My Student Loans Were Just Paid In Full Will This Improve My Credit Score

-SLQ

Dear SLQ,Paying off your student loans is a great accomplishment. Once your lender notifies the credit bureaus that the loans are paid in full, you will see them updated to reflect that on your credit reports. How this change will impact your credit scores can depend on several factors, such as your account history prior to paying off the loans and your overall credit situation. If your account is in default when paid off, you may see an increase in scores, but it’s also possible to see a small dip in scores after paying off a loan. This is especially true if there are no other active installment loans in your credit history. However, this dip is usually temporary.

When Youre Having Problems Paying Your Student Loans

If youre having trouble paying your student loans on time, you may be able to make your loans more affordable, either with a federal income-based repayment plan or by refinancing with an extended loan term.

When you start making your payments by the due date each month, you may see that your student loans can become a more positive part of your credit report. Again, while these options provide short-term relief, they generally will result in paying more over the life of the loan.

Do You Need Good Credit To Apply For Student Loans

Many federal student loans donât require you to undergo a credit check, so your credit score isnât a factor. Direct PLUS loans are an exception: They do require a credit check, but your credit wonât affect your interest rate. All PLUS loans are disbursed at the same rate in a given year.

Many private student loans require a co-signer when you apply. As with other private loans, youâll need to undergo a credit check to see whether you qualify, and if you do, a higher credit score will mean a lower interest rate.

Recommended Reading: How Does Credit Utilization Affect Your Credit Score

How Credit Scores Affect New Student Loans

All of your student loans can affect your credit. But you dont need good credit to take out a student loan in the first place.

-

For federal loans: Most types of federal student loans, including all federal loans for undergraduates, dont require a credit check. Federal direct PLUS loans, available to parents and graduate students, do require one. However, your credit score wont affect your rate all PLUS loans disbursed in the same year have the same rate.

-

For private loans: Private loans require that at least one borrower have good credit. The lender will perform a credit check to determine whether you qualify for the loan. The higher your credit score, the lower the interest rate youll likely receive. Often, undergraduate students need a co-signer to qualify for private student loans.

About the authors:Teddy Nykiel is a former personal finance and student loans writer for NerdWallet. Her work has been featured by The Associated Press, USA Today and Reuters.Read more

Bev O’Shea is a former credit writer at NerdWallet. Her work has appeared in the New York Times, Washington Post, MarketWatch and elsewhere.Read more

Sol And Credit Reporting

Its not uncommon to confuse the Statute of Limitations with credit reporting timelines. The SOL is the time in which a lender has to bring a lawsuit. Federal loans are not subject to an SOL. Private loans ARE subject to SOL, based on either the State where the borrower resides, or the State that controls the contract. Contact a lawyer if youre trying to figure out what controls your private student loan.

The time limit to report on credit reports has nothing to do with SOL. Just because an SOL has run, doesnt mean a debt should be removed from your credit. In fact, an SOL may expire with no lawsuit taking place, but you still owe the debt. The lender cant enforce it, but you still owe it . So, often, a debt is still reportable even though the SOL has run. And the same goes the other way around. Just because a debt isnt reported on your credit, doesnt mean you dont owe it.

Again, credit reporting and time limit to sue are not related.

Recommended Reading: How To Fight Late Payments From Credit Report

How Long Does Student Loans Stay On Your Credit Report

Do student loans fall off your credit report?

- How long do student loans stay on your credit? Student loans will remain on your credit report until you pay them off, or they’re removed seven years after you default. …

- How long do defaulted student loans stay on credit reports? …

- What does it mean if my student loan is closed on my credit report? …

How Long Is A Debt Reported

Only a closed or defaulted account will eventually cease to be reported, known as aging off or fall off the report. Open accounts in good standing will be reported until closed or defaulted. While open, the creditor or servicer will update the report monthly.

Normally, a defaulted debt will fall off a report after 7.5 years from the date of the first missed payment. This applies to private student loans. For federal loans, the time is actually 7 years from the date of default OR from the date the loan is transferred from a FFEL guarantor to the Department of Education. And of course, there is an exception. Perkins loans never age off while a balance is due. If a Perkins loan is in default for more than 7.5 years, the trade line will continue to show until the loan is paid off, be it through an actual payoff or through consolidation. At that point, the trade line will simply disappear.

