Whats The Purpose Of My Credit Report

Your credit report shows your credit history and tells a story of your financial health and responsibility to potential lenders like credit card companies, banks, and often even landlords and cell phone companies. Credit reporting empowers you to participate in the credit economy and have potential offers of credit extended to you.

Your Name And Variations

Your could contain different versions, and maybe even misspellings, of your name. For example, your first and last name might appear along with your first and last name with your middle initial.

Your credit report is compiled using information from the creditors and lenders you do business with. The name you put on your applications is the name that appears on your credit report, so be consistent. Also, if creditors have misspelled your name, that misspelling will appear on your credit report.

How Do I Fix Mistakes In My Credit Report

- Write a letter. Tell the credit reporting company that you have questions about information in your report.

- Explain which information is wrong and why you think so.

- Say that you want the information corrected or removed from your report.

- Send a copy of your credit report with the wrong information circled.

- Send copies of other papers that help you explain your opinion.

- Send this information Certified Mail. Ask the post office for a return receipt. The receipt is proof that the credit reporting company got your letter.

The credit reporting company must look into your complaint and answer you in writing.

Recommended Reading: How To Unlock My Transunion Credit Report

How Do I Get Credit

Do you want to build your credit history? You will need to pay bills that are included in a credit report.

- Sometimes, utility companies put information into a credit report. Do you have utility bills in your name? That can help build credit.

- Many credit cards put information into credit reports.

- Sometimes, you can get a store credit card that can help build credit.

- A secured credit card also can help you build your credit.

How Does A Credit Score Work

Your credit score is a number related to your credit history. If your credit score is high, your credit is good. If your credit score is low, your credit is bad.

There are different credit scores. Each credit reporting company creates a credit score. Other companies create scores, too. The range is different, but it usually goes from about 300 to 850 .

It costs money to look at your credit score. Sometimes a company might say the score is free. But usually there is a cost.

Recommended Reading: Does Carmax Do Credit Checks

How To Read Your Credit Report

Your credit report summarizes your credit history and helps lenders weigh your credit risk. Often your credit report is initiated when you apply for your first credit card. Over time it can help you reach your larger financial goals such as obtaining a rental agreement or mortgage. When you apply for a credit product, you may request your report to get one numberyour credit score. But that detail is just one aspect among a long list of confusing text and alphanumeric codes. Credit reports can seem cryptic and hard for the average consumer to interpret. However, reading and understanding them is an essential part of maintaining good credit and healthy financial habits.

In Canada, consumers are allowed to request their credit report free of charge at least once a year from the two main credit bureaus, Equifax and TransUnion. Asking for your information from one reporting agency and then the other every six months can help you stay up to date with your credit report and ensure the information is accurate.

Heres a quick guide to what your report contains and who is allowed to use it.

How To Read Credit Report Codes

Youll find a variety of different codes on your credit reports. Each major credit bureau has its own codes though, so dont assume a code used by one bureau means the same thing on another bureaus report.

Each bureau offers a guide explaining the codes youll see on that particular bureaus report. Heres where you can access those guides.

Also Check: Credit Score Without Ssn

Why Isnt My Credit Score Listed On My Credit Report

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

When you pull your credit reports online, you may be surprised to realize your credit score is not showing up.

Why isn’t your credit score on your credit reports, and what can you do about it?

How Can You Monitor Your Report And Score For Free

Consumers have not always had access to their scores. Now, however, scores are widely available to consumers for free from a variety of sources. When picking a source of a free score so you can monitor your credit, look for one that includes free credit report information as well, such as NerdWallet, which has scores and reports that update weekly. That gives you a convenient way to check your credit health any time and monitor your progress. It’s smart to choose a particular score and monitor that one, using the same credit bureau and scoring model.

Also Check: Does Zebit Report To The Credit Bureau

Age Of The Collection Account

Items that have recently been added to your credit report affect your score much more than older marks, so new collections are more harmful to your credit than old collection accounts.

