What To Remember When You Are Rate Shopping

If you need a loan, do your rate shopping within a focused period such as 30 days. FICO Scores distinguish between a search for a single loan and a search for many new credit lines, in part by the length of time over which the inquiries occur.

When you look for new credit, only apply for and open new credit accounts as needed. And before you apply, it’s good practice to review your credit report and FICO Scores to know where you stand. Viewing our own information will not affect your FICO Scores.

As a general rule, it is OK to apply for credit when needed. Be mindful of this information so you can start the credit-seeking process with more confidence.

Estimate your FICO Score range

Answer 10 easy questions to get a free estimate of your FICO Score range

Wrapping Up: What A Hard Inquiry Really Is

A hard inquiry is a record of your credit application. Its not your employer, yourself, or a credit company pre-qualifying you for credit.

Those do not count, even though they are inquiries.

It is the hard inquiries the ones that show you applying for new credit that future lenders and credit card companies consider and that you should use with caution.

Expert Credit Resources:

Do Credit Inquiries Affect My Fico Score

FICO’s research shows that opening several credit accounts in a short period of time represents greater credit risk. When the information on your credit report indicates that you have been applying for multiple new credit lines in a short period of time , your FICO Scores can be lower as a result. Although FICO Scores only consider inquiries from the last 12 months, inquiries remain on your credit report for two years.

If you apply for several credit cards within a short period of time, multiple inquiries will appear on your report. Looking for new credit can equate with higher risk, but most are not affected by multiple inquiries from auto, mortgage or student loan lenders within a short period of time. Typically, these are treated as a single inquiry and will have little impact on your credit scores.

Don’t Miss: What Is The Average Credit Score To Buy A House

Hard Inquiries Should Be Removed After 2 Years

The only way that a dispute will work is if the inquiry appears in error on your credit report. Fortunately, hard inquiries only appear for two years on your credit report. Most other negative information will remain for seven years. A Chapter 7 bankruptcy remains for up to 10 years, though its effects on your credit score are much more short-lived.

How Many Hard Inquiries Is Bad

Having a long, consistent history of hard inquiries is not great if you expect to apply for more loans in the future. However, if you are shopping around for loan options, the credit bureaus see this as one event. Depending on the credit bureau, a series of hard inquiries within a 14- to 45-day timeframe will generally be considered as one hard pull.

If you apply for several credit cards within a short period of time, multiple inquiries will appear on your report, FICOreports. Looking for new credit can equate with higher risk, but most credit scores are not affected by multiple inquiries from auto, mortgage, or student loan lenders within a short period of time. Typically, these are treated as a single inquiry and will have little impact on your credit scores.

Hard inquiries will likely remain on your credit report for as long as 2 years. After 1 year, it no longer impacts your credit score.

There is no benchmark for when you have too many hard inquiries, but think about patterns of behavior. If you apply for new credit cards every 2 months for a year, for example, lenders might question your creditworthiness.

You May Like: How Long Do Student Loans Stay On Your Credit Report

Preventing Unauthorized Hard Inquiries

To prevent future unauthorized hard inquiries, consider placing a freeze on your credit report. This option prevents any lenders or creditors from accessing your credit information.

Its great for preventing identity theft because no one can open a new credit account using your financial information since they wont get approved without a credit check. However, it also helps prevent unwanted inquiries if you find this to be an ongoing headache.

Placing a freeze on your credit report and having it removed incur separate fees in most states. So, dont do this if you intend to apply for a new credit card or loan in the near future. But if you anticipate your financials to remain the same for the time being, this can be a convenient option to keep your credit nice and clean.

What Are Inquiries On Your Credit Report

Anytime you seek credit from a lender or credit card issuer, that organization will want to see your track record as a borrower. You can check your credit report before applying for new credit to get an understanding of what they’ll see on your report. Your past and current financial behavior, such as payment history and balances on loans and credit cards, helps lenders decide whether to work with you.

