How To Get Rid Of Serious Delinquency On Credit Report

Send A Letter To The Reporting Creditor

You also want to send a similar letter to the creditor whos currently reporting the debt.

To do this, either reframe your credit bureau letter with copies of your documentation to the creditor or simply send a copy of the same letter with copies of any documents included. Avoid making statements that could restart the debt clock if the statute of limitations has not expired.

As with the credit bureau, send the letter certified with a return receipt requested. The creditor has 30 days to investigate your claims and respond.

Why this is important: Depending on who your creditor is, it may be faster to work directly with it to get your old debt off your credit report.

Who this affects most: Those with older debts with more established companies will benefit from contacting the original creditors. You may find it easier to work with larger, more established creditors than with smaller collection agencies.

Make Sure The Right Accounts Were Reported

After your debts are discharged, review your credit reports to make sure that only the accounts that were part of your bankruptcy are reported by the as discharged or included in bankruptcy on your reports. If you find mistakes, notify the credit bureaus and dispute the errors on your credit reports .

Read Also: Disputing Old Addresses Credit Report

A Fresh Start After Bankruptcy

Mei Ling and Matt are a married couple who rent a flat in Gosford NSW. Both worked full time until two years ago when Matt lost his job. Mei Ling now works part time earning less than $40,000 per year.

For two years they tried to survive on Mei Lings wage, struggling to make repayments on their overdue credit cards and loans. They ended up with unsecured debts of over $65,000.

The only assets they owned were a car worth $5,000 and general household goods .

The pressure from their creditors became too much to handle. Debt collectors and process servers were constantly calling on them. Their electricity was turned off a few times and they stopped answering phone calls because it always seemed to be bad news. Matts health was also suffering and he was treated for depression. Most nights Mei Ling would end up in tears thinking about their situation.

They finally decided to see a financial counsellor. There was no charge for this service. The financial counsellor looked through their finances and suggested they consider filing for bankruptcy.

Matt and Mei Ling went home and looked in detail at the AFSA website. They read all about their options and the consequences of bankruptcy. The AFSA website showed that they would be able to keep their car because it was worth less than the set amount. They read they could also keep their household goods. In the end, they decided that bankruptcy would be the best option for them.

File A Dispute With The Credit Reporting Agency

Once you have your report, make sure to look through each account and see if there are creditors you dont recognize. Its also important to check whether older derogatory items are still being reported.

If you do find errors in your reports, its time to initiate a dispute directly with the reporting bureau through its website or by mail. This will prompt an investigation on the bureau’s part.

Bear in mind that you have to dispute the entry with each agency to make sure the removal is complete across the board.

How to file a dispute online

Each bureau Equifax, Experian and TransUnion has a section dedicated to walking consumers through the online dispute process. Once you create an account, you can file as many disputes as you need and check their status, for free.

How to file a dispute letter

You can also send a dispute letter to the bureaus, detailing any inaccuracies you’ve found in your credit file. When writing your letter, provide documentation that supports your claim and be precise about the information you are challenging. The Consumer Financial Protection Bureau recommends enclosing a copy of your report with the error circled or highlighted.

Depending on the information being disputed, these are some of the documents you can provide to help aid the investigation:

- Copies of checks

Include this dispute form with your letter.

Recommended Reading: Does Pre Approval Hurt Credit Score

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

Waiting For A Bankruptcy Removal From Your Credit History

Once you wait seven to 10 years, the bankruptcy public record will automatically be deleted, and future creditors won’t be able to see it.

The individual accounts that had the debts may have already been deleted during the bankruptcy discharge and bankruptcy plan phase. In some cases, these accounts must remain on the credit report.

The best thing to do is build credit while waiting for the bankruptcy record to clear, follow repayment plans, and avoid more debt.

You May Like: Trimerge Report

How To Get Proof You’ve Been Discharged

Your discharge from bankruptcy will happen automatically, so you won’t necessarily get proof sent to you.

Email the Insolvency Service to get a free confirmation letter. You should only ask for this after the discharge date.

If you ask for a confirmation letter, you must include your:

- full name

- National Insurance number

- court reference number

If youre applying for a mortgage, youll need a Certificate of Discharge. If you originally applied for bankruptcy through a court then youll need to ask them for a certificate. This costs £70 and £10 for extra copies.

If you originally applied for bankruptcy online, email the Insolvency Service for a certificate. Theres no fee for a Certificate of Discharge if you applied online.

Secret To Removing Bankruptcies

Depending on the type of bankruptcy you have, after 7-10 years, it will officially fall off your credit report.

But what if you or your client wants to remove it early?

Removing a bankruptcy early can be life-changing because it opens up all the possibilities to things like qualifying for a mortgage and a car loan. Plus, if the bankruptcy is wiped out from your record, you can qualify for lines of credit without the predatory, high-interest rates that keep people with a bad credit history stuck in a downward spiral of debt.

One mistake does not have to affect your life for the next ten years.

Removing bankruptcy can be a long and tedious process, but it is definitely worth trying because getting one removed is AWESOME!

So heres what you need to know:

- Bankruptcies are filed with the courts, NOT with the credit bureaus

- And the courts dont even report to the credit bureaus

- But they still show up on your credit report!

Thats because the credit bureaus BUY this information. They purchase this information about bankruptcies from companies like LexisNexis, who pull the information from PACER.

This is the key to removing it, and heres the reason why:

It’s essentially a technicality but it does work. You see, the credit bureaus often report the furnisher of information as the Recorder of Deeds, the Clerk of Courts or the Magistrate or sometimes it will be reported as the Municipal Court. All of which are NOT the furnisher.

Heres how you do it:

Whats next?

Don’t Miss: How Bad Is A 500 Credit Score

How Long Can Bankruptcy Affect Your Credit Scores

Bankruptcy can affect your credit scores for as long as it remains on your credit reports. Thats because your scores are generated based on information thats found in your reports.

But the impact of bankruptcy on your credit scores can diminish over time. This means your credit scores could begin to recover even while the bankruptcy remains on your credit reports.

After the bankruptcy is removed from your credit reports, you may see your scores begin to improve even more, especially if you pay your bills in full and on time and use credit responsibly.

Discharge Date Vs Reporting Timeline

The length of time that the bankruptcy reports depends on the type you file. The rules are as follows:

- Total Discharge or Chapter 7- up to 10 years from the date of filing

- Reorganization or Chapter 11- up to 10 years from the date of filing

- Repayment Plan or Chapter 13- completed bankruptcies usually takes 3 to 5 years)- up to 7 years from the date of filing

But individual accounts included in the filing report for seven years. This is the case even if you filed under Chapter 7 or 11.

Read Also: Get Inquiries Removed

How To Remove Negative Items From Your Credit Report

First, it’s important to know your rights when it comes to the information in your credit history.

Under the Fair Credit Reporting Act , credit bureaus and lenders must ensure that the information they report is accurate and truthful.

This means that, if you find mistakes in your , you have the legal right to dispute them. And, if the information disputed is found to be incomplete or erroneous, the bureaus are obligated to remove it from your record.

Some common credit report errors include payments wrongly labeled as late or closed accounts still listed as open. It’s also possible for your report to include information from someone else, possibly someone with a similar name, Social Security number, or identifying information.

Bear in mind that correct information cannot be removed from your credit report. So, if your score is being dragged down by accurate negative information, youll need to repair your credit over time by ensuring you make payments on time and decrease your overall amount of debt.

Here are some tips to help you repair your credit history: