Obtain New Credit Lines

The basic idea is to increase the amount of unused credit that you have available. For example, if you currently have $20,000 in credit limits, but owe $15,000, your credit utilization ratio is an uncomfortably high 75 percent. But if you add a $10,000 credit line, giving you $30,000 in your overall credit limits, your credit utilization ratio will drop to 50 percent .

Be careful with this strategy, however, since its not as black and white as it may seem. The bump you receive for the suddenly lower credit utilization ratio can be offset by your new credit line, which is brand-new debt. That can take a major toll on the New Debt component of your credit score calculation, even though its only 10 percent of your score.

When Is My Credit Usage Calculated And Reported

Your credit score is updated periodically oftentimes every month so it wont always reflect the most recent purchases and payments.

Your credit utilization is usually calculated based on your balance at the end of your statement period. The outstanding balance and total credit limit on this date are what will affect your credit score.

Can I Have Negative Credit Utilization

Its smart to research ways you can use your credit cards to your advantage this includes finding ways your accounts can help you maximize credit scores. Credit cards can definitely be powerful credit-building tools, when you manage them properly. However, some credit card strategies miss the mark.

The idea that you can boost your credit scores by overpaying your credit card account is an example of well-intentioned advice gone bad. Overpaying a credit card account wont help your credit scores. Its also not a good way to manage your money.

When you overpay your credit card, your account will reflect a negative balance. If you check your statement or account activity online, that credit might look something like this:

Account Balance: -$250.00

Overpaying isnt the only way to receive a credit or negative balance on your credit card account. Other potential reasons a negative balance might occur include the following:

- A statement credit is posted to your account, after you make a payment. .)

- You receive a refund for a purchase made on your account, after you make a payment.

- Your card issuer refunds your account as a courtesy or due to an error or fraudulent charge.

Regardless of the cause, a credit or negative balance on your credit card account will not help your credit scores.

In fact, -1% utilization will never show up on your credit reports.

Your statement might show that your balance is -$250. Your credit reports, on the other hand, would show a $0 balance.

Read Also: How To Check Itin Credit Score

Other Factors That Influence Credit Score

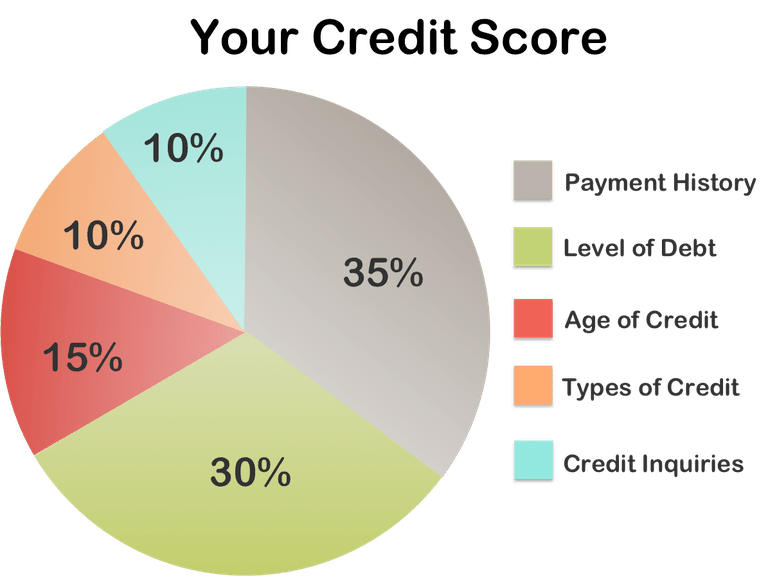

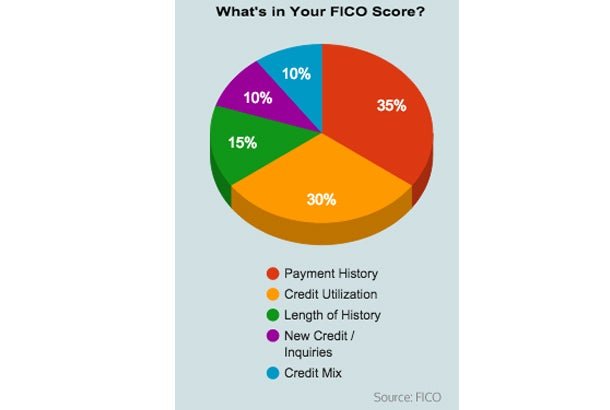

Your credit score is like one big pie credit utilization is just a piece of it.

