Best Cards To Pair With Chase Freedom Flex

Thanks to its diverse earning categories, the Freedom Flex also makes for a great card to stack with other products. By pairing the card with another that earns a better flat rate on general purchases or offers more diverse redemption options, you can ensure your rewards are maximized.

For example, you could pair the Freedom Flex with the Chase Sapphire Reserve, in order to take advantage of the Reserve cards 50 percent bonus on Ultimate Rewards when redeemed for travel in the Ultimate Rewards portal. Alternatively, the Reserve lets you transfer to one of Chases many travel partners another way to potentially boost point value. By pooling all your Chase points onto the Reserve, you reap the benefits of more earning categories and a competitive redemption value.

Another great option is to pair the Freedom Flex with a flat-rate cash back card that offers a higher rewards rate on general purchases. The Wells Fargo Active Cash® Card is one of the most valuable flat-rate cards on the market. It not only earns one of the highest flat rates available an unlimited 2 percent cash back on all purchases but is also one of the rare flat-rate cards that offers a 2 percent rate and comes with a sign-up bonus: $200 after spending $1,000 within the first three months of account opening.

Chase Freedom Student Credit Card Review: Build Credit And Earn Cash Back Rewards

The Chase Freedom® Student credit card is a good entry into the world of credit building and earning rewards. For college students, a student credit card can be a route to building credit history and learning how to be a responsible borrower. Student cards don’t come with the luxury perks of a top-tier rewards credit card but offer simpler benefits that make sense for someone with little to no credit.

The Chase Freedom® Student credit card offers features that are ideal for fledgling cardholders. Its simple cash back rewards structure rewards every card purchase. The card also features a lower APR than many student credit cards, making it a safer choice if you accidentally rack up a higher balance than you can pay off at the end of the billing cycle. It also rewards responsible usage with an automatic credit limit increase just by paying your bills on time.

Chase Freedom Flex & Chase Freedom Unlimited Offers

If you think you fit all the criteria for a Chase Freedom Flex, then apply away! This quarters bonus categories wont last forever.

| $0 | Limited, Bad |

If you are still facing credit card denials, or are feeling overcome by your debt, you may need a debt management program. A reputable company can help you work with your lenders to design a payment plan and get out of debt.

You May Like: How To Unfreeze Experian Credit Report

What Score Do We Need To Qualify For A Chase Freedom Credit Card

We should note that for either the Chase Freedom Unlimited or Flex cards, we will need to have a . Most applications with this score are successful, and many applicants have scores as high as 700.

However, it should be noted that a credit score of 670 or lower will not guarantee us approval for our credit card. It is because Chase looks at several other factors besides the credit score.

One of the most important factors that Chase will consider is the number of credit cards we have obtained in the past 24 months. Chase will most likely reject our application on most applications if we have five or more. For this reason, in these cases, it is best not to apply because we will not be able to pass the review.

Other factors to consider are:

- How long we have had credit.

- Our income.

- Our credit card debt.

- Whether we have a Chase bank account.

Based on this, we can be approved or denied our credit card application at this bank, so we must consider all the factors to know if we qualify for them.

What A Very Poor Credit Score Means For You:

Most of the major banks and lenders will not do business with borrowers in the “very poor” credit score range. You will need to seek out lenders that specialize in offering loans or credit to subprime borrowers andbecause of the risk that lenders take when offering credit to borrowers in this rangeyou can expect low limits, high interest rates, and steep penalties and fees if payments are late or missed.

In this “very poor” credit score range, 30-year mortgages may not even be possible, auto loans can have high interest rates and only a select few credit cards may be made available. A “very poor” credit score could also prevent you from obtaining a rental home or apartment, increase the security deposits required for your utilities, or prevent you from getting a cell phone contract: all which mean additional costs for you in the long run.

Recommended Reading: How Do You Get A 800 Credit Score

What Tool Does Chase Offer Us To Check Our Credit Score

We will be able to use the free Chase Credit Journey tool, which allows us always to keep our credit history monitored and see our activity. In this application, we can check our score through TransUnion.

It will be different than the FICO score, but it is just as valid. There are different providers, and our credit score may vary across the three credit bureaus. It is normal, but we dont have to worry about it because it will always be valid.

How Can I Improve My Score To Get This Card

If you dont yet have a high enough credit score to qualify for the Chase Freedom Unlimited card, you can make several moves to improve your credit score:

- Check your credit report. Its not uncommon for to have errors on them, and theyre not always in your favor. You can request one free copy per year of your credit report from each of the three credit bureaus at Annualcreditreport.com. If you find any errors, you can get them fixed before you apply.

- Get a secured credit card. Think of a secured credit card as a starting point. Theyre available to almost anyone, as long as you put down a refundable deposit. In return, theyll help you build your credit score so you can apply for other better cards later like the Chase Freedom Unlimited.

- Pay down other credit card debts. The amount of credit card debt you have has a big impact on your credit score. If you have credit card debt now, you may be able to see an increase right away if youre able to pay down some of it.

