Banks Score You Based On Products They’d Like To Sell You In The Future

Imagine a bank wants new mortgage customers. That’s a costly sell. Instead, it offers a current account paying a high rate of interest on a small amount kept in it. Yet when you apply, rather than scoring you as a bank account customer, it could actually be scoring to see if you’re likely to be a profitable mortgage borrower in the future you might face rejection if you aren’t.

The secretive nature of credit scoring makes this difficult to ever truly know.

Consider Experian Boost Or Ultrafico

When you have no credit history, adding extra accounts can boost your score. You have two options that could help you: Experian Boost and UltraFICO:

- Experian Boost evaluates your utility, streaming and other accounts and adds on-time payments from these accounts to your Experian credit report. If a lender or card company uses another credit bureau, they wont see any of your Experian Boost accounts.

- UltraFICO is a program from FICO that adds information about your bank account balances, cash flow and bank transactions. However, not every lender uses or accepts the UltraFICO score.

Get A Handle On Your Bill Payments

Organizing your bill payments so that you make every payment on time is one of the best ways to increase your score, as payment history makes up the most significant percentage of your credit score. Some ways to get a handle on your bill payments are to:

- Create a budget: List your expenses and income on a sheet of paper or your computer. Then determine whether or not you can make each of your obligations. If not, immediately cut non-essentials out, like your cable TV package or satellite radio in your car.

- Set due-date alerts: Many people miss bill payments because they forget a bill. An easy way to avoid this is by setting due-date alerts on your calendar or phone to remind you to pay your bills on time.

- Automate your bill payments: If you have recurring bill payments you need to make , consider setting up automated payments. The bank will take money out of your accounts and pay your bills without you needing to worry about it.

Read Also: Affirm Credit Score Requirements

Register To Vote Or It’s Much Harder To Get Credit

If you’re not on the electoral roll, it’s much harder to get accepted for credit, so sign up immediately. Don’t wait for the annual reminder or for the elections to roll around, apply at any time on Gov.uk.

Simply follow the instructions online it’ll ask you a series of questions aimed at identifying you, and the local electoral borough you need to register with. Note that you’ll need your national insurance number to hand.

Many worry some councils sell on the data. But you can opt out of the open electoral register which can be used for marketing.

Credit reference agencies are allowed to use the full register which you can’t opt out of and that you should, by law, be on. The electoral roll can be a factor in scoring, but even where it isn’t, not being on it can lead to delays as lenders also use it to check your address and ID.

It’s worth noting the credit scores sold to you by credit reference agencies may show you’ve a perfect score without being on the electoral roll. Don’t let that fool you into thinking not being registered won’t affect your ability to get credit. It will, because lenders also need to be sure you are who you say you are.

Debt Settlement Vs Credit Repair Vs Credit Counseling

Before deciding what you should do to fix your credit, its important to understand the difference between the three most common debt relief options. can be used to help resolve errors on your credit report. In contrast, debt settlement and are debt relief options focused on helping people avoid bankruptcy and pay off their debt, in full but with a potentially reduced interest rate or for a reduced amount .

The key differences between debt settlement vs. credit repair vs. credit counseling are:

| Debt Settlement | ||

|---|---|---|

| Helps correct credit report errors by filing disputes with creditors and credit reporting agencies. | Creates plans to help people repay debt in full more quickly and works with creditors to negotiate reduced interest rates. | Works with creditors to negotiate debt settlements in an amount less the balance owed. |

Don’t Miss: How To Dispute A Hospital Bill On Credit Report

Apply For New Credit Sparingly

When you apply for new credit such as a credit card or a loan, it’ll be recorded on your credit report as a hard regardless of whether you’re approved or not. These credit inquiries don’t last as long , but they can lower your credit score.

Credit inquiries typically don’t decrease your credit score by a lot, but if you don’t have much information on your credit report already, that dip could be larger. That’s why it’s best to wait to apply for credit until you think you’re likely to be approved. If you are in the market for a loan, don’t let this stop you from shopping around for the best rates. In some cases, such as if you’re shopping for an auto loan, all of your loan applications will be treated as a single inquiry if you complete your rate shopping within a 14- to 45-day period.

Make Your Rental Payments Count

Tenants sometimes pay out much more in monthly rental payments than homeowners yet still find it difficult to prove they could borrow and afford to repay loans such as a mortgage.

But now private, council and social housing tenants can get this record of making regular payments onto their credit report and improve their credit score via a rent reporting platform.

