Transunion: Phone Number: 800

This will get you a live agent. Tell them that you would like for the dispute to be removed from some accounts on your credit report AND that you are no longer disputing those accounts. Ask them how long it takes for this to be done and if he/she says that it will take longer than a couple of days. tell them that you are needing to move forward with the closing on your home and can it be expedited sooner.

Check Your Credit Reports For Updates

It may take some time for your credit reports to be updated. Creditors can take up to 45 days to send a credit bureau new information, according to TransUnion. If the information isnt updated after 45 days, contact the credit bureaus or data furnisher again to see why inaccurate information is still being reported.

What Should I Expect After Filing A Dispute

Investigation of your dispute

When reviewing your dispute, if we are able to make changes to your credit report based on the information you provided, we will do so. Otherwise, we will contact the company that reported the information to us to verify the accuracy of the information you’re disputing.

Your dispute will be processed in approximately 10-15 days for electronic submission and 15-20 days for postal mail

After our investigation is complete, a confirmation letter or email will be sent to you with the results and outcome of the investigation. If we require additional information in order to complete our investigation, we will notify you. If you submitted your dispute electronically, we will notify you by email. If you mailed in your completed form and documents, we will send you a letter. Due to COVID-19, we are experiencing longer than normal processing times. We appreciate your patience.

Recommended Reading: Credit Plus Rescore Form

Use The Advanced Method To Dispute The Charge

If you dont have the money to pay the balance in full, or if you cant get the original creditor to remove the charge-off from your credit report, its time to dispute the negative entry using a more advanced method. To dispute the entry youll first need a copy of your current credit report. Because of the coronavirus pandemic, you can get a free copy of your credit report each week instead of just once a year. Visit annualcreditreport.com to get a free credit report from TransUnion, Experian, and Equifax.

When you have your credit reports in hand, find the charge-off entry and look at every detail to ensure everything is completely accurate. The key here is to be very specific. If anything is inaccurate you have the right to dispute the entire entry.

Here are a few details that you should be verifying are accurate:

- Account Number

- Borrower Names

- Balance

If you find any information that isnt correct, write a letter to each of the three credit bureaus listing the inaccurate information and stating youve found incorrect information that needs to be corrected or removed. If the credit reporting agencies cant verify the entry, theyll have to correct or remove the charge-off in compliance with the Fair Credit Reporting Act. Sometimes the information simply cant be verified and the entry will be removed. Do note however, that if the charge-off is reported accurately, disputing it will not help.

How To Check Your Credit Report For Collections

Checking your credit reports regularly can help you determine whether you have any collection accounts that might be hurting your score. You can request a free copy of your Canadian credit report from Equifax Canada and TransUnion Canada in writing. If you dont have time to wait for your credit reports to be mailed out, you can purchase a copy of your credit reports from either bureau online.

Keep in mind that your credit reports and credit scores are two different things. The information in your Canada credit report is used to calculate your credit scores. If youd also like to see your scores, you can request them separately from each credit bureau for a fee.

Once you have copies of your Equifax and TransUnion credit reports, review them carefully. Look for any collection accounts and if you find them, make a note of:

- Who the debt is owed to

- The name of the collection agency, if there is one

- How much is owed

- How many payments the account is behind

Also, make sure you have the right contact information for debt collectors, which youll need for the next step. Again, some creditors will route past due accounts to their in-house collections department while others will assign or sell past due accounts to a collection agency. You need to know who to contact if you want to remove collections from your credit report in Canada.

Recommended Reading: Which Credit Bureau Does Carmax Use

How To Dispute A Charge

The Fair Credit Reporting Act gives you numerous rights when it comes to the information on your credit reports. For example, you have the right to dispute an item on a credit report with which you disagree.

Disputing a charge-off is actually a simple process. The credit bureaus give you three potential ways to submit a dispute: via mail, online, or over the phone.

Check Your Credit Report For Any Mistake Regarding The Repossession

Do you know that according to a study by the Federal Trade Commission, 1 in 5 people have an error on at least one of their credit reports? It is then very important to review your credit reports very carefully.

Compare all of your three credit reports and compare the repossession entry. You might spot a mistake or an inaccuracy. Common errors include spelling errors, loan amount, phone numbers, addresses, and more.

Don’t Miss: How Does Qvc Payments Work

How Does A Charge

Once an account has been charged off, two things will likely happen:

- First, youre going to start receiving calls and letters from collection agencies attempting to collect the debt.

- Second, the account will be marked as a charge-off on your credit report.

A charged off account on your credit report will devastate your FICO score. A single charge-off can cause your to drop 100 points or more. Its a big deal.

