Your Credit Report Dictates The Product And Rate You’ll Get

In the past 10 years the credit landscape has almost completely shifted towards ‘rate for risk’. This means almost every credit provider on the market uses your credit file to not only dictate whether they’ll provide you with credit, but also what interest rate you’ll get.

The most obvious way this manifests itself is in representative rates on loans.

Here, only a minimum of 51% of accepted customers must get the rate advertised. They might be advertising a 6% rate . But you could be accepted and offered a 40% interest rate instead, because of a poor credit score.

It applies to other products too. Some 0% credit cards give you a shorter 0% period if you’ve got a poor credit history , others will simply offer you a different product to the one you’ve applied for. This is why it’s so important to manage your creditworthiness.

Tips To Increase Your Credit Score

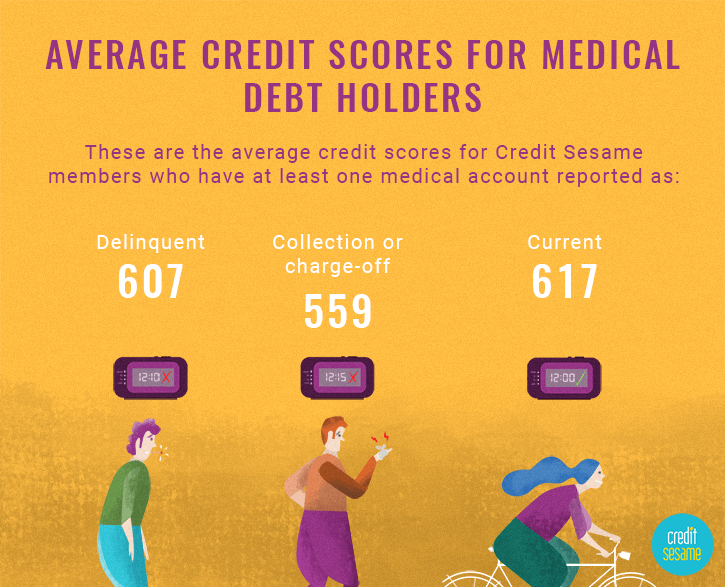

If you are like many consumers and dont know your credit score, there are several free places you can find it. The Discover Card is one of several credit card sources that offer free credit scores. Discover provides your FICO score, the one used by 90% of businesses that do lending. Most other credit cards like Capital One and Chase give you a Vantage Score, which is similar, but not identical. Same goes for online sites like Credit Karma, Credit Sesame and Quizzle.

The Vantage Score comes from the same place that FICO gets its information the three major credit reporting bureaus, Experian, TransUnion and Equifax but it weighs elements differently and there could be a slight difference in the two scores.

Once you get your score, as Homonoff suggested, you might be surprised if its not as high as you expected. These are ways to improve the score.

Sign Up For Experian Boost

If your low score is primarily the result of being new to the credit-seeking game and you are timely with your payments for utilities and your cell phone, ask the lender to pull a report from Experian, using its Experian Boost plan. This hybrid model draws on what the industry calls alternative credit data non-traditional payments that provide lenders useful insight into an applicants creditworthiness.

The way forward gets a little steeper from here, so its a good idea to know what youre up against.

Also Check: What Credit Report Does Comenity Bank Pull

How Do Credit Cards Affect The Credit Score

VantageScore® and FICO® credit scoring calculations consider your credit utilization the ratio between the amount of debt you owe on a credit card and the card’s credit limit. Credit utilization is what constitutes that 30% impact on your credit score.

To determine what your credit utilization is, you can do the following things:

- Add up all of your credit card balances

- Add up all of those credit cards’ credit limits

Pay Attention To Credit Utilization

Your credit utilization rate is the amount of revolving credit youre using divided by the amount of revolving credit you have available. It makes up 30% of your credit score and is often the most overlooked method of improving your score. For most people, revolving credit just means credit cards, but it includes personal and home equity lines of credit as well. A good credit utilization rate never exceeds 30%. So, if you have a credit limit of $5,000, you should never use more than $1,500.

Also Check: Mailed Credit Report

Less Debt Better Scores

It’s always a good idea to pay off credit card debt, regardless of how that debt repayment impacts your credit scores. Unless you have an intro APR deal, any outstanding balance carried from month to month accrues interest — at a high interest rate.

Happily, you don’t have to choose between paying down high-interest debt and your credit score — you should almost always see an improvement in your score when you pay off credit card debt. It’s hard to predict how much your credit score will change, but hopefully this guide helps you estimate the potential change.

Check Your Credit Report For Errors

Carefully review your credit report from all three credit reporting agencies for any incorrect information. Dispute inaccurate or missing information by contacting the credit reporting agency and your lender. Read more about disputing errors on your credit report.

Remember: checking your own credit report or FICO Score has no impact on your credit score.

Don’t Miss: How To Unlock My Experian Credit Report

Know Your Risk Factors

If you’ve been leaving your paid-off credit cards open, there may be other changes in your credit history that could be affecting you. The easiest way to find out which factors in your credit history are currently impacting you the most is to request your .

