What Factors Affect Your Credit Score

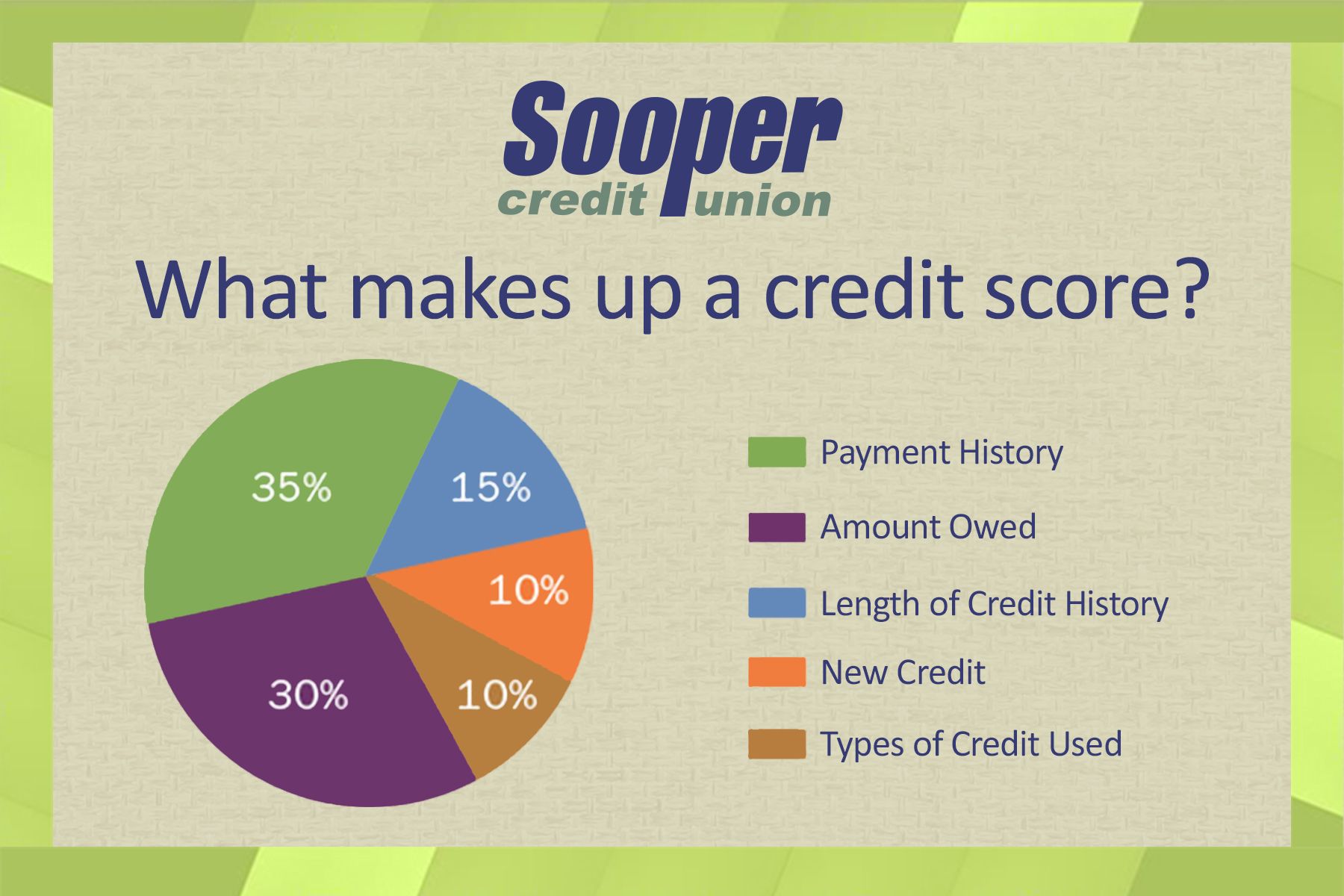

The two main credit scoring models, FICO and VantageScore, consider much the same factors but weight them somewhat differently. For both scoring models, the two things that matter most are:

-

Paying bills on time. A misstep here can be costly, and a late payment that’s 30 days or more past the due date stays on your credit history for years.

