Can I Rent An Apartment With An Eviction On My Record

Your rental history is an important component of your application for a new apartment. Landlords will review this to confirm that you are a trustworthy tenant who consistently pays their rent on time. Any type of negative rental history, including legal action taken as a result of a lease violation, can hurt your chances of approval. Although the reason for less-than-perfect rental history may be an anomaly it still doesnt look great on paper.

Being approved for a lease when you have negative credit or an eviction on your record can be challenging, but its not impossible. In some circumstances, you might not need to reveal your bad rental history depending on how long the eviction stays on your rental history.

Does An Eviction Show Up On My Credit Report

No, but an eviction can still make it difficult to rent in the future. An eviction case is a matter of public record. If an eviction case against you shows up on a public consumer report, any potential landlord may assume you were evicted. This is true even if you won your eviction case.

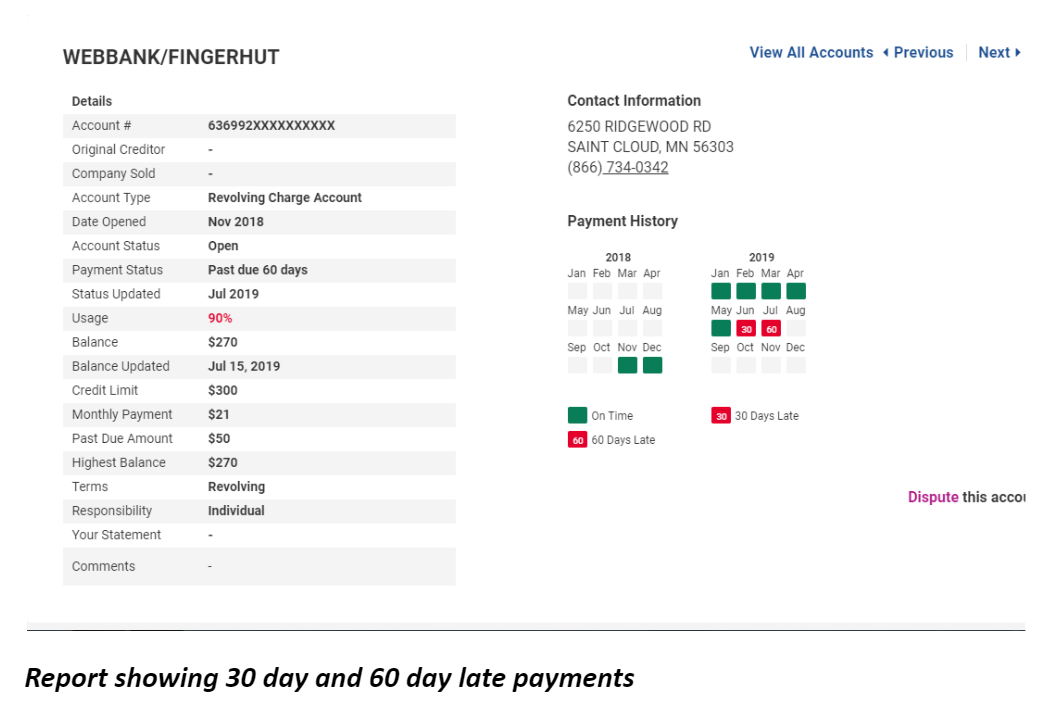

Also, any rent or court fees you owe may go to collections. This will appear on your credit report for seven years.

What Is A Rental History Report Exactly

A rental history report is pretty much exactly what it sounds like: a written history of your past rentals. They’re designed to show potential landlords what you’re like as a tenant. In general, they include:

- A comprehensive list of all the addresses where youve rented

- Contact information for the landlord or property manager that was in charge of the property when you lived there

- The dates you lived at each rental and how much you paid in rent

- Issues like late rent payments, evictions, broken leases, and any other major problems that occurred while you were renting

- An overall recommendation from your previous landlords

Read Also: How To Get Credit Report With Itin Number

How Long Do Derogatory Marks Stay On Your Credit Report

Editorial Note: The content of this article is based on the authors opinions and recommendations alone. It may not have been previewed, commissioned or otherwise endorsed by any of our network partners.

