How To Dispute Hard Credit Inquiries

We recommend checking your credit reports often. If you spot any errors, such as a hard inquiry that occurred without your permission, consider disputing it with the credit bureau. You may also contact the Consumer Financial Protection Bureau, or CFPB, for further assistance.

This could be a sign of identity theft, according to Experian, one of the three major credit bureaus. At the very least, youll want to look into it and understand whats going on.

Keep in mind, you can only dispute hard inquiries that occur without your permission. If youve authorized a hard inquiry, it generally takes two years to fall off your credit reports.

The Bottom Line On A Hard Credit Check Vs Soft Credit Check

Soft credit checks are fairly harmless. However, in the grand scheme of things, even hard credit checks are not worth obsessing over. Far more important is maintaining healthy credit habits like repaying what you owe on time and not borrowing more than you can afford. The impact of hard credit checks is worth thinking about when youre planning to apply for new credit. Just avoid making too many credit applications at once unless youre shopping for mortgage or car loan rates. If you have more specific questions about credit or need help with your personal finances, consider booking a free and confidential appointment with a non-profit credit counselling organization in your area.

Can Hard Inquiries Be Disputed

When you check your credit report, make sure you keep an eye out for hard inquiries that you dont recognize. This could be a warning sign that someone is attempting to apply for credit in your name. Dispute any suspected fraud with the credit bureau.

If, on the other hand, a company pulled your credit report in error, you can ask the company to contact the credit bureau to have the inquiry removed. If a hard inquiry on your credit report is inaccurate, you can dispute it as you would any other credit report error.

Legitimate inquiries cant be disputed or removed from your credit report until the two-year time period is up.

Recommended Reading: Is 761 A Good Credit Score

Can You Remove Inquiries From A Credit Report

Removing a credit inquiry from your credit report may be doable if itâs the outcome of identity theft or fraud. Youâll need to file a dispute with the three major credit bureaus to ask for it to be removed. The Consumer Financial Protection Bureau has more information about this.

However, if you put a hard inquiry in motion by applying for a new line of credit, you canât have it removed.

How Much Will Credit Inquiries Affect My Score

The impact from applying for credit will vary from person to person based on their unique credit histories. In general, credit inquiries have a small impact on your FICO Scores. For most people, one additional credit inquiry will take less than five points off their FICO Scores.

For perspective, the full range for FICO Scores is 300-850. Inquiries can have a greater impact if you have few accounts or a short credit history. Large numbers of inquiries also mean greater risk. Statistically, people with six inquiries or more on their credit reports can be up to eight times more likely to declare bankruptcy than people with no inquiries on their reports. While inquiries often can play a part in assessing risk, they play a minor part are only 10% of what makes up a FICO Score. Much more important factors for your scores are how timely you pay your bills and your overall debt burden as indicated on your credit report.

Recommended Reading: How Do You Get A Copy Of Your Credit Report

Calculating Your Credit Score

Your credit score is a three-digit number that lenders can use to quickly gauge your trustworthiness as a borrower. Scores range from a low of 300 to a high of 850, with higher scores being better. Generally, anything above 760 is seen as an excellent score while scores above 700 are good.

average return of 397%

There are three major credit bureaus: Experian, Equifax, and Transunion. Each tracks your interactions with debt and credit to build a credit report for you. Using the information on those reports, as well as a formula from FICO, they calculate your credit score, often called your FICO score.

There are five factors that affect your credit score.

Do Hard Inquiries Lower Your Credit Score While Theyre On Your Report

Yes, hard inquiries usually lower your credit score, but not by very much. The number of points a hard inquiry will take off your score depends on several factors, but usually your score will drop by no more than 5 points in FICOs models and no more than 10 in VantageScores. As mentioned, even this small effect is temporary.

This is consistent with both models approaches to the pursuit of new credit, which, as shown in the tables below, is one of the least important factors used to calculate your credit score.

Small Impact of Hard Inquiries on Your FICO Score

Small Impact of Hard Inquiries on Your VantageScore

The upshot is that because hard inquiries have only a minor effect and fall off your credit report so quickly, you dont need to worry about them too much. The exception is if you get too many hard inquiries in a short period.

