Beware Of This Credit Repair Strategy When It Comes To Collections And Charge

There are many so-called ” that coach you to raise your credit score by abusing the dispute process. In a nutshell, they instruct you to send letters to the three major credit bureaus disputing the legitimacy of every negative item on your credit report — late payments, collections, charge-offs, judgments, you name it.

- It doesn’t always work. If you have lots of negative information on your credit report, it’s likely that some of the creditors will verify the account on time. Many creditors are aware of this technique and do everything in their power to keep negative information on your report for as long as possible, especially if you owe a balance so you are incentivized to pay it.

- The negative item can come back. Just because a creditor doesn’t verify an item within 30 days and it gets removed doesn’t mean it’s gone for good. In most cases, a creditor can report a negative item for up to seven years from your first delinquency, even if the item was previously removed. So, many people find that their credit score increases significantly at first, only to fall again as the accounts reappear.

- It can backfire. For instance, let’s say that a creditor reports an account as delinquent, but doesn’t update their information often. By legally forcing them to verify it, they’ll also update their files. If one of your accounts is really a charge-off, but was still being reported as 60 days late, confirmation could actually have a negative effect.

What Happens After The Limitation Period Expires

Even though you owe the money until the debt is paid or settled, a debt collectors options are limited when the limitation period expires. At this point, calling and sending collection letters that demand payment before further action is taken are mostly just threats.

However, after the limitations period:

- Debt collectors can continue to call and ask for payment

- The debt will remain on your credit report for seven years from the date of last payment

If a debt collector does try to sue you after the limitation period, you can defend the action by notifying the court that the limitation period has expired. Failure to show up in court and plead this defense can result in a judgment favouring the collection agency.

Whether you choose to pay an old debt is up to you. It will fall off your credit after seven years, but collection agencies can still call. If you want to stop the calls, you can offer to settle. Only make this offer if that is what you intend to do. Otherwise, ignore the calls.

Whether the limitation period has passed or not, you have rights when dealing with a debt collector. Debt collectors can only contact your friends, relatives, neighbours, or employer to get your telephone number or address, but they arent allowed to suggest to them that you should pay your debts. They cant use threatening or intimidating language and apply unreasonable pressure to force you to repay the debt.

What Happens To A Debt After Seven Years

Seven years is a well-known time limit when it comes to debt. It’s referred to so often that many people have forgotten what really happens to credit cards, loans, and other financial accounts after the seven-year mark.

