Equifax Dispute By Phone

To submit a dispute by phone, call the Equifax dispute phone number: 1-866-349-5191. The hours of operation are Monday through Friday from 8 am to 8 pm . Its also a good idea to have your credit report handy, along with pen and paper, to jot down instructions on where to send any supporting documentation.

Here Are Some Common Mistakes

Sometimes, one consumer’s file is wrongly “mixed” with another person. Consumer watchdogs blame some loose matching criteria, which can help ensure that users of credit reports, including lenders and others, don’t miss out on possible negative information.

In some cases, negative information may wrongly remain on a credit report even after court judgments or legal settlements declare that a consumer doesn’t owe a debt.

And there are the after-effects of identity theft, such as when the credit bureaus and creditors don’t believe the victim.

In some cases, a consumer may even be labeled dead when they’re very much alive.

An account or debt can be attributed to the wrong consumer or a payment history may be incorrectly recorded.

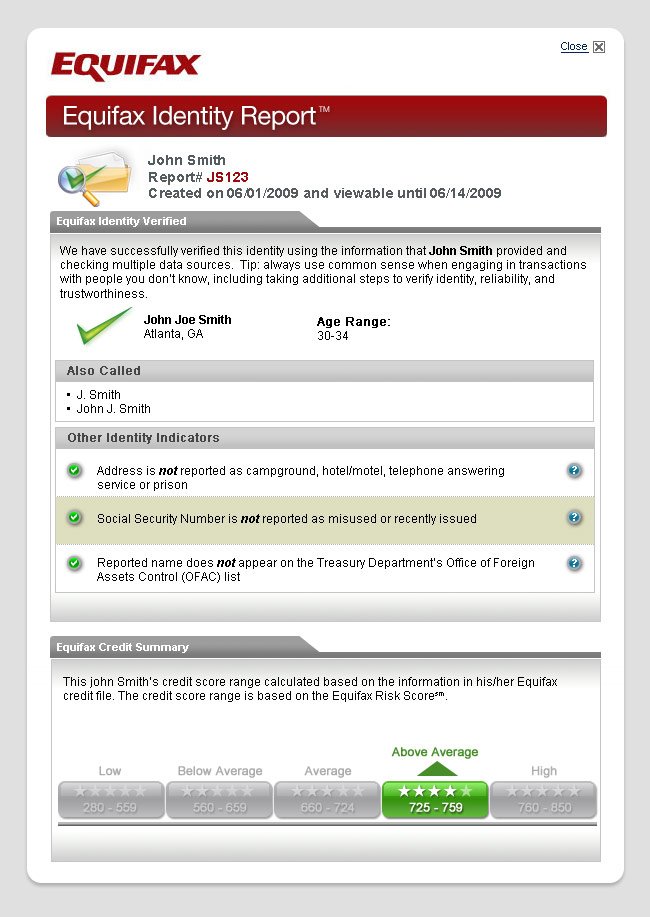

What Is An Equifax Score

Lets first begin by understanding the basics of an Equifax score. An Equifax credit score is a 3-digit number between 300-900 that gives potential lenders a complete picture of your credit health. Also known as a credit rating, a higher score is indicative of good credit health and improves your chances of securing a loan/credit card. In simple terms, a credit score impacts your ability to borrow fresh credit from the banking system.

Recommended Reading: What Credit Score You Need For Apple Card

Obtain An Ein Number For Your Business

EIN stands for Employer Identification Number. The EIN is a number assigned to your business by the IRS for tax identification purposes. Your bank and partner vendors may also require this information before choosing to do business with your company.

If youre just starting out in business, you may be wondering how to obtain an EIN number? You can obtain an EIN by filling out IRS Form SS-4, or you can simply complete the process online.

Caution: Some less than credible websites may lead you to believe there is a fee associated with obtaining an EIN. This is false and predatory, as the IRS does not charge for establishing an EIN.

Tip: If you choose to apply for a business credit card, you can apply with the business EIN rather than your Social Security number. Make sure to build your business credit first, though.

How Your Data Is Collected By Equifax

Equifax uses a number of sources to collect data about consumers.

The U.S. Consumer Financial Protection Bureau estimates that there are approximately 10,000 different companies and sources that report information about you to the credit bureaus. However, some industry experts say that figure could be much higher .8

Information about you is also readily available via public records and/or collection items, such as details regarding a previous bankruptcy you may have filed, or any government tax liens and civil judgments you may owe.

In addition, Equifax provides and collects data through the NCTUE , an exchange of non-credit data including consumer payment history on telecommunications and utility accounts.9

Don’t Miss: How To Self Report To Credit Bureaus

Equifax Must Provide Free Copies Of Your Credit Report

A data breach at Equifax in 2017 compromised the personal information of at least 147 million consumers. As part of a court settlement related to the hack, everyonewhether they were affected by the breach or notcan get six more free credit reports from Equifax each year, beginning in January 2020, for the next seven years.

