What Are The Credit Score Ranges

What is an excellent credit score range? How does it compare to the other credit score ranges? Heres a breakdown of the five FICO credit score ranges, including the points that fall within each range:

FICO Credit Score Ranges |

|

|---|---|

| Poor | 350-579 |

The FICO scoring system occasionally refers to the top credit score range as Exceptional;but dont worry, that means the same thing as Excellent. If you have excellent credit, you dont need to do anything else to get exceptional credit. Youre already there!

Canadian Credit Ratings And What They Mean

Lenders and creditors typically use a credit score to determine youre likelihood of making payments on time. Its important to note that your is only one of the factors that lenders will evaluate when approving you for new credit.

- Excellent Individuals with a rate of 780 or over may enjoy the best interest rates on the market. They also will typically always be approved for a loan.

- Very Good This is considered near perfect and individuals with a rate in this range may still enjoy some of the best rates available.

- Good An individual who has a credit score that falls within this range has good credit and will typically have little to no trouble getting approved for the new credit.

- Average While this is still a good range, individuals with this score may receive slightly higher interest rates than those with higher scores. According to Equifax, at the end of 2012, the average national credit score was 696.

- Poor Scores in this range indicate that the individual is high risk. It may be difficult to obtain loans and if approved, they will be offered higher interest rates.

- Very Poor Scores in this range are rarely approved for anything, but credit can be repaired.

- Terrible ;Individuals whose;credit scores are less than 500 may not get approved for new credit and should seek credit improvement help.

Loans Canada Lookout

How To Improve Your Credit Scores

To improve your credit scores, focus on the underlying factors that affect your scores. At a high level, the basic steps you need to take are fairly straightforward:

- Make at least your minimum payment and make all debt payments on time. Even a single late payment can hurt your credit scores and it’ll stay on your credit report for up to seven years. If you think you may miss a payment, reach out to your creditors as quickly as possible to see if they can work with you or offer hardship options.

- Keep your credit card balances low. Your is an important scoring factor that compares the current balance and credit limit of revolving accounts such as credit cards. Having a low credit utilization rate can help your credit scores. Those with excellent credit scores tend to have an overall utilization rate in the single digits.

- Open accounts that will be reported to the credit bureaus. If you have few credit accounts, make sure those you do open will be added to your credit report. These could be installment accounts, such as student, auto, home or personal loans, or revolving accounts, such as credit cards and lines of credit.

- Only apply for credit when you need it. Applying for a new account can lead to a hard inquiry, which may hurt your credit scores a little. The impact is often minimal, but applying for many different types of loans or credit cards during a short period could lead to a larger score drop.

Recommended Reading: Does Opensky Report To Credit Bureaus

Why Do Credit Scores Vary

The reason why a credit score differs is because of a few reasons. Given there are two scoring systems, they can have differing results.

Further, the credit bureaus dont always receive all of the same information regarding your credit accounts. Additionally, one credit bureau may receive information before another does, which could influence the score.

New Credit And Credit Mix

Coming in at 10% with FICO and less influential for VantageScore are new credit accounts. Just like closing old accounts, you want to be careful about opening new ones. Opening new accounts creates uncertainty and can signal increased risk to lenders, which will bring your score down, at least in the short term.

As for credit mix called credit experience by VantageScore this is really where VantageScore and FICO differ. FICO only considers credit mix as 10% of your credit score while VantageScore weighs it as highly influential. This area accounts for the variety of credit extended to you, including credit cards, mortgages, student loans and car loans.

