Payments On Student Loans Make It Challenging To Save

Sending hundreds of dollars a month to a lender or servicer could seem like the most direct and stressful way that student loans affect one’s ability to buy a home.

However, saving 20% of the home’s value for a down payment, which is usually the recommended sum, is not always sufficient. Investigate the state’s first-time homebuyer services, which can include funds for a down payment or low-down-payment mortgage options.

Federal entities, such as the Federal Housing Administration and the United States Department of Veterans Affairs, sell mortgages with lower down payments or no down payment in the case of VA loans.

Student Loans Allow You To Make Positive Payments

Payments against open loans or lines of credit are reported to the three main credit bureaus and become part of your credit report. When on-time payments land on your credit history, your credit score can grow. So when you make regular payments on your student loans, your credit score could improve.

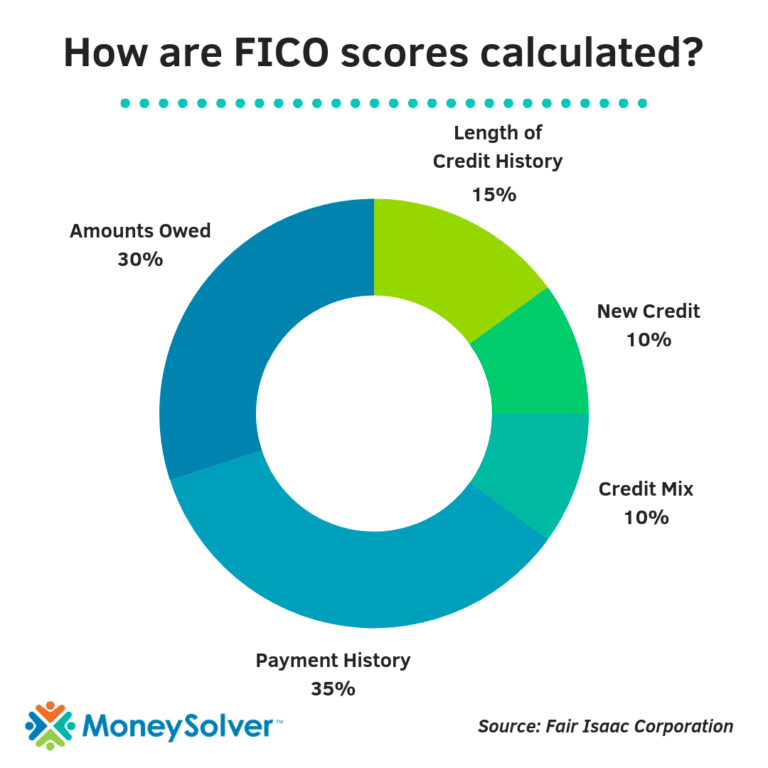

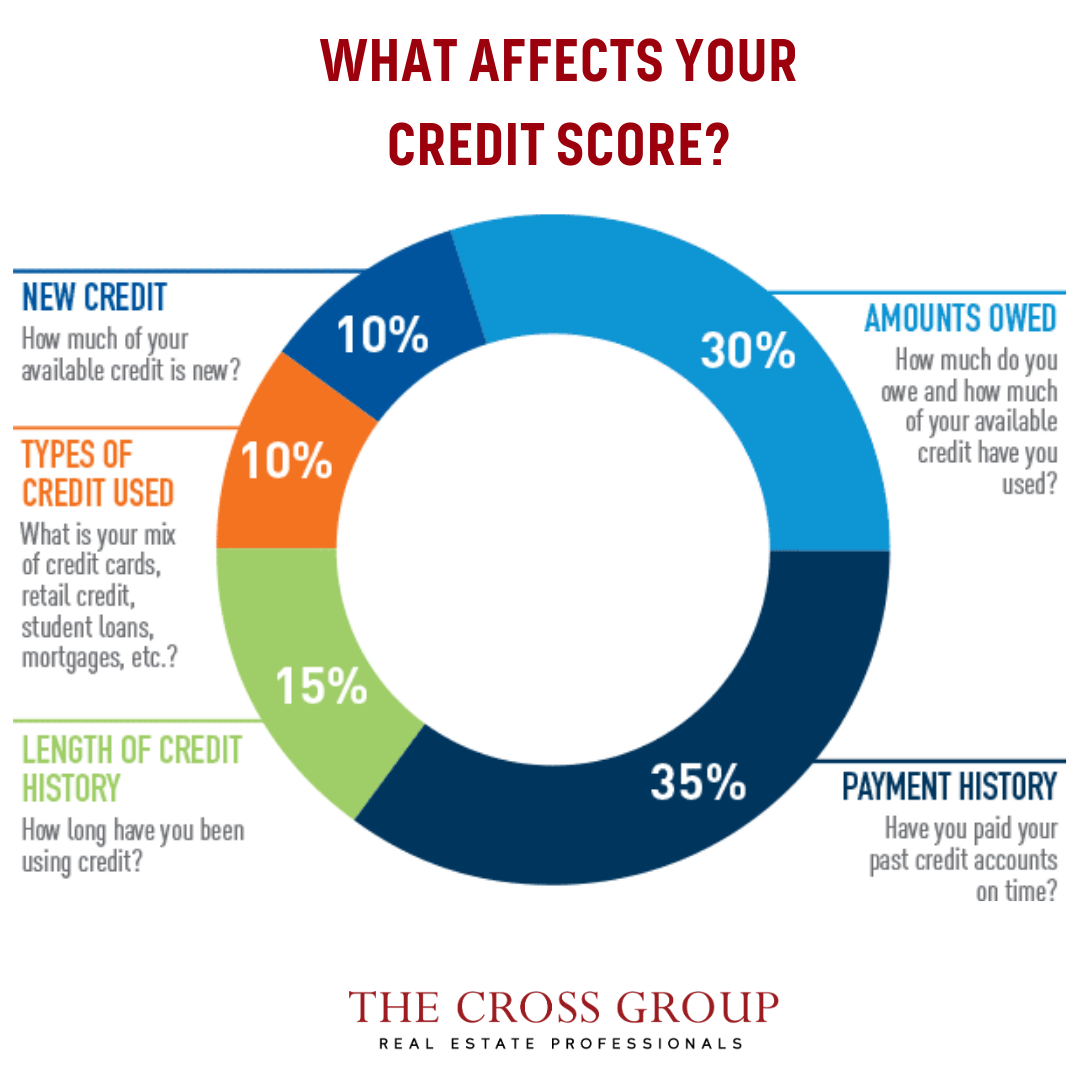

Payment history is one of the important components of your credit score under both the VantageScore® and FICO® score models.

Because payment history is so influential on your overall credit score, it’s important to make all of your scheduled payments on your student loans.

Pay Attention To Loan Announcements

âBorrowers will want to pay close attention to the news and communications from their servicers on any actions they might need to take,â says Thompson.

Frederick Good, senior vice president of student lending at Citizens Bank, says that staying on top of these announcements can help you keep your finances and credit in order.

âIf/when the payment pause ends, borrowers will receive at least 30 daysâ notice before payments resume,â he says, âand therefore will have some time to understand how that monthly payment amount fits in their overall budget.â

You can also check for announcements and updates from the Department of Education, which has advised that more information about loan forgiveness is forthcoming, including details on how you can claim the relief.

You May Like: Do Title Loans Go On Your Credit Report

Achieve Financial Control How Much Debt Do You Have

Or speak to a debt consultant

Student loans can make dealing with college costs easier. You can use student loans to pay tuition, fees, room and board and other necessary expenses to earn a degree. Once you graduate, you’ll need to pay back what you borrow with interest. As of 2022, Americans collectively owe $1.7 trillion in federal and private student loans.

