Protect Your Exceptional Credit Score

People with Exceptional credit scores can be prime targets for identity theft, one of the fastest-growing criminal activities.

85% of identity theft incidents involve fraudulent use of credit cards and account information.

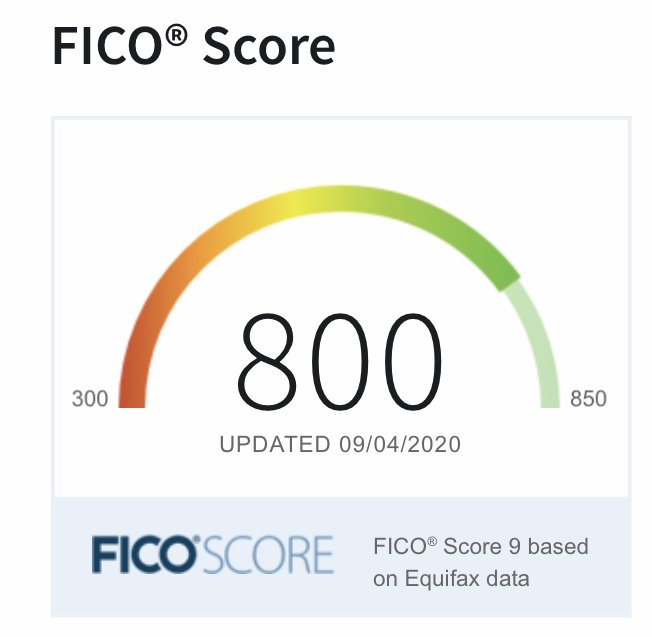

A credit score monitoring service is like a home security system for your score. It can alert you if your score starts to slip and, if it starts to dip below the Exceptional range of 800-850, you can act quickly to try to help it recover.

An identity theft protection service can alert you if there is suspicious activity detected on your credit report, so you can react before fraudulent activity threatens your Exceptional FICO® Score.