-

How much you owe. Credit utilization, or how much of your credit limits you are using, is weighted almost as heavily as paying on time. It’s good to use less than 30% of your credit limits lower is better. You can take several steps to lower your credit utilization. Scores respond fairly quickly to this factor.

Much less weight goes to these factors, but they’re still worth watching:

-

The longer you’ve had credit, and the higher the average age of your accounts, the better for your score.

-

Credit mix: Scores reward having more than one type of credit a traditional loan and a , for example.

-

How recently you have applied for credit: When you apply for credit, a hard inquiry on your credit report may result in a temporary dip in your score.

Use Less Than 30% Of Your Available Credit

Do your best to keep your balances way below your credit card limit. The amount you owe compared to your credit limit typically has a big impact on your credit score. If your monthly credit card spending is usually close to your credit limit, it can negatively affect your score even if you pay off your credit card bills on time. If you can get your spending down to 20% of your limit, thats a great formula for a real credit rating boost.

Become An Authorized User On A Credit Card

Ask a friend or family member to contact their credit card issuer and have you registered as an authorized user. The card issuer will need your personally identifiable information in order to process the request. And the payoff can be big: you may find yourself with a credit score boost in a few months time.

Don’t Miss: Affirm Credit Score

Why Building Credit Takes Time

One of the most important pieces of advice someone can give to someone whos learning how to establish credit is to not obsess over their credit score.

The worst thing you can do is focus so much on your credit score that you end up making decisions that are bad for your finances.

In fact, an important principle of building credit is to focus on things that are good for your credit and your money, such as:

- Using revolving credit but never letting it turn into debt.

- Paying on time.

- Not taking on any new loans unless you need them.

If the decisions youre making are good for your finances, theres a good chance theyll be good for your credit.

Dont forget: it takes time to learn how to start building credit and maintain the good habits youve learned. Stay focused, stay responsible and let time do its thing. Soon enough, youll have a good credit score and the tools to help you keep it that way.

Rebecca Safier contributed to this report.

Pay Off Debt And Accounts

Paying off student loans and other debt can help raise your credit score. One smart way to start hacking away at that debt is to make smaller, bi-weekly credit card payments vs. one monthly payment.

Scheduling automated payments can help you pay down that credit card debt more quickly, which is one of the fastest ways you can boost your scores. And if youve got any accounts on your credit report that are in collections, lenders may settle for a lesser amount if you approach them with a plan to pay the debt back.

Recommended Reading: Remove Eviction From Public Record

Limit Your Number Of Credit Applications Or Credit Checks

Its normal and expected that you’ll apply for credit from time to time. When lenders and others ask a credit bureau for your credit report, its recorded as an inquiry. Inquiries are also known as credit checks.

If there are too many credit checks in your credit report, lenders may think that youre:

- urgently seeking credit

- trying to live beyond your means

Not Eligible To Vote In The Uk Add Proof Of Residency

If you aren’t eligible to vote in the UK so can’t be on the electoral roll , send all three credit reference agencies proof of residency and ask them to add a note to verify this. This should help you get credit.

Some foreign nationals are allowed to vote in local elections, and therefore can be registered on the electoral roll in the normal way.

Update: Despite the UK having left the EU, and the so-called transition period having ended, the rules described above about EU citizens and their right to vote in UK local elections remain the same.

Recommended Reading: How Long Is A Repossession On Your Credit

Report Any Inaccuracies On Your Credit Report

Once you get your report, check for:

- Errors in credit card and loan accounts, such as a payment you made on time that is shown as late this could impact your credit score negatively

- Mistakes in your personal information, such as a wrong mailing address or incorrect date of birth

- Accounts listed that you never opened, which could be a sign of identity theft

- Negative information about your accounts that is still listed after the maximum number of years its allowed to stay on your report.

