What If You Have No Accounts

You need open, active, positive accounts to build a positive credit history. If you dont already have open accounts, start by applying for the types of credit cards or loans for people with no credit or bad credit, like a secured credit card or retail store credit card. If you cant get approved on your own, a relative or friend may be willing to co-sign for you or make you an authorized user on one of their credit cards to help boost your credit. If the primary cardholder has a positive payment history, you might see a boost in your credit score.

However, beware of schemes that claim to help you improve your credit score by adding you as an authorized user to a stranger’s account. Such a tactic may cause you legal troubles.

Applying For Utility Services Is Applying For Credit

If youre moving into a new home and you need to set up and pay for utilities, youll need to apply for those services. When you apply, companies often look at how youve paid your bills in the past, including how youve paid bills for utilities where youve lived before.

Heres what you should know when you apply for utilities:

- Youre applying for credit. Utility companies send you a bill at the end of the month based on how much gas, water, or electricity you use. That means theyre extending you credit for their services until you pay your bill.

- Companies will look at your credit history. Like other creditors, utility companies will ask for information like your Social Security number so they can check your . A good credit history can make it easier for you to get services. A poor credit history can make it harder.

- How you pay your utility bills can become part of your credit history. If you pay your bills in full and on time, it can help your credit. If you dont, it can hurt your credit. Failing to pay on time can also lead to collections and charge-offs, which can especially damage your credit. Not paying on time also can affect whether you can get other types of credit. Learn more in Understanding Your Credit.

Does Paying Rent Build Credit

Simply paying your rent will not help you build credit. But reporting your rent payments can help you build credit especially if you are new to credit or do not have a lot of experience using it.

A 2017 TransUnion study followed 12,000 renters for a year as they reported their rent payments. Scores rose 16 points on average within six months after rent reporting began, according to the study. The largest increase was for scores below 620, which is considered bad credit.

Having rental payment information in your credit report can be useful if you rent again. Landlords prefer tenants who can show a history of paying on time.

But other strategies to build credit are more efficient than rent reporting because they influence all types of credit scores and usually report to all three credit bureaus. They also can cost less or, in the case of authorized usership, nothing.

-

You can become an on someones else credit card and benefit from their good credit history.

-

You can get a secured credit card, which requires a deposit and often serves as your credit limit.

-

You can get a at many credit unions or community banks. Your loan payments are reported to the bureaus and you get access to the funds only after you have paid it off.

You May Like: How Long For Collections To Fall Off Credit Report

Can Utility Bills Hurt My Credit

While Experian Boost wont use late payments for utility bills, its still possible for a delinquent account to damage your credit score.

Specifically, this can happen if the service provider sends the account to collections or charges off the debt. This typically wont happen after just one missed payment. But if you miss multiple payments or leave a monthly bill unpaid for months, the provider may enlist the help of a debt collector. Leave it long enough, and it may charge off the account instead, assuming youre not going to pay.

Your payment history is the most important factor in determining credit scores. It makes up 35% of your FICO® Score and is considered extremely influential to your VantageScore. So having a collections account or a charge-off reported to the credit reporting agencies can damage your credit score significantly.

Whats more, the negative tradeline will stay in your credit file with each reporting agency for seven years. And while adding positive payment history can help reduce its impact on your credit score, it can take a long time to recover fully.

Can Late Phone And Utility Bill Payments Affect Credit

Now the flipside: Getting behind on payments can lower your credit score even if your bills arenât being reported regularlyâwhether that reporting is done by companies themselves or through self-reporting.

Depending on how far behind you fall, you could incur penalties or late charges, and your account could be turned over to a collections agency. If itâs reported to the credit bureaus, collections activity can stay on your credit report for seven years, sometimes longer, according to the CFPB.

Recommended Reading: Syncb/ppc Account

Pay Your Utility Bills With A Credit Card

If you dont like any of the methods above, you can always just pay your utility bills with a credit card. Credit card companies almost always report to the credit bureaus, so a record of your payments will show up on your credit reports.

Provided that you pay your credit card bills on time every month, you can boost your credit because timely payments benefit your payment historythe most important factor affecting your credit score.

However, make sure to only use a small fraction of your on the card you use to pay, or else your credit score may suffer. A good rule of thumb is to keep the amount you spent on the card below 30% of your limit, although under 10% is ideal. 4

You should also make sure that your utility provider wont charge you steep processing fees for paying by credit card. Call them to make sure.

