What If Im Denied Credit Or Insurance Or Dont Get The Terms I Want

Under federal law, a creditors scoring system may not use certain characteristics for example, race, sex, marital status, national origin, or religion as factors when figuring out whether to give you credit. The law lets creditors use age, but any credit scoring system that includes age must give equal treatment to applicants who are older.

You have the right to:

Know whether your application was accepted or rejected within 30 days of filing a complete application.

Know why the creditor rejected your application. The creditor must

- tell you the specific reason for the rejection or

- that you are entitled to learn the reason if you ask within 60 days.

Learn the specific reason the lender offered you less favorable terms than you applied for, but only if you reject these terms. For example, if the lender offers you a smaller loan or a higher interest rate, and you dont accept the offer, you have the right to know why those terms were offered. Read to learn more.

If a business denies your application for credit or insurance because of information in your credit report, federal law says the business has to

- give you a notice that includes, among other things, the name, address, and phone number of the credit bureau that supplied the information.

- include your credit score in the notice if your credit score was a factor in the decision to deny you credit or to offer you terms less favorable than most other customers get.

If you get one of these notices:

Answered By: Lippincott Librarylast Updated: Jul 27 2021 Views: 75673

Mergent BondViewer includes Fitch, Moody’s and S& P ratings for individual bond issues on the synopsis page for the bond.

Use Bloomberg .

- Type the ticker symbol of the company you want, hit the yellow < CORP> key, then type CRPR and hit < GO> . Bonds are listed by Bloomberg composite ratings.

- To see Moody’s, S& P and Fitch ratings, click on individual bond issues and choose DES from the menu. You can find historical bond ratings for particular issues.

Thomson One includes S& P, Moody’s, Fitch and Eagan Jones ratings. Select Debt Overview from the Company Views menu. Note: Thomson One only works using Internet Explorer .

What Is A Corporate Credit Rating

A corporate is a numerical or quantified assessment of a company’s creditworthiness, which shows investors the likelihood of a company defaulting on its debt obligations or outstanding bonds.

Corporate credit ratings are issued by rating agencies. A or company helps investors decide how risky it is to invest in a specific country, security, or bond by providing independent, objective assessments of the creditworthiness of companies and countries.

Don’t Miss: Does Affirm Show Up On Credit Report

Reporting Agencies: Who Are They And How Do They Track Your Business Credit Score

Nearly all small business lending institutions rely on Dun & Bradstreet PAYDEX® scores as at least one of the tools they use to decide whether or not to grant credit. Your D& B PAYDEX® score is based on how quickly your business pays its bills, and collects lots of additional information beyond payment data.

Here is a link to a sample Dun & BradstreetBusiness Information Reportshowing PAYDEX®, D& B Rating, Composite Credit Appraisal and D& B Viability Rating. Dun & Bradstreet compiles a tremendous amount of information about every small business that has been issued a D-U-N-S® Number. They collect this information from public records, personal telephone interviews with the business itself, and with other companies who conduct business with the company being rated.

A Dun & Bradstreet report provides the following information in detail:

Lenders also use information from Equifax and Experian to make lending decisions. In these cases they are basing their decisions on composite scores from different sources.

Although not nearly as extensive as D& B PAYDEX®, ExperiansIntelliscore PlusSM compiles a collection of both business and personal statistics to predict whether or not a business will default within the next 12 months. Once again, businesses do not want to be in the red zone when being considered for small business financing.

How To Get A Business Loan With Bad Credit

The process of applying for a business loan varies by financial institution, but most banks and online lenders impose similar requirements. That said, its more difficult to get a business loan with bad credit, so there are some additional steps to take before submitting a formal application. Follow these steps to get a business loan with bad credit:

You May Like: Is Chase Credit Journey Accurate

Enroll In A Family Plan

Joining a family plan is another way to get a cell phone approved with bad credit. The great thing with a family plan is that if the main account holder has an excellent credit, you also get to enjoy the great offers that are not available to people with bad credit.

Another benefit is that all of the users will get a better deal and save money because family plan packages often offer discounts. The catch with any family plan is that the primary account holder will be responsible if any of the other users fail to pay the monthly payments.

Costa Coffee To Shake

3 September 2021

Everyone should take time to manage their credit score, especially during this time of coronavirus uncertainty. It’s no longer just about whether you can get a mortgage, credit card or a loan, it can also affect mobile phone contracts, monthly car insurance, bank accounts and more. Here’s what you need to know about credit checks and how to boost your credit score.

Don’t Miss: Does Paypal Credit Report To Bureaus

Importance Of Credit Ratings

Credit ratings for borrowers are based on substantial due diligence conducted by the rating agencies. Though a borrowing entity will strive to have the highest possible credit rating because it has a major impact on interest rates charged by lenders, the rating agencies must take a balanced and objective view of the borrowers financial situation and capacity to service and repay the debt.

