How To Maintain Your Credit Score

Getting on top is easy staying on top is the challenge. So, make sure you borrow only as much as you need rather than opting for a credit loan amount just because you have been offered one. Ensure that you keep separate savings for repayment, as a dip in your score is possible when you face an emergency or due to unforeseen problems in your income.

Addition read:CIBIL score for personal loan

Now that you know what your credit score says about your behaviour regarding personal finances and credit utilisation, work on improving it or maintaining it. It is worthy to note that acting as a guarantor for someone who defaults on their payment will also hurt your credit score. So, become a co-signor with careful thought and boost your score following the tips mentioned above. With a good score, you can save more money on loans and credit cards and be well on your way to financial independence and security.

*Terms and conditions apply

What Does Vantagescore Have To Say

Though there are no magic score numbers or strict cutoffs, VantageScore does provide some guidance on the quality of certain VantageScore 3.0 score ranges in this credit score chart:

The above grades/categories are meant to give a general idea of how a score stacks up, but again, it all depends on the lender, the loan and your entire application.

While you cant control how a lender might view your TransUnion credit score, you can control credit behaviors affecting your score. So make sure you use credit responsibly: pay your bills on time, dont borrow more than you can afford, and watch how frequently youre applying for credit.

See your credit trends, at a glance. Get smarter about your credit with our interactive score-trending graph.

How To Turn A 665 Credit Score Into An 850 Credit Score

There are two types of 665 credit score. On the one hand, theres a 665 credit score on the way up, in which case 650 will be just one pit stop on your way to good credit, excellent credit and, ultimately, top WalletFitness®. On the other hand, theres a 665 credit score going down, in which case your current score could be one of many new lows yet to come.

Everyone obviously wants his or her credit score to be on an upward trajectory. So whether you need to turn things around or increase the pace of your improvement, youd better get to work. You can find personalized advice on your WalletHub credit analysis page, and well cover the strategies that everyone can use below.

Don’t Miss: How To Get A Repo Off Your Credit

What Constitutes A Credit Score

Your credit score is dictated by debt management history, as seen in your credit file. The score shows potential lenders how you have bill payment and credit. Erratic and poor credit habits will negatively affect your score, while good borrowing habits will raise your credit scores.

We breakdown factors influencing your 668 credit Score as follows:

Pay All Your Bills On

This should be completely obvious, but it bears repeating. A single late payment could drop your credit score 20 or 30 points. That can drop you from average to fair credit in a matter of weeks. Its not just about repaying your creditors on time either. If you get behind with a utility company or a landlord, they may report the unpaid balance to the credit bureaus. That will also drop your credit score. This is why its critical to pay all bills on time, all the time.

You May Like: Cricket Affirm

What Is A Good Credit Score For A Credit Card

Like other lenders, credit card issuers will consult your credit score to determine the risk of doing business with you before approving you for a new credit card. If you want to open a premium travel rewards credit card, you may need good and perhaps even excellent credit scores to qualify. For other types of credit cards, even some with 0% introductory APR offers, a good credit score may be sufficient to be approved for the card.

Beyond qualifying for a credit card, your score can also have a significant impact on the APR and other terms of your account. Credit card issuers not only rely on credit scores to help them determine whether or not to approve applications, but they also use scores to set the pricing on the accounts they approve.

Take this list of top credit cards, for example. Youll notice that every credit card offer features not a specific rate, but rather an APR range. A card issuer might advertise an APR of 13.49% to 24.49%. The reason for that range is because the card issuer will base the final rate it offers you on the condition of your credit.

Defining a specific number that a credit card issuer defines as a good score is tough for two reasons:

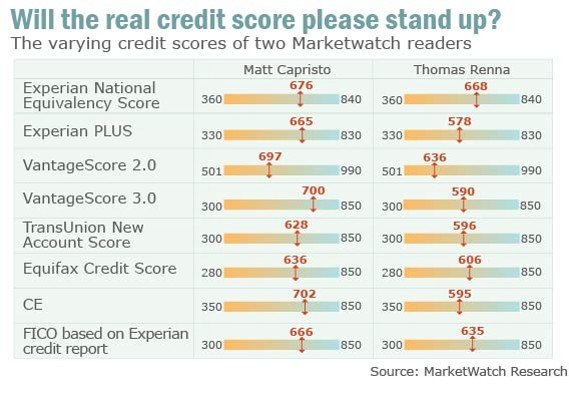

Fico Score Vs Vantage Score

The three major credit bureaus created the Vantage Score back in 2006 to compete with Fair Isaac Corporations FICO credit score model. Since then Vantage Score has released several new credit score models, including Vantagescore 3.0 and 4.0.

