What Credit Score Do I Need To Get A Credit Card

Home \ \ What Credit Score Do I Need to Get a Credit Card?

Join millions of Canadians who have already trusted Loans Canada

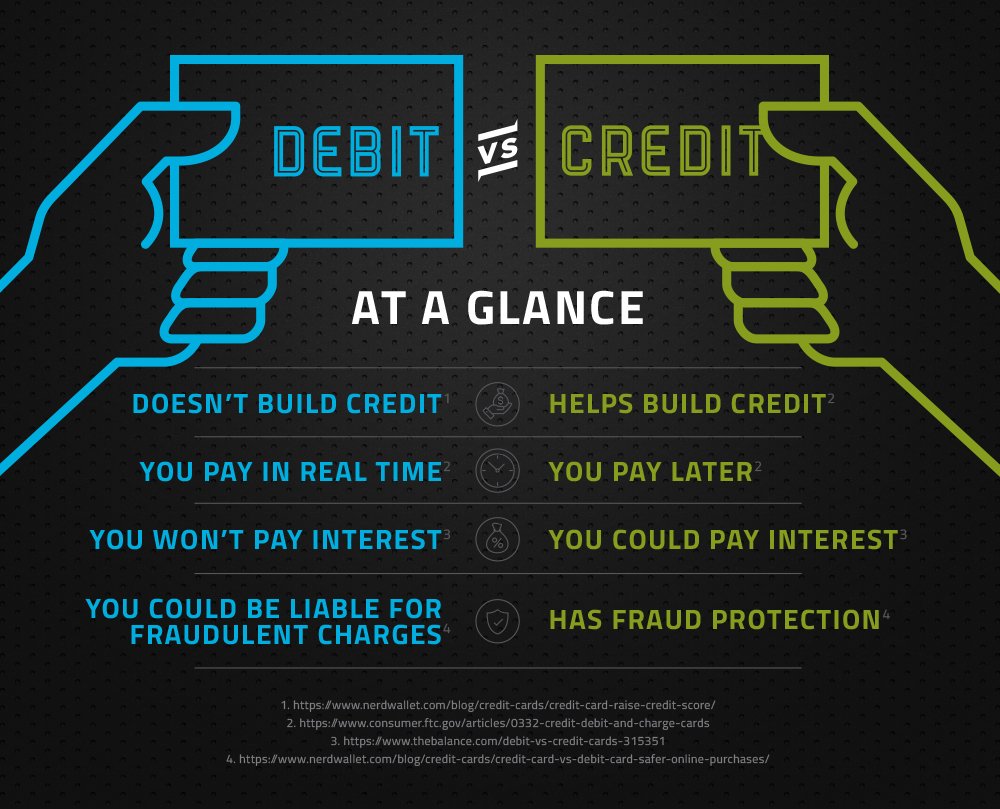

A credit card can help you manage your cash flows and can allow you to pay for expenses without having to put up the cash for it immediately. When applying for a credit card, one of the most important components is your credit score a numerical value between 300 and 900 that represents a borrowers creditworthiness. This value is calculated based on the individuals credit history which includes considerations for the number of open accounts, total debt, and payment history. From the lenders perspective, a borrowers credit score is the likelihood that the borrower will be able to repay their debt on time.

What Is A Good Credit Score

The standard for creditworthiness is a FICO score, a three-digit number, ranging from 300 to 850 that lets lenders know what sort of risk you pose as a borrower. Building a good credit score anything over 700 will help you borrow money at lower interest rates and receive credit cards that offer better rates, larger borrowing limits and more perks.

To get a FICO score, you must have a credit history, which means you need to get out of the invisible and unscorable categories. The first step in that direction usually is opening a credit card and making on-time payments over an extended period.

Protect Your Personal Information

Only share your Social Security number and personally identifiable information with those that really need it. Banks and lending institutions generally need this number. However, in the hands of a malicious operator, your personally identifiable information can be used to open other accounts that you dont know about. The damage caused by identity theft can ruin your credit and leave your good name tarnished with creditors for years.

Disclosure: CitizenPath partners with certain vendors who serve the immigrant community to bring you information about their services. Myra Wealth, Nova and Stilt are valued partners, but this is not a sponsored post.

Also Check: How To Get A Repossession Off Your Credit Report

Build Your Credit History For 6 Months

Whichever type of credit you choose, pay it off responsibly for at least six months. Make sure to make all of your payments on time. If you have a secured credit card, try to pay off the balance in-full every month.

After roughly six months to a year, you should have enough credit history to qualify for other financing. If you want to apply for large-scale financing such as a mortgage, you may wish to consult with a or housing counselor. These experts can help analyze your credit and make recommendations to help you get the approval you want.

Additional Resources

5701 West Sunrise Blvd. Fort Lauderdale, FL 33313

Cookie Policy

Thank you for your application!

Consolidated Credit has helped over 10.2 million people find relief from debt. Now were here to help you.