If you have student debt , there’s a lot to consider, including:

-

How do student loans affect calculations?

-

Does paying student loans build credit?

Like other types of loans, student loans can appear on your credit reports. Whether student loans impact your credit scores positively or negatively can depend on how you manage them.

Do Student Loans Affect Your Credit Score

Student loans could have a positive impact on your credit score, such as if you make on-time payments or are able to diversify your credit mix.

Edited byAshley HarrisonUpdated January 27, 2022

Our goal is to give you the tools and confidence you need to improve your finances. Although we receive compensation from our partner lenders, whom we will always identify, all opinions are our own. By refinancing your mortgage, total finance charges may be higher over the life of the loan. Credible Operations, Inc. NMLS # 1681276, is referred to here as “Credible.”

A credit score is a three-digit number that lenders use to decide if a borrower is creditworthy which is why having a good credit score is important if you want to qualify for a loan. Your credit score can also impact whether youll be able to rent a home, get a cell phone, or land a job.

There are several things that can impact your credit score including student loans.

If youre wondering how student loans affect your credit score, heres what you should know:

You May Like: How Do You Get Your Credit Score

Can Student Loans Help Improve Your Credit Score

While missing student loan payments can lower your credit score, consistently paying on time helps build a positive payment history, says Black.

Adding another account to your credit report can also help you if you have a thin credit file, Black adds. Having a student loan could improve your credit mix, which makes up 10% of your FICO score calculation. A good credit mix could increase your credit score and show lenders that youre able to handle multiple types of credit.

And, as time passes and your student loan gets older, the average age of your credit accounts increases, which can also provide you with a small credit score boost.

Of course, this all depends on you regularly making payments on time. Kantrowitz recommends setting up AutoPay with your private lender or federal loan servicer. That way, you wont have to try to remember to make your payments each month, and you reduce the chances that youll end up paying late or worse missing payments altogether.

