World Of Hyatt Credit Card

The World of Hyatt credit card is a great option for folks who prefer to earn Hyatt points or who stay at Hyatt hotels frequently. This card offers a sign-up bonus of up to 60,000 Hyatt points: 30,000 Bonus Points after spending $3,000 on purchases within the first 3 months from account opening Plus, up to 30,000 more Bonus Points by earning 2 Bonus Points total per $1 spend on purchases that normally earn 1 Bonus Point, on up to $15,000 in the first six months of account opening.

This card carries a $95 annual fee and rewards you with 9x Hyatt points per dollar spent at Hyatt hotels and resorts. Youll typically need a slightly higher credit score to get approved for the World of Hyatt card, likely in the 700+ range. Read our World of Hyatt credit card review here.

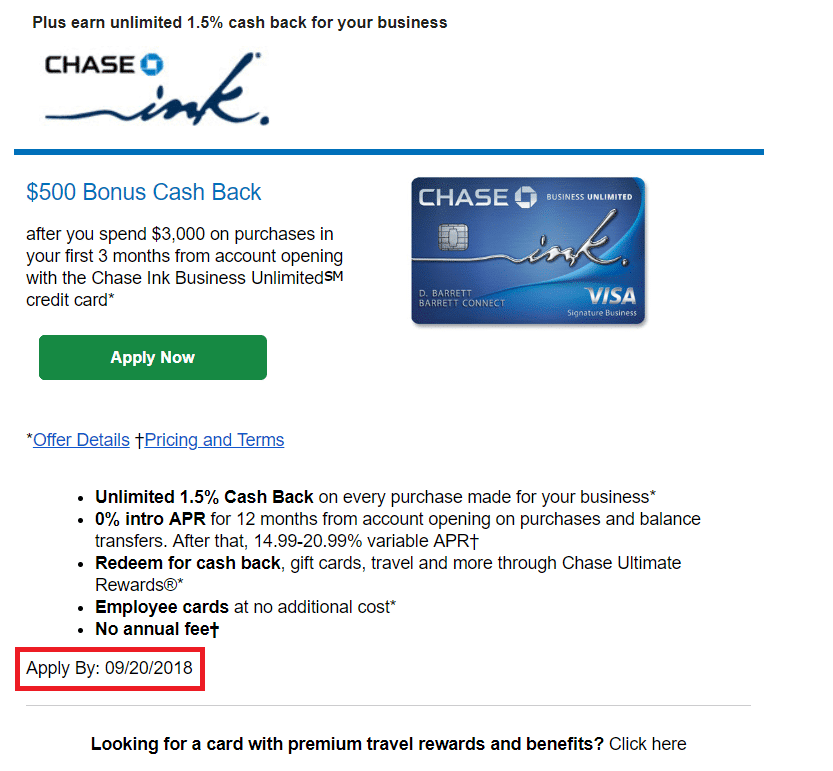

How Big Must Your Company Be For A Chase Ink Business Card

You dont necessarily need to have a full-fledged corporation to qualify for one of the Chase Ink Business credit cards. These cards are designed for all types of business, both big and small, as well as those in various industries. However, if your business is very new, you might run a greater risk of being denied when applying for a Chase business credit card.

Other Chase Ink Business Unlimited Card Benefits

- Employee Cards: Additional cards on the same account for employees at no cost.

- Auto Rental Collision Damage Waiver: Car rental damage insurance is primary when rented for business.

- Roadside Dispatch: Access to pay-per-use roadside dispatch service.

- Purchase Protection: Purchases are protected from theft and damage up to $10,000 per claim and $50,000 per account for up to 120 days.

- Extended Warranty Protection: Extends original manufacturer warranties on eligible products by an extra year.

- Account Alerts: Chase notifies account holders when potentially fraudulent activity is detected.

You May Like: Is 630 A Good Credit Score

Chase Business Ink Reporting To Credit Bureau

Awk … to my surprise my Chase Business Ink Cash Card is included in the new Experian website “total credit available” but, does not show as an individual account. It did not show in their previous website. The Chase Business Card does not show up in the Trans Union or Equifax credit reports. Anybody else have any feed back? This was a hidden trade line and it only serves to increase my total credit available which I don’t need.

850 EX 831 EQ 840 TU 834 850

What If My Application Is Denied

If your application is denied due to not meeting Chase Ink Business Unlimited credit score requirements, or for any other reason, you have a right to know why. In fact, rules under the Fair Credit Reporting Act require Chase to tell you in writing.

Any lender that turns you down using a credit score has to provide you with the type of score it used as well. You do not need to ask for it this information is automatically sent to you. The lender will also tell you what credit bureau they used and how you can get a free credit report. When you receive this correspondence, you should review the information so you know what you need to do next.