A credit rating determines not only whether or not a borrower will be approved for a loan but also the interest rate at which the loan will need to be repaid. As companies depend on loans for many startup and other expenses, being denied a loan could spell disaster, and a high-interest-rate loan is much more difficult to pay back. A borrower’s credit rating should play a role in determining which lenders to apply to for a loan. The right lender for someone with great credit likely will be different than for someone with good or even poor credit.

Rbi Governor Affirmative On Revised Guidelines On Nbfc Bad Loans

The Reserve Bank of India governor Shaktikanta Das has stated that the revised guidelines on NBFC bad loans will sustain improvement in credit culture. The central bank issued a revised ‘Prudential Framework for Resolution of Stressed Assets. The move comes from the central bank a month after the Supreme Court scraped the Reserve Bank’s circular of 12 February 2018 for resolution of stressed assets.

The RBI governor was speaking at the NIBM, at the 15th Annual Convocation of Post Graduate Diploma in Management in Pune. He added that the RBI was taking necessary regulatory and supervisory steps in a bid to uplift and strengthen the NBFC sector and to maintain stability and avoid regulatory arbitrage. Das also mentioned that to maintain financial stability, the RBI will not hesitate to take any required steps. He also stated that the apex body will continue to monitor the activity and performance of the NBFC sector with a focus on major entities and their inter-linkages with other sectors.

