Medical Id Reports And Scams

Use your medical history report to detect medical ID theft. You may have experienced medical iD theft it if there is a report in your name, but you haven’t applied for insurance in the last seven years. Another sign of medical ID theft is if your report includes medical conditions that you don’t have.

What Do I Need To Sign Up For A Credit Karma Account

In addition to creating a username and password, Credit Karma may ask you for your Social Security number. This information allows us to confirm your identity with the consumer credit bureaus to ensure that we show you accurate data.

You must be at least 18 years old to sign up for a Credit Karma account.

How To Get A Free Credit Report

Order a copy of your credit report from both Equifax Canada and TransUnion Canada. Each credit bureau may have different information about how you have used credit in the past. Ordering your own credit report has no effect on your credit score.

Equifax Canada refers to your credit report as credit file disclosure.

TransUnion Canada refers to your credit report as consumer disclosure.

Recommended Reading: 626 Credit Score Car Loan

Ask The Experts: Credit

Checking your credit score is easier than ever. But people still dont do it enough. Why? We posed the following questions to a panel of personal finance experts to find out as well as to get tips for saving money while staying on top of your score. You can see what they said below.

- How much easier is it for people to check their credit scores now than it was 5-10 years ago?

- Is there ever a reason to pay to check your credit score?

- Which benefits a consumer more: daily credit score updates based on one bureaus credit reports or weekly updates based on two bureaus reports?

- What is the biggest mistake that people make in regards to checking their credit scores?

Top Sources For Free Credit Scores

InvestopediaForbes AdvisorThe Motley Fool, CredibleInsider

Thomas J Catalano is a CFP and Registered Investment Adviser with the state of South Carolina, where he launched his own financial advisory firm in 2018. Thomas’ experience gives him expertise in a variety of areas including investments, retirement, insurance, and financial planning.

You May Like: Opensky Billing Cycle

Important Disclosures And Information

Bank of America credit cards are issued and administered by Bank of America, N.A. Better Money Habits, Merrill Lynch, U.S. Trust, Bank of America and the Bank of America logo are registered trademarks of Bank of America Corporation. All other company and product names and logos are the property of their respective owners.

Mobile Banking requires that you download the Mobile Banking app and is only available for select mobile devices. Message and data rates may apply.

Negative Information In A Credit Report

Negative information in a can include public records–tax liens, judgments, bankruptcies–that provide insight into your financial status and obligations. A credit reporting company generally can report most negative information for seven years.

Information about a lawsuit or a judgment against you can be reported for seven years or until the statute of limitations runs out, whichever is longer. Bankruptcies can be kept on your report for up to 10 years, and unpaid tax liens for 15 years.

Read Also: How Many Authorized Users Can Be On A Capital One Credit Card

What Is A Free Credit Report

The free My Credit Check and My Credit Expert services generate full free credit reporst which provide a comprehensive records of your financial history, detailed information on your borrowing and spending habits, payment trends and contact details. Information includes accounts you opened, payments youve skipped, judgments taken against you and what you owe your creditors.

Getting Your Free Credit Report And Score

Getting your free credit report and score

Since the acquisition of Compuscan in 2019, Experian provides free credit reports and free credit scores on My Credit Check and My Credit Expert, which are our easy-to-use, online portals that allows all South African citizens with valid South African ID numbers to access their credit information via their personal extensive credit reports.

Whether you are a first-time credit report user or not, My Credit Check and My Credit Expert will help you understand your credit data, show you how to monitor accounts, manage debt, and improve your credit profile.

You can access your personal credit reports through either the My Credit Check or My Credit Expert portals.

- My Credit Check

- The My Credit Check portal, available at www.mycreditcheck.co.za, references data from the Experian Sigma database, which is the historical Compuscan bureau database.

- Your My Credit Check credit report and credit score are generated from the Experian Sigma database.

Note: Your credit score based on the Experian Sigma Database may be different to the one based on the Experian Database because the formulas and variables used to create the scores differ. Currently, these two databases and the scoring models are kept separate.

Don’t Miss: How To Get Rid Of Repossession On Credit Report

Request Your Free Medical History Report

You have the right to get one free copy of your medical history report each year. You can request a copy for:

- Yourself

- Someone else, as a legal guardian

- Someone else, as an agent under power of attorney

Request a medical history report online from MIB or by phone at 1-866-692-6901.