This creates an interesting phenomenon for federal non-Perkins student loans. A defaulted federal student loan, older than 7 years may not appear on a credit report. However, because there is no Statute of Limitations, collections can and will continue.

Don’t Miss: How To Remove Hard Inquiries From My Credit Report

Defaulting On Student Loans

Its also worth reviewing what happens when a student loan goes into default. One in ten people in the United States has defaulted on a student loan, and 7.8% of total student loan debt is in default, according to the Education Data Initiative.

The point when a loan is considered to be in default depends on the type of student loan you have. For a loan made under the William D. Ford Federal Direct Loan Program or the Federal Family Education Loan Program, youre considered to be in default if you dont make your scheduled student loan payments for a period of at least 270 days .

For a loan made under the Federal Perkins Loan Program, the holder of the loan may declare the loan to be in default if you dont make any scheduled payment by its due date. The consequences of defaulting on student loans can be severe, including:

The entire unpaid balance of your student loans, including interest, could be due in full immediately.

The government can garnish your wages by up to 15%, meaning your employer is required to withhold a portion of your pay and send it directly to your loan holder.

Your tax return and federal benefits payments may be withheld and applied to cover the costs of your defaulted loan.

You could lose eligibility for any further federal student aid.

What Does Account Closed Mean On A Credit Report

If you have closed credit card accounts, your credit report will indicate whether the account was closed by you or by the account issuer. You might close an account because of fees or poor service. The account issuer might close one because of default, late payments or inactivity.

If closing a credit card account does sway your score, its most likely because of something called utilization. is how much of your available credit limits youre using, and it plays a big role in scoring. Closing a card removes its credit limit, so any balances you have outstanding now look bigger in comparison to the lower overall available credit.

Paying off a loan or closing a credit card could also have a small effect on your score if it lowers the average age of your accounts or gives you a slimmer mix of credit types.

You May Like: How Accurate Is Creditwise Credit Score

You May Like: How Long Does A Derogatory Stay On Your Credit Report

Is There A Statute Of Limitations For A Debt Appearing On Your Credit Report

This is a fairly common question and highlights the confusion associated with the term statute of limitations. It is important to note the fact that the time limit to file a lawsuit and the time associated with a debt appearing on a credit report are not related.

The statute of limitations typically comes into play when someone is interested in learning about the amount of time a lender has to file a lawsuit against them. You should know that public loans are not subject to a statute of limitations.

In contrast, private student loans are in fact subject to a statute of limitations. The applicable limitations period will be predicated either on the state in which you reside or the state that controls the loan agreement.

You may be asking yourself, What happens to the debt that appears on the credit report when the statute of limitations expires? As mentioned previously, the two issues are not related. As a result, when a statute of limitations expires, it does not mean a debt will be, or should be, removed from your credit report.