Les Demandes De Votre Dossier De Crdit

Cest ici que les demandes sur lhistorique de votre dossier crédit apparaissent. Certains établissements bancaires comme American Express utilisent TransUnion et dautres comme CIBC ou TD / MBNA Equifax. Sachez toutefois que les établissements reporteront votre compte une fois ouvert aux deux bureaux.

Il y a ce que lon appelle les hard hits et les soft hits.

- Un hard Hit est provoqué par une nouvelle demande de crédit: demande de carte, demande de prêt hypothécaire, demande dautorisation de découvert sur votre compte-chèques Ce Hard Hit impactera votre score et il reste affiché pendant 3 ans sur votre dossier.

- Un soft hit est une interrogation régulière effectuée par un prêteur. Il nimpactera pas votre score.

Note à part: je suis particulièrement remonté contre Chase. Comme vous pouvez le voir, ma demande de carte Marriott en Avril a provoqué 2 hard hits à 2 mois dintervalle. Cela ma fait perdre une dizaine de points.

NB: Notez que les hards hits dAmerican Express saffichent sur le dossier Transunion et non Equifax.

You May Like: How Long Are Late Payments On Credit Report

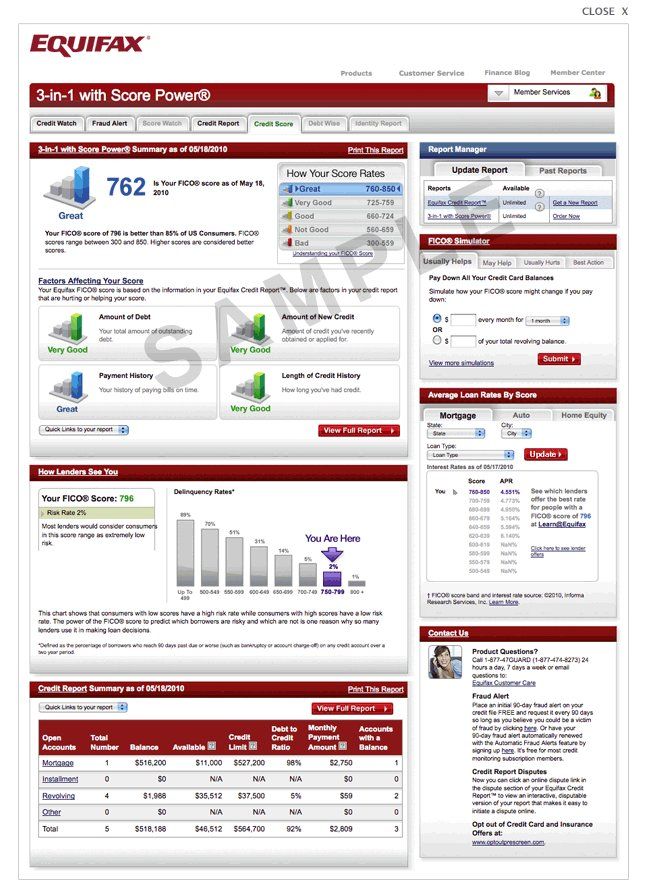

Do You Need All Three Scores

Yes. Credit information is often not reported with the same accuracy across all three credit bureaus, so it is important for consumers to check each report and score. Under the 2003 Fair and Accurate Credit Transactions Act , an amendment to the above-mentioned FCRA, consumers are able to receive a free copy of their report from each credit reporting agency once a year.

As some creditors and collectors only report to one or two agencies, some items get disputed off one report but are verified on another. Items also get removed from one or two reports for various reasons. This variation often means a large credit score difference from bureau to bureau. When a credit score is requested, it is calculated based on what is in that particular credit report. Thus, while a consumer may have a solid credit score based on one report, they may have a dicier credit score based on another.

If a consumer is denied credit based on one bad credit score but has a better credit score with another bureau, they may have luck calling the creditor and asking for the better score to be considered, especially if there is a good reason why the first credit score is so low.

How To Dispute Your Equifax Credit Report

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

Its smart to review your credit reports regularly to double-check the information being submitted by lenders, credit card issuers, public agencies and sometimes landlords.

Federal law gives you the right to see the data that the three major credit bureaus Equifax, Experian and TransUnion have collected. Use AnnualCreditReport.com to request the free reports youre entitled to. Errors in your credit reports can cost you points on your credit scores, so fixing mistakes is worth the effort.

If you find an error in your Equifax report for example, a late payment you believe was made on time you can dispute it.