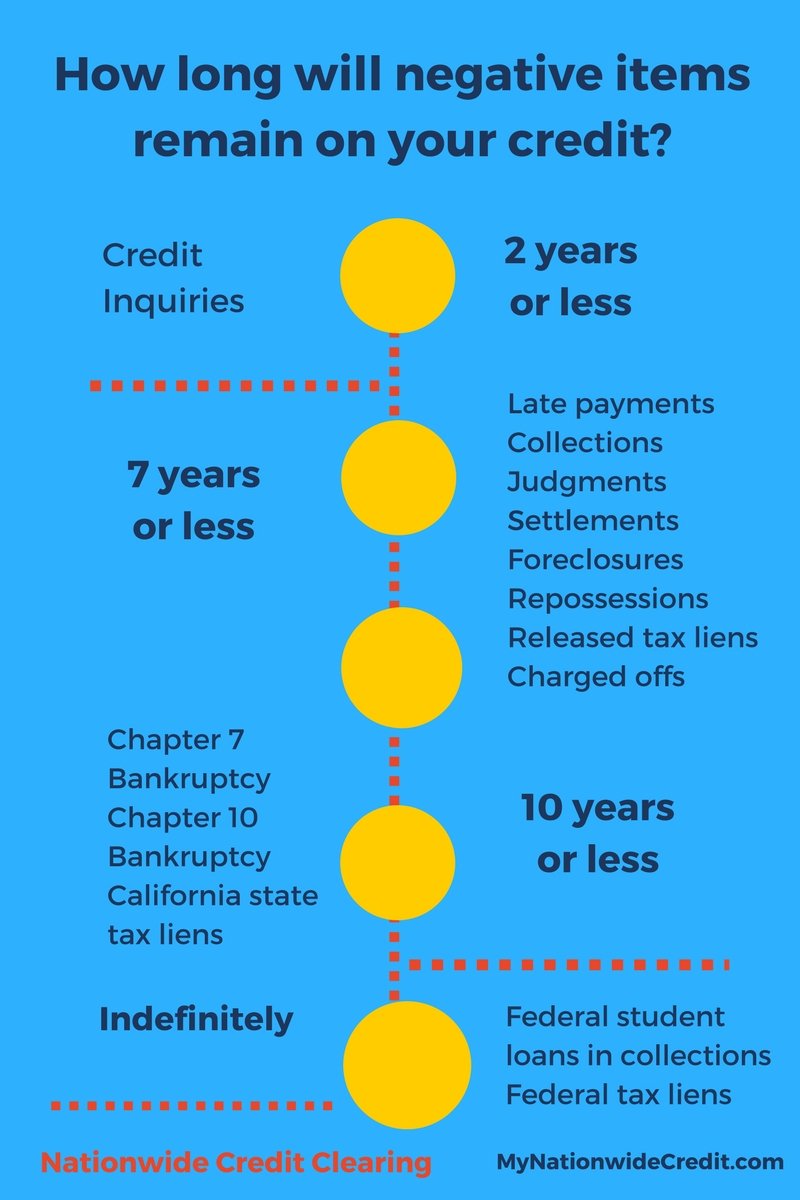

Seven years is the length of time that many negative items can be listed on your credit report, as defined by the Fair Credit Reporting Act. This includes things like late payments, debt collections, charged-off accounts, and Chapter 13 bankruptcy. Certain other negative items, like some judgments, unpaid tax liens, and Chapter 7 bankruptcy, can remain on your credit report for more than seven years.

Recommended Reading: Does Titlemax Go On Your Credit

How Long Do Paid Off Credit Accounts In Good Standing Stay On My Report

A credit account that was paid off on time and is in good standing will remain on your credit account for 20 years after the last day it was active. Often, people mistakenly believe that old credit accounts are bad information and do not want then on their reports. In fact, this is the exact type of information that you want to appear on your credit report. Old accounts, which were paid off on time, show potential future lenders that you can responsibly handle credit. A long and positive credit history is created by using credit and taking on loans.

How Do Collections Affect Your Credit Scores

A collection account is a negative item that can hurt your credit scores. But the impact on your score can depend on the type of credit score and whether you’ve paid off the collection.

For example, the latest FICO® Score and VantageScore® models ignore paid collection accounts, while previous score versions may count paid collections against you.

But when you’re applying for a loan with a lender that uses older scoring modelssuch as a mortgage lenderpaying down your collections could still be important. Credit scores aside, the lender may review your credit history, and having unpaid collections could make it more difficult to qualify. While even paid collection accounts are negative, they may be viewed more positively by lenders than an account that remains unpaid.

You May Like: How Long Until Closed Accounts Fall Off Credit Report

Your Complete Guide To Dealing With Collections And Charge

Many or all of the products here are from our partners that pay us a commission. Its how we make money. But our editorial integrity ensures our experts opinions arent influenced by compensation. Terms may apply to offers listed on this page.

There are five categories of information that make up your FICO® Score. None is more important than your payment history, which accounts for 35% of the total. The most obvious piece of this category is whether you pay your bills on time or not, and for people with strong credit histories, it usually ends there.

On the other hand, if you’re one of the millions of Americans without a spotless credit history, some other things could be weighing down your in the payment history category. Two big ones are collection accounts and charge-offs. These can be score-killers and can linger on your credit for years, especially if you don’t know how to deal with them.

