Is My Credit Score Affected By A Credit Check

According to BCs two credit agencies, Equifax Canada and TransUnion, it depends on what kind of credit check is taking place.

- Soft inquiries. Soft inquiries do not affect credit scores and are not visible to potential lenders that may review your credit reports. They are visible to you and will stay on your credit reports for 12 to 24 months, depending on the type of inquiry. Here are some examples:

- You requested a copy of your own credit report or checked your credit score

- A company reviewed your credit and sent you a promotional credit card offer for an account you already have

- With your approval, your future landlord checked your credit score

- Hard inquiries. Hard inquiries do impact your credit score and they may stay on your credit report for up to 36 months. Recent hard inquiries on your credit report tell a lender that youre currently shopping for new credit. Here are some examples:

- You applied for a loan

- You applied for a new credit card

Whats The Difference Between Prequalification And Preapproval For Credit Cards

A common difference between prequalification and preapproval is in how thorough the provider has checked your finances. During a prequalification, a provider typically just looks at your basic finances and may perform a soft pull on your credit score. Think of a prequalification as an invitation from the provider to see if youre more qualified.

The preapproval process tends to look at more details of your finances and may prove a better indication of your approval odds. Preapproval offers are also often sent by the provider to the consumer, rather than the consumer seeking out their prequalification offers. Either way, neither prequalification or preapproval guarantees youll actually qualify for the card.

Some providers tend to use these terms interchangeably as well, so dont sweat it if you get a prequalified offer instead of a preapproval offer or vice versa.

Why prequalification doesnt affect your credit score

When you apply for a credit card, the card provider will make a hard pull on your credit, which will cause your credit score to drop by around five points.

On the other hand, prequalification has no effect on your credit score because the card issuer makes a soft pull on your credit. Consider this a simple glance at your credit score that helps the card issuer determine if youre a good fit for a certain credit card.

Dont Miss: How To Boost Credit Score

Why Your Credit History Is Important

When you apply for a loan or other type of credit, such as a credit card,overdraft, HP or personal contract plan , the lender has to decide whetheror not to lend to you.

The information on your credit report can be used to decide:

- Whether to lend to you

- How much to allow you to borrow

- How much interest to charge you

Under EUlaw, lenders must assess your creditworthiness before agreeing to give youa loan. Creditworthiness means your ability to repay the loan. This assessmentmust be based on the information you provide as part of your loan application,and also on the information in your credit report.

Information in your credit report may mean that lenders could decide not tolend to you, even if you have the income to repay the loan. They could refuseyour loan if they believe they might be taking a high risk in lending toyou.

If you are applying for an overdraft, mortgage, credit card or other type ofloan, it is a good idea to check your credit report before you apply. It canhelp you spot any missed payments you did not realise were missed, or mistakesin your credit report.

Importantly, you can get incorrect information corrected. You also have theright to add a statement to your credit report to explain any specialcircumstance see Rules below.