Not everyone has a medical history report. Even if you currently have an insurance plan, you won’t have a report if:

- You haven’t applied for insurance within the last seven years

- Your insurance policy is through a group or employer policy

- The insurance company isnt a member of MIB

- You didnt give an insurer permission to submit your medical reports to MIB

How Can I Build My Credit Score

The two biggest factors in your credit score are paying on time and managing how much of your credit limits you’re using. Thats why they come first in this list of tips:Pay all your bills, not just credit cards, on time. Late payments and accounts charged off or sent to collections will hurt your score.Use no more than 30% of your credit limit on any card less, if possible. The best scores go to people using 10% or less of their credit limits.Keep accounts open and active when possible that gives you a longer payment history and can help your “credit utilization,” or how much of your limits you’re using.Avoid opening too many new accounts at once. New accounts lower your average account age and each application causes a small ding to your score. We recommend spacing credit applications about 6 months apart. Make sure you conduct thorough research on the best credit card for your needs before applying.Check your credit reports and dispute errors.

You May Like: Credit Score Without Ssn

To View Your Score In Online Banking:

- Sign in to Online Banking

- Scroll down to the box on the right-hand side labelled My Services

- In the My Services box, select View Your Credit Score

- Review the legal disclaimer and select Continue

- Review the CreditView Dashboard agreement and select I Accept & Continue

Your credit score appears, along with various tools, calculators and educational information about credit reports, credit monitoring, credit cards, mortgages and much more.

What Do Your Free My Credit Check And My Credit Expert Reports Look Like

Each of Experians free credit reports includes your credit score and payment behaviour in a simple and easy to understand format. Information is grouped for you to see what activity has the biggest impact on your credit score and finances. The free credit report is an in-house credit bureau check.

We have included quick tips to explain the data and give advice on how to better manage your credit. On the dashboard, you will be able to see an overview of your credit report you dont need to spend hours sifting through a lot of data.

The free credit check platform includes:

- Your personal details

Don’t Miss: Repossession Removed From Credit Report

Factors Affecting Credit Score

The importance of a good credit score for those seeking a new loan/credit card cannot be overstressed. Hence it is important to know the key factors affecting your credit score. Some factors which affect a persons credit score are given below:

a) Credit Utilization Ratio: Credit Utilization Ratio is obtained by dividing the total credit availed by the available credit limit across all credit cards and loan accounts. It indicates your dependence on credit. A high credit utilization ratio indicates greater repayment burden and negatively impacts your credit score. A low credit utilization ratio indicates low repayment burden that can help improve credit score.

b) Multiple Simultaneous Loan Enquiries/Applications: Making several loan enquiries and applications with multiple lenders within a short period of time shows you to be credit hungry. This also leads to an increase in the number of hard inquiries made by these lenders on your credit report which negatively affects your credit score.

c) Repayment History:A history of timely payment of your EMIs and credit card bills helps maintain a high credit score. Similarly, frequently missing of credit card or loan EMI payments has a negative impact on your score.

See Your Latest Credit Information

See the same type of information that lenders see when requesting your credit.

Your Credit Report captures financial information that lenders use to determine your creditworthiness. This includes the type of credit accounts, current balances, payment history, and any derogatory items you may have. You will also get a summary of your account totals, total debt, and personal information.

Read Also: Minimum Credit Score For Carmax

Do I Get Penalized For Checking My Credit Score

Its true: Your credit scores will not be affected even if you check all your credit report or credit history. Indeed, it is important to regularly check your credit reports and credit scores to ensure that personal and account information is accurate and to identify signs that identity theft might be taking place.

Free Business Credit Score Services

- Get a summary of your Dun & Bradstreet, Experian and Equifax business credit report

- Receive business credit grades for each score, plus your personal Experian credit score

- Tools to help you build business credit

What’s missing: You don’t receive your full business credit reports and scores with the free version. But you can upgrade to a paid version, starting at $29.99 per month for Nav Business Manager, to receive your full report and score with Dun & Bradstreet, Experian and Equifax, plus the ability to dispute errors on business credit reports and more. Compare Nav business credit products. There are alternative paid options to view your actual score, which we break down below.