Although theres also no hard limit on how often you can apply for credit cards and loans, you should only apply for credit when you actually need it. This way, the number of inquiries on your report will remain reasonably low and your credit score wont suffer.

FICO and VantageScore have a special rate-shopping window where multiple hard inquiries are treated as one. This means you wont be penalized for comparing interest rates from different lenders, as long as you submit all your credit applications within a short period . 31

Don’t Miss: What Is Transunion Credit Score

How Do Credit Inquiries Affect Your Credit Score Overall

Inquiries make up 10% of your credit score, so their impact is relatively small. How much you can expect your score to change depends on your credit history. An inquiry might have a greater impact if you have few credit accounts or short credit history, or you have numerous inquiries. But most consumers see their score drop five points or less per inquiry, according to Fair Isaac, the company that created the FICO scoring model.

Although hard inquiries can affect your credit score for up to a year, their impact lessens within a few months, according to Experian.

Soft inquiries have no impact on your credit score.

Three Ways To Remove Negative Items From Your Credit Report Yourself

You can help remove negative items from your credit report yourself:

- Ask your creditors to remove them You may be able to convince your creditors to remove the negative items in certain circumstances. For example, if youve never missed a mortgage payment, but you miss one by accident, you may be able to convince your creditor to remove the negative item from your credit report.

- File a dispute with your credit agency You can ask your credit bureau for a free copy of your yearly credit report to check for errors. If you notice any inaccuracies in your report, you can file a complaint with the credit bureau and the creditors have 30 days to respond to it. Keep in mind that you should provide proof to back your claims. And if youre right, the negative information can be removed from your credit report.

- File a complaint with The Financial Consumer Agency If you notice that your credit report shows inaccurate information, you can file a complaint with The Financial Consumer Agency of Canada. The Agency can help you address inaccuracies made by financial institutions or credit card companies.

Book your free, no-obligation, confidential consultation and get personalized advice that can help you eliminate debt and regain your financial freedom

If you enjoyed this article, or found it helpful, consider sharing it:

Recommended Reading: Can You Dispute Credit Report

What About Rate Shopping

One of the best ways to save money on a loan especially a large loan like a mortgage or an auto loan is to shop around. If you get quotes from multiple lenders, you can choose the one with the lowest interest rate and fees to minimize your costs.

If each application results in a hard inquiry that hurts your credit score, rate shopping too extensively could damage your credit.

The good news for borrowers is that the FICO scoring formula accounts for the importance of rate shopping. For large loans like mortgages, auto loans, and student loans, all inquiries that occur within a short span 14 to 45 days depending on the formula used are treated as a single inquiry when calculating your score.

That means that you can safely compare rates from multiple lenders, as long as you get your quotes within a short period.

How Do Multiple Credit Inquiries Affect Your Score

Can multiple credit inquiries have a negative effect on your credit score? It depends on what kind of credit youre shopping for.

If youre rate shopping to find the best interest rate on something like a mortgage or an auto loan, the major credit bureaus and FICO understand youre likely to have multiple credit inquiries on your account. Thats why multiple inquiries for the same type of credit are considered as a single inquiry if they occur within a specific time span. Older FICO scoring models consolidate inquiries made within two weeks, while the newest FICO score gives consumers 45 days to shop around for the best rates and terms.

If you apply for multiple credit cards in a short time period, each application will add a new hard credit inquiry to your credit report. This could make a big difference in your interest rates if you are on the border between good credit and excellent creditand its one of the reasons why its a good idea to wait at least 90 days between credit card applications.

You May Like: Does American Express Give You A Free Credit Report

Why Credit Inquiries Affect Everyone Differently

Its important to keep in mind that FICO does treat different types of credit inquiries differently and that the same credit inquiry can affect people in different ways.

