Keep Credit Cards Open

If;you’re racing to improve your credit profile, be aware that closing credit cards can make the job harder. Closing a credit card means you lose that cards credit limit when your overall credit utilization is calculated, which can lead to a lower score. Keep the card open and use it occasionally so the issuer wont close it.

Consider Consolidating Your Debts

If you have a number of outstanding debts, it could be to your advantage to take out a debt consolidation loan from a bank or credit union and pay them all off. Then you’ll just have one payment to deal with and, if you’re able to get a lower interest rate on the loan, you’ll be in a position to pay down your debt faster. That can improve your credit utilization ratio and, in turn, your credit score.

A similar tactic is to consolidate multiple credit card balances by paying them off with a balance transfer credit card. Such cards often have a promotional period during which they charge 0% interest on your balance. But beware of balance transfer fees, which can cost you 35% of the amount of your transfer.

How We Make Money

The offers that appear on this site are from companies that compensate us. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories. But this compensation does not influence the information we publish, or the reviews that you see on this site. We do not include the universe of companies or financial offers that may be available to you.

Also Check: Does Klarna Improve Credit Score

Limit New Lines Of Credit

When you apply for a new credit card or loan, a hard inquiry will appear on your credit report, possibly leading to a brief dip in your score. Plan to apply only for the credit you truly need, after you’ve done enough research to understand which accounts you’ll likely qualify for. Avoiding multiple hard inquiries cluttering your credit fileand new loans you may have difficulty payingcan help your credit stay on track and even improve.

Hard Hits Versus Soft Hits

Hard hits are credit checks that appear in your credit report and count toward your credit score. Anyone who views your credit report will see these inquiries.

Examples of hard hits include:

- an application for a credit card

- some rental applications

- some employment applications

Soft hits are credit checks that appear in your credit report but only you can see them. These credit checks don’t affect your credit score in any way.

Examples of soft hits include:

- requesting your own credit report

- businesses asking for your credit report to update their records about an existing account you have with them

Recommended Reading: Aargon Collection Agency Address

Make The Most Of A Thin Credit File

Having a thin credit file means you dont have enough credit history on your report to generate a credit score. An estimated 62 million Americans have this problem. Fortunately, there are ways you can fatten up a thin credit file and earn a good credit score.

One is Experian Boost. This relatively new program collects financial data that isn’t normally in your credit report, such as your banking history and utility payments, and includes that in calculating your Experian FICO credit score. Its free to use and designed for people with no or limited credit who have a positive history of paying their other bills on time.

UltraFICO is similar. This free program uses your banking history to help build a FICO score. Things that can help include having a savings cushion, maintaining a bank account over time, paying your bills through your bank account on time, and avoiding overdrafts.

A third option applies to renters. If you pay rent monthly, there are several services that allow you to get credit for those on-time payments. Rental Kharma and RentTrack, for example, will report your rent payments to the credit bureaus on your behalf, which in turn could help your score. Note that reporting rent payments may only affect your VantageScore credit scores, not your FICO score. Some rent reporting companies charge a fee for this service, so read the details to know what youre getting and possibly purchasing.

Check Your Credit Reportson A Regular Basis To Track Your Progress

No matter where you turn for your credit check-in your bank, or one of the major consumer credit bureaus its important to keep an eye on your credit. And if you find any mistakes or inaccuracies, we can help you file a dispute. If your dispute is approved by the credit bureaus, you may see the error corrected as soon as within 30 days, which can help raise your credit scores.

Read Also: Why Is There Aargon Agency On My Credit Report

Take Advantage Of Score

The number of accounts and average age of your accounts are both important factors in your credit score, which can leave those with a limited credit history at a disadvantage.

Experian Boost and UltraFICO are programs that allow consumers to boost a thin credit profile with other financial information.

After opting into Experian Boost, you can connect your online banking data and allow the credit bureau to add telecommunications and utility payment histories to your report. UltraFICO allows you to give permission for your banking data, like checking and savings accounts, to be considered alongside your report when calculating your score.

Option 1 Request A Credit Limit Increase

Another way to reduce your credit utilization ratio if youre carrying high balances is to bump up your credit limits.

For example, if youre carrying $700 in debt on a card with a $1,000 credit limit, your credit utilization is 70%. If youre successful in increasing your credit limit to $2,000, then your utilization rate drops to 35%.

Some issuers make it easy to request a credit limit increase via your online account. For example, Citi allows cardholders to make such a request on the Credit Card Services page:

You can also call the number on the back of your card to make the request. Know that some issuers may conduct a hard pull on your credit before granting you a higher credit line, which can ding your credit score a few points. Your score will recover, but inquire exactly how your request will be handled before you allow them to proceed so you know what to expect.