Recommended Reading: Removing Inquiries From Transunion

Correct An Inaccuracy On Your Equifax Credit Report

If you find any information that you believe is inaccurate, incomplete or a result of fraud, you have the right to file a dispute with Equifax Canada. You will need to complete the enclosed with your package. You can also review how to dispute information on your credit report for additional details on the Equifax dispute process.

How To Get Your Experian Credit Score For Free

The largest credit reference agency offers new customers a free 30-day trial of its , which gives you access to your credit report, score, and email alerts about any changes on your file.

After the trial ends, it will cost you £14.99 a month.

You can access your Experian credit score through a free Experian account. This is designed to help people shop around to see how they can save money by comparing credit deals based on their financial profile.

Once you’ve signed up, your score will remain free to access, but unlike the paid-for CreditExpert service, you won’t be able to see your credit report.

To be able to access both your Experian credit report and score for free, you can sign up to the Money Saving Expert Credit Club.

You can also see how likely you are to be accepted for the market-leading cards and loans and work out how much you can afford to borrow.

Unlike CreditExpert, you won’t receive alerts about any changes to your report.

Recommended Reading: What Does Syncb Ppc Stand For

What Is Your Free Credit Score

Your credit score is the single most important financial score youll ever get. Yes, its even more important than matric aggregate, body fat count, or golf handicap, since credit providers use this credit score when deciding whether or not to extend credit to you. So be sure to maintain a good track record!

Your Experian credit score is calculated via a credit bureau check, using information from your full credit profile. Experian evaluates all of your accounts, your negative and positive information, and your payment history to assign you a credit score of 0999. The higher your credit score is, the better your credit profile, and the lower your risk will be of defaulting on an account or loan would be.

My Free Credit Check Know Your Rights

You have the right to apply for credit

The National Credit Act gives you the right to apply for credit. All consumers must be treated equally in relation to one another when credit providers assess your application, determine rates/fees and compile and enforce the credit agreement.

You have the right to know why credit has been refused

You may ask the credit provider or bank to explain, in writing, their main reasons for:

- Refusing your application for a new loan/credit

- Refusing your application for an increased limit on existing loan/credit

- Refusing to renew a renewable loan/credit

- Offering a lower credit limit than the limit you applied for

- Reducing your existing credit limit

If your credit score or report was the main problem, the bank or credit provider has to disclose the name, address and contact details of the credit bureau that issued the report, so that you can get hold of your credit report to see what information on the credit report is keeping you from a successful application. Please note, your credit score and report are not the only factors lenders, banks and other credit providers look at when doing an assessment. The criteria they look at differs from company to company.

You have the right to receive your credit information in plain and understandable language

You have the right to confidentiality

You have the right to one free credit report per year!

