Option : Get Instant Access To Your Free Credit Report By Phone

The second fastest way to obtain a free copy of your credit report is to call each of the credit reporting agencies toll free numbers. If you call these numbers, a computer will ask you some questions about your personal information so that it can verify your identity. Then the automated system will mail you a copy of your credit report. It can take up to 3 weeks for your credit report to arrive by mail. You can obtain your free credit report by calling the numbers below:

- Equifax – 1-800-465-7166

- TransUnion – 1-800-663-9980

What Is A Good Credit Score

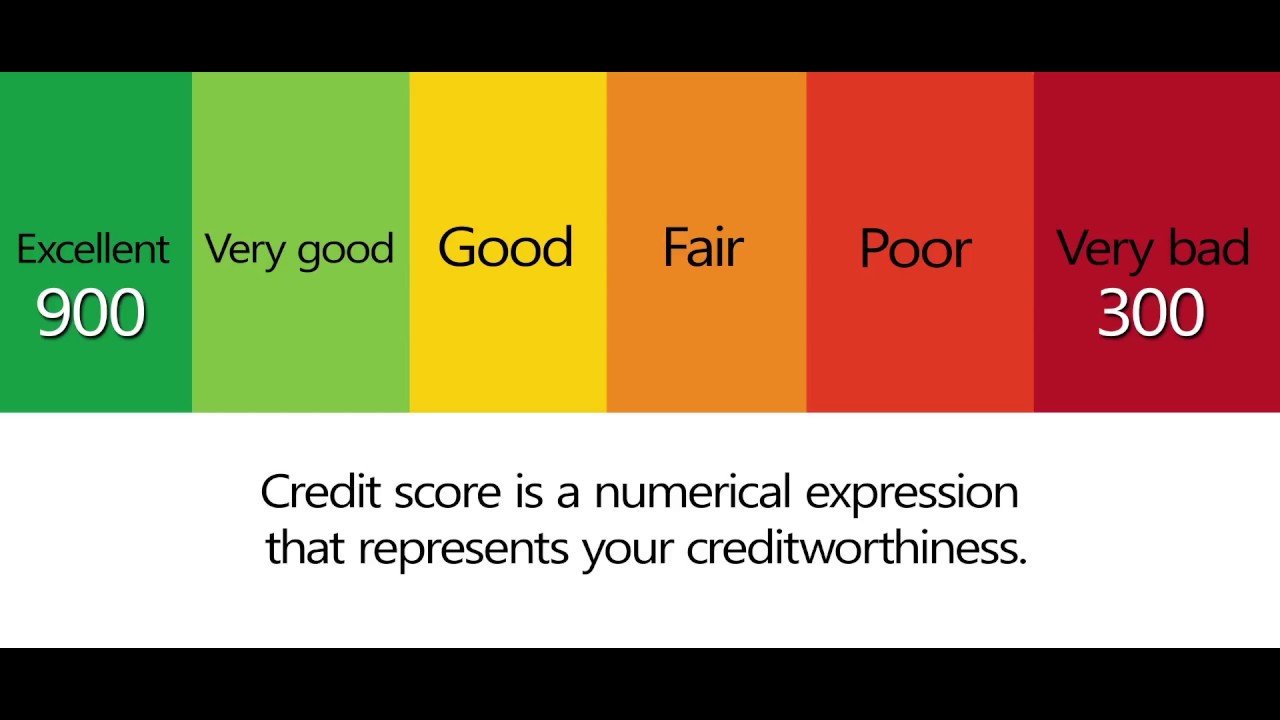

This is a somewhat loaded question, but in general a FICO score below 670 is not where you want to be. This is considered sub-prime. Anything in the 670 to 739 range is considered a good credit score. Above that, your credit score is considered excellent and you are golden.

In the case of VantageScores, you want to be above 600. From 661 to 780 is considered a good VantageScore and likely to get you credit at competitive rates.