Can Student Loans Be Deleted From Your Credit Report

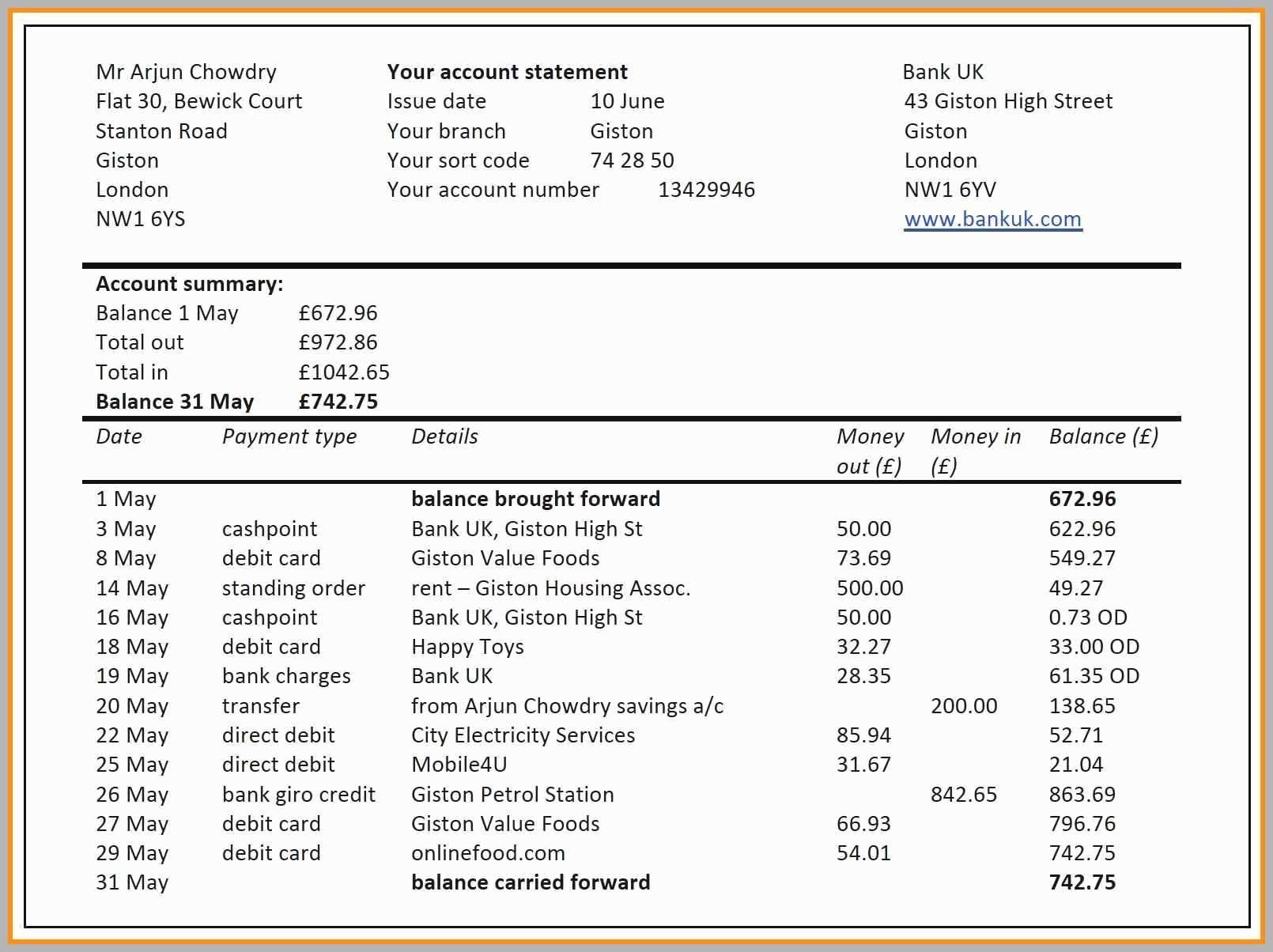

After you take out a new student loan, the lender will report it to the three major credit bureaus. Each loan will be listed as a separate account on your credit report. Federal student loans and private student loans may begin reporting while youâre still in school and in deferment. Your credit score wonât be harmed by student loans in deferment, but future lenders could consider your student loan debt when determining creditworthiness.

Once youâre out of school and making student loan payments, your payment history will be reported on your credit report. On-time payments and late payments will both be reported.

