What Does The Affirm Process Look Like

The process for using an Affirm loan is simple.

Shop your favourite stores, including Apple, Sephora, or Oakley. When you are ready to check out, select Affirm as your payment option of choice.

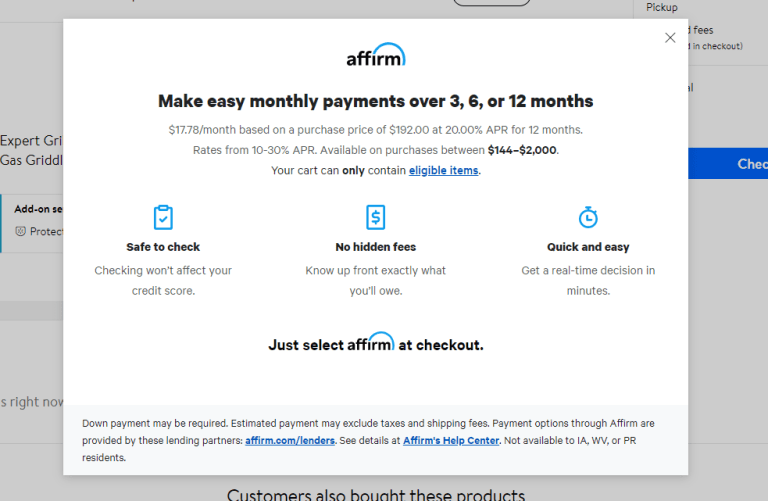

Use your mobile phone to enter some personal information and then select the payment plan that works for you. Affirm will outline all of the loan terms including APR, interest charges, your installment payments, and the total loan amount.

If you qualify for the payment plan, you can confirm and make your purchase.

How Buy Now Pay Later Services Affect Credit Scores

In December, Equifax, one of the three major credit reporting agencies, announced that it had developed a formal process for BNPL companies to report short-term loan data to be included on its credit reports. While BNPL providers are not required to report data to credit bureaus, Equifax says it anticipates that its new policy will encourage more to do so. The company plans to begin implementing that process at the end of February.

Experian, another credit reporting agency, said it has worked with BNPL providers since 2016 and is in the process of adding more data to credit reports “in a way that will ensure the responsible use of BNPL products does not negatively impact consumer credit scores.

Liz Pagel, senior vice president and consumer lending business leader at credit reporting agency TransUnion, said the company believes that reporting BNPL data will provide a more complete picture of a borrower and promotes financial inclusion. She added that TransUnion is well on our way to including the data in credit reports.

Affirm Vs Afterpay: Interest And Fees

The interest rates on Affirm loans vary based on the merchant you are purchasing from. Some merchants offer a 0% interest promotion, while others may charge a higher rate. All of the financing information will be presented during your transaction so that you can make a decision before finalizing your purchase. You’ll never pay more than what you agree to upfront.

If you are going to be late with a payment, you can log into your account online or through the Affirm app to reschedule your payment. Although Affirm does not charge late fees, if you make a partial payment or have a late payment, it could affect your credit score or your ability to get approved for another loan.

Afterpay does not charge interest or fees as long as you make all of your scheduled pay-in-four loan payments. You are charged a $10 fee if your payment is late. If your account is not brought current within seven days, you’ll be charged another $7 fee.

Also Check: Syncb/ppc Credit Inquiry

Does A Loan Modification Negatively Affect Your Credit Score

Depending on how your lender reports it to the credit bureaus, changing your credit could lower your credit rating. At the same time, however, it will have much less negative impact than an â â â â â â â â â or series of late payments, so in this case it can really help with your long-term evaluation.

How Can You Use Klarna At Walmart In

The process for using Klarna at Walmart is similar to the method for Quadpay. You have to first install the Klarna app and search for the Walmart store inside the app.

Once there, you can either add items to your cart and proceed to Pay with Klarna or specify the total amount you want to pay in-store at Walmart.

Once you have completed the initial transaction, you will have the freedom to complete the purchase through 4 easy installments, with each paid once every 2 weeks.