When you get your free score from Experian, you will also receive a list of your top risk factors. This will give you insight into what could be lowering your scores and help you to determine what changes you can make to improve them.

If I Pay Off My Credit Card In Full Will My Credit Go Up

The short answer to whether your score improves when you pay off credit card debt is: Yes. The longer answer: It depends on where you started.

As we noted above, most of the credit score improvements when you pay off credit card balances come from your “amounts owed” factor. More specifically, it comes from changing your utilization rate.

Because your utilization is a ratio of how much you owe versus how much available credit you have, changing either part of the equation changes your utilization. Decreasing how much you owe — without reducing your available credit — decreases your utilization rate.

Here’s an example: If you have a credit card with a $3,000 credit limit and a balance of $1,200, your utilization is $1,200 / $3,000 = 0.4 = 40%. If you make a payment and reduce your balance to $600, your utilization rate becomes $600 / $3,000 = 0.2 = 20%.

FICO® looks at your utilization across all of your credit cards, but they also consider the individual utilization of each card. Since lower utilization is better, reducing your utilization typically increases your credit score.

Keep in mind that a balance transfer card only reallocates your debt. It doesn’t pay off credit card debt. So a balance transfer probably won’t improve your credit score, though it can give you a lower interest rate. Paying off your cards with a personal or debt consolidation loan, on the other hand, can reduce your revolving debt utilization.

Read Also: Will Balance Transfer Affect Credit Score

What You Should Focus On

When trying to balance paying off debts with building credit, it can be difficult to understand how to do whats good for your money while doing whats good for your credit score.

Rather than stressing, focus on paying your bills and loans in a timely fashion and do what you can to build good credit. These two actions go hand in hand.

Only take on new debt and credit cards if you think you can remain in control of the balances and pay them on time. Otherwise, you risk undoing your good work.

If you worry about how long it will take after paying off debt for your credit score to improve, be patient. Congratulations on paying off your debt.

Andrew Pentis and Alli Romano contributed to this report.

Sign up for weekly digest to receive the latest rate updates and refinance news!

Thank you! Keep an

Dont Stick To Minimum Payments

Minimum monthly repayments tend to be set at very low levels. These are sometimes as low as 1%,plus fees, interest and charges but most will be higher.

If you only make the minimum repayment, your debt could take decades to pay off and you could pay thousands of pounds in interest.

Here are some tips:

- Aim to pay off the entire bill each month so you wont pay any interest at all. With a standard credit card, if you always pay off your monthly bill in full, you can enjoy between 45 and 56 days of interest-free credit.

- If thats not possible, pay off as much as you can and work out a repayment plan.

- Dont use the cards for cash withdrawals.

Lenders are required to suggest higher affordable repayments. If you dont respond, or ignore the issue, and the situation persists for more than 36 months this could lead to your account being suspended.

Read Also: Paypal Working Capital Log In

Aim For 30% Credit Utilization Or Less

refers to the portion of your credit limit that youre using at any given time. After payment history, its the second most important factor in FICO credit score calculations.

The simplest way to keep your credit utilization in check is to pay your credit card balances in full each month. If you cant always do that, a good rule of thumb is to keep your total outstanding balance at 30% or less of your total credit limit. From there you can work on whittling that down to 10% or less, which is considered ideal for improving your credit score.

Use your credit cards high balance alert feature so you can stop adding new charges if your credit utilization ratio is getting too high.

Another way to improve your credit utilization ratio: Ask for a credit limit increase. Raising your credit limit can help your credit utilization, as long as your balance doesnt increase in tandem.

Most credit card companies allow you to request a credit limit increase online you’ll just need to update your annual household income. Its possible to be approved for a higher limit in under a minute. You can also request a credit limit increase over the phone.

I Settled My Debt But When Will My Credit Score Go Up Again

Question:OK, so I had a student loan go delinquent, as well as two credit cards because of two years of not having steady employment. However, I have paid the settlement amounts on everything but my student loans those I paid in full. My question is this, at what point will I start to see a change in my credit score?

I have two credit cards with low balances that I pay off all transactions in full on time every month. I just want my credit score to improve sooner rather than later. The last two years have been brutal, but Im back on track now.

R. Michele

Read Also: How To Check Credit Score With Ssn

Fact: Paying Less Than The Minimum Is Still A Missed Payment

If you dont pay the total minimum payment on your credit card bill, your credit card company may report it as a missed payment. This can bring down your credit score and make it more difficult to qualify for credit in the future. Check your statement for the minimum amount due, and be sure to pay it on time to keep your account current. And remember: Paying more than the minimum amount due is a great way to pay down your debtand until you pay it off, interest will continue to be charged each month.

How To Increase Your Credit Score

Dont Apply for too Much New Credit

If too many lenders are looking at or asking about your credit score in a short period of time, it will likely have a negative effect on that score. However, remember that your score isnt hurt when you ask for information about it, only when others do.