You May Like: What Credit Report Does Capital One Auto Pull

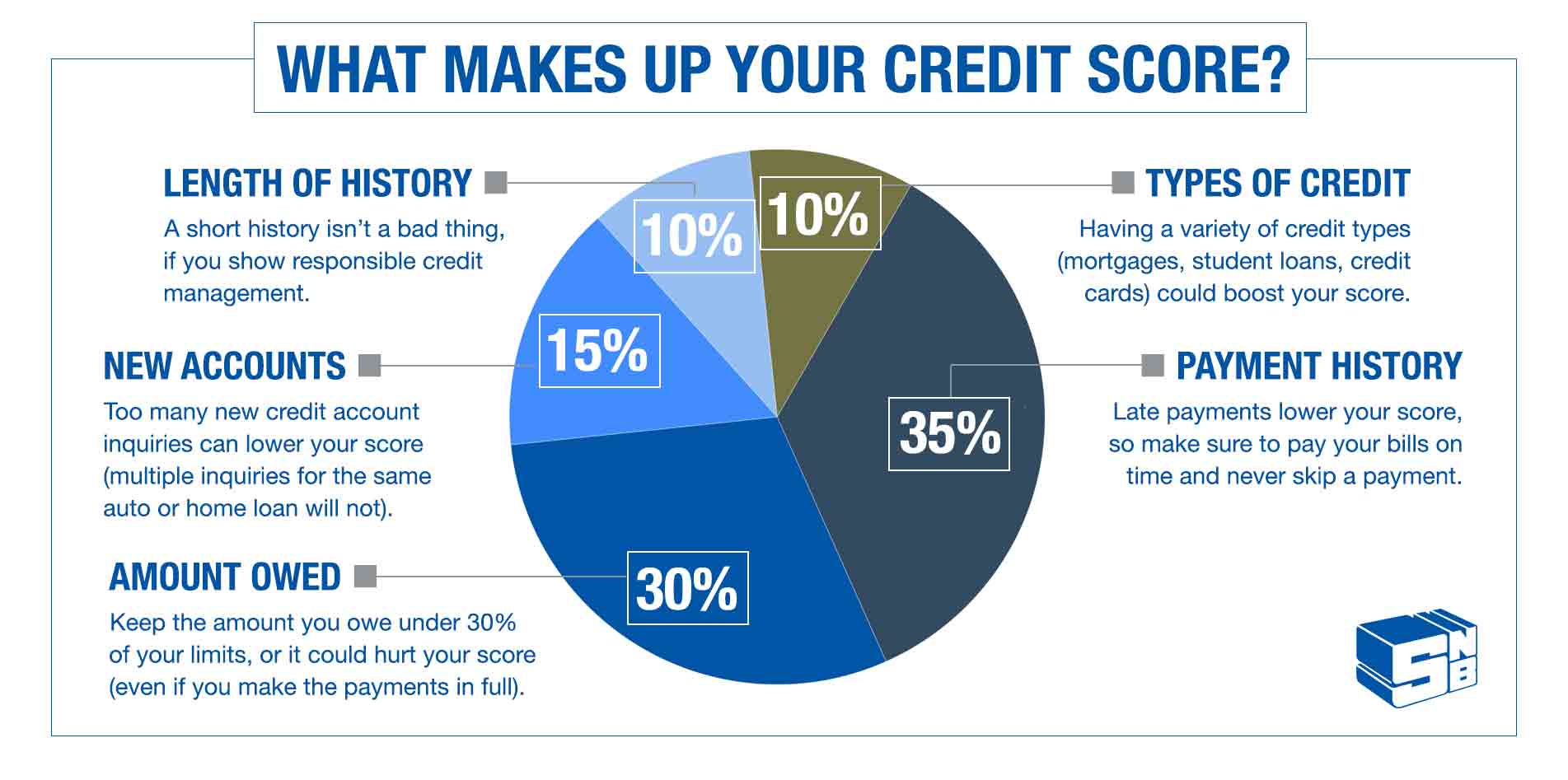

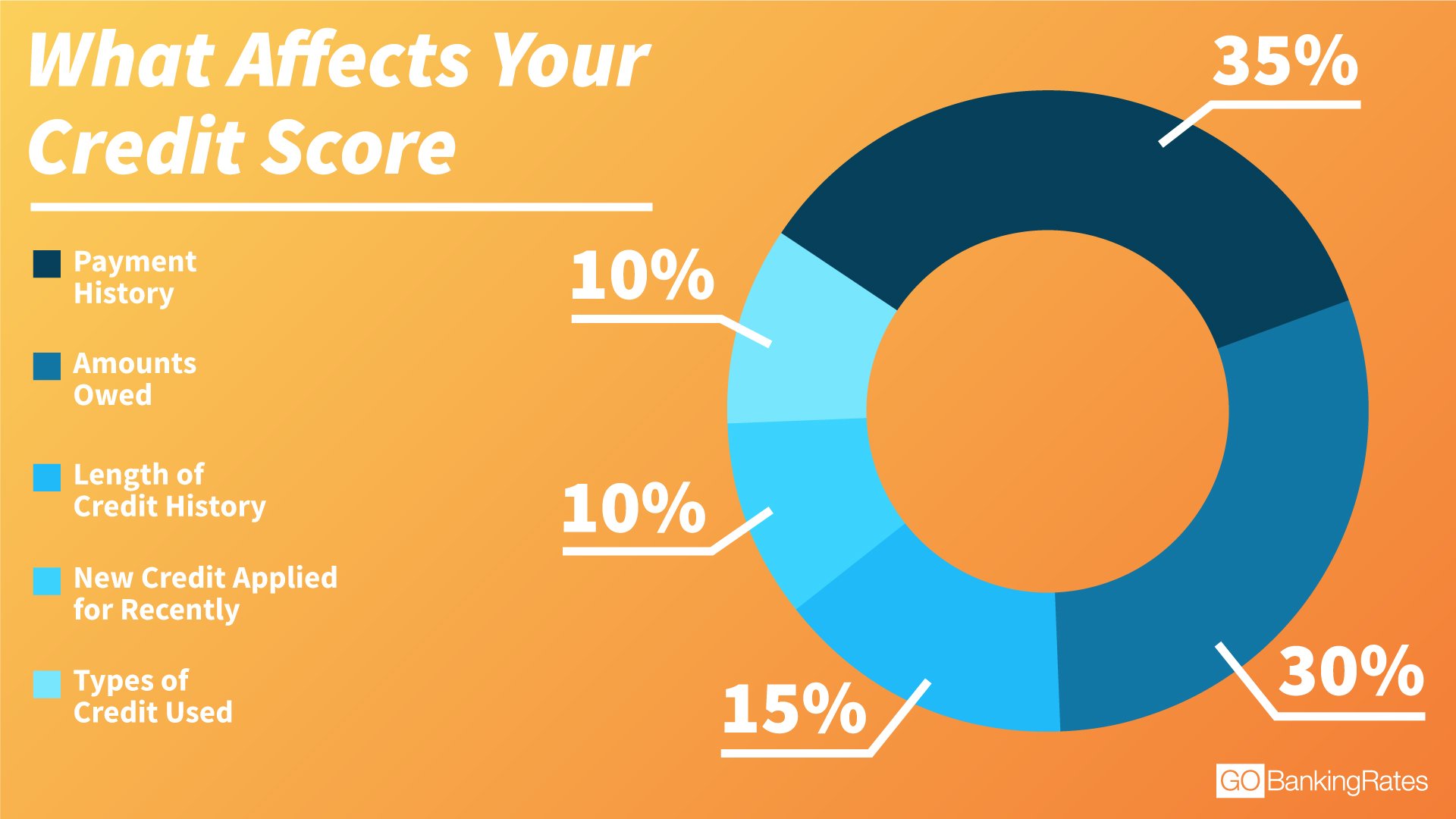

How Applications Affect Your Credit Scores

You have multiple , but the most common credit-scoring model is used by FICO. Since new applications for credit make up 10% of your FICO credit score, simple math indicates your credit score could fall as much as 70 points if you have a 700 credit score. Fortunately, it’s not likely that you’ll lose that many points over a single credit card application because there’s much more information included in your credit score that will “absorb” the impact of one credit card application. However, making multiple applications in a short period of time impacts your score more significantly. The exact impact on your credit score depends on the other information in your credit report.

Whether your application is approved or denied does not directly affect your credit score. If you’re approved, opening a new credit card could cost you points in the age of credit history area because it lowers your average age of credit history. Being denied, on the other hand, won’t impact your credit score. The average age of your credit accounts makes up 15% of your credit score.

The good news is that only credit inquiries made within the past 12 months are used to calculate your credit score. And after 24 months, the inquiries fall off your credit report completely. That time limit only applies to credit inquiries. Other negative credit report information will remain on your credit report for longer.

How To Control The Number Of Credit Checks

To control the number of credit checks in your report:

- limit the number of times you apply for credit

- get your quotes from different lenders within a two-week period when shopping around for a car or a mortgage. Your inquiries will be combined and treated as a single inquiry for your credit score.