Recommended Reading: What Credit Report Does Paypal Pull

Dispute Mistakes With The Credit Bureaus

You should dispute with each credit bureau that has the mistake. Explain in writing what you think is wrong, include the credit bureaus dispute form , copies of documents that support your dispute, and keep records of everything you send. If you send your dispute by mail, you can use the address found on your credit report or a credit bureaus address for disputes.

Equifax

Place A Credit Freeze

Contact each credit reporting agency to place a freeze on your credit report. Each agency accepts freeze requests online, by phone, or by postal mail.

Experian

PO Box 26Pittsburgh, PA 15230-0026

Your credit freeze will go into effect the next business day if you place it online or by phone. If you place the freeze by postal mail, it will be in effect three business days after the credit agency receives your request. A credit freeze does not expire. Unless you lift the credit freeze, it stays in effect.

Also Check: What Is The Maximum Credit Score

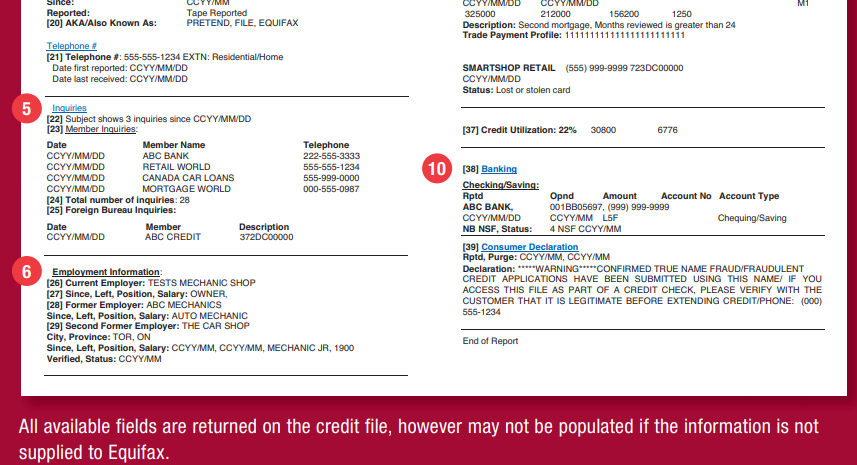

What’s In Your Credit Reports

A credit report may include basic information about a consumer’s debts, creditworthiness, credit standing, credit capacity, character, general reputation, personal characteristics, or mode of living. The data in the reports from the different credit reporting agencies can vary to some degree, depending on which company produces the report.

Monitor Your Business Credit Report

Stay informed on your business credit status by requesting a report from Equifax Small Business. You can use this report to make sure your business information is correct and up to date.

Equifax Small Business also offers several paid services that can help you protect and grow your business. You can choose from services that give you access to your business credit report and services to help protect and monitor your business credit.

Recommended: Continue building your business credit with paid credit services offered by Equifax Small Business. They offer multiple options to suit your business needs.

Read Also: What Does A Good Credit Score Mean

Escalate The Issue If Required

If you feel that a credit bureau has not treated you properly, you may file a complaint. This complaint can be made in writing to your provincial or territorial consumer affairs office. The federal government does not regulate credit bureaus.

In Quebec, these complaints must be directed to the Commission d’accès à l’information du Québec .

Dispute The Information With The Credit Reporting Company

If you identify an error on your credit report, you should start by disputing that information with the . You should explain in writing what you think is wrong, why, and include copies of documents that support your dispute. You can also use our instructions

If you mail a dispute, your dispute letter should include:

You may choose to send your letter of dispute to credit reporting companies by certified mail and ask for a return receipt, so that you will have a record that your letter was received.

You can contact the nationwide credit reporting companies online, by mail, or by phone:

Read Also: Does Chase Credit Journey Affect Credit Score

How To Report Late Rent

Report Late Rent and Reduce tenant delinquencies by 36%

Report Late Rent and Reduce tenant delinquencies by 36%

For Canadian Landlords and Property Managers there has never been a tenant registry that enables them to report tenants rent payments. Leaving many asking the question, how do I report late rent on a tenant?

The Landlord Credit Bureau empowers Landlords and Property managers to report rent payments, paid, late or otherwise owing. For tenants who consistently pay rent on time LCB will reward them with a positive Tenant Record as well as an improved credit report. For those tenants who choose to not pay rent, they will receive a negative Tenant Record, and this will be reported on their credit report.

LCB is a Reporting Agency in Canada.

LCB handles notifying tenants that their rent payments are reported to LCB and of the benefits and consequences for late rent payments and non-payment of rent. Tenants can view and monitor their records, and if information is disputed, there are multiple mechanisms in place to handle such disputes. LCB will then investigate.

With LCB you can also report former tenants. In the case of former tenants who owe unpaid rent, the amount you record will automatically roll over each new month, until you login and record it as paid. You can also report a positive rent payment history for former tenants.