10 June 2019

Recommended Reading: How Personal Responsibility Can Affect Your Credit Report

It Can Affect Your Finances

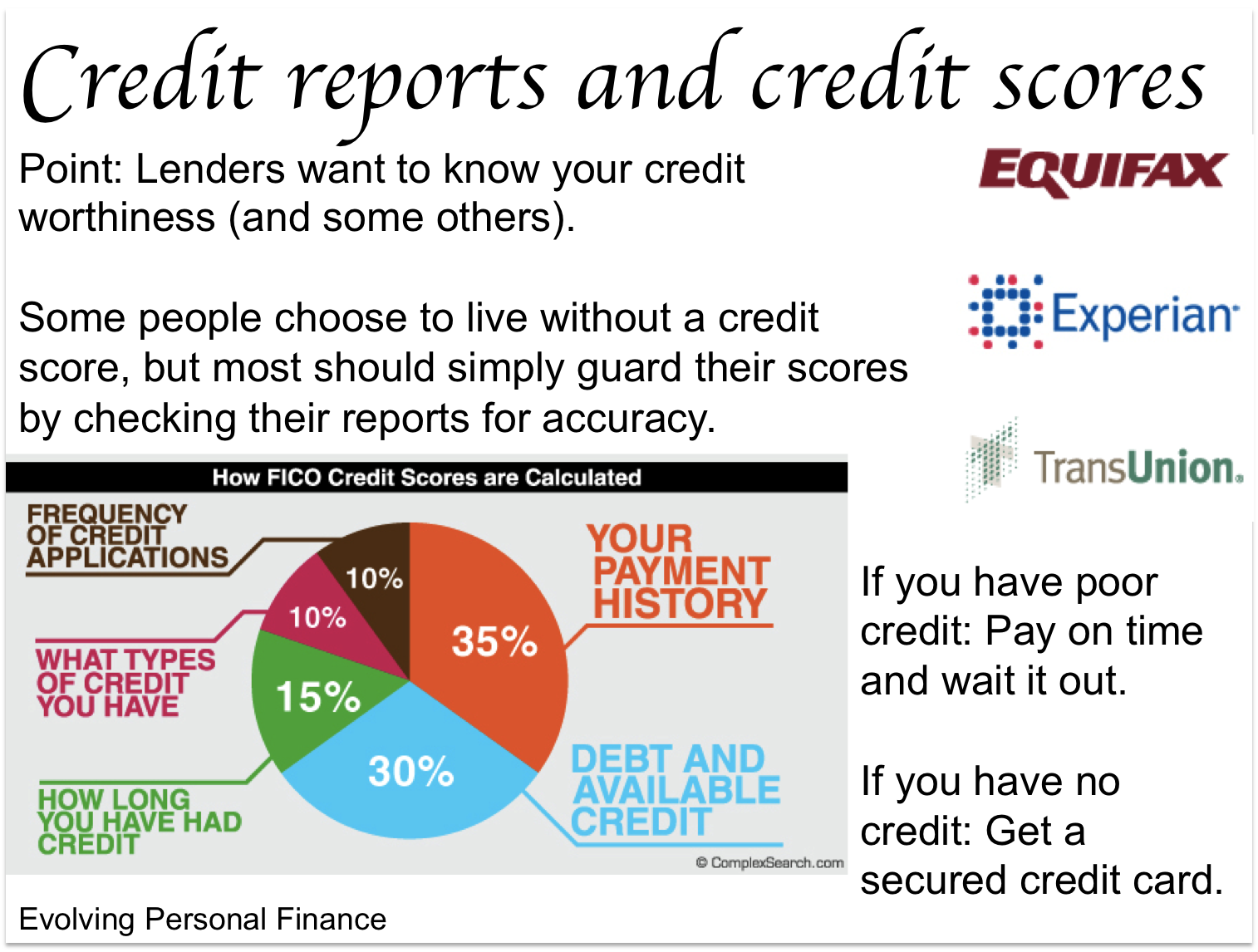

Financial institutions look at your credit report and credit score to decide if they will lend you money. They also use them to determine how much interest they will charge you to borrow money.

If you have no credit history or a poor credit history, it could be harder for you to get a credit card, loan or mortgage. It could even affect your ability to rent a house or apartment or get hired for a job.

If you have good credit history, you may be able to get a lower interest rate on loans. This can save you a lot of money over time.

Understanding Business Credit Scores

Before we dive into the details about business credit scores, how they are used, and how to keep track of them, its important to understand why they are so important, and why this is such a difficult topic for so many. Even highly educated business owners find business credit difficult to understand. There are a lot of reasons that make it complicated…and very important.

Don’t Miss: Does Klarna Run Your Credit

The Big Three Agencies

Credit rating is a highly concentrated industry, with the “Big Three” credit rating agencies controlling approximately 95% of the ratings business.Moody’s Investors Service and Standard & Poor’s together control 80% of the global market, and Fitch Ratings controls a further 15%.

As of December 2012, S& P is the largest of the three, with 1.2 million outstanding ratings and 1,416 analysts and supervisors Moody’s has 1 million outstanding ratings and 1,252 analysts and supervisors and Fitch is the smallest, with approximately 350,000 outstanding ratings, and is sometimes used as an alternative to S& P and Moodys.

The three largest agencies are not the only sources of credit information. Many smaller rating agencies also exist, mostly serving non-US markets. All of the large securities firms have internal fixed income analysts who offer information about the risk and volatility of securities to their clients. And specialized risk consultants working in a variety of fields offer credit models and default estimates.

Market share concentration is not a new development in the credit rating industry. Since the establishment of the first agency in 1909, there have never been more than four credit rating agencies with significant market share. Even the Financial crisis of 200708where the performance of the three rating agencies was dubbed “horrendous” by The Economist magazineled to a drop in the share of the three by just one percentfrom 98 to 97%.

What Is A Business Credit Report

![How to Get an 850 Credit Score [Infographic]](https://www.knowyourcreditscore.net/wp-content/uploads/how-to-get-an-850-credit-score-infographic-tradeline.jpeg)

A business credit report is an aggregate of your business’s credit history. This is similar to a personal credit report, which is a snapshot of your personal credit use. Lenders use information found in your credit report to judge whether you can repay credit extended to you.

Here’s the typical information found in a business credit report, according to the Small Business Association :

- Company information including number of employees, sales, ownership and subsidiaries

- Historical data of the business

- Business registration details

- Public filings, such as liens, judgments and UCC filings

- Past payment history and collections

- Number of accounts reporting and details

Information in your business credit report impacts numerous financial decisions, which the SBA also provides:

- How much business credit a supplier will extend to you

- What repayment terms you’ll receive

- What interest rates you’ll pay

- How much credit or funding a bank or lender will extend to you

- How your customers view your business

- What insurance premiums you’ll pay

You May Like: Paypal Credit Report To Credit Bureau

Do You Work With Other Businesses

Because businesses arent protected by consumer protection regulations, anyone can check your business credit score and report. The most obvious individual that will check your business credit report is potential or existing lenders.

Other businesses can check your credit score too. Usually, they do this to determine if they can trust that you will pay them for a product or service. Businesses extending credit to other businesses cannot afford to not get paid, particularly small businesses, which is why they consider business credit scores. This concept goes both ways, if you are extending credit to another business, it is definitely wise to do a quick check up on their credit score and report.

For more ins and outs of business credit, .

Your Credit Report Dictates The Product And Rate You’ll Get

In the past 10 years the credit landscape has almost completely shifted towards ‘rate for risk’. This means almost every credit provider on the market uses your credit file to not only dictate whether they’ll provide you with credit, but also what interest rate you’ll get.

The most obvious way this manifests itself is in representative rates on loans.