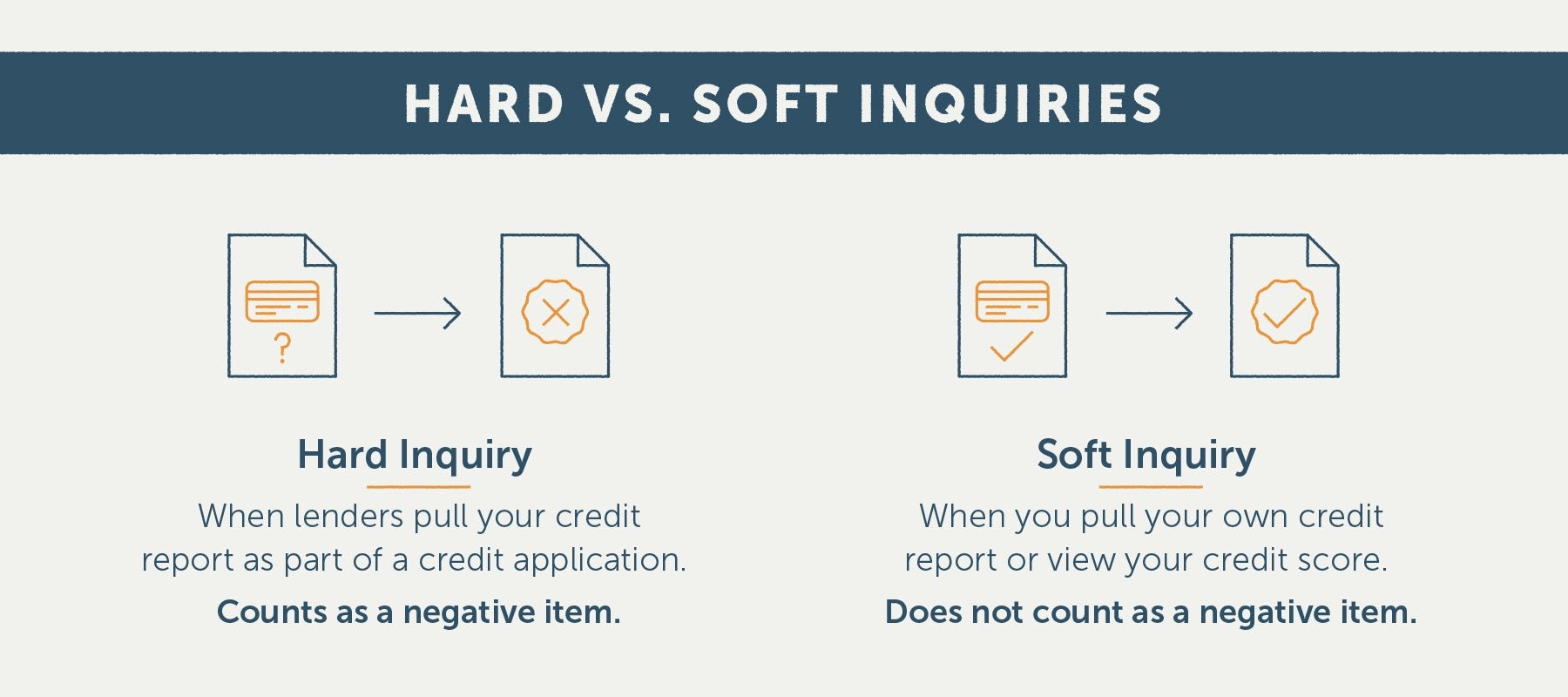

Lenders could interpret several missed bill payments, for instance, as a sign that you’re likely to miss a payment again in the future. That could lead to you getting denied for a loan or being charged higher interest rates. To get the information it needs, the lender must request your credit file from the credit bureaus, and that results in a hard inquiry. That inquiry, in turn, will appear on your credit report.

In contrast, a soft inquiry occurs when you check your own credit, for instance, or when a company wishes to prequalify you for a loan offer, but you haven’t yet submitted a full application. Soft inquiries do not impact your credit score.

Also Check: How Do You Check Your Child’s Credit Report

Why Does A Hard Inquiry Affect Your Credit Score

Your credit score is a measure of how likely you are to repay your debts. When a loan application triggers a hard inquiry, it signifies that you are requesting to open a new line of credit, which adds an extra degree of uncertainty to the likelihood of you keeping up with your payments.

While one hard inquiry might put a dent into your credit score, too many hard inquiries will add up and significantly lower your credit score. It might also throw up red flags for lenders, who will think twice about approving a loan. Kelly says that creditors might wonder “why is this person getting credit? What’s happening? Why do they need all four or five new accounts?”

When you’re shopping around for the best rates on a loan, you may incur multiple hard inquiries as you submit applications to several lenders. Fortunately, you are allowed to rate shop for 30 days after your first hard inquiry. This means that all the hard inquiries that you rack up while shopping for a loan will only be calculated as one inquiry on your credit score, though all the inquiries will still show up on your credit history.