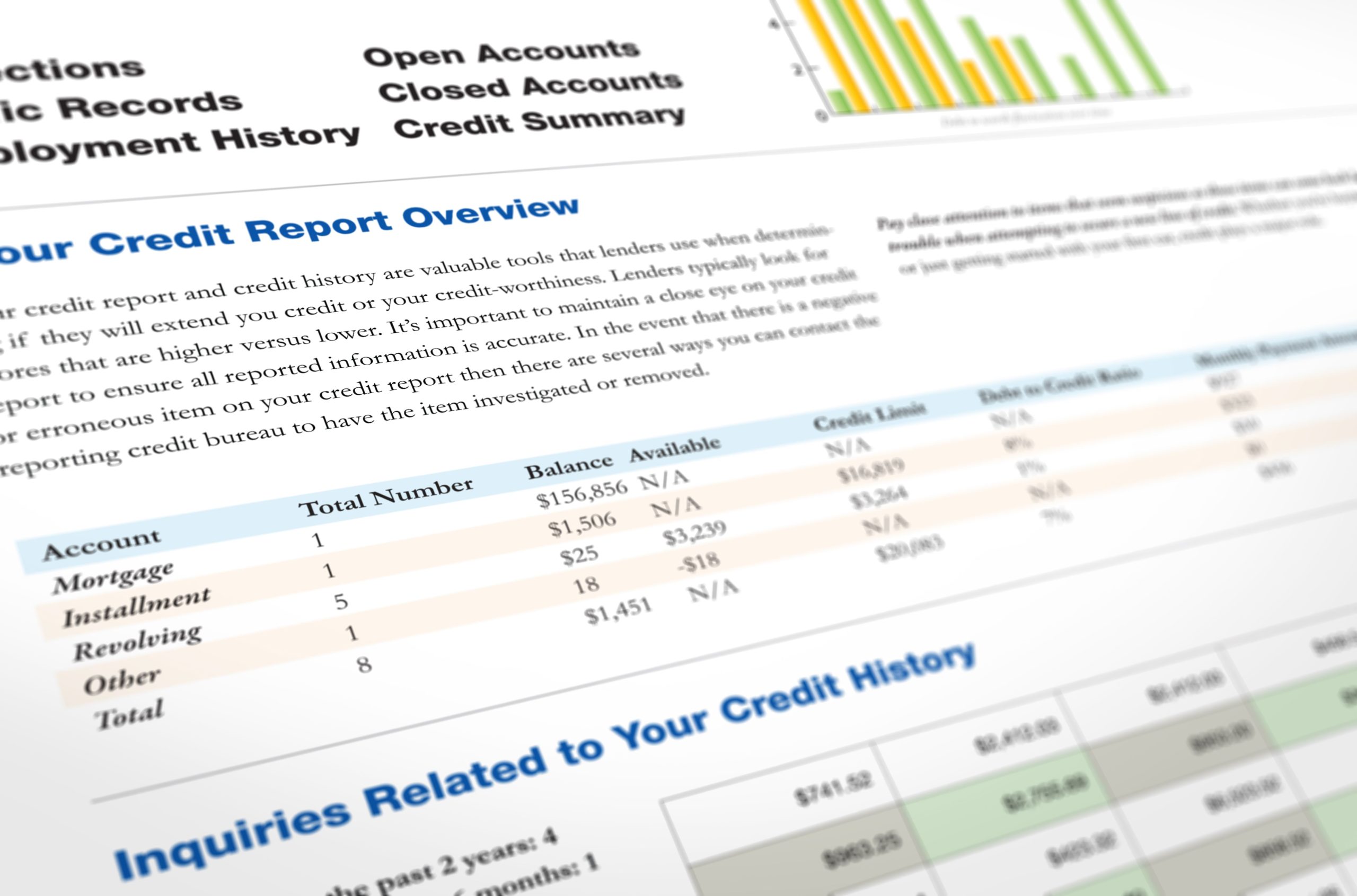

Itâs important to monitor your credit report to make sure that your student loan, credit cards, and other consumer accounts are being accurately reported. Incorrect credit reporting can harm your credit scores. You can have multiple credit scores, depending on which calculating software is used and which lender checks your credit score. The most well-known and widely-respected credit score is your FICO score, which takes into account the credit histories reported by the three major credit reporting bureaus listed above. It is particularly important that you monitor activity on your credit histories maintained by each of these bureaus.

There are three ways to request your credit report. Youâll want to regularly monitor your credit report from each credit bureau.

Also Check: Is 756 A Good Credit Score

Can You Garnish Your Wages If You Have Student Loans

There’s no statute of limitations for federal student loan debt. So even if your loans no longer show in your credit history, you still owe your loans. They didn’t go away. And that means the U.S. Department of Education can still garnish your wages, take your tax refund, and offset your Social Security Benefits.

Do Student Loans Ever Go Away

While there are few private student loan debt relief programs, there are many loan discharge options federal borrowers can take advantage of to wipe out their remaining loan balance.

Federal student loans go away:

- After 10 years â Public Service Loan Forgiveness.

- After at least 20 years of student loan payments under an income-driven repayment plan â IDR forgiveness and 20-year student loan forgiveness.

- After 25 years if you borrowed loans for graduate school â 25 year federal loan forgiveness.

Learn More:How to Apply for Student Loan Forgiveness

Recommended Reading: Will Checking My Credit Score Lower It

If You Want To Get Out Of Debt Entirely

Repayment

When student loans default, the full amount owed becomes due immediately. If you can afford that, you can pay off your loans and be done with your debt. Of course, that wont be possible for most borrowers. You may be able to negotiate a student loan settlement for less than you owe, but dont expect big savings.

Dont take on a personal loan to pay your student loans even if theyre in default. Personal loans typically carry higher interest rates than student loans. Explore other remedies that wont put you in more debt.

