Remove Equifax Credit Freeze

Through Equifax, you have the option to request a temporary security freeze removal that is either specific to a certain creditor or a general removal that applies for a set period, ranging from one day to one year.

Through a simple online process, you can submit your request through this link. You can also call Equifax at 298-0045, or if you prefer, request your security freeze removal in writing and sending it to the following address:

Equifax Security Freeze PO Box 105788 Atlanta, GA 30348

If the request is submitted in writing, you will need to provide your full name, current address, social security number, date of birth, and applicable proof of identification, like a copy of your drivers license, is also required.

Through the online or other methods, you will need to provide your security freeze PIN. Check the process for retrieving your PIN if youve misplaced that information.

Timing And Cost Of Lifting A Credit Freeze

The Fair Credit Reporting Act requires that both freezing your credit and lifting a freeze be free.

In terms of timing, a credit freeze must be removed no later than one hour after a credit bureau receives your request by phone or online. If you mail in a request to have a freeze lifted, credit bureaus have three business days after receiving it to lift the credit freeze.

Can You Unfreeze Your Credit Report For A Specific Period

Yes. Log in to your online TransUnion account. Instead of choosing Remove Credit Freeze, select the Temporary Lift Freeze option. Choose the dates you want to lift the freeze. When that period ends, TransUnion will automatically freeze your credit report. TransUnion will allow you to set specific dates you want to unfreeze your credit report up to 15 days before you want it to happen. Remember, you can also unfreeze your credit report via phone or mail.

Read Also: Remove Evictions From Credit Report

How Many Points Will My Credit Score Go Up When A Derogatory Item Is Removed

The impact of an item deleted from your credit report depends on whether the item was negative, such as inquiries, late or missed payments, write-offs, collections, bankruptcies, settlements, liens, and foreclosures.

The impact of these deletions can range from a credit score increase of a few points to hundreds of points . Deleting a negative item is like removing weight from your score, allowing it to rise.

The impact on your score as a result of removing a negative item depends on the severity and the age of the item. Inquiries are not severe problems, so removing them will have, at best, a minimal impact on your score. Other items are more severe, so removing them could add dozens of points to your score.

The other factor is the items age. The impact of removal will always be greater if the item is relatively recent.

Even severely derogatory items begin to lose their bite after a couple of years. The impact of an item aging off your report will be muted because the negative effects have already eroded over time. Nonetheless, you should see your score rebound whenever a negative item is removed.

Why You Can Trust Bankrate

At Bankrate we strive to help you make smarter financial decisions. While we adhere to strict editorial integrity, this post may contain references to products from our partners. Here’s an explanation for how we make money. The content on this page is accurate as of the posting date however, some of the offers mentioned may have expired. Terms apply to the offers listed on this page.

Also Check: Highest Credit Limit For Victoria Secret

How To Temporarily Lift A Security Freeze At Experian

wikiHow is a wiki, similar to Wikipedia, which means that many of our articles are co-written by multiple authors. To create this article, volunteer authors worked to edit and improve it over time.There are 8 references cited in this article, which can be found at the bottom of the page. This article has been viewed 6,285 times.Learn more…

A security freeze is a good way to protect your identity.XTrustworthy SourceFederal Trade CommissionWebsite with up-to-date information for consumers from the Federal Trade CommissonGo to source Security freezes prevent new lenders from seeing or adding information to your credit report. This stops identity thieves in their tracks because they cannot open new accounts in your name if the lender cannot access your credit report.XResearch source However, it also prevents you from opening new accounts. Luckily, you can temporarily lift your credit freeze so that it’s only open when you plan to apply for a new line of credit. This article will tell you how to temporarily lift your security freeze with Experian. If your planning to apply for a new line of credit, and the lender your applying with uses Experian to check your credit, then this article is for you.

Who Can Access My Credit Report If Its Frozen

As a reminder, a freeze on your credit report will prevent lenders and creditors from accessing your credit history. So, dont expect to get approved for a personal loan, auto loan, home loan, or a new credit card as long as the freeze is in place.

Entities that can access your credit report even with a credit freeze in place include the following:

- The company that provides or monitors your credit report

- The government and courts

- Companies investigating individuals for possible fraud

- Collection agencies

You May Like: Does Les Schwab Report To Credit

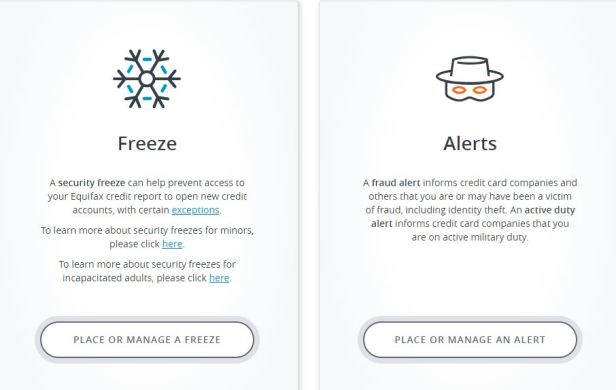

Stay Alert Stay Protected

Concerned about identity theft or someone stealing your credit card number? Itâs important to take steps to secure your information and identity. Part of that might include freezing your credit.