In addition to your credit score dropping, youre also going to have a really difficult time getting approved for any new , mortgages, or auto loans. Lenders rarely extend credit to people with even one charge-off on their credit report.

The Credit Repair Organizations Act

The makes it illegal for credit repair companies to lie about what they can do for you, and to charge you before they’ve performed their services. The CROA is enforced by the Federal Trade Commission and requires credit repair companies to explain:

- your legal rights in a written contract that also details the services they’ll perform

- your three day right to cancel without any charge

- how long it will take to get results

- the total cost you will pay

- any guarantees

What if a credit repair company you hired doesn’t live up to its promises? You have some options. You can:

- sue them in federal court for your actual losses or for what you paid them, whichever is more

- seek punitive damages money to punish the company for violating the law

- join other people in a class action lawsuit against the company, and if you win, the company has to pay your attorney’s fees

Recommended Reading: Bp Visa Syncb

How An Error On Your Credit Report Can Affect You

Is it really necessary to keep close tabs on your credit report? Can one error really have an impact on you? Yes. Your credit report contains all kinds of information about you, such as how you pay your bills, and if youve ever filed for bankruptcy. You could be impacted negatively by an error on your credit report in many ways.

To start, its important to understand that credit reporting companies sell the information in your credit reports to groups that include employers, insurers, utility companies, and many other groups that want to use that information to verify your identity and evaluate your creditworthiness.

For instance, if a utility company reviews your credit history and finds a less-than-favorable credit report, they may offer less favorable terms to you as a customer. While this is called risk-based pricing and companies must notify you if theyre doing this, it can still have an impact on you. Your credit report also may affect whether you can get a loan and the terms of that loan, including your interest rate.

What To Do When Cfpb Is Not Able To Give The Result

If the Consumer Finance and Protection Bureau does not give you the result . Then sending EQ and ITS letter should be your next move is going to be, at this point you need to wait for the CFPB to complete. Normally it had great success going the CFPB route. This is the way you exactly solve credit reporting complaints with all CRAS.

Erroneous items on credit card reports often go unchallenged. Even though the FTC reports that 79 percent of consumer who disputed credit report errors was successful in removing them. Monitoring your credit score at a regular interval can be a good way to catch identity fraud.

If you invest a little time to overcome the hurdles put in place by creditors. Then youll transcend achieve your credit score and get the life of your dreams. This is how you could increase your credit score. More detailed advice is available on theFederal Trade Commission website.

Don’t Miss: Removing Items From Credit Report After 7 Years

Consider Contacting A Data Furnisher

When disputing credit report errors, the FTC recommends sending a dispute letter to the data furnisher as well. A data furnisher is a financial institution, such as a lender or credit card issuer, that provides data to the credit bureaus. Each credit report that includes the error should list the furnishers name and address. If you dont see an address listed, contact the company.

Once you submit your dispute to the furnisher, it has 30 days to conduct an investigation. If it finds that the information youre disputing is inaccurate, it is required to notify each credit bureau it has reported the information. However, if the information is found to be accurate, it will remain on your credit report.

How Does A Repossession Affect My Credit Score

The number of points that will be taken out from your credit score will vary depending on your individual circumstances, however, this point drop will typically range from 50 to 150 points. Take note that aside from the repossession itself, the missed payments leading to the repossession also play a role in chipping off points from your credit score.

If you plan to apply for mortgage, personal loans, or even credit cards, having a repossession included in your credit report may discourage lenders from giving you the best deals or you may not even be eligible for a loan if the repossession is very recent. This is because a record of repossession somehow gives out the message that you are not a good risk and you may be capable of making timely payments on the loan that you are applying for.

The impact of the repossession will lessen as the years pass, depending on whether you have improved your financial status. If you are able to rebuild your credit score to a good or very good rating, a repossession that is 4 to 5 years old may not affect you that much compared to its impact during the first year of repossession.

If the repossession on your credit report is the only negative entry thats keeping you from reaching a good credit score and getting new lines of credit, you may want to try having it removed from your credit report.