That being said, you can also call Chase to see if they will reconsider your application. The card issuer even has a phone line you can call for this purpose, which you can reach at 1-800-453-9719.

When you call Chase for reconsideration, they may be able to take a closer look at your application if youre willing to send them more information. For example, you may need to send them documentation of your business income or proof of your business registration.

You May Like: What Is A Good Credit Score To Have

You Must Have A Business

Even if your credit score is stellar, you most likely won’t get approved for the Chase Ink Business Preferred if you don’t actually have a business.

You may be surprised by what could be considered a business. Basically, if you do anything for profit, it can be considered a small business. In fact, you don’t even have to be already making income. You just need to have a reasonable intention to make money and have business expenses.

To start, check out the latest Ink Business Preferred promotion.

- If you’re a freelance web designer

- If you have an Etsy shop

- If you sell books on eBay

- If you drive Uber in your spare time

- If you tutor students

- If you sell cookies at the farmer’s market

It’s very important that you tell the truth on your application. If you’re not making money yet, just put “0” as the annual business revenue. Chase may follow up with a phone call and ask for clarifications. It’s okay to explain that you’re starting out.

Chase Business Cards And The 5/24 Rule

If youve opened five or more personal credit cards in the past 24 months, you wont be approved for a new Chase business credit card.

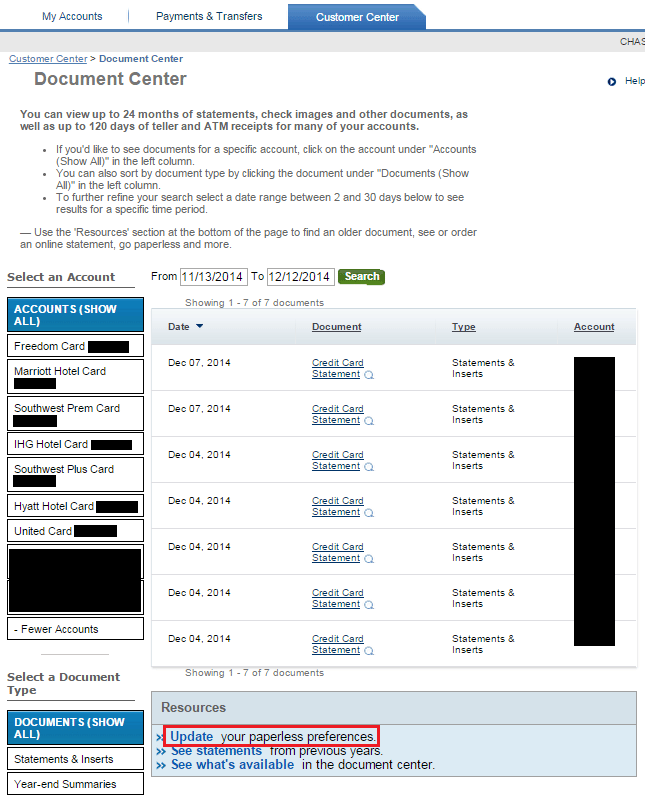

Most of the time, the business credit cards youve opened in the previous 24 months dont count toward the five-card limit. For example, business cards from American Express, Bank of America, Citi, Wells Fargo and even Chase dont count against you because they dont appear on your personal credit report. Youll find more information about how to find out if youre over the Chase 5/24 rule here.

Don’t Miss: Does Paypal Credit Affect Credit Score

Can I Apply For Chase Ink Without A Business

All Ink cards are business cards, which means you need a business to qualify for one. But this doesnt mean you have to run a large business with hundreds of employees. Small businesses are also eligible, including side hustles and independent contractor work. For example, if you earn income from selling items on Amazon or you work as a freelance writer, thats technically business income and could qualify you for a business card.

Does Chase Business Report To Personal Credit

There is no definitive answer to this question since it can vary depending on the banks policies. However, in general, business credit cards are reported to the business owners personal credit report if the account is in good standing. Therefore, if you have a business credit card with Chase and you make your payments on time, it is likely that your account will be reported to your personal credit report. This can be beneficial if you are trying to build or improve your credit score.

If the card issuer reports activity to the credit bureaus on the card, it may appear on a personal credit report. The others do not report negative information, such as when you pay late or late. If you want to work with the company, ask about its policies first. You will begin building a business credit score as soon as you establish business credit. This number, which ranges from zero to 100, is used to determine how much debt a company owes and how often it pays it back. You can limit your personal credit damage by using specific issuers to apply for business credit cards.

