How To Dispute Or Remove Credit Inquiries

Its possible to dispute or remove some credit inquiries from your credit report. If you initiated the hard credit pull by applying for new credit, you cannot remove the credit inquiry from your report. However, if the credit inquiry is the result of identity theft or some other error, you can file a dispute with the credit bureaus and request a hard inquiry removal.

To dispute a credit inquiry, follow the instructions associated with the credit bureau that developed the report.

According to a 2013 Federal Trade Commission study, 5 percent of Americans have errors on their credit reportsbut that doesnt mean every unfamiliar credit inquiry on your credit report is the result of an error. As Experian reminds us, credit inquiries can come from lender names we dont recognize and we often dont realize that applying for a car loan or a mortgage could prompt multiple hard credit inquiries from potential lenders. Think carefully about where those credit inquiries might have come from before filing a dispute.

Erase Inaccurate Negative Items For Good W/help From Credit Glory

Disputing negative items on your credit report is hard work! It takes a lot of time, effort, organization, and follow up. The good news? Our team of credit repair professionals is here to simplify everything! Let your dedicated credit repair expert relieve you of the stress, hassle, and time needed to fight your inaccuracies and boost your credit score

Call us at or set up a consultation to get started, today!

Does Your Credit Score Go Up When A Hard Inquiry Is Removed

If you have applied for a credit card or loan, you may have noticed that a hard inquiry was added to your credit report. A hard inquiry, unlike a soft inquiry, does lower your credit score anywhere from 5 to 10 points. So, does your credit score go up when a hard inquiry is removed from your credit report? We will answer this question in much detail below.

You May Like: Credit Wise Is Not Accurate

Losing Points On Your Credit Score

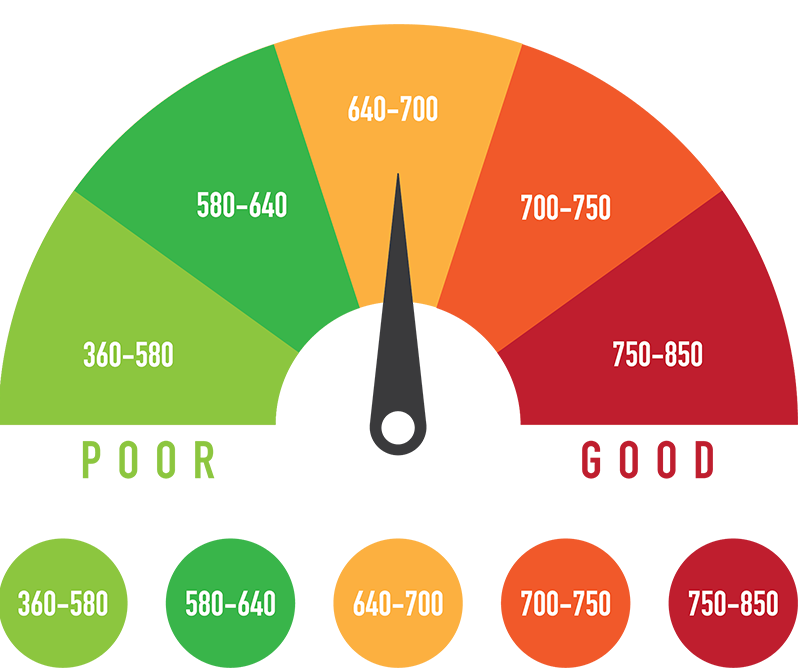

To reiterate, hard inquiries can lower your FICO credit score anywhere from 5 to 10 points. While this seems like nothing, 5 to 10 points could end up being a deal breaker. Some companies look through thousands of loan and credit card applications every day. To make the process go by faster, they might only look at your credit score. They might have a threshold that if you are even one point under they wont lend to you. According to credit.org, a good credit score ranges from about 680-740 and the threshold of a good score usually is about 700 points and above. If youre trying to get a loan from a company that has a strict threshold of 700 points, a 5 or 10 point decrease could put you below that line and you could be denied an important loan.

While many other things lower your credit score more than hard inquiries do, they still shouldnt be ignored. Hard inquiries arent exactly avoidable though, so try to only get them once in a while. If you have had 4 inquiries over the past year your score could be down as much as 40 points until it goes away!

How Many Hard Inquiries Is Too Many

The effect of a hard inquiry on your credit scores ultimately depends on your overall credit health. In general, adding one or two hard inquiries to your credit reports could lower your scores by a few points, but its unlikely to have a significant impact.

Having a lot of hard inquiries within a short time frame though will likely have a greater impact on your scores. This is because lenders and in effect, credit-scoring models look at multiple credit applications in a short amount of time as a sign of risk. Though there can be exceptions when youre shopping for specific types of loans, like car loans, student loans or mortgages.

Don’t Miss: 524 Credit Score Credit Card

How Can You Improve Your Credit Score

If you have multiple hard inquiries on your credit report that are causing a drop in your credit score, can you still improve your credit score prior to the hard inquiry dropping off your credit report? Yes, there are a variety of things that you can do in the meantime to improve your credit score. Here are some of the things you can do:

- Make timely payments. Making timely payments on your credit and loan accounts is the best thing you can do to improve your credit score. Payment history accounts for 35% of your credit score, so make sure you dont miss any payments and that you make them on time.