FICO uses a pie chart to illustrate the five different factors that influence your credit score, cut into different sizes to reflect their significance:

VantageScore, the other popular source of credit score checks, uses the same five factors but weighted differently:

-

Total credit usage, balance and available credit Extremely influential

-

Highly influential

-

Payment history Moderately influential

-

Age of credit history Less influential

-

New accounts opened Less influential

Ashley Davison Of Credit Saint Responds

This may come as a shock but: Paying your credit card when its due may be lowering your credit score.

One of the first things you learn about credit is the importance of revolving credit credit cards. Love them or hate them, credit card balances account for 30% of your credit score and can make or break you depending on how you manage them.

When I work with clients, its not uncommon to see them with at least one maxed-out credit card. They rarely realize how dramatic the impact can be Ive seen as many as 100 points deducted overnight for maxed-out cards . Anything North of 50%-60% of your total limit can do this, and the closer you get to your combined credit limit the worse it gets .

Also Check: Can You Use Klarna On Walmart

What Are The Limitations Of Credit Utilization Ratios

If youre reducing your credit utilization ratio to improve your credit score, you might not see results immediately. Credit reporting is not updated every day. Recent payments or new credit wont reflect immediately.

Another limitation is a credit utilization ratio is not everything. Having credit available to you can help in an emergency, such as losing your job or an unexpected expense. If you need to use your credit in a pressing financial situation, thats what its there for. Fixating on how much credit youre using isnt everything. Of course, you should manage your personal finances with stability in mind. But sometimes financial emergencies arise and thats okay.

What Is Amounts Owed

In a very general sense, Amounts owed refers to how much debt you carry in total. However, the amount of debt you have is not as significant to your credit score as your credit utilization. When a high percentage of a person’s available credit is been used, this can indicate that a person is overextended, and is more likely to make late or missed payments.

Read Also: Carmax Approve Bad Credit

How Your Credit Utilization Impacts Your Credit Score

FICO indicates your credit utilization ratio makes up 30% of your entire credit score.

Managing credit utilization is a relatively fast way to improve or damage your credit. As you pay off your revolving credit card bills, you will see your credit utilization rate go down, and your credit score will likely go up. If left unchecked, it can impact your ability to get mortgages and auto loans.

When managing your credit, keep a general rule to use as little of it as possible, yet try to have as much credit awarded to you as possible. By doing this, you will continue to prove you can manage your credit responsibly.

Pay Your Credit Cards Twice Each Month

This is probably the most low-maintenance way to keep your utilization low. This way, even if youre using the cards throughout the month, a mid-month payment can pay the card back down to a level that stays below the 30% threshold.

Fortunately, a high credit utilization won’t hurt your credit score forever. As soon as you reduce your credit card balances or increase your credit limits, your credit utilization will decrease, and your credit score will go up.

Also Check: Can You Get An Eviction Removed From Your Credit

How To Calculate Credit Utilization

To calculate your credit utilization do the following:

- Add up the balances on all your credit cards

- Add up the credit limits on all your cards

- Divide the total balance by the total credit limit

- Multiply by 100 to see your credit utilization ratio as a percentage

For example, lets imagine you have the following credit card balances and credit card limits:

| $2,750 | $6,000 |

After adding up the total balance and the total credit limit , you then divide $2,750 by $6,000 which gets us .46. Then multiply that number by 100 to get your credit utilization percentage, which in this case would be 46%.