How Can A Utility Bill Hurt Your Credit

Utility companies do not report accounts and payment history to the three major credit bureaus , and as a result, these types of bills have not historically had an impact on your credit scores. For a utility company to be able to report information to a credit bureau, they must meet the requirements of the Fair Credit Reporting Act, such as updating payment information regularly and being able to respond to disputes within legally mandated timeframes.

One of the few instances where your utility and telecom billsincluding energy, phone and cablewill affect your credit score is if you miss enough payments that the provider sends your debt to a collection agency or charges off your account, assuming you’re not going to pay it.

You May Like: Does Hsn Report To Credit Bureaus

How Could This Affect You

For many consumers, Experian Boost has potential to help their credit. If youre wondering whether to try it, there are some factors to consider, though:

- Not all lenders use the same credit scores: Perhaps the biggest thing to keep in mind is that lenders today can choose from a variety of credit scores to help determine your creditworthiness. Experian Boost uses the FICO® Score 8 model and might increase that particular FICO® score but your other credit scores could be lower by comparison.

- Falling behind on bill payments can affect your score: Experian Boost only improves your score if you make on-time payments to your utility and telecom bills. Experian will remove from your credit report any accounts that you neglect to pay for three consecutive months and this in turn would reverse any positive credit score gain you saw from the addition of the account.

- Signing up requires you to give Experian access to your bank account info: To use Experian Boost, you have to sign up for an Experian account and you have to agree to let Experian connect to your online bank account to track bill payments. Recent public data breaches including one involving Equifax in 2017 that affected nearly 148 million U.S. consumers have highlighted the potential risk involved when companies have extensive access to personal data.

Why Do I Have So Many Student Loans

Student loans may be reported as multiple entries on a credit report based on disbursements. A disbursement may occur for each school semester attended. The numbers added before and after the account number indicate that an additional disbursement was made. These extra numbers also help differentiate between the entries.

Student loans are often sold to other lenders and can be reflected on the credit report as transferred. Because they are not considered duplicates, we will continue to report the accounts separately.

Please contact the creditor directly if you want to dispute this information or need additional information.

Also Check: Does Paypal Credit Help Your Credit Score

You Should Add Information Showing Stability And Unreported Positive Accounts To Your Credit Report Heres How

Get Free Credit Reports Weekly During the Coronavirus Crisis

During the coronavirus national emergency, the three major credit reporting bureaus are offering free weekly credit reports to consumers.

In addition to disputing incorrect or incomplete information and adding explanations for negative information the wont remove, you might want to ask the credit reporting agency to add information to your report that makes you look more creditworthy. This information usually includes:

- information demonstrating your stability, and

- positive account histories that are missing from your report.

Recommended Reading: Carmax Auto Finance Defer Payment

How Can Utility Bills Help My Credit

Utility bills aren’t typically used to determine your credit score. But if you’re making those monthly payments on time, you may feel like you should get credit for it.

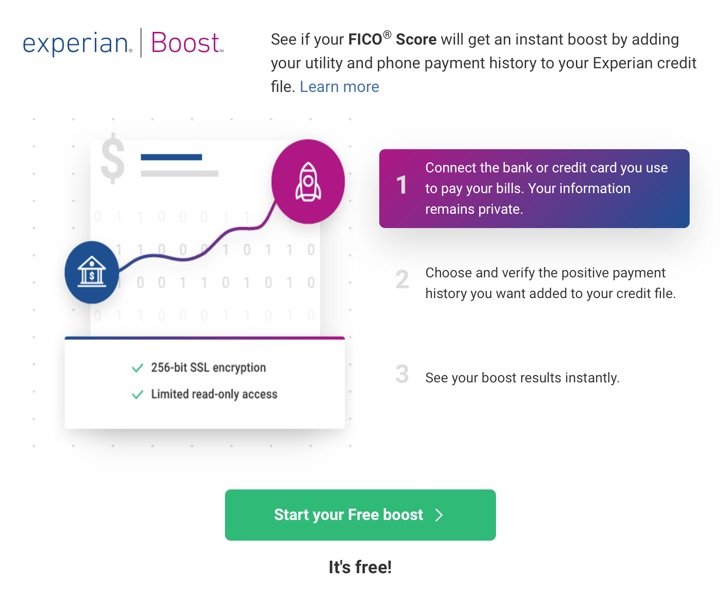

You now have the opportunity to get that credit with Experian Boost. Through this tool, you allow Experian to access your bank account information to identify various utility and telecom payments, including your cell phone bill.

You’ll then have a chance to verify the information and confirm that you want to add it to your credit report. The entire process takes roughly five minutes and, if you qualify for a boost to your credit score, it will happen immediately.

Experian Boost only considers on-time payments, so you don’t have to worry about late payments having a negative impact on your credit score.