- Ask for a credit limit increase on your other credit cards. If you have other credit cards with a balance on them, call those banks and ask for a credit limit increase. This makes it look like youre using a smaller percentage of your available credit, which can positively impact your score. But remember, dont exhaust the new credit limit or youll be in the same spot as before.

In most cases, building your credit score is more of a long-term process. You should always be doing the following:

Don’t Miss: Does Credit Karma Affect Credit Score

How To Improve Your Credit Score

Improving your credit score is a great way to improve the odds of approval for a Chase credit card.

Several routes toward better credit are available:

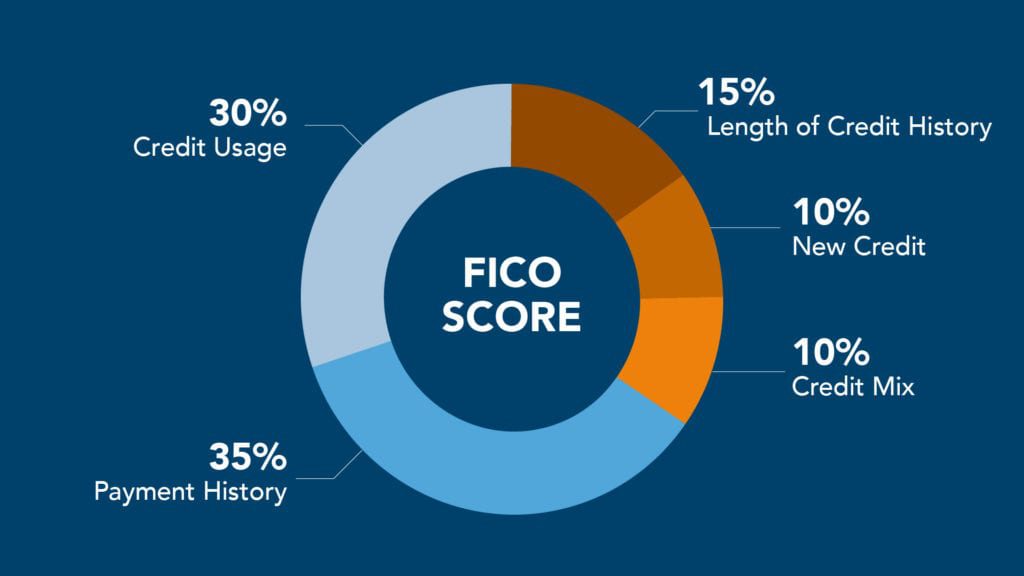

- Pay every bill on time. Payment history makes up 35% of a credit score rating, so it should be a primary focus. Set up automatic payments and try to pay off the balance every month.

- Get a secured credit card.Secured cards are usually designed for applicants with poorer credit who want to improve a credit score. Secured cards require a deposit that becomes the credit line. Use the credit to make small payments, then pay off the balance on time every month to help improve your credit.

- Become an authorized user. Ask a friend or family member to add you as an authorized user to a credit account in good standing. Most cards allowing authorized users will report authorized user activity to credit bureaus, allowing you to improve your credit using your own card on someone elses account.

- Pay off existing debt. Paying down debt will help decrease your credit utilization, which makes up 30% of your credit score. Try paying the smallest balances off first or pay down the debts with the highest interest rates.

- Get a credit builder loan. are designed to help people with no or poor credit history build history. The borrower pays the lender a minimum amount every month, and the lender reports the payment activity to credit bureaus. A healthy payment history can go a long way to improving a credit score.

Chase Freedom Flex Vs Chase Freedom Unlimited

The choice between the Chase Freedom Flex and the Freedom Unlimited will likely come down to your spending habits and how much work you want to put into earning rewards. If you get a kick out of strategizing ways to maximize your rewards and prefer a straightforward sign-up bonus with an easy spend requirement, the Freedom Flex can be a great fit. But if you favor consistency and ease of use, the Freedom Unlimited is likely a better choice for you, though youll need to spend quite a bit more to get the full value of the sign-up bonus.

While the Freedom Flex offers a 5 percent cash back rate on the first $1,500 you spend per quarter in a variety of rotating categories , you wont have any control over which categories Chase offers, and you may struggle to maximize your earnings in the cards categories each quarter. Meanwhile, with the Freedom Unlimited, youll earn 1.5 percent cash back even on purchases that fall outside the Chase travel, restaurant and drugstore categories. Thats lower than the cash back rate offered in the Freedom Flex cards rotating categories, but you wont be at the mercy of the Chase cash back calendar and wont need to track or enroll in categories. As such, it could be a better long-term option for everyday spending.

Recommended Reading: Why Would My Credit Rating Go Down

What Can You Do If You Don’t Get Approved

If you get a rejection, it may not be the end. Here are a couple of things you can do.

- : If you believe you have great credit and meet the criteria, you can talk to a representative. Chase has a line where you can explain your situation. This can help credit card issuers like Chase better understand you and possibly reconsider the decision. Here are some tips:

- Be polite and ask if there’s any more information you can provide.

- Be ready to explain any recently opened credit accounts or credit inquires. Maybe you took out a mortgage or just switched to a new cell phone provider.