- apply for credit only when you really need it

Also Check: Can You Dispute A Closed Account On Your Credit Report

Not Regularly Checking Your Credit Report

To that end, its a good idea to regularly check your credit report and make sure the information is correct. You can get a copy of your credit report from a credit reporting body, such as Equifax, Experian and Illion. You can typically get a free copy once a year.

You can check your credit score as often as you like, so you might want to do this regularly as well. Canstar offers a free credit score checker, through which you can check your score each month.

If you are finding it difficult to manage your bills or loan repayments, you can ask your lender or service provider for financial hardship assistance. You might also want to contact a financial counsellor for help. You can speak to a financial counsellor for free by calling the National Debt Helpline on 1800 007 007.

This article was reviewed by our Sub Editor Tom Letts and Finance Editor Sean Callery before it was updated, as part of our fact-checking process.

Main image source: Kite_rin .

Follow Canstar on and for regular financial updates.

Thanks for visiting Canstar, Australias biggest financial comparison site*

Looking to find a better deal? Compare car insurance, car loans, health insurance, , life insurance and home loans with Canstar. You can also check your for free.

This content was reviewed by Sub EditorTom Letts and Deputy Editor Sean Callery as part of our fact-checking process.

If You Have A Goal To Reach A Higher Score Or Just Want To Learn More About Credit Scores In General Its Important To Know What Affects Your Credit Scores And How Your Actions Could Improve Or Hurt Your Credit

Although there are many credit-scoring models, the goal of these formulas is to figure out your credit risk that is, the likelihood of you paying your bill on time, or even at all. And whether youre looking at a FICO® or VantageScore® credit score, your scores are based on the same information: the data in your credit reports.

While various credit-scoring models may treat factors differently, the leading models, FICO® and VantageScore®, place similar relative importance on the following five categories of information. Weve ranked them by which ones are often most important to the average consumer.

Also Check: How To Find Credit Rating Of A Company

Example Of Why Lenders Look At Your Debt

When you apply for a mortgage, for example, the lender will look at your total existing monthly debt obligations as part of determining how much mortgage you can afford. If you have recently opened several new credit card accounts, this might indicate that you are planning to go on a spending spree in the near future, meaning that you might not be able to afford the monthly mortgage payment the lender has estimated you are capable of making.

Lenders can’t determine what to lend you based on something you might do, but they can use your credit score to gauge how much of a credit risk you might be.

FICO scores only take into account your history of hard inquiries and new lines of credit for the past 12 months, so try to minimize how many times you apply for and open new lines of credit within a year. However, rate-shopping and multiple inquiries related to auto and mortgage lenders will generally be counted as a single inquiry since the assumption is that consumers are rate-shoppingnot planning to buy multiple cars or homes. Even so, keeping the search under 30 days can help you avoid dings to your score.

Does A Mortgage Affect Your Credit Score

Having a mortgage can greatly affect your credit score. If you make your mortgage on time, you can build excellent credit. This is so because your payment history makes up 35% of your credit score. So, making timely payments on your mortgage will boost your credit score.

Additionally, opening a mortgage account can improve your credit mix. Your credit mix makes up 10% of your credit score, and it rewards persons who have a diverse mix of credit accounts with a higher credit score. Opening a variety of different accounts, such as credit cards, car loans, mortgages, and student loans will increase the diversity of your accounts, contributing to a higher credit score.

That said, although a mortgage can increase your credit score in the long run, when you first apply for a mortgage, you could see a small but temporary drop in your credit score. This small drop is caused by the hard inquiry that is placed on your credit report when a lender reviews a copy of your credit report.

That said, the impact that a hard inquiry has on your credit report is temporary. In fact, after 12 months, a hard inquiry will no longer affect your credit score, and it will be removed after 2 years from the date it was added to your credit report.

Donât Miss: How Long To Get A Mortgage

Recommended Reading: How To Raise Your Credit Score 100 Points Fast

New Electronic Alerts From Your Bank

Some banks have started sending new electronic alerts to help you manage your day-to-day finances and avoid unnecessary fees.