I always recommend that you shoot for a score that is good enough to get what you want at a price you want, as opposed to shooting for the elusive perfect credit score of 850. This will save you from chasing an ever-moving target to no avail.

How To Access Your Report

You can request a free copy of your credit report from each of three major credit reporting agencies Equifax®, Experian®, and TransUnion® once each year at AnnualCreditReport.com or call toll-free 1-877-322-8228. Youre also entitled to see your credit report within 60 days of being denied credit, or if you are on welfare, unemployed, or your report is inaccurate.

Its a good idea to request a credit report from each of the three credit reporting agencies and to review them carefully, as each one may contain inconsistent information or inaccuracies. If you spot an error, request a dispute form from the agency within 30 days of receiving your report.

Also Check: Does Klarna Affect Your Credit Score

Place A Credit Freeze

Contact each credit reporting agency to place a freeze on your credit report. Each agency accepts freeze requests online, by phone, or by postal mail.

Experian

PO Box 26Pittsburgh, PA 15230-0026

Your credit freeze will go into effect the next business day if you place it online or by phone. If you place the freeze by postal mail, it will be in effect three business days after the credit agency receives your request. A credit freeze does not expire. Unless you lift the credit freeze, it stays in effect.

Can Someone Run A Credit Report Without Me Knowing

It depends. Like we said earlier, there are soft inquiries and hard inquiries. Soft inquiries happen all the time without you even knowinga company might check your credit score if theyre planning on mailing you a promotional offer. These inquiries dont affect your credit score at all.

But hard inquiries require your actual consent before they can happen. These impact your credit score and cant legally be done without you knowing, so breathe easy. If you notice a hard inquiry you didnt authorize, youll need to dispute it with the credit agency.

Don’t Miss: When Does Usaa Report To Credit Bureaus

Why You Could Have Different Credit Reports From Different Bureaus

The credit bureaus can only report on the information thats provided to them. Since lenders are not required to report to all three major credit bureaus, you might find information about certain accounts on one credit report, but not others.

Even when lenders do report information to all three major bureaus, they may report that information at different times. Given all the credit information included in a typical credit report, its perfectly normal to observe some minor differences between your credit reports.

Mistakes do happen from time to time. If you think your credit reports are different due to legitimate errors, you can dispute those errors with each credit bureau.

How Does A Credit Score Work

Your credit score is a number related to your credit history. If your credit score is high, your credit is good. If your credit score is low, your credit is bad.

There are different credit scores. Each credit reporting company creates a credit score. Other companies create scores, too. The range is different, but it usually goes from about 300 to 850 .

It costs money to look at your credit score. Sometimes a company might say the score is free. But usually there is a cost.

Don’t Miss: Bp Visa Syncb

What Can Lenders See On Your Credit Report

Your creditreport provides a detailed summary of your credit history. It includes your personal information and lists details on your past and current credit accounts. It also documents each time you or a lender requests your credit report, as well as instances where your accounts have been passed on to a collection agency. Financial issues that are part of the public record, such as bankruptcies and foreclosures, are included, too.

How We Make Money

You have money questions. Bankrate has answers. Our experts have been helping you master your money for over four decades. We continually strive to provide consumers with the expert advice and tools needed to succeed throughout lifes financial journey.

Bankrate follows a strict editorial policy, so you can trust that our content is honest and accurate. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. The content created by our editorial staff is objective, factual, and not influenced by our advertisers.

Were transparent about how we are able to bring quality content, competitive rates, and useful tools to you by explaining how we make money.

Bankrate.com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and, services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range can also impact how and where products appear on this site. While we strive to provide a wide range offers, Bankrate does not include information about every financial or credit product or service.

Recommended Reading: Will Balance Transfer Affect Credit Score

Who Can See My Credit Report

Most people cant legally use your personal information to access your credit report. However, there are several types of organizations that are allowed to pull your credit: banks, creditors, lenders, insurance companies, potential landlords, collections agencies, potential employers and the government.