You May Like: Paypal Credit Soft Or Hard Pull

Don’t Miss: How Long Do A Repo Stay On Your Credit

Do You Have To Do A Credit Check On A Tenant

No matter how good a tenant may seem at first glance, there is always the possibility that there are more risks involved in renting than you think. One step in the verification process, which can be a little tedious or tedious for landlords, is verifying the creditworthiness of tenants applying to move into your home.

When Does Affirm Show Up On Your Credit Report

Does the claim appear on the credit report? The confirmation may appear on your credit report. If you got an installment loan with an interest rate above 0% with four payments every two weeks or within a three-month payment term, it most likely won’t appear on your report. In all other cases, confirmed installment loans will appear on your Experian credit report.

Don’t Miss: What Company Is Syncb Ppc

Are Payments Automatically Split Into Four Installments With Affirm

With some point of sale loans, your payments are automatically divided into four installments. Specifically, that means an initial down payment at the time of purchase, followed by three additional installments.

Affirm, on the other hand, allows you to choose your payment option. So, for example, you may be able to split purchases up into three payments, six payments, or 12 payments.

Does Affirm Affect Your Credit Score

Asked by: Ebony Doyle

Affirm will perform a soft credit check. This won’t affect your credit score or show up on your credit report. … There is no minimum credit score to use Affirm. Loan approval depends on your credit score, your payment history with Affirm, how long you’ve had an Affirm account and the merchant’s available interest rate.

Also Check: How To Remove A Repossession From Credit Report

Get Your Credit Score Improved Professionally

In some cases, we recommend speaking with a Credit Repair professional to analyze your credit report. It’s so much less stress, hassle, and time to let professionals identify the reasons for your score drop.If you’re looking for a reputable company to increase your credit score, we recommend Credit Glory. Call them on or setup a consultation with them. They also happen to have incredible customer service.Credit Glory is a credit repair company that helps everyday Americans remove inaccurate, incomplete, unverifiable, unauthorized, or fraudulent negative items from their credit report. Their primary goal is empowering consumers with the opportunity and knowledge to reach their financial dreams in 2020 and beyond.

Have A Professional Remove The Collection

Lastly, if youre the type of person who would rather have a professional handle it and just be done with the whole thing, I suggest you check out Lexington Law Credit Repair. Theyll take care of you, and honestly they usually get negative items removed quicker than if you try to do it yourself. Give them a call at 1-844-331-6062 or Check out our review of their service.

Recent Posts

Read Also: Ccb Ppc Credit Report

How Peloton Financing Works

Affirm, which is Pelotons financing partner, will do a soft pull on your credit when you apply for financing. The lenders review of your loan eligibility wont affect your credit scores.

If youre approved for a loan, you may be able to get 0% APR financing with no money down. But not everyone can qualify. Affirm says on its website that a down payment may be required and that interest rates range between 0% and 30%, depending on the strength of your credit.

Loan terms are flexible. You can spread your payments over 12, 24, 39 or 43 months.

Unfortunately, loans apply only to Peloton equipment, so you wont be able to finance the $39 monthly all-access Peloton membership fee that lets you access classes.

Recommended Reading: How Does A Balance Transfer Affect Your Credit Score

Can Affirm Affect Your Credit Score

Yes. Using Affirm can affect your credit score. I was frankly appalled when I began researching whether Affirm affects your credit score. Most of the answers, even on websites I would otherwise deem credible like Investopedia, make it seem like Affirm doesnt impact your credit score.

The only two situations where Affirm would not affect your credit score is first, when you apply to get approved for an Affirm loan. Affirm does a soft pull of your credit history which typically does not impact your credit score. So initially, no, Affirm likely wont impact your credit score.

The second instance where Affirm would not impact your credit score is if you end up qualifying for a 0% interest loan with only 4 biweekly payments or a 0% interest loan and your only option was a 3 month repayment period. This information comes directly from Affirms website here. All other loans through affirm are reported to Experian. Since we know that the average user pays 18% in interest to Affirm, that means the majority of users are not getting 0% interest with Affirm which means the loan is being reported to Experian.