See related: 13 bad credit habits you need to break now

Don’t Miss: Credit Score Without Social Security Number

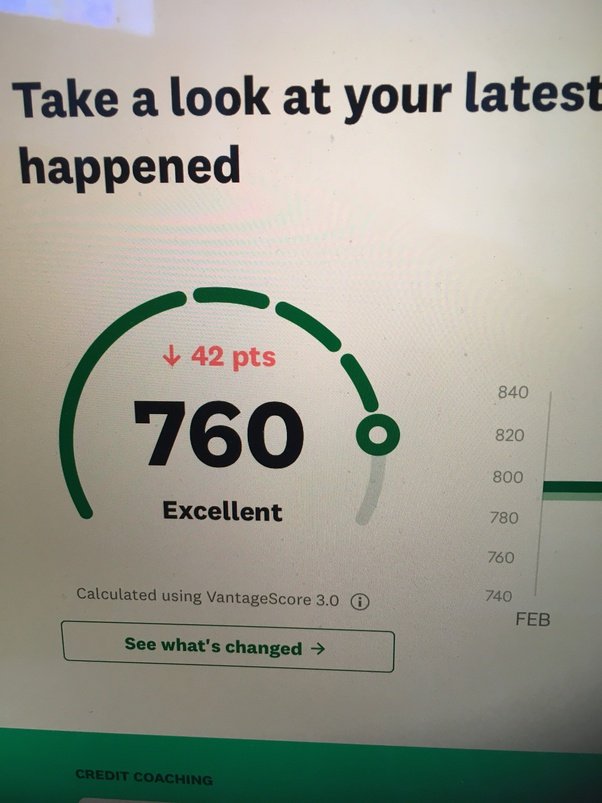

Vantagescore Credit Score Ranges

Launched in 2003, VantageScore is a joint venture between the three major credit reporting agenciesEquifax, TransUnion and Experian. Although FICO Scores are the most popular choice among lenders, VantageScore credit scores deserve your attention too.

VantageScores use a 300 to 850 credit score range. Just like FICO Scores, the higher your credit score on the VantageScore scale, the lower the risk you represent to lenders.

How Long Does It Take To Get A Good Credit Score

It depends on where youre starting from and what challenges youre facing. But building good credit probably wont happen overnight.

If youre brand new to credit, it could take months of using beginner products like secured cards to make significant progress in the types of financial products you qualify for. If you have dings on your credit reports, like late or missed payments or a bankruptcy, it could take years for those derogatory marks to fall off and stop affecting your scores.

But even if you have years left before those derogatory marks officially fall off, you can still see significant progress. The important thing is to work steadily toward getting your credit in good shape and understand that building credit is a journey.

Recommended Reading: How To Remove Items From Credit Report After 7 Years

How To Go From Good To Great

To borrow from Leo Tolstoy, all great credit scores are alike, but all bad credit scores are bad in their own way. That is, ideal credit scores are built on a similar set of healthy financial habits, but your scores can be damaged by any number of factors. There are many different issues that;can hurt your credit, such as:

Late or missed payments. Too many open credit accounts. High credit card balances. High balances on loans.;Too many credit applications.

The first step toward improving your credit health is avoiding getting trapped in the highs and lows of managing your credit.

Heather Battison, vice president of;TransUnion Canada;explains how consistency is key: The most important factor for building and maintaining your scores is to pay your bills on time and in full each month. This activity demonstrates your ability to responsibly manage credit and can positively impact your credit scores.

Its also key to remember that your payment history isnt just about paying your credit card bill. It also includes things like your cellphone bill, says Trevor Gillis, associate vice president of account management at;TD Credit Cards.

Gillis says building good credit scores is based on using your credit card responsibly, which means making at least the required monthly minimum payment , making your payments by the payment due date and keeping your credit card utilization low.

How To Raise Your Credit Score:

1. Correct errors, and track your report for future errors. Order your credit file from each bureau at least once per year.

2. Lower your balances. If your debt levels are above 50% of your available limit, create a payment plan to reduce your balances.

3. The biggest tip to having a good credit rating and a high credit score is to continually use credit and to repay that credit on time all the time. Set up automated payments to help with this.

4. If you have no credit history, or need to rebuild your credit, open a secured credit card account. You pay a deposit, which sets the limit of your card, then use it like a regular credit card.;The secured credit card provider reports your payment habits to the credit bureau, so you will be able to gain points with an account in good standing.;Choose from a;Home Trust Secured VISA.

5. Look over our list, read your credit report, and identify any areas that could be improved for a higher credit rating.

Remember, your credit rating is not a reflection of your personal worth it is merely a credit reporting tool Margaret H. Johnson. The good news is your credit rating is like your self-esteem, sometimes in your life it will be high and sometimes it will be low however, you can always rebuild it over time!

You May Like: Syncb/ppc Closed

Your Score Range: 800

Your score sits between 800 and 850 on the FICO scale, putting you in a category with only 18 percent of the population. Although you have little or no room for improvement, this score tells lenders and potential lenders that you are an excellent investment. Achieving a top score shows that you are a low risk and that lenders are very likely to receive payment on loans they grant to you.

