Dont Apply For Every Credit Card

Too many credit inquiries in a short period of time can hurt your credit score. This can be difficult to avoid during Christmas when it seems that every department store is offering you a discount for signing up for its credit card.

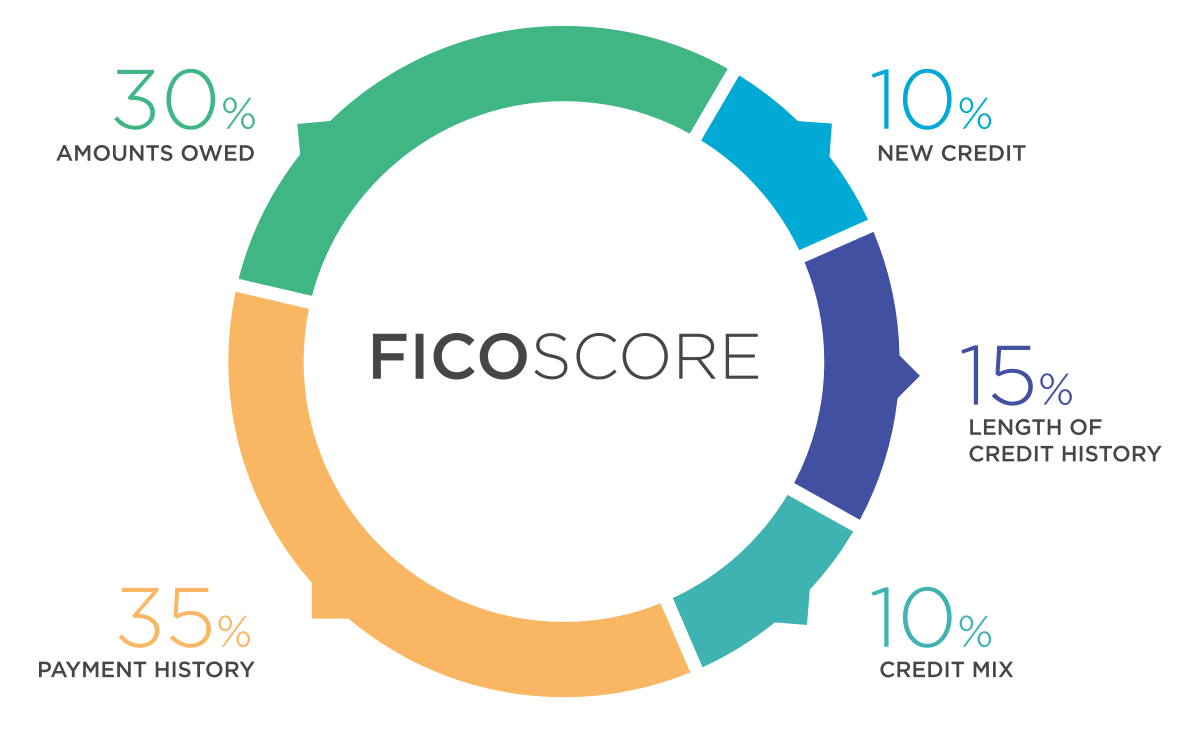

Applying for new credit card accounts can account for 10% of your credit score, which isnt a huge number, but it can be enough to push you into the 800+ credit score club.

Holly Wolf, who with her husband has a credit score in the 800 range and is a chief marketing officer at Conestoga Bank, says she doesnt open a lot of credit cards and often closes cards she may have opened to get a store discount.

Honestly, this isnt a lifestyle to which most folks aspire, Wolf says. They need to have a nice car a big house and all the accouterments of prosperity over having a high credit score. Living debt-free or with as little debt as possible has enabled us to save for retirement, get the best rates on loans, and be prepared for unexpected expenses when they arise.

How Your 731 Credit Score Was Calculated

As mentioned earlier, the two main credit scoring models are FICO and VantageScore. Although the two models have minor differences, both calculate credit scores based on the following factors:

- Payment history:Late payments lower your credit score. The later the payment, the more damage it will do. Charge-offs, collection accounts, and bankruptcies are even more damaging to your score.

