Maintain Your Good Credit

The first thing you need to think about when you have a very high credit score is how to make sure that you dont lose all the progress that youve made.

To keep your credit score high, follow these tips:

- Pay all of your bills on time.

- Avoid opening any new credit accounts .

- Avoid closing old accounts.

- Send a debt validation letter demanding proof of any future debts that anyone tries to collect from youthis is one of your rights under the Fair Debt Collection Practices Act .

Is 714 A Good Credit Score For Buying A Car

There is no specific minimum credit score required to buy a car. But the higher your credit score is, the more options youll have and the more youll save on auto loan interest. For example, new-car buyers had an average credit score of 714 as of the first quarter of 2017, according to the latest data from Experian.

How Your Credit Scores Are Set

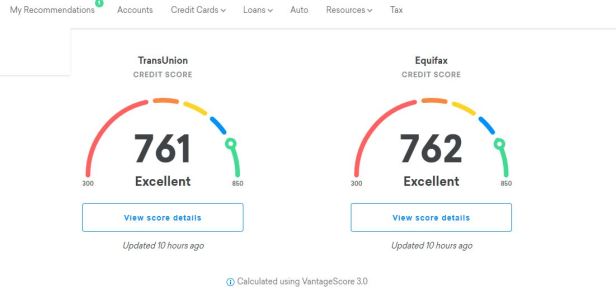

Canadian credit scores are officially calculated by two major credit bureaus: Equifax and TransUnion.

They use the information in your credit file to calculate your scores. Factors that are used to calculate your scores include your payment history, how much debt you have and how long youve been using credit.

Pro Tip: You can view sample credit scores summaries from each bureau to get a sense of what to expect.

Also Check: How To Raise Your Credit Score By 50 Points

Number Of Americans With No Credit History

According to the Consumer Financial Protection Bureau , approximately 26 million adults are considered to be credit invisible, meaning they have no credit history as theyre without credit cards, loans, and other lines of credit.1

Of course, if you have a credit card, that doesnt necessarily mean you will have a credit score. Around 19 million adults lack a score altogether due to credit reports with minimal credit usage or out-of-date credit history. Nows the time to open a credit card or loan to build your history.

How To Get A 761 Credit Score

Theres no secret for getting a 761 credit score. Rather, it simply requires consistency and commitment. You need to pay your bills on time, use only a portion of the credit made available to you, and generally work to make any mistakes youve made look like freak occurrences rather than standard practice. You also need to know exactly where youre starting from and then actually track your progress over time to hold yourself accountable. So make sure to regularly check your latest credit score for free on WalletHub as you work your way to a 761 credit score.

You can find specific recommendations for what we recommend doing in your situation on your personalized credit analysis page. And below, you can check out some of the most common steps people need to take to get a credit score of 761.

You May Like: Can Landlord Report To Credit Bureau

Monitor Your Credit Score Regularly

The only way to do that is by monitoring your credit score on a regular basis. You dont have to become obsessive about this, but knowing where it is on a monthly basis will alert you of any problems. You can then correct them immediately, which will prevent so much time from passing that you lose the options to do so.

What An 800+ Credit Score Can Mean

The advantages of having an 800+ credit score are huge. Ilene Davis, a certified financial planner with an 800+ credit score, says she did a calculation on the mortgage payments for a $300,000 home loan for various FICO scores.

If the difference between payments for borrowers with the highest and lowest credit scores were invested at 6% a year, at the end of a 30-year mortgage the borrower with the highest credit score would have accumulated around $750,000. Thats a chunk of money worth improving your credit score for.

Feeling overwhelmed or like you are drowning in credit card debt? ACCCs Debt Management Plan may be your answer!

Our Debt Management Plan will help you consolidate your unsecured debt into one monthly payment and restructure your payments to make it more affordable.

A Debt Management Plan:

- Is designed to fit your budget

- Will reduce your interest rate on most credit card accounts

- Will reduce or eliminate the penalty fees

Don’t Miss: Does Carmax Do Credit Checks

How To Improve Your 761 Credit Score

Knowing how to improve your credit score is a big deal. You want to ensure that your credit is the best out there so that you do not have a problem applying and being granted loans and lines of credit.

Here are some tips to help you maintain or even grow your 761 credit score a bit more than it currently is:

- Always make sure that youre making all of your monthly payments on time, every time.

- You should always pay off your debt as quickly as you can to ensure that you have a boost in your credit.

- Keep your credit utilization to 30% of the available credit that you have overall. This will ensure that you have the best credit utilization and that you are not using too much all at once.

- Dont move the debt around that you have, pay it off and it will move quicker and benefit the score even more.

- Dont keep opening up new accounts every month since this can negatively impact the score and having hard checks done can also bring the score down.

- Never open up new accounts just to increase the amount of available credit, always just use the ones you have.