Excellent Credit Qualifies You For Top

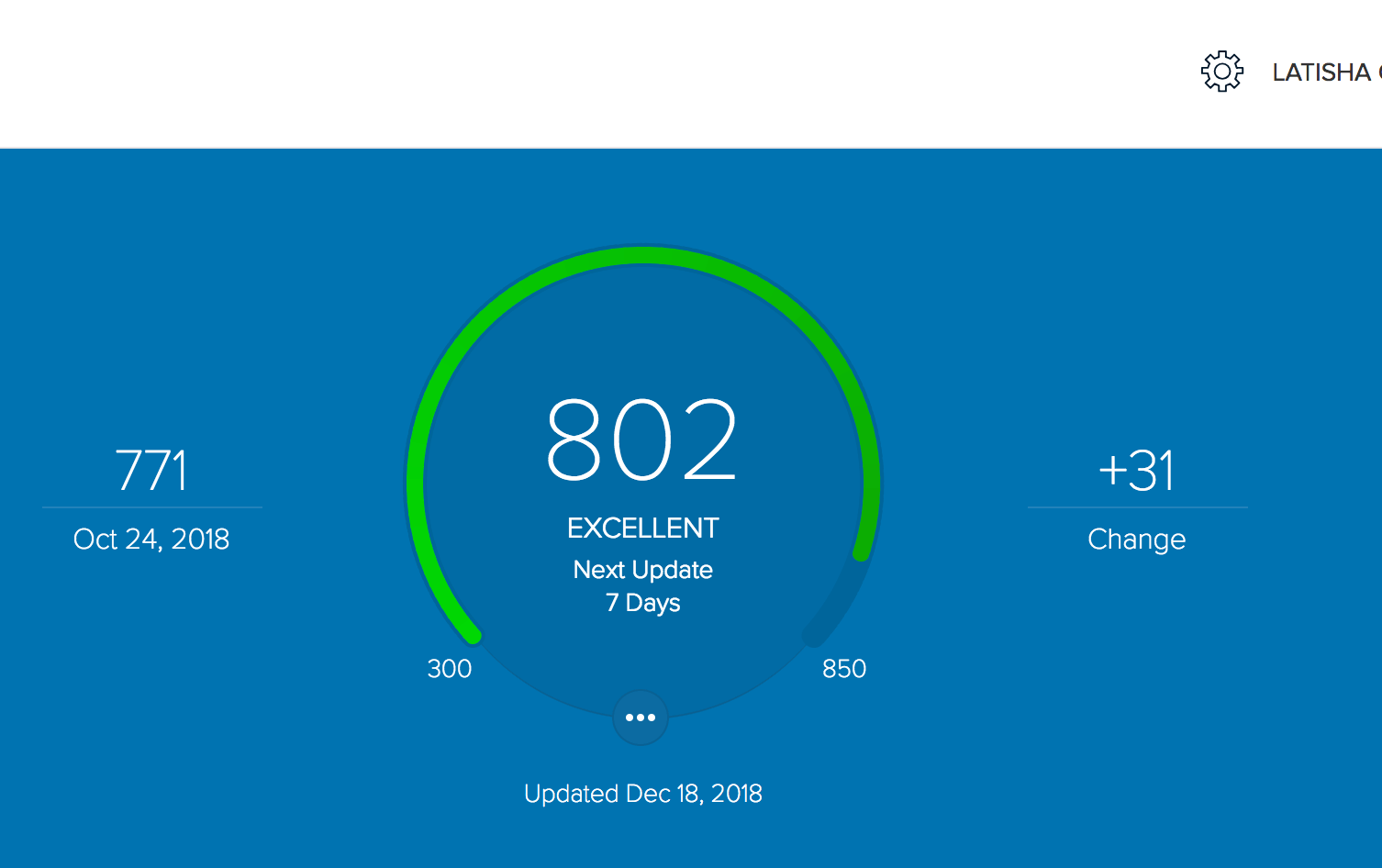

Years before Kevin King, a credit consultant business owner and personal finance podcaster, became known by the moniker The 800 Credit Score Man, the only plastic he could get with his 585 credit score was a JC Penney credit card with a $100 limit. He made improvements over time, and was pleasantly surprised when he took advantage of a free credit score check and discovered it had climbed to 805.

The first thing I did was call my brother because he was the only person in the world who knew how low my score was. It was a great feeling. It gave me a sense of pride, swagger, and I felt that I had clout, he says.

Beyond clout, high credit scorers such as King also gain access to top-notch consumer benefits.

Excellent credit gives you leverage to take advantage of the best kinds of offers that lenders and other businesses might make to get you and keep you as a customer, says Rod Griffin, director of public education for Experian, one of the three major credit bureaus.

Ready to start taking advantage of your top-notch credit status? Here are three big moves you should consider once you join the excellent credit score club.

Lower Your Credit Utilization Rate

A high ratio of debt to credit can negatively affect your credit score. You can either pay off this debt or apply for a credit increase to reduce your utilization rate. Another way to do this is by paying your credit cards off early each month so that your posted balance is lower than your spending for the month.

Read Also: How To Unlock Transunion Credit Report

Credit Score Club Benefits

Being in the top tier of credit scores definitely has its perks from credit cards to mortgages to refinancing. Lets take a look at the exclusive benefits of being in the 800 Credit Score Club below.

- Credit Cards: With a credit score of 800 or higher, you can get approved for virtually any . In addition, you will have access to no annual fees, 0% financing, no foreign fees, retail, airline and hotel benefits.

- Mortgage Rates: You will qualify for the lowest mortgage rates by being a part of the 800 Credit Score Club.

- Refinancing: You will qualify for lower interest rates when refinancing by having a credit score of 800 or higher.

- Car Loans: Access car loan offers with 0% introductory rates with credit scores of 800 or higher.

- Insurance Premiums: By being a part of the 800 Credit Score Club, you will have lower insurance premiums.

- Personal Loan Rates: More affordable rates on personal loans will be available to you by having a credit score of 800 or higher.

- Apartment Leases: It will be easy for you to get access to the apartment leases or rentals you want by being in the 800 Credit Score Club

Take a look at this infographic to learn about how your credit score is calculated.

Fundamental Tips For Improving Your Credit

We know that a high credit score is often a requirement to apply for loans, mortgages, and other forms of private financing. In the United States, consumers with good credit scores are more likely to be offered lower interest rates when applying for these forms of credit.

In addition, it takes less time to get approved for a loan with a good score. So if you want to be able to borrow money from various sources in the future, it might be best to start working on your credit now. Improving your credit score can be challenging but not impossible. There are a few things you can do to help improve your credit score.

