Does No Credit Mean Bad Credit

Having no credit history and no credit scoreas might be the case if you’re just out of school or newly arrived in the U.S.doesn’t mean you have “bad” credit. Even so, it can make it harder to rent an apartment, open a credit card account, or obtain a loan. In many cases, you can get around your lack of a score by using alternative methods to prove your financial responsibility.

If you want a mortgage, for example, you can submit a history of timely rent and utility payments with your mortgage application. Or, if you aren’t eligible for a conventional credit card, you can apply for a secured credit card, which, after a period of time, may qualify you for a conventional one.

Check Your Credit Score For Free

Knowing where you stand and watching your progress can be important. With Experian, you can check your FICO® Score for free. Your account gives you a breakdown of which factors are impacting your score the most, so you can take a focused approach to improving your score. Your credit score will also automatically be tracked and updated each month.

Lower Your Credit Utilization Ratio

Your credit utilization ratio refers to how much you owe compared with the amount of available credit you have. For example, if you have a $10,000 credit limit across all your credit cards and you have balances totaling $9,000, youve utilized 90% of your credit. This drags down your score.

What these consumers often need to do is pay down the balances on their existing credit accounts, which can be a challenge if theyve allowed the balances to creep up over time, says , compliance manager and director of education at Cambridge Credit Counseling of Agawam, MA.

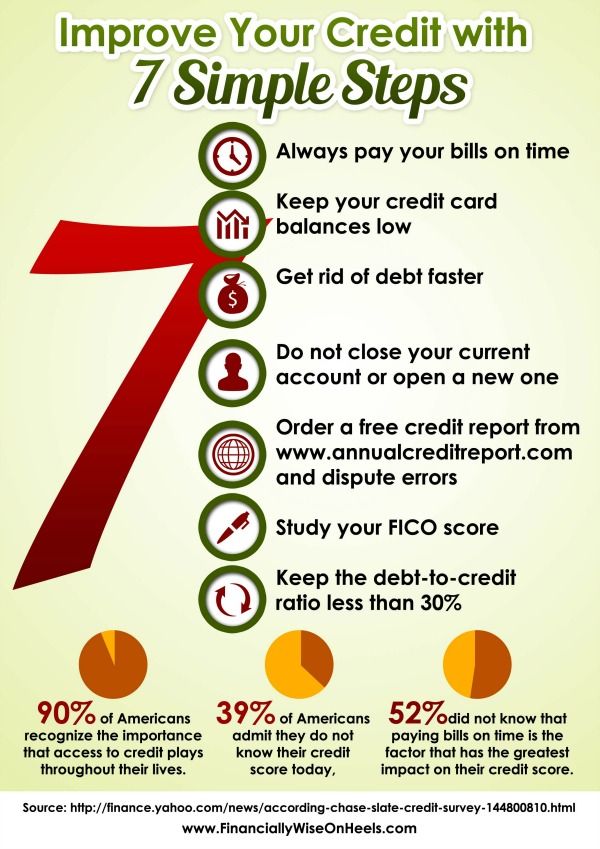

The ratio of whats owed to the amount of credit available represents 30% of the consumers score, so rapid improvement is possible if theres a large amount of money available to pay down balances.

Linda L. Jacob, a financial counselor at Consumer Credit of Des Moines, IA, recommends paying down balances to below one-third of your credit line. Any payments you make will be reflected on your credit report as soon as your creditors report your payment to the credit bureaus.

Scores are updated on an ongoing basis, and creditors typically report once per month, so if you make a payment that lowers your credit utilization, that should be reflected on your score within two months.

A creditor may be willing to give you a credit line increase with a soft pull, which will not hurt your score. Soft inquiries are for background purposes only.

Read Also: How To Get Credit Report Without Social Security Number

Have Open Active Accounts In Good Standing

Your credit score is a measure of how well youve handled credit accounts in the past. You wont have a good credit score if you dont have any accounts or if all the accounts you do have are closed or delinquent.

Adding good accounts to your credit report will boost your credit score. That may mean starting over with a secured credit card or another credit card for bad credit.

Consider Experian Boost Or Ultrafico

When you have no credit history, adding extra accounts can boost your score. You have two options that could help you: Experian Boost and UltraFICO:

- Experian Boost evaluates your utility, streaming and other accounts and adds on-time payments from these accounts to your Experian credit report. If a lender or card company uses another credit bureau, they wont see any of your Experian Boost accounts.

- UltraFICO is a program from FICO that adds information about your bank account balances, cash flow and bank transactions. However, not every lender uses or accepts the UltraFICO score.

Read Also: Unlock Your Experian Credit Report

How Long Does It Take To Raise Your Credit Score

For the most part, developing a strong credit score takes time. Credit reporting bureaus want to see that you have a history of paying your bills on time, and that you use credit judiciously. A FICO credit score ranges between 300-850. Scores above 670 range from “good” to “exceptional,” while anything below 670 is considered “fair” to “poor.” To get in the “good” to “exceptional” range you need to build a good bill payment and credit history.