Don’t Miss: Aargon Collection Agency Address

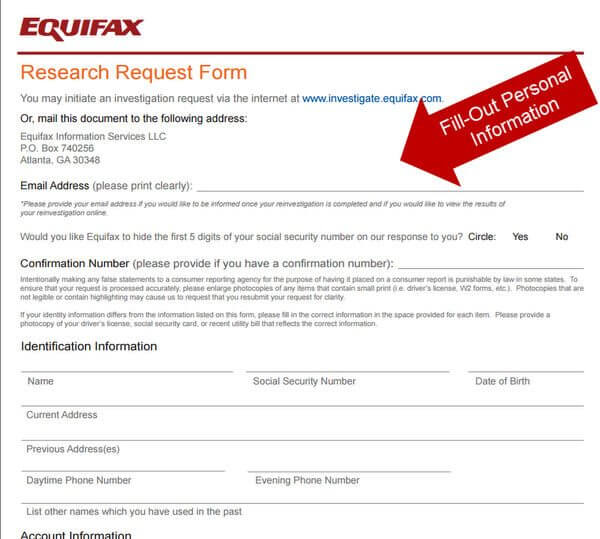

Documentation To Provide For Your Dispute

In addition to the above, you’ll need to provide:

-

Proof of identity

-

Your Social Security number and date of birth

-

A copy of government-issued identification

-

Your current address and past addresses going back two years

-

A copy of a utility bill or bank or insurance statement that includes your name and address

Try To Negotiate New Payments

Your first option is to start negotiating with your original auto lender. This could be a bank, an online lender like Capital One, or the in-house finance company at the dealership.

You may be wondering how you could possibly negotiate a deal after the lender already repossessed the car? That is a very good question.

Your leverage is the fact that you owe money. If you can get the right person on the phone someone with the authority to make policy decisions you can propose a deal: Paying off the balance of the loan in exchange for getting the negative mark off your credit report.

If you do strike this kind of deal, get the details in writing before making the payment or payments.

Other than coming up with the cash, the most difficult part of this strategy is getting the right person on the phone. Youll need some persistence.

And, this strategy assumes you could come up with the payment which I know isnt a given. So if this wont work for you, move on to the next step.

Also Check: Itin Credit Report

What To Do If The Complaint Is Not Solved With Equifax

If your complaint is not solved with Equifax then what can you do? What if the credit bureau does not respond in 30 days. Here is another example of such kind of problem that I am going to share with you. Someone from Georgia sent a statement and police report to Equifax one month before. However, what happened to him after one month? Please stick to the context I am describing to you the full incident.

After one month, the dispute was complete and all 3-fraud accounts came back as belonging to him, which is a lie. The creditors are B.O.A, Capital One, and Macys. Then he filed a complaint with the Consumer Finance Protection Bureau against Equifax that initiate another dispute. After this, he has to wait for another 15 days for the outcome of his complaint to CFPB according to the CFPB guideline.

Wait Up To 45 Days For The Results

After you dispute credit reporting errors with a credit bureau, it typically has 30 days to investigate your claim. It must notify you of the results five days after completing the investigation. However, it can take up to 45 days under the following circumstances:

- Youve submitted a dispute after receiving a free credit report from AnnualCreditReport.com

- During the 30-day investigation window, you submit new materials and documents

Also Check: Eviction Credit Report

Contact The Creditor Directly

Contact the creditor that furnished the incorrect information, and demand that it tell the credit reporting agency to remove the data from your report. You can use Nolo’s Request to Creditor to Remove Inaccurate Information or write your own letter. If you get a letter from the creditor agreeing that the information is wrong and should be deleted from your credit file, send a copy of that letter to the agency that made the flawed report.

If you already contacted the creditor directly, it doesn’t have to deal with this dispute again unless you supply more information. But if you escalate your complaint, like to the president or CEO, because you believe the dispute was not properly investigated, and you demonstrate a strong basis for your belief, the company is likely to respond.

If the company can’t or won’t assist you in removing the inaccurate information, contact the credit reporting agency directly. Credit reporting agencies have toll-free numbers to handle consumer disputes about erroneous items in their credit files that aren’t removed through the normal reinvestigation process. Go to the Equifax, Experian, and TransUnion websites to find contact information for these three nationwide credit reporting agencies.

Place A Credit Freeze

Contact each credit reporting agency to place a freeze on your credit report. Each agency accepts freeze requests online, by phone, or by postal mail.

Experian

PO Box 26Pittsburgh, PA 15230-0026

Your credit freeze will go into effect the next business day if you place it online or by phone. If you place the freeze by postal mail, it will be in effect three business days after the credit agency receives your request. A credit freeze does not expire. Unless you lift the credit freeze, it stays in effect.

Recommended Reading: Open Sky Unsecured Credit Card

Fixing Credit Report Errors

To ensure mistakes are corrected as quickly as possible, contact both the credit bureau and organization that provided the information to the bureau. Both these parties are responsible for correcting inaccurate or incomplete information in your report under the Fair Credit Reporting Act.