Based on data from Experian, 75% of people with a FICO® Score below 680 saw an improvement in their score after adding utility payment information to their report.

Read Also: Paypal Credit Reporting To Credit Bureaus 2019

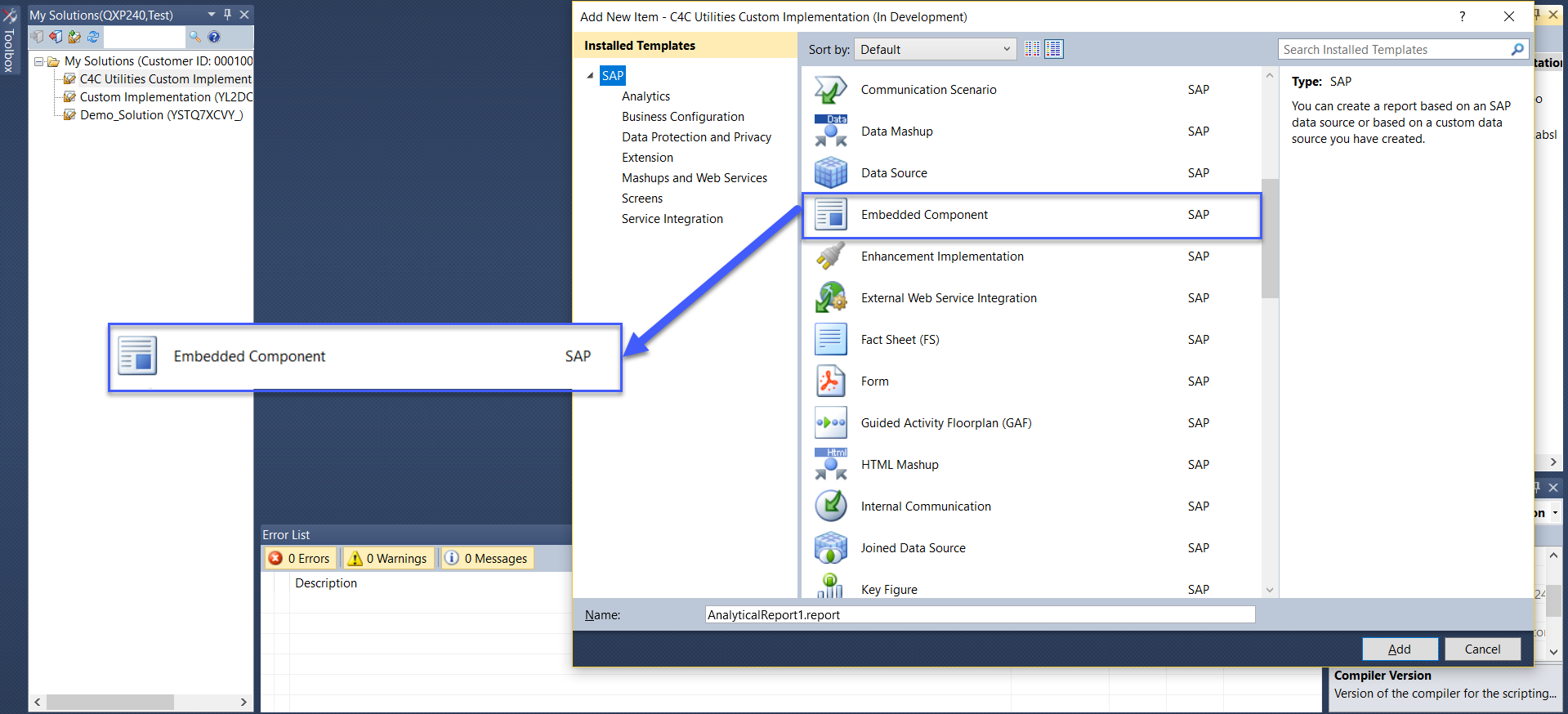

Why Experian Boost Is A Big Deal

New credit reporting policies and new credit scores are introduced from time to time. In truth, they arent always that exciting.

Despite updates and changes, the basic credit reporting and scoring process has worked the same for around three decades, since the FICO score was introduced at Equifax in 1989.

- Step One: Creditors report your account history to the credit bureaus.

- Step Two: The bureaus use the information to create credit reports.

- Step Three: Lenders buy those reports to evaluate your creditworthiness when you apply for new loans, credit cards and services.

Experian Boost is a big deal because it makes groundbreaking changes to step one of this 30-year-old process. For the first time in credit-reporting history, you have the option to add account information to your own credit report.