A poor credit score can make a lot of things harder. It can make borrowing difficult or more expensive. It can even cause your insurance premiums to rise or make it harder to rent an apartment.

All of which means that if you have derogatory marks on your credit report that are dragging down your score, youd like them to be cleared up as soon as possible.

So how long do derogatory marks stay on your credit report? In many cases, theyll stay for seven years, but it depends on the specific type of derogatory mark. This article lays it out mark-by-mark and explains exactly how you can get each one removed.

In this article:

Can An Eviction Make It Harder For Me To Rent In The Future

Yes. Some landlords report to tenant screening services, like Experian’s RentBureau or TransUnion’s SmartMove. Even though your credit report may not read “eviction”, a check with one of these services will reveal your eviction record. If the screening service has incorrect information about your rental history, you should contact them to dispute the information. If someone rejects your lease application because of one of these rental reports, they must give you the name and contact information of the company that made the report.

An eviction will make it difficult to rent in the future. The best way to avoid an eviction is to pay your rent on time and comply with your lease.

Read Also: Does Affirm Show Up On Credit Karma

How Long Does It Take For An Eviction To Appear On My Record

If your landlord sued you for not paying rent and the landlord wins, you can expect the eviction to appear on your credit report within 30 to 60 days. The eviction will remain on your record for up to seven years and then it is usually deleted from public records. Every time someone pulls your credit report or rental history background check, the eviction will appear as long as the civil judgment remains in the public records. Additionally, don’t assume that the civil judgment will be erased automatically after seven years. There are plenty of examples of clerical errors causing evictions staying on record beyond seven years.

Do I Have A Broken Lease On My Record

broken leaseyourThe broken leaseyourthe

Also to know is, how long does a broken lease stay on your record?

seven years

One may also ask, is a broken lease the same as an eviction? Eviction is when a LL uses the judicial process to legally force a tenant to move out, usually involuntarily. Breaking a lease is a voluntary thing done by a tenant for a variety of reasons. They are quite different.

Keeping this in view, can you rent an apartment if you owe money to another?

If your former landlord receives a judgement against you that’s reported to the credit bureaus, it can make renting an apartment even more difficult. Although every rental management company evaluates broken leases differently, if you owe money to another rental company, most won’t rent to you.

How can I break my apartment lease without paying?

Here’s how to get out of a lease:

Don’t Miss: How Bad Is A 500 Credit Score

How Does An Eviction Affect My Credit

Evictions may result in negative marks that bring down your credit score. If you did not pay the full amount due, your landlord may bring you to court. Once you are sued for unpaid rent as well as the landlord wins the case, you will have a civil judgment against you. The civil judgment is important for your credit history. A civil judgment is a serious negative mark and stays on your credit report usually up to 7 years, even if you have paid off the amount. A potential employer or landlord can review the credit reports and learn about your civil judgment.

Lawsuit Or Judgment: Seven Years

Both paid and unpaid civil judgments used to remain on your credit report for seven years from the filing date in most cases. By April 2018, however, all three major credit agencies, Equifax, Experian, and TransUnion, had removed all civil judgments from credit reports.

Limit the damage: Check your credit report to make sure the public records section does not contain information about civil judgments, and if it does appear, ask to have it removed. Also, be sure to protect your assets.

Don’t Miss: How To Get Credit Report Without Social Security Number

How Long Will Rental Judgements Stay On Your Credit Report Or Rental History In The State Of Virginia

- on Mar 7, 2018

You can expect it disappear from your credit reports after 7 years.But there is a catch. The case record in court is still there, and it remains a public record. Many landlords will use a service that searches older court records to see if you have an older eviction. If so, it will turn up. However, that was a long time ago. A potential landlord may be willing to overlook it, or perhaps you can offer a larger security deposit to make a landlord more comfortable about renting to you.

Do Tenant Evictions Show Up On Background Checks

Everyone makes a mistake now and then, but most people dont get evicted from their rental property. A previous eviction is one of the biggest red flags a landlord can look for when screening prospective tenants.

Rental property owners want to protect their property and the neighborhood, and an eviction is an indication that a tenant could quickly become a problem once the lease is signed.

Read Also: How To Remove Child Support From Credit Report

Does An Eviction Show Up On Your Credit Report

While positive rental payment history may be included in your Experian credit report, your report will not show eviction information. Eviction records can be found in a separate rental history report, which can be obtained through a tenant screening company or through Experian RentBureau.