Note: If youve only had the card a few months, have a history of late payments or are carrying really high balances, your request may be denied until youre seen as a less risky customer.

How much will this action impact your credit score?

The impact a credit line increase could have on your credit score depends on much of an increase you get. If its enough to bring your utilization under 30%, you should see a reasonable increase in your score. However, it wont improve your score as much as paying off your balance and bringing your utilization to or near zero.

Don’t Miss: What Credit Report Does Paypal Pull

How To Maximize The Benefits Of Your Secured Credit Card

When I first checked my credit score with MyFICO in March of 2011, it was sitting at 621.

I set up my new secured credit card with a credit limit of $1,100. The credit limit should be a function of what cash you have, and also what you plan on using the credit card for.

According to many bankers and friends I talked to, you should try to run a 75% utilization rate on your credit card to maximize your potential to raise your credit score.

So, if you only spend around $300 a month, you should give your secured credit card a $500;down payment so that you are utilizing your credit rather than having a $1,000 dollar limit and only spending $300.

My expenditures were approximately $700 dollars a month so the $1,100 dollar limit fit my needs.

How To Build Credit Fast

Many or all of the products here are from our partners. We may earn a commission from offers on this page. Its how we make money. But our editorial integrity ensures our experts opinions arent influenced by compensation. Terms may apply to offers listed on this page.

Although you can build credit with any credit product, credit cards are usually the easiest and quickest way to establish or improve your . In fact, most of the tips for how to build credit fast revolve around credit cards. Read on for seven simple ways you can build your credit and increase credit score growth.

Also Check: How Long Does A Repossession Stay On Your Credit Report

Build Your Credit File

Opening new accounts that will be reported to the major credit bureausmost major lenders and card issuers report to all threeis an important first step in building your credit file. You can’t start laying down a good track record as a borrower until there are accounts in your name, so having at least several open and active credit accounts can be helpful.

These could include or secured cards if you’re starting out or have a low scoreor a great rewards credit card with no annual fee if you’re trying to improve an established good score. Getting added as an on someone else’s credit card can also help, assuming they use the card responsibly.

Additionally, you can sign up for Experian Boost to add positive utility, cellphone and streaming service payments to your Experian credit report. These on-time payments wouldn’t otherwise be added to your credit report, but using Boost means they’ll be factored into your Experian credit scores.

Sign Up For Experian Boost

If your low score is primarily the result of being new to the credit-seeking game and you are timely with your payments for utilities and your cell phone, ask the lender to pull a report from Experian, using its Experian Boost plan. This hybrid model draws on what the industry calls alternative credit data ; non-traditional payments that provide lenders useful insight into an applicants creditworthiness.

The way forward gets a little steeper from here, so its a good idea to know what youre up against.

You May Like: What Is Aargon Agency

How Is Your Credit Score Determined

Your credit score is based primarily on your ability to pay your debts in a timely manner. According to FICO, your ability to avoid late or missed payments makes up 35% of your overall score.

Other variables used to create your credit score include your credit mix and your credit age. Often, your credit score will be higher if you have a mix of secured and unsecured debts. Secured debts include mortgages, auto loans or any other type of loan that is backed by collateral. Collateral is anything of value that a lender can seize and sell to obtain the money it’s owed.

Unsecured debts include credit cards, medical bills and certain types of personal loans. As the name suggests, this type of balance is not backed by collateral. Instead, it’s backed only by your promise to repay the debt in a timely manner.

In such a scenario, your credit age would be 31 months. It may also be reflected on your credit report as two years and seven months. Generally speaking, those who have a longer track record handling debt will have a higher score than those who do not. This is why it’s rarely a good idea to close your oldest account even if you no longer use it.

Your DTI simply compares the amount of debt that you have to the amount of money that you earn in a given period. For example, let’s say that you earn $3,000 a month before taxes. Let’s also say that you have monthly debt payments of $1,500. In this pretend situation, you would have a DTI of 50%.

Get Late Payments Removed

Before disputing late payments you should contact your creditors and tell them you have a late payment on your credit report on your account and you believe its inaccurate. They may remove it as an act of goodwill for customers who have been with them for awhile.

I had a creditor remove a late payment from my credit report by calling and coming up with an excuse for why it was late. They removed it as an act of goodwill because I had been a customer for several years. If that doesnt work, you can start disputing it with the three major credit reporting companies.

I had four late payments with two different creditors at one point. I contacted the creditors and got one removed and disputed the other 3 with the Credit Bureaus. I was able to get another one removed, and my credit score jumped up by 84 points.

Also Check: 779 Credit Score

Become An Authorized User

If you have a relative or friend with a long record of responsible credit card use and a high credit limit, consider asking if you can be added on one of those accounts as an . The account holder doesnt have to let you use the card or even tell you the account number for your credit to improve.