Review Your Credit Report

You are entitled to one free a year from each of the three reporting agencies and requesting one has no impact on your credit score. Review each report closely. Dispute any errors that you find. This is the closest you can get to a quick credit fix.

A government study found that 26% of consumers have at least one potentially material error. Some are simple mistakes like a misspelled name, address, or accounts belonging to someone else with the same name. Other errors are costlier, such as accounts that incorrectly are reported late or delinquent debts listed twice closed accounts that are reported as still open accounts with an incorrect balance or credit limit.

Notifying the credit reporting agency of wrong or outdated information will improve your score as soon as the false information is removed. About 20% of consumers who identified mistakes saw their credit score increase.

Read Also: How To Report A Death To Credit Bureaus

Pay Your Bill On Time

The most important factor in your credit scores is payment history. To build credit with your credit card, make at least your minimum payment on time every month. If you miss your bill’s due date, the card issuer may charge you a fee and you could lose any introductory or promotional interest rates on your account.

One of the best ways to ensure you never miss a payment is to set up autopay on your account. You can make the minimum payment using autopay, then pay the remaining balance, or as much as you can, separately.

If you make a late payment, the credit card company can report your account as late to the credit bureaus once it’s 30 days past due. A late payment is a negative mark that can hurt your credit scores and stay on your credit report for up to seven years.

Equifax Financial Health Index

The Equifax Financial Health Index uses information from Open Banking or the information that customers supply themselves, which they combine with existing credit record information, to develop a fuller picture of customers financial circumstances.

The Financial Health Index lets you add information to your credit records about:

- savings and investments.

The Index can also fill in credit information gaps, by including information such as rent and utilities payments.

There are other credit reference agencies joining the market, such as Credit Kudos, which also take Open Banking into account.

Also Check: How To Remove Repossession From Credit Report

Things That Affect Your Credit Scores

The following impact your FICO credit scores:

- Payment history 35% of your FICO score

- Amounts owed 30% of your FICO score

- Length of credit history 15% of your FICO score

- Types of credit 10% of your FICO score

- New credit 10% of your FICO score

Heres what holds weight in the VantageScore model:

- Overall credit usage, available credit and outstanding balances Extremely influential

- Payment history Moderately influential

- Age of credit history Less influential

- New accounts Less influential

How To Use A Credit Card To Build Credit

At Experian, one of our priorities is consumer credit and finance education. This post may contain links and references to one or more of our partners, but we provide an objective view to help you make the best decisions. For more information, see our .

In this article:

Recommended Reading: Capital One Rapid Rescore

Consider Getting A Credit

If you have a poor credit history, you might want to think about getting a credit-builder credit card. These are cards designed for people who either have made little previous use of credit or who have a bad credit history. But credit limits on these cards are often low and the interest rates are high. This reflects the level of reassurance your credit file information provides to lenders.

Butbe aware that the interest rates charged are much higher than standard credit cards. Typically, youll be paying over 30% in interest a year, which is another reason to try to pay off any balance in full each month. Otherwise, you might end up in debt that you struggle to get out of, which could harm your credit rating even further.

Your Technology Is Tracking You Take These Steps For Better Online Privacy

Never get too close to your credit card spending limit

Let’s say your credit card company tells you you can have a credit card with a $100 spending limit. That’s how much money you can borrow and spend. But … you actually shouldn’t spend that full amount. You shouldn’t get even close to your $100 limit. You should spend much less. Just 30% of your spending limit, so $30. If your credit card limit is $1,000, you can spend $300. If you spend more than 30% of your limit, that hurts your credit.

So if you have a good credit score and you want to maintain it, spending 30% of your credit card limit is fine. If you have a $100 credit card limit and you only spend $30 each month, that keeps you at 30% utilization of your card, and the credit score people like that.

If you want to increase your credit score, though, you need to spend less than 30% of your spending limit. Only use $20 of your credit card limit. Or $15 . That shows the credit bureau that you don’t need all of their credit. And for some reason, that makes your credit score go up.

If you do need to use your full credit card limit, one way to get around this is to pay your balance before your statement date. Your statement date is different from your payment due date. The statement date is the day that credit card companies notify the credit bureaus of your card usage. If you can beat them to the punch and pay off the card before it’s reported, you can use more than 30% of your spending limit.

Recommended Reading: What Credit Score Does Les Schwab Require

Building Credit Without Credit Cards

The need for good credit history is inevitable for most of us. When the time comes to buy a car or a home, rent an apartment, set up new utility accounts, obtain a cell phone, or handle other financial transactions, a healthy is crucial. For many, the first step in establishing a credit history is through the use of credit cards.

Luckily, only a small portion of your is based on having and using revolving credit products . However, consumers who can’tor don’t want toobtain a credit card can build a credit history in other ways.

Find Out When Your Issuer Reports Payment History

Theres something called a credit utilization ratio. Its the amount of credit youve used compared to the amount of credit you have available. You have a ratio for your overall credit card use as well as for each credit card.