With that in mind, here’s a guide to dealing with collections and charge-offs on your credit. To be clear, these aren’t easy to get rid of, but they’re definitely worth confronting head-on. With smart planning you can put yourself in a position to deal with them wisely and help accelerate your credit-repair process.

But What If Im Rate Shopping

So does all this mean you shouldnt get multiple quotes when youre rate shopping for the best mortgage or car loan? Each time you get a rate quote your credit score goes down, right?

No, not if the hard credit checks happen within a 30-day period. All of them should count as one hard inquiry.

Plus, a soft inquiry will usually be enough to get an accurate rate quote while youre comparing lenders.

When you ask for a quote, be sure to find out whether the lender will do a hard check.

Recommended Reading: Realpage Credit Inquiry

Ask For A Goodwill Deletion

If you have a paid collection listed on your report, you can simply ask the debt collector or original collector to remove the collection. This usually involves sending the debt collector or collection agency a goodwill deletion letter explaining your mistake, asking for its forgiveness and showing them how your payment history has improved.

With this option, theres no guarantee your collection will be removed from your credit report, but its worth a shot. If the account is removed, it may help you qualify for better terms on personal loans, mortgages and credit cards.

What Is The Statute Of Limitations In Canada

The statutes of limitations for collection actions bars a creditor, or collection agency, from suing you after a specific time limit. After this times expiration, it is much harderand often impossiblefor a creditor to collect money from a debtor for an unpaid debt.

Canadian law starts with a limitation period of six years. However, each province and territory in Canada has its own statute of limitations. Each provincial limitation period as of January 2020 is as follows:

- Alberta: 2 years

- Saskatchewan: 2 years

- Yukon: 6 years

Limitation periods typically apply to unsecured debts. An old credit card debt, cell phone bill or gym membership account, for example, is subject to the limitation period. However, you cannot use provincial limitation laws to avoid a court judgment for:

- secured debt

- government debt, including student loans and tax debts

- non-dischargeable debts such as child and spousal support, fines and obligations arising out of fraud.

Provincial limitations laws do not apply to the Canada Revenue Agency. Generally, CRA collections has ten years to commence legal action for most tax debts and government student debt.

Also Check: Does Carmax Pre Approval Affect Credit

Why Does Information Show Up On Your Credit Report For Years

Information on your credit report gives potential lenders an idea of financial responsibility. Data stays on credit reports for fixed periods of time. The goal is to provide accurate estimations of your reliability to repay loans. Depending on a few factors, most information stays on credit reports for 6 to 7 years.

This is enough of a time frame to show creditors any highs and lows in your credit history. The better managed on average, the higher your credit score. Months would not be long enough to give an accurate assessment.

Information held and shared for life would be too critical. Having information available for limited years is best. It allows for the correction of past errors while ensuring you repay your creditors.

Choose Your Plan Of Action

There are a few ways to handle a collection account on your credit reports:

- If the collection account is inaccurate, dispute it with each credit bureau thats reporting it. The consumer credit bureaus let you file disputes online for convenience. You can also dispute inaccuracies with debt collectors and creditors themselves, though these disputes will typically have to be by phone or mail. In this case, consider sending a 609 dispute letter via certified mail.

- If the account is legitimate but has been paid, contact the collection agency to request a goodwill deletion. This literally involves asking for the account to be removed because you paid it. Its probably not going to work, but its worth a shot. A goodwill adjustment may be more viable if you havent made any other credit blunders in the past.

- Just wait. A collection can usually remain on your reports for about seven years after the account was declared delinquent, even if its unpaid, and its impact on your scores will dissipate over time.

Also Check: Suncoast Credit Union Truecar

Misconceptions About When Collections Will Fall Off

There are some common misconceptions about what affects the date a collection will fall off your credit report. Below is a list of other dates that do not affect the date a collections account rolls off your credit report.