You can also monitor your credit by regularly reviewing your credit reports. You can get free copies from all three bureaus by visiting AnnualCreditReport.com.

Another tool that might help is . Itâs free for everyone, even if youâre not a Capital One cardholder. And it has security features like dark web surveillance and an SSN Tracker to help you take action quicker if your personal information is compromised.

You can also use CreditWise to monitor your credit in other ways. It gives you access to your TransUnion credit report and weekly VantageScore® 3.0 credit score. Best of all, using CreditWise wonât hurt your scores.

Learn more about Capital Oneâs response to COVID-19 and resources available to customers. For information about COVID-19, head over to the Centers for Disease Control and Prevention.

Government and private relief efforts vary by location and may have changed since this article was published. Consult a financial adviser or the relevant government agencies and private lenders for the most current information.

The CreditWise Simulator provides an estimate of your score change and does not guarantee how your score may change.

How To Unfreeze An Experian Report

Experian has a “Freeze Center” dedicated to helping you remove or lift a security freeze.

The credit bureau will grant you an unfreeze online after you fill out the form on its website.

You can specify how long you want the freeze to be lifted, and even allow a specific lender to access your frozen report. If you want to completely unfreeze your file, you can request removal by phone or by mail.

Contact info: Experian Security Freeze, P.O. Box 9554, Allen, TX 75013.

You May Like: Minimum Credit Score For Affirm

The Significance Of A Credit Freeze

The most important reason why consumers consider a credit breeze and also why it is a federally mandated service is security. Identity theft is more common than one may imagine. Thousands of people are victims of identity theft every month. Not all cases get reported in the media but ordinary people have to endure the fallout. Data breaches have become far too common to consider them aberrations. Tech giants have been victims of data breaches, from outright data theft to hacking and phishing leading to a denial of service attacks. Millions of people have had their data compromised, including sensitive information such as banking details, medical records, emails, and social media profiles.

A credit freeze enables an ordinary citizen to prevent identity thieves, data thieves and anyone with access to the personal identity or data of them from using that information to get loans, credit cards, and other privileges. Personal data can be used to apply for credit cards, loans, financial services, and other products that will effectively be debts or liabilities of the victim whose identity has been stolen. These processes that are exploited by identity and data thefts can be disrupted with a credit freeze. If a bank, lender, financial institution or credit card company is unable to access the credit file of a person, then the thief misusing the personal details will not be able to avail the product or service. Thereby a victim is being protected from further exploitation.

When Do You Need A Pin To Unfreeze Your Credit

Two of the three major credit bureaus have recently changed their policies related to security freezes and PINs. As of 2018, if youre unfreezing your credit reports online through Equifax or TransUnion, you wont need a PIN at all. Youll only need to enter your account username and password.

However, you will need a PIN if youre unfreezing your Experian credit report. Youll also need one if you want to thaw out your Equifax or TransUnion credit report over the phone though it is possible to thaw an Equifax credit freeze over the phone without a PIN, as well explain below.

Read Also: How To Unlock Your Credit

Remove Transunion Credit Freeze

TransUnion also offers temporary or permanent credit freeze removal, and the simplest way to request it is through its online platform found here.

Individuals may also call TransUnion at 1-888-909-8872 to request a security freeze removal by phone, or send the request in writing to the following address:

TransUnion Fraud Victim Assistance PO Box 2000 Chester, PA 19022

Requests made in writing and over the phone require you to know your PIN, but not when updating your credit freeze information online. If youre submitting your request in writing, make sure to also include your personal details such as your SSN, your PIN, and proof of identity.

Related Content:

How To Remove A Security Freeze From Credit Report Experian Equifax Transunion

With all the buzz around massive data breaches and identity theft, many consumers have made the smart choice to take various degrees of security measures as it relates to their credit reports. One such tool is a credit freeze, also known as a security freeze, which gives notice to any creditor attempting to view ones credit information for the purpose of getting a new loan, credit card, home mortgage, or line-of-credit account.

With a security credit freeze in place, new creditors are required to stop an application in its tracks since verification of past payment history, other credit accounts, and other relevant details necessary for approving a new account cannot be done. While a security freeze is a long-term tactic in safeguarding your credit from bad actors, there are times when it needs to be accessed. Heres how to unfreeze your credit report by removing a security credit freeze.

Recommended Reading: What Credit Score Is Needed For Affirm

How Do I Freeze My Credit Report

To freeze your credit report, you need to contact the three major credit bureaus Experian, Equifax and Transunion online or by phone to make your request.

You will receive a verification PIN, which will be needed in the future for temporarily or permanently removing the freeze. The selected agency will complete the process within one business day. If the freeze is being removed, then they must comply within one hour of the request.

Keep track of your freeze start and end dates. You can request a free copy of your Annual Credit Report each year from Experian, Equifax and TransUnion. Compare the three reports to verify that there are no unfamiliar charges.