Don’t Miss: Does Self Lender Do A Hard Inquiry

Is 810 A Good Credit Score

Your 810 FICO® Score falls in the range of scores, from 800 to 850, that is categorized as Exceptional. Your FICO® Score is well above the average credit score, and you are likely to receive easy approvals when applying for new credit. 21% of all consumers have FICO® Scores in the Exceptional range.

Do You Need An 850 Credit Score

Nothing magical will happen if your credit score of 800 ticks up to 850. And most importantly, you probably wont save more money. You dont need to take our word for it, though. We consulted a panel of financial experts, all of whom said the same thing.

Disclaimer: Editorial and user-generated content is not provided or commissioned by financial institutions. Opinions expressed here are the authors alone and have not been approved or otherwise endorsed by any financial institution, including those that are WalletHub advertising partners. Our content is intended for informational purposes only, and we encourage everyone to respect our content guidelines. Please keep in mind that it is not a financial institutions responsibility to ensure all posts and questions are answered.

Ad Disclosure: Certain offers that appear on this site originate from paying advertisers, and this will be noted on an offers details page using the designation “Sponsored”, where applicable. Advertising may impact how and where products appear on this site . At WalletHub we try to present a wide array of offers, but our offers do not represent all financial services companies or products.

Related Scores

Read Also: How To Get Public Records Removed From Credit Report

Act Quickly On Any Errors In A Credit Report

Any errors on credit reports can negatively influence credit scores. As such, it is crucial to verify that the accounts recorded in the reports are correct.

If a credit report has any inaccuracies, report the error and have it corrected immediately. Regularly monitoring credit can help spot any mistakes earlier to avoid hurting the credit score.

When Excellent Credit Is Good Enough

A credit score of 800 is generally considered excellent. It’s an indication you pay bills on time, you have a healthy mix of loans and , and you’re not carrying too high a balance on your various cards.

If you apply for a loan or a credit card with a score of 800, you’re extremely likely to get approved. You’re also likely to snag an affordable interest rate on a loan with a score that high. As such, if you have a credit score of 800, it definitely pays to work on maintaining it. But do you need to boost it? Probably not.

Once your credit score reaches a certain level — usually, the upper 700s — it almost doesn’t matter exactly what it is. Or, to put it another way, raising a credit score of 800 to an 810 or 815 may not change anything for you when it comes to borrowing money or getting a new credit card. If you apply for a 30-year mortgage, for example, and the best rate lenders in your area are offering is 3.9%, you’re likely to snag that rate whether your score is an 800, an 810, an 815, or a perfect 850.

In fact, it really doesn’t pay to chase a perfect credit score because that 850 is nearly impossible to attain. The simple act of applying for a new credit card can drop your score by a handful of points. And if there’s a credit card offer that appeals to you — say, one with a generous sign-up bonus — then you shouldn’t deprive yourself of that offer because you’re worried it will wreck your chances of attaining perfect credit.