Note: Rate shopping doesn’t apply to credit card applications. Each hard inquiry requested by a credit card company will be factored independently on your credit score.

When To Be Cautious

New lines of credit represent only 10 percent of your credit score, according to myFICO.com, but that doesnt mean you should rack up hard inquiries without giving it a second thought.

- Although credit checks are factored into your credit score for only 12 months, they remain on your credit report for two years.

- Credit checks can have a greater impact for someone with a short credit history and few accounts, compared with someone who has a long history and wide range of credit experience.

- To a lender reviewing your credit report, many hard credit checks in a short time may indicate higher credit risk because it could appear that you are trying to get a lot of credit quickly.

- Drops in your credit score can result in higher interest rates when you borrow, which means you pay more over the life of a loan.

Recommended Reading: Can Student Loans Be Removed From Credit Report

How Long Do Hard Inquiries Stay On Your Credit

Hard inquiries stay on your credit reports for two years, but they only affect your FICO® Scores for one year.

The impact of a single hard inquiry is relatively small, usually dinging your FICO® Score five points or less. You can gain those points back over just a few months’ time, however, with positive credit habits such as paying down debt and making all your payments on time.

If you accrue several hard inquiries by applying for different types of credit within a short period of time, however, your scores may experience a bigger drop. Multiple applications can also hurt your chances of getting a new loan, since they indicate to lenders that you’re potentially taking on lots of new debt all at once. The exception is if you’re rate-shopping for a mortgage or car loan and multiple lenders request your report within a short period of time: Although you will see each individual inquiry listed on your report, most credit scoring models will only count them as one.

S To Take If You Do Not Get The Results You Want

If the investigation resulting from the dispute process does not go your way, you have several options:

- You can dispute directly with the creditor that reported the inaccurate information, including getting documentation or written verification.

- You can submit additional documents to the credit reporting company.

- You can request a brief statement related to your dispute to get added to your credit report.

- You can file a complaint with the Consumer Financial Protection Bureau or reach out to your states Attorney Generals office.

You May Like: What Credit Score Do They Use To Buy A House

Whats The Difference Between Hard And Soft Inquiries

As mentioned, there are two types of inquiries that can appear on your credit report: hard and soft. Soft credit checks have a few notable differences from hard inquiries:

- Theyre unrelated to applications for credit

- They dont hurt your credit score

- Anyone can run a soft credit check without asking your permission or notifying you

- Only you can see them on your credit report

It’s More Than Just The Effect On Your Credit Score

A hard credit inquiry is when a lender checks your credit before approving you for a loan, such as a mortgage or car loan, or a credit card youve applied for. A soft inquiry happens when you receive an offer from a lender, like a pre-approved credit card, or when you check your own credit.

But do you know why hard inquiries happen instead of soft inquiries? What about the differences between the two? How about whether an inquiry is going to be hard or soft before it happens or whether there are repercussions for either? Learn the similarities and differences between hard and soft credit checks and more.

Don’t Miss: What Do You Need To Get A Credit Report

Hard Pulls Vs Soft Pulls

Along with hard pulls, soft credit inquiries also exist that do not appear on your credit report and have no effect on your credit score. Checking your credit report yourself or applying for a pre-approved credit card are considered soft pulls. Other cases, like a periodic review of your credit by a company already lending to you or the Internal Revenue Service verifying your identity, can also result in soft pulls.

Importantly, checking your credit report yourself has no effect on your credit report or credit score.

Does Rate Shopping Affect Your Credit

No, rate shopping doesnt usually affect your credit. The major credit scoring models dont want to punish you for being responsible and seeing what interest rates and terms different companies can offer you when you only intend to take out a single loan.

For this reason, they have a rate-shopping window where multiple inquiries for the same type of loan are counted as one. This prevents your credit score from dropping significantly while you look around for the best loan.

VantageScore offers a 14-day grace period, which applies to every type of credit. 4 By contrast, newer FICO models offer a 45-day grace period, but it only covers inquiries for student loans, auto loans, and mortgages. 5

In addition, FICO doesnt lower your credit score right away when a hard inquiry appears on your credit report. Theres a 30-day buffer period before hard inquiries appear on your report and lower your score.