A Certified Credit Counselor will be calling you at the number you provided. Theyll complete your free debt and budget analysis, then discuss the best options for getting out of debt with you. If a debt management program is right for you, your counselor can also help you enroll immediately.

For immediate assistance, please call:

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

Read Also: Affirm Credit Score Needed For Approval

What Goes Into A Credit Score

Each company has its own way to calculate your credit score. They look at:

- how many loans and credit cards you have

- how much money you owe

- how long you have had credit

- how much new credit you have

They look at the information in your credit report and give it a number. That is your credit score.

It is very important to know what is in your credit report. If your report is good, your score will be good. You can decide if it is worth paying money to see what number someone gives your credit history.

Your credit history is important. It tells businesses how you pay your bills. Those businesses then decide if they want to give you a credit card, a job, an apartment, a loan, or insurance.

Find out what is in your report. Be sure the information is correct. Fix anything that is not correct.

Will I Have A Credit Score If I Never Had A Credit Card Or Loan Before

Get answers to commonly asked questions related to the credit score and credit reports

When you have not borrowed in the past or have never had a Credit Card or a loan, there will be no updates about you with the credit bureau, who mark such cases as NH or ‘No History’. Due to a lack of details, the credit bureau will be unable to comment on your payment behaviour. In such cases, some banks / financial institutions/NBFCs may not provide you with any unsecured credit facilities.

Recommended Reading: Highest Credit Score Possible 900

Get A Student Credit Card

If youre a student, you may qualify for a student credit card. These cards are designed for college students who may not have enough income or credit history. To qualify, you may have to provide proof that you’re enrolled in a qualified college or university.

There are several great student credit cards that you can choose from. Narrow down your options by comparing student credit cards based on the fees, interest rate, and other perks.

Some credit card issuers allow you to use use scholarships, grants, or work study as income to qualify for a credit card.

Is It Worse To Have No Credit Than Bad Credit

If you have no credit, it means creditors dont have a good way to predict how likely you are to pay your bills as agreed. Its not the same as bad credit, which means you have a credit history with major blemishes.

What is the lowest score to buy a house? Minimum Credit Score By Mortgage Loan Type

| Type of loan |

|---|

What is a good credit score 2020?

For a score with a range between 300 and 850, a credit score of 700 or above is generally considered good. A score of 800 or above on the same range is considered to be excellent. Most consumers have credit scores that fall between 600 and 750.

Can you recover bad credit? The short answer is that it usually takes at least a year to recover from bad credit, assuming you do everything right. But it all depends on your starting point, the length of your credit history and the moves you make going forward.

Read Also: How To Report To Credit Bureaus On Tenants

Best Unsecured Credit Cards For No Credit

You cant get your own credit card account at 16 because the law prohibits issuers from offering credit cards to anyone under 18 years old. The only way to get access to a credit card at 16 years old is if a friend or family member makes you an on their account. You wont be responsible for bill payments as an authorized user, but you will build credit as long as the primary cardholder pays on time.

What Lenders Are Looking For

If you have a thin file, lenders might be reluctant to let you borrow from them. This might seem counterintuitive â if you have never got into debt or had to borrow money, shouldnât you be the perfect customer?

However, creditors are not looking for someone who has always had enough money to cover their expenses, but rather for someone who knows how to manage credit well. They want to make sure that you can repay your debt and if you have done so in the past, they know that youâre more likely to do so in the future.

Read Also: Credit Score Needed For Les Schwab Account

Factors That Affect Your Ability To Get A Credit Card

Credit card issuers will also look at other factors besides your credit score when reviewing your application. One of the most important considerations is your income whether or not it is a steady source of income that is sufficient to pay back your debt. Card providers will also consider how you have utilized previous credit accounts. Even with a good credit score, it is still possible for your credit card application to be denied if you have too much existing debt or limited credit history.

Additionally, lenders will consider an applicants credit history which provides a more holistic view of long term credit tendencies rather than just a single score or rating. includes detailed reports of whether previous debts have been paid in full and on time, and whether the debtor tends to keep a balance on their credit cards.

Usually, credit card providers prefer to offer credit to those who are employed full time. Students, retirees, part-time workers and self-employed workers may find that they are eligible for lower credit amounts and have limited options in regards to which credit card they qualify for.

Check With Your Utility Company

The majority of utility providers only report derogatory information to the credit bureaus, but if you live in Detroit and you pay your bills on time, youre in luck. DTE Energy reports all payment histories, both positive and negative. Customers who pay their bills on time benefit from responsible management of this household expense.

Not in Detroit? Contact your utility provider to find out if it reports to the credit bureaus, and if so, put the bill in your name. If not, you can still use the positive payment history to your advantage. Most utility providers are happy to provide a letter of reference for an account holder in good standing.

You May Like: Credit Score Without Ssn

It Can Affect Your Finances

Financial institutions look at your credit report and credit score to decide if they will lend you money. They also use them to determine how much interest they will charge you to borrow money.