Don’t Miss: Will Closed Credit Card Affect Score

Chase Ink Business Card Credit Score

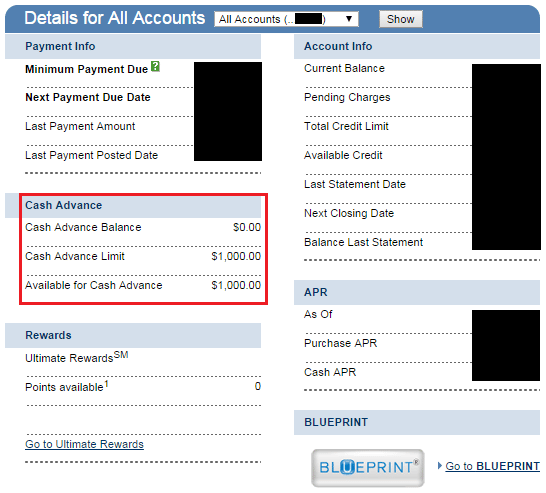

A chase ink business card credit score is a number that indicates the level of credit risk associated with a business credit card account. The higher the number, the higher the risk. The chase ink business card credit score is used by lenders to make decisions about whether or not to extend credit to a business.

You must have a credit score of 700 or higher in order to apply for Chases Ink Business Preferred Credit Card. Income, debt load, number of open accounts, and employment status are all critical criteria in addition to income. If you excel in more than one area, you may be able to get approved for credit with slightly lower credit scores. If you are approved, the new card will be mailed out within seven to ten business days. Your annual income and the amount of outstanding debt you have will have an impact on your approval odds for the U.S. Bank Business Triple Cash Card. When you sign up for a free WalletHub account, youll be asked if youre likely to be approved. The information provided on WalletHub Answers is subject to change without notice, and it should not be relied upon as financial, legal, or investment advice.

Can Anyone Get A Chase Business Card

As mentioned above, you need a for-profit venture to qualify for a business card. That can be anything from selling baked goods at your local farmers market to running a small business that has multiple employees.

Just remember, even if youre eligible for a small business card, its ultimately up to the bank to decide whether or not they will approve you.

Read Also: How Much Does A Hard Inquiry Affect Your Credit Score

Best Chase Business Credit Card For Most People

Earn $750 bonus cash back after you spend $7,500 on purchases in the first 3 months from account opening.

- Earn $750 bonus cash back after you spend $7,500 on purchases in the first 3 months from account opening

- Earn 5% cash back on the first $25,000 spent in combined purchases at office supply stores and on internet, cable and phone services each account anniversary year

- Earn 2% cash back on the first $25,000 spent in combined purchases at gas stations and restaurants each account anniversary year. Earn 1% cash back on all other purchases

- With Fraud Protection your card transactions will be monitored for possible signs of fraudulent activity using real-time fraud monitoring

- With Zero Liability you won’t be held responsible for unauthorized charges made with your card or account information

- Redeem rewards for cash back, gift cards, travel and more through Chase Ultimate Rewards®

- 0% introductory APR for 12 months on purchases

- High rewards rate on common purchase categories

- Bonus categories capped at $25,000

Our Thoughts

Best for businesses with moderate expenses

Chase Ink Business Preferred Card Benefits

Some of the perks of using a Chase Ink Preferred card are summarized above. Now, lets explore them further.

Telephone Damage and Theft Protection

If you pay your business phone bill with a Preferred card, you will be eligible for up to $600 per claim on damage and theft for you and your employees. This is a standout feature not offered by competitors credit cards. You will be eligible for up to three such claims per year, which will have a $100 deductible.

Free Employee Cards

Once your account is approved, you can get employee cards at no cost. For each card, set spending limits to control your budget. All rewards will pool into the master account. This means that employee spending on a company Chase Ink Preferred card will count toward your bonuses and points.

Auto Rental Collision Damage Waiver

When you rent a car and pay with your Business Preferred card, you dont need to purchase insurance, because Chase automatically has you covered with damage protection up to the actual cash value of the vehicle. This can save you quite a bit on business travel, especially when multiple employees rent cards when traveling for business.

Trip Cancellation/Interruption Insurance

Purchase Protection and Extended Warranties

Transferable Points & Rewards That Never Expire

Login to your Chase Ultimate Rewards program dashboard or check with your frequent flyer program to find out for sure if your points would be transferrable not all travel programs have a partnership with Chase.

Read Also: How Long Can Something Stay On Your Credit Report

What Credit Score Do You Need For A Chase Ink Business Unlimited

A good or excellent credit score is recommended by the Visa network to qualify for the Chase Ink Business Unlimited, though no credit score guarantees an approval. A good credit score is typically one of 670 or above on the FICO scale. Scores 740 or above on the FICO scale are considered excellent. With many business credit cards, small business owners will likely be required to provide a personal guarantee on any business credit account unless the business has sufficient business credit and collateral.