Recommended Reading: Experian Viewreport

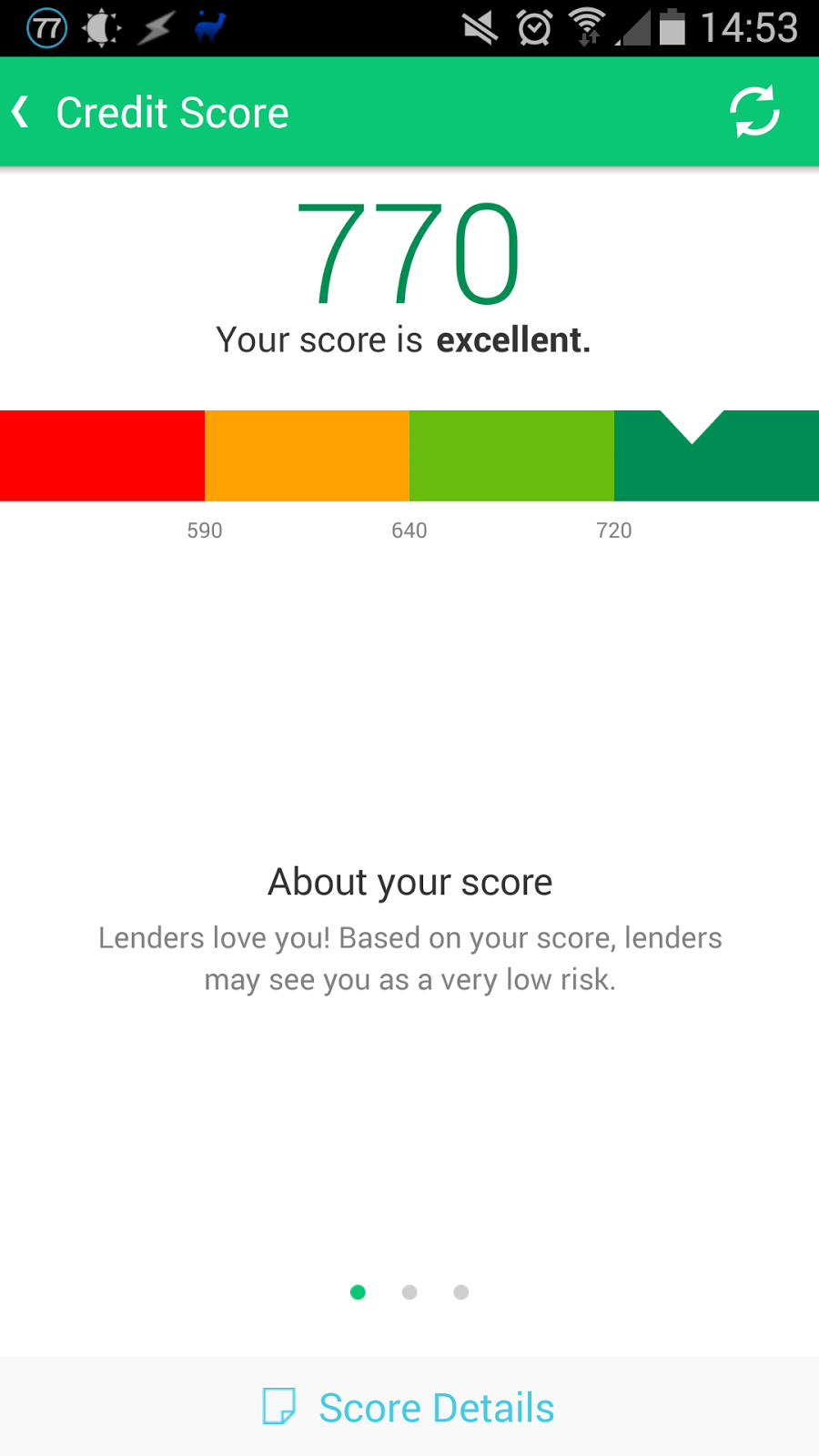

Is My Free Credit Score On Credit Karma Accurate

The free credit scores you see on Credit Karma come directly from Equifax or TransUnion. Its possible that more-recent activity will affect your credit scores, but theyre accurate in terms of the available data.

If you see errors on your credit reports that may be affecting your credit scores, you have options to dispute those errors.

How To Check Your Credit Score For Free

You can check your credit score for free in less than two minutes on WalletHub, the first site with free daily credit score updates. Just quickly confirm your identity, and youll get access to your latest credit score, based on your TransUnion credit report. Youll then be able to check your score for free at any time, on any device including your smart phone and tablet.

Fortunately, it is now easier than ever to see your credit score without paying for the service. From free credit score websites to credit card companies that offer free monthly credit score updates, there are plenty of places to check your credit score these days. So, the problem is not how to check your credit score, but rather where you should check it and whether youre seeing the latest information. Some free credit scores are updated far more frequently than others, and the services you get along with free scores vary, too.

Recommended Reading: Does Klarna Affect Your Credit Score

Get Your Credit Score

A lender will use your credit score to determine if they will lend you money and how much interest they will charge you to borrow it. Your credit score is a number calculated from the information in your credit report. It shows the risk you represent to a lender compared to other consumers.

Knowing your credit score before a major purchase, such as a car or a home, may help you to negotiate lower interest rates.

You usually need to pay a fee when you order your credit score online from the two credit bureaus.

Some companies offer to provide your credit score for free. Others may ask you to sign up for a paid service to see your score.

Make sure you do your research before providing a company with your information. Carefully read the terms of use and privacy policy to know how your personal information will be used and stored. For example, find out if your information will be sold to a third party. This could result in you receiving unexpected offers for products and services. Fraudsters may also offer free credit scores in an attempt to get you to share your personal and financial information.

Always check to see if a website is secured before providing any of your personal information. A secured website will start with https instead of http.