Use Your Credit Card

If you dont use your credit card or other credit accounts, you will not grow your credit card. So dont be afraid to use your card, but just ensure you use it responsibly. This means not spending over your limit and always paying it off. Over time, as long as you are using your card responsibly, it will help to slowly but surely raise your credit card.

Is cancelling a credit card bad for your credit score? Find out here.

Keep Your Balance Low

While you should use your card, its best not to go overboard with it. You shouldnt be using more than 30 to 35% of your available credit each month to show that you do indeed use it, but dont get reckless. Before any major application for credit such as a car loan or mortgage, it can be a good idea to keep this usage rate even lower to get your score as good as it can possibly be.

Raise Your Credit Limits

However, if you have a low limit, having low utilization can be tough. In this case, it can be a good idea to raise your credit limit. This will give you more access to funds and more flexibility each and every month. Of course, only raise your limit if you can handle it and not go crazy with the extra spending.

You May Like: Does Paypal Credit Report To Credit Bureaus

Your Credit Card Debt Questions Answered

Your credit utilization ratio measures the amount of credit youre using compared to your cards credit limit. If you dont carry a balance, your credit utilization is 0. A high utilization rate may indicate youll have a hard time paying your credit card balance on time, so a lower utilization rate is better for your credit score. You should aim to have a credit utilization ratio of 30% or less. Anything higher can damage your credit score. Not using your card enough can also affect your credit score because lenders wont be able to measure your creditworthiness.

Set Up Payment Reminders

With so much going on in your life, you might find yourself having a late or missed payment. This paints a dire picture of you as a beneficiary to the lenders. They may make a horrible payment history to the credit bureaus and set you in for a bad score. Why then dont you try setting up payment reminders only, e.g., with the Google Calendar? Since you use your phone often, you will see the reminders and pay your bills on time, increasing the chances of improving your credit score.

Read Also: Does Klarna Affect Your Credit Score

Don’t Withdraw Cash On Credit Cards

This is both expensive to do, as interest is higher and you’re charged it even if you repay in full each month. Crucially, many lenders see it as evidence of poor money management.

The one exception is withdrawing cash on a specialist card abroad. See Overseas Credit Card ATM Withdrawals for full info and why they’re not too bad.

Paying Off Other Delinquent Debts

Obviously, collection accounts dont represent the entire universe of possible delinquent debts. You can be behind on your mortgage, credit cards, student loans and or car loans without any of them being in collection status. Paying past due debts to a zero balance isnt going to cause FICO and VantageScore to ignore them so youre less likely to see a significant improvement in your scores as a result. You may earn a few points because scoring systems do consider balances on delinquent accounts, but the fact that you were late in paying in the first place wont be erased.

Once youve gotten caught up on past due accounts and paid off delinquent debts, your focus should be on maintaining the health of your credit score. Paying all of your bills on time, keeping your balances low and limiting how often you apply for new credit are the most important things you can do to keep your score on track.

Don’t Miss: Does Opensky Report To Credit Bureaus

Howard Dvorkin Cpa Answers

The simple answer, Michele, is: You should see some improvement within six months of paying off those student loans and behaving responsibly with your credit cards. Every day that you make good credit decisions, your credit score will improve.

Of course, little in life is all that simple, especially when it comes to money. Fortunately, its not all that confusing, either. Lets break it down in three easy steps

Can A Credit Card Improve Your Credit Score

have earned a reputation of leading more people down the road to ruin than the devil himself. While procuring a credit card nowadays can be a piece of cake – as long as you have the right documentation – making them work to your advantage is a far more daunting task. Not only do they have the power to bury you under an avalanche of perennial debt, but they also possess the power to work wonders for your financial health by potentially improving your credit report and significantly impacting your CIBIL score in a positive manner.

Banks and financial institutions today rely almost solely on CIBIL scores to gauge whether or not to issue loans or credit cards to customers. Applicants with bad credit history or even no credit history at all, stand little chance of acquiring credit from a lender.

For those who already own one or more credit cards, there are numerous ways to use them to strengthen your CIBIL score.

Don’t Miss: How To Remove Repossession From Credit Report

Double Your Monthly Payments

As stated previously, there are many tricks and tips to raise your credit score. However, nothing works better than paying your bills on time and using your credit card sparingly. One strategy of improving two tenets is tapping on the billing cycle and paying twice a month rather than just once. This lowers your credit utilization ratio, a critical factor in determining the FICO Score, and ultimately increases your credit score.

Use Credit Monitoring To Track Your Progress

are an easy way to see how your credit score changes over time. These services, many of which are free, monitor for changes in your credit report, such as a paid-off account or a new account that youve opened. They typically also give you access to at least one of your credit scores from Equifax, Experian, or TransUnion, which are updated monthly.

Many of the best credit monitoring services can also help you prevent identity theft and fraud. For example, if you get an alert that a new credit card account that you dont remember opening has been reported to your credit file, you can contact the credit card company to report suspected fraud.

Read Also: Does Snap Finance Report To The Credit Bureau