Its worth noting that Affirm allows the merchant to have a say in the interest rate on purchases made with Affirm.

Don’t Miss: How To Report Bad Tenants To Credit Bureaus

Creating And Using An Affirm Account

Before you can make purchases through Affirm, you will need to have an account with the lender. You can do this easily through their website.

You will need to be at least 18 years old and be a permanent resident or citizen of the U.S. to qualify. You must have a cell phone number and agree to receive texts from the company. It is also ideal to have a credit score of at least 550.

The company has also launched a mobile app that can be downloaded at the Apple store and Google Play Store to create an account.

Buy Now Pay Later Services Offering No Hard Credit Checks

Disclosure: This post may contain affiliate links, meaning we get a commission if you decide to make a purchase through our links, at no cost to you. Please read our disclosure for more info.

Buy now pay later no credit check loans are increasing in popularity. Youve probably seen it on your favorite retailers websites. When you checkout theres the option to buy now and pay later, allowing you to pay in four equal installments and usually for no interest or fees and with no hard credit check.

If you have no credit or bad credit, these can seem like a great optionbut only if you know how they work, and which companies are the best options for those in search of no-credit-check online financing.

In This Post:

Also Check: How Long Does A Dismissed Bankruptcy Stay On Credit

Does Affirm Pull Credit

Simply select Confirm as your payment method when placing your order. Unlike other lenders or credit cards, Affirm exerts light pressure on your creditworthiness, meaning it does not affect your creditworthiness. Upon receipt of the loan, you will be notified by text or email before each monthly payment is due.

What Happens If I Fail To Pay My Affirm Loan

Yes, if you are unable to pay your loan, Affirm may share this information with Experian, which could negatively affect your creditworthiness. What about the confirmation? If you receive a zero price offer and pay on time, there is no catch. However, terms vary by seller and some approved loans have an interest rate of 30%, which is a high rate.

You May Like: 671 Credit Score Good

Can You Get Affirm If You Dont Have A Credit Card

You don’t necessarily need to have a credit card to use Affirm. If you don’t have a credit card and Affirm didn’t approve your loan application, it’s not necessarily because of the card. Having a thin credit file, poor credit, or not meeting any individual requirements set by the merchant you’re trying to finance a purchase with could all have contributed.

Affirm Personal Loan Rates Terms And Fees

Affirm provides personal loans with interest rates from 10.00% 30.00% with no other fees. Depending on the retailer, some Affirm loans offer a 0% APR, which could be a good option for consumers who need time to pay off the loan. Generally, loan terms are 3, 6 or 12 months but select merchants may offer different terms, such as a 30-day payment option for purchases under $50. If a retailer allows you to use Affirm for purchases between $50 and $99.99, you must choose between a loan term of 0.25 months or 0.25 months.

| Loan Amount Range |

|---|

| Yes |

You May Like: Report A Death To Credit Bureaus

Affirm Vs Afterpay: Other Products

In addition to buy now, pay later financing, many of these companies offer additional products to meet their customers’ needs. These additional products provide additional sources of revenue and help them become the financing option of choice when it is time to make a purchase.

Affirm offers a variety of payment options beyond the typical pay-in-four loan services. During checkout, customers are provided multiple financing options so they can choose which payment amount and term work best for them.

Customers can also earn a higher rate of interest on their money with the Affirm Savings Account. This account is FDIC-insured up to $250,000 and has no monthly fees or minimum balance requirements. You can open an account with just one penny. While the interest rate is subject to change, the current rate offered is 0.65%, which Affirm advertises is 13 times the national average.

Affirm will soon release a credit card, and you can join the waitlist to be notified when it becomes available. The Affirm credit card will offer pay-in-four financing for purchases over $100 at any eligible retailer. This means that you can split your purchases into four easy payments without incurring any interest or fees. There will be no annual fees, no late fees, and no prepayment penalties when using the card.