Managing Your Credit Utilization Ratio

Managing this credit may seem overwhelming, but it is fairly simple. Keep these few points in mind when you are using your allocated credit:

- Pay off your balances in full, and aim to keep your utilization under 30% at all times.

- Dont be shy to ask for more credit. Next time you speak to your credit card company, ask the customer service representative if you are eligible for a credit line increase. Issuers are more than happy to issue more credit, as long as you are a responsible customer, so dont be afraid to ask.

- Balance transfer credit cards don’t directly help. But if you are transferring to lower interest rates , it can help you lower overall debt and utilization.

Don’t Miss: How To Get A Repossession Off Your Credit Report

Tips For Proactive Revolving Utilization

Managing your revolving utilization will help you maintain a good credit score. Carrying balances on your credit cards will cost you a lot of money on interest. Credit cards typically have interest rates that are a few times more than on a collateralized loan like a car. Keeping out of debt is simply in your best interest. Here are three things you can do to keep your credit score optimized.

How Credit Utilization Impacts Borrowers

A borrowers credit utilization ratio will vary over time as borrowers make purchases and payments. The total outstanding balance due on a revolving credit account is reported to at various times throughout the month.

The timeframe used by lenders for reporting credit balances to an agency can affect a borrowers credit utilization levels. Therefore, borrowers seeking to decrease their credit utilization must have patience and expect that it may take two to three credit statement cycles for credit utilization levels to drop when debt is being paid down.

Some lenders report to credit reporting agencies at the time a statement is issued to a borrower while others choose to report on a designated day of each month.

Also Check: What Is Leasingdesk

How Often Should You Apply For A Credit Card

In theory, you can apply for new credit cards as often as you like. Since the average online application only takes a few minutes, you can apply for a lot of cards in a very short amount of time.

But that doesnt mean you should apply for multiple credit cards all at once. In most cases, waiting between credit card applications is better for your credit scoreand it can even improve your chances of getting accepted.

Before We Dive Into How Using Your Credit Card May Affect Your Credit Scores Lets Recap What We Mean When We Talk About Credit Card Utilization

You can figure out your credit utilization rate by dividing your total credit card balances by your total credit card limits. The resulting percentage is a component used by most of the credit scoring models because its often correlated with lending risk.

Most experts recommend keeping your overall credit card utilization below 35%. Lower credit utilization rates suggest to creditors that you can use credit positively without relying too heavily on it, so a low credit utilization rate may be correlated with higher credit scores.

Now that weve defined our terms, lets look more closely at how your credit utilization relates to your credit scores.

Don’t Miss: 888-826-0598

Pay Off Your Balances

The best way to lower your credit utilization ratio is to pay off your credit card balances. Every dollar you pay off reduces your credit utilization ratio and your total debt, which makes it a win-win scenario. Plus, paying off your balances means no longer having to pay interest on those balances. So ask yourself how much debt you can pay off in the next few months, and see how it affects your credit utilization and your credit score.

Can I Use My Credit Utilization Ratio To Improve My Credit Score

Yes but only if you know how. The simplest thing is to keep an eye on your balances, ensuring that they are under 30% of your limit. However, there are a few workarounds.

- Opening another credit card. It may sound counter-intuitive, but opening another credit card could improve your credit utilization ratio, which in turn could increase your credit score. If you plan on using this strategy, steer clear of store credit cards as they typically come with low credit limits which could be maxed out in just one shopping trip.

Case study: Increasing your credit utilization ratio

When you open up a balance transfer credit card, your credit utilization ratio goes down. Heres how:

- You have a $500 balance on your current card. This card has a $1,000 credit limit. Right now, your credit utilization ratio is 50%.

- You transfer that $500 balance to a new card with a $1,000 credit limit.

- Now you have a $2,000 limit spread between the two cards with a balance of $500, which brings your credit utilization ratio down to 25%.