Council or social housing tenants should ask their landlord to report the rental payments they make to a free scheme called The Rental Exchange and information will appear on their Experian credit report.

Tenants renting through a private landlord or letting agent can also ask them to report rental payments to The Rental Exchange or they can choose to self-report via or Canopy .

Example of how rental payments will appear on an Experian credit report.

CreditLadder and Canopy use open banking, which allows them to track the rental payments being made each month through your current account – with your permission.

If you make your rental payments on time, getting your rent on your credit report is likely to boost your Equifax or Experian credit score.

How long will rent reporting take to boost your score?

However, lenders might be slower to factor rent reporting into their assessments of creditworthiness. In 2018, Which? asked major lenders how they would be using rental payments data for making lending decisions and many said they hadn’t incorporated the payments into their scoring yet.

Also Check: Cbe Group Verizon

Some Defaults Or Missed Payments & Declined Applications

Defaults or missed payments will usually stay on your report for six years. If you close an account, the missed payments could stay on the account for six years after the closure, so keep that in mind. Bankruptcy is wiped six years from the date you’re declared bankrupt, provided it’s been discharged.

And when it comes to declined applications, lenders can only see whether you’ve applied for credit elsewhere, not whether you’ve been accepted or declined. However, they may be able to guess by examining the credit accounts you have open and when they were opened.

If you’ve attempted to, or have successfully reclaimed PPI or bank charges, it won’t appear on your credit files. If you’ve had bank charges, the penalties will show on your records.

Pitfalls To Avoid When Working On Your Credit Scores

When it comes to building credit, its easy to get overly focused on ways to raise your credit scores fast. The truth is that building credit takes time. So take a step back and make sure your strategy doesnt do more harm than good.

Here are a few donts to keep in mind.

- Dont apply for a bunch of new credit cards just because you want to increase your credit utilization. Even though this might help lower your credit utilization ratio, it could also make you look like a risky borrower thanks to the new hard inquiries on your reports.

- For the same reason, dont take out a loan just to improve your credit mix. Only apply for a new loan if you actually need it.

- Dont carry a balance on your credit card just so you can build credit. Carrying a balance can lead to unnecessary interest charges, and it might actually hold your scores down by increasing your credit utilization ratio.

- Dont cancel your credit card after you pay it off unless you have a good reason to do so. Closing your credit card will hurt your length of credit history, so its better to leave it open, even if youre not using it anymore. Of course, if having a card tempts you to spend more, or it comes with an expensive annual fee, you might want to rethink this conventional wisdom.

Also Check: Factual Data Credit Inquiry

What Lenders Don’t Know Ignore Conspiracy Theories

Many people believe every element of their life is on their credit reference files, but actually it’s mainly just a strict set of financial data. Though over recent years, the information contained on them has grown.

So let’s debunk some myths. Here are a few of the more common things people think are on their files, but aren’t.

Race, religion, ethnicity. These personal details about you are not held.

Salary. How much you earn isn’t on your file either, though you’ll usually be asked on the application form.

Savings accounts. As savings are not a credit product, they don’t appear on credit files. This data is therefore only available to banks you hold savings accounts with. However, when you apply for a savings account, the provider might do a soft search of your credit report to check your ID, and do anti-money-laundering checks.

Medical record. Medical problems you may have had in the past aren’t listed.

Criminal record. No criminal convictions are listed.

There are a host of other things that aren’t held on your credit report, including:

Check Whether Youre Financially Linked To Someone Else

If you are thinking of getting a mortgage or joint account with someone, it’s worth knowing that your future credit rating will be affected by the other persons previous financial record too.Other people may appear on your credit report if theyre registered to vote at your address, or if you share a mortgage or joint loan with them. Lenders may use this information to help them decide whether they give you credit or not.Your credit rating could be affected by someone youre not living with any more like ex-housemates or former partners if you’re still financially linked. Its always worth having a look at your credit report to make sure any info on joint financial commitments is up to date . If youre no longer connected, you may be able to ask for them to be removed from your credit report.

You May Like: How To Unlock Your Credit Report

What Lenders Really Know About You

It’s important to be aware of exactly what lenders know when you apply, so you can present yourself in the best light. Importantly, it’s more than just what’s on your credit file.

The application form. In many ways this is the most important part. Here, lenders obtain the key details: your postcode, salary, family size, reason for the loan and whether you’re a home owner.