Does Affirm Hurt Credit Score

975 Views

Affirm will perform a soft credit check. This wont affect your credit score or show up on your credit report. There is no minimum credit score to use Affirm. Loan approval depends on your credit score, your payment history with Affirm, how long youve had an Affirm account and the merchants available interest rate.

Just so, Does Afterpay build credit?

Afterpay will not help you build your credit history because it does not report its loans to the credit bureaus. While this is helpful to get approved, its lack of reporting of your positive payment history will not help your credit either.

Is Klarna legit? Is Klarna safe? Putting aside the issue of taking on unnecessary additional debt, Klarna is safe in the way it takes payments and stores customers details.

Similarly, Does PayPal credit affect credit score?

Yes, applying for PayPal Credit affects your credit score. PayPal is partnered with a bank called Synchrony Bank, which will review your application and then complete an audit. This hard check will appear on your credit report for 2 years and could lower your credit score by a few points.

Read Also: Navy Federal Auto Loan Reviews

Does Affirm Charge Interest

If you read the fine print, Affirm does not guarantee that you’ll qualify for 0% interest financing. Depending on your credit and eligibility, your APR can end up being 0%, or 10% to 30%. A down payment may also be required for some purchases.

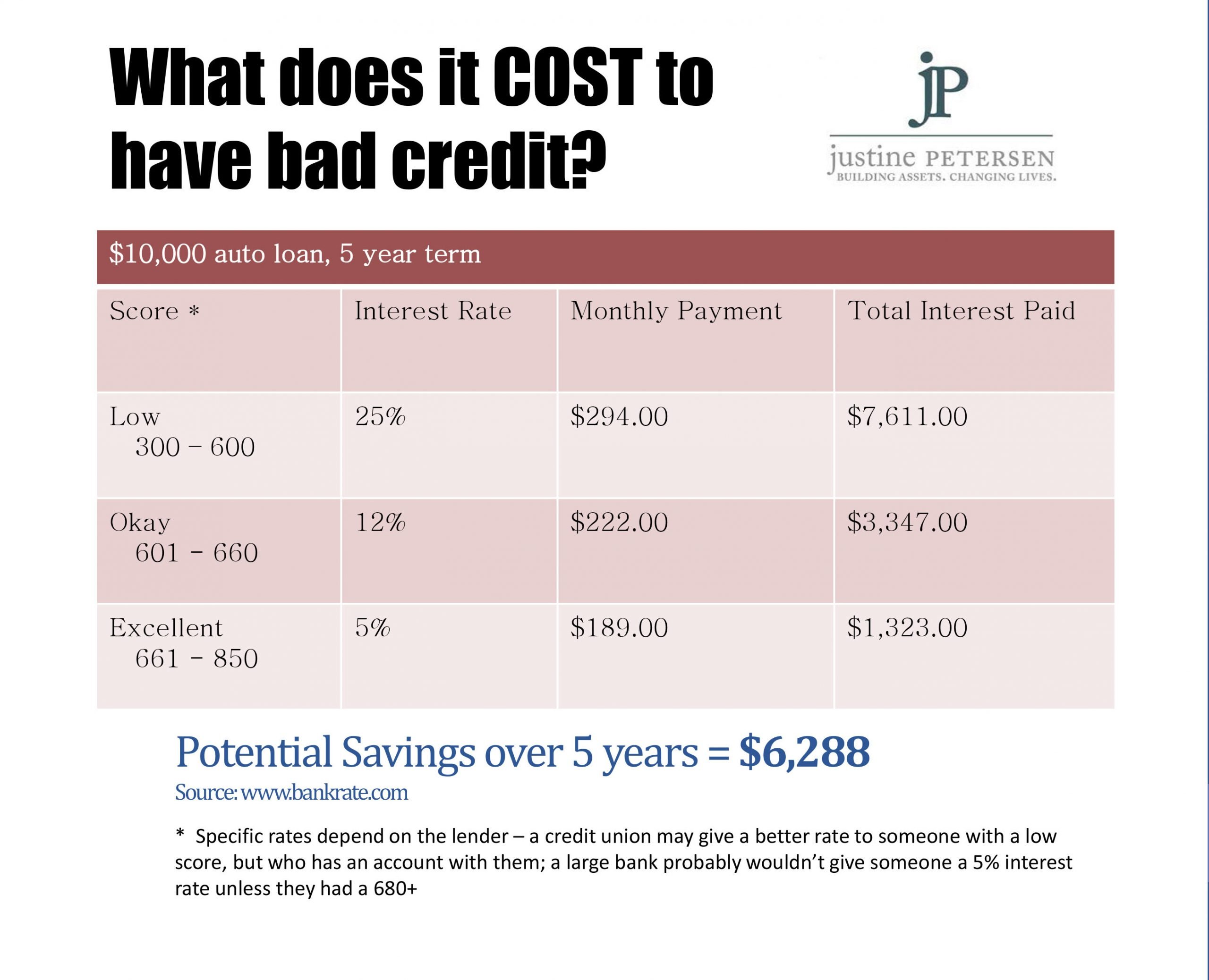

So how do Affirm’s interest rates compare to the average credit APR? As of February 2021, Federal Reserve data put the average credit card APR at 15.91% for all accounts that assessed interest. So it’s possible that Affirm could be a less expensive option, assuming you qualify for 0% financing.

But if not, then it’s possible that you could end up with a higher interest rate compared to what you might pay with a credit card.

You may also be wondering whether you can pay an Affirm loan off early to save money on interest. The answer is yes. And in case you’re curious about whether Affirm charges a prepayment penalty for doing so, the answer is no.

Why You Can Trust Bankrate

At Bankrate, we have a mission to demystify the credit cards industry regardless or where you are in your journey and make it one you can navigate with confidence. Our team is full of a diverse range of experts from credit card pros to data analysts and, most importantly, people who shop for credit cards just like you. With this combination of expertise and perspectives, we keep close tabs on the credit card industry year-round to:

- Meet you wherever you are in your credit card journey to guide your information search and help you understand your options.

- Consistently provide up-to-date, reliable market information so you\’re well-equipped to make confident decisions.

- Reduce industry jargon so you get the clearest form of information possible, so you can make the right decision for you.

At Bankrate, we focus on the points consumers care about most: rewards, welcome offers and bonuses, APR, and overall customer experience. Any issuers discussed on our site are vetted based on the value they provide to consumers at each of these levels. At each step of the way, we fact-check ourselves to prioritize accuracy so we can continue to be here for your every next.

Read Also: 824 Fico Score

Is There A Credit Limit

Affirm doesn’t have a minimum or maximum , per se. Though there is an upper limit of $17,500 on purchases as mentioned, your individual credit limit is determined by things like:

- Your credit history

- Your payment history with Affirm

- How long you’ve had an account with Affirm

- The interest rate offered by the merchant where you’re applying

What this all means is that it’s possible to be approved for more than one Affirm loan at a time, with more than one merchant. Affirm also mentions that it takes current economic conditions into account so whether or not you’re approved and your credit limit can depend on things beyond your financial history.

Impact On Credit Score

People should be aware that Affirm can have a positive or negative effect on their . Whether or not Affirm has an effect on your credit score depends on a variety of factors such as the type of loan and your payment history. When Affirm first determines your eligibility for a loan, they perform only a soft inquiry which has no effect on your credit score.

When it comes to paying off the loan, the provider reports only some loans to Experian. Specifically, it does not report loans with 0% APR and 4 biweekly payments or loans where people were given one option of a three month payment term with 0% APR.

If Affirm does report your payment history to Experian, the entire loan history is reported, regardless of whether it’s positive or negative. When this happens, your payment history, the amount of credit you’ve used, the amount of time you’ve had the credit and late payments are all reported to Experian. By defaulting on your loan or making late payments, you risk decreasing your .

Don’t Miss: Student Loans Fall Off Credit Report