Length Of Credit History

The remaining three pieces are not weighted as heavily, but they are still important. At 15% for FICO and considered less influential with VantageScore is credit history, which is not to be confused with your payment history. This measures the length of your oldest credit line and the average age of your accounts, so try to keep your oldest accounts open if possible.

Also Check: 739 Credit Score Good Or Bad

What Factors Influence Your Credit Score

FICO Score

VantageScore

How We Make Money

The offers that appear on this site are from companies that compensate us. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories. But this compensation does not influence the information we publish, or the reviews that you see on this site. We do not include the universe of companies or financial offers that may be available to you.

Read Also: Does Paypal Credit Report To Credit Bureaus

Relation Between Credit Scores And Mortgage Approval

If you have an excellent credit score, lenders are willing to approve your mortgage application because you do not pose a high risk of defaulting on your payments. The lower your credit score, the higher the risk for the lenders. Lenders are likely to charge you a high-interest rate to compensate for the risk they are taking.

Understanding The Max Credit Score

While 850 is the max credit score available, a perfect score like that will not be possible for most people. Fortunately, though, you dont need the highest credit score possible to benefit from the very best interest rates and deals on loans.

If your score reaches is 740 or more, it will be considered to be in the highest range. Credit scores are categorized as being either poor, fair, good, very good, or excellent. These are the credit score ranges:

- 800 or more Excellent credit score

- 740 to 799 Very good credit score

- 670 to 739 Good credit score

- 580 to 669 Fair credit score

- Below 580 Poor credit score

So when someone asks, what is a good credit score;you now have the answer. In order to borrow money, you should always be striving to achieve at least a good credit score. Mortgage lenders will reward you in the form of lower interest rates. Low interest rates translate into having smaller monthly payments on all your loans.

Work towards getting into the good credit score range and then go from there.

As you can see, the credit score ranges quite a bit.

You May Like: Aragon Collection Agency

Exceptional Credit Score: 800 To 850

Consumers with a credit score in the range of 740 to 850 are considered consistently responsible when it comes to managing their borrowing and are prime candidates to qualify for the lowest interest rates. However, the best scores are in the range of 800 to 850.

People with this score;have a long history of no late payments, as well as low balances on credit cards. Consumers with excellent credit scores may receive lower interest rates on mortgages, credit cards, loans, and lines of credit, because they are deemed to be at low risk for defaulting on their agreements. Having an excellent credit score is particularly useful for qualifying for a personal loan, as it typically more than makes up for a lack of collateral.

Why Is My Credit Score Low

Lower credit scores arent always the result of late payments, bankruptcy, or other negative notations on a consumers credit file. Having little to no credit history can also result in a low score.

This can happen even if you had established credit in the past if your credit report shows no activity for a long stretch of time, items may fall off your report. Credit scores must have some type of activity as noted by a creditor within the past six months.If a creditor stops updating an old account that you dont use, it will disappear from your credit report and leave FICO and or VantageScore with too little information to calculate a score.

Similarly, consumers new to credit must be aware that they will have no established credit history for FICO or VantageScore to appraise, resulting in a low score. Despite not making any mistakes, you are still considered a risky borrower because the credit bureaus dont know enough about you.

Also Check: How Bad Is A 524 Credit Score

Only Use The Credit You Really Need

Just because you have three credit cards, that doesnt mean its wise for you to max them out every month, even if youre making the monthly payments on time. The credit bureaus frown on individuals using too much of their available credit; although they do like to see a diversity of credit accountsmortgages, auto loans, credit cards, installment accountsmanaged responsibly. Solution: Go easy on the credit. Make a determined effort to not use more than 10% of your total available credit. Your credit score will thank you.

Have Low Credit Card Balances

A credit utilization rate of 30% or more can negatively impact your credit score. As part of an effort to stay below 30% credit utilization, you should make sure your card balances dont get too high.

You can figure out your utilization rate by dividing your total credit card balances by your total credit limits. Usually, keeping a credit cards balance smaller relative to the cards credit limit will help increase your credit scores.

For the highest credit scores, your utilization rate should be under 6%.