If you had an unpaid debt following your eviction, such as unpaid rent and any fees, your landlord or leasing company could have sold that debt to a collection agency. If the collection agency that purchased the debt reports to Experian, the account would then appear on your credit report as a collection account.

How To Improve Your Credit Score

No matter what your history looks like, its always possible to start improving your credit score. By paying your bills on time, paying off debt, and working to get your balances low relative to your overall credit limit, you can increase your score and establish a positive credit history.

Some of those negative marks may stick around for a while, but their impact decreases over time. And in the meantime, those positive habits will help you build a more stable financial foundation.

Read Also: Does Removing An Authorized User Hurt Their Credit Score

How Can You Avoid An Eviction

If you think that you may not pay your rent on time, contact your landlord or the leasing office as soon as you can to work out a repayment plan to help you get caught up. Many landlords would rather help you stay in the property and avoid the eviction process in favor of finding another renter for the property. Its also in your best interest to work with the landlord to prevent eviction so that you can remain in the rental unit and keep your record clean.

If you need more information about evictions or the rental process in general, check out our resources. You can also take virtual home tours or search for apartments. With Instarent, you can reserve apartments you love online. This feature allows you to reserve the apartment for 24 hours for a small fee, which takes the unit off the market and lets you apply without losing it to another renter. Once youve reserved the unit, you complete an online application and get approved in 24 hours or less.

Ready to find your next place? Search thousands of apartments on Zumper and find your new home.

How Does An Eviction Impact Your Future Housing Prospects

Unfortunately, an eviction will almost undoubtedly hurt your ability to secure housing in the future.

Many landlords perform credit checks on prospective tenants. So, if your credit report contains debts owed through collection agencies or civil judgments, that will raise a big red flag on your application.

Even if a landlord cant tell that the collection debt is rent-related, theyll still question your ability or propensity to pay the rent on time each month.

Youll also have trouble getting approved for a mortgage, credit card, or personal loan during those seven years because your credit score will take a huge hit.

Don’t Miss: How To Remove Repossession From Credit Report

Student Loan Default: Seven Years

Failure to pay back your student loan remains on your credit report for seven years plus 180 days from the date of the first missed payment for private student loans. Federal student loans are removed seven years from the date of default or the date the loan is transferred to the Department of Education.

Limit the damage: If you have federal student loans, take advantage of Department of Education options including loan rehabilitation, consolidation, or repayment. With private loans, contact the lender and request modification.

Can Anyone Check My Credit Report

The Fair Credit Reporting Act has a strict limit on who can check your credit and under what circumstance. The law regulates credit reporting and ensures that only business entities with a specific, legitimate purpose, and not members of the general public, can check your credit without written permission.

Read Also: 766 Credit Score Mortgage Rates

Impact Of Eviction On Credit And Future Housing

House & Apartment

Having an eviction in your past can make it more difficult to find housing in the future.

Eviction is a legal process where a landlord removes a tenant for breaking their lease agreement. Breaking the lease agreement is called a breach. A breach can be because of nonpayment of rent, repeatedly late payment of rent, having too many people inside the residence, subleasing without permission, damaging the property, having pets where prohibited, or any other conduct that the lease does not allow.

To be evicted, you must first have an eviction hearing. The hearing will be at your local Justice of the Peace court. The judge must decide against you and in favor of your landlord before you can be evicted.

Always go to your hearing. If you do not attend, you almost always lose. If you lose, you will have to move out, pay any rent that you owe, and may have to pay court fees.

However, just having an eviction case can make it harder to find housing. This is true even if you win.

How Does The Eviction Get Done If They Dont Leave

Once a final decision has been made in your favour, the judge will issue a “writ available on “date. If they still live in this house on this day, you will go back to court and pay extra to file the Writ of Possession. Once the Writ of Possession has been filed, the case will go to the local legal department for final implementation. It can take anywhere from 1 to 30 days for the officer to identify and remove residents and household goods. Back in the good days of ole, they would come with a moving truck and movers.

Read Also: Creditwise Score Accuracy

Ways: How To Dispute An Eviction On Credit Report

Read over your eviction notice thoroughly to know which type of eviction you were served. Depending on which one you may have some wiggle room like simply offering to pay your debt.