While the Vantage Score has grown more popular and is easier to check, thanks to free credit monitoring services like Credit Sesame, both your FICO score and your Vantage Score work to reveal your credit behavior.

The credit score ranges are very similar, although Vantage Score does have a category for perfect credit .

If you earn an improvement within one of these credit score models, you will almost always see the same result with the other model, too especially if you have a shaky credit history and have a couple years of work to achieve a good credit score.

Recommended Reading: Does Wells Fargo Business Credit Card Report To Bureaus

Check Your Credit With A Secure Credit Check From Birchwood Credit

Finding out your credit score may bring on feelings of stress, but it doesnt have to. Understanding your credit situation will help you become financially independent, work towards realistic goals and empower you to feel confident with managing your finances.

Now you can get a complimentary, secure credit report so you can know where your credit stands. Start your Secure Credit Check and take your first step to financial independence.

If you need a new vehicle and are looking for an affordable payment plan, our credit experts are ready to help you, even if you have bad credit. You can fill out an online Car Loan Application and our credit experts will help you find a payment plan that meets your budget and lifestyle.

How Does Your Credit Score Compare

Most of the top credit rating agencies have five categories for credit scores: excellent, good, fair, poor and very poor. Each credit rating agency uses a different numerical scale to determine your credit score which means each CRA will give you a different credit score. However, youll probably fall into one category with all the agencies, since they all base their rating on your financial history.

|

Experian |

|---|

|

628-710 |

A fair, good or excellent Experian Credit Score

Experian is the largest CRA in the UK. Their scores range from 0-999. A credit score of 721-880 is considered fair. A score of 881-960 is considered good. A score of 961-999 is considered excellent .

A fair, good or excellent TransUnion Credit Score

TransUnion is the UKs second largest CRA, and has scores ranging from 0-710. A credit score of 566-603 is considered fair. A credit score of 604-627 is good. A score of 628-710 is considered excellent .

A fair, good or excellent Equifax Credit Score

Equifax scores range from 0-700. 380-419 is considered a fair score. A score of 420-465 is considered good. A score of 466-700 is considered excellent .

To get a peek at the other possible credit scores, you can go to ‘What is a bad credit score‘.