- Dont own too many credit cards all at once, or other loans since this can become overwhelming and actually harm your credit more than do it any good.

- Keep a comfortable income coming in and budget for expenses going out so that your credit score can benefit from bills being paid.

What Factors Affect Your Credit Score

Your credit score is comprised of five factors: payment history, amounts owed, length of credit history, new credit, and credit mix, as this screenshot from myFico.com shows. If your FICO Score is 750 and above, theres a good chance your credit report contains no derogatory information. That means youre perfect when it comes to payment history.

Your is also most likely in a very desirable range. That means you have total outstanding credit card balances of 30% or less of your total credit card limits. Even so, youll want to keep a close eye on this ratio. As it moves above 30%, it begins to negatively impact your credit score. And if youre in the excellent credit score range, that can be easier to do than you might think.

Read Also: Credit Score To Get Care Credit

Shopping For Credit Cards With A 761 Credit Score

When shopping for credit cards, make sure you explore all of your options. In other words, dont just sit down with one potential creditor and decide to accept their deal or not. Sit down with multiple potential creditors and compare and contrast them to find out what works best for you.

If you already have a credit card, but have been shopping for one that is cheaper, you can then go to your existing creditor and request them to either match or beat an offer from another credit card company. Tell them that you believe you are paying too much money in fees and interest, and ask them if they are willing to lower their rates and fees down to the other credit card company that you are thinking about switching to.

If they refuse, then you can switch accounts, but dont close your existing account immediately. You still want to make the minimum payment on. it while you are waiting for your balance to transfer to your new account. You only want to close a credit account when your balance is at zero.

Factors That Affect Credit Scores

Five factors are included and weighted to calculate a person’s FICO credit score:

- 35%: Payment history

- 15%: Length of credit history

- 10%: New credit and recently opened accounts

- 10%: Types of credit in use

It is important to note that FICO scores do not take age into consideration, but they do weigh the length of credit history. Even though younger people may be at a disadvantage, it is possible for people with short histories to get favorable scores depending on the rest of the credit report. Newer accounts, for example, will lower the average account age, which in turn could lower the credit score.

FICO likes to see established accounts. Young people with several years worth of credit accounts and no new accounts that would lower the average account age can score higher than young people with too many accounts, or those who have recently opened an account.

Recommended Reading: Bby Cbna

Here’s What Americans’ Fico Scores Look Like

by The Ascent Staff | Updated Sept. 7, 2021 – First published on July 29, 2020

Many or all of the products here are from our partners that pay us a commission. Its how we make money. But our editorial integrity ensures our experts opinions arent influenced by compensation. Terms may apply to offers listed on this page.

The average American has a FICO credit score of 706. But unless your credit score is exactly 706, this doesn’t tell you much about where you stand. Wondering how you compare with other American consumers? Here’s a look at the current distribution of FICO scores, and some guidelines that can help you interpret what your score means.

The Credit Score Needed To Buy A House

Your FICO score plays a major role in your ability to secure a mortgage. The type of mortgage that youre looking to secure will determine what your score should be. According to QuickenLoans, these are the following credit scores you need to work with lenders14:

- Conventional Mortgage: 620

- FHA Loan With 3.5 Percent Down: 580

- FHA Loan With 10 Percent Down: 500

If you fall below these guidelines, ask yourself, how long does it take to build credit? Then, come up with a plan of action to help you work towards your goal.

Recommended Reading: Can A Closed Account Be Reopened On My Credit Report

The Average American Credit Score

The average FICO score in the United States is 706. But this varies based on a variety of factors. Most peoples’ . Some states have higher or lower average credit scores, too. For example, Minnesotans on average have the highest FICO credit scores in the nation at 733.

As of this report, 55% of Americans have a FICO score of 740 or higher. This has historically been the case, but the decade of steady economic growth since the Great Recession has caused Americans’ credit profiles to improve significantly. Credit scores are higher when fewer consumers have serious delinquencies weighing down their scores. The state of the economy can influence whether or not people are financially able to avoid credit score pitfalls from year to year.

Know What Information You Need To Look At

You also need to know what information you should look at when looking at credit cards. When you are offered a credit card, you will be given a variety of information, such as the APR . Sometimes the credit card offer will offer a variety of rates, and you wont know what rate you will get until after you have been approved. You would be foolish to assume that you will get the lowest rate possible.

Another piece of information to look at is the credit limit. Your potential creditor will tell you that your card is limited up to a certain point, but again, you may not qualified for the maximum limit. When you do max out a credit card that has a low credit limit, it can harm your credit score.

Some credit card companies will also have a penalty APR. Always find out what the penalty rate is before applying for a card, what causes you to have the penalty, and how long the penalty will last.