Catch It Before It Hits Collections

You have a good chance of getting this done if you have a Pay or quit and Cure or quit eviction.

If The Information is True: Can I Remove An Eviction From My CR?

Nope. Unfortunately, evictions are public records.

They are in the same boat as Tax Liens, Civil Court Judgments, Bankruptcies, and Collections. Thats why its best to catch it/ speak to your landlord or property management before going to collection agencies if you can.

You never know what they can do for you until you ask.

How long do evictions stay on your record

In most states, an eviction will come off your .

Related: Is CreditRepair.com Legit?

Good Luck!

What Can I Do If The Information On My Rental History Is Wrong

Once you get a copy of your rental history report, check it carefully to make sure its accurate. And dont let anything slip byincorrect dates for even one apartment could jeopardize your chances for a new place, because it could erroneously show late rent payments. If any information on the report is wrong, you can dispute it. Supply the company with supporting information, and theyll review the issue and fix any problems.

Also Check: 698 Credit Score Mortgage

Is My Rental History On My Credit Report

When you review your credit reports, you might notice that your history making on-time rent payments isn’t listed anywhere. But that doesn’t mean there’s no way to use your history as a reliable tenant to improve how lenders and credit card issuers view you as a borrower.

There are steps you can take to add your monthly rent payments to your credit reports and possibly improve your credit scores in the process. Here’s how to do it and why you may want to.

Can You Dispute An Eviction

If you have an eviction listed on a tenant screening report that you believe is inaccurate, contact the tenant screening company directly to dispute the information.

To check if there are any collection accounts for eviction-related debt appearing on your Experian credit report, you can request your free Experian credit report online.

If you have a collection account on your Experian credit report that you believe is incorrect, you can dispute that information quickly and easily through the online Dispute Center.

Also Check: Does Carvana Build Credit

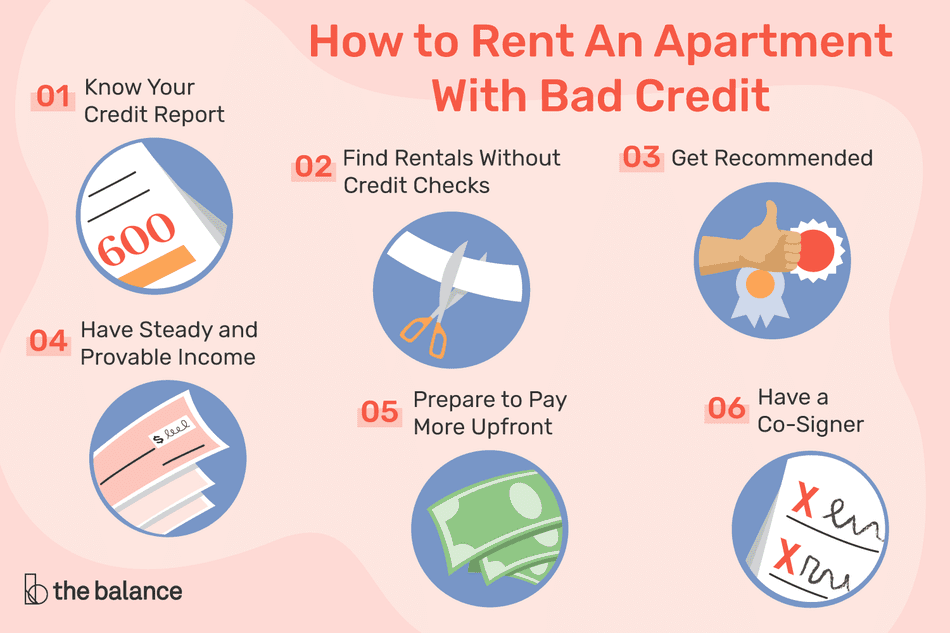

How Do I Get Over A Bad Rental History

Some landlords will overlook past irresponsible behavior, but you usually need compensating factors such as a co-signer or a larger security deposit.

- What Is a Bad Rental History?

- Have a Co-Signer Sign the Rental Agreement.

- Max Out the Security Deposit.

- Focus on Your Strong Points.

- Find a Landlord Who Will Work With You.