Understanding Credit Score & Credit Report

- Detailed information of loans and credit card accounts including limits, outstanding balance and current status

- Information regarding late payments and defaults

- A list of entities that have made an enquiry for your credit report and the reason for the enquiry along with date of enquiry

- Your personal information

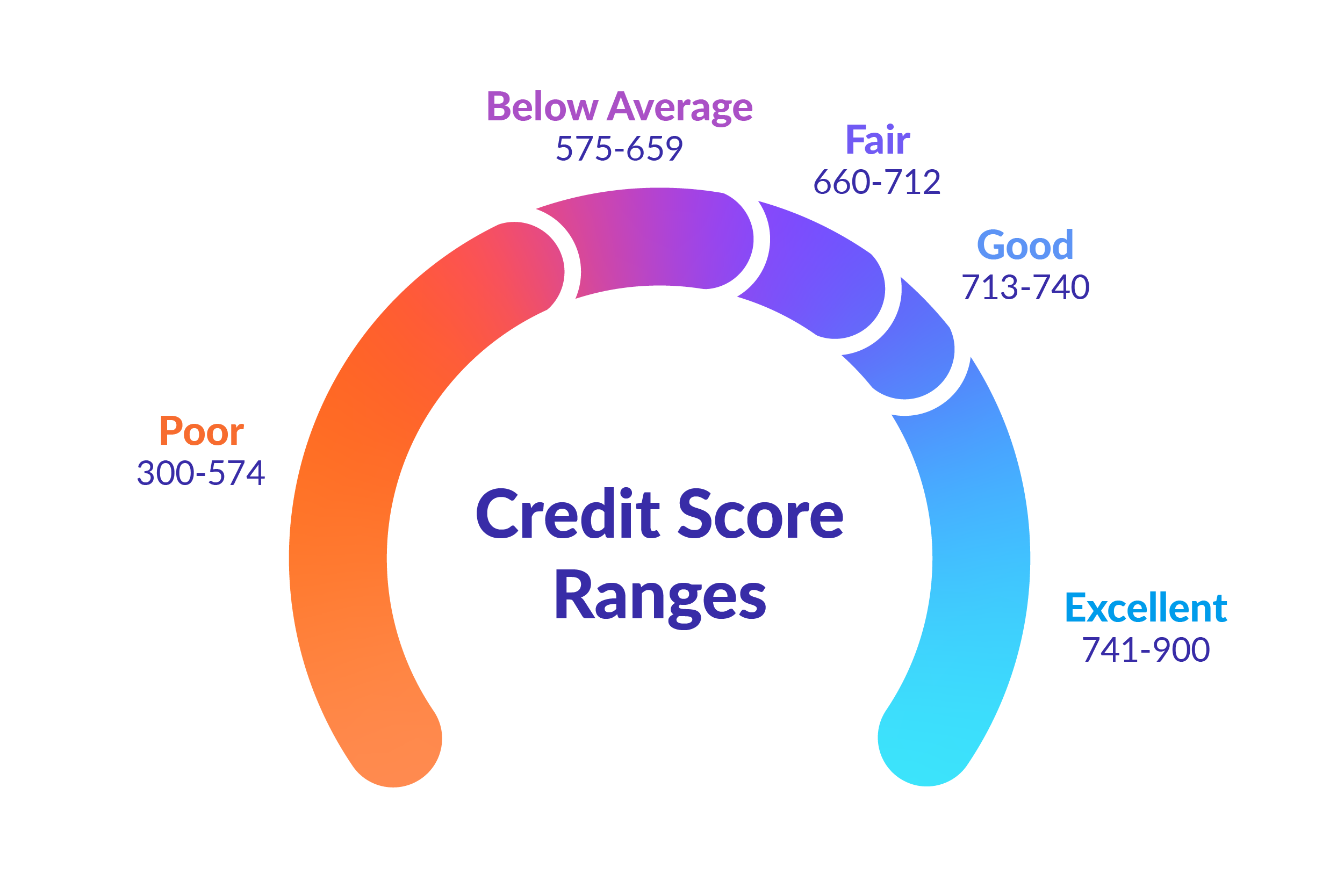

*It must be pointed out that credit reports in India do not include information about your savings, investments, utility bill payments, house rent payments, etc. Credit scores range between 300 and 900. A score closer to 900 is generally considered to be a good score and indicated fiscal prudence.

Also Check: Chase Sapphire Preferred Score