Its best to have a ratio overall and on individual cards of less than 30%. But heres an insider tip: To boost your score more quickly, keep your credit utilization ratio under 10%.

Heres an example of how the utilization ratio is calculated:

Lets say you have two credit cards. Card A has a $6,000 credit limit and a $2,500 balance. Card B has a $10,000 limit and you have a $1,000 balance on it.

This is your utilization ratio per card:

Card A = 42% , which is too high.

Card B = 10% , which is awesome.

This is your overall credit utilization ratio: 22% , which is very good.

But heres the problem: Even if you pay your balance off every month , if your payment is received after the reporting date, your reported balance could be high. And that negatively impacts your score because your ratio appears inflated.

So pay your bill just before the closing date. That way, your reported balance will be low or even zero. This lowers your utilization ratio and boosts your score.

You May Like: What Is Syncb Ntwk On Credit Report

What Is Considered A Good Credit Score

According to the Fair, Isaac and Company , the creator of the three-digit score used to rate your borrowing risk, the higher the number, the better your credit score. The FICO score ranges from 300-850. MyFICO.com says a good credit score is in the 670-739 score range.

Your credit score is made up of five different factors.

5 categories that make up your credit score

- 35% Payment history: This is a record of your payments on all accounts for the length of the account history. Think of this as a report card for your finances.

- 30% Amounts owed: This is what makes up your credit utilization ratio. To determine your utilization ratio, take the amount of outstanding balances on each account, add them up and divide that by your total credit limit. So a credit card with a $5,000 credit line that has $3,000 in used credit would be a 60% credit utilization ratio not so good.

- 15% Length of credit history: This considers the number of years you have been borrowing. The longer your credit history of positive payments and responsible account management, the better.

- 10% Credit mix This includes all types of credit, such as installment loans, revolving accounts, student loans, mortgages, etc.

- 10% New credit: Every time you apply for a new credit card or loan, a hard inquiry is reported on your credit report.

Build A Credit History If Needed

A low credit score doesnt always mean you have bad credit. It can just mean you have thin credit. In other words, you havent demonstrated enough creditworthiness to potential lenders, at least that they can see on your credit report.

If thats the case, you may need to open a credit account, such as a credit card, and make payments on it regularly. Try to get a card with no annual fee, if possible. Dont overspend, or use this as an excuse to take out loans you dont need.

You could get a secured credit card, for example, and pay for gas and other regular expenses with it. To avoid paying high interest charges or building credit card debt, track your balance throughout the month and pay the balance off every month.

You May Like: What Is Syncb Ntwk On Credit Report

Protect Your Personal Information To Avoid Fraud

Your credit can be affected by identity theft, which is when fraudsters access your personal information and open accounts in your name. To help keep your data safe, use a password manager to create and store unique passwords and avoid making financial transactions on public Wi-Fi networks, which could leave you vulnerable.

Tips To Increase Your Credit Score

If you are like many consumers and dont know your credit score, there are several free places you can find it. The Discover Card is one of several credit card sources that offer free credit scores. Discover provides your FICO score, the one used by 90% of businesses that do lending. Most other credit cards like Capital One and Chase give you a Vantage Score, which is similar, but not identical. Same goes for online sites like Credit Karma, Credit Sesame and Quizzle.

The Vantage Score comes from the same place that FICO gets its information the three major credit reporting bureaus, Experian, TransUnion and Equifax but it weighs elements differently and there could be a slight difference in the two scores.

Once you get your score, as Homonoff suggested, you might be surprised if its not as high as you expected. These are ways to improve the score.

You May Like: Does Snap Finance Report To The Credit Bureaus

How To Build Credit

If you haven’t already, it likely won’t be long until you encounter a life situation where someone asks to check your credit. From buying a new cellphone to getting a mortgage, credit reports and scores are used by businesses to evaluate your creditworthiness and establish your borrowing terms.

Building a good credit score can take time, but the benefits of doing so are numerous. Even if you don’t expect to apply for credit anytime soon, it’s important to start working on it now so you can build a good score for when you need it.

What Lenders Don’t Know Ignore Conspiracy Theories

Many people believe every element of their life is on their credit reference files, but actually it’s mainly just a strict set of financial data. Though over recent years, the information contained on them has grown.

So let’s debunk some myths. Here are a few of the more common things people think are on their files, but aren’t.

Race, religion, ethnicity

These personal details about you are not held.

Salary

How much you earn isn’t on your file either, though you’ll usually be asked on the application form.

Savings accounts

As savings are not a credit product, they don’t appear on credit files. This data is therefore only available to banks you hold savings accounts with. However, when you apply for a savings account, the provider might do a soft search of your credit report to check your ID, and do anti-money-laundering checks.

Medical record

Medical problems you may have had in the past aren’t listed.

Criminal record

No criminal convictions are listed.

There are a host of other things that aren’t held on your credit report, including:

Don’t Miss: What Is Syncb Ntwk On Credit Report