Recommended Reading: Wipe Your Credit Clean

The Components Of Your Credit Score

Contents

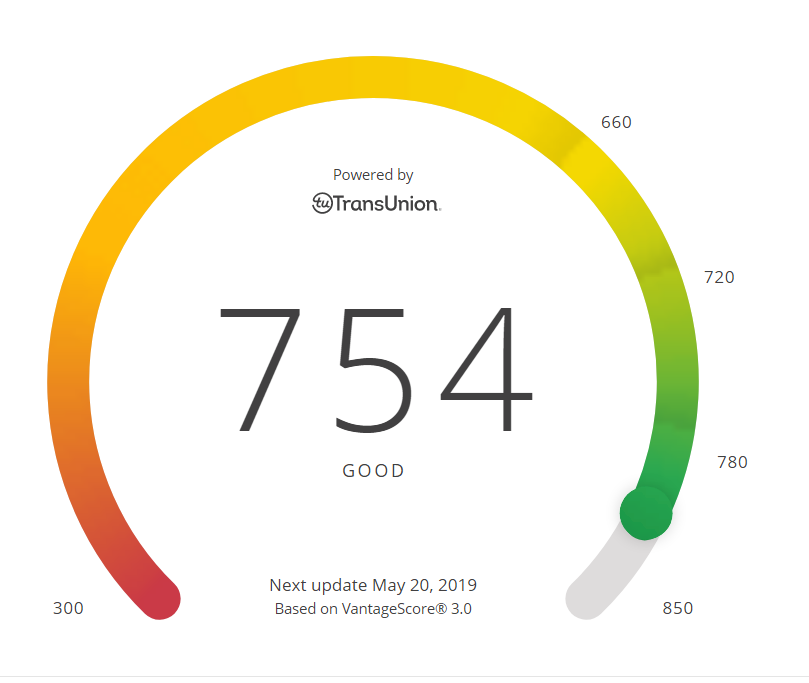

There are two types of credit scores. FICO is the most common credit score used by lenders to assess your creditworthiness. Your FICO score consists of a three-digit number between 300 and 850. VantageScore is a new credit rating system, designed to help consumers that do not have a long enough payment history with creditors to determine a FICO score.

Most lenders assess your FICO score before opening a credit facility in your name. Credit reporting agencies notify the credit bureaus on all of the activity on your credit accounts. The bureaus take this information and create your FICO score using the data. Your score may differ from bureau to bureau, depending on the data they receive from credit reporting agencies.

When it comes to the data involved in creating your credit score, the bureaus rely on the following factors.

Amounts outstanding This criterion shows all of your current outstanding debt, and how many loans you have in your name. This factor accounts for 30-percent of your credit score.

FICO scores dont take into account your employment history, age, income, zip code, race, or gender. Its a blanket score that lenders utilize to gauge your financial health, regardless of your personal information.

Can You Get A Home Loan With 700 Credit Score

A 700 credit score meets the minimum requirements for most mortgage lenders, so its possible to purchase a house when youre in that range. A credit score of 700 also might not qualify you for the best interest rate on your mortgage loan, you may still want to work on improving your credit scores to save on interest.

Read Also: How Does Navy Federal Auto Loan Work

How Do I Get My Credit Score From 700 To 800

- Score4.7/5

How to Get an 800 Credit Score

-

How to Get From 700 credit score to 800 in 30 days

Watch Youtube video

You May Like: Does Eviction Notice Go On Credit Report

How To Maintain An 800 Credit Score

Once you achieve an 800 credit score, your work is far from finished. Your credit score isnt set in stoneit fluctuates based on the factors we discussed above. If you want to keep your score in the highest credit score range possible, youll have to continue practicing good credit habits. This means monitoring your credit score and reports often, keeping your credit utilization low and paying your bills on time.

You May Like: Average Credit Score For Care Credit

How Good Is A 816 Credit Score

Your 816 FICO® Score falls in the range of scores, from 800 to 850, that is categorized as Exceptional. Your FICO® Score is well above the average credit score, and you are likely to receive easy approvals when applying for new credit. 21% of all consumers have FICO® Scores in the Exceptional range.

What Is A Good Credit Score

Reading time: 3 minutes

-

Different lenders have different criteria when it comes to granting credit

Its an age-old question we receive, and to answer it requires that we start with the basics: What is a credit score, anyway?

Generally speaking, a credit score is a three-digit number ranging from 300 to 850. Credit scores are calculated using information in your credit report, including your payment history the amount of debt you have and the length of your credit history.

There are many different scoring models, and some use other data in calculating credit scores. Credit scores are used by potential lenders and creditors, such as banks, credit card companies or car dealerships, as one factor when deciding whether to offer you credit, like a loan or credit card. Its one factor among many to help them determine how likely you are to pay back money they lend.

It’s important to remember that everyone’s financial and credit situation is different, and there’s no “magic number” that may guarantee better loan rates and terms.

Although ranges vary depending on the credit scoring model, generally credit scores from 580 to 669 are considered fair 670 to 739 are considered good 740 to 799 are considered very good and 800 and up are considered excellent. Higher credit scores mean you have demonstrated responsible credit behavior in the past, which may make potential lenders and creditors more confident when evaluating a request for credit.

What Factors Impact Your Credit Score?

You May Like: How To Get Rid Of Repo On Credit

Avoid Hard Inquiries Into Your Credit Score

A hard inquiry into your credit scores comes from financial institutions when you are inquiring about a new credit facility, such as a mortgage, auto loan, or credit card. If a landlord checks your score, then the bureaus do not consider this as a hard inquiry.