Your payment history is the most important factor for your credit score.

To improve your payment history:

- always make your payments on time

- make at least the minimum payment if you cant pay the full amount that you owe

- contact the lender right away if you think you’ll have trouble paying a bill

- don’t skip a payment even if a bill is in dispute

What If I Dont Have A Long Payment History

Some people dont have a very long history of debt payments theyve never taken out a loan or mortgage, theyve never used a credit card, or theyve only been making payments for a short period of time.

If you want to establish a history of prompt debt payment, consider opening a credit card. However, if youre unable to open a credit card , consider building your credit by opening a store credit card.

Store credit cards arent weighed as heavily as bank credit cards, but theyre one way to prove your reliability in paying debts, and they may build your credit. Whether you open a bank credit card or store credit card, just remember to make your payments on time!

It takes time to develop a long payment history, but its helpful to be aware of how to build credit as a young adult so that you can get started as quickly as possible. Well be discussing various later on in Chapter 8 of this series.

Also Check: How To Get Fed Loans Off Credit Report

Check Your Credit Report

Your credit report contains all the information which makes up your credit score. You can check your credit report for free using:

Its worth checking with each of these, as the information they hold on you can be different as they are each based on data from different credit reference agencies.

Your credit report will give you advice about areas for improvement.

Number Of Credit Inquiries

Each time you submit an application that requires a credit check, an inquiry is placed on your credit report showing that you’ve made a credit-based application. Inquiries make up 10% of your credit score. One or two inquiries won’t hurt much, but several inquiries, especially within a short period of time can cost you many points off of your FICO score. Keep your applications to a minimum to preserve your credit score.

The good news is that only those inquiries made within the last 12 months factor into your credit score. Inquiries completely disappear from your credit report after 24 months.

Note that checking your own credit report results in a “soft” inquiry, which does not affect your credit score.

Read Also: What Is My True Credit Score

Increase The Length Of Your Credit History

The longer you have a credit account open and in use, the better it is for your score. Your credit score may be lower if you have credit accounts that are relatively new.

If you transfer an older account to a new account, the new account is considered new credit.

For example, some credit card offers come with a low introductory interest rate for balance transfers. This means you can transfer your current balance to this new product. The new product is considered new credit.

Consider keeping an older account open even if you don’t need it. Use it from time to time to keep it active. Make sure there is no fee if the account is open but you don’t use it. Check your credit agreement to find out if there is a fee.

Whats Good For Your Credit Score

While there isnât just one score, there are some general rules about what could affect your score positively, negatively, or not at all.

If you have a history of managing money responsibly then you’re likely to have a good credit score. Lenders often like to see a proven track record of timely payments and sensible borrowing.

Whether youâre working to improve a poor credit score or need to build up credit history from scratch, here are some basic pointers:

Read Also: What Hurts Your Credit Score The Most

Myth #: Paying My Utilities Bills On Time Will Improve My Credit

Unfortunately, this isnt the case. Utilities and most cable/Internet providers do not report payment histories to the credit bureaus unless payments are in default. If payments are up to date, they will not influence your credit score. If payments get behind or go to collections, they can be reported and will have a negative affect on the credit score. One exception to this appears to be Rogers Cable, which some have said are reporting to the bureaus regularly. Cell phone companies also report payment histories to the credit bureaus, so keeping your cell phone payments current can help to improve your credit score.

Other Accounts Included In A Credit Report

Your mobile phone and internet provider may report your accounts to your credit bureau. They can appear in your credit report, even though they arent credit accounts.

Your mortgage information and your mortgage payment history may also appear in your credit report. The credit bureaus decides if they use this information when they determine your credit score

A home equity line of credit that is added to your mortgage may be treated as part of your mortgage in your credit report. If your HELOC is a separate account from your mortgage, it is reported separately.

You May Like: How To Get A Truly Free Credit Report

Whats Bad For Your Credit Score

When lenders check your credit history, they may see some kinds of financial behaviour as a red flag. If possible, you should avoid or minimise these to keep your score as high as possible: