How To Increase Your Chances Of Approval For A Credit Limit Increase With Capital One

According to Capital One, there are a number of steps you can take to increase your chances of approval for a higher credit line in the future. Of course, even if you follow all of these steps, you are never guaranteed to receive approval.

How Many Credit Reports Should I Get

When you use AnnualCreditReport.com to request free access to credit reports, request all three. Check all three at once if:

- Its been a long time since youve checked your credit

- Youre getting ready to apply for financing

Otherwise, consider staggering them every 4 months. And either way, supplement with free credit monitoring sites.

Increase Your Credit Limit

Relatedly, increasing your credit limit means your existing debts will be a smaller percentage of your total available credit. This will improve your credit score.

Most credit card companies let you request a limit increase online, though some will make a hard pull on your credit, lowering your score.

Don’t Miss: Does Paypal Working Capital Report To Credit Bureaus

Access Your Credit Score And Transunion Credit Report

With CreditWise, youll get access to your;VantageScore 3.0 credit score, provided by TransUnion, as well as your TransUnion credit report.;

Your credit score is a good way to quickly evaluate your credit health and see how its changing over time. Keep in mind that lenders use many different credit scores.;If you compare the VantageScore 3.0 credit score you see in CreditWise, it may be different than the score;a;lender provided. Dont worry; this is normal!;The most important thing is to regularly check;up on your;overall credit health.

In addition to seeing your credit score, you can review your TransUnion credit report for signs of error, theft, or fraud. If you spot something that doesnt look right, CreditWise will tell you what to do next.

The only negative;to CreditWise is that you only get access to one credit score;and a credit report from one bureau out of three. But, remember, you can always review all three of your credit reports once a year at annualcreditreport.com.

The Ugly About Capital Ones Creditwise

The worst part about this free service is the type of credit score they offer.

Its a VantageScore 3.0 credit score. VantageScore isnt typically the type of credit score used to make lending decisions, so your lender will likely see a different credit score than you do.

Using a VantageScore is cheaper than using a FICO score, so this is likely a cost saving measure by Capital One. This makes sense because the service is free. When youre getting something for free, dont expect to get the best of everything.

Capital One may also use your information to market their credit and banking products to you.

You May Like: Aargon Agency

What To Know About Your Free Credit Score

Capital One gives you a free VantageScore 3.0 credit score based on your TransUnion credit report. This credit score ranges from 300 to 850 and is categorized as follows according to Capital One:

- 761 to 850 Excellent

- 621 to 700 Average

- 300 to 620 Below Average

Since Capital One uses a soft pull to gather this information, it will not impact your credit score or hurt your credit score in any way.

You can update your credit score weekly using the service, but you must log in once per week for this update to occur.

If you dont log in once per week, it will automatically update your score monthly. This is nice because it gives you a history even if you dont log in on a regular basis.

In addition to your credit score, Capital One shows you the six main factors impacting your score and whether your factors are excellent, good, average or below average in each category.

The categories include:

- Percent of available credit used

- Number of recent inquiries in the past two years

- Number of new accounts in the past two years

- Your amount of available credit

What Credit Bureau Does Capital One Use

So, you have a capital one credit card and youre wondering which major credit bureau the lender is using. A lot of lenders only use one major credit bureau when they pull your credit report.

Other credit lenders can pull 2, even all 3 major credit bureaus, but what about Capital One?

First, theres a lot of different scenarios that can play a role as it pertains to what credit bureaus a specific credit card lender is going to use. For Capital One, there is a few that you need to know .

When it comes to Capital One, they can pull credit reports from all 3 major credit bureaus, which includes TransUnion, Experian and Equifax. This is called the triple pull.

Why does Capital One pull your credit from all 3 when other banks will only use one credit?

Well, lets think about that for a second.

Does it make sense to pull all 3 credit reports versus just one or two? Absolutely, you want to get a complete picture of the person youre going to potentially lend too.

Some lenders only report to one credit bureau. Credit scores can widely differ if your lenders favor one credit bureau versus the next.

Our opinion, Capital One does it to minimize risk and you cant blame them for that.

Were sure it works into their algorithms for choosing people that are worthy of having credit.

This gives Capital One more data to implement into the complete equation, allowing them the opportunity to be more accurate than other lenders as it pertains to determine rates, interest, loan amounts, etc.

Read Also: Does Speedy Cash Report To Credit Bureaus

Why Is A Good Credit Score Valuable

Now you know a little about where scores come from. But that doesnât explain why good credit scores are so valuable. Credit scores are often associated with credit card or loan applications, but their influence goes beyond that.;

Good scores can affect interest rates, credit limits, housing applications and even job prospects. And they can offer more options, more bargaining power and more financial flexibility.