If youre considering about taking on new debts, then shop around for the best rates, and make a list of your preferred providers. Start with the first lender on your list, and wait for their decision, before moving onto the next.

This strategy reduces inquires into your credit report, improving your FICO score.

Length Of Credit History: 15% Of Score

You may think that theres nothing you can do about the length of your credit history, but hear me out on this one.

My length of credit history is 18 years. I opened my first credit card account when I was a teenager after hearing it was a good idea to establish credit early on.

For those just starting out, student and secured credit cards are two solid options to build your credit.

In addition to the age of your oldest credit account, FICO also takes into consideration the age of your newest credit account and the average of all credit accounts.

Thats why credit experts say you should keep credit cards active and avoid closing old accounts.

The thinking here is that if you cancel a credit card, it will lower the average for all of your credit accounts. That action alone could result in a credit score drop.

I took this advice very seriously until I got my credit score to the exceptional range above 800.

However, Ive stopped worrying so much about the impact of closing an old credit card. And if Im not getting value out of a card with an annual fee, Ill cancel it.

This hasnt impacted my credit score much, but I probably wouldnt risk it if I had a lower score.

Also Check: Does Paypal Report To The Credit Bureau

Maintain A Good Credit Mix

Lenders like to see that you can handle a diverse mix of credit accounts. For example, having a credit card, a mortgage and an auto loan will do more for your credit score than having three credit cards.

Thats not to say that you need to take out these different types of loans solely to build credit. Itll typically occur naturally over time as you use credit cards for everyday expenses, finance the purchase of a car and get a mortgage to buy a home.

Habit : They Use Their Cards Regularly

Once you have an exceptional credit score, you qualify for cards with some pretty sweet . But people with a high credit score typically use all their cards from time to time even those older cards that dont offer flashy perks. If you dont use a card regularly, the credit card issuer can cancel you for inactivity. That will decrease your credit limits and your credit age, both of which are bad for your score.

Alli Williams, founder and CEO of FinanciALLIFocused, keeps her oldest card open for this reason and only uses it for subscriptions. This card isnt the best for rewards points, so I am not missing out on much by just putting a few small subscriptions on it, she said.

You May Like: 820 Fico Score

Maintain Good Habits And Be Patient

If you feel like youre doing everything right and your credit score hasnt yet passed 800, you might simply have to wait. Fifteen percent of your credit score comes from the length of your credit historywhich means that even if you have been practicing responsible credit habits since you opened your first credit card, it might take a while for those habits to earn you an exceptional credit score.

It might also be hard to achieve an 800 credit score until you have a mix of credit under your name. Were not saying you should take out a mortgage or a car loan just to get your credit score over 800, but if the only credit accounts on your file are credit cards, you might struggle to reach that 800 credit score. If thats the case, dont worryhaving excellent credit is just as good, and youll receive nearly all of the benefits that come with a near-perfect credit score.

Free Credit Reports From Credit Karma

We recommend , a website and mobile app which allows you to get your latest credit report completely free. Its a great service which also allows you to monitor your credit score and has other features like free tax filings & a credit score simulator.

Read our full review to find out more.

Also Check: How To Get Rid Of A Repo On Your Credit

How Do I Get My Credit Score Up To 800

Home> > Understanding Credit Reports> What is a Credit Score & How is it Calculated?> How Do I Get My Credit Score up to 800?

You dont have to be a millionaire to know what achieving that financial ranking means.

Being a millionaire means you have crossed a huge economic threshold. Doors open. Opportunities are offered. Rewards are granted. You arent invulnerable, but you do have a comfortable status.

If you arent a millionaire but like the privileges that go with being one try pushing your credit score up to 800 and you too will qualify for some really nice perks. Bankers are your best friends. Credit card companies are begging for your business. Loans are practically automatic.

Granted, the people in the 800 Club dont have the same cache or economic clout as millionaires, but its still an elite status in todays economy. And the 800 Club is a lot easier to join. More than 40 million American consumers have 800 or better credit scores. Only 12 million are millionaires.

And all you gotta do to join the 800 Club is pay every bill, every month on time and be ultra, ultra conservative about using a credit card for spending.

OK, thats not ALL you have to do, but it is most of it.

On-time payment and credit utilization make up the bulk of your credit score. The rest comes from the length of credit history , new credit and mix of credit .