In fact, according to VantageScore, most negative items have little impact on your credit score after 2 years. 3 Even collections, which are among the most damaging derogatory marks, will eventually stop affecting your credit altogether.

What’s In A Credit Report

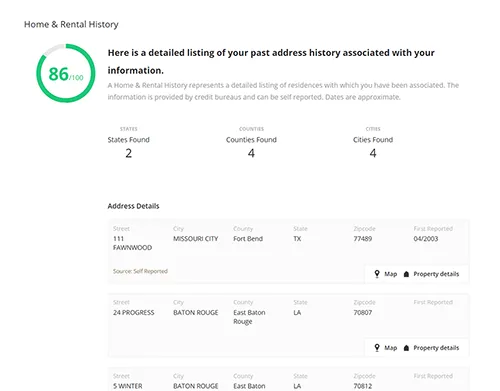

Your credit report lists what types of credit you use, the length of time your accounts have been open, and whether you’ve paid your bills on time. It tells lenders how much credit you’ve used and whether you’re seeking new sources of credit. It gives lenders a broader view of your credit history than do other data sources, such as a bank’s own customer data.

A credit report also includes information on where you live, and whether you’ve been sued or arrested, or have filed for bankruptcy.

You May Like: Navy Fed Car Buying Program

Get Collections Removed From Your Credit Report

You may be able to convince the debt collection agency handling your debt to remove collections from your credit report so that they stop hurting your credit score.

There are two main strategies you can use to get collections deleted from your credit history:

- Pay for delete: With this approach, you offer to pay your debt if the collection agency will delete the record of your collection account. Use a pay-for-delete letter template and send it to your debt collector.

- Goodwill deletion: While this is less likely to work, you may be able to convince your debt collectors to erase paid collections out of kindness. To do this, youll need to use a goodwill letter template and explain the circumstances that led to your delinquency.

Whats A Credit Report

A credit report includes information about your past and existing credit agreements, such as credit card accounts, mortgages, and student loans, and lists inquiries about your credit history. It outlines how much you owe creditors, how long each account has been open, and how consistently you make on-time payments. Credit reports also list related public records, such as collections or bankruptcy filings.

You May Like: How To Check Credit Score Without Social Security Number

Become An Authorized User

If a spouse or family member can add you as an authorized user on a card, you have an opportunity to start building credit. Keep in mind that as an authorized user you wonât be solely responsible for paying the bill, so make sure to coordinate accordingly.

Also, others may be reluctant to add you if you have a history of questionable money mistakes. In that case, see if you can be added as an authorized user but not actually get the physical card to spend on. This move can also affect your score negatively if the person fails to pay a bill, so partner up with someone who is money smart.