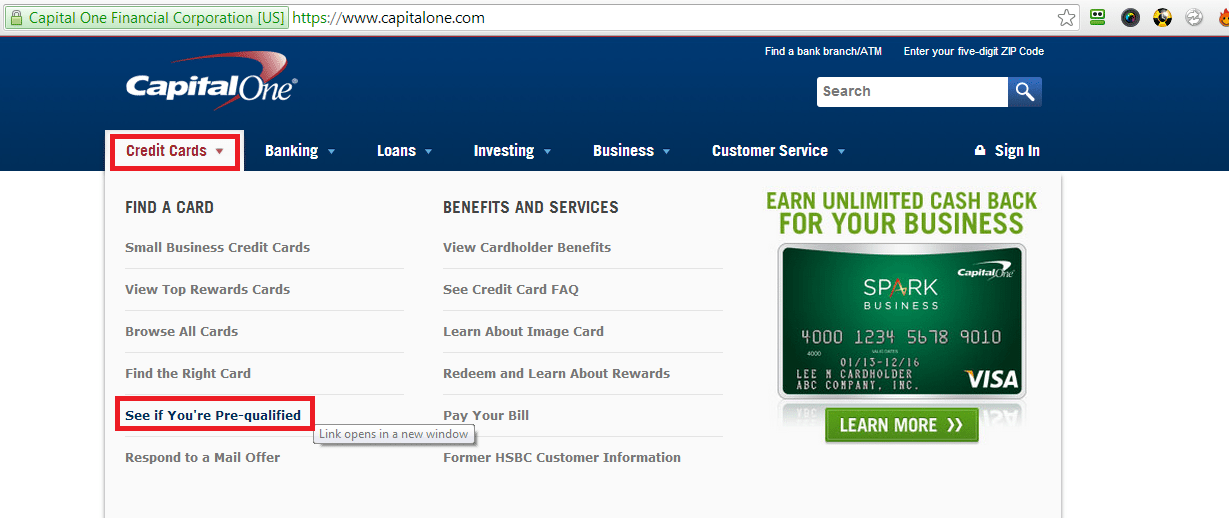

Pre-Approval, Pre-Qualification and Comparing Offers

For starters, you may be pre-approved or pre-qualified for more credit card offers if you have a good score. That may allow you to compare offers and find the best fit for your situationâwhether youâre looking at mortgages, credit cards or auto loans. But if youâre shopping around, be sure to understand how credit inquiries can affect your credit.

Interest Rates and Credit Limits

If youâre approved for a loan or a credit card, a good credit score could mean higher credit limits, lower interest rates or both. And when youâre paying less in interest, you may have smaller payments and be able to pay off your debt faster.;In general, that means that higher credit scores could decrease the cost of borrowing money.

Beyond Credit Cards and Loans

Finally, good credit scores could affect other parts of your life, too:

Here Are 10 Ways To Increase Your Credit Score By 100 Points

Don’t Miss: Can I Get A Credit Card With A 524 Credit Score

Auto Lenders Most Commonly Use The Fico Score 8 System

When you submit your credit information to a dealership or directly to a lender to apply for an auto loan, the information they pull from the credit bureaus is typically under the FICO Score 8 scoring model. The FICO Score 8 model follows a lot of same credit-granting guideline as other models, like the VantageScore system, but its more sensitive to certain aspects of your credit such as:

- High credit card usage: If you high balances on your credit cards

- Isolated late payments: If you were at least 30 days late with any of your payments

- Amounts owed on your credit lines

- Payment history

- New credit inquiries: Although new credit inquiries dont weigh heavily on your FICO score, they are taken into account.

While the differences between the FICO Score 8 and the other systems like the VantageScore might seem minimal, auto lenders have historically used the FICO Score model 8 for loan approvals, so that one would be better for you to keep in mind.

The Difference Between Your Credit Score And Credit Report

There are three credit bureaus that produce : Equifax, Experian and TransUnion. When you open a credit card or loan, the lender will report activity to at least one credit bureau, which will then add it to your credit report. Your credit reports show both current and past credit accounts, as well as legal judgments like liens and bankruptcies.

A credit score is a three-digit number that ranges from 300 to 850. The score is determined by an algorithm that takes all the items on your credit report into account. The higher the score, the more responsible you appear as a borrower.

There are two main companies that produce credit scores: FICO and VantageScore. FICO is responsible for 90% of all credit scores used by lenders, but VantageScore is more common with free credit scoring websites. Both companies use similar scoring models to determine your scores, so there should only be a slight discrepancy between a FICO score and a VantageScore.

There are dozens of credit score iterations, and which one is used depends on the type of lender looking at it. For example, the credit score an auto lender sees may be slightly different than the one a mortgage lender sees.