If you have no credit history or a poor credit history, it could be harder for you to get a credit card, loan or mortgage. It could even affect your ability to rent a house or apartment or get hired for a job.

If you have good credit history, you may be able to get a lower interest rate on loans. This can save you a lot of money over time.

Can I Expect The Fico Score Version I Receive From Wells Fargo To Change

FICO® periodically updates its scoring models and Wells Fargo may choose to upgrade to a more updated score version. If this happens, we’ll notify you when a change to the score version change occurs. You can locate the score version on your FICO® Score display. It is listed directly below the score and rating.

Read Also: Is Mrs Bpo Legit

What Does Your Credit Score Start At

It all depends on how you start using credit. Some people wonder whether the starting credit score is zero, for example, or whether we all start with a credit score of 300 . The truth is that theres no such thing as a starting credit score. We each build our own unique credit score based on the way we use credit.

If you havent started using credit yet, you wont have a credit score. You begin to build your credit score after you open your first line of credit, such as a credit card or a student loan. At that point, your credit score is determined by the way you use that initial credit account. As lenders report your credit activity to the three major credit bureaus , youll begin to build a credit file that will be used to determine your starting credit score.

According to FICO, the minimum scoring criteria is as follows:

It is important to note that you can meet these requirements with just one account or several.

What is the starting credit score? Thats the wrong question to ask, since the answer doesnt technically exist. Instead, ask yourself how you can build the best credit score possible.

Why Do You Need Good Credit

When you start using credit responsibly, your improves and you will gain enormous advantages from both a convenience and financial perspective.

And when was the last time you saw someone pay for a restaurant meal with a check?

Having a credit history is crucial for bigger purchases, too. If you want to buy a car and need a loan, the dealership will run a credit check and look at your credit score.

If youre planning to rent an apartment, expect a credit check as part of the vetting process. Cable companies and utilities check your credit and, if you dont have a solid credit history, will require a security deposit.

Sometimes, prospective employers will access your credit rating when they are deciding whether to offer you a job.

So, having a credit history, and the credit report and credit score that go with it, is vital to your financial future. Here are some ways to get out of the credit invisible or unscorable categories.

Also Check: Prosper Webbank On Credit Report

How Is Your Credit Score Calculated

If you want to build and maintain a good credit score, you need to know how a credit score is calculated. Your FICO credit score is based on the following five factors:

- Payment history : Your history of on-time payments is the most important factor that makes up your score. Even if you can only make the minimum payment on your credit cards, make sure you make it on time.

- Amounts owed : This is your . Try to keep the amounts you owe below 30 percent of your available credit. If you have a credit card with a $1,000 credit limit, for example, try to keep your outstanding balance below $300. If your balance gets any higher, do your best to pay it off as quickly as possible.

- Length of credit history : This represents how long youve been using credit is another key role to building your credit score. If you are new to credit, your credit history isnt going to be very longbut its only a matter of time.

- The different types of credit accounts under your name also play a key role. Your credit score could improve if you have both revolving debt and installment debt in your credit historybut dont worry if you havent taken out any loans yet. You can still establish a good credit score with just credit cards.

- New credit : The last factor of your credit score is based on how often you apply for new credit. Try to wait three to six months between credit card applications to avoid lowering your credit score with too many new credit requests.

How Can I Check My Credit Score Without Lowering It

You May Like: Syncb/ppc On Credit Report

I Opted In But It Says No Score Is Available Why

The most common reasons a score may not be available:

- The credit report may not have enough information to generate a FICO® Score

- The credit bureau wasnt able to completely match your identity to your Wells Fargo Online® information. To keep your information current, sign on to Wells Fargo Online®, visit the Profile and Settings menu, select My Profile and then Update Contact Information. Make sure your email addresses, phone numbers, and mailing addresses are current.

- If you’ve frozen your credit with the credit bureau, you may not immediately receive a credit score. A score should become available for you to view after the next monthly update. Contact Experian® with further questions.

How Will I Know If My Fico Score Is Available

If your account is eligible, the link to View Your FICO® Credit Score will automatically display on your Account Summary screen. Just select the link to opt in and view your FICO® Score.

Note: You can also access your FICO® Score in Spanish with your smartphone.

- Direct your mobile browser to wellsfargo.com or download the Wells Fargo Mobile® app.

- You can update your setting any time on the Language Preference screen. Just sign on to your account, go to the Profile and Settings menu, and select Language Preference.

Also Check: Is An 820 Credit Score Good

Apply For A Passbook Loan

Along the same lines is a passbook or first step loan. This is a loan that, again, is backed by your own funds .

One advantage of this method is that it gives you the chance to increase your credit mix. The credit mix scoring factor is not nearly as important as payment history and in the scoring matrix, but it does count. A passbook loan would be considered installment credit, where credit cards are revolving credit.