Also Check: What Credit Score For Care Credit

Best Practices To Mitigate Hard Inquiries

Because the impact on your credit history is relatively small, you shouldnt worry too much about hard inquiries if you are responsibly shopping around for a new lender.

The best way to reduce the effect of hard inquiries on your credit score is to improve your overall credit history. Focus on making loan repayments on time and reducing your overall amount of debt.

The first step toward improving your credit report is to see it yourself. There are now manyfree ways to check your credit score and credit report. Many banks now offer this service free to customers.

How To Minimize The Number Of Hard Inquiries You Have

Hard inquiries aren’t bad to have even if they may cause a slight temporary dip in your credit scores but it can be good practice to know how to minimize the number of inquiries on your credit report.

Below, CNBC Select rounded up some general guidelines to keep track of your hard inquiries:

- Don’t apply for several credit cards within a short timeframe. Experts generally recommend only applying for a credit card every six months.

- Only apply for credit cards you would actually benefit from using.

- Make sure you check your credit score beforehand . You can do so for free with most card issuers, using apps such as Discover’s Credit Scorecard and Chase’s Credit Journey .

- Before applying for a credit card, shop around with prequalification tools, which allow you to check your likelihood of qualifying for a card without damaging your credit.

Don’t Miss: How To Access Free Credit Report

How Rate Shopping Affects Your Credit Score

The FICO score ignores all mortgage and auto inquiries made in the 30 days before scoring. If you find a loan within 30 days, the inquiries wont affect your score while youre rate shopping.

The credit-scoring model recognizes that many consumers shop around for the best interest rates before purchasing a car or home, and that their searching may cause multiple lenders to request their credit report. To compensate for this, multiple auto or mortgage inquiries in any 14-day period are counted as just one inquiry.

In the newest formula used to calculate FICO scores, that 14-day period has been expanded to any 45-day period, Watt said.

This means consumers can shop around for an auto loan for up to 45 days without affecting their scores.

If youre wondering how to get the most bang for your buck while rate shopping, a nonprofit credit counselor can help walk you through the process. The advice is free and can save you from committing a costly error while perusing over various rates.

To sum things up, soft inquiries have no effect on your credit score. They happen all the time without your knowledge, so dont worry about them. A single hard inquiry will go mostly unnoticed by the credit bureaus. Any damage done will mend itself in a couple months.

However, if you make too many hard inquiries in a short enough period of time, your credit score will plummet.

5 MINUTE READ

When Does A Hard Inquiry On Your Credit Score Occur

Its important to keep an eye on your credit report so that youre alerted to any significant fluctuations of your credit score. Many people worry that when lenders make what is known as a hard inquiry to check their credit it could have a negative impact on their score. However, thats not necessarily the case.

Also Check: Who Looks At Your Credit Report

How To Dispute A Hard Inquiry On Your Credit Report

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

If youve checked your credit reports, you may have noticed youre not the only one taking a peek.

-

Utilities use them to decide whether to charge you a deposit.

-

Companies may check your credit standing so they can market products to you.

-

Potential landlords and employers may look to see how reliable you are.

Inquiries stay on your report for two years, but not all of them affect your score. Heres what you need to know about when and how to remove a hard inquiry from your credit report.

Hard Inquiries Sometimes Appear In Error

There are several reasons that inaccurate hard inquiries might appear. All of them impact whether you receive credit and loans, and the interest rates that you receive for these loans. One cause of error is identity theft. When you receive a fraud alert, itâs sometimes because someone is using your personal information that they gained through identity theft to apply for credit or a loan in your name.

A hard credit inquiry carried out through identity theft will hurt your credit score, so the inquiry itself is worth disputing. If the fraud threatens immediate harm, you can put a on your record, to prevent anyone from accessing it until the issue is resolved.

Hard inquiries are supposed to last for only two years on a credit report. If one is older than two years, itâs in error. The mistake still hurts your credit score, so you should contest it. Additionally, a hard inquiry from a single application could mistakenly appear on your credit report multiple times. This is an innocent slip up, but you should still dispute it.

Sometimes retailers or lenders run unauthorized hard inquiries, where they look up a credit report by mistake and/or without permission. This can also happen if a merchant sends out multiple inquiries to try to get you the best financing for a loan. In situations like this, as long as the inquiries are all within 14 days of each other, they will only count as one inquiry against your credit score.

Don’t Miss: How Long Does Bankruptcy Take To Come Off Credit Report