How Long Does Credit Information Stay On Your Credit Report

Home \ \ How Long Does Credit Information Stay On Your Credit Report?

Join millions of Canadians who have already trusted Loans Canada

Your credit report is essentially your credit history. It compiles all the information concerning your credit habits and creates a tool that can be used by lenders and creditors to assess your creditworthiness. While your credit report does represent a good portion of your credit history, the information is not saved for the total duration of your credit using life. Your credit information is eventually removed from your to make room for newer information.

Of course, the question on everyones mind is, how long does this credit information stay on my credit report for? This is what were going to take a closer look at so you can know exactly how long specific credit information will affect your credit report.

Recommended Reading: How Long Will A Repo Stay On My Credit

How To Remove Collections From Credit Report

Having collections on your credit report hurts your score. There are 3 ways you can remove collections from your credit report without paying. 1) sending a Goodwill letter asking for forgiveness 2) disputing the collections yourself 3) working with a credit repair company like Credit Glory that can dispute it for you.

How To Avoid Debt Collections

There are several popular debt reduction strategies, including Dave Ramseys debt snowball method that focuses on paying off outstanding balances in order, small to large, and debt avalanche, which prioritized high interest accounts first. Look into these and other debt payoff strategies to eliminate the possibility of collection actions on overdue accounts.

Another way to avoid collections is to seek out debt consolidation options before you get behind on your monthly payments. This can help you lower interest rates and payments, not to mention avoiding the negative Fico score changes that come from missed payments. Those stay on your credit report for seven years also, though their impact decreases over time.

Taking out a debt consolidation loan and using it to pay off credit card balances wont have an immediate positive effect on your credit report. You might even see a slight after paying off debt in this manner. Be patient. After a few months, your credit score should increase, even if the late payments are still showing on your credit report.

Don’t Miss: Chase Sapphire Preferred Score Needed

How Long Do Delinquent Credit Accounts Stay On My Report

When it comes to delinquent credit accounts or other negative credit information, its best for your overall credit health if that information is removed from your credit report as soon as possible. Its this type of information that will lower your credit score and hinder your ability to get approved for the credit and loan products you need.

Unfortunately, negative credit information does stay on your credit report as its used by creditors and lenders to assess your risk level. The good news is that negative credit information doesnt stay on your credit report for as long as positive credit information.

Because there are so many different types of negative credit information that can appear on your credit report, here is a detailed list of how long each will stay on your report.

How Delinquent Debts Are Reported On Your Credit Reports

After your debt has been transferred or sold to a debt collector, it will probably appear twice in your credit history. According to the credit reporting agency Experian, this is how it works: The debt starts as a current, never late account. As you get behind on the payments, it is typically reported as being 30 days late, 60 days late, 90 days late, and so forth.

Recommended Reading: How To Fix A Repossession On Your Credit

What Triggers A Hard Inquiry On Your Credit Report

If you see a hard inquiry listed on your credit report it is because you have applied for credit in the last two years.

This could mean that you applied for a credit card, whether it be a rewards card, a cash-back card or even a balance transfer card like the U.S. Bank Visa® Platinum Card.

A hard inquiry will also end up on your personal credit report when you open a business credit card. This is because your personal credit is usually reviewed by the issuer even when applying for a small business credit card, such as the Capital One Spark Classic for Business.

When you apply for a mortgage, student or auto loan, a hard inquiry will be noted on your credit report. Theres a difference, however, between applying for multiple credit cards in a short amount of time and shopping around for the best mortgage rate in a short amount of time.

There are certain instances, such as applying for a car loan or a mortgage, that only count as one inquiry for scoring purposes as long as they occur within a certain window of time, typically 14 to 45 days, Shon Anderson, a certified financial planner and president at Anderson Financial Strategies, tells CNBC Select. The reason is they know you are probably shopping around for the best terms, and you are probably not going to get three or four car loans or mortgages all at once.