The laws about who can access your credit score are different from state to state. If youre worried at all, do some research and find out what the law is where you live.

Escalate The Issue If Required

If you feel that a credit bureau has not treated you properly, you may file a complaint. This complaint can be made in writing to your provincial or territorial consumer affairs office. The federal government does not regulate credit bureaus.

In Quebec, these complaints must be directed to the Commission d’accès à l’information du Québec .

You May Like: How To Get Credit Report Without Social Security Number

Knowing Your Credit Score Is An Important Part Of Maintaining Your Overall Financial Health But Your Score Alone Wont Give You The Full Picture Of Your Situation Because Your Credit Score Is Based On Information In Your Credit Report Its Important To Also Check Your Report Heres How To Obtain Both

How to Check Your Credit Report

How to Check Your Credit Score

Content Type: Article

How Do I Establish A Good Credit Rating

The easiest way to establish a good credit rating is to pay your bills on time. If you don’t have a credit card, apply for one, and use it responsibly. If you make your minimum payments, you can develop a good credit history. This will have a positive impact on your ability to borrow in the future.

To find out more about establishing credit, talk to a CIBC advisor.

Also Check: How To Remove Repossession From Credit Report

Your Credit Report Vs Your Credit Score

First, let’s break down the difference between your and your credit score.

Your credit report details your credit history, including any credit card account information, your balances, your available credit and your payment history. Your credit score is a 3-digit number that basically sums up that information into a rating. A good credit score means you’re a good credit risk , whereas a low credit score means you’re a poor credit risk.

Does Checking Your Credit Hurt Your Score

Checking your credit score yourself will never hurt your score. Doing so is considered a soft inquiry because you are not trying to obtain new credit when you check for yourself.

Of course, you may be checking so you can do that, but the hard inquiry only comes when the lender pulls your credit in order to see if they are going to extend that new credit to you. Along the same lines, those offers you get online or in the mail for new credit cards or other financial offerings based on your good credit are soft inquiries and also do not hurt your score, unless and until you take advantage of one of those offers.

Read Also: Print Out Credit Report

It’s Easy To Be In Control

Sign up for MyCredit Guide at no charge to see your detailed TransUnion credit report, updated weekly upon log in, get alerts, and use the credit score simulator.

Already enrolled to MyCredit Guide? Log In Here

Articles about Credit

Here is how to check your credit score for free and get the most accurate picture of your credit.

Enroll with MyCredit Guide to get a free credit report that you can access at anytime or you can request a copy of your credit report 3 credit bureaus once a year.

Learn about credit score ranges from FICO and VantageScore, and how they classify Excellent, Good, or Poor credit score.

Tips to Improve Your Credit Score

The better your credit score, the better chance you may have to secure a mortgage for a house or get approved for that premium credit card. Watch this short video from American Express to learn how to improve your credit score.

Your Credit Score And Report

You can get your Equifax credit score and credit report for free with Borrowell! Check your credit score or download your credit report whenever you’d like. Receive weekly updates on how your score has changed, get personalized tips how to improve your score, and find the best financial products that match your profile. Checking your credit score with Borrowell doesn’t hurt it.

You May Like: How Accurate Is Creditwise Credit Score

American Express Mycredit Guide

Available even if you are not an American Express customer. All for free.

Not a Card Member?

Why MyCredit Guide?

We believe everyone should know their credit score and have the tools to understand it better. That’s why we’re giving you VantageScore® 3.0 by TransUnion, and the key factors that affect your score.

Using MyCredit Guide won’t hurt your credit score.

Use it as often as you like, it wont affect your credit score.

There is no cost to using MyCredit Guide.

We provide a secure login that helps keep your information safe.

MyCredit Guide offers you tools and information to help you take charge of your credit.

In addition to your credit score, get a detailed TransUnion credit report that helps you stay informed.