Not only are you less likely to be late with a payment, but many lenders offer an interest rate reduction when you enroll in AutoPay, Kantrowitz says. You typically see a 0.25 or 0.50 percentage point reduction as an incentive.

Length Of Credit History

Many college students and recent grads dont have established credit histories. Having a student loan can help with that it allows you to build credit history even while youre still in school.

Having an established credit history when you graduate can be helpful, as you may be ready to use your credit to purchase a car or get a credit card with a low interest rate. The length of your credit history makes up about 15% of your score.

Also Check: How To Get An Eviction Off Your Credit Report

High Monthly Payments Can Impact Your Ability To Qualify For Future Credit

Late or missed payments are not the only way student loans can affect your ability to qualify for new credit. If your monthly payments are on the high side, they could affect your debt-to-income ratio, making it harder for you to qualify for other loans, such as a mortgage.

Your debt-to-income ratio is calculated by adding all of your monthly debt payments and dividing the total by your monthly gross income

Lenders, particularly those in the mortgage industry, prefer borrowers that have a debt-to-income ratio of 43% or less. If you have a debt-to-income thats higher than that, you may still get the loan, but you wont be able to secure the best terms or interest rates.

Loitz says that you can improve this percentage by applying for an income-driven repayment plan in the case of federal loans, or by refinancing your private ones, as both of these options can help you lower your monthly payments.

It doesn’t mean that you can’t choose to pay more, but you could change your payment plan to better fit numbers the way the banks look at them, Loitz says.

How Do Student Loans Affect Mortgage Applications

Although having student debt will be worse for an applicant than for someone who does not have it, graduates tend to have higher salaries, which cancels some negativity. When lenders assess applicants for mortgages, they will perform affordability checks. This means that they will calculate the actual amount of money that a person has left from their salary after having made student loan repayments to see how they will be able to afford the mortgage repayments. Naturally, lower repayments will mean a lower amount of money they will be prepared to lend.

Recommended Reading: What Credit Score Is Needed For An Amazon Credit Card

Types Of Student Loans And How They Could Affect Credit Scores

There are two types of student loans: federal and private. Federal student loans are funded by the Department of Education, while private loans are typically made by a bank or other financial institution.

Whether theyâre federal or private, student loans are classified as a common type of loan called installment loans. An installment loan is for a fixed amount of money plus interest over a set period of time. And the borrower agrees to make payments until the loan is paid off.

Mortgages and auto loans are other kinds of installment loans. And like those loans, if student loans are reported to credit bureaus, they could affect your credit.

Speaking of credit bureaus, the following may help clarify some things about credit reporting and scoring:

First, there are three major credit bureaus: Equifax®, Experian® and TransUnion®. These credit bureaus collect and compile the information that goes into your credit reports.

Those credit reports are used by credit-scoring companies, such as FICO® and VantageScore®, to create credit scores. And those companies may have multiple scoring models they use to calculate credit scores.

Those are just some of the basics. But the important thing to remember is that you have more than one credit report and more than one credit score that may be used to judge your creditworthiness.

Back to student loans.

Account History and Payment History

One: Fill Out The Fafsa

Filling out the FAFSA, or Free Application for Federal Student Aid, should be the first step for all students looking for student loans.

This application is used by the Department of Education to determine your student loan eligibility, as well as your eligibility for free aid, such as grants and work-study programs.

Completing the application is free and can be done online. Youll need to submit the FAFSA every year youre enrolled in college to review your eligibility.

You May Like: Is Fast Loan Direct Legit

You May Like: What Is A Closed Account On Your Credit Report

How Do Student Loans Affect My Credit

ScoreSense

Student loans affect your credit similarly to other loans: If you fulfill your commitment to make payments on time, the loan can have a positive impact on your credit, but if you make late payments or miss payments, that can have a negative impact on your credit.

However, student loans have some important differences from other types of loans. First, you may not have to undergo a credit check to open certain types of student loans. And you may have extra time before any late payments would be reported to the credit bureaus.

Heres a look at the potential ways that student loans can affect your credit scores and reports.

How Credit Score Is Calculated

Your based on several factors that demonstrate your creditworthiness. The credit scores used by the three major credit bureaus Experian, Equifax, and TransUnion are your FICO Score and VantageScore.

FICO scores are typically in a range between 300 and 850 where a higher credit score shows better credit. Your credit score tells lenders how likely you are to repay a loan based on your credit history.

Credit scores are calculated based on five categories from your credit report:

- payment history

- length of credit history

The percentage reflects the importance of each category when determining your credit score.

The three major credit bureaus can also have different data from one another, so your credit score may vary depending on what data was used.

Also Check: What Does My Credit Score Mean

Applying For The Loan

Some federal loans, including direct subsidized loans and direct unsubsidized loans, are available regardless of your credit history. To qualify for them, you’ll need to complete the FAFSA and provide financial details, but you won’t have to undergo a credit check.