This works best for if you have a thin credit file,;and the impact can be significant.;It can fatten up your credit file, give you a longer credit history and lower your credit utilization.

Keep Old Accounts Open

Even if you no longer use an old credit card, it’s typically best to keep the account open. That’s because your credit scores benefit from a long credit history and a high total credit limit. Closing established accounts will shorten the average age of your accounts and lower your total credit limit. It will take years before an account closed in good standing drops off your credit report, but the effects on your credit utilization rate are immediate. If a credit card comes with a high annual fee you can’t afford, closing the account could be a good optionor ask your issuer to downgrade the card to a no-fee version if possible.

Also Check: How Long Does A Repossession Stay On Your Credit Report

Check Your Credit Score For Free

Knowing where you stand and watching your progress can be important. With Experian, you can check your FICO® Score for free. Your account gives you a breakdown of which factors are impacting your score the most, so you can take a focused approach to improving your score. Your credit score will also automatically be tracked and updated each month.

How Long Does It Take To Improve Credit Score

How fast youre able to increase your credit score depends on why its the number that it currently is. For instance, if youre just starting to build credit after not having any at all, you can raise your credit score rather quickly by just using credit and making payments on time and in full every month. As you add more credit cards and dont use them or only make small charges with them your total debt compared to the amount of available credit lowers, thereby increasing your credit score.

Will paying off your credit card help raises your credit score? Find out here.

Also, if you currently have a lot of debt on the books, you can increase your credit score more quickly if you pay down that debt because your debt-to-credit ratio improves.

However, if your score is low as a result of a history of missed payments, bankruptcy, or another financial misstep, it will take longer to increase your credit score. In this case, it can take many months and sometimes even years depending on how badly you damaged your score.

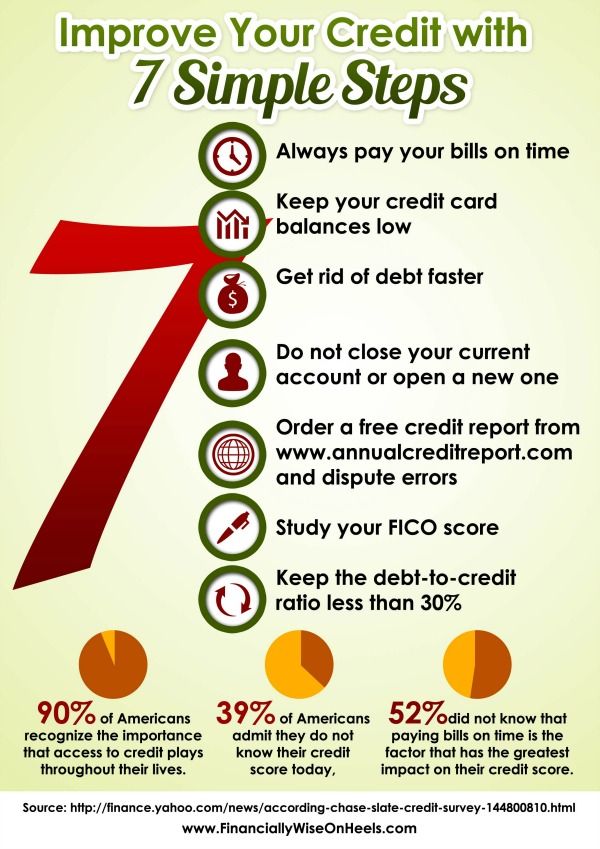

Check out this infographic for a visual look at how your credit score is calculated.;

Also Check: How To Get Credit Report Without Social Security Number

The Benefits Of Improving Your Credit Score:

A higher credit score means that you have a bigger chance of getting approved for credit. This is because a high credit score indicates that you are responsible with your money and you have a history of paying your bills on time. Below is a list of benefits for building your credit score:

- Higher credit allowance If you build up your credit score, you will be able to borrow more significant amounts of money helping you to reach your goals faster, such as home renovations and purchasing a new car.

- Lower interest rates You will get better and cheaper interest rates on the credit you borrow if the lender sees that you are lower risk.

- Greater access to credit offers A better credit score means that your chances of approval are much higher, and your range of credit choices will be much bigger.