- : This refers to the proportion of your available credit that youre using . A lower utilization rate is better for your credit score. Many experts recommend keeping yours below 30% . VantageScore recommends keeping your credit utilization even lower, under 10% if possible. 1

- Length of credit history: This is determined by the age of your oldest and newest credit accounts as well as the average age of all of your accounts. Old accounts that youve had for many years boost your credit score, whereas new accounts lower it.

- : Your credit score will be lower if you dont have a balanced mix of revolving credit accounts and installment accounts .

- New accounts: When you apply for a credit card or loan, the lender will run a credit check. This will trigger a hard inquiryHard inquiries take a few points off your credit score, and the effect lasts for up to 12 months. 2 Actually opening the account can further hurt your score and have even longer-lasting effects.

To maintain your good credit score, follow these tips:

How To Get A 731 Credit Score

While theres no sure-fire way to achieve an exact credit score, theres plenty you can do to build and maintain your credit within a range. Most importantly, youll want to practice healthy credit habits.

Even with so many different credit scores out there thanks to different scoring models and different credit bureau data some general principles apply. Most credit scores take into account at least five main credit factors.

Heres a breakdown of each factor and how it can affect your overall credit.

Recommended Reading: Is 789 A Good Credit Score

Getting Auto Loans With A 731 Credit Score

There is no credit score too low to get an auto loan, and youll be able to get one when your credit score is 731. However, if you want the best interest rates on the market, youll probably need to wait until you get your score a bit higher.

According to a 2020 quarterly report by Experian, people with credit scores of 661780 had average interest rates of 5.59% on their used car loans and 3.69% on new car loans, whereas people with credit scores of 781850 received average rates of 3.80% and 2.65%. 8 Although this is a relatively small difference, waiting until your score improves could still potentially save you hundreds of dollars on a car loan.

If youre set on getting an auto loan right now, then pay as large of a down payment as you can afford and consider getting prequalified or applying for a preapproval from your bank or credit union to increase your bargaining power.

A Quick Guide Explaining Credit Scores Including How They Work What Range Is Considered Good And Why Theyre Valuable

- FICO says good credit scores fall between 670 and 739. Thatâs on a scoring range from 300 to 850.

- VantageScoreâs good scores are reported to fall between 661 and 780. And like FICO, VantageScore also uses a scoring range of 300 to 850.

But thereâs a lot more to it than that. So keep reading to take a closer look at credit scores, including how theyâre determined, whoâs looking at them and what you can do to monitor and improve yours.

Read Also: How To Get Credit Report With Itin Number

Is A 731 Credit Score Good

Asked by: Yessenia Stracke

A 731 FICO®Score is Good, but by raising your score into the Very Good range, you could qualify for lower interest rates and better borrowing terms. A great way to get started is to get your free credit report from Experian and check your credit score to find out the specific factors that impact your score the most.

Whats A Good Credit Score Range

A good credit range depends on where a score comes from and whoâs judging it. Itâs important to remember that lenders set their own and standards to determine . That means what FICO, VantageScore or anyone else considers good may not all be the same.

However, there are some general guidelines for how being within a score range can impact your choices:

- A poor to fair score means you may find it difficult to qualify for many credit cards or loans. You might need to start with a secured credit card or credit-builder loan to build or rebuild your credit. And if you do qualify for an account, you may have to pay high fees and interest rates if you don’t pay your balance in full each month.

- A fair to good score means you may be able to qualify for more options, but you wonât necessarily receive the best rates or terms. You also might find you can qualify for a traditional unsecured but have a harder time qualifying for a premium card.

- A very good or excellent score means you may be able to qualify for the best products with the lowest-advertised rates. While creditors consider other factors too when determining your eligibility and rates, your credit score probably wonât be holding you back.

Hereâs a closer look at how FICO and VantageScore define their score ranges.

Whatâs a Good FICO Credit Score Range?

Whatâs a Good VantageScore Credit Score Range?