This new credit utilization of 25% is certainly a better ratio. However, be cautious with this approach: A new credit card can reduce the average age of your credit accounts and around 15% of your credit score depends on credit age.

Recommended Reading: Does Overdrafting Affect Credit Score

What Is Credit Utilization

is the ratio of your outstanding credit card balances to your credit card limits. It measures the amount of available credit you are using. For example, if your balance is $300 and your credit limit is $1,000, then your credit utilization for that credit card is 30%. If youre adding $500 per month of new charges on your card and your limit is $1,000, youll have a utilization rate of 50%.

To calculate your credit utilization ratio, simply divide your credit card balance by your credit limit, then multiply by 100. The lower your credit utilization percentage, the better. A low credit utilization shows that you’re only using a small amount of the credit that’s been extended to you.

Five major factors have an influence on your FICO , the most commonly used credit scoring model:

- Payment history

- Level of debt/credit utilization

- The age of credit

- Mix of credit

Your credit scoreincluding your credit utilization ratiois calculated based on the most recent information posted on your credit report. Because credit card information is updated on your credit report based on billing cycles and not in real time, your credit score may not reflect the most recent changes to your credit card balance and credit limit.

The balance and credit limit as of your credit card account statement closing date is what’s used to calculate your credit score.

Why Credit Utilization Matters

The whole goal of the credit scoring algorithms is to determine how likely it is that someone will default on his or her obligations in the next six or 12 months. To that end, is a pretty reliable indicator that a borrower is encountering financial stress.

Suppose we have two people, each of whom has a credit card with a $10,000 credit limit. One person has a balance of $8,000. The other person has a balance of $500.

With only this information in hand, which person do you think is most likely to have a budget shortfall, or encounter problems paying back his or her balances? I suspect you’d answer that the person with the larger balance is the person most likely to have budget problems right now or in the future. I agree.

Also Check: How Long Before Eviction Shows On Credit Report

How To Improve Credit Utilization

If using too much credit aka having a high credit utilization percentage is affecting your credit score, and youre working on building credit, there are a few things you can do.

When you apply for a new credit card, your credit score may drop slightly. Thats because theres a hard inquiry where a lender does a full check on your credit to review your creditworthiness. Luckily, it recovers pretty quickly if you use that increased limit to your advantage instead of charging more on the card. Overall, having a higher credit limit and lower balance will improve your credit utilization ratio, which is a good thing!

How Does A Personal Line Of Credit Affect Your Credit

Nearly everyone needs a spot of cash now and then. Today, you have a wide range of options for accessing credit: credit cards personal loans buy now, pay later arrangements home equity linesto say nothing of willing friends and family.

One of your options is a personal line of credit. If you’ve heard about personal lines of credit but never actually had one, you’re not alone. Personal lines of credit are less common today than they were a decade or two ago, but they’re still an option that’s potentially worth pursuing. Read on to learn more about them, if they’re right for you and how they’ll affect your credit.

Recommended Reading: What Credit Bureau Does Care Credit Use

How Many Credit Cards Is Too Many

Even having two credit cards can be one too many if you cant afford to pay your bills, dont need them, or dont plan to use them for some purpose.

While getting a new credit card can sometimes improve your credit score by potentially lowering your total credit line utilization ratio, getting a lot of cards in a short period of time is not advised. Many card issuers even have rules in place to combat this phenomenon, which has arisen with customers who try to game the system by signing up for lots of credit cards to earn the bonuses and then cancel after meeting the spending requirements. For example, Chase has a policy termed 5/24, which doesnt allow you to be approved if you have applied for more than five credit cards in the past 24 months.

Another potential downside of having a large number of cards is that it can make you look risky to lenders and lower your credit score. Even if you have them all paid off, the mere fact that you have a lot of open and available credit lines can make you look like a potential liability to the next lender. So, while there is no absolute number that is considered too many, its best to only apply for and carry the cards that you need and can justify using based on your credit score, ability to pay balances, and rewards aspirations.