- Dont utilize too much credit. Dont utilize too much of your available credit. Its a good rule of thumb to keep your credit utilization below 30%. For example, if you have a $10,000 credit limit, you should keep the balance on your credit cards below $3,000. This ensures that your credit score does not drop due to high credit utilization.

- Dont apply for too much credit. You should avoid applying for too many credit cards and loans within a short period of time. This is so because every time you apply, a hard inquiry is added to your credit report. Although a single hard inquiry wont lower your score by much, too many hard inquiries within a short period of time can cause a significant drop in your credit score.

Can You Remove Hard Inquiries From Your Credit Report

Say you went through a period of applying for many loans, and your credit score was dinged several times. Youre probably wondering, Is there a way to file for a hard inquiry removal?

If youve been a victim of identity theft or did not authorize the hard pull, you can dispute with the creditor to try and have it removed. If you approved the hard pull, there is no way to remove it from your credit report. However, hard inquiries will naturally fall off your credit report after two years.

The good news is that if multiple hard inquiries happen in the same span, they may only count as one. Loan applications for a mortgage or auto loan that occur within a 14-day windowor sometimes up to a 45-day windowwill only count as one inquiry. This is intentional, so you can shop around to get the best deal.

Given the impact of hard inquiries on your credit score, you must be diligent about checking your credit report every year. Flag any derogatory marks you dont recognize and dispute them with the three major credit reporting bureaus: Transunion, Experian, and Equifax.

Don’t Miss: Attcidls

As You Pay Down Your Mortgage

In the long run, having a mortgage and paying it off as agreed can help you build a stronger credit profile.

A study by LendingTree found that U.S. borrowers saw an average credit score drop of 20.4 points after getting a mortgage. It took an average of 165 days after closing for credit scores to reach their low points, and another 174 to rebound. In total, the decline and rebound averaged 339 daysjust shy of a year.

While your score will likely drop initially, a track record of on-time monthly payments on the sizable loan will help to improve your score and trustworthiness as a borrower.

How To Avoid Too Many Hard Inquiries

Although a single hard inquiry will not damage your credit score, having too many within a short period of time can. So, how can you avoid racking up too many hard inquiries? You should only apply for as much credit as you need. Also, you should check the requirements for the credit card or loan that youre applying for before applying. For example, if you want to apply for an American Express Gold Card, you should check the requirements for the card before applying. If you believe youre a good fit, only then should you apply for the card. This saves you from racking up unnecessary hard inquiries on your credit report.

CSP Pro Tip: Always try to keep your hard inquiries to a minimum. Racking up too many hard inquiries within a short period of time makes you look like youre credit hungry. This is something that lenders do not like to see. As such, only apply for the credit that you need.

Recommended Reading: How To Get Rid Of Repossession On Credit Report

Plan Before Shopping For A Loan

Before shopping for a loan, it’s always smart to proactively plan your finances.

First, learn whether the type of credit you’re applying for can have its hard inquiries treated as a single inquiry. If so, determine the applicable timeframe. Then you can plan your shopping period accordingly.

Second, you may also want to check your credit reports before getting quotes to understand what information is reported. Find out how to request a free credit report from Equifax.

If you’re worried about the effect that multiple hard inquiries may have on your credit reports, it may be tempting to accept an offer early rather than allow multiple hard inquiries on your credit. However, consider your individual situation carefully before cutting your shopping period short. In many cases, the impact hard inquiries have on your credit scores from shopping around will likely be minimal compared to the long-term benefits of finding a loan with a lower interest rate. The more informed you are about what happens when you apply for a loan, the better you can prepare for the process before you start shopping.

How Long Will A Hard Inquiry Affect My Credit

Inquiries stay on your report for two years. The Fair Credit Reporting Act requires credit bureaus to disclose to you all credit inquiries on your credit report for the past two years.

But credit scoring models typically only count inquiries that have occurred in the past twelve months. And for most consumers, inquiries wont matter after a few months. The impact will level off, especially if everything else in the credit report is strong.

Pro Tip: One way to avoid too many hard inquiries is to check a lenders approval requirements before you apply. Only apply if youre reasonably confident youll be approved. That way you dont rack up inquiries for credit when youre likely to be denied.

Don’t Miss: Jefferson Capital Systems Verizon Phone Number

Hard Credit Inquiries Vs Soft Inquiries

There are two types of credit inquiries: a soft inquiry and a hard inquiry, also referred to as a soft pull and hard pull.

Soft inquiries happen more frequently than you may think and do not directly impact your score. A soft inquiry might occur before a company sends you a credit card offer, a review of your credit by a prospective employer, or when you check your own credit score.1

A hard inquiry is a credit check that youve knowingly consented to and generally occurs when you apply for credit or a loan. Hard inquiries are flagged since part of your credit score calculation considers how frequently you apply for credit.

But if a soft inquiry has no impact, what is the effect of hard inquiries that you knowingly initiate, like when youre applying for a mortgage or new auto loan?