Any inconsistencies or incidents of fraud should be reported to the respective credit bureaus without any delay and get it corrected. Monitoring your credit on a regular basis can help you spot inaccuracies before they impact your credit rating.

| Note:A credit bureau cant change accurate information related to a credit account on your report. For example, if you missed payments on a credit card, paying the debt in full or closing the account wont remove the negative history. |

Start With Only One Credit Card

It’s easy as a first-time credit card user to accumulate a collection of credit cards within just the first few years of using credit. Be careful not to make the mistake of opening up too many credit cards too soon. The more credit you have, the more you’ll end up using and the harder it will be to keep up with your balances and payments.

Too many inquiries into your credit and too many new credit cards can negatively affect your credit score. Credit inquiries count for 10% of your credit score and opening new credit cards lowers your average credit age, a factor that’s also 10% of your credit score.

Spend time learning to be responsible with credit and apply for new credit cards sparingly.

Don’t Miss: Approval Odds For Care Credit

Whats The Difference Between Credit Score And Credit History

Your credit history is like your financial CV and its different from your credit score, which is simply a number.

If youre looking for help building your credit history, youll need to understand the differences between your credit history and credit score.

It may help to think of your credit history as a complete list of all the credit payments you’ve made for the past couple of years.

Your credit score is like the mark you get for performing well on an exam.

What Credit Score Do You Start With

You don’t start with any credit score, and you won’t get a score until you open a credit account that reports to the credit bureaus. Once you open an account, you will receive a score based on that account. It probably won’t be the best score since you don’t have a long enough credit history, but it won’t be the worst score, either.

Recommended Reading: When Does Wells Fargo Report To Credit Bureaus

‘soft Searches’ Incl If You’ve Checked Your Own File

Some lenders will do a soft search of your credit report, to tell you both whether you qualify to borrow from them, and what rate they are willing to give you. This isn’t passed on to other lenders when they credit-check you.

When you check your own file, it does appear on your credit report. It’s not always clear, but the words “administration check” or “quotation search” should indicate something, but lenders can’t see this so it doesn’t play any role in any assessment of you.

Open A Secured Credit Card

![Steps To Build Your Credit Score [Infographic]](https://www.knowyourcreditscore.net/wp-content/uploads/steps-to-build-your-credit-score-infographic-all.jpeg)

Getting a secured credit card is relatively easy because its not actually credit. Well, it is and it isnt.

A secured credit card is a credit card because :

- Its used as a credit card with merchants that accept credit cards.

- Your payments and balances are reported to credit bureaus.

- Youre responsible for making the monthly minimum payments.

- Youll incur interest charges if you dont pay off your balance monthly.

Secured credit cards arent credit cards because:

- You need to make a cash deposit to get one.

- Your credit limit is usually the amount youve deposited.

This form of collateral is why its easier to get one of these credit cards and your first stop when considering your options is the bank you opened your initial account with.

How will a credit card build credit? While you wont actually be given any credit, your purchasing activity will be reported to the credit bureaus, which can help build your credit history up from nothing as quickly as possible.

Don’t Miss: Walmart Affirm Apply

Dont Open Too Many Accounts At Once

Although you need lines of credit to build your credit score, opening too many accounts at once can hurt your score. I know, its a bit of a Catch 22.

To avoid hurting your score, dont incur lots of hard credit inquiries in a short period of time. Even if lenders or credit cards are sending you preapproval letters in the mail or cashiers are offering you store credit cards, you dont have to open an account.

Open your accounts strategically, rather than signing up for every offer that comes your way. Note that when youre shopping for a car loan or a mortgage, you usually do have a window of time where you can check your rates with multiple lenders without harming your credit score.

And some lenders will let you check your rates without pulling a hard inquiry on your credit, such as when youre comparing offers to refinance student loans.

Understand How Much Of Your Available Credit Youre Using

Your credit utilization ratio compares how much of your credit card limit youâre using, for each billing cycle. You can determine the ratio by dividing your total credit card statement balance, by your total credit card limit. For example, if your credit card bill is $800 and your limit is $1,000, your credit utilization ratio is 80%. A lower numberâunder 30% is good, and under 7% is idealâshows that youâre managing your available credit well. A single month of big spending wonât make a significant impact to your ratio, but try not to make it a habit. Keep an eye on your credit utilization ratio as an average of how much money you borrow on a regular basis.