You can discharge defaulted student loans via bankruptcy, but federal student loans are trickier to get rid of through this process than other debts. Private student loans may be easier to discharge in bankruptcy.

Make sure bankruptcy is right for you because it has a long-term effect on your finances. If you go this route, look for a bankruptcy attorney who specializes in student loans.

Can Credit Repair Remove Student Loans

Credit repair is a service offered by numerous companies and is the process of fixing inaccurate credit history reports that appear on your credit report. Credit repair canât remove student loans that are correct on your credit report. You can dispute errors on your credit report for free. Be mindful of scams when it comes to companies offering credit repair.

Recommended Reading: How To Have A Good Credit Score

Taking On Student Loan Debt

models typically take the length of your credit history into account, so applying for any new debtincluding student loanscan adversely affect your score.

Of course, your student loan will eventually become an old account over time. If it’s the first debt you’ve applied for, it may actually help you start developing the long borrowing history lenders look for.

Borrowing a large sum to fund your education can also hurt your score because credit scoring formulas look at how much debt you owe overall.

Amounts owed is a key factor in determining your credit score. Credit card balances largely influence this component of your credit score, but installment loans like student loans play a role, too. Credit scores consider how much you owe compared to the amount you initially borrowed, so when you first take out a loan, youll have a high loan balance. But as you pay down the debt, youll show you can manage taking on debt and paying it off, which is good for your credit score.

Is It Possible To Have Your Student Loans Deleted From Your Credit Report

Yes, If you make a mistake on your student loans, the smallest of mistakes can lead to the immediate erasure of all or part of your debt.However, if youve repaid them , they may be removed from your credit report if reported incorrectly. You must dispute the record to remove it from your credit report

Also Check: Does Apple Card Affect Credit Score

You Know What’s Scarier Than Halloween Season Unpaid Student Loans And The Impact They Have On Your Credit

Shortly after graduate school, my husband took a job in northwestern Iowa. One of the first couples we befriended were two of the coolest people we’d ever met. He was a pilot, and she was a smart, sophisticated, private school grad from the East Coast. We bonded by being out-of-towners in an area that rarely welcomed new faces.

About a year into the friendship, they mentioned that they were purchasing the ranch on which they lived. We were a little surprised, having believed that they already owned the property. They seemed so successful and were quite a bit older than us. At some point during the loan process, the wife confided to me that they were having trouble securing a mortgage. They had both walked away from their student loans decades earlier and were now considered a high lending risk.

What I remember about that conversation was how incensed my friend was. “Can you believe they won’t just let that go?”

Um, yeah. I never got the impression that lenders were the forgiving types.

How Long Does Debt Stay On Your Credit Report

How long a collection stays on your credit report depends on the type of loan you have. Derogatory items may stay on your credit reports for seven to 10 years or more, according to the Fair Credit Reporting Act.

Heres how long you can expect derogatory marks to stay on your credit reports:

| Hard inquiries | |

| Money owed to or guaranteed by the government | 7 years |

| 7 years or until the state statute of limitations expires, whichever is longer | |

| Unpaid taxes | Indefinitely, or 7 years from the last date paid |

| Unpaid student loans | Indefinitely, or 7 years from the last date paid |

| Chapter 7 bankruptcies | 10 years |

Also Check: How To Get Credit Score Report

How To Change Student Loan Servicers

There are 7 circumstances in which you may change your student loan servicer or something you do might initiate a servicer change:

- Federal student loan consolidation

- Applying for Public Service Loan Forgiveness

- Filling out an Employment Certification Form for any loan forgiveness program

- Applying for a Total and Permanent Disability discharge

Removing Student Loans From Your Credit Report If Your Loans Were Wrongly Placed In Default

If your loans should have been placed in deferment or forbearance and something went wrong, it is possible that the loans were wrongfully placed in default. If that’s the case, the easiest way to figure out how to remove student loans from your credit report is to contact your loan servicer.

Your loan servicer may be able to correct the mistake if it conducts a review of your account history and discovers that a default was improperly reported. You also have the option to appeal the inaccurate information with Equifax, Experian and TransUnion just as you do with fraudulent loans.

If you can prove that you didn’t default because your loans should have been in forbearance or deferment, then you can get the record of the delinquency removed.

You May Like: How Long Is A Credit Report Good For Mortgage