Don’t Miss: How To Build Your Credit Score

Making Debt Payments On Time And Not Opening Too Many Accounts Are Among The Things You Can Do To Boost Your Number

My 26-year-old daughter recently checked her credit score through Equifax and was surprised that it was just 708. She thought it would be higher — she has one credit card that she always pays by the deadline, and she generally charges around $700 or less of the $2,500 limit. The only other debt she has is student loans. What can she do to improve her score?

One reason her score was different than expected is because she received a proprietary score from Equifax, rather than the more-common FICO score. Both scores take information from your credit report and distill it into a single number that measures your credit risk. But they use different calculations and have different score ranges — the Equifax Credit Score ranges from 280 to 850, and the FICO score ranges from 300 to 850. For more information about different kinds of credit scores, see How to Get Your Credit Score for Free and Conflicting Credit Scores.

One common misconception is that paying your balance in full each month can help your utilization ratio. Thats not the case. The number used in the calculation is the balance on your monthly statement, whether or not you pay the bill in full by the deadline. If it shows up on your statement, it shows up on your credit report, says Ulzheimer.

How Credit Scores Break Down By Generation

The range in from Generation Z to the Silent Generation is wide. Based on the commonly used FICO 8 score, the credit reporting agency Experian calculates that Gen Z adults had an average score of 674 in October 2020, while the average among the oldest generation was almost 85 points higher, at 758.

Millennials are not scoring far above Generation Z, with just a 680 average. From there, it’s a 19-point bump to Generation Xs average of 699 , and then a bigger jump to the average baby boomer score of 736 .

A person’s age is not an explicit factor in calculating their credit score. However, older consumers have had opportunities to build up their credit history and establish a positive repayment track record for longer than younger ones have.

| Average FICO 8 Score by Generation |

|---|

| Generation |

Also Check: What Happens When Credit Score Dropped During Underwriting

How To Read Your Credit Report

Your credit reports contain both personal information and financial information. Your credit reports illustrate who you are as a borrower, both the good and the bad. Checking it allows you to keep an eye on your accounts, make sure there are no errors, and even potentially prevent the damaging effects of fraud. A credit report is the report card of your credit life and understanding how to read it can help you take control of your credit and be prepared for any of your future credit needs.

Getting Mortgages With 731 Credit Score

As with personal loans, credit scores in this range tend to produce favorable terms. With 731 FICO credit score an interest rates on a mortgage could be anywhere from four to five percent, often falling somewhere around four to four point five percent. If youre in the market for house, try pushing off your search until your credit slightly improves to lock in a more ideal rate.

Considering these things, your credit score is one of the most important numbers in your life. It can affect every action you take, from the house you live in to the car you drive. Taking steps to improve your 731 credit score is the best way to save money and make your life easier down the road. Theres no excuse to not improve your credit score!

How is a 731 credit score calculated?

The three major credit bureaus rely on five types of information to calculate your credit score. They collect this information from a variety of sources, and compile it to give you an overall score. The score is comprised of 35% payment history, 30% amount owed, 15% credit history, 10% new credit, and 10% credit diversity.

You May Like: How To Remove Old Late Payments From Credit Report

Credit Score: Good Or Bad

At a glance

731 is a good credit score. Scores in this range are high enough to get most types of credit, but you might not qualify for the best interest rates. Well explain what financing you can get with a score of 731 and what you can do to improve your credit score.

Get all 3 credit reports and FICO score monitoring, or instantly boost your credit score.

Fresh advice you can trust

We promise to always deliver the best financial advice that we can. That’s our first priority, and we take it seriously. Our writers and editors follow strict editorial standards and operate independently from our advertisers and affiliates. Learn more about how we make money.

Pay All Your Bills On

If your credit score is over 700, youre probably doing this faithfully. At the same time, you should be aware that a single late payment could have a serious negative effect on your credit rating.

Set up automatic debits for any recurring payments you have. You should do this even with rent and utility payments. Though they wont report to credit bureaus in the normal course, they will report unpaid balances. Automatic debits will eliminate that possibility.

You May Like: What Is A Default On My Credit Report

Keep Old Accounts Open

The last factor in credit scoring is the length of your credit history. This one takes time. But everyone has to start somewhere. What you do want to avoid is closing an account because you dont use it often or dont want it anymore. Killing your oldest account and removing that card from the mix could work against you by shortening your credit history. If you can avoid it, try to keep your oldest accounts open and in good standing.