Also Check: How To Remove A Repo From Credit Report

Dont Change Houses And Jobs Frequently

Lenders want evidence that youâre a stable character. They want to see you have staying power â that youâre not here one day, gone the next. Put simply, they want evidence of stability so try not to change jobs and addresses too frequently.

Looking to change your home loan? Use our home loan selector tool or call .

Pay Your Credit Card Balance In Full

If you’re only charging what you can afford to pay, paying off your full balance each month won’t be a problem. Paying off your balance each month shows that you’re capable of paying bills, something creditors and lenders want to see. Since a large part of your is based on the timeliness of your payments, paying your balances on time improves your credit.

Paying your full balance each month also helps you avoid racking up credit card debt.

Recommended Reading: Usaa Credit Monitoring Service

How To Build Credit Without A Credit Card

While credit cards are a great tool for building credit, they aren’t your only option. Since your credit score is a reflection of how well you’ve managed debt in the past, any accounts you have that are reported to credit bureaus in good standing have the potential to help you boost your score.

Even if you’re just starting out and don’t yet have any credit accounts, there are other ways you can build your score over time. Here are four strategies for building credit without a credit card:

How To Improve Your Credit

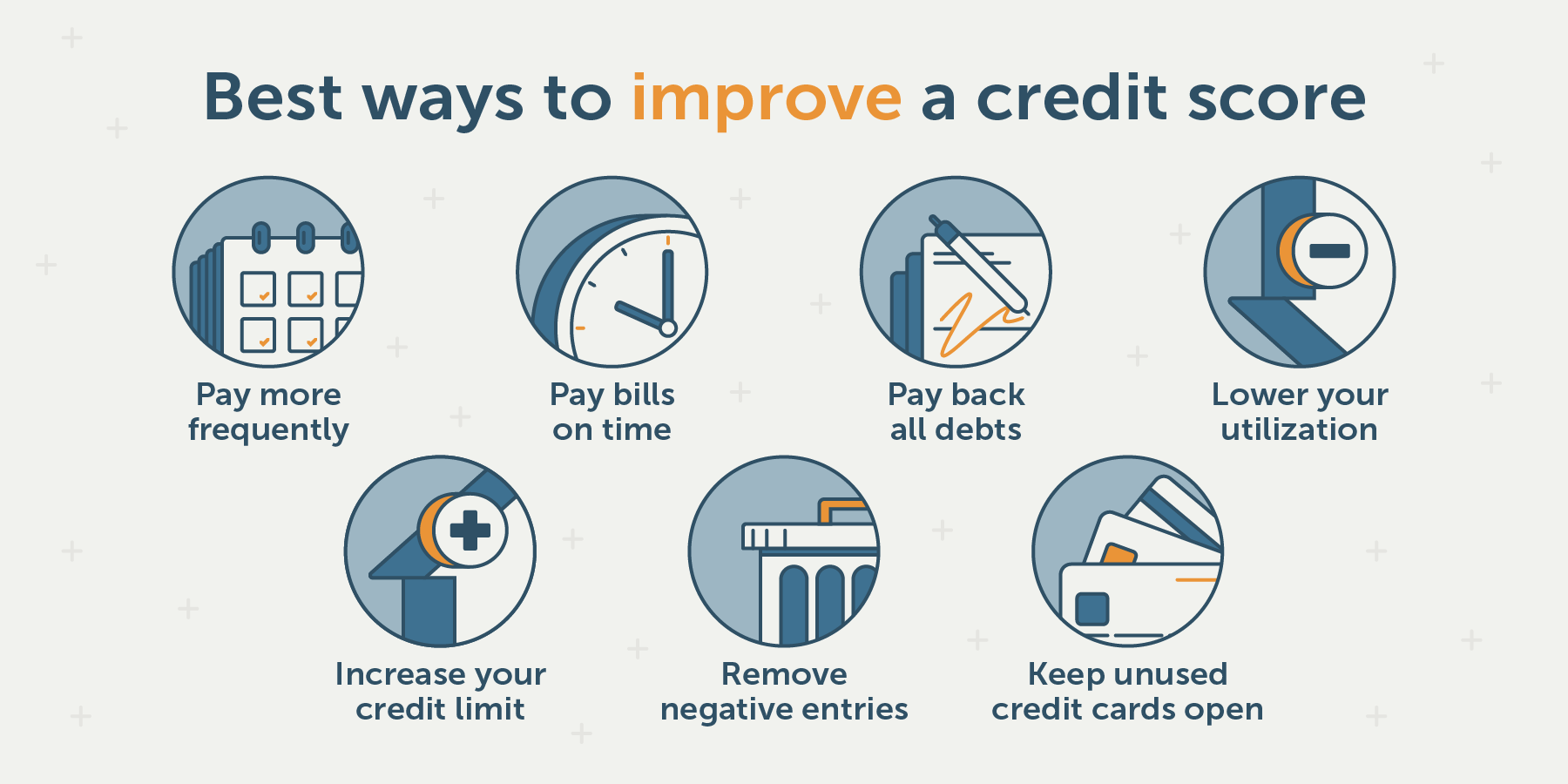

The factors that go into your score point out ways to build up your score:

-

Pay all bills on time.

-

Keep credit card balances under 30% of their limits, and ideally much lower.

-

Keep older credit cards open to protect the average age of your accounts, and consider having a mix of credit cards and installment loans. Space out credit applications instead of applying for a lot in a short time.

There are several ways to build credit when you’re just starting out, and ways to bump up your score once it’s established.

You May Like: Highest Credit Limit For Victoria Secret

Get A Handle On Bill Payments

More than 90% of top lenders use FICO credit scores, and theyre determined by five distinct factors:

- Payment history

- Age of credit accounts

- New credit inquiries

As you can see, payment history has the biggest impact on your credit score. That is why, for example, its better to have paid-off debts remain on your record. If you paid your debts responsibly and on time, it works in your favor.

So, a simple way to improve your credit score is to avoid late payments at all costs. Some tips for doing that include:

- Creating a filing system, either paper or digital, for keeping track of monthly bills