Federal PLUS loans, however, are generally unavailable to borrowers with bad credit. If you apply for these loans as a parent or graduate student, you can expect an inquiry on your credit report. And private student loan lenders also check your credit.

Too many inquiries in a short time could cause your credit score to go down. If you’re applying for several student loans, including PLUS loans and private loans, multiple inquiries could end up on your credit report and have a negative impact.

Student Loans Expand Your Credit Mix

The final factor that student loans affect in your credit score is credit mix: that is, the diversity of credit you have in your portfolio. Account mix contributes to your overall VantageScore® or FICO® score.

If you have multiple kinds of credit in your name one or more credit cards, a home loan, a personal loan, or student loans, for instance you are seen as someone who can manage many different demands in your financial life. By reducing your perceived risk as a borrower, a better credit mix could help to increase your credit score.

Don’t Miss: Does Free Credit Report Hurt Your Score

Bottom Line: Student Loans Can Help Or Hinder Your Credit Score

When youre trying to build credit, student loans might seem like a hurdle. But they dont need to be.

When managed properly, your student loans can help you build a positive repayment history and diversify the types of credit that show up on your credit report.

Of course, as is the case with any type of debt, late payment can damage your score.

To keep your score in check, pay on time every time. If you run into trouble, contact your lender or loan servicer and ask about your repayment options.

Protecting Your Credit When You Have Student Loans

The best way to protect your credit with student loans is to never miss a payment. If you recently graduated or are unemployed, don’t assume that you don’t have to begin repayment. If you can’t make a payment, never ignore it. You always have options, and lenders are generally willing to work with you.

A common option is to change your repayment plan to extend the life of the loan but lower your monthly payments. Keep in mind that you’ll likely pay more interest over time with this option, but it is worth considering if youre unable to meet your current monthly payments.

If you’re unable to make any student loan payments at all, you may qualify for forbearance or deferment, depending on your situation. Forbearance allows you to stop making payments for a set amount of time, but interest will continue to accrue. Deferment allows you to put your payments on hold, but the government will cover the cost of your interest payments. Exploring these options can help lower your monthly payments and protect your credit score.

You should never take on more debt to improve your credit score. However, if you already have student loan debt, it’s important to know exactly how it affects your credit and how to use it to your advantage.

Don’t Miss: How To Challenge Your Credit Report

How Your Credit Score Can Affect New Student Loans

If you need to get a new student loan, but your credit score is not good, you still have options. Not all lenders use your credit score when deciding whether to grant a loan application.

Most kinds of federal student loans dont require any kind of credit check. One exception is the federal direct PLUS student loan.

Several private student loan lenders also use other criteria besides your credit score. For example, some agreements are based on your future income.

Age Of Credit History

The longer youve had a history of credit, the better. And for many Americans who took on student loans as young adults entering college, those loans may be the oldest accounts on their credit reports.

The age of your credit accounts isnt the most important factor in your score it makes up about 15% of your FICO credit score but it can be affected when your accounts close, especially the oldest ones.

However, the drop is temporary, and paying down your loan in full makes any temporary credit hit well worth it.

Recommended Reading: How To Get Bad Stuff Off Your Credit Report

Do You Qualify For The Best Student Loan Interest Rates

For the most part, private lenders dont release their tier information. They consider the number of tiers, the ranges of credit scores and the mapping from tiers to interest rates to be trade secrets.

Its fairly typical, though, for less than 10% of a lenders borrowers to qualify for the lowest advertised rates. Most borrowers will not get the lenders best advertised rate. Instead, more borrowers will get the lenders highest interest rate than get the lenders lowest interest rate.

Many college students dont have established credit scores high enough to qualify them for the best private student loan rates or to even qualify for a private student loan on their own. More than 90% of private student loans to undergraduate students and more than 75% of private student loans to graduate students require a cosigner.

A well-qualified cosigner, however, can help you get a better loan offer. If you can find a cosigner with a higher credit score, you might be able to get a lower interest rate. Most private student loans are made based on the strength of the cosigners credit, not the students.

What Student Loan Factors Affect My Credit Score

So, how exactly does a student loan affect your credit score? Well, when FICO creates your credit score, it takes loans into consideration. Not only that, it evaluates your payment patterns thus far on any loans.

That means if you fail to repay or continually pay late on your loan, your credit score will see a dip. The more you fall behind, the harder the hit to your score. If you stop paying at all, or default, then you may even face consequences.

However, student loans can also positively affect your credit score. A responsible debt owner may experience no credit changes or even see positive shifts, such as if they continually make on-time payments.

Here are the main factors to look for that could impact your credit, in either direction:

Making late payments

Failing to pay at all

Expanding your credit mix

Applying for new credit

Don’t Miss: What Is My True Credit Score