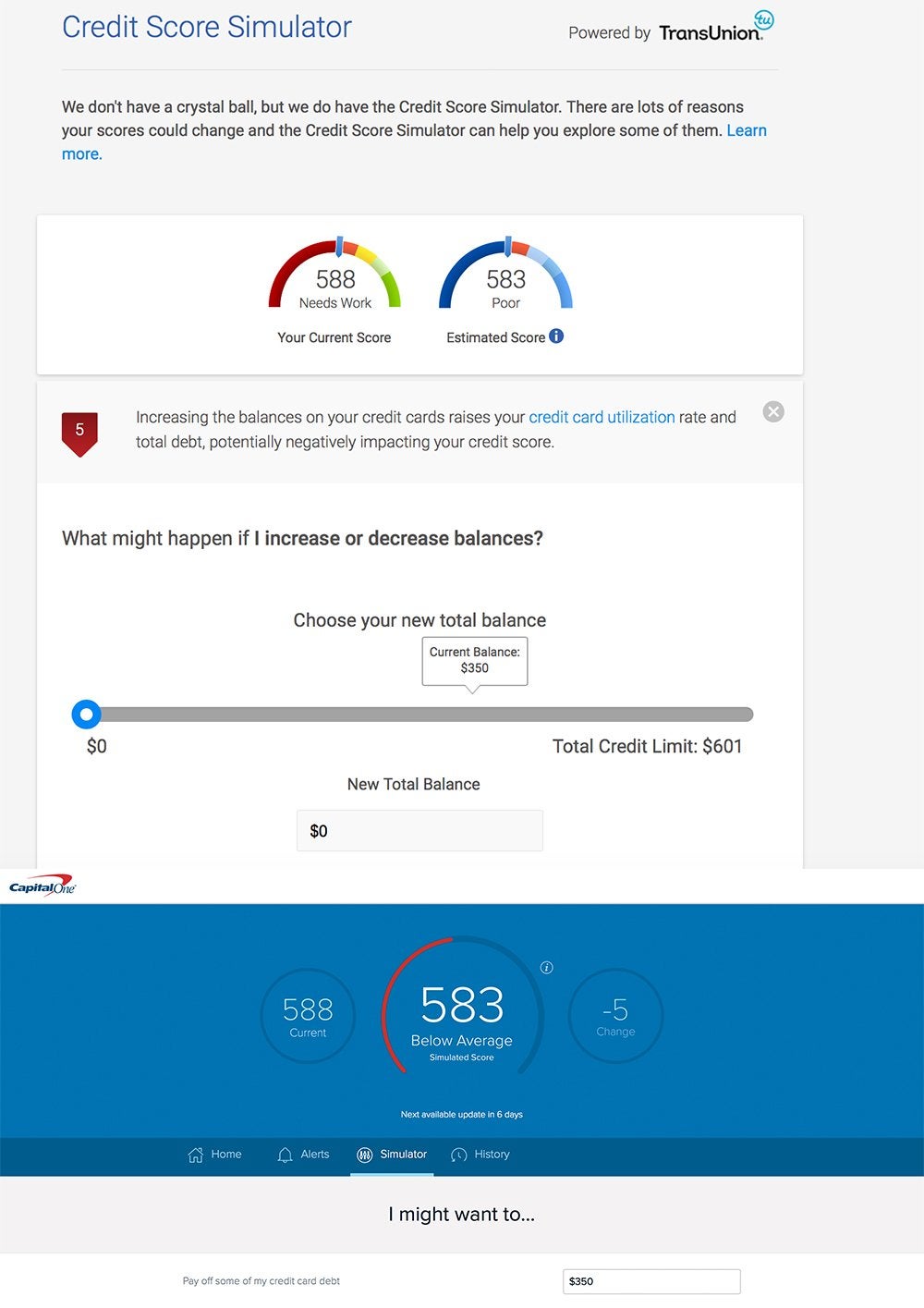

How Do You View Your Credit Score And Credit Report

You can check your credit report for free once every 12 months by going to the Annual Credit Report website, however, because of a rise in credit fraud since the COVID-19 pandemic, you can access free weekly reports from all three credit bureaus through April 2022.

You can also sign up for Experian to view your FICO score and report and credit scores from the other two bureaus as well. Capital One also offers free credit monitoring through .

If you want a more comprehensive service, check out Select’s ranking of the best credit monitoring services.

Catch up on Select’s in-depth coverage of personal finance, tech and tools, wellness, and to stay up to date.

Read Also: Pre Approval Hurt Credit Score

Sign Up To Have Rent Payments Reported

If you rent, you may be able to use your on-time payments to build your credit score. Rent payments arenât usually reported to agencies by default, but itâs OK to ask your landlord or management company if itâs an option. There are a few independent reporting companies that will take on this responsibility for you as well. Experian, for example, partners with several through its RentBureau partnership. Prices for these services vary.