- Setting due-date alerts, so you know when a bill is coming up

- Automating bill payments from your bank account

Another option is charging all of your monthly bill payments to a credit card. This strategy assumes that youll pay the balance in full each month to avoid interest charges. Going this route could simplify bill payments and improve your credit score if it results in a history of on-time payments.

Use Your Credit Card to Improve Your Credit Score

Only Charge What You Can Afford

Credit cards are a tool, not an excuse for a shopping spree. If you open a card to start building a credit score, use it for small purchases that fit your budget and pay the card off in full each month. Regular use and full payment are important, because your credit utilization ratiothe proportion of debt compared to available creditis the second biggest factor impacting your credit score.

Read Also: Remove Eviction From Credit

Get Credit For Paying Eligible Bills

If you want to avoid credit cards altogether, you’re not out of options. You can get credit for paying monthly utility, cell phone and streaming service bills on time with Experian Boost, which is free to use.

“Two out of three people see instant increases to their credit scores with an average increase of more than 10 points,” Griffin says. “As you develop good credit habits overtime, you’ll be rewarded as your credit score responds positively.”

How Long Does It Take To Build Credit History

Building a credit history wonât happen overnight, but if you follow the steps we get to later in this guide, you can actually start to see some good results with it sooner than you might think. If youâre just starting out with your own finances, youâll need to have an active account for at least three to six months before a credit score can be calculated.

When youâve started to build your credit history, make sure you keep on top of any payments you need to make, so that the history you do build is one that youâre really proud of, and one thatâll make lenders more keen to lend to you.

Also Check: Credit Score For Affirm

Apply For A Secured Loan Or A Credit

Another great first step for establishing credit is to get a secured credit-builder loan. It works like this: youll deposit a few hundred dollars into a secured loan savings account, which acts as collateral on a loan from the lender.

Youll then make scheduled payments which are reported to the credit bureaus until the amount you owe is paid back. The deposit is then released back to you after the account is closed. Secured loan groups like Kikoff and Self may be worth considering. After youve proven that you can pay back the loan, your FICO score may improve and credit card issuers can be quick to offer credit.