Also Check: Does Paypal Credit Report To Credit Bureaus

What Affects A Credit Score

While every credit scoring model is different, there are a number of common factors that affect your score. These factors include:

- ;Payment history

- ;Balances on your active credit

- ;Available credit

- ;Number of accounts

Each factor has its own value in a credit score. If you want to keep your number at the higher end of the credit score scale, its important to stay on top of paying your bills, using your approved credit, and limiting inquiries.

However, if you are in the market to purchase a house or loan, there is an annual 45-day grace period in which all credit inquiries are considered one cumulative inquiry. ;In other words, if you go to two or three lenders within a 45-day period to get find the best rate and terms available for a loan, this only counts as one inquiry. This means that they are not all counted against you and will not affect your credit score.;

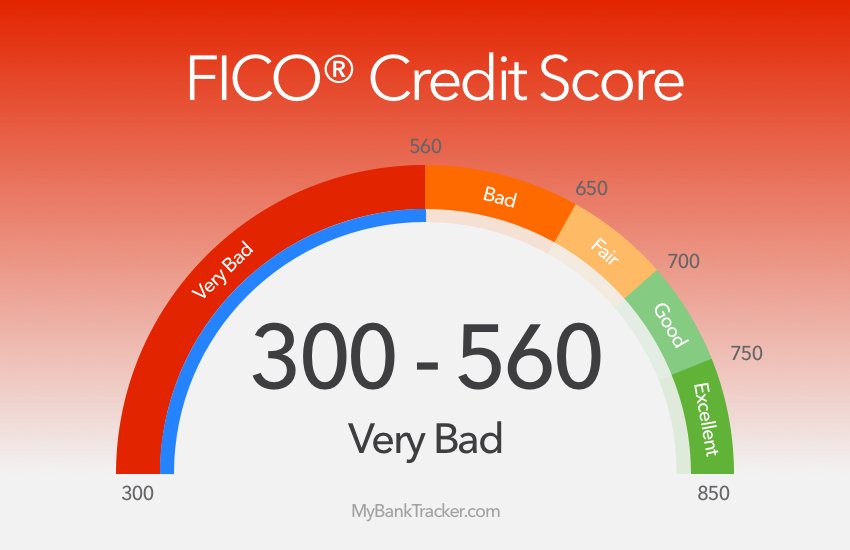

What Is A Good Fico Score

FICO® creates different types of consumer credit scores. There are “base” FICO® Scores that the company makes for lenders in multiple industries to use, as well as industry-specific credit scores for credit card issuers and auto lenders.

The base FICO® Scores range from 300 to 850, and FICO defines the “good” range as 670 to 739. FICO®’s industry-specific credit scores have a different range250 to 900. However, the middle categories have the same groupings and a “good” industry-specific FICO® Score is still 670 to 739.

Don’t Miss: How To Get Credit Report Without Social Security Number

Avoid Security Deposits On Utilities

These deposits are sometimes $100 to $200 and a huge inconvenience when youre relocating. You may not be planning to move soon, but a natural disaster or an unforeseen circumstance could change your plans. A good credit score means you wont have to pay a security deposit when you establish utility service in your name or;transfer service to another location.

There Are Ways To Improve It

An excellent credit score is like the top math score on the SAT. With both, 800 is exceptional.;

But if your credit score isn’t near that number, you should know what constitutes a good credit score that will let you qualify for a loan at a decent interest rate.

The answer: It should be at least in the mid to high 600s.

If your score isn’t that high yet, you’ll need to exercise good borrowing behavior, take some strategic steps, and have patience. You may also want to take advantage of two new programs offered by credit industry companies that are designed to improve those numbers .

The FICO score is the brand of credit score used by most consumer lenders, so it’s the one to pay the most attention to. FICO credit scores typically range from a low of 300 to a high of 850. ;When you get a credit score report from your lender, your number is often depicted on a continuum like a spectrum or rainbow, with bright green denoting the 800 range and red representingwell, you know.

FICO says there’s no “cutoff”;where, say, a good credit score becomes a very good credit score, or a very good credit score becomes exceptional. But Experian, one of three major credit bureaus that supply data used in the FICO score,;lays out the boundaries this way:

Also Check: Why Is There Aargon Agency On My Credit Report