How to report Late Rent Payments?

It is easy with Landlord Credit Bureau, and it is free to sign up.

Ready to make renting easier?

Will My Credit Score Increase If A Collection Account Is Removed

Since payment history accounts for 35% of your FICO score, your score might build if a collection account is removed. However, how much it increases will depend on other items listed in your credit report. For example, if this negative account is the only one listed on your credit report, removing it could boost your score more than if you had several other collection accounts on your report.

Also Check: Does Removing An Authorized User Hurt Their Credit Score

One Email A Day Could Help You Save Thousands

Tips and tricks from the experts delivered straight to your inbox that could help you save thousands of dollars. Sign up now for free access to our Personal Finance Boot Camp.

By submitting your email address, you consent to us sending you money tips along with products and services that we think might interest you. You can unsubscribe at any time. Please read our Privacy Statement and Terms & Conditions.

Collection Accounts And Your Credit Scores

Reading time: 3 minutes

Highlights:

- If you fall behind on payments, your credit account may be sent to a collection agency or sold to a debt buyer

- You are still legally obligated to pay debts that are in collections

- Collections accounts can have a negative impact on credit scores

Past-due accounts that have been sent to a collection agency can be a source of confusion when it comes to your credit reports and credit scores. What does that mean? And if you pay off the accounts, can they be removed from your credit reports? Weve broken down what you need to know.

What is a collection account? If you fall behind on payments, the lender or creditor may transfer your account to a collection agency or sell it to a debt buyer. This generally occurs a few months after you become delinquent, or the date you begin missing payments or not paying the full minimum payment.

Typically, lenders and creditors will send you letters or call you regarding the debt before it is sent to a collection agency. You may not be notified if your account is being sold to a debt buyer, however. The collection agency or debt buyer will then attempt to collect the debt from you.

If your debt is sold to a debt buyer or placed for collection with a collection agency, you are still legally obligated to pay it. You may end up making payments directly to the collection agency or debt buyer instead of the original lender.

Recommended Reading: Does Afterpay Affect Credit Score

Fixing Errors In A Credit Report

Anyone who denies you credit, housing, insurance, or a job because of a credit report must give you the name, address, and telephone number of the credit reporting agency that provided the report. Under the Fair Credit Reporting Act , you have the right to request a free report within 60 days if a company denies you credit based on the report.

You can get your credit report fixed if it contains inaccurate or incomplete information:

- Contact both the credit reporting agency and the company that provided the information to the CRA.

- Tell the CRA, in writing, what information you believe is inaccurate. Keep a copy of all correspondence.

Some companies may promise to repair or fix your credit for an upfront fee–but there is no way to remove negative information in your credit report if it is accurate.

Errors On Your Credit Report

If you find errors on your credit report, write a letter disputing the error and include any supporting documentation. Then, send it to:

Find a sample dispute letter and get detailed instructions on how to report errors.

The credit reporting agency and the information provider are liable for correcting your credit report. This includes any inaccuracies or incomplete information. The responsibility to fix any errors falls under the Fair Credit Reporting Act.

If your written dispute does not get the error fixed, you can file a complaint with the Consumer Financial Protection Bureau .

You May Like: How To Up Credit Score

Obtain A Civil Judgment

If the tenant has skipped out without paying rent or you are evicting him for failing to pay rent, then you may want to sue the tenant to recover your financial loss. If you obtain a judgment, the court order becomes public record and eventually makes its way to the credit reporting agencies. It then shows up as a monetary judgment on the public records section of the tenant’s credit report. A civil court judgment can knock 100 points of the tenant’s credit score and stays on the report for seven years. This should alert future landlords to the tenant’s previous poor behavior.

References

Wait Up To 45 Days For The Credit Bureau Or Furnisher To Investigate And Respond

The credit bureau generally has 30 days after receiving your dispute to investigate and verify information with the furnisher. The credit bureau must also report the results back to you within five days of completing its investigation.

If you dispute the error with the information furnisher, that company must also report the results of its investigation to you. It also typically has 30 days to investigate. But if the furnisher stands by the accuracy of the information it reported, it wont update or remove the error.

One more thing to note is that either the credit bureau or the furnisher may decide that your dispute is frivolous. This generally happens when youve submitted incorrect or incomplete information on the dispute, but can also occur if youve tried to contest the same item multiple times without any new information or if youve attempted to claim that everything on your credit report is incorrect without proof.

If the bureau decides that your dispute is frivolous, it doesnt need to investigate it further as long as it communicates that to you within five days, along with the reasoning for deeming the dispute frivolous. If your original dispute was labeled frivolous, you can try to resubmit a dispute with updated materials.

Don’t Miss: How To Get Collections Off Of Your Credit Report