What Credit Score Is Needed To Get A Chase Ink Business Card

As the business owner, you are ultimately responsible for all charges on your business credit card. For this reason, its no surprise that issuers check your personal when you apply for a business card. Most business cards require good or excellent credit to qualify, and the Chase Ink Business cards are no exception. Here are the credit score requirements:

- Chase Ink Business Preferred® Credit Card: Excellent

- Chase Ink Business Cash® Credit Card: Excellent

- Chase Ink Business Unlimited® Credit Card: Excellent/Good

Your FICO® Score, the most commonly used credit scoring model, can fall into one of five tiers:

- Excellent: 800 to 850

- Fair: 580 to 669

- Poor: 300 to 579

So, while no credit card application is ever guaranteed approval, youll likely be in a better position to be apply for a Chase Ink Business card if your personal FICO Score is in the upper tiers.

Read Also: How Long Can A Debt Appear On Your Credit Report

What Score Is Needed For A Chase Ink Business Card

For the Ink Business Cash card, you can use it for a Ink Business Cash® Credit Card. A score of 700 or higher is usually required for good to excellent credit. Chase will use your personal credit score when making a credit decision, as it would with the Ink Business Preferred, regardless of whether you use the Ink Cash as a business card or not.

Bonus Tip: Monitor Your Business Credit

Know what is happening with your credit. Make sure it is being reported and fix any inaccuracies as soon as possible. Get in the practice of checking credit reports and digging into the particulars, and not just the scores.

We can help you monitor business credit at Experian, Equifax, and D& B for only $24/month. See: .

Fix Business Credit

So, whats all this monitoring for? Its to fix business credit inaccuracies in your records. Mistakes in your credit report can be fixed. But the CRAs often want you to dispute in a particular way.

Disputing credit report errors commonly means you precisely itemize any charges you challenge.

You May Like: What Is 11 Sprint On My Credit Report

Tell Chase About Your Business

Heres how to fill out this form.

Legal name of business: If you are a sole proprietor, your legal business name can be your own name or the name of your business.

Business name on card: This is the business name you want to appear on your credit card. It can be your name or a variation of your name with your profession Jane Doe Photography.

Business mailing address: Use your home address if you run the business from your home.

Business phone: Use can use your personal phone number if thats all that you have.

Type of business: Choose sole proprietor , partnership or select the appropriate legal structure of your business .

Taxpayer identification number: If you dont have an Employer Identification Number , use your Social Security Number . The box is formatted differently than your Social Security Number, but both numbers are nine digits long, so it works.

Number of employees: This is the total number of employees you have. Select 1 if youre a sole proprietor.

Annual business revenue or sales: Enter the total amount you receive annually for selling your products or services. If you are just starting out and havent sold anything yet, enter zero.

Years in business: Enter the number of years since you started the business. This includes the time it took to get up and running before you earned any money or made a profit.

Select an industry, category and type: Select the options that best describe your business.

Is An American Express Business Card Worth It

In most cases, American Express business cards are not required to report to credit bureaus. Only if your account has reached delinquency will it be reported to TransUnion, Experian, or Equifax. If you use the Amex Business Platinum card, you will almost never report your personal credit to your credit bureaus. Because this is a business credit card, it is critical to keep a record of your credit and payment history. Because this is a business credit card, you will build a credit and payment history in your business credit report. A EIN will not affect your credit record if you only provide one during the loan application process for your business. If you sign on any document without providing your personal information and social security number, your lender cannot hold you liable.

Also Check: How To Rebuild Credit Score

How Hard Is It To Get The Chase Ink Business Preferred

Also, note that cardholders can redeem points for cash back, gift cards, travel, and more. Points dont expire as long as the account is open. Additionally, cardholders get fraud protection and zero liability. Purchase protection covers new purchases for 120 days against damage or theft, up to $10,000 per claim and $50,000 per account.

You may already know why you want the Chase Ink Business Preferred® Credit Card . However, you probably dont know if Chase will approve your application.

Before submitting an application, its important to know your approval odds.

Related: The Ink Preferred vs Ink Unlimited: Which Business Credit Card is Better?

You Can Also Try Secure Small Business Credit Cards For Fair Credit

For Fair Credit, we like the Capital One Spark Classic for Business. It has no yearly fee. There are cash-back rewards. But you will have to have a credit score of 690 or better.

But BEAR IN MIND: the standard APR is 23.99% variable APR.

Get it here:

Also Check: When Does Chapter 7 Drop Off Credit Report