Don’t Miss: How Long Does A Repossession Stay On Your Credit Report

Capital One Savor Cash Rewards Credit Card: Best For Dining

- Welcome bonus: $300 bonus when you spend $3,000 in the first three months

- Rewards: 4 percent cash back on dining, entertainment and popular streaming services, 3 percent at grocery stores and 1 percent on everything else; plus, earn 8 percent back on purchases from Vivid Seats through Jan. 31, 2023

- Annual fee: $95

If eating out is one of your biggest spending categories, then this card is sure to be a lucrative option. The Capital One Savor Cash Rewards Credit Card earns an impressive and unlimited 4 percent cash back on dining and entertainment, which means that you can earn rewards on every takeout and delivery splurge. Plus, the card now earns an additional 4 percent cash back on select popular streaming services and 3 percent back at grocery stores.

The Savor card also comes with a welcome bonus of $300 when you spend $3,000 in the first three months, which is a nice additional perk. You do have to pay a $95 annual fee, so if youre looking for a similar card without the added charge, the Capital One SavorOne Cash Rewards Credit Card is another great option.

Top Credit Card Wipes Out Interest Into 2023

If you have credit card debt, transferring it to;this top balance transfer card;secures you a 0% intro APR into 2023! Plus, youll pay no annual fee. Those are just a few reasons why our experts rate this card as a top pick to help get control of your debt.;Read The Ascent’s full review;for free and apply in just 2 minutes.

Recommended Reading: How To Get Credit Report Without Social Security Number

Have A Professional Remove It

Professional credit repair companies exist to do the legwork Ive described in the steps above.

I recommend checking out , their advisors are helpful and friendly.

But having a professional on the case full-time can make the overwhelming tasks of credit repair seem simple.

Request A Goodwill Adjustment

Your best bet for getting the collection removed from your credit report is to contact Capital One and ask it to remove the collection out of goodwill.

You should write a letter stating why you were late on the account and ask if the debt collector would kindly remove the negative entry from your credit reports with all three credit bureaus.

This will work only if youve already paid the debt and there is no outstanding balance owed.

Recommended Reading: Does Klarna Affect Your Credit Score

Other Industry Credit Scores

TransUnion offers , which is tailored for auto lenders, financing companies, and dealers. The score ranges from 300 to 850 and helps predict the likelihood of 60-day delinquency within the first 24 months of a new auto loan.

The auto score isn’t the only industry-specific score FICO sells to businesses. The company also sells a mortgage score, a medication adherence score, insurance risk score, a bankruptcy score, and even a predictive score for how much revenue your loan might generate. Lenders may use any of these scores to help decide whether to approve your loan application.

Which Credit Reports Should I Check

If youre applying for financing and you know with certainty which credit bureau a lender uses; you could limit your check to that one report. If you dont know which bureau they use, check all three. Beyond that, request all three reports once a year through AnnualCreditReport.com and consider free credit monitoring sites all year long.;Back to Top

Read Also: What Credit Report Does Paypal Pull

How Rate Shopping Can Impact Your Credit Score

Oct 8, 2019 When you apply for a mortgage or car loan, lenders will make a hard pull of your credit report. These hard inquiries will often lower your;

The Difference Between FICO Score and Credit Score. Different types and versions of credit scores can enter the car credit report lenders will pull to determine;Which FICO score do auto lenders use?Which auto lenders use TransUnion?

What Credit Report Does Capital One Pull

Unlike other credit card issuers, Capital One pulls from all three credit bureaus. Thats not to say they;could;pull from any one of the three, but that they pull all three every time. If you look at the Credit Pulls Database, theres one bureau listed in the CRA column, but the notes column specifies multiple credit pulls.;Back to Top

You May Like: How Long Does Repossession Stay On Credit Report

Capital One Spark Business

I just received an invitation, in a nice looking package, from Capital One for the Spark Business card so they have my attention, at least temporarily!

Just wondering does anyone know what type of limit they usually offer on this card and is this a three bureau pull? I know Capital One is infamous for the three bureau pull.

Factors That Affect Credit Scores

So, you can see credit-scoring models and credit reports are two big factors that determine your credit score. But if you donât know what information from your credit report is being used, itâs not much help.;

Here are a few factors the CFPB says âmake up a typical credit scoreâ:

- Payment history: How well youâve done making payments on time.;

- Debt: How much current unpaid debt you have across all your accounts.

- A ratio that reflects how much of your available credit youâre using compared with how much you have available. is usually expressed as a percentage.

- Loans: How many loans and what kinds they are, such as revolving credit accounts and installment loans. Sometimes this is called your credit mix.

- How long youâve had your accounts open. But remember, what qualifies as your oldest line of credit depends on whatâs being shown in your credit reports.

- New credit applications: How many times youâve applied recently for new credit. The effect on your scores might be minor, but a lot of new hard credit inquiries could still give a negative impression to lenders.

How Does FICO View Those Credit Factors?

FICO is pretty specific about what it views as the most important credit factors: Payment history makes up about 35% of its scoring. About 30% is based on the total debt. The other primary factors are credit history , credit mix and new credit .

How Does VantageScore View Those Credit Factors?

Read Also: Zebit Report To Credit Bureau