Here, only a minimum of 51% of accepted customers must get the rate advertised. They might be advertising a 6% rate . But you could be accepted and offered a 40% interest rate instead, because of a poor credit score.

It applies to other products too. Some 0% credit cards give you a shorter 0% period if you’ve got a poor credit history , others will simply offer you a different product to the one you’ve applied for. This is why it’s so important to manage your creditworthiness.

Recommended Reading: What Is Syncb Ntwk On Credit Report

What Is Credit Monitoring

Canadas credit bureaus, as well as many credit card issuers and financial institutions, offer credit monitoring services. These services provide you with a notification after certain updates to your credit file, such as a credit inquiry.

You could consider using this service if you think youve been the victim of fraud or if you have been affected by a data breach. This can help you see if somebody is trying to apply for credit in your name.

You usually need to pay for these services.

Role In Capital Markets

Credit rating agencies assess the relative of specific debt securities or structured finance instruments and borrowing entities , and in some cases the of governments and their securities. By serving as information intermediaries, CRAs theoretically reduce information costs, increase the pool of potential borrowers, and promote liquid markets. These functions may increase the supply of available risk capital in the market and promote economic growth.

Read Also: Is 672 A Good Credit Score

Growth Of Bond Market

The end of the Bretton Woods system in 1971 led to the liberalization of financial regulations and the global expansion of capital markets in the 1970s and 1980s. In 1975, SEC rules began explicitly referencing credit ratings. For example, the commission changed its minimum capital requirements for broker-dealers, allowing smaller reserves for higher-rated bonds the rating would be done by “nationally recognized statistical ratings organizations” . This referred to the “Big Three”, but in time ten agencies were identified by the SEC as NRSROs.

Rating agencies also grew in size and profitability as the number of issuers accessing the debt markets grew exponentially, both in the United States and abroad. By 2009 the worldwide bond market reached an estimated $82.2 trillion, in 2009 dollars.

Business Credit Scores Explained

If you are a small business owner, youve probably considered ways to get funding to grow your business. Even if you were able to start your business with your own savings, the time will come when you may need to access additional funds. It will be incredibly helpful to you to understand the bigger picture when it comes to business credit. Understanding how small business funding works, how business credit scores are calculated, how business credit scores differ from personal credit scores, and the importance of establishing good credit, will all help you achieve success as you expand your business.

In this guide, well address all of these common questions. Well also discuss why they are important to every business, whether you are currently looking for additional capital or not. After all, its important to establish good credit before you apply for funding. Well also discuss how conventional small business financing companies use your credit score information.

Read Also: Cbcinnovis Credit Check

Can I Still Take Out A Loan With A Bad Credit Score

Having a good credit score can help you get a better interest rate on a business loan or credit card, and can also mean you get better terms from your suppliers. Missed payments or a bad credit score will indicate to lenders that you may not be able to pay back your debt. This means that banks may offer you a product with higher interest rates or they may reject you for finance altogether.

If you do have a blemish on your company credit score but still need to obtain finance, there are other options available to you. Some alternative lenders will still consider your finance application and allow you to use a personal guarantor who will be liable to pay if you default. If you also have valuable assets, such as a property, using this as collateral against a secured loan may help to offset a low credit score.

‘soft Searches’ Incl If You’ve Checked Your Own File

Some lenders will do a soft search of your credit report, to tell you both whether you qualify to borrow from them, and what rate they are willing to give you. This isn’t passed on to other lenders when they credit-check you.

When you check your own file, it does appear on your credit report. It’s not always clear, but the words “administration check” or “quotation search” should indicate something, but lenders can’t see this so it doesn’t play any role in any assessment of you.

Don’t Miss: Jefferson Capital Systems Verizon

Ratings Use In Sovereign Debt

Credit rating agencies also issue credit ratings for sovereign borrowers, including national governments, states, municipalities, and sovereign-supported international entities. Sovereign borrowers are the largest debt borrowers in many financial markets. Governments from both advanced economies and emerging markets borrow money by issuing government bonds and selling them to private investors, either overseas or domestically. Governments from emerging and developing markets may also choose to borrow from other government and international organizations, such as the World Bank and the International Monetary Fund.

Sovereign credit ratings represent an assessment by a rating agency of a sovereign’s ability and willingness to repay its debt. The rating methodologies used to assess sovereign credit ratings are broadly similar to those used for corporate credit ratings, although the borrower’s willingness to repay receives extra emphasis since national governments may be eligible for debt immunity under international law, thus complicating repayment obligations. In addition, credit assessments reflect not only the long-term perceived default risk, but also short- or immediate-term political and economic developments. Differences in sovereign ratings between agencies may reflect varying qualitative evaluations of the investment environment.

Conflict of interest in assigning sovereign ratings