Bottom Line: How To Remove A Judgement From Your Credit Report

Most judgments wont make it to your credit report, but you should still handle them right away. If you have a judgment on your credit report, it will knock your score down quickly and a lot and make it hard to get future credit. The best thing to do is to either repair your credit yourself or hire a reputable credit company.

Its a lot easier today to remove judgments since the Fair Credit Reporting Act doesnt allow them, so take the necessary steps to remove them from your credit report today.

Additional Items to Remove from Your Credit Report:

Recommended Reading: Brksb Cbna

The Process Of Removing A Credit Freeze

You should remove a credit freeze before a potential lender or company will initiate the credit check. If the credit check fails due to the inaccessibility or unavailability of the credit file, then the lender or the company you have applied for any financial service with will reject your application. The time it right so there are no avoidable problems or delays. Credit bureaus are often steadfast with freezing a credit file. It happens instantly in most cases of identity theft and data breach. Unfreezing may not happen instantly. As per the federal law, credit bureaus can take up to three business days to process a request of removing a credit freeze and effectively unfreezing the file. Three business days may not sound much but if your lender or a company you are dealing with initiates the credit check in that time then the process will not be completed.

Removing a credit freeze is a simple process. You must choose if you want a temporary unfreeze or thaw if you want one or select applications to be permitted if you want the removal of the freeze to be permanent or you want it to be time-bound wherein the file will be frozen again after the expected credit checks are completed. Here are the processes of removing a credit freeze with each of the three leading bureaus of the land.

Make A Goodwill Request For Deletion

If you have a good relationship with a creditor that has listed a late or missed payment, consider sending a goodwill request for deletion letter. The letter requests the original creditor to pretty please remove the offending item from your credit report. You can send the letter through the mail or make the request through email or on the phone.

Goodwill requests work best when you have a long and positive relationship with the creditor. Naturally, youll have to be completely current on your payments to the creditor. The letter you send should be polite because the creditor is under no obligation to agree.

As with other credit repair letters, examples of goodwill request for deletion letters are available on the internet for free. Note that a creditor may be willing yet unable to remove an item due to its own policies or agreements with credit bureaus. Nonetheless, you have nothing to lose by making the request, except for some of your time.

Since a goodwill letter is not considered an official credit dispute letter, you may never get a response back from the creditor there are no mandatory deadlines for response. Your best bet is to demonstrate that the late payment was a rare oversight, and youll never do it again.

Goodwill letters are usually less successful for more serious transgressions, such as collections and repos.

Read Also: Comenitycapital Mprc

Removing A Credit Freeze With Transunion

TransUnion has similar processes as well for removing a credit freeze. You can do so online or on 1-888-909-8872. You may write to them if you want. Send a letter to TransUnion Security Freeze at PO Box 2000 in Chester, PA 19022. You must have the personal identification number handy. The letter should be accompanied by proofs of identification. Online requests are expedited so you may prioritize them. Mail anyway takes time and it is less secured than directly speaking with an official representative.

You may issue specific instructions if necessary given the needs of the hour. You can also explain why you want the unfreezing or thaw but it is not necessary. If you have been a victim of identity theft or data breach, then you may be asked if the situation has been resolved before the credit bureaus process your request and effectively remove the security freeze. The exact cost you must bear to either enforce or remove a credit freeze shall vary. The fee usually varies by state and also from one bureau to another. Victims of identity and data theft do not need to pay any fee for enforcing or removing a credit freeze.

How To Unfreeze Credit At Equifax

- To lift a security freeze on your Equifax credit report online you need to start a myEquifax account.

- Because of this, a PIN is not needed for online freezing or unfreezing.

- Equifax allows you to unfreeze your credit temporarily for a specific creditor or for a specified period. Equifax allows you to do this for a time period ranging from 1 to 365 days.

- You can also choose to permanently unfreeze credit.

To lift or reinstate a credit freeze with Equifax by either phone or mail, you will need a PIN.

Also Check: Does Uplift Report To Credit Bureaus

When Do You Need To Unfreeze Your Credit

If you can ask TransUnion to freeze your credit report, you also have the option to thaw or unfreeze it.

Here are the reasons to lift the freeze on your credit report:

- If youre applying for a loan. Lenders and credit card issuers need to check your creditworthiness and pull your credit report to help them decide whether to approve your application or not.

- If youre going apartment or house hunting. Whether youre planning to buy or rent, landlords and creditors providing home loans need to access your credit history.

- If youre applying for utility services. Utility companies may conduct a credit check if you wish to install new services on your new home.

- If youre buying a new phone. Cell phone providers will check your credit report first if you want to purchase a new phone in installments.

- If youre looking for a job. Employers may check your credit report, especially if youre applying for a job that deals with money all the time.

Keep in mind that removing the credit report freeze means you wont be protected from possible identity theft and fraud. Unfreeze your credit only if you have to and for a limited time only until youve fixed the problem with your compromised information.

Can I freeze or Unfreeze my Credit Reports on All Major Credit Bureaus at One Time? No. You have to get in touch with each of the credit reporting agencies to freeze and unfreeze your credit report.