Recommended Reading: Does Walmart Take Klarna

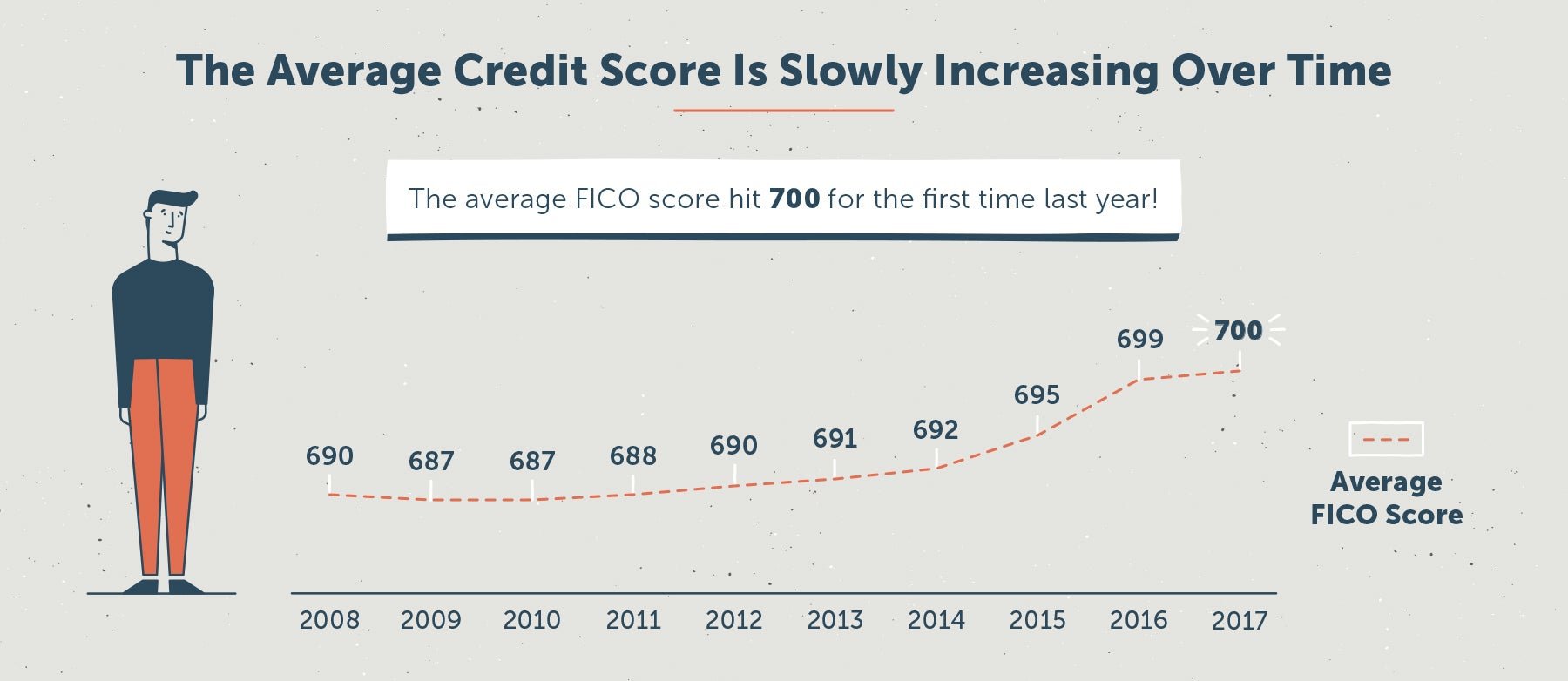

Millennials Average Fico Score Increased 25 Points Since 2012

A good credit score is essential for obtaining the best rates on a mortgage, auto loan or even opening a credit card. Good credit can help you

How is a credit score calculated? · Your debt repayment history. · Amounts owed. · Types of credit applied for and how often. · How long your accounts have been

A good credit score is generally anything above 720. A bad credit score is usually anything below 620. Your score will get there over time as long as you have

Learn More About Your Credit Score

A 668 FICO® Score is a good starting point for building a better credit score. Boosting your score into the good range could help you gain access to more credit options, lower interest rates, and reduced fees. You can begin by getting your free credit report from Experian and checking your credit score to find out the specific factors that impact your score the most. Read more about score ranges and what a good credit score is.

Also Check: How To Fix Delinquency On Credit Report

Rebuilding Your 668 Credit Score

A Credit Repair company like Credit Glory can:

An industry leader like Credit Glory can guide you through this process. Give them a call @ , or chat with them, today â

What Credit Score Is Needed To Buy A House

Ah, the dreaded . Its one of the biggest criteria considered by lenders in the mortgage application process three tiny little digits that can mean the difference between yes and no, between moving into the house of your dreams and finding yet another overpriced rental. But despite its massive importance, in many ways the credit score remains mysterious. If you dont know your number, the uncertainty can hang over you like a dark cloud. Even if you do know it, the implications can still be unclear.

Is my score good enough to get me a loan? Whats the best credit score to buy a house? What’s the average credit score needed to buy a house? Whats the minimum credit score to buy a house? Does a high score guarantee I get the best deal out there? And is there a direct relationship between credit score and interest rate or is it more complicated than that? These are all common questions, but for the most part they remain unanswered. Until now.

Today, the mysteries of the credit score will be revealed.

Also Check: When Does Self Lender Report To Credit Bureaus

Your Fico Score: Just One Piece Of The Puzzle

Id like to conclude this post by offering a little perspective. You may want a perfect credit score, and if you do I suggest you go for it.

But theres more to your personal finance life than perfect credit. Different lenders consider criteria other than your credit history when you apply for a loan or a credit card.

Your debt-to-income ratio, for example, could disqualify you for some of the best credit cards and loan options. This ratio measures how well youre able to pay your current bills with the income youre bringing in.

Your employment history could matter to some lenders, too. Just like with the length of credit history, a longer employment history works in your favor.

If you work to create the most stable personal finance life possible, your FICO score will fall into place, and youll stay at the top of the credit score range.