- Explain why you want the card. Don’t just talk about the bonus. For example, maybe you want to join the Ultimate Rewards family.

- Most of all, be courteous. Don’t seem desperate for credit.

The reconsideration number is 1-888-270-2127.

- Work on paying off the balances on your other credit cards. Don’t miss or be late with any payments.

- You can ask for credit limit increases on your other cards, which will 1) help with the credit utilization ratio, and 2) show Chase that you can be trusted with credit.

- Refrain from opening new credit accounts, unless it’s for something other than a credit card .

Remember, you don’t only have one chance. You can apply again after your credit has improved.

Chase Freedom Unlimited: Is It Worth Getting

The Chase Freedom Unlimited® is a great deal for consumers especially for those who already have the Chase Sapphire Preferred® Card or Chase Sapphire Reserve®.

It comes with a potentially rich sign-up offer, useful bonus rewards categories and plenty of options for cashing in rewards. Its not as simple as a flat-rate cash-back card, but its versatility and value make it a strong choice.

Also Check: How Often Can You Get A Free Credit Report

Should You Get The Chase Freedom Flex Card

Before we break down how hard it is to get the Chase Freedom Flex, lets take a quick look at the benefits and bonuses that come with this card.

For one, there are several ways to earn rewards. Cardholders earn 5% cash back on rotating quarterly bonus categories , up to $1,500 spent per quarter. Plus, you can earn 5%, 3%, or 1% back anytime on select bonus categories:

- 5% cash back on up to $1,500 in combined purchases in bonus categories each quarter you activate

- 5% cash back on travel purchased through Chase Ultimate Rewards®

- 3% cash back on dining at restaurants, including takeout and eligible delivery services

- 3% cash back on drugstore purchases

- 1% on all other purchases

New Chase Freedom Flex cardholders can earn a $200 bonus after you spend $500 on purchases in the first 3 months from account opening.

Unlike The Chase Freedom Unlimited®, the Chase Freedom Flex is a Mastercard . You can learn more about both cards in our comparison of the Chase Freedom Flex vs Freedom Unlimited.

The Platinum Card From American Express

- Terms Apply.

High 600s to 850

The Platinum Card® from American Express is perhaps the most premium mainstream card on the market. Its annual fee is a whopping The Platinum Card® from American Express, signaling that it’s not a card for those just starting out in the world of credit. It offers 100,000 Membership Rewards points after you spend $6,000 in your first 6 months of card membership.

While cardmembers have been anecdotally approved for this card with credit scores under 700, realize that this card is a long shot without excellent credit. Additionally, if your score is in the 600s, you may want to prove to yourself that you can handle credit responsibly before opening a pricey card like the Amex Platinum. Read our Amex Platinum review here.

You May Like: How To Get Hospital Bills Off My Credit Report

How To Earn A Very Good Credit Score:

As with borrowers in the excellent/exceptional credit score range, borrowers labeled as “very good” by their FICO Score will have a solid history of on-time payments across a variety of credit accounts. Keeping them from an exceptional score may be a higher than 30% debt-to-credit limit ratio, or simply a short history with credit.

Is There A Way To Earn Even More Cash Back With A Chase Freedom Card

Yes, in addition to the primary rewards of both the Chase Freedom and Chase Freedom Unlimited, you can earn bonus points when you Shop Through Chase via their online shopping portal. With over 350 stores to shop at, you can earn between one to 15 bonus points per dollar spent each time you make a purchase, making it a great way to earn extra cash back on items you plan to buy anyway.

Read Also: How To Get Credit Report With Itin Number

The Minimum Requirements For Chase Credit Cards

What We Know for Sure · A Good to Excellent Credit Score While the terminology can vary by credit bureau, you will generally need to have a

Chase does not offer recommendations on its website regarding minimum credit scores, but they do recommend that applicants have good to

Both the Chase Freedom Unlimited® and Chase Freedom Flex cards are a great place to start to build a relationship with Chase. Just like the

Which Chase Card Is Easiest To Get

Chase Freedom® Student credit cardThe easiest Chase credit card to get is the Chase Freedom® Student credit card because applicants can get approved with limited credit. This means the odds of approval are good even for people who are new to credit, making the Chase Freedom® Student credit card much easier to get than other Chase credit cards.

How many Chase cards can you apply for in one day?

two personalChase will typically approve you for at most two personal cards in a 30 day period, and at most one business card in a 30 day period.

Also Check: What Companies Use Transunion Credit Report

How To Get A Credit Limit Increase

If your initial credit limit given is very low, don’t worry. There are ways to get it increased over time.

- Automatic credit limit increases. If you have been using your card responsibly for several months, Chase may automatically award you an increase. Using your card responsibly means:

- You make your payments on time each month

- You pay off your card in full each month

- You keep your credit utilization low, ideally at 30% or below

Some users have reported that they got automatic increases within months. Others have waited a year or more with no increase. If you have not gotten an increase after 6 months, you can try our next step.

- The best time to ask is when you have paid off your balance.

- Explain why you want the increase .

- Know how much you want. Be reasonable.

Note that Chase will need to check your credit again. This will trigger a hard pull, which will ding your credit a little.