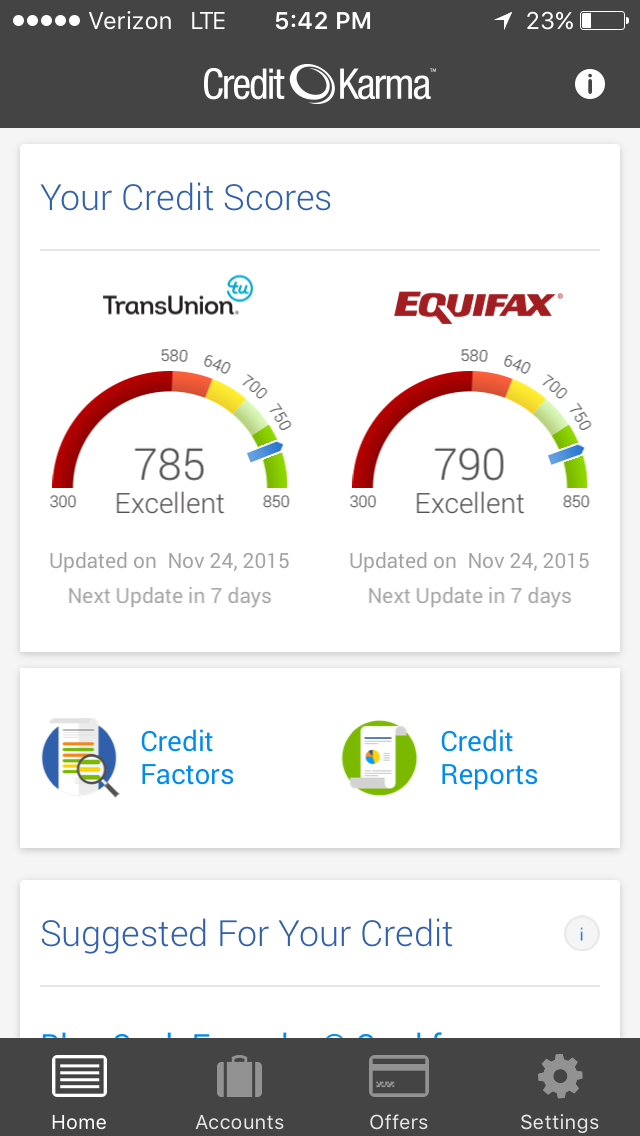

Best For Credit Monitoring: Credit Karma

Youll have access to your credit report information along with an explanation of the factors that are currently contributing to your credit score. Credit Karma also uses your free credit report information to show credit card and loan offers that you may qualify for based on your credit standing. You dont have to take advantage of these offers if youre not on the market for a new credit card or loan product.

Also Check: Comenity Bank Shopping Cart Trick

What Does Your Credit Report Show

Eric is a duly licensed Independent Insurance Broker licensed in Life, Health, Property, and Casualty insurance. He has worked more than 13 years in both public and private accounting jobs and more than four years licensed as an insurance producer. His background in tax accounting has served as a solid base supporting his current book of business.

When you’re reading your credit report for the first time, it can be overwhelming, especially if you’ve had a lot of accounts over a long period of time. Knowing what types of things appear on your credit report can make it much easier to read and understand.

Place A Credit Freeze

Contact each credit reporting agency to place a freeze on your credit report. Each agency accepts freeze requests online, by phone, or by postal mail.

Experian

PO Box 26Pittsburgh, PA 15230-0026

Your credit freeze will go into effect the next business day if you place it online or by phone. If you place the freeze by postal mail, it will be in effect three business days after the credit agency receives your request. A credit freeze does not expire. Unless you lift the credit freeze, it stays in effect.

Read Also: What Company Is Syncb Ppc

What Is A Credit Rating

A credit rating is a measure of how dependable you are in repaying your debts. Most credit-reporting agencies will give you a rating on a scale of 1 to 9, others will assign letters corresponding to the type of credit you’re using. For example, a rating of “1” means you pay your bills within 30 days of the due date, while a rating of “9” can mean that you never pay your bills at all.