Compare More Recommended Credit Card

Is your credit score not 650, 660, 670, 680, or 690? Find more top credit cards for your credit score range:

Note: According to our research, these credit cards offer the best chance of approval for applicants with credit scores of 650, 651, 652, 653, 654, 655, 656, 657, 658, 659, 660, 661, 662, 663, 664, 665, 666, 667, 668, 669, 670, 671, 672, 673, 674, 675, 676, 677, 678, 679, 680, 681, 682, 683, 684, 685, 686, 687, 688, 689, 690, 691, 692, 693, 694, 695, 696, 697, 698 and 699. This does not mean guaranteed approval as credit decisions take into factors other than FICO score.

Petal credit cards are issued by WebBank, Member FDIC.

Also Check: What Is A Serious Delinquency On Credit Report

Dont Apply For Loans Or Credit Cards For At Least A Year

Once youve paid down your installment loans, I suggest you stop applying for loans and credit cards altogether. By this point, you should have a few credit cards in your wallet, a couple of paid off cars, and a mortgage.

When youre in this position, there is really no need to apply for more credit.

By not applying for credit, you wont get any hard inquiries on your credit report and this helps your credit score. If you need to apply for credit, just keep in mind the hard inquiries will stay on your credit for about a year.

Again, you should be in a situation by this point where you dont need anymore credit.

A Good Credit Score Is In The Eye Of The Beholder

Although the FICO and VantageScore charts above display a general idea of how lenders may interpret different credit score ranges, lenders and other companies can, and often do, differ in their opinions of creditworthiness.

For example, just because youre considered to have a good credit score to an auto dealer doesnt mean a mortgage lender would consider that same score to be a good credit risk. Each lender has their own criteria for credit scoring as well as their own thresholds for a good score vs. a bad score.

Also Check: Is Cbe Group Legit

Heres How To Improve A 668 Credit Score:

- Dispute Negatives: If you can prove that negative information on your credit report is inaccurate , you can dispute the record to have it corrected or removed.

- Pay Off Collections Accounts: Once you bring a collection accounts balance down to zero, it stops affecting your VantageScore 3.0 credit score.

- Reduce Utilization: Its best to use less than 30% of the available credit on your credit card accounts each month. You can reduce your credit utilization by spending less, making bigger payments or paying multiple times per month.

- Pay On Time: Payment history is the most important ingredient in your credit score. Paying on time every month establishes a track record of responsibility as a borrower, while a single late payment on your credit report can set back credit improvement efforts significantly.

You can track your credit scores progress for free on WalletHub, the only site with free daily updates and personalized advice.

Was this article helpful?

Ad Disclosure: Certain offers that appear on this site originate from paying advertisers, and this will be noted on an offers details page using the designation “Sponsored”, where applicable. Advertising may impact how and where products appear on this site . At WalletHub we try to present a wide array of offers, but our offers do not represent all financial services companies or products.

Related Scores

What A Fair Good Or Excellent Credit Score Means For You

The better your credit score, the more choices youll have when it comes to applying for a loan or credit card. Thats the bottom line.

If you have a fair credit score and are approved for a credit card, you may be offered a slightly higher interest rate. Your initial credit limit may also be on the lower side. But if you make your payments on time and demonstrate financial stability, you might be able to have your limit increased after 6-12 months.

If you have a good credit score, your chances of being approved for loans and credit cards increases. Youre also more likely to be offered a more competitive interest rate, as well as a more generous credit limit.

Finally, an excellent credit score makes borrowing money and getting credit cards much easier. Its also more likely to get you the best available interest rates and generous credit limits.

Read Also: Care Credit Hard Inquiry

Charge No More Than You Can Easily Repay When The Bill Comes In

In order to be able to pay your balance in full each month, you should avoid charging more than youll be able to repay the next month. A credit card is not a blank check. No matter what the credit limit is, you need to set your own budget for that card. If the credit limit is $2,000, but you can afford to repay only $400 the following month, then $400 needs to be your credit limit.

Can You Get A Personal Loan With A Credit Score Of 668

Very few lenders will approve you for a personal loan with a 668 credit score. However, there are some that work with bad credit borrowers. But, personal loans from these lenders come with high interest rates.

Its best to avoid payday loans and high-interest personal loans as they create long-term debt problems and just contribute to a further decline in credit score.

To build credit, applying for a may be a good option. Instead of giving you the cash, the money is simply placed in a savings account. Once you pay off the loan, you get access to the money plus any interest accrued.

Read Also: How To Get Inquiries Off Your Credit Report