How Many Points Does A Hard Inquiry Take Away From Your Credit Score

- 6:21 pm

Your credit score is one of the most critical aspects of your financial life. It affects whether you will qualify for a mortgage, car loan, or personal loan, and it also impacts what interest rates youll be offered on those loans.

A hard inquiry into your credit rating can lower it by 5-10 points.

Recommended Reading: Afterpay Affect Credit Score

How Much Does A Hard Inquiry On Your Credit Report Hurt

For people with extensive credit histories, a single credit application and hard inquiry has no effect or a fairly minimal one.

If youve lost points because you applied for a lot of credit in a short time span, take heart. Credit applications are not a major factor in calculating your credit scores.

VantageScore describes recent credit behavior and inquiries as less influential. Applications for new credit account for 10% of FICO scores.

But people who have short credit histories or few accounts may see a bigger change.

If youre trying to build credit, every point counts, and pulling back on new applications for a few months should restore lost points. Particularly if you are taking out a mortgage, wait until after closing to apply for new credit.

Multiple hard inquiries can put a serious dent in your credit, particularly if you are new to credit, and its an easy mistake to make. Say youve just rented an apartment. The leasing agent may check your credit. And then you may apply for financing for furniture. Then you decide you want a card with travel rewards, so you apply for a couple of those. That could be four credit inquiries within a short period, and it could result in a lower score.

Statistics cited by FICO show that people with six or more recent inquiries are eight times as likely to file for bankruptcy as those with none, and scoring formulas reflect that.

In the meantime, focus on the two things that have the most powerful effect on your scores:

How Many Hard Inquiries Will Affect Your Credit Score

Even if inquiries cause a one-point change in your score, they will be listed as a factor that affects your score.

To avoid credit score damage from multiple hard inquiries over a short time, scoring models recognize that borrowers often shop around for the best loan. Seeking a mortgage, auto or student loan may cause several lenders to request your credit report, despite the fact you are only looking for one loan.

Inquiries for mortgage loan and auto loan purposes in a certain period of timeusually 14 dayscounted as a single inquiry by most scoring systems. For those purposes, a limit to inquiries does not exist.

While auto, mortgage and student loan applications over a short period of time are treated as one single inquiry, that is not the case for credit cards.

Therefore, every new credit card inquiry can perhaps hurt your credit score . Dont randomly apply for new credit cards. Rather, when credit card shopping, do your homework. Compare rates, terms and features offered by lenders. Then, only apply for the card that best meet your personal needs.

Need to know more about how many hard inquiries will affect your credit score? Let us know! To enlist the help of a trustworthy, effective credit repair company, contact Go Clean Credit today.

Recommended Reading: How To Remove From Credit Report

Recommended Reading: Does Removing Hard Inquiries Increase Credit Score

What Is A Hard Credit Inquiry

A hard credit inquiry typically takes place when you apply for a credit card, mortgage, or car loan.

The credit bureaus track much of your financial activity, including:

Credit card balances

History of payments for revolving credit and installment loans

Number and type of credit accounts

Bankruptcy and other public record filings if they meet the minimum standards for reporting

The Fair Credit Reporting Act dictates that a person or organization must have a permissible purpose to access your reports. But federal law and some state laws allow quite a few parties to pull your credit if you have a current or potential relationship with them, Nolo says.

These entities can legally request your credit reports, according to the Fair Credit Reporting Act:

Employers

Insurance companies

Entities that have a court order

All hard inquiries will show up on your credit reports, and each hard pull outside the scope of rate shopping for a single loan may lower your credit score a tadby less than five points, according to FICO® . FICO and VantageScore are the two most common scoring models used to convert credit report information into credit scores, ranging from 300 to 850 points.

Multiple inquiries from auto, mortgage, or private student loan lenders within a short period of time are typically treated as a single inquiry. For FICO, its a 45-day window for VantageScore, its 14 days.

How Hard Inquiries Impact Your Credit Score

Hard inquiries may, but do not always, impact your credit scores, Ulzheimer said, noting that one of the most common misconceptions about credit inquiries is that they always have a negative effect on your credit score. If a hard credit inquiry does negatively impact your credit score, it is likely to drop by no more than 10 pointsand the damage should last no longer than a year. Hard inquiries automatically fall off your credit report after two years.

The impact, if any, will last 12 months, Ulzheimer advises. Once an inquiry becomes older than 12 months, they are not seen by either FICO or VantageScores credit scoring models.

You May Like: 688 Credit Score Credit Card

Do Credit Inquiries Affect My Fico Score

FICO’s research shows that opening several credit accounts in a short period of time represents greater credit risk. When the information on your credit report indicates that you have been applying for multiple new credit lines in a short period of time , your FICO Scores can be lower as a result. Although FICO Scores only consider inquiries from the last 12 months, inquiries remain on your credit report for two years.

If you apply for several credit cards within a short period of time, multiple inquiries will appear on your report. Looking for new credit can equate with higher risk, but most are not affected by multiple inquiries from auto, mortgage or student loan lenders within a short period of time. Typically, these are treated as a single inquiry and will have little impact on your credit scores.