Finally, look at any fees that come with the credit card. Examples of fees include late payment fees, cash advance fees, annual fees, and transfer fees. Again, dont apply for a credit card until after you have found out exactly what these rates are.

You May Like: How To Get Public Records Off Your Credit Report

Smart Tips To Improve Your Cibil Score

- Dont be a co-signer for a loan unless you dont need to borrow around the same time

- Avoid acquiring too many debts over a short period of time

- Ensure you repay all your EMIs and credit card bills on time

- Use debt consolidation loans as and when necessary so that your dues arent handed over to a debt collection agency

- Be cautious about borrowing loans without a proper repayment plan in place

- Always negotiate your rate of interest with lenders to keep your costs down

- Dont borrow the entire amount you receive a sanction for

- Choose a shorter loan tenor to repay your loan fast and at a lower interest payment

- Talk to a CA or financial planner to get help on saving taxes and managing your money more efficiently

- If you dont have any credit history, borrow a small personal loan and repay it on time to build a credit score

Now that you know everything about your CIBIL credit score, be smart about your financial practices. Try to keep your CIBIL score high and youll be able to access funds on your terms.

Additional Read:What is CIBIL and what does it have to do with your credit score?

Taking your credit score and financial profile into consideration, Bajaj Finserv brings you pre-approved offers for personal loans, home loans, business loans and a host of other financial products. Not only does this simplify the process of availing financing, but also helps you save on time and effort.

*Terms and conditions apply

What Is A Good Credit Score To Avail Of A Home Loan

To avail a home loan, you need to ensure that you have a CIBIL score at least above 650. Since a home loan is a secured loan, lenders have the option of seizing your home if you are unable to repay the loan. This is why a slightly lower credit score is allowed. However, it is in your best interest to maintain a good credit score so you can get a larger loan amount at nominal interest

You can maintain a good CIBIL score by following these simple steps:

- Pay your EMIs on time to create a proper track record

- Avoid having a credit card that you dont use cancel dormant credit cards

- Manage your credit cards carefully by setting payment reminders or limit your use to one credit card

- Avoid re-applying for loans or credit cards that you did not get approved for in quick succession

- Dont make too many loan applications in a short span of time

- Choose lengthy loan tenors with care and try to make part-prepayments when you can

Don’t Miss: Does Aarons Report To Credit Bureaus

Percent Of Americans Who Have A Credit Score Of 800 Or Higher

Another report from The Ascent reveals that only 22 percent of Americans have a credit score of 800 or greater7.

Those who have a credit score of 800 to 850 are considered to have exceptional credit, and it appears that older individuals as well as those with incomes ranging from $101,000 to $150,000 have much higher credit scores within the perfect range.

Example Of How A Credit Score Impacts Loans

A person’s credit score affects their ability to qualify for different types of credit and varying interest rates. A person with a high credit score may qualify for a 30-year fixed-rate mortgage with a 3.8% annual percentage rate . On a $300,000 loan, the monthly payment would be $1,398.

Conversely, a person with a low credit score, assuming they qualify for the same $300,000 mortgage, may pay 5.39% on the loan, with a corresponding monthly payment of $1,683. That’s an additional $285 per month, or $102,600 over the life of the mortgage, for the person with a lower credit score.

The importance of having a strong credit score isn’t limited to just mortgages. For instance, if you have a good to excellent credit score, you are far more likely to qualify for the best rewards credit cards.

FICO credit scores take five financial factors into consideration. The two most important factors are a person’s payment history and the amounts owed on their accounts.

You May Like: Can A Repo Be Removed From Credit Report

Is Paying Off Credit Card Early Bad

Paying your credit card early can improve your credit score, especially after a major purchase. This is because 30% of your credit score is based on your credit utilization. To counter this, a lower balance will be reported to credit agencies if you pay part or all of your balance before your statement closes.

A 761 Credit Score Is Often Considered Very Good Or Even Excellent

With excellent credit, your credit scores become more of a bridge and less of a roadblock a high score can help you qualify for premium rewards credit cards, auto loans and mortgages with the best terms.

Having excellent credit scores doesnt guarantee approval, but it certainly helps. Thats because your excellent scores make you more attractive to lenders, who may see it as an indicator that you pose less of a risk. And the more they trust you to repay the money you borrow, the less they need to hedge their bets with things like down payments, security deposits and low credit limits.

Of course, your arent the only factor lenders look at. They also consider details like your employment status and income.

Its also important to keep in mind that you might have dozens of different credit scores. And it may not be clear which score a particular lender looks at, or how high that score needs to be in order to grant you approval at the best terms.

But in general, your excellent credit scores will impress them.

Take a look at how your credit scores stack up against the scores of people from different generations.

| Percentage of generation with 750850 credit scores |

|---|

| Generation |

Ranges identified based on 2021 Credit Karma data.

Also Check: Speedy Cash Collection Agency