What Are The Disadvantages Of Self

At first glance, self-reporting may look like a miracle cure for struggling credit: A chance to dramatically increase your score in a relatively short time, without needing to change your lifestyle or take on additional debt. While all those things are true, there are a few important drawbacks to watch out for.

Some of the disadvantages of self-reporting stem from the fact that itâs still a relatively new practice. As such, many variables can affect whether the strategy yields a significantly higher credit score. One of these variables is the credit reporting bureaus. Most self-reporting services report your payment information to one or two of the three major credit bureaus. Very few reporting services report to all three bureaus.

For example, Experian Boost only reports payment activity to Experian. This means that your self-reported data appears on your Experian credit report, but not on reports from the other two bureaus. In this scenario, if a lender pulls your credit report from TransUnion or Equifax instead of Experian, your rent and other self-reported activity wonât show up, which means they wonât help your credit score at all.

Although FICO currently dominates the credit scoring scene, itâs worth noting that FICOâs competitor, VantageScore, considers rent and other nontraditional payments in versions 3.0 and 4.0 , but not in previous versions.

Don’t Miss: How Long Can A Repo Stay On Your Credit

How To Boost Your Credit Score By Self

If youve been working hard to build your credit score by making wise financial decisions and paying your bills on time, it may come as a surprise that some of those timely payments may not be impacting your credit score at all.

Traditionally, credit scores are not impacted by utility, phone and cable TV bills unless they are severely delinquent, explained Rod Griffin, director of consumer education and awareness at Experian.

Utility and other similar providers typically do not report positive payment information to the three national credit bureaus Equifax, TransUnion and Experian which is why this information is not usually included in your credit report or factored into your credit score. But Experian recently launched a new program, called Experian Boost, that gives individuals more control over their credit scores by self-reporting these positive payments.

The Open Door Coalition spoke to Griffin to learn more about how Experian Boost works, and how you can leverage your utility, phone and internet bills to improve your credit score.

Adding Positive Credit History To Your Credit Report

As more businesses use your credit history to decide whether to do business with you, your positive credit history is becoming more important than ever. You need good credit to get approved for a mortgage loan, rent an apartment, buy a car, qualify for a good insurance rate, and sometimes even get a job.

If you have bad creditor no credityour goal is to build a positive credit history so you can have your applications approved easily. Building a positive payment credit history isn’t magic. You cant directly add things to your credit report, even if they are bills you pay each month. Instead, you must depend on your creditors and lenders to send updates to the credit bureaus based on your account history.

There are three major credit bureaus in the U.S.: Equifax, Experian, and TransUnion. Creditors you have accounts with may report your credit history to one or all three of the bureaus based on their existing relationship with that bureau. Bureaus dont share information under normal circumstances, so theres a chance some of your accounts may only appear on one credit report.

Recommended Reading: What Is Syncb Ppc

Will Lenders Use My Experian Boost Score

Experian Boost applies to most credit scores that lenders use, including the base FICO® Score, as well as bankcard, mortgage, and auto scores. So once you opt-in and agree to add utility payments to your Experian credit report, they will be included in credit scores based on your Experian credit file.

Remember, though, that the tool does not affect your credit files with Equifax and TransUnion. So if a lender uses a score based on your credit data from those credit reporting agencies, your utility bill payments won’t be baked into the score they see.

Are Utility Bills Reported To Credit Bureaus

Utility bills have historically been left out of consumer credit reports entirely, primarily because they’re not considered credit accounts. Even now, utility companies don’t automatically report your monthly payments to the three credit reporting agencies .

With a new tool called Experian Boost, however, you can have certain utility accounts included in your credit report to help increase your credit score.

This tool is available only for your Experian credit report, which means that utility bills will continue to have no influence on your Equifax and TransUnion credit reports, along with your credit scores based on those reports.

Read Also: How Many Years Does An Eviction Stay On Your Record

Collections On Your Credit Report

Companies typically turn to collection agencies when bills are severely past due and the providers are unsure whether they will ever recover the debt. Once a collection agency assumes the debt, it typically opens a collection account in the debtor’s name and sends a record of that account to one or all of the three major credit bureaus. When that happens, the collections account becomes a part of your credit file.

Once a collection account or charge-off becomes part of your credit history, it can have a lasting negative effect on your credit score. These are considered derogatory marks and can remain in your credit file for seven years. Even if you pay the collection agency and the account is closed, a record of the debt will still remain.

Collection accounts don’t only negatively impact your credit scores, but they can also come with expensive fees that increase your overall debt. If you’ve had a collection account opened for a past debt, it’s best to try to resolve it as soon as you can before the issue escalates any further.