An “R” rating is also included in your credit score. This rating is assigned by lenders based on your past history of borrowing and paying off debts, and it can range from 1 through 9. An R1 rating is the best, meaning you pay your debts on time, within 30 days, and an R9 is the worst.

Your credit rating is not established by the government or by financial institutions – it is established by you. If you don’t pay your bills on time or fail to repay a loan, you may be reported to a credit bureau.

How Can A Credit Report Help Over Time

Good credit can set you up for other financial successes. For example, you may be more likely to receive a loan or you may qualify for a lower interest rate, which can save you money in the long run. A clean credit reportand its positive effect on your credit scorecan make it easier to get rewards credit cards, which offer perks, such as travel deals or cash back. And you may qualify for higher credit limits on your cards.

Recommended Reading: Realpage Consumer Report

States That Ban Credit Checks For Employment

Several states have passed laws restricting when employers can pull your credit report.

For instance, in Colorado, employers are generally prohibited from checking your credit unless youre applying to be a police officer or for a job at a financial institution.

The following 11 states either restrict or ban employment credit checks:

- California

- Vermont

- Washington

Cities like Chicago, New York City, and Philadelphia have also passed laws to limit employer credit checks.

Contact your states Department of Labor if youre unsure if your prospective employer can run your credit in your area.

How To Deal With Your Debt Collection Agency

If you think you have a debt in collection but you dont see any new entries on your credit report, you can find out what collections you have by contacting your original creditor or the debt collection agency thats pursuing payments from you.

When dealing with debt collection, its important that you start by finding out which collection agency you supposedly owe by checking your credit reports and letters youve received about the debt. You can then search the agencys name in this list of debt collection agencies to find out more about the company and how to contact them.

Once youve done that, youll be able to find out what debts you have in collection, verify whether the debt collector is legit, and either assert your rights or make arrangements to pay your collections.

You May Like: Afni Subrogation Department Bloomington Il

How Can I Check Credit Scores

Reading time: 2 minutes

Highlights:

-

You may be able to get a credit score from your credit card company, financial institution or loan statement

-

You can also use a credit score service or free credit scoring site

Many people think if you check your credit reports from the three nationwide credit bureaus, youll see credit scores as well. But thats not the case: credit reports from the three nationwide credit bureaus do not usually contain credit scores. Before we talk about where you can get credit scores, there are a few things to know about credit scores, themselves.

One of the first things to know is that you dont have only one credit score. Credit scores are designed to represent your credit risk, or the likelihood you will pay your bills on time. Credit scores are calculated based on a method using the content of your credit reports.

Score providers, such as the three nationwide credit bureaus — Equifax, Experian and TransUnion — and companies like FICO use different types of credit scoring models and may use different information to calculate credit scores. Credit scores provided by the three nationwide credit bureaus will also vary because some lenders may report information to all three, two or one, or none at all. And lenders and creditors may use additional information, other than credit scores, to decide whether to grant you credit.

So how can you get credit scores? Here are a few ways:

Apply For A Secured Credit Card

If you have cash available, you could be approved for a secured credit card. These cards can be used just like your typical credit card, but they only allow you to charge up to the credit line equal to a cash deposit put down in advance.

If you put down $500 in cash deposits, for example, youâll have $500 to spend with that card. Prompt repayment of the card bill will soon have you building that much-needed credit score.

You May Like: Bby Cbna

Closeclosewhich Credit Scores Matter

The importance of a from a credit reportYour credit report reveals many aspects of your borrowing activities. All pieces of information should be considered in relationship to other pieces of information. The ability to quickly, fairly and consistently consider all this information is what makes credit scoring so useful. This is the value of FICO® Scores.

Does An Employer Credit Check Hurt Your Score

No, employer credit checks dont hurt your credit score. The checks that employers perform are called soft inquiries, and only hard inquiries lower your score.

Youre the only person who can see soft inquiries on your credit report, which also means that potential employers cant check which other jobs youve applied for.

Also Check: Chase Sapphire Preferred Credit Score Requirement