FAQs:

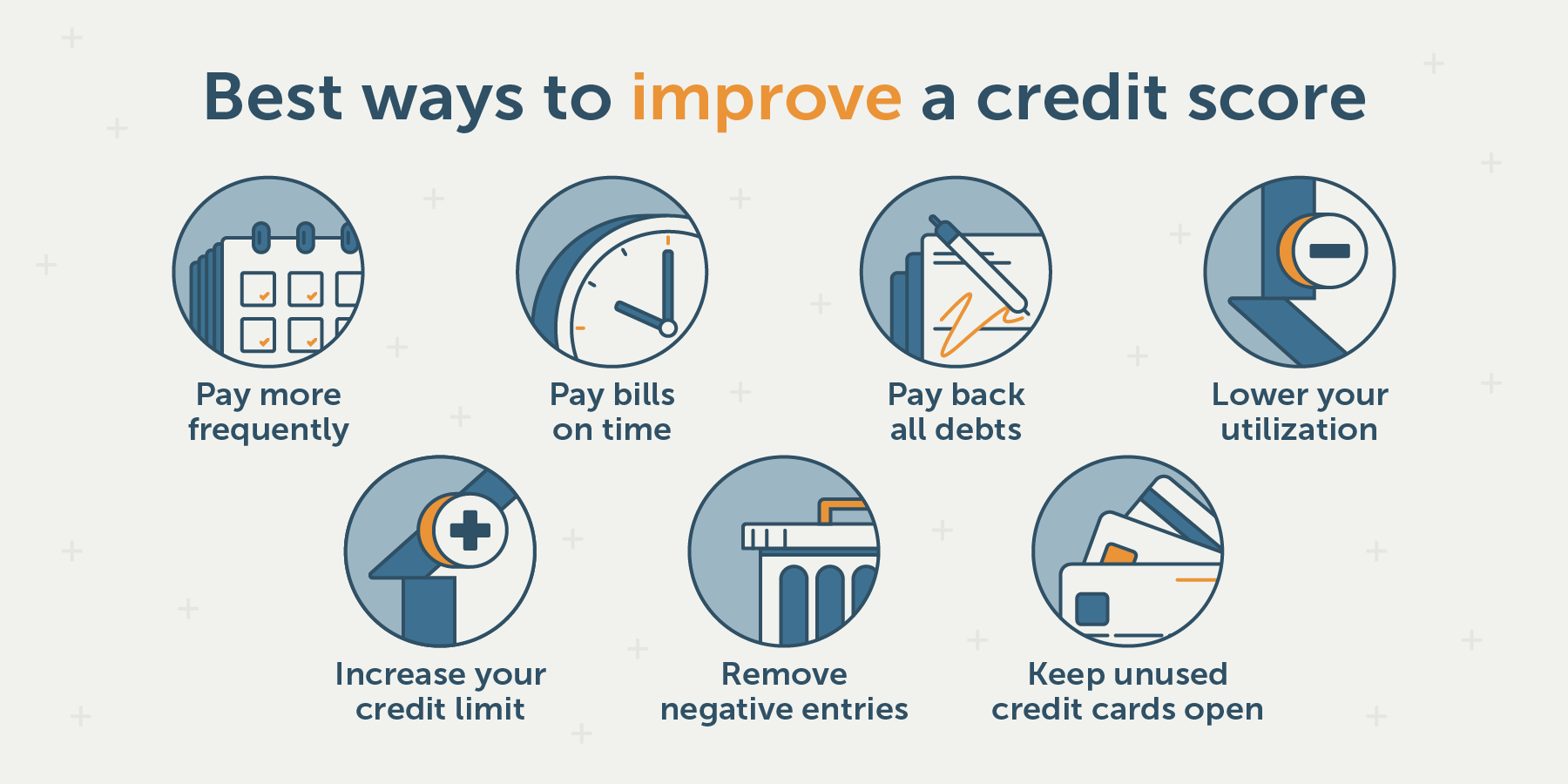

If you are looking to improve your credit score in a short time frame, there are many steps that you can follow. Some of these are, but not limited to, cleaning up your credit report, paying down your balance, paying twice a month if possible, opening new accounts, increasing your credit limit, and become an authorised user. You may also wish to negotiate outstanding credit card balances with your creditor. credit reference agencies are independent and have different scoring systems.

How can I check my credit score?

Need To Boost Your Credit Score Quickly Use These 5 Tips

Having bad credit can negatively impact your financial wellness in a variety of ways, but these five tips can help you improve your FICO score quickly.;

Having bad credit can negatively impact your financial wellness in a variety of ways. It can prohibit you from saving money on monthly loan payments due to high interest rates, and it can also keep you from drawing a line of credit for loans like a mortgage, auto loan, personal loan, credit card, or student loan.

To check your rates and see what rates you could get on a personal loan, visit Credible to get prequalified in minutes.;

Use Experian Boost to instantly add points

Experian Boost allows Americans to share their bank accounts with the credit bureau in exchange for an increase in their score when Experian reports their positive payment history. The credit bureau adds that payment history to your report, which will subsequently increase your FICO score, VantageScore and other credit scores.

This can help improve your credit score and get you closer to achieving excellent credit. It can also establish a credit history for the credit invisible, those who have never used credit and therefore have no score.;

Open a secured credit account

Become an authorized user

Have your rent reported

Read Also: Why Is There Aargon Agency On My Credit Report