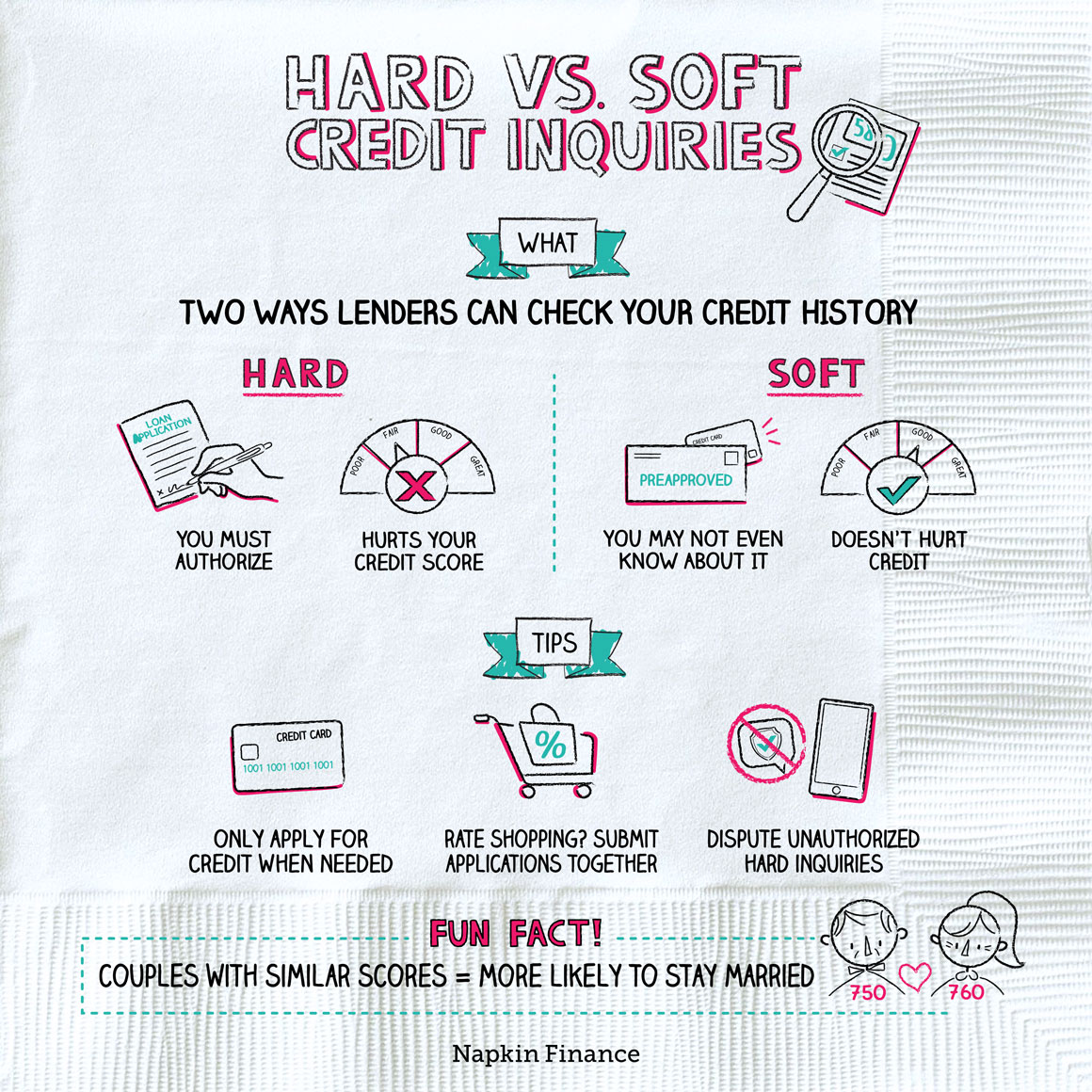

According to Tina Hay of Napkin Finance, different peoples scores will be affected differently by a hard pullsome may not lose any points, while others may lose several for a single new inquiry.

The reasons for this ultimately come down to your own credit history. However, theres one more important point that can change how individual hard credit inquiries affect your credit score. And its a neat little trick that everyone should be aware of .

Ready for the trick on dropping hard inquiries from your credit report with minimal effort? Here it is:

FICO considers multiple same hard credit inquiries done within the same period of time as one single hard inquiry.

Why is this important? When youre searching for a business loan or are looking to rent an apartment, people often apply at several different locations before they find a deal that works best for them. For this reason, FICO considers these inquiries as one single hard inquiry provided it falls within the 45-day window .

This is great to keep in mind the next time youre shopping for a loan or are looking to apply for credit to make a purchase because you can use this to your advantage to not only maintain your current credit score while maximizing your opportunities to shop around for the best deal possible.