Keep in mind that all three of the credit bureaus now accept the filing of disputes online, with Experian now only accepting online submissions.

Find out how to initiate a dispute online.

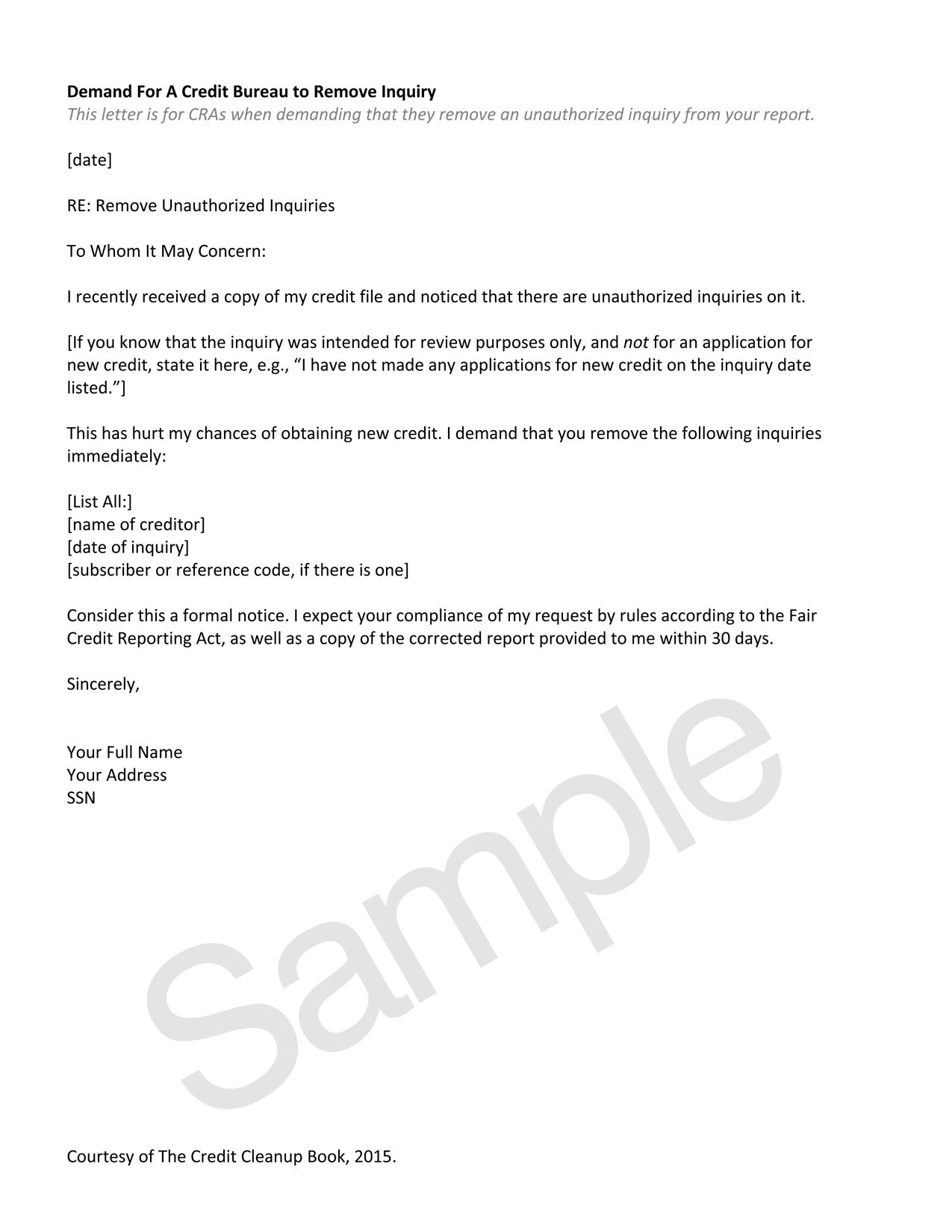

Begin by telling the credit bureau what information you believe is inaccurate. Credit bureaus must investigate the item in question-usually within 30 days-unless they consider your dispute frivolous. Include copies of documents that support your position. In addition to providing your complete name and address, your communication should:

- Clearly identify each disputed item in your report.

- State the facts and explain why you dispute the information.

- Request deletion or correction.

You may also want to enclose a copy of your report with the items in question circled. Your communication may look something like this sample.

If mailing a letter, send it by certified mail, return receipt requested, so you can document that the credit bureau did, in fact, receive your correspondence. Also, keep copies of your dispute letter and enclosures. If you want help disputing mistakes on your credit report, myFICO can help you write a free letter in minutes.