Make sure you fill in the forms carefully. One slight slip, such as a “£2,000” salary rather than a “£20,000” one, can kibosh any application.

Be consistent too, fraud-scoring firms filter applications and if there are many inconsistencies such as changing your job title or different phone numbers, it can cause a problem that you may not be told about.

Past dealings you’ve had with the lender. Companies use any data on previous dealings they’ve had with you to feed into the credit score. This means those with limited credit history may find their own bank more likely to lend to them than others.

Of course, those who’ve had problems with a lender in the past may find it more difficult to get accepted there too.

Equifax, Experian and TransUnion credit files. The three UK credit reference agencies compile information, allowing them to send data on any UK individual to prospective lenders. All lenders use at least one agency. This data comes from four main sources:

– Electoral roll information. This is publicly available and contains details of addresses and who lives at them.

How Do I Get My Credit Score Up 100 Points In One Month

Increasing your credit score by 100 points in a single month is almost impossible, especially if youre starting from nothing. However, if you have a significant mistake on your credit report, like a default that never happened or a credit card that doesnt belong to you, removing it can boost your score significantly.

Recommended Reading: Syncb/ppc Credit Card

Make All Your Payments On Time

Not all of your monthly payments are listed on your credit report. Bills that aren’t regularly reported to the credit bureaus won’t affect your credit as long as you’re paying on time. However, any bill can potentially wind up on your credit report if you become delinquent and the account is sent to a third-party collection agency.

Prevent negative accounts from being added to your credit report to build a good credit score. A serious delinquency like a debt collection can be hard to overcome.

Make The Most Of A Thin Credit File

Having a thin credit file means that you dont have enough credit history on your report to generate a credit score. An estimated 62 million Americans have this problem. Fortunately, there are ways to fatten up a thin credit file and earn a good credit score.

One is Experian Boost. This relatively new program collects financial data that isnt normally in your credit report, such as your banking history and utility payments, and includes that in calculating your Experian FICO credit score. Its free to use and designed for people with limited or no credit who have a positive history of paying their other bills on time.

UltraFICO is similar. This free program uses your banking history to help build a FICO score. Things that can help include having a savings cushion, maintaining a bank account over time, paying your bills through your bank account on time, and avoiding overdrafts.

A third option applies to renters. If you pay rent monthly, there are several services that allow you to get credit for those on-time payments. For example, Rental Kharma and RentTrack will report your rent payments to the credit bureaus on your behalf, which in turn could help your score. Note that reporting rent payments may only affect your VantageScore credit scores, not your FICO score. Some rent-reporting companies charge a fee for this service, so read the details to know what youre getting and possibly purchasing.

Recommended Reading: Does Speedy Cash Report To Credit Bureaus

Reduce The Amount Of Debt You Owe

Your , or the balance of your debt to available credit, contributes 30% to a FICO Score’s calculation. It can be easier to clean up than payment history, but it requires financial discipline and understanding the tips below.

Keep balances low on credit cards and other revolving credit: high outstanding debt can negatively affect a credit score.

Pay off debt rather than moving it around: the most effective way to improve your credit scores in this area is by paying down your revolving debt. In fact, owing the same amount but having fewer open accounts may lower your scores. Come up with a payment plan that puts most of your payment budget towards the highest interest cards first, while maintaining minimum payments on your other accounts.

Don’t close unused credit cards as a short-term strategy to raise your scores.

Don’t open several new credit cards you don’t need to increase your available credit: this approach could backfire and actually lower your credit scores.

Budgeting Skills Give You An Edge

Mapping out your retirement income and expenses can help you decide when to retire and whether your retirement timeline is realistic. A retirement budget can also help you manage finite resources once you’re no longer collecting a paycheck. Wherever you are on the path to retirement, knowing how to create and stick to a budget is an excellent skill to master. Though it won’t add to your account balance or raise your Social Security benefits, being budget savvy can help you move confidently into retirement, knowing you can manage your money no matter how much, how little or how limited it may be.

Also Check: How Long Closed Accounts On Credit Report

Always Make Your Payments On Time

The biggest factor affecting your credit score is whether you make your payments on time. Just one missed payment can have a significant impact on your credit score. Even worse, the mark will stay on your credit report for seven years, although the negative effect will fade over time.

The good news is that you can completely avoid missed payments by committing to make those payments on time, every time. One trick is to set up autopay on your credit card account for at least the minimum payment due each month.