What Does A Lender Look For

Lenders want to know that you will pay back your loan. The best predictor of your future behavior is your past behavior. So, the underwriters will look at your past spending habits. If your patterns reflect the current models that predict bankruptcy or repossessions as likely, you will not get a loan. People with six inquiries or more on their credit reports can be up to eight times more likely to declare bankruptcy than people with no inquiries on their reports.

In addition to your report, the market changes can affect whether you will get loans in the future. If bankruptcy rates are high and even good credit risks are getting into debt trouble, you are less likely to get a loan regardless of your credit pulls.

Read Also: How To Get A Dispute Removed From Credit Report

Prevention Is Worth A Pound Of Cure

The best way to prevent having too many hard inquiries on your credit is to keep track of how many hard pulls you have in your credit history. You can easily keep a list for each time you apply for a new loan or credit card, mortgage or apartment lease. You want to keep your number of credit inquiries to less than 6 per year.

So if you rent an apartment, buy a washing machine and dryer on store credit, buy a car, and apply for two credit cards and a store credit card in the same month, you will not likely qualify for a student loan from a private lender anytime soon. It will also most likely be at least a year before mortgage companies will want you to buy a home.

How Many Credit Inquiries Is Too Many

The effects of one or two credit inquiries on your credit score wont necessarily have to be significant. People that have no other negative marks on their credit reports might not even see a difference. However, the more of them you have, the higher the odds of a lender characterizing you as a high-risk client.

Even though every lender has their own criteria for determining how many inquiries are too many, six is usually considered unacceptable. That being said, some bad-credit lenders are willing to overlook even that many hard checks.

Don’t Miss: How To Boost Credit Score 100 Points

What Is A Hard Inquiry

When a lender or company makes a request to review your credit reports as part of the loan application process, that request is recorded on your credit reports as a hard inquiry, and it usually will impact your credit scores. This is different from a soft inquiry, which can result when you check your own credit reports or when a promotional credit card offer is generated. Soft inquiries do not impact your credit scores.

Hard inquiries serve as a timeline of when you have applied for new credit and may stay on your credit reports for up to 36 months. Depending on your unique credit history, they could indicate different things to different lenders.

Recent hard inquiries on your credit reports tell a lender that you were recently shopping for new credit. This may be meaningful to a potential lender when assessing your creditworthiness.

How Long Do Hard Inquiries Stay On The Credit Report

You might be wondering how much hard inquiry is too many hard inquiries. Well, you dont need to stress. You can learn everything here. Hard inquiries on credit happen when you apply for credit or a loan. It will stay on the credit report for at least 24 months. But a hard inquiry doesnt affect the score after 12 months.

Even though hard inquiries stay on the credit report for over two years, the credit Bureau considered for the past 12 months. It is seen that hard inquiries might cause harm to the credit scores of people with short credit history. If you are someone who is just starting out to build their credit, then hard inquiry can do severe damage to the credit score. But it doesnt mean that you have to stay away from applying for the credit. Its pretty fine to have a few inquiries regularly. It shows that you are trying to build an excellent credit score and ensure that you dont apply for too many credits in a short amount.

Don’t Miss: What Credit Score Does Synchrony Bank Require

Next Stepscheck Your Credit Score & Report Regularly

Its a good idea to check your credit score at least once per quarter and your credit report once per year to check for errors. Free credit report websites can be a handy source to notify you about any new inquiries on your report. Signing up with one of these sites can help you receive any new updates about your credit reports in real-time.

If Youve Applied For Financing Or Other Credit And The Lender Checked Your Credit Scores As Part Of The Process Youve Probably Experienced Whats Called A Hard Credit Inquiry

When lenders check your credit with a hard inquiry , they often make a note of their official review in your . They use that information to assess how youve handled credit in the past, how often youve paid your debts and bills on time, and whether you have any derogatory marks on your credit reports.

They also want to know how much credit youre juggling and how long youve been managing your credit. All of these factors help creditors decide whether to extend new credit to you or give you additional credit.

You can help yourself prepare for a hard credit pull by monitoring your credit reports and making sure there arent any unpleasant surprises. Checking your own credit reports often involves whats known as a soft credit inquiry, or soft pull.

Lets take a deeper look at the differences between hard credit inquiries and soft credit inquiries.

You May Like: How Do You Dispute Something On Your Credit Report