Whats In A Credit Report

A credit report includes:

- Who is examining your credit. Any inquiries by lenders or others about your credit is recorded as well.

- Any judgments against you, such as bankruptcy.

- Personal information about you, such as your addresses , Social Security number and your previous employers.

- A section for comments by you, in the event you have disputed the report specifics in the past.

Also Check: Is 830 A Good Credit Score

Is 731 A Good Credit Score For A Car Loan

Iâve had my car for almost 15 years, and I think itâs about to finally give up. Iâve got plenty of savings, so I figured I would splurge on a nice new carâwill my 731 credit score get me good loan terms?

about 3.5%roughly 3.64%around 5.3%The average Jerry user saves $887 on car insurance.

Credit Score Is It Good Or Bad How To Improve Your 731 Fico Score

Before you can do anything to increase your 731 credit score, you need to identify what part of it needs to be improved, plain and simple. And in order to identify what needs to be improved, you should probably be aware of all the things that count and dont count towards your score.

You May Like: How To Get Rid Of Late Payments On Credit Report

Toro Exmark Credit Card

Category: Credit 1. Citi Cards: Create Your Account Lets get started. Card Number. Please enter the card number printed on your card. Continue. I dont have my card on hand Convenience Access, view and download invoices and statements. Security Review your bill securely online. Green Help save

Can I Get A Mortgage & Home Loan W/ A 731 Credit Score

Getting a mortgage and home loan with a 731 credit score shouldn’t be very difficult. Your current score is a mid-to-high credit rating.

The #1 way to get a home loan with a 731 score is to complete minimal credit repair, and simply apply and wait for approval.

After a few short months of repairing your credit , youâll be in a much better position to get your ideal home loan terms.

Don’t Miss: Is 722 A Good Credit Score

What Is A Good Vantagescore

FICO’s competitor, VantageScore produces a similar score using the same credit report data from the three bureaus.

A good VantageScore lies between 661 and 780, which the company calls a “prime” credit tier. VantageScores above 780 are considered “superprime” while those between 601 and 660 are “near prime.” VantageScores below 600 are considered “subprime.”

The average VantageScore 3.0 in July 2021 was 693.

Best Cash Rewards And Balance Transfer Credit Card:

Card features

- Annual fee: $0.

- 0% introductory APR: 0% for 15 months on purchases& 0% for 15 months on balance transfers.

- Sign-on bonus offer: Earn $200 cash rewards bonus after spending $750 in the first three months of account opening.

- Rewards: 5% cash back on up to $500 of purchases made within your top spending category each billing cycle, plus unlimited 1% cash back on all other purchases.

- Other features: Citi Entertainment® gives exclusive access to live event experiences and ticket presales.

Why the Citi Custom Cash Card is a good option for those with good/excellent credit

The Citi Custom Cash Card offers a rare mix of high rewards, a generous welcome bonus, PLUS no annual fee, and 0% APR on both balance transfers and new purchases, making it a compelling jack-of-all-trades card for those looking to crush old debt while avoiding new debt.

How to use the Citi Custom Cash Card

Since the Citi Custom Cash Card offers 5% cash back on your spendiest category each billing cycle, you can maximize your rewards by focusing your spending each month on travel, home improvement, etc. If you need to initiate a balance transfer, just be sure to do it within the first four months.

Why you might not want to consider the Citi Custom Cash Card

The Citi Custom Cash Cards chief drawback is that it only gives 5% cash back in one category. If you tend to spend broadly, you may be more rewarded by a card offering 5% cash back in multiple, rotating categories.

Card features

Recommended Reading: Does Income Affect Credit Score

What Is A Good Credit Score According To Lenders

Lenders, such as credit card issuers and mortgage providers, may set their own standards on what “good credit” means as they decide whether to grant you credit and at what interest rate.

In practice, though, a good credit score is the one that helps you get what you need or want, whether that’s access to new credit in a pinch or lower mortgage rates.