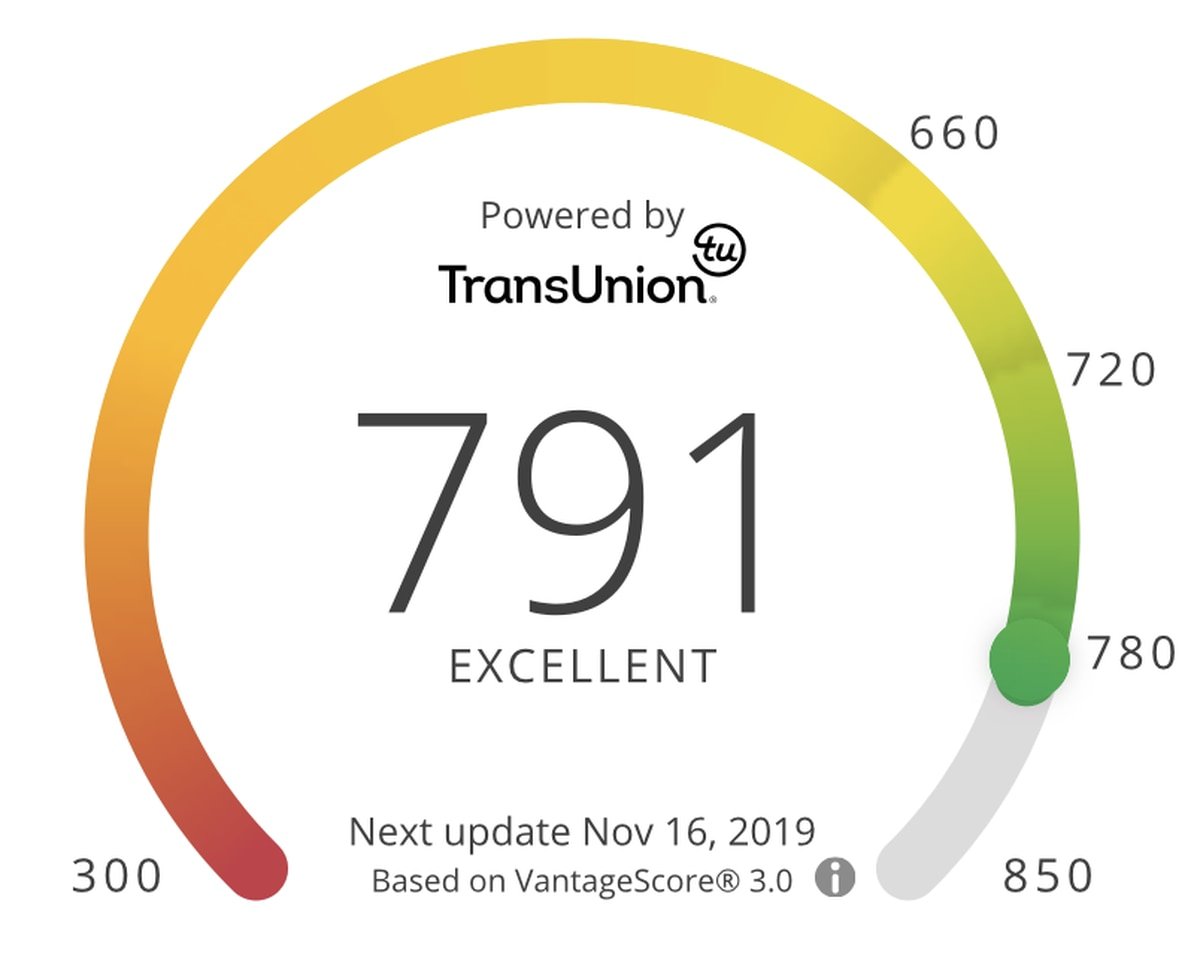

Use Credit Monitoring To Track Your Progress

are an easy way to see how your credit score changes over time. These servicesmany of which are freemonitor for changes in your credit report, such as a paid-off account or a new account that youve opened. Also, they typically give you access to at least one of your credit scores from Equifax, Experian, or TransUnion, which are updated monthly.

Many of the best credit monitoring services can also help you prevent identity theft and fraud. For example, if you get an alert that a new credit card account that you dont remember opening has been reported to your credit file, you can contact the credit card company to report suspected fraud.

Also Check: Which Credit Bureau Does Wells Fargo Use