Alerts

We will let you know if there are any changes to your TransUnion credit report to help detect identity theft. Alerts include address updates, new inquires on your credit report, new accounts opened, and more.

See how different actions like paying down debt or opening a new account, could affect your score.

Why Would A Potential Employer Look At Your Credit

More than half of employers conduct background checks during the hiring process only, and the No. 1 reason is to protect their employees and customers, says the 2018 HR.com report.

For security purposes, the credit report can be used to verify someone’s identity, background and education, to prevent theft or embezzlement and to see the candidate’s previous employers . For employers, it is a big picture snapshot of how a potential candidate handles their responsibilities.

“Credit reports indicate whether or not you’re responsible,” financial expert John Ulzheimer, formerly of FICO and Equifax, tells CNBC Select. “And, they also indicate if you’re in financial distress. These are attributes that are important to employers. For example, would you want to hire someone in your accounting department who can’t manage their own obligations?”

If an employer is running a credit check on you, it is most likely only after they already made a decision to hire you, and it is usually the last thing they check. Since pulling credit checks cost employers both time and money , credit checks aren’t necessarily used to weed out a big pool of potential applicants and not all applicants will have their credit checked.

Employers are more likely to run a credit check for candidates applying for financial roles within a company or any position that requires handling of money .

Don’t Miss: Does Paypal Credit Report To Bureaus

Why Should I Check My Credit Report

Your credit report has information that can affect whether you’re approved for a loan or credit card and the amount you’ll be approved for. Getting a copy of your credit report is valuable to:

- Make sure the information is accurate, complete and updated before applying for a line of credit

- Help protect yourself from identity theft

Option : Request Your Free Credit Report By Filling Out A Form

Quick Links to Equifax and TransUnion Credit report forms

You can also request a free copy of your credit report from Equifax and TransUnion by filling out an Equifax form and/or a TransUnion form. You can then mail the completed forms to Equifax and TransUnion and they will mail you a free credit report.

For all the options listed above, when your credit report arrives by mail, certain personal and identifying details will be blocked out. If this is your own report, there is enough information there for you to know whats going on. If someone should get your report in error, or take it out of the mail, there isnt enough information there for them to harm your identity.

Also Check: How Does A Repo Show On Your Credit

What To Do When Your Credit Report Request Is Rejected

If you make a mistake while using the automated telephone service or if the information you enter does not precisely match the credit agencys records, the automated service will reject your request, and it wont send you a copy of your credit report. If this happens to you, dont panic and assume that theres a problem with your credit bureau. Instead, try the next option to verify what may have gone wrong.

How Your Credit Score Is Calculated

Your credit score is calculated based on what’s in your credit report. For example:

- the amount of money youve borrowed

- the number of credit applications youve made

- whether you pay on time

Depending on the credit reporting agency, your score will be between zero and either 1,000 or 1,200.

A higher score means the lender will consider you less risky. This could mean getting a better deal and saving money.

A lower score will affect your ability to get a loan or credit. See how to improve your credit score.

Don’t Miss: What Bank Is Syncb Ppc

Where Can I Find My Credit Score

If you got a free credit report, dont be surprised when it doesnt include your . To see that, youll have to use a free web service or pay for it through MyFico.com or a credit bureau.

But keep in mind, when it all comes down to it, a credit score is really just an I love debt score. Thats right, a good score simply shows how well youve played the debt game. It doesnt reflect your actual net worth or the amount of money you have in the bank. In other words, its nothing to be proud of. The only way to keep your stellar credit score is to live in debt and stay there. No thanks!

It is possible to live life without a credit score, which is exactly what Dave recommends. But that doesnt mean you should trash your credit to lower it! Just start paying off your debt, close your credit accounts once theyre paid off, and dont take on any new debt. If youre following the Baby Steps, you should reach that indeterminable score within a few months to a few years. Remember: No credit is not the same as having a low credit score.